Documentos de Académico

Documentos de Profesional

Documentos de Cultura

5197 PDF

Cargado por

arpannath0 calificaciones0% encontró este documento útil (0 votos)

72 vistas1 páginaTítulo original

5197(8).pdf

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

72 vistas1 página5197 PDF

Cargado por

arpannathCopyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 1

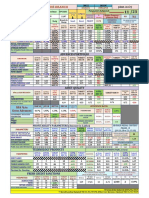

CIRCLE REGION

PERFORMANCE OF THE BRANCH KOLKATA DURGAPUR (Amt. in Cr)

Name of the Branch Name of the Branch Head DP CODE

Population

group

Category

Parameters Achieved:

(Dec.2018 Quarter) 11 /23

Profit/Loss By Shikhar Category :-

DIGHI ARPAN NATH 5197 (FEB'19) Amount (Mention Star) NO NA

(in Lakhs)

Branch In OVERSEEING SRI BRIJESH KUMAR

Date of Opening: 27/02/2014 Desig

Charge

Small Rural PROFIT 23.38 EXECUTIVE PATHAK- DM

Y-O-Y GROWTH% POSITION GAP TO

PARAMETERS

ACTUAL ACTUAL ACTUAL ACTUAL TARGET ACTUAL ACH% TARGET

GROWTH OVER ON MAR'19

MAR'17 MAR'18

%

JUNE'18 SEPT'18 DEC'18 DEC'18 DEC'18 MAR'18 MAR'19 27/03/19 TARGET

TOTAL BUSINESS 6.50 9.42 44.80% 10.03 9.93 10.68 10.81 ACH 14.83% 11.16 10.87 -0.29

CURRENT DEPOSIT 0.13 0.17 28.57% 0.22 0.16 0.18 0.21 ACH 21.23% 0.18 0.34 ACH

SAVINGS BANK DEPOSIT 3.76 5.58 48.54% 6.05 5.93 6.31 6.66 ACH 19.30% 6.61 6.36 -0.25

CASA DEPOSITS 3.89 5.75 47.85% 6.27 6.09 6.49 6.87 ACH 19.36% 6.80 6.71 -0.09

AVERAGE CASA 2.92 4.55 56.18% 5.90 5.84 5.45 6.07 ACH 33.30% 5.56 6.19 ACH

% CASA TO AGG. DEP 74.83% 74.79% 75.58% 75.18% 75.44% 77.38% 75.85% 75.60%

RETAIL TERM DEPOSITS 1.31 1.94 48.16% 2.03 2.01 2.11 2.01 39.33% 3.51% 2.16 2.15 -0.01

AGGREGATE DEPOSITS 5.20 7.69 47.93% 8.29 8.10 8.60 8.87 ACH 15.37% 8.96 8.87 -0.09

AVERAGE DEPOSITS 3.99 6.15 54.28% 7.98 7.89 8.14 8.11 99.64% 31.91% 8.27 8.26 -0.01

No. of Quality Fresh CASA a/cs

14 128 447 268 59.96% 596 378 -218

opened

ADVANCES PORTFOLIO

Y-O-Y GROWTH% POSITION GAP TO

ACTUAL ACTUAL ACTUAL ACTUAL TARGET ACTUAL ACH% TARGET

PARAMETERS GROWTH OVER ON MAR'19

MAR'17 MAR'18 JUNE'18 SEPT'18 DEC'18 DEC'18 DEC'18 MAR'18 MAR'19 22/03/19

% TARGET

GROSS ADVANCES 1.30 1.73 32.33% 1.73 1.83 2.08 1.94 60.73% 12.42% 2.20 2.00 -0.19

AVERAGE ADVANCES 0.96 1.48 54.00% 1.69 1.72 1.89 1.75 92.44% 18.30% 1.96 1.78 -0.19

PRIORITY CREDIT 1.05 1.47 40.21% 1.46 1.55 1.72 1.69 86.11% 14.58% 1.80 1.68 -0.12

AGRICULTURE CREDIT 0.77 1.03 33.74% 1.04 1.02 1.12 1.15 ACH 12.41% 1.16 1.11 -0.05

MSME CREDIT 0.28 0.45 57.80% 0.42 0.53 0.54 0.53 90.03% 19.59% 0.56 0.56 ACH

CD RATIO 25.07% 22.43% 20.90% 22.58% 24.16% 21.86% 24.52% 22.58%

RETAIL LENDING (15.03.19) 0.44 0.50 13.22% 0.47 0.40 0.55 0.37 NEG NEG 0.58 0.46 -0.13

HOUSING LOAN #DIV/0! ACH #DIV/0! ACH

VEHICLE LOAN 0.20 0.23 13.50% 0.20 0.17 0.27 0.15 NEG NEG 0.28 0.22 -0.05

OTHER PERSONAL LOAN 0.24 0.27 13.00% 0.28 0.22 0.29 0.23 NEG NEG 0.31 0.23 -0.07

EDUCATION LOAN #DIV/0! ACH #DIV/0! ACH

ASSET QUALITY

Y-O-Y POSITION GAP TO

ACTUAL ACTUAL ACTUAL ACTUAL TARGET ACTUAL ACH%

NPA & CASH RECOVERY INCR/ TARGET MAR'19 ON MAR'19

MAR'17 MAR'18 JUNE'18 SEPT'18 DEC'18 DEC'18 DEC'18 16/03/19

DECR TARGET

NPA 0.04 0.01 0.03 0.02 0.02 0.02 NEG 0.03 -0.03

CASH RECOVERY 0.06 0.11 0.05 0.02 0.03 0.01 0.04 ACH 0.01 0.05 ACH

RECOVERY under D4/LOSS & W/O

Accounts (in Lakhs)

0.29 0.57 0.53 0.72 ACH 0.76 0.73 -0.03

MAR'18 JUN'18 SEPT'18 DEC'18 INCR / DECR OVER

EFFICIENCY RATIO

NPA % to MAR'18

TARGET ACTUAL

Gross Advances 0.67% 1.43% 1.23% 1.13% -0.46% PARAMETERS

DEC'18 DEC'18

ACH%

GOVERNMENT INITIATIVE TARGET ACTUAL ACH% TARGET GAP TO

MAR'19 COST TO INCOME

PARAMETERS DEC'18 DEC'18 DEC18 MAR'19

TARGET 39.50% 43.53% NOT ACH

RATIO

APY 60 15 -45

PMJJBY 73 16 -57 BURDEN EFFICIENCY

19.46% 22.60% ACH

PMSBY 151 17 -134 RATIO

PROFITABILITY PARAMETERS (Amount in Lakhs) SB GOLD MEDAL CONTEST

ACTUAL ACTUAL ACTUAL TARGET ACTUAL ACH% TARGET POSITION ON GAP TO PHASE - II

PARAMETERS MAR'18 JUN'18 SEP'18 DEC'18 DEC'18 MAR'19 18.03.2019 MAR'19 TGT (19.11.18 to 21.12.18)

DEC'18

COST OF DEPOSITS (%) 4.53% 4.33% 4.22% 4.47% 4.24% ACH TOTAL QUALITY CASA

ACCOUNTS OPENED 85

YIELD ON ADVANCES (%) 10.09% 9.15% 9.30% 8.48% 10.06% ACH

BOOK PROFIT -27.68 -8.32 -15.86 -28.28 -23.21 ACH -37.56 -29.50 ACH TOTAL CASA MOBILIZED

(in Lakhs) 1.23

NON-INTEREST INCOME 3.81 0.85 2.13 2.55 3.09 ACH 3.67 4.26 ACH

INTEREST INCOME 14.89 3.86 8.00 12.02 13.17 ACH 17.04 16.43 -0.61 RTD FIESTA POSITION

OTHER OPERATING EXPENSES 6.08 -3.02 2.97 4.71 4.79 Not Ach 6.28 5.83 ACH TARGET ACHV GAP

Profit /Loss after HO interest 10.12 13.88 17.72 ACH 100 5.45 -94.55

TECHNOLOGY PRODUCTS ASSOCIATE PRODUCTS (Rs. in lacs)

ACTUAL ACTUAL TARGET ACTUAL ACH% TARGET ACTUAL TARGET ACTUAL ACH% TARGET

PARAMETERS PARAMETER

JUN'18 SEPT'18 DEC'18 DEC'18 DEC'18 MAR'19 SEPT'18 DEC'18 DEC'18 DEC18 MAR'19

DEBIT CARDS Life Ins. 0.73 1.38 0.73 52.45% 1.98

CREDIT CARDS 2 2 3 10 ACH 4 MF (NNM) 0.58 5.16 0.86 16.66% 6.19

MOBILE BANKING CUST. 89 95 85 99 ACH 125 Health Ins. 0.25 0.31 0.43 ACH 0.47

INTERNET BANKING CUST. 48 50 51 53 ACH 53 Gen. Ins 0.09 1.63 0.10 6.25% 2.17

Merchant On - Boarding TOTAL 1.64 8.48 2.12 24.96% 10.81

New CASA Accounts Opened Inoperative Accounts Status

FRESH CREDIT SANCTIONS (from 01.04.2018 TO 31.12.2018) (As on 31.12.2018)

TARGET ACTUAL ACH% TARGET GAP TO SB Amt CA Amt SB CA % of

PARAMETERS SB A/cs CA A/cs

DEC'18 DEC'18 DEC18 MAR'18 MAR'19 Mobilized Mobilized Inoperative Inoperative Inoperative

AGRICULTURE 75 24 32.00% 101 -77 accounts

MSME 10 10 ACH 14 -4

559 17.35 12 -6.75 1399 2 12.89%

RETAIL LENDING 15 6 40.00% 20 -14

TOTAL FRESH SANCTIONS 100 40 40.00% 135 -95

*Average Data Updated till 28/02/2019

** Retail Lending Updated Till 08/03/2019 & Other Core Business Updated Till 11/03/2019

También podría gustarte

- DCFTemplateDocumento5 páginasDCFTemplateRob Keith100% (1)

- 0001 CatDocumento108 páginas0001 CatJorge CabreraAún no hay calificaciones

- Quantamental Research - ITC LTDDocumento1 páginaQuantamental Research - ITC LTDsadaf hashmiAún no hay calificaciones

- Bi-Monthly Sales SSM v2 0Documento5 páginasBi-Monthly Sales SSM v2 0api-19650311Aún no hay calificaciones

- Tracking KPI HO Ytd Mar 2021 - Infra Workshop Rev 2Documento475 páginasTracking KPI HO Ytd Mar 2021 - Infra Workshop Rev 2daniel siahaanAún no hay calificaciones

- ABS Part4 - Vessel Systems & Machinery - 2001Documento710 páginasABS Part4 - Vessel Systems & Machinery - 2001AndréMenezesAún no hay calificaciones

- S 01 13 III EconomicsDocumento24 páginasS 01 13 III EconomicsshreeshlkoAún no hay calificaciones

- HSBC Technology Manifesto Vision for Healthy CultureDocumento15 páginasHSBC Technology Manifesto Vision for Healthy CulturearpannathAún no hay calificaciones

- Amazon Copywriting Secrets How Everyone Can Use The Power of Words To Get More Clicks Sales and P20200309 62415 1he8taq PDFDocumento4 páginasAmazon Copywriting Secrets How Everyone Can Use The Power of Words To Get More Clicks Sales and P20200309 62415 1he8taq PDFarpannath0% (3)

- 06wk48 - CSSR Improvement Fach Power Trial Phase II - VDF UKDocumento19 páginas06wk48 - CSSR Improvement Fach Power Trial Phase II - VDF UKsyedAún no hay calificaciones

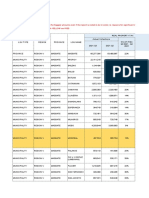

- Performance of The Branch: Advances PortfolioDocumento1 páginaPerformance of The Branch: Advances PortfolioarpannathAún no hay calificaciones

- Branch FormatDocumento1 páginaBranch FormatShweta YaragattiAún no hay calificaciones

- Mis Oct KarDocumento2 páginasMis Oct Karsyed roshanAún no hay calificaciones

- Talwalkars Better Value Fitness Limited BSE 533200 FinancialsDocumento36 páginasTalwalkars Better Value Fitness Limited BSE 533200 FinancialsraushanatscribdAún no hay calificaciones

- BLUE STAR LTD - Quantamental Equity Research Report-1Documento1 páginaBLUE STAR LTD - Quantamental Equity Research Report-1Vivek NambiarAún no hay calificaciones

- BAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTDocumento1 páginaBAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTVivek NambiarAún no hay calificaciones

- Analisis FinancieroDocumento124 páginasAnalisis FinancieroJesús VelázquezAún no hay calificaciones

- Result Presentation (Result)Documento14 páginasResult Presentation (Result)Shyam SunderAún no hay calificaciones

- Performance Analysis Q4: FY 2018-19: Relationship Beyond BankingDocumento38 páginasPerformance Analysis Q4: FY 2018-19: Relationship Beyond Bankingarti guptaAún no hay calificaciones

- Chetanbhai PatelDocumento8 páginasChetanbhai Patelservice.remehsanaAún no hay calificaciones

- 1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationDocumento8 páginas1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationJAún no hay calificaciones

- Progress Billing No 17 Pl-EvaluatedDocumento212 páginasProgress Billing No 17 Pl-EvaluatedLuzon ThorinAún no hay calificaciones

- Performance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Documento37 páginasPerformance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Mahesh DhalAún no hay calificaciones

- Year-To-Date: January - March 2018Documento10 páginasYear-To-Date: January - March 2018Erlyn Jamaica SantosAún no hay calificaciones

- Canara Rob Emerging Equitties FundDocumento1 páginaCanara Rob Emerging Equitties Fundjaspreet AnandAún no hay calificaciones

- Listed Companies Highlights: Financial FocusDocumento1 páginaListed Companies Highlights: Financial FocusT'Tee MiniOns'TmvsAún no hay calificaciones

- CEA March 2022Documento45 páginasCEA March 2022Sumiran BansalAún no hay calificaciones

- ADRO Energy Company Profile and Financial RatiosDocumento1 páginaADRO Energy Company Profile and Financial RatiosfajarAún no hay calificaciones

- Business Review (Month/Year) JUNE 2022: Name of CLUSTERDocumento41 páginasBusiness Review (Month/Year) JUNE 2022: Name of CLUSTERVinch Samuel AchacosoAún no hay calificaciones

- Accounting For Managers: Report Over The Financial Performance of JB HifiDocumento8 páginasAccounting For Managers: Report Over The Financial Performance of JB HifiMah Noor FastNUAún no hay calificaciones

- Invesco India Corporate Bond Fund (G)Documento3 páginasInvesco India Corporate Bond Fund (G)paresh vAún no hay calificaciones

- 01 Kpi Individual - Staff Ga - M Rajib - (Juli - September)Documento7 páginas01 Kpi Individual - Staff Ga - M Rajib - (Juli - September)Polaris YudaAún no hay calificaciones

- CEA Northern Region Electricity Generation ReportDocumento45 páginasCEA Northern Region Electricity Generation ReportPrabhjot Singh SahiAún no hay calificaciones

- Sample Budget 2023-24Documento14 páginasSample Budget 2023-24Rituraj UtsavAún no hay calificaciones

- 3Q18 Income Declines On Lowest VIP Hold Rate Since 2014: Bloomberry Resorts CorporationDocumento8 páginas3Q18 Income Declines On Lowest VIP Hold Rate Since 2014: Bloomberry Resorts CorporationJajahinaAún no hay calificaciones

- Daily 01-05-2023Documento1 páginaDaily 01-05-2023Andi RiyantoAún no hay calificaciones

- BCP - UPDATE A123 Q4 - 16 NOV 2020Documento6 páginasBCP - UPDATE A123 Q4 - 16 NOV 2020prasprisprosAún no hay calificaciones

- Performance During Q4: FY17-18: The Star ShineDocumento38 páginasPerformance During Q4: FY17-18: The Star Shinearti guptaAún no hay calificaciones

- Bcel 2019Q1Documento1 páginaBcel 2019Q1Dương NguyễnAún no hay calificaciones

- Max S Group Inc PSE MAXS FinancialsDocumento36 páginasMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniAún no hay calificaciones

- MTAR Technologies LTD Financial Results and Price Chart - ScreenerDocumento4 páginasMTAR Technologies LTD Financial Results and Price Chart - ScreenerAbi TestAún no hay calificaciones

- Revenue and EBITDA Forecast AnalysisDocumento8 páginasRevenue and EBITDA Forecast AnalysisSouliman MuhammadAún no hay calificaciones

- DuPont AnalysingDocumento2 páginasDuPont AnalysingNiharika GuptaAún no hay calificaciones

- Report RajgirDocumento1 páginaReport RajgirAyush JhaAún no hay calificaciones

- MARCH2020finalDocumento37 páginasMARCH2020finalRohit AggarwalAún no hay calificaciones

- 2019 March NEW REPORT FORMAT - STOREDocumento78 páginas2019 March NEW REPORT FORMAT - STOREKay Kay KaelAún no hay calificaciones

- Sharekhan Morning Tiger (Pre Market Insight) 28 July 2023Documento10 páginasSharekhan Morning Tiger (Pre Market Insight) 28 July 2023Vivek BishtAún no hay calificaciones

- Laporan Pencapaian Harian: Pt. Pinus Merah Abadi - BojonegoroDocumento1 páginaLaporan Pencapaian Harian: Pt. Pinus Merah Abadi - BojonegoroSakaRahardianAún no hay calificaciones

- Y-O-Y Sales Growth % 18% 19% 12% 10% 1% 9% 2% 11% 2% - 2%Documento7 páginasY-O-Y Sales Growth % 18% 19% 12% 10% 1% 9% 2% 11% 2% - 2%muralyyAún no hay calificaciones

- RNF 3Documento2 páginasRNF 3Muhammad HanifAún no hay calificaciones

- YTD (Actual) Curent Year (Actual)Documento12 páginasYTD (Actual) Curent Year (Actual)Vikas SharmaAún no hay calificaciones

- Asset Management Companies: Date: 20 February, 2020Documento34 páginasAsset Management Companies: Date: 20 February, 2020Ikp IkpAún no hay calificaciones

- Straco Corporation Limited SGX S85 FinancialsDocumento80 páginasStraco Corporation Limited SGX S85 FinancialsP.RaviAún no hay calificaciones

- Vikas Bhola Family: Portfolio Performance Report - Aggregated ViewDocumento15 páginasVikas Bhola Family: Portfolio Performance Report - Aggregated ViewVikas BholaAún no hay calificaciones

- Central Electricity Authority Go&Dwing Operation Performance Monitoring DivisionDocumento45 páginasCentral Electricity Authority Go&Dwing Operation Performance Monitoring DivisionJayBajrangAún no hay calificaciones

- Indian Overseas BankDocumento43 páginasIndian Overseas Bankkrishna_buntyAún no hay calificaciones

- Financial Ratio Analysis of ABC CompanyDocumento4 páginasFinancial Ratio Analysis of ABC CompanyObaid KhanAún no hay calificaciones

- Masbate Q3 2021Documento34 páginasMasbate Q3 2021Monreal Municipal TreasurerAún no hay calificaciones

- Avanza G 2018 MT BMDocumento13 páginasAvanza G 2018 MT BMMarzuki SinurayaAún no hay calificaciones

- BS English Delhi 17-11-2023Documento19 páginasBS English Delhi 17-11-2023Anurag SinghAún no hay calificaciones

- BHDFHKVHDFJJHDocumento1 páginaBHDFHKVHDFJJHerosennin2006Aún no hay calificaciones

- Tesla Financials and ValuationDocumento36 páginasTesla Financials and ValuationSuyash KelaAún no hay calificaciones

- 2020 11 18 PH e Meg PDFDocumento8 páginas2020 11 18 PH e Meg PDFJAún no hay calificaciones

- Weekly Pro. November.1th WeekDocumento5 páginasWeekly Pro. November.1th Weeklight of moonAún no hay calificaciones

- Pareto Diagram: Jumlah Inspeksi Kerusakan Dalam 3 BulanDocumento1 páginaPareto Diagram: Jumlah Inspeksi Kerusakan Dalam 3 BulandarnoAún no hay calificaciones

- NibDocumento1 páginaNibarpannathAún no hay calificaciones

- Help Manual For IOs Doing Inspection of Computerized Branches Updated Till 30th September 2008-1 PDFDocumento194 páginasHelp Manual For IOs Doing Inspection of Computerized Branches Updated Till 30th September 2008-1 PDFarpannathAún no hay calificaciones

- Reasoning TricksDocumento1 páginaReasoning TricksarpannathAún no hay calificaciones

- 1st Round Training 2011Documento91 páginas1st Round Training 2011arpannathAún no hay calificaciones

- MySQL database settings for WordPressDocumento1 páginaMySQL database settings for WordPressarpannathAún no hay calificaciones

- SLBCDocumento10 páginasSLBCarpannathAún no hay calificaciones

- Math TricksDocumento1 páginaMath TricksarpannathAún no hay calificaciones

- 5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19Documento1 página5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19arpannathAún no hay calificaciones

- 1971 PDFDocumento339 páginas1971 PDFarpannathAún no hay calificaciones

- SBI Recruitment of Specialist Cadre OfficersDocumento2 páginasSBI Recruitment of Specialist Cadre OfficersSekar MariappanAún no hay calificaciones

- Vision Ias - Material July August 2018Documento120 páginasVision Ias - Material July August 2018Anonymous DD1ICVZfoAún no hay calificaciones

- Art and Culture: Visual Arts and Architecture in Ancient IndiaDocumento103 páginasArt and Culture: Visual Arts and Architecture in Ancient IndiaarpannathAún no hay calificaciones

- E-Lock Installation GuideDocumento9 páginasE-Lock Installation GuidearpannathAún no hay calificaciones

- Subject (01) ECONOMICS: Ugc - Net Exam June 2013 DATE OF EXAM:30/06/2013 Keys - Paper 2Documento1 páginaSubject (01) ECONOMICS: Ugc - Net Exam June 2013 DATE OF EXAM:30/06/2013 Keys - Paper 2arpannathAún no hay calificaciones

- Canara Bank officer permission to operate from third placeDocumento1 páginaCanara Bank officer permission to operate from third placearpannathAún no hay calificaciones

- Agri Snap Shot 2013 222 QuestionsDocumento9 páginasAgri Snap Shot 2013 222 QuestionsarpannathAún no hay calificaciones

- Architecture of Aadhaar Payment SystemDocumento1 páginaArchitecture of Aadhaar Payment SystemarpannathAún no hay calificaciones

- Cboa Descriptive MsmeDocumento32 páginasCboa Descriptive MsmearpannathAún no hay calificaciones

- LLP Master Data3Documento1 páginaLLP Master Data3arpannathAún no hay calificaciones

- 1 Retail LendingDocumento7 páginas1 Retail LendingarpannathAún no hay calificaciones

- IT FormsDocumento2 páginasIT FormsarpannathAún no hay calificaciones

- Siva MantraDocumento5 páginasSiva MantraarpannathAún no hay calificaciones

- IIESTDocumento4 páginasIIESTarpannathAún no hay calificaciones

- Jaiib BreakthroughDocumento3 páginasJaiib BreakthrougharpannathAún no hay calificaciones

- CrazycommandDocumento2 páginasCrazycommandarpannathAún no hay calificaciones

- MSE 2103 - Lec 12 (7 Files Merged)Documento118 páginasMSE 2103 - Lec 12 (7 Files Merged)md akibhossainAún no hay calificaciones

- Homework 5 - 2020 - 01 - v3 - YH (v3) - ALV (v2)Documento5 páginasHomework 5 - 2020 - 01 - v3 - YH (v3) - ALV (v2)CARLOS DIDIER GÓMEZ ARCOSAún no hay calificaciones

- RESEARCH PROPOSAL-Final AfraaaazzzzzzzzzDocumento13 páginasRESEARCH PROPOSAL-Final AfraaaazzzzzzzzzRizwan Abdul Maalik50% (2)

- Human Resources Management Article Review On "The 3 Essential Jobs That Most Retention Programs Ignore"Documento14 páginasHuman Resources Management Article Review On "The 3 Essential Jobs That Most Retention Programs Ignore"Pang Kok ShengAún no hay calificaciones

- Somali Guideline of InvestorsDocumento9 páginasSomali Guideline of InvestorsABDULLAHI HAGAR FARAH HERSI STUDENTAún no hay calificaciones

- Schneider - Cptg010 en (Print)Documento16 páginasSchneider - Cptg010 en (Print)el_koptan00857693Aún no hay calificaciones

- Buhos SummaryDocumento1 páginaBuhos Summaryclarissa abigail mandocdocAún no hay calificaciones

- Flashover Influence of Fog Rate On The Characteristics of Polluted Silicone Rubber InsulatorsDocumento5 páginasFlashover Influence of Fog Rate On The Characteristics of Polluted Silicone Rubber InsulatorsdaaanuAún no hay calificaciones

- Secondary AssessmentsDocumento12 páginasSecondary Assessmentsapi-338389967Aún no hay calificaciones

- Darnell's Father Goes StrictDocumento2 páginasDarnell's Father Goes StrictDavid Theodore Richardson IIIAún no hay calificaciones

- Otology Fellowships 2019Documento5 páginasOtology Fellowships 2019Sandra SandrinaAún no hay calificaciones

- Presente Continuo Present ContinuosDocumento4 páginasPresente Continuo Present ContinuosClaudio AntonioAún no hay calificaciones

- Accuracy of Real-Time Shear Wave Elastography in SDocumento10 páginasAccuracy of Real-Time Shear Wave Elastography in SApotik ApotekAún no hay calificaciones

- Edna Adan University ThesisDocumento29 páginasEdna Adan University ThesisAbdi KhadarAún no hay calificaciones

- IOSA Self Evaluation Form - 31 October 2014Documento45 páginasIOSA Self Evaluation Form - 31 October 2014pknight2010Aún no hay calificaciones

- Byk-A 525 enDocumento2 páginasByk-A 525 enさいとはちこAún no hay calificaciones

- Requirement & Other Requirement: 2.311 Procedure For Accessing Applicable LegalDocumento2 páginasRequirement & Other Requirement: 2.311 Procedure For Accessing Applicable Legalkirandevi1981Aún no hay calificaciones

- Guide To Admissions 2024-25Documento159 páginasGuide To Admissions 2024-25imayushx.inAún no hay calificaciones

- Lesson 8 - Philippine Disaster Risk Reduction and Management SystemDocumento11 páginasLesson 8 - Philippine Disaster Risk Reduction and Management SystemMary Joy CuetoAún no hay calificaciones

- Mechanical Thrombectomy For Acute Ischemic StrokeDocumento19 páginasMechanical Thrombectomy For Acute Ischemic StrokeCarlos Alfredo Vargas QuinteroAún no hay calificaciones

- Regional Ecology Test ScoringDocumento14 páginasRegional Ecology Test Scoringaisyah Wardah201Aún no hay calificaciones

- Compensation and BenefitsDocumento8 páginasCompensation and BenefitsOthman FaroussiAún no hay calificaciones

- IC 33 Question PaperDocumento12 páginasIC 33 Question PaperSushil MehraAún no hay calificaciones

- TSB 20230831 - Reconnect FATL WM Error Code & Troubleshooting GuideDocumento6 páginasTSB 20230831 - Reconnect FATL WM Error Code & Troubleshooting GuideNavjot KaurAún no hay calificaciones

- HBV Real Time PCR Primer Probe Sequncence PDFDocumento9 páginasHBV Real Time PCR Primer Probe Sequncence PDFnbiolab6659Aún no hay calificaciones

- Rawat Inap Rumah Sakit Santa Elisabeth Medan Englin Moria K. Tinambunan, Lindawati F. Tampubolon, Erika E. SembiringDocumento14 páginasRawat Inap Rumah Sakit Santa Elisabeth Medan Englin Moria K. Tinambunan, Lindawati F. Tampubolon, Erika E. SembiringafrilianaAún no hay calificaciones

- Ficha Tecnica StyrofoamDocumento2 páginasFicha Tecnica StyrofoamAceroMart - Tu Mejor Opcion en AceroAún no hay calificaciones