Documentos de Académico

Documentos de Profesional

Documentos de Cultura

39759

Cargado por

MonikaDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

39759

Cargado por

MonikaCopyright:

Formatos disponibles

Chandan Poddar

Test

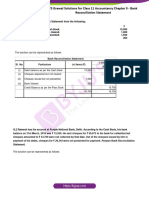

Bank Reconciliation Statement

Q.1 . From the following information, prepare Bank Reconciliation Statement as on 31st

March, 2018: 5

i) Balance as per Cash Book as on 31st March, 2018 Rs.12,000.

ii) Balance as per Bank Statement as on the date Rs.15,600.

iii) Out of the total cheques amounting to Rs.10,000 issued, cheques aggregating Rs.3,000

were encashed in March, 2018, cheques aggregating Rs.4,000 were encashed in April,

2018 and the rest have not been presented yet.

iv) Out of the total cheques amounting to Rs.5,000 deposited, cheques aggregating

Rs.1,500 were credited in March, 2018, and balance cheques were credited in April,

2018.

v) Bank has debited Rs.100 as bank charges and has credited Rs.200 as interest.

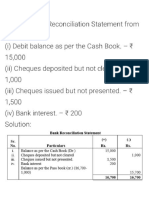

Q.2 . Prepare Bank Reconciliation Statement from the following particulars on 30th June,

2018: 5

Bank statement showed a favourable balance of Rs.9,214.

i) On 29th June, 2018 bank credited a sum of Rs.1,650 in error.

ii) Certain cheques, valued at Rs.4,500 issued before 29th June, 2018 were not cleared.

iii) A hire purchase payment of Rs.950, made by a standing order was not entered in the

Cash Book.

iv) A cheque of Rs.600 received, deposited and credited by bank, was accounted as a

receipt in the cash column of the Cash Book.

v) Other cheques for Rs.8,500 were deposited in June but cheques for Rs.6,000 only

were cleared by the bankers.

Q.3 Prepare Bank Reconciliation Statement as on 30th June, 2018 for Jyoti Sales Private

Limited from the information given below: 5

Rs.

(i) Bank overdraft as per Cash Book on 30th June, 2018. 1,10,450

(ii) Cheques issued on 20th June, 2018 but not yet presented. 15,000

(iii) Cheques deposited but not yet credited by the bank. 22,750

(iv) Bills for collection not advised by the bank but credited to the account. 47,200

(v) Interest debited by the bank on 27th June, 2018 but no advice received. 12,115

(vi) Subsidy received from the authorities by the bank on our behalf,

credited to the account. 22,000

(vii) Amount wrongly debited by the bank. 2,400

(viii) Amount wrongly credited by the bank. 5,000

YouTube Channel – Grooming Education Academy 99536 33448, 87502 77038

Chandan Poddar

Q. 4 From the following particulars, prepare Bank Reconciliation Statement as on 31st

March, 2018: 5

i) Balance as per Pass Book on 31st March, 2018 overdrawn Rs.80,000.

ii) Cheques drawn on 25th March, 2018 but not presented for payment till April, 2018

Rs.15,000; Rs.5,000 and Rs.8,000.

iii) Interest on bank overdraft not entered in the Cash Book Rs.2,000.

iv) Outstation cheque Rs.30,000 deposited into bank but collected in April, 2018.

v) Rs.10,000 Insurance premium paid by the bank as per the trader’s standing

instructions has not been entered in the Cash Book.

vi) Chamber of Commerce fee Rs.3,000 paid by the bank for traders but not recorded

in the Cash Book

vii) Collection charges of Rs.1,000 charged by the bank but not entered in the Cash Book.

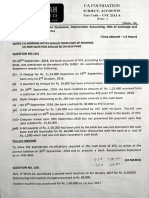

Q.5 My bank Pass Book for Account No. 1 shows an overdraft of Rs.65,000 on 31st March,

2018. This does not match with the Cash Book balance which shows debit balance of

Rs.17,800. Following differences were noted between Pass Book and Cash Book:

Cheques amounting to Rs.1,50,000 were paid into the bank in March out of which only

cheques amounting to Rs.45,000 were credited by the bank. Cheques issued during March

amounted in all to Rs.1,10,000. Out of these, cheques for Rs.30,000 were unpaid on 31st

March, 2018. The bank has wrongly debited Account No. 1 with Rs.5,000 in respect of a

cheque drawn on Account No. 2. The Account is debited with Rs.1,500 for interest and with

Rs.300 for bank charges. The bank has paid annual subscription of Rs.1,000 to my club

according to my instructions. The entries for interest, bank charges and subscription have

not yet been recorded in the Cash Book.

Prepare Bank Reconciliation Statement. 5

Q.6 On 30th December, 2017 the bank column of A. Philip’s cash book showed a debit balance

of ` 4,610. On examination of the cash book and bank statement you find that:

i) Cheques amounting to ` 6,30,000 which were issued to trade payables and entered in

the cash book before 30th December, 2017 were not presented for payment until that

date.

ii) Cheques amounting to ` 2,50,000 had been recorded in the cash book as having been

paid into the bank on 30th December, 2017, but were entered in the bank statement

on1st January, 2018.

iii) A cheque for ` 73,000 had been dishonoured prior to 30th December, 2017, but no

record of this fact appeared in the cash book.

iv) A dividend of ` 3,80,000, paid direct to the bank had not been recorded in the cash

book.

v) Bank interest and charges amounting to ` 4,200 had been charged in the bank

statement but not entered in the cash book.

YouTube Channel – Grooming Education Academy 99536 33448, 87502 77038

Chandan Poddar

vi) No entry had been made in the cash book for a trade subscription of ` 10,000 paid

vide banker’s order in November, 2017.

vii) A cheque for `27,000 drawn by B. Philip had been charged to A. Philip’s bank account

by mistake in December, 2017.

You are required:

a) to make appropriate adjustments in the cash book bringing down the correct balance,

and

b) to prepare a statement reconciling the adjusted balance in the cash book with the

balance shown in the bank statement. 5

YouTube Channel – Grooming Education Academy 99536 33448, 87502 77038

También podría gustarte

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDe EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAún no hay calificaciones

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsDe EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsAún no hay calificaciones

- Q-10 Prepare Bank Reconciliation Statement As On 31Documento2 páginasQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaAún no hay calificaciones

- BRS PDFDocumento14 páginasBRS PDFGautam KhanwaniAún no hay calificaciones

- BRS Practice QuestionsDocumento2 páginasBRS Practice Questionssyed ali raza kazmiAún no hay calificaciones

- SET B 11th Acc BRS N RECT.Documento2 páginasSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariAún no hay calificaciones

- 0c26dbank Reconciliation Statement Practice QuestionsDocumento2 páginas0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalAún no hay calificaciones

- 6 BRS 08-2023 RegularDocumento7 páginas6 BRS 08-2023 RegularjahnaviAún no hay calificaciones

- Business Acoounting (2020)Documento4 páginasBusiness Acoounting (2020)harshdeepgarg5Aún no hay calificaciones

- Bank Reconciliaton Statement Practice Questions: ST ST STDocumento2 páginasBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelAún no hay calificaciones

- BRS Statement IllustrationsDocumento3 páginasBRS Statement Illustrationssurekha khandebharadAún no hay calificaciones

- Tsgrewal BRSDocumento11 páginasTsgrewal BRSDhruvAún no hay calificaciones

- Worksheet BRSDocumento2 páginasWorksheet BRSCA Chhavi Gupta100% (1)

- Accountancy XI: Pankaj Rajan 9810194206Documento4 páginasAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhAún no hay calificaciones

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocumento4 páginasSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanAún no hay calificaciones

- CA F BRS WithDocumento10 páginasCA F BRS WithG. DhanyaAún no hay calificaciones

- Dkgoel BRS 11Documento15 páginasDkgoel BRS 11DhruvAún no hay calificaciones

- BRS RevisionDocumento2 páginasBRS RevisionHarsh ModiAún no hay calificaciones

- Bank Reconciliation StatementDocumento12 páginasBank Reconciliation StatementBhuvan PrajapatiAún no hay calificaciones

- Accountancy XI Half Yearly WorksheetDocumento8 páginasAccountancy XI Half Yearly WorksheetDeivanai K CSAún no hay calificaciones

- BRS WSDocumento2 páginasBRS WSShrajith A NatarajanAún no hay calificaciones

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocumento34 páginasTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9Aún no hay calificaciones

- WS - Xi BRS - 2Documento5 páginasWS - Xi BRS - 2richshivamshahAún no hay calificaciones

- FA1 Bank ReconciliationDocumento4 páginasFA1 Bank Reconciliationamir100% (1)

- Ch-3 BRSDocumento8 páginasCh-3 BRSAFTAB KHANAún no hay calificaciones

- Exercises of Bank Reconciliation Statement: Exercise No. IDocumento9 páginasExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliAún no hay calificaciones

- Baf1201 Financial Accounting I CatDocumento5 páginasBaf1201 Financial Accounting I CatcyrusAún no hay calificaciones

- Practice With MT - BRSDocumento6 páginasPractice With MT - BRSsrushtibhawsar07Aún no hay calificaciones

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Documento9 páginasWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiAún no hay calificaciones

- CA Foundation BRS Practice Questions - DRS - CTC ClassesDocumento2 páginasCA Foundation BRS Practice Questions - DRS - CTC ClassesAnas AzeemAún no hay calificaciones

- BRS Class 11Documento1 páginaBRS Class 11tarun aroraAún no hay calificaciones

- Test 4Documento6 páginasTest 4Jayant MittalAún no hay calificaciones

- Test Aldine FinalDocumento3 páginasTest Aldine FinalAkshay TulshyanAún no hay calificaciones

- Amazing RaceDocumento6 páginasAmazing RaceHanns Lexter PadillaAún no hay calificaciones

- Model Paper, Accountancy, XIDocumento13 páginasModel Paper, Accountancy, XIanyaAún no hay calificaciones

- Accounts - First Half TestDocumento4 páginasAccounts - First Half TestPeriyanan VAún no hay calificaciones

- Additional Practical Problems-13-1Documento5 páginasAdditional Practical Problems-13-1sharmaarmaan103Aún no hay calificaciones

- FINANCIAL ACCOUNTING - Cash To Receivables Problems and SolutionsDocumento8 páginasFINANCIAL ACCOUNTING - Cash To Receivables Problems and Solutionsstan iKONAún no hay calificaciones

- 06 SLLC - 2021 - Acc - Review Question - Set 03Documento7 páginas06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaAún no hay calificaciones

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocumento10 páginasPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaAún no hay calificaciones

- BRS Ca FoundationDocumento9 páginasBRS Ca FoundationJunaid Iqbal MastoiAún no hay calificaciones

- Accounting RevisionDocumento8 páginasAccounting RevisionAnish KanthetiAún no hay calificaciones

- Bank Reconciliation Statement AssignmentDocumento3 páginasBank Reconciliation Statement AssignmentDev KumarAún no hay calificaciones

- Class XI Acc SM Arya Annual 2023-24Documento5 páginasClass XI Acc SM Arya Annual 2023-24pandeyansh962Aún no hay calificaciones

- Navyug Commerce Institute Lakhanpur Kanpur Topic-B.R.SDocumento2 páginasNavyug Commerce Institute Lakhanpur Kanpur Topic-B.R.SparthAún no hay calificaciones

- Test of BRSDocumento3 páginasTest of BRSPervaiz AkhterAún no hay calificaciones

- Test Paper Ca FoundDocumento5 páginasTest Paper Ca FoundSarangapani KaliyamoorthyAún no hay calificaciones

- BRSDocumento3 páginasBRSAimen ImranAún no hay calificaciones

- K - J.K. Shah: TOPICS: Bank ReconclatlonDocumento3 páginasK - J.K. Shah: TOPICS: Bank ReconclatlonJpAún no hay calificaciones

- Ca Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 MinutesDocumento3 páginasCa Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 Minutesvanshikha.agarwal345Aún no hay calificaciones

- Cash N Cash Equivalent Problem Set 1Documento3 páginasCash N Cash Equivalent Problem Set 1Jamaica DavidAún no hay calificaciones

- Accounting Round 1Documento6 páginasAccounting Round 1Malhar ShahAún no hay calificaciones

- BRS PPT StudentDocumento26 páginasBRS PPT StudentgganyanAún no hay calificaciones

- 5.bank Reconcile Question and AnswerDocumento42 páginas5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Adobe Scan 05 Jan 2024Documento2 páginasAdobe Scan 05 Jan 2024Harshit GargAún no hay calificaciones

- Audit of Cash and Cash Equivalent Problem 1 (Adapted)Documento6 páginasAudit of Cash and Cash Equivalent Problem 1 (Adapted)Robelyn Asuna LegaraAún no hay calificaciones

- FINANCIAL ACCOUNITNG B.com-I Rizwan AnjumDocumento2 páginasFINANCIAL ACCOUNITNG B.com-I Rizwan AnjumsajidAún no hay calificaciones

- File 9563Documento29 páginasFile 9563dhananijeneelAún no hay calificaciones

- Good Shepherd International School, Ooty: Winter Holiday Homework 2018 - 19Documento4 páginasGood Shepherd International School, Ooty: Winter Holiday Homework 2018 - 19Aaryaman ModiAún no hay calificaciones

- 11 Sample Papers Accountancy 2020 English Medium Set 1 PDFDocumento13 páginas11 Sample Papers Accountancy 2020 English Medium Set 1 PDFpriyaAún no hay calificaciones

- SSCDocumento67 páginasSSCSukanya Ray100% (1)

- IDFC Subsidiaries AR 2016 17Documento380 páginasIDFC Subsidiaries AR 2016 17Kumar RajputAún no hay calificaciones

- Chapter03 001Documento39 páginasChapter03 001mamimomashesheAún no hay calificaciones

- PCAB Mandate Licensing and Registration - 60 PagesDocumento60 páginasPCAB Mandate Licensing and Registration - 60 PagesWilliam80% (5)

- Core Funding Strategies: What Are Core Costs?Documento8 páginasCore Funding Strategies: What Are Core Costs?oxade21Aún no hay calificaciones

- 01-Angadanan2020 Transmittal LettersDocumento14 páginas01-Angadanan2020 Transmittal LettersAlicia NhsAún no hay calificaciones

- Standard Request For ProposalDocumento55 páginasStandard Request For ProposalNasir R AyubAún no hay calificaciones

- PankajKumar - Business ExcellenceDocumento2 páginasPankajKumar - Business ExcellenceRenitaAún no hay calificaciones

- Case Study On Auditing (Satyam Computers LTD.)Documento10 páginasCase Study On Auditing (Satyam Computers LTD.)niti saxenaAún no hay calificaciones

- CompassGroup AR2016Documento176 páginasCompassGroup AR2016realm1902mAún no hay calificaciones

- خطوات المراجعة الخارجية مترجمDocumento34 páginasخطوات المراجعة الخارجية مترجمAbduh AfifAún no hay calificaciones

- Auditing Theory Cpa ReviewDocumento53 páginasAuditing Theory Cpa ReviewIvy Michelle Habagat100% (1)

- RESUME - Payam RahrowDocumento2 páginasRESUME - Payam RahrowPayam RahrowAún no hay calificaciones

- Chapter 24 Test Bank - CompressDocumento24 páginasChapter 24 Test Bank - Compresslender kent alicanteAún no hay calificaciones

- FT20 Internal Audit PlanDocumento5 páginasFT20 Internal Audit Plansanjeev kumarAún no hay calificaciones

- Chapter 06Documento30 páginasChapter 06Mss Faiza100% (1)

- Solutions Manual: Modern Auditing & Assurance ServicesDocumento17 páginasSolutions Manual: Modern Auditing & Assurance ServicessanjanaAún no hay calificaciones

- Chapter 7: Audit PlanningDocumento7 páginasChapter 7: Audit PlanningAngela RamosAún no hay calificaciones

- Annual Report 2014 PDFDocumento470 páginasAnnual Report 2014 PDFLen Len TanugrahaAún no hay calificaciones

- AP Municipal Budget ManualDocumento65 páginasAP Municipal Budget ManualSAtya GAndhiAún no hay calificaciones

- Danielle Jackson Resume 2Documento2 páginasDanielle Jackson Resume 2api-397506864Aún no hay calificaciones

- RuchisoyaDocumento561 páginasRuchisoyaHimal ThapaAún no hay calificaciones

- Olympic Industries LTD Annual Report 2017Documento127 páginasOlympic Industries LTD Annual Report 2017রাসেলআহমেদAún no hay calificaciones

- Org&mgt - q2 - Mod5 - Different Controling MethodsDocumento28 páginasOrg&mgt - q2 - Mod5 - Different Controling Methodsjohn_mateo50% (4)

- CE F3i 001 PDFDocumento24 páginasCE F3i 001 PDFhayarpiAún no hay calificaciones

- CIRCULAR No. 06/2016/TT-BKHDTDocumento22 páginasCIRCULAR No. 06/2016/TT-BKHDTAnonymous 7uoreiQKOAún no hay calificaciones

- Sue Reyer Joins Eva Garland Consulting As Director of Accounting and ComplianceDocumento2 páginasSue Reyer Joins Eva Garland Consulting As Director of Accounting and CompliancePR.comAún no hay calificaciones

- The December 31 2014 Balance Sheet of The Datamation PartnershipDocumento1 páginaThe December 31 2014 Balance Sheet of The Datamation PartnershipMuhammad ShahidAún no hay calificaciones

- Frauds - Classification and ReportingDocumento57 páginasFrauds - Classification and Reportingpadam_09Aún no hay calificaciones

- Sample Request For ProposalDocumento2 páginasSample Request For ProposalTey PanganAún no hay calificaciones