Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Loan Agreement Template 03

Cargado por

Yusuf Wahid0 calificaciones0% encontró este documento útil (0 votos)

243 vistas2 páginasThis simple loan agreement outlines the terms of a loan between a borrower and lender. The borrower promises to repay a principal amount plus interest within a set number of months. The agreement details repayment amounts and dates, penalties for late payments, what security is used for the loan, and consequences for defaulting on repayment.

Descripción original:

Agrement Spesial

Derechos de autor

© © All Rights Reserved

Formatos disponibles

DOCX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoThis simple loan agreement outlines the terms of a loan between a borrower and lender. The borrower promises to repay a principal amount plus interest within a set number of months. The agreement details repayment amounts and dates, penalties for late payments, what security is used for the loan, and consequences for defaulting on repayment.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

243 vistas2 páginasLoan Agreement Template 03

Cargado por

Yusuf WahidThis simple loan agreement outlines the terms of a loan between a borrower and lender. The borrower promises to repay a principal amount plus interest within a set number of months. The agreement details repayment amounts and dates, penalties for late payments, what security is used for the loan, and consequences for defaulting on repayment.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 2

SIMPLE LOAN AGREEMENT

1. Parties: The undersigned is ______________________, the Borrower, and the Lender is

_______________________________________.

2. Date of Agreement: ________________________________________________.

3. Promise to Pay: Within _____ months from today, Borrower promises to pay to

Lender_________________________ dollars ($_______) and interest as well as other

charges avowed below.

4. Accountability: Although this agreement may be signed below by more than one person, each of

the undersigned understands that they are each as individuals responsible and jointly and

severally liable for paying back the full amount.

5. Breakdown of Loan: Borrower will pay:

Amount of Loan: $__________

Other (Describe) $__________

Amount financed: $__________

Finance charge: $__________

Total of payments: $__________

ANNUAL PERCENTAGE RATE________________%

6. Repayment: Borrower will pay back in the following manner: Borrower will repay the amount of

this note in _____equal continuous monthly installments of $____________ each on the _____

day of each month preliminary on the _____day of _______, 20____, and ending on

_________, 20____.

7. Prepayment: Borrower has the right to pay back the whole exceptional amount at any time. If

Borrower pays before time, or if this loan is refinanced or replaced by a new note, Lender will

refund the unearned finance charge, figured by the Rule of 78-a commonly used formula for

figuring rebates on installment loans.

8. Late Charge: Any payment not remunerated within ten (10) days of its due date shall be subject

to a belatedly charge of 5% of the payment, not to exceed $____________ for any such late

installment.

9. Security: To protect Lender, Borrower gives what is known as a security interest or mortgage in:

[Describe:]

__________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

10. Default: If for any reason Borrower not succeeds to make any payment on time, Borrower shall

be in default. The Lender can then order instant payment of the entire remaining unpaid balance

of this loan, without giving anyone further notices. If Borrower has not paid the full amount of

the loan when the final payment is due, the Lender will charge Borrower interest on the unpaid

balance at ______ percent (%) per year.

11. Collection fees: If this note is placed with a legal representative for collection, then Borrower

agrees to pay an attorney's fee of fifteen percent (15%) of the voluntary balance. This fee will

be added to the unpaid balance of the loan.

12. Co-borrowers: Any Co-borrowers signing this agreement agree to be likewise accountable

with the borrower for this loan.

Agreed: ______________________________

Lender

________________________________ ______________________________

Borrower Borrower

También podría gustarte

- Promissory Note TemplateDocumento5 páginasPromissory Note TemplateJason AbanesAún no hay calificaciones

- Payment Installment AgreementDocumento5 páginasPayment Installment AgreementLhen TrinidadAún no hay calificaciones

- April Personal Loan AgreementDocumento4 páginasApril Personal Loan AgreementSheena JordanAún no hay calificaciones

- General SS AgreementDocumento10 páginasGeneral SS AgreementMay AdvAún no hay calificaciones

- BR1 - Board Resolution For Account Level Access - With Minutes of MeetingDocumento2 páginasBR1 - Board Resolution For Account Level Access - With Minutes of Meetingmy trainingAún no hay calificaciones

- DL Standard Terms of Engagement at 1 Nov 22Documento6 páginasDL Standard Terms of Engagement at 1 Nov 22Juliet DewhirstAún no hay calificaciones

- Loan Agreement Template SignaturelyDocumento3 páginasLoan Agreement Template SignaturelyQuốc ThịnhAún no hay calificaciones

- Repayment Agreement FormDocumento1 páginaRepayment Agreement FormbryanastollAún no hay calificaciones

- Rotating Saving and Credit Association (Rosca)Documento4 páginasRotating Saving and Credit Association (Rosca)Misheck D BandaAún no hay calificaciones

- Assignment of Partnership InterestDocumento4 páginasAssignment of Partnership InterestJoebell VillanuevaAún no hay calificaciones

- New York Property Management Agreement PDFDocumento12 páginasNew York Property Management Agreement PDFDrake MontgomeryAún no hay calificaciones

- Lease Takeover Notification FormDocumento1 páginaLease Takeover Notification FormNithish SajiAún no hay calificaciones

- Personal Loan Agreement: BetweenDocumento2 páginasPersonal Loan Agreement: BetweenAbarra MichelleAún no hay calificaciones

- Property Management AgreementDocumento4 páginasProperty Management AgreementCandy ValentineAún no hay calificaciones

- Maklumat Pinjaman Kereta - IslamicDocumento6 páginasMaklumat Pinjaman Kereta - IslamicIsham119Aún no hay calificaciones

- Investor AgreementDocumento4 páginasInvestor AgreementAshmika RajAún no hay calificaciones

- Wks SBD NCB Section 9Documento6 páginasWks SBD NCB Section 9Zeleke TaimuAún no hay calificaciones

- Referral AgreementDocumento4 páginasReferral AgreementFrances Athena BaraoidanAún no hay calificaciones

- Wholesale Real Estate Purchase ContractDocumento4 páginasWholesale Real Estate Purchase ContractansonAún no hay calificaciones

- Contract Personal SimpleDocumento8 páginasContract Personal SimpleRalp Anthony AustriaAún no hay calificaciones

- Loan Application Form - With Pretermination - 05092019Documento2 páginasLoan Application Form - With Pretermination - 05092019Theresa Martinez - EscarioAún no hay calificaciones

- Personal Loan Agreement: Page 1 of 3Documento3 páginasPersonal Loan Agreement: Page 1 of 3Azzia Morante LopezAún no hay calificaciones

- Sample Autosale2Documento6 páginasSample Autosale2nathaniel070% (1)

- Loan Agreement Template 27Documento3 páginasLoan Agreement Template 27Lavaniya 8363Aún no hay calificaciones

- PDF Template Master Service Agreement TemplateDocumento9 páginasPDF Template Master Service Agreement TemplateAlex Loredo GarciaAún no hay calificaciones

- Escrow AgreementDocumento3 páginasEscrow AgreementJamesbogan100% (1)

- Vehicle Lease AgreementDocumento10 páginasVehicle Lease AgreementregaraajaAún no hay calificaciones

- Credit Line AgreementDocumento2 páginasCredit Line AgreementPilar Joy BantoloAún no hay calificaciones

- Exclusive Right To Sell Listing AgreementDocumento9 páginasExclusive Right To Sell Listing Agreementj4dprints deocampoAún no hay calificaciones

- Da Clubhouse Events-2 1Documento6 páginasDa Clubhouse Events-2 1api-525965677Aún no hay calificaciones

- TEMPLATE Contract For Secured LoanDocumento6 páginasTEMPLATE Contract For Secured LoanHYIP NATIONAún no hay calificaciones

- Hire Purchase AgreementDocumento4 páginasHire Purchase AgreementJosphine WaruiAún no hay calificaciones

- Form of Performance SecurityDocumento2 páginasForm of Performance SecuritySagheer AhmedAún no hay calificaciones

- Home RentalDocumento2 páginasHome Rentalrlewis5699Aún no hay calificaciones

- At Will Employment ContractDocumento5 páginasAt Will Employment ContractPrem Raj TamangAún no hay calificaciones

- Assignment of Membership Interest and JoinderDocumento2 páginasAssignment of Membership Interest and JoinderAdriana Jisela Serrano SuarezAún no hay calificaciones

- Conditional Sale AgreementDocumento3 páginasConditional Sale AgreementmmleelaasAún no hay calificaciones

- Payday Loan PamphletDocumento2 páginasPayday Loan Pamphletrw helgesonAún no hay calificaciones

- Loan Agreement 3Documento1 páginaLoan Agreement 3Lj PolcaAún no hay calificaciones

- Admin Services Agreement SampleDocumento18 páginasAdmin Services Agreement SampleWayne B KademaungaAún no hay calificaciones

- Service Contract TemplateDocumento4 páginasService Contract TemplateLuminita IancAún no hay calificaciones

- Account Opening Form and Investment FormDocumento5 páginasAccount Opening Form and Investment FormEngr Muhammad Talha IslamAún no hay calificaciones

- Flooring ContractDocumento4 páginasFlooring ContractRocketLawyer100% (1)

- Full Conditional WaiverDocumento1 páginaFull Conditional WaiverChristopher HájekAún no hay calificaciones

- LoansDocumento64 páginasLoans9897856218Aún no hay calificaciones

- Example - Assignable Purchase AgreementDocumento2 páginasExample - Assignable Purchase AgreementRiangelli Exconde100% (1)

- Application For Insurance Agent'S License: (Under Chapter IV, Title I of The Insurance Code)Documento4 páginasApplication For Insurance Agent'S License: (Under Chapter IV, Title I of The Insurance Code)Cheeken CharliAún no hay calificaciones

- Indemnityagreement: Page 1 of 5Documento5 páginasIndemnityagreement: Page 1 of 5M KashifAún no hay calificaciones

- Confidentiality and Non-Disclosure Agreement TemplateDocumento3 páginasConfidentiality and Non-Disclosure Agreement TemplateKALIDASS KAún no hay calificaciones

- Law Partnership Agreement With Provisions For The Death, Retirement, Withdrawal, or Expulsion of A PartnerDocumento2 páginasLaw Partnership Agreement With Provisions For The Death, Retirement, Withdrawal, or Expulsion of A PartnerKaya YurtkuranAún no hay calificaciones

- Draft NDA 01.02.2018Documento4 páginasDraft NDA 01.02.2018Anonymous TNhYf7kAún no hay calificaciones

- Corporation Resolution To Open A Bank AccountDocumento2 páginasCorporation Resolution To Open A Bank AccountEdmond Aragon PareñasAún no hay calificaciones

- PDF Template Intellectual Property Agreement TemplateDocumento8 páginasPDF Template Intellectual Property Agreement TemplateAngelita MolanoAún no hay calificaciones

- Sample Loan ProposalDocumento24 páginasSample Loan ProposalFarhan TariqAún no hay calificaciones

- Payroll Services AgreementDocumento5 páginasPayroll Services AgreementAugustoAún no hay calificaciones

- Asset Management ContractDocumento4 páginasAsset Management ContractArchisha DharAún no hay calificaciones

- Deed of ConditionalDocumento2 páginasDeed of Conditionalsonia vallenteAún no hay calificaciones

- Lease Agreements Homestead RoadDocumento5 páginasLease Agreements Homestead Roadevans munakuAún no hay calificaciones

- Series A Share Purchase Agreement - Template-1Documento17 páginasSeries A Share Purchase Agreement - Template-1David Jay MorAún no hay calificaciones

- The Insider Secret of Business: Growing Successful Financially and ProductivelyDe EverandThe Insider Secret of Business: Growing Successful Financially and ProductivelyAún no hay calificaciones

- Soal Acept: VocabularyDocumento6 páginasSoal Acept: VocabularyYusuf WahidAún no hay calificaciones

- Simple Present TenseDocumento18 páginasSimple Present TenseYusuf WahidAún no hay calificaciones

- Lampiran Loan AgreementDocumento15 páginasLampiran Loan AgreementYusuf WahidAún no hay calificaciones

- Ino LBJDocumento20 páginasIno LBJYusuf WahidAún no hay calificaciones

- FRM-Quiz 8Documento2 páginasFRM-Quiz 8Mienh HaAún no hay calificaciones

- 12Documento8 páginas12Ishaq EssaAún no hay calificaciones

- Soal Asistensi Pertemuan 12Documento2 páginasSoal Asistensi Pertemuan 12Cut Farisa MachmudAún no hay calificaciones

- Midterms - Oblicon - 2019 - 1st SemDocumento2 páginasMidterms - Oblicon - 2019 - 1st SemVlad ReyesAún no hay calificaciones

- San Beda College of Law: Dividend in InsolvencyDocumento2 páginasSan Beda College of Law: Dividend in InsolvencyRachel LeachonAún no hay calificaciones

- Ap Receivables Quizzer507doc 2 PDF FreeDocumento20 páginasAp Receivables Quizzer507doc 2 PDF FreeRaymond ManalangAún no hay calificaciones

- Unsecured X Secured LoansDocumento2 páginasUnsecured X Secured LoansEllaAún no hay calificaciones

- Valuation of Fixed IncomeDocumento45 páginasValuation of Fixed IncomeANKIT AGARWALAún no hay calificaciones

- Plaintiff-Appellant Defendants-Appellees Intervenor-Appellee Block, Johnston & Greenbaum Lutero, Lutero & Maza Arroyo & EvangelistaDocumento22 páginasPlaintiff-Appellant Defendants-Appellees Intervenor-Appellee Block, Johnston & Greenbaum Lutero, Lutero & Maza Arroyo & EvangelistaJerwin DaveAún no hay calificaciones

- Fixed Income Securities: IntroductionDocumento33 páginasFixed Income Securities: IntroductionYogaPratamaDosen100% (1)

- Lecture 6 - Interest Rates and Bond ValuationDocumento56 páginasLecture 6 - Interest Rates and Bond Valuationabubaker janiAún no hay calificaciones

- Internship Report Al BarakaDocumento38 páginasInternship Report Al BarakaIrsa Khan100% (2)

- Financial Markets and Institutions: Abridged 10 EditionDocumento37 páginasFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- NBFC Thematic On Securitisation - Spark - 25nov19Documento35 páginasNBFC Thematic On Securitisation - Spark - 25nov19chetankvoraAún no hay calificaciones

- Chapter 14 - Homework AnswerDocumento10 páginasChapter 14 - Homework AnswerSaja AlbarjesAún no hay calificaciones

- Accounting Principles 10e Chapter 2 NotesDocumento18 páginasAccounting Principles 10e Chapter 2 NotesallthefreakypeopleAún no hay calificaciones

- Mortgage Letter 2010-14Documento3 páginasMortgage Letter 2010-14YuriAún no hay calificaciones

- DLP Pauline M. CustodioDocumento7 páginasDLP Pauline M. CustodioPauline Custodio100% (2)

- Deutsche V HoldenDocumento8 páginasDeutsche V HoldenTL AndersonAún no hay calificaciones

- SBM Proc Fees 231116Documento9 páginasSBM Proc Fees 231116Andreea CAún no hay calificaciones

- Financial Rehabilitation & Insolvent Act of 2010 or FRIA (RA 10142), Sec. 2 Id., Sec. 3Documento55 páginasFinancial Rehabilitation & Insolvent Act of 2010 or FRIA (RA 10142), Sec. 2 Id., Sec. 3Amvigatun to MacottorAún no hay calificaciones

- Bankruptcy OutlineDocumento99 páginasBankruptcy OutlineRooter CoxAún no hay calificaciones

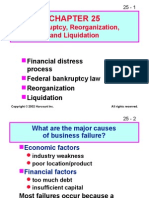

- Financial Distress Process Federal Bankruptcy Law Reorganization LiquidationDocumento31 páginasFinancial Distress Process Federal Bankruptcy Law Reorganization LiquidationsidhanthaAún no hay calificaciones

- The Third World Crisis System of Public Debt Management in The PhilippinesDocumento22 páginasThe Third World Crisis System of Public Debt Management in The PhilippinesKenneth Delos SantosAún no hay calificaciones

- True Discount (Ch16)Documento8 páginasTrue Discount (Ch16)Vishal JalanAún no hay calificaciones

- Security List DetailsDocumento1795 páginasSecurity List Detailssantosh0% (1)

- R52 Fixed Income Markets Issuance Trading and Funding PDFDocumento34 páginasR52 Fixed Income Markets Issuance Trading and Funding PDFDiegoAún no hay calificaciones

- Compound InterestDocumento14 páginasCompound InterestCarl Omar GobangcoAún no hay calificaciones

- HP-12C Solutions HandbookDocumento165 páginasHP-12C Solutions Handbookjfvegaya100% (1)

- Time Value of MoneyDocumento14 páginasTime Value of MoneyRakesh Gupta100% (1)