Documentos de Académico

Documentos de Profesional

Documentos de Cultura

TP 1 - Accounting II

Cargado por

AbiTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

TP 1 - Accounting II

Cargado por

AbiCopyright:

Formatos disponibles

2101723154 – Ramad Abi Bramagi

Tugas Personal ke-1

(Minggu 3 / Sesi 5)

Tugas personal 1 minggu 3 ini diambil dari buku wajib:

Weygandt, Kimmel, Kieso. (2013). Financial Accounting, IFRS Edition. 2nd edition.

John Wiley & Sons. Inc. New Jersey. ISBN: 978-1-118-28590-9.

Buatlah soal-soal berikut ini:

Chapter 11

E11 – 2 dan E11 – 3 halaman 562

ACCT6128 – Introduction to Accounting II

Answer :

E11 – 2

1. True.

2. False. Corporation management (separation of ownership and management), government

regulations, and additional taxes are the major disadvantages of a corporation.

3. False. When a corporation is formed, organization costs are expensed as incurred.

4. True.

5. False. The number of issued shares is always less than or equal to the number of authorized

shares.

6. False. No journal entry is required for the authorization of ordinary shares.

7. False. Publicly held corporations usually issue shares indirectly through an investment banking firm

8. True.

9. False. The market value of ordinary shares has no relationship with the par value.

10. False. Share capital is the total amount of cash and other assets paid in to the corporation by

shareholders in exchange for shares.

E11 – 3

a. Jan. 10

Cash (70,000 X Rs4) 280,000

Share Capital—Ordinary 280,000

July 1

Cash (30,000 X Rs7) 210,000

Share Capital—Ordinary (30,000 X Rs4) 120,000

Share Premium—Ordinary (30,000 X Rs3) 90,000

b. Jan. 10

Cash (70,000 X Rs4) 280,000

Share Capital—Ordinary (70,000 X Rs1) 70,000

Share Premium—Ordinary (70,000 X Rs3) 210,000

July 1 Cash (30,000 X Rs7) 210,000

Share Capital—Ordinary (30,000 X Rs1) 30,000

Share Premium—Ordinary (30,000 X Rs6) 180,000

ACCT6128 – Introduction to Accounting II

P11 – 1A dan P11 – 2A halaman 567

Answer :

P11 – 1A

ACCT6128 – Introduction to Accounting II

A

Jan. 10 Cash (100,000 X HK$50 5,000,000

Share Capital—Ordianry (100,000 X HK$20) 2,000,000

Share Premium—Ordinary (100,000 X HK$30) 3,000,000

Mar. 1 Cash (5,000 X HK$1,050) 5,250,000

Share Capital—Preference (5,000 X HK$1,000) 5,000,000

Share Premium—Preference (5,000 X HK$50) 250,000

Apr. 1 Land 920,000

Share Capital—Ordinary (18,000 X HK$20) 360,000

Share Premium—Ordinary (HK$920,000 – HK$360,000) 560,000

May 1 Cash (80,000 X HK$45) 3,600,000

Share Capital—Ordinary (80,000 X HK$20) 1,600,000

Share Premium—Ordinary (80,000 X HK$25) 2,000,000

Aug. 1 Organization Expense 300,000

Share Capital—Ordinary (10,000 X HK$20) 200,000

Share Premium—Ordinary (HK$300,000 – HK$200,000) 100,000

Sept. 1 Cash (10,000 X HK$50) 500,000

Share Capital—Ordinary (10,000 X HK$20) 200,000

Share Premium—Ordinary (10,000 X HK$30) 300,000

Nov. 1 Cash (1,000 X HK$1,080) 1,080,000

Share Capital—Preference (1,000 X HK$1,000) 1,000,000

Share Premium—Preference (1,000 X HK$80) 80,000

ACCT6128 – Introduction to Accounting II

B

Share Capital-Preference

Date Explanation Ref Debit Credit Balance

Mar 1 J5 5,000,000 5,000,000

Nov 1 J5 1,000,000 6,000,000

Share Capital-Ordinary

Date Explanation Ref Debit Credit Balance

Jan 10 J5 2,000,000 2,000,000

Apr 1 J5 360,000 2,360,000

May 1 J5 1,600,000 3,960,000

Aug 1 J5 200,000 4,160,000

Sept 1 J5 200,000 4,360,000

Share Premium-Preference

Date Explanation Ref Debit Credit Balance

Mar 1 J5 250,000 250,000

Nov 1 J5 80,000 330,000

Share Premium-Ordinary

Date Explanation Ref Debit Credit Balance

Jan 10 J5 3,000,000 3,000,000

Apr 1 J5 560,000 3,560,000

May 1 J5 2,000,000 5,560,000

Aug 1 J5 100,000 5,660,000

Sept 1 J5 300,000 5,960,000

ACCT6128 – Introduction to Accounting II

C

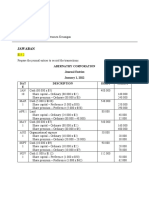

GAO CORPORATION

Statement of Financial Position

December 31, 2014

Equity

Share capital—preference

8%, HK$1,000 par

value, 10,000 shares

authorized, 6,000 shares

issued and outstanding HK$ 6,000,000

Share capital—ordinary, no par, HK$20

stated value, 500,000 shares

authorized, 218,000 shares

issued and outstanding 4,360,000

Share premium—preference 330,000

Share premium—ordinary 5,960,000

Total share capital HK$16,650,000

11 – 2A

Mar 1 Treasury Shares (5,000 x $9) 45,000

Cash 45,000

June 1 Cash (500 x $12) 6,000

Treasury Shares (500 x $9) 4,500

Premium-Treasury (500 x $3) 1,500

ACCT6128 – Introduction to Accounting II

Sept 1 Cash (2,500 x $10) 25,000

Treasury Shares (2,500 x $9) 22,500

Share Premium-Treasury (2,500 x 1 2,500

Dec 1 Cash (1,000 x $6) 6,000

Share Premium-Treasury (1,000 x $3) 3,000

Treasury Shares (1,000 x $9) 9,000

31 Income Summary 34,000

Retained Earnings 34,000

Share Premium-Treasury

Date Explanation Ref Debit Credit Balance

June 1 J10 1,500 1,500

Sept 1 J10 2,500 4,000

Dec 1 J10 3,000 1,000

Treasury Shares

Date Explanation Ref Debit Credit Balance

Mar 1 J10 45,000 45,000

June1 J10 4,500 40,500

Sept 1 J10 22,500 18,000

Dec 1 J10 9,000 9,000

Retained Earnings

Date Explanation Ref Debit Credit Balance

Jan 1 Balance 100,000

Dec 31 J10 34,000 134,000

ACCT6128 – Introduction to Accounting II

C

Elston Corporation

Statement Of Financial Position

December 31, 2014

Equity

Share Capital-Ordinary, $5 par,

80,000 Shares Issues and

79,000 Outstanding $400,000

Share Premium-Ordinary 200,000

Share Premium-Treasury 1,000

Retained Earnings 134,000

Less : Treasury Shares (1,000 Shares) 9,000

Total Equity $726,000

P11 – 5B dan P11 – 6B halaman 572

ACCT6128 – Introduction to Accounting II

Answer

P11 – 5B

ACCT6128 – Introduction to Accounting II

A

Andes Company

Retained Earnings Statement

For the Year Ended December 31,2014

Balance, January 1, as reported $ 900,000

Correction for overstatement of net

Income in 3013 (65,000)

Balance, January 1, as adjusted 835,000

Add: Net Income 3,600,000

4,435,000

Less: Cash dividens-Ordinary $1,480,000

Cash dividens-preference 800,000 2,280,000

Balance, December 31 $2,155,000

ACCT6128 – Introduction to Accounting II

B

Andes Company

Partial Statement of Financial Position

December 31, 2014

Equity

Share Capital-Preference

$100 par value, 8% Cumulative,

100,000 Shares Issued

And Outstanding $10,000,000

Share Capital-Ordinary, $10 par value,

1,500,00 share issued

And 1,480,000 shares

Outstanding 15,000,000

Share Premium-Preference 500,000

Share Premium-Ordinary 1,500,000

Retained Earnings 2,155,000

Less: Treasury Shares

(20,000 Shares) 280,000

Total Equity $28,875,000

P11 – 6B

Bu Maaf saya tidak lihat ada instruksi pengerjaannya.

ACCT6128 – Introduction to Accounting II

También podría gustarte

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsDe EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsAún no hay calificaciones

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeDe EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeAún no hay calificaciones

- 11 (1a 2c)Documento9 páginas11 (1a 2c)Jason SugiantoAún no hay calificaciones

- Ganang Surya Hananta Swara 1901572691 Tugas Personal Ke-4 Minggu 8Documento22 páginasGanang Surya Hananta Swara 1901572691 Tugas Personal Ke-4 Minggu 8Vira JilmiAún no hay calificaciones

- Diandra Murti Liza Aulia 2022210006 Tugas P-12 Pengantar Akuntansi 2Documento3 páginasDiandra Murti Liza Aulia 2022210006 Tugas P-12 Pengantar Akuntansi 2Diandra MurtiAún no hay calificaciones

- Book Value Per Share 950,000.00 500,000.00 250,000.00 (Add) 100,000.00 Bvps 17Documento9 páginasBook Value Per Share 950,000.00 500,000.00 250,000.00 (Add) 100,000.00 Bvps 17jose.labianoAún no hay calificaciones

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocumento6 páginasJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesAún no hay calificaciones

- Act Stock Equity JournalDocumento2 páginasAct Stock Equity Journalkevin phillipsAún no hay calificaciones

- Accounting AnswersDocumento3 páginasAccounting AnswersMheg NervidaAún no hay calificaciones

- E 16.3 Date Account Ref DR CRDocumento13 páginasE 16.3 Date Account Ref DR CRNicolas ErnestoAún no hay calificaciones

- FAR ch13 ProblemsDocumento8 páginasFAR ch13 Problemsmhrzyn27Aún no hay calificaciones

- Session 17Documento23 páginasSession 17Serena KassabAún no hay calificaciones

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocumento14 páginasPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyAún no hay calificaciones

- QuizDocumento5 páginasQuizQasim KhanAún no hay calificaciones

- Chap11 ConnectDocumento5 páginasChap11 ConnectThanh PhuongAún no hay calificaciones

- Kelompok 6 Latihan Soal EquityDocumento7 páginasKelompok 6 Latihan Soal EquityTria SalzanabillaAún no hay calificaciones

- Ak 2Documento12 páginasAk 2nikenapAún no hay calificaciones

- Corporations, Issue of Common StockDocumento5 páginasCorporations, Issue of Common StockSheikh RakinAún no hay calificaciones

- Problem 3: Carr Company Reported The Following Shareholders' Equity On January 1, 2021Documento2 páginasProblem 3: Carr Company Reported The Following Shareholders' Equity On January 1, 2021Katrina Dela Cruz100% (1)

- Ia Activity 4Documento23 páginasIa Activity 4WeStan LegendsAún no hay calificaciones

- ACC 3003 - ReviewDocumento22 páginasACC 3003 - Reviewfalnuaimi001Aún no hay calificaciones

- Jawaban Soal Hitungan Bab 4Documento16 páginasJawaban Soal Hitungan Bab 4Aheir lessAún no hay calificaciones

- UAS PA 2020-2021 Ganjil - JawabanDocumento27 páginasUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaAún no hay calificaciones

- Tugas Sesi 7Documento5 páginasTugas Sesi 7mutmainnahAún no hay calificaciones

- Cercado, Geran Kearn L. ACC 221 2:15 - 4:15PM BSA-2 P.T - 3.3 Shareholder 'S EquityDocumento3 páginasCercado, Geran Kearn L. ACC 221 2:15 - 4:15PM BSA-2 P.T - 3.3 Shareholder 'S EquityKearn CercadoAún no hay calificaciones

- Auditing Problem Quiz 2 Long Problem SolutionsDocumento7 páginasAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoAún no hay calificaciones

- Shadden PanaoDocumento5 páginasShadden PanaoJoebin Corporal LopezAún no hay calificaciones

- Midsemester Exam-C Problem 1: Show Your CalculationsDocumento5 páginasMidsemester Exam-C Problem 1: Show Your CalculationsMario KaunangAún no hay calificaciones

- Dave Chapter 9Documento11 páginasDave Chapter 9Mark Dave SambranoAún no hay calificaciones

- Tugas Sesi 7Documento5 páginasTugas Sesi 7mutmainnahAún no hay calificaciones

- Problem: Andres Adi Putra S 43220110067 AKM2-Forum 6Documento17 páginasProblem: Andres Adi Putra S 43220110067 AKM2-Forum 6tes doangAún no hay calificaciones

- AF210 Final Exam SolutionsDocumento17 páginasAF210 Final Exam SolutionsSmriti LalAún no hay calificaciones

- HI 5001 Accounting For Business DecisionsDocumento5 páginasHI 5001 Accounting For Business Decisionsalka murarkaAún no hay calificaciones

- Credit Sales $10,000,000 Accounts Receivable 3,000,000 Allowance For Doubtful Accounts 50,000Documento11 páginasCredit Sales $10,000,000 Accounts Receivable 3,000,000 Allowance For Doubtful Accounts 50,000rahul ambatiAún no hay calificaciones

- Chapter 3 SolutionsDocumento7 páginasChapter 3 Solutionshassan.murad63% (8)

- Calculation of Net Increase and Decrease in Assets, Current Liabilities and Shareholders Fund'sDocumento13 páginasCalculation of Net Increase and Decrease in Assets, Current Liabilities and Shareholders Fund'schatterjee rikAún no hay calificaciones

- ACC 3003 - Final Exam Revision - SolutionDocumento22 páginasACC 3003 - Final Exam Revision - Solutionfalnuaimi001Aún no hay calificaciones

- Tugas Akm Ii Pertemuan 10Documento5 páginasTugas Akm Ii Pertemuan 10Alisya UmariAún no hay calificaciones

- Chapter 8Documento10 páginasChapter 8Vip BigbangAún no hay calificaciones

- Answers Part 5Documento24 páginasAnswers Part 5Great Empress GalaponAún no hay calificaciones

- MGMT AssignmentDocumento79 páginasMGMT AssignmentLuleseged Gebre100% (1)

- Soal Chapter 15 Dividend - Kelompok 1Documento11 páginasSoal Chapter 15 Dividend - Kelompok 1suci monalia putriAún no hay calificaciones

- ACCCOB1 Module 2 ActivitiesDocumento20 páginasACCCOB1 Module 2 ActivitiesAndrei AngAún no hay calificaciones

- Akl Soal 3 Kelompok 2Documento9 páginasAkl Soal 3 Kelompok 2dikaAún no hay calificaciones

- Akl Soal 3 - Kelompok 2Documento9 páginasAkl Soal 3 - Kelompok 2M KhairiAún no hay calificaciones

- Partnership QuizzerDocumento18 páginasPartnership QuizzerJehannahBarat100% (1)

- 04 Case Problem - SheDocumento13 páginas04 Case Problem - SheJen DeloyAún no hay calificaciones

- SCM Topic 1 Blades Solution 2022Documento3 páginasSCM Topic 1 Blades Solution 2022Adi KurniawanAún no hay calificaciones

- Study Guide Principle CH 10-11Documento28 páginasStudy Guide Principle CH 10-11PPBP 90 Astrella ElvarettaAún no hay calificaciones

- Maria Claudine B. Fortaliza. Basic Earnings Per Share Average Shares 1. (IFRS)Documento14 páginasMaria Claudine B. Fortaliza. Basic Earnings Per Share Average Shares 1. (IFRS)maria evangelistaAún no hay calificaciones

- Assignment 3 ACC 401Documento9 páginasAssignment 3 ACC 401ShannonAún no hay calificaciones

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocumento8 páginasTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Chpater 4 SolutionsDocumento13 páginasChpater 4 SolutionsTamar PkhakadzeAún no hay calificaciones

- Jawaban Uas Pa 2 KasusDocumento39 páginasJawaban Uas Pa 2 KasusSylviaAún no hay calificaciones

- Magic Dominique Julius Julius TotalDocumento4 páginasMagic Dominique Julius Julius TotalPaupauAún no hay calificaciones

- CFASDocumento3 páginasCFASataydeyessaAún no hay calificaciones

- Ia2 Ia2 Millan Solution - CompressDocumento6 páginasIa2 Ia2 Millan Solution - CompressWynne RamosAún no hay calificaciones

- Advanced Accounting 1A Quiz 3 Name: Seat No: Calculate Pat Investment in Saw and Controlling Interest OnDocumento6 páginasAdvanced Accounting 1A Quiz 3 Name: Seat No: Calculate Pat Investment in Saw and Controlling Interest OnJeferly DengahAún no hay calificaciones

- CH 19Documento4 páginasCH 19Nickey DickeyAún no hay calificaciones

- Bab III Buku Bu IinDocumento14 páginasBab III Buku Bu IinAditya Agung SatrioAún no hay calificaciones

- Nanyang Business School AB1201 Financial Management Tutorial 3: Financial Markets and Institutions and Interest Rates (Common Questions)Documento1 páginaNanyang Business School AB1201 Financial Management Tutorial 3: Financial Markets and Institutions and Interest Rates (Common Questions)asdsadsaAún no hay calificaciones

- Audited FS 2017 PDFDocumento85 páginasAudited FS 2017 PDFJai Valdez100% (1)

- A2Z Annual Report 2018Documento216 páginasA2Z Annual Report 2018Siddharth ShekharAún no hay calificaciones

- The EXPLOITATION of Security Mispricing inDocumento13 páginasThe EXPLOITATION of Security Mispricing inJorge J MoralesAún no hay calificaciones

- Important Mafa SuggestionDocumento60 páginasImportant Mafa Suggestioncyrex33Aún no hay calificaciones

- Above 11050, It Is Hunky - Dory !: Support ZoneDocumento12 páginasAbove 11050, It Is Hunky - Dory !: Support ZonepremAún no hay calificaciones

- FMDocumento20 páginasFMQuyen HoangAún no hay calificaciones

- Chapter 14Documento5 páginasChapter 14RahimahBawaiAún no hay calificaciones

- An Intro To Bussiness AccountingDocumento57 páginasAn Intro To Bussiness AccountingNadia AnuarAún no hay calificaciones

- Full Download Essentials of Investments 10th Edition Bodie Test BankDocumento35 páginasFull Download Essentials of Investments 10th Edition Bodie Test Banksultryjuliformykka100% (44)

- Lehman Inc Financial Fraud Case StudyDocumento78 páginasLehman Inc Financial Fraud Case StudyericAún no hay calificaciones

- Once You Upload An Approved Document, You Will Be Able To Download The DocumentDocumento3 páginasOnce You Upload An Approved Document, You Will Be Able To Download The Documentaaa100% (3)

- Merchant Banking in IndiaDocumento66 páginasMerchant Banking in IndiaNitishMarathe80% (40)

- Pengukuran Kinerja Keuangan Berdasarkan Roi (Return On Investment) Dengan Pendekatan Sistem Dupont Pada Pt. Tropica Cocoprima PDFDocumento10 páginasPengukuran Kinerja Keuangan Berdasarkan Roi (Return On Investment) Dengan Pendekatan Sistem Dupont Pada Pt. Tropica Cocoprima PDFAgung SetiawanAún no hay calificaciones

- Work Experience Watiga & Co. (S) Pte LTD: IgnatiusDocumento3 páginasWork Experience Watiga & Co. (S) Pte LTD: IgnatiusankiosaAún no hay calificaciones

- One Person CorporationDocumento6 páginasOne Person CorporationJohannah AgasAún no hay calificaciones

- KPMG Flash News Draft Guidelines For Core Investment CompaniesDocumento5 páginasKPMG Flash News Draft Guidelines For Core Investment CompaniesmurthyeAún no hay calificaciones

- FAR570 Topic 2 EARNINGS PER SHAREDocumento25 páginasFAR570 Topic 2 EARNINGS PER SHARE2022920039Aún no hay calificaciones

- Final Sip - SuyashDocumento37 páginasFinal Sip - Suyashshrikrushna javanjalAún no hay calificaciones

- EUR Xtreme FadeDocumento17 páginasEUR Xtreme Fadereynancutay4624Aún no hay calificaciones

- Income From Other SourcesDocumento9 páginasIncome From Other Sourcesrajsab20061093Aún no hay calificaciones

- Investments and Portfolio ManagementDocumento6 páginasInvestments and Portfolio ManagementDonatas JocasAún no hay calificaciones

- BFC5935 - Tutorial 10 SolutionsDocumento8 páginasBFC5935 - Tutorial 10 SolutionsAlex YisnAún no hay calificaciones

- Review PKG1 PDFDocumento25 páginasReview PKG1 PDFjennifer weiAún no hay calificaciones

- Limitations On The Power of TaxationDocumento2 páginasLimitations On The Power of TaxationApril Anne Costales100% (1)

- Brian Anthony ByrneDocumento4 páginasBrian Anthony ByrneBrianByrne4Aún no hay calificaciones

- Fixed - Income CfaDocumento21 páginasFixed - Income CfaSophy ThweAún no hay calificaciones

- CHAPTER 15 - TranspoDocumento6 páginasCHAPTER 15 - TranspoRenz AmonAún no hay calificaciones

- Introduction To The Course Matlab For Financial EngineeringDocumento30 páginasIntroduction To The Course Matlab For Financial EngineeringqcfinanceAún no hay calificaciones

- Service Charges - BoB - As On 6.11.17Documento63 páginasService Charges - BoB - As On 6.11.17Praneta pandeyAún no hay calificaciones