Documentos de Académico

Documentos de Profesional

Documentos de Cultura

THE CURSE OF COMMODITY WEALTH

Cargado por

Paul ClearyDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

THE CURSE OF COMMODITY WEALTH

Cargado por

Paul ClearyCopyright:

Formatos disponibles

20 May 3-4, 2008 The Weekend Australian Financial Review www.afr.

com

PERSPECTIVE

THE MIGHTY DOLLAR

From previous page report that concluded growth in the casualties in other sectors,

ANZ economist Alex Joiner says: services, particularly in such as receding services

‘‘All the variables we use in our knowledge-intensive industries, exports, or the factory closures

model – including two-year bond was slowing, while developing that would have been big news if

yield splits between Australia and nations had lifted their game. unemployment were high.

the US, commodity prices, price The Business Council of Opinions differ on whether

modelling in various economies Australia estimated last year that commodity prices have peaked.

and the domestic cash rate – Australia’s share of global AMP’s Oliver points out that

worked well until January/ services exports had dropped previous booms were driven by

February. What the model didn’t from 1.45 per cent in 1996 to demand from nations in which

take into account is the higher 1.15 per cent in 2005, equating to millions of people were swept up

risk aversion now in evidence. a $9.7 billion loss in export by waves of industrialisation.

‘‘We estimated according to a revenue. But these days it’s hard ‘‘This one is being powered by

stable environment which no to look past the commodity boom. billions of people so I would

longer exists. The Australian It’s been such a big story for so suggest it has a lot longer to run,’’

dollar will trade on fundamentals long that people tend to overlook he says.

in the absence of other shocks. ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●

And it’s not just demand and

The shock this year was the supply pressures that are pushing

financial volatility related to the Growing foreign reserves up prices. In a recent research

sub-prime crisis. note, Morgan Stanley points out

‘‘Right now, everything – the also push up commodity that growing foreign reserves also

cash rate here, the reduced cash prices and in January, push up commodity prices and in

rate in the US and very strong January, foreign exchange

THE CURSE

commodity prices – is working in foreign exchange reserves reserves were growing at close to

favour of the currency were growing at close to 30 per cent.

appreciating. Everything except ‘‘This evidence suggests that

this risk aversion.’’ 30 per cent. liquidity has been a driver of the

● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●

Another factor could be very current commodity boom, and it

bad news for the Australian may continue to remain so in the

dollar. This is what JPMorgan near future,’’ says the note, which There is evidence that a resources’’. ‘‘How is it possible

Australia chief economist Stephen concludes the $A was a buy from that a superabundance of natural

Walters refers to as the ‘‘big fur a structural perspective. mismanaged resource resources, oil, gas, copper, iron

ball’’ – a current account deficit Parity here we come. bounty can damage long- ore, would not significantly add to

that, at 7.5 per cent of gross a nation’s production and wealth?

domestic product, is at its highest ❙ 왘 Editorial, page 62 term prosperity. Paradoxically, most analysts

in 50 years. In absolute terms, it’s conclude that, particularly in

the fourth-highest in the world. Story Paul Cleary developing countries, natural

In previous years, current Winners and losers resource bonanzas tend to reduce

account deficits were thought to THE GOOD THE BAD rather than enhance living

be hugely influential on exchange PETROL TOURISM standards,’’ Greenspan wrote in

rates. That sort of thinking is out The Age of Turbulence.

of favour but Walters says it might

Bowser prices would be The tourism industry ate one evening in late ‘‘[It] takes the form of an

L

return. He believes the $A might even higher if the dollar has a human deficit April 1999, foreign economic affliction nicknamed the

nudge US97¢ before falling back. wasn't so high. There problem and it’s getting minister Alexander Dutch disease. Dutch disease

‘‘The deficit has been ignored are other factors at worse. The numbers of Downer retired to his strikes when foreign demand for

for the last few years,’’ he says. play; whenever there are international tourists hotel room in Bali after an export drives up the exchange

‘‘It has been a puzzle. One of the supply problems coming here have attending a special value of the exporting country’s

reasons we were quite bearish anywhere in the world, shippers put their dropped off this year while tens of summit with Indonesia’s president, currency.’’

then was that big current account prices up and then there are wharfage thousands more Australians are B. J. Habibie, on the ballot to be And it appears that Australia

deficit. But clearly that wasn’t and insurance charges but nevertheless, holidaying overseas every month. The held in East Timor in August that has in recent years succumbed to

what investors were looking for – year. After slipping into a dressing this disease. Yet it is no accident.

said RACV’s David Cumming “if the strong Aussie dollar has combined with

they were looking for yield. gown and slippers, he invited some There has been a deliberate policy

‘‘As far as we can tell, yield is dollar was worth less there is no doubt cheap flights to make overseas trips members of his travelling party to to spend the proceeds of the

still one of the main drivers of the we would be paying more’’. more attractive and holidaying here has his room where he lit a pipe and resources boom.

currency but once the current become a more expensive option, shared a few drinks. The fiscal profligacy of John

easing and tightening cycles [in US TRAVEL particularly for Americans. Some Asian As the foreign minister held Howard, Peter Costello, Alexander

the US and Australia] end, we Now is the time to see countries, such as Korea, typically price court the conversation quickly Downer, Brendan Nelson, Tony

think investors will go down that America. The number of travel in US dollars as well. turned to oil. The prospect of an Abbott and other senior ministers

list of current account deficits and Australians travelling to independent East Timor in recent years has now been

find Australia pretty high on the the US was up by 13.5 PORK immediately raised issues over documented in a recent paper by

list of developed markets.’’ per cent in the first two Many businesses that control of the Timor Sea’s vast oil Treasury economists Kirsty Laurie

CommSec chief equities months of the year. compete directly with and gas resources. Would and Jason McDonald, from the

economist Craig James agrees the Travel agents say around-the-world importers are struggling Australia grant an independent department’s budget policy

current account deficit could yet East Timor its right to a bigger division. Of the rise in tax revenue

tickets have become more popular in but spare a thought for

rear its ugly head. ‘‘If there was a share of the resources? since 2004-05 of $334 billion, new

downturn in the global economy, recent months as European-bound pig farmers. This With the minister looking and spending decisions and income tax

investors would be quick to shun travellers add on a US stopover. industry is ‘‘imploding’’, sounding very much like Lord cuts reduced the surplus by

high-debt countries so that does says Australian Pork chief executive Downer, this suggestion was $314 billion.

mean we are vulnerable to an exit CARS Andrew Spencer, thanks to cheap treated with disdain. The ‘‘Effectively, the additional

of foreign investment dollars,’’ Makers of imported imports of frozen pigmeat (from Timorese, Downer thundered, revenue from the commodity boom

he says. cars say favourable countries where the industry is heavily would piss it up against the wall. A has been spent, or provided as tax

‘‘One thing which holds in our exchange rates subsidised) and high grain prices. far better outcome would be where cuts,’’ the authors conclude.

favour is that the current account eventually result in Australia retained its control of the There you have it officially –

deficit is almost wholly private extra features for no WINERIES vast majority of the resources and 94 per cent of the windfall revenue

sector. It’s a huge range of The rising currency has in return East Timor would be from the resources boom was

extra dollars. Imported

companies and consumers driving given foreign aid, Downer spent. Over the life of the Howard

goods have become cheaper to bring hit small business

that debt, rather than one central explained. government the Australian people

government, so the economy as a into the country but car companies and exporters at a time Downer should have made the became hooked on an ever-

whole is not vulnerable.’’ just about everyone else are reluctant to when they have also same point at home. For his own increasing amount of fiscal

On the whole though, James, pass on those savings directly by had to cope with higher government – under prime minister largesse. Real federal payments

who thinks there is a 50/50 reducing prices. interest rates. More John Howard – has done exactly increased by an astonishing 50 per

chance the dollar will go one for than half of Australia’s wine production what he predicted the East cent over the decade to 2007-08 at

one with the greenback in the ONLINE SHOPPING is exported and winemakers, many of Timorese would do and a time when the economy was

next couple of months, is inclined It's a great time to buy whom are already facing the water squandered an absolutely massive booming.

to be bullish on both the dollar goods from US internet shortage crisis in the Murray-Darling revenue windfall from Australia’s Australia is now suffering from

and the economy. retailers. Shoppers own resources boom. The result the resource curse because it lacks

basin, rely heavily on repatriated dollars.

‘‘Everything is falling into place around the world has been rising inflation and rising a mechanism to manage swings in

for Australia,’’ he says. ‘‘You have interest rates. income from commodities. And it

appear to have EDUCATION EXPORTS

to play to your strengths and ours It is called the resource curse, lacks the fiscal discipline to ensure

lie in mining and agriculture.’’ discovered this: Australian universities the paradox of plenty or the Dutch that the tax revenue from natural

Not all are so optimistic. Amazon reported its international sales started to build their disease, but whatever the name it resources is spent at a sustainable

In the future this could be grew 44 per cent to $US2.01 billion in export business in the means one thing – that a natural rate.

viewed as the time we failed to the first three months of the year and 1990s so no one is quite resource bounty is often The floating Australian dollar

invest in other sectors to ensure a accounted for 49 per cent of total sure how a dollar close mismanaged and can lower long- was to be the mechanism to help

secure position in a carbon- revenue, up from 46 per cent last year. to parity with the US term prosperity by inflating the Australia cope with roller-coaster

constrained future (see report at dollar will affect enrolments. Most agree economy and undermining swings in national income. Former

right: The Curse of Plenty). it takes 18 months to filter through to competitiveness. prime minister Paul Keating, who

There are some signs the enrolments so if the strong dollar is a Former US Federal Resource floated the currency 25 years ago

services sector is beginning to Board chairman Alan Greenspan this year, argued that it acted like

deterrent, it will become apparent in the

suffer from neglect. recently identified the ‘‘economic a shock absorber. It provided

On April 23, Prime Minister numbers of foreign students starting affliction’’ that can result from ‘‘a stimulus to the economy through

Kevin Rudd was briefed about a studies midyear. superabundance of natural depreciation in economic

FBA 020

También podría gustarte

- Breakfast With Dave 122010Documento8 páginasBreakfast With Dave 122010richardck50Aún no hay calificaciones

- Lane Asset Management Stock Market Commentary November 2010Documento8 páginasLane Asset Management Stock Market Commentary November 2010eclaneAún no hay calificaciones

- Westpack JUN 28 Weekly CommentaryDocumento7 páginasWestpack JUN 28 Weekly CommentaryMiir ViirAún no hay calificaciones

- Weekly Comment 2 June Asia's V-Shaped DevelopmentsDocumento2 páginasWeekly Comment 2 June Asia's V-Shaped DevelopmentsFlametreeAún no hay calificaciones

- Euphoria Gives Way To Panic: Previous IssuesDocumento2 páginasEuphoria Gives Way To Panic: Previous IssuesFa HianAún no hay calificaciones

- Big Freeze IVDocumento5 páginasBig Freeze IVKalyan Teja NimushakaviAún no hay calificaciones

- TheSun 2008-11-05 Page22 A Cuts Rates As Glbal Recession Gloom BuildsDocumento1 páginaTheSun 2008-11-05 Page22 A Cuts Rates As Glbal Recession Gloom BuildsImpulsive collectorAún no hay calificaciones

- CR 1Q17 OutlookDocumento12 páginasCR 1Q17 OutlooknmkdsarmaAún no hay calificaciones

- 06-10-10 Breakfast With DaveDocumento8 páginas06-10-10 Breakfast With DavefcamargoeAún no hay calificaciones

- 全球零售巨头收入持续增长 德勤全球预测零售业将面临数字化鸿沟挑战-en-160122 PDFDocumento48 páginas全球零售巨头收入持续增长 德勤全球预测零售业将面临数字化鸿沟挑战-en-160122 PDFTorresLiangAún no hay calificaciones

- WEEK 48 - DAILY For December 1, 2010Documento1 páginaWEEK 48 - DAILY For December 1, 2010JC CalaycayAún no hay calificaciones

- TC&CrisisDocumento7 páginasTC&CrisiszafarAún no hay calificaciones

- Thesun 2009-08-11 Page16 Bright Lights Amid The GloomDocumento1 páginaThesun 2009-08-11 Page16 Bright Lights Amid The GloomImpulsive collectorAún no hay calificaciones

- Report On Capital MarketsDocumento17 páginasReport On Capital MarketsSumairAún no hay calificaciones

- 10-Rules of Thumb - Morgan Stanley PDFDocumento8 páginas10-Rules of Thumb - Morgan Stanley PDFParas BholaAún no hay calificaciones

- Headlines: Thursday, December 7, 2006Documento10 páginasHeadlines: Thursday, December 7, 2006Andru VolumAún no hay calificaciones

- Spillovers, capital flows and macroprudential policy in small open economiesDocumento39 páginasSpillovers, capital flows and macroprudential policy in small open economiesAnonymous uUsjeq9Aún no hay calificaciones

- Uncertainty Economics 1Documento3 páginasUncertainty Economics 1Zarmina Khan NaveedAún no hay calificaciones

- AMM - Q1 2010 LetterDocumento4 páginasAMM - Q1 2010 LetterGlenn BuschAún no hay calificaciones

- KPMG Valuation ReportDocumento14 páginasKPMG Valuation ReportShrinivas PuliAún no hay calificaciones

- Breakfast With Dave 20100928Documento8 páginasBreakfast With Dave 20100928marketpanicAún no hay calificaciones

- Investment Compass - Quarterly Market Commentary - Q1 2009Documento6 páginasInvestment Compass - Quarterly Market Commentary - Q1 2009Pacifica Partners Capital ManagementAún no hay calificaciones

- The Myanmar Exchange Rate: A Barrier To National Strength: Rajawali Foundation Institute For AsiaDocumento9 páginasThe Myanmar Exchange Rate: A Barrier To National Strength: Rajawali Foundation Institute For AsiaMa Meaw MomentAún no hay calificaciones

- Gavekal-IS Complementary ReportDocumento6 páginasGavekal-IS Complementary ReportAndré Santos100% (1)

- Me Cio Weekly LetterDocumento8 páginasMe Cio Weekly LetteralexAún no hay calificaciones

- The Allen & Overy M&a Index: 60% Increase in Value of Global Public M&a in q1 2011Documento28 páginasThe Allen & Overy M&a Index: 60% Increase in Value of Global Public M&a in q1 2011Shraddha BiradarAún no hay calificaciones

- The Next Consumer Recession: Preparing NowDocumento22 páginasThe Next Consumer Recession: Preparing NowPanther MelchizedekAún no hay calificaciones

- Breakfast With Dave - 060909Documento8 páginasBreakfast With Dave - 060909variantperceptionAún no hay calificaciones

- Making Slow But Undeniable ProgressDocumento1 páginaMaking Slow But Undeniable ProgressAmerican Century InvestmentsAún no hay calificaciones

- Industrial Forecast2015 17 PDFDocumento20 páginasIndustrial Forecast2015 17 PDFKepo DehAún no hay calificaciones

- SWOT of India and ChinaDocumento2 páginasSWOT of India and ChinaSatish KorabuAún no hay calificaciones

- Fall 2010Documento2 páginasFall 2010gradnvAún no hay calificaciones

- Iacoviello 2005Documento27 páginasIacoviello 2005YueAún no hay calificaciones

- TD Economics: Special ReportDocumento6 páginasTD Economics: Special ReportInternational Business TimesAún no hay calificaciones

- Breakfast With Dave June 12Documento7 páginasBreakfast With Dave June 12variantperception100% (1)

- Aliaga-Diaz Et Al-2017-Economic InquiryDocumento23 páginasAliaga-Diaz Et Al-2017-Economic InquiryxeniachrAún no hay calificaciones

- Us Economy: Structural Deflation?: MacromarketsDocumento6 páginasUs Economy: Structural Deflation?: MacromarketsTsvetan KintisheffAún no hay calificaciones

- C W Global Investment Atlas 2019 PDFDocumento62 páginasC W Global Investment Atlas 2019 PDFANURADHA JAYAWARDANAAún no hay calificaciones

- How Exchange Rates Affect Corporate Balance Sheets and Monetary PolicyDocumento12 páginasHow Exchange Rates Affect Corporate Balance Sheets and Monetary PolicyHospital BasisAún no hay calificaciones

- G Ê Corporate Choice For Overseas Borrowings:The Indian Evidence #$ #Documento3 páginasG Ê Corporate Choice For Overseas Borrowings:The Indian Evidence #$ #Vish PatelAún no hay calificaciones

- CHAPTER 1-B - Financial MarketDocumento15 páginasCHAPTER 1-B - Financial MarketNur Aina SyazanaAún no hay calificaciones

- Future Drivers 2021Documento19 páginasFuture Drivers 2021iosifelulfrumuselulAún no hay calificaciones

- Breakfast With Dave June 5Documento8 páginasBreakfast With Dave June 5variantperception100% (2)

- Australian Economy - Australia Could Be First Domino To Fall' in CollapseDocumento6 páginasAustralian Economy - Australia Could Be First Domino To Fall' in CollapseYC TeoAún no hay calificaciones

- Saving Themselves?Documento3 páginasSaving Themselves?Daniel O'ConnorAún no hay calificaciones

- Firm DynamicDocumento7 páginasFirm DynamickahramaaAún no hay calificaciones

- Margin - The Journal of Applied Economic Research-2010-Vines-157-75Documento19 páginasMargin - The Journal of Applied Economic Research-2010-Vines-157-7525526Aún no hay calificaciones

- Lessons and Strategies of A Recession: Retail Economics 101Documento7 páginasLessons and Strategies of A Recession: Retail Economics 101achuthaAún no hay calificaciones

- Moneycontrol PRO - Week Ended 22.10.21Documento2 páginasMoneycontrol PRO - Week Ended 22.10.21Aakruti FuriaAún no hay calificaciones

- FE GlobalFund Annual LetterDocumento8 páginasFE GlobalFund Annual LetterCanadianValueAún no hay calificaciones

- BCG How Private Equity Can Capture The Upside in A Downturn August 2019 - tcm9 225891Documento8 páginasBCG How Private Equity Can Capture The Upside in A Downturn August 2019 - tcm9 2258919980139892Aún no hay calificaciones

- Tracking The Trends 2011: The Top 10 Issues Mining Companies Will Face in The Coming YearDocumento20 páginasTracking The Trends 2011: The Top 10 Issues Mining Companies Will Face in The Coming YearRicardoOct57Aún no hay calificaciones

- Snack With Dave: David A. RosenbergDocumento9 páginasSnack With Dave: David A. RosenbergroquessudeAún no hay calificaciones

- Lane Asset Management Stock Market Commentary February 2011Documento7 páginasLane Asset Management Stock Market Commentary February 2011eclaneAún no hay calificaciones

- Beyond The Rubicon NA Asset Management 2019 PDFDocumento34 páginasBeyond The Rubicon NA Asset Management 2019 PDFJuan Manuel VeronAún no hay calificaciones

- Equity Markets Weekly: Evidently, Rally Won't BeDocumento6 páginasEquity Markets Weekly: Evidently, Rally Won't Beinvisible_stAún no hay calificaciones

- The Effect of Economic Recession in Textile Manufacturing Industries in NigeriaDocumento13 páginasThe Effect of Economic Recession in Textile Manufacturing Industries in NigeriaTetouani ChamaliAún no hay calificaciones

- Lecture1Documento30 páginasLecture1Raman SinghAún no hay calificaciones

- Disequilibrium: How America's Great Inflation Led to the Great RecessionDe EverandDisequilibrium: How America's Great Inflation Led to the Great RecessionCalificación: 4 de 5 estrellas4/5 (1)

- FI08-12 AccrualsDocumento8 páginasFI08-12 AccrualsHanoze ZaveriAún no hay calificaciones

- Common Size AnalysisDocumento5 páginasCommon Size Analysissu2nil0% (2)

- Air Transport Beyond The Crisis - Pascal Huet - WTFL 2009Documento18 páginasAir Transport Beyond The Crisis - Pascal Huet - WTFL 2009World Tourism Forum LucerneAún no hay calificaciones

- AURANGABAD Industrial ListDocumento240 páginasAURANGABAD Industrial ListSAGAR SONAR67% (3)

- East Coast Yachts Financial Ratio AnalysisDocumento3 páginasEast Coast Yachts Financial Ratio Analysisbrentk112100% (1)

- Brochure 021820 Spanish Single-Pages ICML-webDocumento4 páginasBrochure 021820 Spanish Single-Pages ICML-webAMERICO SANTIAGOAún no hay calificaciones

- Human Development IndexDocumento3 páginasHuman Development Indexapi-280903795Aún no hay calificaciones

- Restaurant Service: Prostart Chapter 4Documento14 páginasRestaurant Service: Prostart Chapter 4ad_gibAún no hay calificaciones

- Dagupan's "BangusDocumento4 páginasDagupan's "BangusRomel BucaloyAún no hay calificaciones

- LIL's Distribution Network Structure and RecommendationsDocumento13 páginasLIL's Distribution Network Structure and RecommendationsAbhishek KumarAún no hay calificaciones

- The Copperbelt University BS 361: Entrepreneurship Skills: Lecture 2C: Business Startups K. Mulenga June, 2020Documento40 páginasThe Copperbelt University BS 361: Entrepreneurship Skills: Lecture 2C: Business Startups K. Mulenga June, 2020Nkole MukukaAún no hay calificaciones

- Bay Field Mud CaseDocumento3 páginasBay Field Mud CaseexsavezeroAún no hay calificaciones

- MR Dia Putranto HarmayDocumento2 páginasMR Dia Putranto HarmayDia Putranto HarmayAún no hay calificaciones

- The Secrets of Successful Tailoring - E Watkins (1910)Documento106 páginasThe Secrets of Successful Tailoring - E Watkins (1910)Cary MacMahon-dann67% (6)

- Sop F&B Controls (Documento12 páginasSop F&B Controls (Abid SayyedAún no hay calificaciones

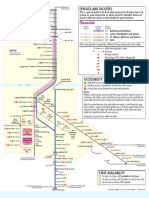

- Thameslink Route Map LondonDocumento1 páginaThameslink Route Map LondonAlexandru ChinciuAún no hay calificaciones

- Chapter 1 - Introduction - Why Study Financial Markets and InstitutionsDocumento23 páginasChapter 1 - Introduction - Why Study Financial Markets and Institutionsmichellebaileylindsa100% (4)

- Elf Shoes PDFDocumento4 páginasElf Shoes PDFIreneIrene100% (1)

- Break Even Analysis Chapter IIDocumento7 páginasBreak Even Analysis Chapter IIAnita Panigrahi100% (1)

- Chapter 3 Principle of AccountingDocumento11 páginasChapter 3 Principle of AccountingAbrha Giday100% (1)

- Complete Sewing Instructions 1917Documento100 páginasComplete Sewing Instructions 1917shedzaAún no hay calificaciones

- Chapter 5 - Production and CostDocumento29 páginasChapter 5 - Production and CostYusuf OmarAún no hay calificaciones

- Understand Residence Status for Individuals in MalaysiaDocumento40 páginasUnderstand Residence Status for Individuals in MalaysiaIfa Chan100% (1)

- Sam and Neneng capital contribution and profit sharing calculationsDocumento19 páginasSam and Neneng capital contribution and profit sharing calculationsJasmine ActaAún no hay calificaciones

- Chapter 2 Solutions To Assignment ProblemsDocumento2 páginasChapter 2 Solutions To Assignment ProblemsBhadra MenonAún no hay calificaciones

- Why Auditor Cannot Provide Absolute Level of Assurance in Audit EngagementDocumento2 páginasWhy Auditor Cannot Provide Absolute Level of Assurance in Audit EngagementAkif AlamAún no hay calificaciones

- Mobil Philippines v. City Treasurer of Makati 1.business Tax v. Income TaxDocumento4 páginasMobil Philippines v. City Treasurer of Makati 1.business Tax v. Income TaxFloyd MagoAún no hay calificaciones

- Ashraf TextileDocumento5 páginasAshraf Textiles_iqbalAún no hay calificaciones

- Salomón Juan Marcos and Grupo DenimDocumento1 páginaSalomón Juan Marcos and Grupo DenimSalomon Juan Marcos VillarrealAún no hay calificaciones

- Elem Na PDFDocumento174 páginasElem Na PDFPhilBoardResultsAún no hay calificaciones