Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Substantive Tests Application

Cargado por

d0 calificaciones0% encontró este documento útil (0 votos)

126 vistas5 páginasThis document provides a sample exam for an auditing theory course, containing 18 multiple choice questions covering various auditing concepts and procedures. Some key topics addressed include:

- Analytical procedures such as comparing financial information to industry data

- The purpose of an unadjusted differences schedule in an audit

- Factors affecting the competence and reliability of audit evidence

- Common components of audit working papers such as supporting documentation

- Audit procedures for validating inventory, fixed assets, payroll, and more.

Descripción original:

Título original

SUBSTANTIVE TESTS APPLICATION.doc

Derechos de autor

© © All Rights Reserved

Formatos disponibles

DOC, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoThis document provides a sample exam for an auditing theory course, containing 18 multiple choice questions covering various auditing concepts and procedures. Some key topics addressed include:

- Analytical procedures such as comparing financial information to industry data

- The purpose of an unadjusted differences schedule in an audit

- Factors affecting the competence and reliability of audit evidence

- Common components of audit working papers such as supporting documentation

- Audit procedures for validating inventory, fixed assets, payroll, and more.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOC, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

126 vistas5 páginasSubstantive Tests Application

Cargado por

dThis document provides a sample exam for an auditing theory course, containing 18 multiple choice questions covering various auditing concepts and procedures. Some key topics addressed include:

- Analytical procedures such as comparing financial information to industry data

- The purpose of an unadjusted differences schedule in an audit

- Factors affecting the competence and reliability of audit evidence

- Common components of audit working papers such as supporting documentation

- Audit procedures for validating inventory, fixed assets, payroll, and more.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOC, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 5

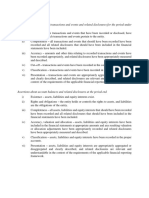

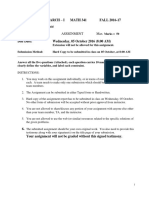

DE LA SALLE LIPA

College of Business, Economics, Accountancy and Management

Accountancy Department

Auditing Theory

SUBSTANTIVE TESTS APPLICATION

Direction: Read and answer the following questions.

___1. Which of the following is an example of analytical procedure?

a. Comparison of financial information with similar information regarding the industry in which the entity operates.

b. Comparison of recorded amounts of major disbursements with appropriate invoices.

c. Comparison of results of a statistical sample with the expected characteristics of the actual population.

d. Comparison of EDP-generated data with similar data generated by a manual accounting system.

___2. In the course of the audit of financial statements for the purpose of expressing an opinion thereon, the auditor will normally

prepare a schedule of unadjusted differences for which he did not propose adjustments when they were uncovered. The primary

purpose of this schedule is to

a. Point out to the responsible client officials the errors made by various company personnel.

b. Summarize the adjustments that must be made before the company can prepare and submit its income tax returns.

c. Identify the potential effects on the financial statements of errors or disputed items that were considered immaterial when discovered.

d. Summarize the errors made by the company so that corrections can be made after the audited financial statements are released.

___3. Which of the following presumptions does not relate to the competence of audit evidence?

a. The more effective internal control is, the more assurance it provides about the accounting data and financial statements.

b. An auditor’s opinion, to be economically useful, is formed within a reasonable time and based on evidence obtained at a reasonable

cost.

c. Evidence obtained from independent sources outside the entity is more reliable than evidence secured solely within the entity.

d. The independent auditor’s direct personal knowledge, obtained through observation and inspection, is more persuasive than

information obtained indirectly.

___4. Which of the following is usually included or shown in the auditor’s working papers?

a. The procedures used by the auditor to verify the personal financial status of members of the client’s management team.

b. Analyses that are designed to be a part, or a substitute, for the client’s accounting records.

c. Excerpts from authoritative pronouncements that support the underlying generally accepted accounting principles used in preparing

the financial statements.

d. The manner that the exceptions and unusual matters as disclosed by the auditor’s procedures were resolved or treated.

___5. Objective evidence is more reliable than evidence that requires considerable judgment to determine whether it is correct. Which

of the following is not an example of objective evidence?

a. Confirmation of accounts receivable

b. Confirmation of bank balances

c. Confirmation by client’s attorney of the likely outcome of outstanding lawsuits against client

d. Adding a list of accounts payable to determine if it balances with the general ledger

___6. The auditor is concerned that a client usually fails to bill customers for shipments. An audit procedure that would gather relevant

evidence would be to

a. Select a sample of duplicate sales invoices and trace each to related shipping documents.

b. Trace a sample of shipping documents to related duplicate sales invoices.

c. Trace a sample of sales journal entries to the accounts receivable subsidiary ledger

d. Compare the total of the schedule of accounts receivable with the balance of the accounts receivable account in the general ledger.

___7. Which of the following is not a factor affecting the independent auditor’s judgment about the quantity, type, and content of audit

working papers?

a. The need for supervision and review of the work performed by assistants.

b. The nature and condition of the client’s records and internal controls.

c. The expertise of client personnel and their participation in preparing schedules.

d. The type of the financial statements, schedules, or other information on which the auditor is reporting.

___8. During the working paper review, an audit supervisor finds that the auditor’s reported findings are not adequately cross-

referenced to supporting documentation. The supervisor will most likely instruct the auditor to

a. Prepare a working paper to indicate that the full scope of the audit was carried out.

b. Familiarize himself with the sequence of working papers so that he will be able to answer questions about the conclusions stated in

the report.

c. Eliminate any cross-references to other working papers since the system is unclear.

d. Provide a working paper indexing system that shows the relationship between findings, conclusions, and the related facts.

___9. The permanent file section of the working papers that is kept for each audit client most likely contains

a. Review notes pertaining to questions and comments regarding the audit work performed.

b. A schedule of time spent on the engagement by each individual auditor.

c. Correspondence with the client’s legal counsel concerning pending litigation.

d. Narrative descriptions of the client’s internal control policies and procedures.

___10. Observation, though considered a reliable audit procedure, has limited usefulness. However, it is used in a number of different

audit situations. Which of the following statements is true regarding observation as an audit technique?

a. It is the most effective audit methodology to use in filling out internal control questionnaires.

b. It is the most persuasive technique to learn how transactions are really processed during the period under audit.

c. It is rarely sufficient to satisfy any audit assertion other than existence.

d. It is the most persuasive audit technique for determining if fraud has really occurred.

DLSL CPA Board Operation – Auditing Theory

Page 1 of 4

___11. An auditor should trace bank transfers for the last part of the audit period and the first part of the subsequent period to detect

whether

a. The cash receipts journal was held open for a few days after the year-end.

b. The cash balances were overstated because of kiting.

c. The last checks recorded before the year-end were actually mailed by the year-end.

d. Any unusual payments to or receipts from related parties occurred.

___12. Negative confirmation of accounts receivable is less effective than positive confirmation of accounts receivable because

a. A majority of recipients usually lack the willingness to respond objectively.

b. Some recipients may report incorrect balances that require extensive follow-up.

c. The auditor cannot infer that all nonrespondents have verified their account information.

d. Negative confirmations do not produce evidential matter that is statistically quantifiable.

___13. Which of the following audit procedures is best for identifying unrecorded trade accounts payable?

a. Reviewing cash disbursements recorded subsequent to the balance sheet date to determine whether the related payable apply to

the prior period.

b. Investigating payable recorded just prior to and just subsequent to the balance sheet date to determine whether they are supported

by receiving reports.

c. Examining unusual relationships between monthly accounts payable balances and recorded cash payments.

d. Reconciling vendor’s statements to the file of receiving reports to identify items received just prior to the balance sheet date.

___14. When auditing merchandise inventory ay year-end, the auditor performs a cutoff test to obtain evidence that

a. All goods purchase before year end are received before the physical inventory count.

b. No goods held on consignment for customers are included in the inventory balance.

c. No goods observed during the physical count are pledged or sold.

d. All goods owned at year end are included in the inventory balance.

___15. An auditor is verifying the existence of newly acquired fixed assets recorded in the accounting records. Which of the following is

the best evidence to help achieve this objective?

a. Documentary support obtained by vouching entries to subsidiary records and invoices.

b. Physical examination of a sample of newly recorded fixed assets.

c. Oral evidence obtained by discussions with operating management.

d. Documentary support obtained by reviewing titles and tax returns.

___16. A common audit procedure in the audit of payroll transactions involves tracing selected items from the payroll journal to

employee time cards that have been approved by supervisory personnel. This procedure is designed to provide evidence in support of

the audit proposition that:

a. Only bonafide employees worked and their pay was properly computed.

b. Jobs on which employees worked were charged with the appropriate labor cost.

c. Controls relating to disbursements are operating properly.

d. Employees worked the number of hours for which their pay was computed.

___17. When a corporation has convertible debentures or stock options, which of the following procedures should the auditor perform?

a. Verify that dividends paid are being held in a secured account.

b. Determine that enough shares are held in reserve to fulfill the obligations.

c. Determine that all stock options and convertible debentures have been recorded in the stockholder ledger.

d. Confirm options and debentures with stock transfer agent.

___18. Auditors try to identify predictable relationships when using analytical procedures. Relationships involving transactions from

which of the following accounts most likely would yield the highest level of evidence?

a. Accounts payable

b. Advertising expense

c. Accounts receivable

d. Interest expense

___19. Which of he following procedures would provide the most reliable audit evidence?

a. Inquiries of the client’s internal audit staff held in private.

b. Inspection of prenumbered client purchase orders filed in the vouchers payable department.

c. Analytical procedures performed by the auditor on the entity’s trial balance.

d. Inspection of bank statements obtained directly from the client’s financial institution.

___20. Which of the following audit procedures is most likely to assist an auditor in identifying related party transactions?

a. Retesting ineffective controls previously reported to the audit committee.

b. Sending second requests for unanswered positive confirmations of accounts receivable.

c. Reviewing information provided by management identifying related parties and being alert for other material related party

transactions.

d. Inspecting communications with law firms for evidence of unreported contingent liabilities.

___21. Which of the following procedures does not require the assistance of an expert?

a. Evaluating the adequacy of disclosure in the notes to the financial statements.

b. Determining the physical condition or quantity of underground mineral.

c. Ascertaining the value of works of art.

d. Interpreting major contracts.

DLSL CPA Board Operation – Auditing Theory

Page 2 of 4

___22. To assess the objectivity of the internal auditors, an independent external auditor would most likely

a. Consider the professional qualifications and experience of the internal auditors.

b. Consider the organizational level to which the internal auditors report the results of their work.

c. Consider proper planning, supervision and documentation of internal auditor’s work.

d. Consider the nature and extent of the internal auditor’s assignment.

___23. Which of the following statements is incorrect about accounting estimates?

a. When evaluating accounting estimates, the auditor should pay particular attention to assumptions that are objective and are

consistent with industry patterns.

b. Management is responsible for making accounting estimates included in the financial statements.

c. The risk of material misstatements is greater when accounting estimates are involved.

d. The evidence available to support an accounting estimate will often be more difficult to obtain and less conclusive than evidence

available to support other items in the financial statements.

___24. Audit documentation is the record of audit procedures performed, relevant audit evidence, and the auditor’s conclusions. Which

of the following statements concerning audit documentation is incorrect?

a. Audit documentation should include superseded drafts of working papers and financial statements.

b. Audit documentation prepared after the performance of the audit work is likely to be less accurate than documentation prepared at

the time such work is performed.

c. Audit documentation may include abstracts or copies of the entity’s records such as significant and specific contracts and

agreements.

d. Audit documentation is not a substitute for the entity’s accounting records.

___25. Substantive procedures for payroll transactions and balances primarily focus on analytical procedures to identify unexpected

fluctuations in recurring payroll entities. Which of the following is an appropriate analytical procedure for payroll?

a. Reconcile the payroll bank account.

b. Compare the relationship of hours worked and payroll with that of the preceding year.

c. Inspect authorization of time cards.

d. Compare authorized wage rates with payroll records.

___26. In an audit of shareholder’s equity, an auditor is most concerned that

a. Share capital transactions are properly authorized.

b. All changes in the shareholder’s equity accounts are monitored by an independent transfer agent and registrar.

c. Share splits are charged to retained earnings at par or stated value.

d. Dividends declared during the year were approved by the shareholders.

___27. In auditing long-term bonds payable, an auditor most likely will

a. Confirm the existence of individual bondholders at year-end.

b. Perform analytical procedures on the bond premium and discount accounts.

c. Compare interest expense with the bond payable amount for reasonableness.

d. Examine documentation of assets purchased with bond proceeds for liens.

___28. In violation of a company policy, Victoria Company erroneously capitalized the cost of painting its warehouse. The auditor

examining Victoria’s financial statements will most likely detect the misstatement when

a. Observing, during the physical inventory observation, that the warehouse had been painted.

b. Examining the construction work orders supporting items capitalized during the year.

c. Examining maintenance expense accounts.

d. Discussing capitalization policies with Victoria’s controller.

___29. The auditor is making an assessment as to whether the client has adopted the appropriate accounting policy for its investment

in the voting stock of the investee. The auditor should obtain evidence primarily by

a. Inquiries to the client as to whether the client has the ability to exercise significant influence over the financial and operating policy

decisions of the investee.

b. Direct confirmation with the investee about the control influence that can be exercised by the client.

c. An independent, third party’s opinion concerning the potential influence or control that can be exercise by the client over the investee.

d. Comparison of the number of shares held by the investor with the investee’s number of shares outstanding according to the written

confirmation.

___30. Which of the following audit procedures most likely would provide assurance about a manufacturing entity’s inventory valuation?

a. Tracing test counts to the entity’s inventory listing.

b. Reviewing shipping and receiving cutoff procedures for inventories.

c. Obtaining confirmation of inventories pledged under loan agreements.

d. Testing the entity’s computation of standard overhead rates.

___31. Which of the following is a substantive procedure that an auditor would most likely perform to verify the existence and valuation

of recorded accounts payable?

a. Confirming accounts payable balances with known suppliers who have zero balances.

b. Investigating the open purchase order file to ascertain that prenumbered purchase orders are used and accounted.

c. Receiving the client’s mail, unopened, for a reasonable period of time after year-end to search for unrecorded vendor’s invoices.

d. Vouching selected entries in the accounts payable subsidiary ledger to purchase orders and receiving reports.

___32. What is the purpose of the proof of cash?

a. To validate that the client’s bank did not make an error during the period being examined.

b. To confirm that the client has properly separated the custody function from the recording function with respect to cash.

c. To prove that the client’s year-end balance of cash is fairly stated.

d. To determine whether any unauthorized disbursements or unrecorded deposits were made for the given time period.

DLSL CPA Board Operation – Auditing Theory

Page 3 of 4

___33. Which of the following procedures would an auditor most likely perform for year-end accounts receivable confirmations when the

auditor did not receive replies to second requests?

a. Inspect the shipping records documenting the merchandise sold to the debtors.

b. Review the cash receipts journal for the month prior to year-end.

c. Intensify the study of internal control concerning the revenue cycle.

d. Increase the assessed level of detection risk for the existence assertion.

___34. Which of the following statements concerning the use of analytical procedures is false?

a. Substantive analytical procedures are applicable when there is only a small volume of transactions.

b. The application of substantive analytical procedures is based on the expectation that relationships among data exist and continue in

the absence of known conditions to the contrary.

c. The presence of relationships among data provides evidence as to the completeness, accuracy, and occurrence of transactions

captured in the information produced by the entity’s information system.

d. Reliance on the results of substantive analytical procedures will depend on the auditor’s assessment of the risk that the analytical

procedures may identify relationships as expected when, in fact, a material misstatement exist.

___35. Which of the following statements concerning audit evidence is correct?

a. An audit usually involves the authentication of documentation.

b. A given set of procedures may provide audit evidence that is relevant to certain assertions, but not to others.

c. Audit evidence obtained from an independent external source is always reliable.

d. An entity’s accounting records can be sufficient audit evidence to support the financial statements.

___36. Using personal computers in auditing may affect the methods used to review the work of staff assistants because

a. Working paper documentation may not contain readily observable details of transactions.

b. The quality control standards may differ.

c. Documenting the supervisory review may require assistance of consulting services personnel.

d. Supervisory personnel may not have an understanding of the capabilities and limitations of personal computers.

___37. PSA 501 states that when inventory is material to the financial statements, the auditor should obtain sufficient appropriate audit

evidence regarding its existence and condition by attendance at physical inventory counting unless impracticable. Which of the

following statements concerning this audit procedure is incorrect?

a. Regardless of the inventory system operated by the client, an annual physical count must be made of each item in the inventory, and

test counts must be made by the auditor.

b. Inventories located in public warehouses may be verified by direct confirmation in writing from the custodians, provided that,

depending on the materiality of these inventories, additional procedures are applied as deemed necessary.

c. When the well-kept perpetual inventory records are checked by the client periodically by comparisons with physical counts, the

auditor’s observation procedures usually can be performed either during or after the end of the period under audit.

d. The independent auditor, when asked to audit financial statements covering the current period and one or more periods for which

he/she had not observed or made some physical counts, may be able to become satisfied as to such prior inventories through

appropriate alternative procedures.

___38. In a payables application, checks are authorized and paid based on matching purchase orders, receiving reports, and vendor

invoices. Partial payments are common. An appropriate audit procedure for verifying that a purchase order has not been paid twice is to

sort the

a. Check register file by purchase order, compute total amounts paid by purchase order, compare total amounts paid with purchase

order amounts, and investigate and discrepancies between the total amounts paid and purchase order amounts.

b. Receiving report file by vendor invoice amounts and investigate any discrepancies between the total amounts received and vendor

invoice amounts.

c. Vendor invoice file by purchase order, compute total amounts invoiced by purchase order, compare total amounts invoiced with

purchased order amounts, and investigate any discrepancies between the total amounts invoiced and purchase order amounts.

d. Receiving report file by purchase order, compute total amounts received by purchase order, compare total amounts received with

purchase order amounts, and investigate any discrepancies between the total amounts received and purchase order amounts.

___39. An auditor ordinarily sends a standard confirmation request to all banks with which the client has done business during the year

under audit, regardless of the year-end balance. A purpose of this procedure is to

a. Detect kiting activities that may otherwise not be discovered.

b. Provide the data necessary to prepare a proof of cash.

c. Request that a cutoff bank statement and related checks be sent to the auditor.

d. Seek information about other deposit and loan amounts that come to the attention of the institution in the process of completing the

confirmation.

___40. Which of the following combination of procedures is an auditor most likely to perform to obtain evidence about fixed asset

additions?

a. Confirming ownership and corroborating transactions through inquiries of client personnel.

b. Inspecting documents and physically examining assets.

c. Recomputing calculations and obtaining written management representations.

d. Observing operating activities and comparing balances to prior period balances.

DLSL CPA Board Operation – Auditing Theory

Page 4 of 4

SOLUTION

1. A

2. C

3. B

4. D

5. C

6. B

7. C

8. D

9. D

10. C

11. B

12. C

13. A

14. D

15. B

16. D

17. B

18. D

19. D

20. C

21. A

22. B

23. A

24. A

25. B

26. A

27. C

28. B

29. A

30. D

31. D

32. D

33. A

34. A

35. B

36. A

37. A

38. A

39. D

40. B

DLSL CPA Board Operation – Auditing Theory

Page 5 of 4

También podría gustarte

- Substantive Test of Accounts PayableDocumento5 páginasSubstantive Test of Accounts PayableHari HikmawanAún no hay calificaciones

- Risk of Material Misstatement - How To AssessDocumento6 páginasRisk of Material Misstatement - How To AssessKenny Christony NugrohoAún no hay calificaciones

- Ch9 SalesCycleDocumento30 páginasCh9 SalesCycleIchsanAún no hay calificaciones

- Market AnalysisDocumento19 páginasMarket AnalysisAshwin Davis RCBSAún no hay calificaciones

- 1.) Transaction Cycles - The Means Through Which An Accounting System Processes Transactions of Related ActivitiesDocumento17 páginas1.) Transaction Cycles - The Means Through Which An Accounting System Processes Transactions of Related ActivitiesKhizzyia Paula Gil ManiscanAún no hay calificaciones

- TBCH04Documento6 páginasTBCH04Ronnelson PascualAún no hay calificaciones

- NteDocumento8 páginasNtevishnuvermaAún no hay calificaciones

- Chapter 3 SolutionsDocumento13 páginasChapter 3 SolutionsjessicaAún no hay calificaciones

- Audit Practice and Assurance Services - A1.4 PDFDocumento94 páginasAudit Practice and Assurance Services - A1.4 PDFFRANCOIS NKUNDIMANAAún no hay calificaciones

- TOPIC 3 2021 B RevisedDocumento40 páginasTOPIC 3 2021 B Revisedkitderoger_391648570Aún no hay calificaciones

- Chapter 12 Richuitte Financial ManagementDocumento6 páginasChapter 12 Richuitte Financial ManagementKelvin Kenneth ValmonteAún no hay calificaciones

- Audit Glossary of TermsDocumento37 páginasAudit Glossary of Termsiwona_lang1968Aún no hay calificaciones

- Best Practices B2B Collection ManagementDocumento22 páginasBest Practices B2B Collection ManagementJohn MetzgerAún no hay calificaciones

- DocxDocumento50 páginasDocxmacmac29Aún no hay calificaciones

- Audit ReviewDocumento12 páginasAudit ReviewAmanda ClaroAún no hay calificaciones

- Functions of Marketing DepartmentDocumento10 páginasFunctions of Marketing Departmentdani9203Aún no hay calificaciones

- RFOC Learner's Guide Page 1-212Documento240 páginasRFOC Learner's Guide Page 1-212Travel GnrOneAún no hay calificaciones

- Chap 011Documento15 páginasChap 011Roger PolancoAún no hay calificaciones

- Overtime Audit Report-EDocumento0 páginasOvertime Audit Report-EGarto Emmanuel SalimAún no hay calificaciones

- CH 18 quiz-ACC302Documento12 páginasCH 18 quiz-ACC302thangdongquay152Aún no hay calificaciones

- Case Studies WorksheetDocumento7 páginasCase Studies Worksheetbrighton_2014Aún no hay calificaciones

- Auditing ReportDocumento47 páginasAuditing ReportNoj WerdnaAún no hay calificaciones

- Q1. What Is Emotional Intelligence? Explain Goleman's Model of Emotional IntelligenceDocumento22 páginasQ1. What Is Emotional Intelligence? Explain Goleman's Model of Emotional IntelligenceRaven MikhailAún no hay calificaciones

- Lending Checklist: Study ViaDocumento8 páginasLending Checklist: Study Viapatrick wafulaAún no hay calificaciones

- Auditing and Assurance StandardsDocumento19 páginasAuditing and Assurance StandardsPankaj KumarAún no hay calificaciones

- Ipcc Auditing 4 Chapters PDFDocumento56 páginasIpcc Auditing 4 Chapters PDFmounika100% (1)

- Chapter 12 Review Questions-IsSACDocumento5 páginasChapter 12 Review Questions-IsSACPhilimon YambaleAún no hay calificaciones

- Chemometrics: Views A N D Propositions?: Chemistry. UniversityDocumento3 páginasChemometrics: Views A N D Propositions?: Chemistry. UniversityAlejandro RomeroAún no hay calificaciones

- ML and TF in The Securities SectorDocumento86 páginasML and TF in The Securities SectorYan YanAún no hay calificaciones

- Law and Ethics Case StudyDocumento6 páginasLaw and Ethics Case Studyiman.zawadiAún no hay calificaciones

- BSBLDR401 Communicate Effectively As A Workplace Leader - Last VersionDocumento2 páginasBSBLDR401 Communicate Effectively As A Workplace Leader - Last VersionAngelica MoralesAún no hay calificaciones

- APES 310 Audit ProgramDocumento13 páginasAPES 310 Audit ProgramShamir Gupta100% (1)

- ChecklistDocumento3 páginasChecklistjessie100% (1)

- Regular Board Meeting Agenda Package - June 18, 2019 - 1Documento42 páginasRegular Board Meeting Agenda Package - June 18, 2019 - 1Jess PetersAún no hay calificaciones

- Bcom 3 Audit FinalDocumento17 páginasBcom 3 Audit FinalNayan MaldeAún no hay calificaciones

- Management AssertionsDocumento2 páginasManagement AssertionsTeh Chu LeongAún no hay calificaciones

- TOPIC 3d - Audit PlanningDocumento29 páginasTOPIC 3d - Audit PlanningLANGITBIRUAún no hay calificaciones

- Training Plan Template 36Documento5 páginasTraining Plan Template 36NEW WESTERN CARRIERAún no hay calificaciones

- Self Assessment ToolDocumento13 páginasSelf Assessment Toolapi-272218126Aún no hay calificaciones

- Chapter 6 MC Employee Fraud and The Audit of CashDocumento7 páginasChapter 6 MC Employee Fraud and The Audit of CashJames HAún no hay calificaciones

- The Human Resources Audit Assessment: If Yes: If YesDocumento5 páginasThe Human Resources Audit Assessment: If Yes: If YesRahul GoleAún no hay calificaciones

- Presentation Audit Auditors ChallengesDocumento11 páginasPresentation Audit Auditors ChallengesghazieAún no hay calificaciones

- AuditingCh6 PracticeDocumento9 páginasAuditingCh6 PracticeAnn Yuheng DuAún no hay calificaciones

- Define Internal Control.: Activity Sheet - Module 6Documento9 páginasDefine Internal Control.: Activity Sheet - Module 6Chris JacksonAún no hay calificaciones

- JURAN Vs DEMINGDocumento38 páginasJURAN Vs DEMINGgurudarshan85% (13)

- At 5908 - Audit Planning Tapos NaDocumento4 páginasAt 5908 - Audit Planning Tapos NaPsc O. AEAún no hay calificaciones

- 14 - IRM Organizational Capacity Assessment Tool - Section ADocumento13 páginas14 - IRM Organizational Capacity Assessment Tool - Section AFakhar E NaveedAún no hay calificaciones

- The Hospitality Business ToolkitDocumento4 páginasThe Hospitality Business ToolkitAmarendra Singh50% (2)

- Internal Auditing (Online) - Syllabus - ConcourseDocumento15 páginasInternal Auditing (Online) - Syllabus - Concoursebislig water districtAún no hay calificaciones

- MID TERM EXAM - Sales & Promotion - MORDocumento4 páginasMID TERM EXAM - Sales & Promotion - MORMadhav RajbanshiAún no hay calificaciones

- How To Conduct A Financial AuditDocumento4 páginasHow To Conduct A Financial AuditSherleen GallardoAún no hay calificaciones

- BizPod Business Plan WorkshopDocumento59 páginasBizPod Business Plan WorkshoppreetimutiaraAún no hay calificaciones

- Comparison of GP-Norampac Gasifier ProjectsDocumento3 páginasComparison of GP-Norampac Gasifier Projectsart9165Aún no hay calificaciones

- Customer Service and RetentionDocumento17 páginasCustomer Service and RetentionAdi SopianAún no hay calificaciones

- Forensic Accounting by Makanju 2Documento12 páginasForensic Accounting by Makanju 2Babajide AdedapoAún no hay calificaciones

- Evaluating Employee PerformanceDocumento12 páginasEvaluating Employee PerformancenurfitriaAún no hay calificaciones

- ACCT220 Supplemental Syllabus June 2020Documento7 páginasACCT220 Supplemental Syllabus June 2020melissa adkinsAún no hay calificaciones

- Intel College: Course Name: Business Finance and EconomicsDocumento2 páginasIntel College: Course Name: Business Finance and EconomicsRocky Kaur100% (1)

- AT7Documento8 páginasAT7gazer beamAún no hay calificaciones

- AT - Material4 Audit Planning-2Documento10 páginasAT - Material4 Audit Planning-2Zach RiversAún no hay calificaciones

- FTSE 100 Index FactsheetDocumento2 páginasFTSE 100 Index FactsheetGaurang GuptaAún no hay calificaciones

- The Great Divide Over Market EfficicnecyDocumento10 páginasThe Great Divide Over Market EfficicnecynamgapAún no hay calificaciones

- Policy Document Shriram Life Wealth Plus PDFDocumento25 páginasPolicy Document Shriram Life Wealth Plus PDFAdithyan SuneendranAún no hay calificaciones

- Strategic Space Matrix ofDocumento5 páginasStrategic Space Matrix ofTayyaub khalid100% (6)

- The Senior Voice - January 2010Documento16 páginasThe Senior Voice - January 2010The Senior VoiceAún no hay calificaciones

- Strategy Based On PsychSignal - DeltixDocumento9 páginasStrategy Based On PsychSignal - DeltixtabbforumAún no hay calificaciones

- Ibm Case Study 5th Sem PDFDocumento4 páginasIbm Case Study 5th Sem PDFvaksoo vaiAún no hay calificaciones

- Clients' Views On Quantity Surveying CompetenciesDocumento23 páginasClients' Views On Quantity Surveying CompetenciescityrenAún no hay calificaciones

- CimaDocumento3 páginasCimacapslocktabAún no hay calificaciones

- Brief Exercise 7-1 (10 Minutes)Documento45 páginasBrief Exercise 7-1 (10 Minutes)Ashish BhallaAún no hay calificaciones

- Forecasting - Module 4 AllDocumento22 páginasForecasting - Module 4 AllSandeepPusarapu50% (2)

- MATH4512 hw3Documento5 páginasMATH4512 hw3Anonymous pPeyKBmYAún no hay calificaciones

- INTERNATIONAL MARKETING Auto ComponentDocumento18 páginasINTERNATIONAL MARKETING Auto ComponentJas777100% (1)

- Financial Statement AnalysisDocumento59 páginasFinancial Statement AnalysisRishu SinghAún no hay calificaciones

- A Study On Profitability Ratio Analysis of The Sundaram Finance LTD in ChennaiDocumento3 páginasA Study On Profitability Ratio Analysis of The Sundaram Finance LTD in ChennaiInternational Journal of Innovative Science and Research TechnologyAún no hay calificaciones

- Present Value of The Principal (P2,000,000 X 0.6830) Present Value of The Interest ( (P2,000,000 X 8% X 3.1699)Documento2 páginasPresent Value of The Principal (P2,000,000 X 0.6830) Present Value of The Interest ( (P2,000,000 X 8% X 3.1699)lanimfa dela cruzAún no hay calificaciones

- Stark Industries Broker ReportDocumento5 páginasStark Industries Broker Reportapi-254731572Aún no hay calificaciones

- Project of HSBC - Harish DhanjaniDocumento4 páginasProject of HSBC - Harish DhanjaniArvind ChauhanAún no hay calificaciones

- Chapter 14Documento52 páginasChapter 14Pia SurilAún no hay calificaciones

- Midsemester Practice QuestionsDocumento6 páginasMidsemester Practice Questionsoshane126Aún no hay calificaciones

- Alpari Uk Bank DetailsDocumento3 páginasAlpari Uk Bank DetailsreniestessAún no hay calificaciones

- Assign-01 (Math341) Fall 2016-17Documento4 páginasAssign-01 (Math341) Fall 2016-17Rida Shah0% (1)

- Case 27Documento18 páginasCase 27Mỹ Trâm Trương ThịAún no hay calificaciones

- Statement of Title To The Lands of Ballyogloghs in The County of AntrimDocumento6 páginasStatement of Title To The Lands of Ballyogloghs in The County of AntrimNevinAún no hay calificaciones

- Corporate Governance in Indian Banking SectorDocumento11 páginasCorporate Governance in Indian Banking SectorFàrhàt HossainAún no hay calificaciones

- Ivey - Case Book - 2005Documento26 páginasIvey - Case Book - 2005g_minotAún no hay calificaciones

- Madura IFM10e TB Ch02-1Documento4 páginasMadura IFM10e TB Ch02-1Le Ngoc HienAún no hay calificaciones

- 15 Language Tests For Bac. StudentsDocumento33 páginas15 Language Tests For Bac. StudentsMubarak Abdessalami82% (28)

- Ladang Perbadanan-Fima Berhad Annual Report 2006Documento67 páginasLadang Perbadanan-Fima Berhad Annual Report 2006ibn Abdillah100% (4)

- Comparitive Analysis of Mutual Fund of HDFC and Icici: Submitted To:-Department of Business AdministrationDocumento22 páginasComparitive Analysis of Mutual Fund of HDFC and Icici: Submitted To:-Department of Business AdministrationRashi GuptaAún no hay calificaciones

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideDe Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideCalificación: 2.5 de 5 estrellas2.5/5 (2)

- Musings on Internal Quality Audits: Having a Greater ImpactDe EverandMusings on Internal Quality Audits: Having a Greater ImpactAún no hay calificaciones

- Internal Audit Checklists: Guide to Effective AuditingDe EverandInternal Audit Checklists: Guide to Effective AuditingAún no hay calificaciones

- Breaking Into Risk Management In BanksDe EverandBreaking Into Risk Management In BanksCalificación: 4 de 5 estrellas4/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersDe EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersCalificación: 4.5 de 5 estrellas4.5/5 (11)

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachDe EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachCalificación: 4 de 5 estrellas4/5 (1)

- The Layman's Guide GDPR Compliance for Small Medium BusinessDe EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessCalificación: 5 de 5 estrellas5/5 (1)

- Internal Controls: Guidance for Private, Government, and Nonprofit EntitiesDe EverandInternal Controls: Guidance for Private, Government, and Nonprofit EntitiesAún no hay calificaciones

- Financial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsDe EverandFinancial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsCalificación: 4 de 5 estrellas4/5 (26)

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceDe EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceCalificación: 4 de 5 estrellas4/5 (1)

- Amazon Interview Secrets: A Complete Guide to Help You to Learn the Secrets to Ace the Amazon Interview Questions and Land Your Dream JobDe EverandAmazon Interview Secrets: A Complete Guide to Help You to Learn the Secrets to Ace the Amazon Interview Questions and Land Your Dream JobCalificación: 4.5 de 5 estrellas4.5/5 (3)

- Business Process Mapping: Improving Customer SatisfactionDe EverandBusiness Process Mapping: Improving Customer SatisfactionCalificación: 5 de 5 estrellas5/5 (1)

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowDe EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowAún no hay calificaciones

- Building a World-Class Compliance Program: Best Practices and Strategies for SuccessDe EverandBuilding a World-Class Compliance Program: Best Practices and Strategies for SuccessAún no hay calificaciones

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyDe EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyAún no hay calificaciones

- Audit. Review. Compilation. What's the Difference?De EverandAudit. Review. Compilation. What's the Difference?Calificación: 5 de 5 estrellas5/5 (1)

- Bribery and Corruption Casebook: The View from Under the TableDe EverandBribery and Corruption Casebook: The View from Under the TableAún no hay calificaciones

- Internet Fraud Casebook: The World Wide Web of DeceitDe EverandInternet Fraud Casebook: The World Wide Web of DeceitAún no hay calificaciones

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsDe EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsAún no hay calificaciones