Documentos de Académico

Documentos de Profesional

Documentos de Cultura

1701rmo 04 - 08

Cargado por

smtm06Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

1701rmo 04 - 08

Cargado por

smtm06Copyright:

Formatos disponibles

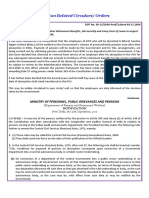

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

08 March 2004

REVENUE MEMORANDUM ORDER NO. 8-2004

SUBJECT : Tasks of Centennial Taxpayers Recognition Program (CTRP)

Responsible Officials

TO : All CTRP Coordinating Group Heads, Regional Directors and

Revenue District Officers

I. BACKGROUND

To attain widest taxpayer participation to the Centennial Taxpayers

Recognition Program (CTRP), RSO 96-2004 dated 03 March 2004 was issued

designating Coordinating Group Heads (CGH) for each identified business and

civil society group whose support will be enlisted in the promotion of the program

to taxpayers. For the same reason, RMC No. 13- 2004 dated 01 March 2004

tasked all Regional Directors (RD) and Revenue District Officers (RDO) the

responsibility for the widest dissemination and participation for the program.

This Order provides clear guidelines on how CGHs, RDs and RDOs are to

perform their respective responsibilities under the CTRP.

II. CTRP OVERALL STRATEGY

To insure success of the program, the BIR National Office (NO) will

promote the CTRP at the national level even as the regions and the district

offices shall promote the program at the local level. The NO shall enlist and work

with the national officers of business and civil society groups while the RDs and

RDOs shall work with the local chapters of said groups even as they shall directly

promote the program to the taxpayers.

III. WORK DEFINITION OF CGHs, RDs and RDOs on the CTRP

The following activities are suggested guides for the conduct of work of

CTRP responsible officials:

1. Agreement Between BIR and Sectoral Groups. – CGHs must seek

to sign up the national office of the sectoral group assigned to them

to an agreement to work together to implement the CTRP (draft

MOA attached marked Annex “A”). RDs and RDOs for their part

must seek out the local chapters of sectoral groups with which the

national office has already signed an agreement and draft a joint

schedule for the execution of the agreement and CTRP at the local

level. In addition, RDs & RDOs must endeavor to sign-up business

and civil society groups present in their areas without a national

organization with which BIR has already an agreement with.

2. Distribute CTRP Materials. – Distribute all relevant materials and

participation form to all members of the business/civil society

groups. For groups with financial resources, obtain their support in

the printing of materials.

3. Symposia and Workshops. – Undertake symposium and workshops

to include Participation Fairs with the objective of promoting the

benefits if CTRP and getting commitment to participate in the

Program.

4. News Media Release. – Provide TAS materials for news report on

the success of their respective sectoral groups/districts for release

at the national office and directly release news stories on CTRP to

the local media.

5. Participation Calls. – Follow-up Participation by calling up the group

member/taxpayers directly for copies of the duly accomplished

participation forms. It is followed by a second “call for

participation”.

6. Submits Reports. – Submission to CIR (Attn:. Mr. Alemar M. Sani)

of the CTRP Report provided for in RMC No. 13-2004.

IV. DCIRs’ as Resource Persons

CHGs may seek the support of their respective group DCIRs to act as

speakers and resource persons in the conduct of Symposiums and

Workshops on CTRP.

V. Effectivity

This Order shall take effect immediately.

(Original Signed)

GUILLERMO L. PARAYNO, JR.

Commissioner of Internal Revenue

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- 9 Cayetano V LeonidasDocumento2 páginas9 Cayetano V Leonidassmtm06Aún no hay calificaciones

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Kilusang Mayo Uno V GarciaDocumento2 páginasKilusang Mayo Uno V Garciasmtm06Aún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- 7TH Day ProvisionsDocumento2 páginas7TH Day Provisionssmtm06Aún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- 8 Vasquez V CADocumento2 páginas8 Vasquez V CAsmtm060% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Albano v. Reyes, 175 SCRA 264 PDFDocumento15 páginasAlbano v. Reyes, 175 SCRA 264 PDFJey RhyAún no hay calificaciones

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- 95 Phil Charter Insurance V Chemoil Lighterage CorpDocumento2 páginas95 Phil Charter Insurance V Chemoil Lighterage Corpsmtm06100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- 16 Abueg V San DiegoDocumento2 páginas16 Abueg V San Diegosmtm06Aún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Gelisan V AldayDocumento9 páginasGelisan V Aldaysmtm06Aún no hay calificaciones

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Rmo 20 90Documento2 páginasRmo 20 90smtm06Aún no hay calificaciones

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Philippine Airlines, Inc., Petitioner, vs. Civil Aeronautics Board and Grand International Airways, Inc.Documento12 páginasPhilippine Airlines, Inc., Petitioner, vs. Civil Aeronautics Board and Grand International Airways, Inc.AlvinClaridadesDeObandoAún no hay calificaciones

- RR No 17-18 Estate and Donor's TaxDocumento1 páginaRR No 17-18 Estate and Donor's TaxGil PinoAún no hay calificaciones

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Philippine Airlines, Inc., Petitioner, vs. Civil Aeronautics Board and Grand International Airways, Inc.Documento12 páginasPhilippine Airlines, Inc., Petitioner, vs. Civil Aeronautics Board and Grand International Airways, Inc.AlvinClaridadesDeObandoAún no hay calificaciones

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- RMONo14 2016Documento3 páginasRMONo14 2016Yan Rodriguez DasalAún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- RR No. 30-2002Documento1 páginaRR No. 30-2002smtm06Aún no hay calificaciones

- RR No 21-2018 PDFDocumento3 páginasRR No 21-2018 PDFJames Salviejo PinedaAún no hay calificaciones

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- CIR vs. Procter Gamble Pilippine Manufacturing CorpDocumento45 páginasCIR vs. Procter Gamble Pilippine Manufacturing CorpLRBAún no hay calificaciones

- RR No. 7-2018Documento2 páginasRR No. 7-2018Rheneir MoraAún no hay calificaciones

- RR 9-2013 PDFDocumento1 páginaRR 9-2013 PDFnaldsdomingoAún no hay calificaciones

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- 413rr04 08Documento2 páginas413rr04 08Sy HimAún no hay calificaciones

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Phil Journalists Inc V CIRDocumento2 páginasPhil Journalists Inc V CIRsmtm06Aún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- CIR V Fortune Tobacco EscraDocumento69 páginasCIR V Fortune Tobacco Escrasmtm06Aún no hay calificaciones

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Phil Journ V CirDocumento7 páginasPhil Journ V Cirsmtm06Aún no hay calificaciones

- Phil Journ V CirDocumento7 páginasPhil Journ V Cirsmtm06Aún no hay calificaciones

- CIR V Fortune Tobacco EscraDocumento69 páginasCIR V Fortune Tobacco Escrasmtm06Aún no hay calificaciones

- Vector Shipping Cor V Adelfo MacasaDocumento2 páginasVector Shipping Cor V Adelfo Macasasmtm06100% (2)

- CIR V Fitness by DesignDocumento3 páginasCIR V Fitness by Designsmtm06100% (4)

- CIR V Fitness by DesignDocumento14 páginasCIR V Fitness by Designsmtm06Aún no hay calificaciones

- Abesco Construction and Development Corporation vs. RamirezDocumento9 páginasAbesco Construction and Development Corporation vs. RamirezT Cel MrmgAún no hay calificaciones

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- San Miguel V MAERC Integrated ServicesDocumento3 páginasSan Miguel V MAERC Integrated Servicessmtm06Aún no hay calificaciones

- SCOR ModelDocumento13 páginasSCOR ModelMeghana KanseAún no hay calificaciones

- Performance MeasurementDocumento42 páginasPerformance MeasurementSanam Chouhan50% (2)

- Assignment Strategic ManagementDocumento9 páginasAssignment Strategic ManagementHarpal PanesarAún no hay calificaciones

- PepsicoDocumento20 páginasPepsicoUmang MehraAún no hay calificaciones

- Pens I o CircularsDocumento7 páginasPens I o Circularspj_bsnlAún no hay calificaciones

- UntitledDocumento11 páginasUntitledHannah Bea AlcantaraAún no hay calificaciones

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2102)

- How To Turn Your HR StrategyDocumento99 páginasHow To Turn Your HR StrategyKhinphone OoAún no hay calificaciones

- Shakey's 2021Documento69 páginasShakey's 2021Megan CastilloAún no hay calificaciones

- Organisational Commitment Towards Employee RetentionDocumento17 páginasOrganisational Commitment Towards Employee RetentionSukesh RAún no hay calificaciones

- TSRTCMSRDEOIDocumento15 páginasTSRTCMSRDEOIdishaAún no hay calificaciones

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- 2019 CIMIC Group Annual Report - 4 February 2020Documento252 páginas2019 CIMIC Group Annual Report - 4 February 2020SAMUEL PATRICK LELIAún no hay calificaciones

- A Case Study and Presentation of TATA NANODocumento11 páginasA Case Study and Presentation of TATA NANOK Y RajuAún no hay calificaciones

- Musembi 2017 Commercial BanksDocumento82 páginasMusembi 2017 Commercial Banksvenice paula navarroAún no hay calificaciones

- What Is Talent ManagementDocumento8 páginasWhat Is Talent ManagementarturoceledonAún no hay calificaciones

- The Town of Brookside Annual Financial Report 2021Documento62 páginasThe Town of Brookside Annual Financial Report 2021ABC 33/40Aún no hay calificaciones

- In Re Facebook - Petition To Appeal Class Cert Ruling PDFDocumento200 páginasIn Re Facebook - Petition To Appeal Class Cert Ruling PDFMark JaffeAún no hay calificaciones

- Civil Engineering - Challenges and OpportunitiesDocumento6 páginasCivil Engineering - Challenges and OpportunitiessmwAún no hay calificaciones

- 06 Task Performance 1Documento1 página06 Task Performance 1Richmon RabeAún no hay calificaciones

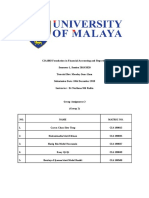

- Cia1002 Group Assignment 2Documento23 páginasCia1002 Group Assignment 2U2003136 STUDENTAún no hay calificaciones

- Darden Case Book 2019-2020 PDFDocumento155 páginasDarden Case Book 2019-2020 PDFJwalant MehtaAún no hay calificaciones

- TCS-Recruitment and SelectionDocumento17 páginasTCS-Recruitment and SelectionChirag PatelAún no hay calificaciones

- A Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Documento19 páginasA Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Shaun WooAún no hay calificaciones

- Maidens, Meal and Money Capitalism and The Domestic Community (Claude Meillassoux) PDFDocumento213 páginasMaidens, Meal and Money Capitalism and The Domestic Community (Claude Meillassoux) PDFjacoAún no hay calificaciones

- LT B SWOT Analysis NUR 587Documento18 páginasLT B SWOT Analysis NUR 587Susan MateoAún no hay calificaciones

- FoodpandaDocumento10 páginasFoodpandaMd. Solaiman Khan ShafiAún no hay calificaciones

- FPA Candidate HandbookDocumento32 páginasFPA Candidate HandbookFreddy - Marc NadjéAún no hay calificaciones

- Chapter 4 - Retail Market Strategy SVDocumento29 páginasChapter 4 - Retail Market Strategy SVBẢO ĐẶNG QUỐCAún no hay calificaciones

- AE12 Module 1 Economic Development A Global PerspectiveDocumento3 páginasAE12 Module 1 Economic Development A Global PerspectiveSaclao John Mark GalangAún no hay calificaciones

- Shareholders Agreement Free SampleDocumento4 páginasShareholders Agreement Free Sampleapi-235666177100% (1)

- Chapter 7 (II) - Current Asset ManagementDocumento23 páginasChapter 7 (II) - Current Asset ManagementhendraxyzxyzAún no hay calificaciones

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeDe EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeCalificación: 2 de 5 estrellas2/5 (1)

- Broken: The most shocking childhood story ever told. An inspirational author who survived it.De EverandBroken: The most shocking childhood story ever told. An inspirational author who survived it.Calificación: 5 de 5 estrellas5/5 (45)

- 1177 B.C.: The Year Civilization Collapsed: Revised and UpdatedDe Everand1177 B.C.: The Year Civilization Collapsed: Revised and UpdatedCalificación: 4.5 de 5 estrellas4.5/5 (111)

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansDe EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansCalificación: 4 de 5 estrellas4/5 (17)

- Why We Die: The New Science of Aging and the Quest for ImmortalityDe EverandWhy We Die: The New Science of Aging and the Quest for ImmortalityCalificación: 4 de 5 estrellas4/5 (3)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldDe EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldCalificación: 4.5 de 5 estrellas4.5/5 (1145)

- Briefly Perfectly Human: Making an Authentic Life by Getting Real About the EndDe EverandBriefly Perfectly Human: Making an Authentic Life by Getting Real About the EndAún no hay calificaciones

- If You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodDe EverandIf You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodCalificación: 4.5 de 5 estrellas4.5/5 (1800)