Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Press Release Clarification Regarding Applicability Standard Deduction Pension Received Former Employer 5-4-2018

Cargado por

kumar45caDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Press Release Clarification Regarding Applicability Standard Deduction Pension Received Former Employer 5-4-2018

Cargado por

kumar45caCopyright:

Formatos disponibles

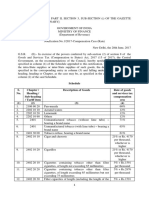

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, 5th April, 2018

PRESS RELEASE

Clarification regarding applicability of standard deduction to pension received

from former employer

Finance Act, 2018 has amended Section 16 of the Income–tax Act, 1961(“the

Act”) to provide that a taxpayer having income chargeable under the head “Salaries”

shall be allowed a deduction of Rs 40,000/- or the amount of salary, whichever is

less, for computing his taxable income.

Representations have been received seeking clarification as to whether a

taxpayer, who receives pension from his former employer, shall also be eligible to

claim this deduction.

The pension received by a taxpayer from his former employer is taxable under

the head “Salaries”. Accordingly, any taxpayer who is in receipt of pension from his

former employer shall be entitled to claim a deduction of Rs 40,000/- or the amount

of pension, whichever is less, under Section 16 of the Act.

(Surabhi Ahluwalia)

Commissioner of Income Tax

(Media & Technical Policy)

Official Spokesperson, CBDT

También podría gustarte

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Tds - and - Tcs Rate Chart Fy 2019 20 TdsmanDocumento2 páginasTds - and - Tcs Rate Chart Fy 2019 20 Tdsmankumar45caAún no hay calificaciones

- Form GSTR 9cDocumento24 páginasForm GSTR 9ckumar45caAún no hay calificaciones

- Form 12BB in Excel FormatDocumento4 páginasForm 12BB in Excel Formatkumar45caAún no hay calificaciones

- Gkepl - Sac Codes: SL - No Nature of ServiceDocumento4 páginasGkepl - Sac Codes: SL - No Nature of Servicekumar45caAún no hay calificaciones

- Taxguru - In-All About DEFERRED TAX and Its Entry in BooksDocumento8 páginasTaxguru - In-All About DEFERRED TAX and Its Entry in Bookskumar45caAún no hay calificaciones

- GST - ITC 04 - Guidelines - GSTN Official - 10-04-2018Documento36 páginasGST - ITC 04 - Guidelines - GSTN Official - 10-04-2018kumar45caAún no hay calificaciones

- Notfctn 1 Compensation Cess EnglishDocumento5 páginasNotfctn 1 Compensation Cess Englishkumar45caAún no hay calificaciones

- CBEC Press Release 29.11.2017 GST RefundDocumento2 páginasCBEC Press Release 29.11.2017 GST Refundkumar45caAún no hay calificaciones

- 22 GST Council MeetDocumento2 páginas22 GST Council Meetkumar45caAún no hay calificaciones

- Press Information Bureau Government of India Ministry of FinanceDocumento3 páginasPress Information Bureau Government of India Ministry of Financekumar45caAún no hay calificaciones

- Stock Account of Inputs, For Use in or in Relation To The Manufacture of Final Products, Issued For Clearance On Payment of DutyDocumento3 páginasStock Account of Inputs, For Use in or in Relation To The Manufacture of Final Products, Issued For Clearance On Payment of Dutykumar45caAún no hay calificaciones

- Gover Ment of Ndia MIN Stry of Corporate A Fairs Notification Ew Delhi Uly 2018Documento17 páginasGover Ment of Ndia MIN Stry of Corporate A Fairs Notification Ew Delhi Uly 2018kumar45caAún no hay calificaciones

- SAC From Gst4u.inDocumento42 páginasSAC From Gst4u.inkumar45caAún no hay calificaciones

- Form R.G. 23 A - Part - II Entry Book of Duty Credit October-08 Page No. 07Documento2 páginasForm R.G. 23 A - Part - II Entry Book of Duty Credit October-08 Page No. 07kumar45caAún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)