Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Art 1772-1774

Cargado por

CMLTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Art 1772-1774

Cargado por

CMLCopyright:

Formatos disponibles

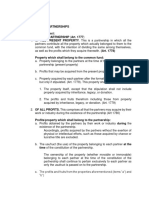

ART. 1772.

Every contract of partnership — The requirement of public instrument is

having a capital of three thousand pesos or imposed as a prerequisite to registration, and

more, in money or property, shall appear in registration is necessary as “a condition for the

a public instrument, which must be issuance of licenses to engage in business or

recorded in the Office of the Securities and trade.

Exchange Commission. Failure to comply

with the requirements of the preceding

paragraph shall not affect the liability of the In this way, the tax liabilities of big partnerships

partnership and the members thereof to cannot be evaded and the public can also

third persons. determine more accurately their membership

and capital before dealing with them.

Registration of partnership. (3) When partnership considered registered.

(1) Partnership with capital of P3,000.00 or — The Securities and Exchange Commission

more. performs the works of a mercantile registrar

insofar as the recording of articles of

partnership is concerned.

— There are two requirements where the

capital of the partnership is P3,000.00 or

more,25 in money or property, namely: Since the recording of articles of partnership

is not for the purpose of giving the partnership

(a) The contract must appear in a public juridical personality (see Art. 1784.), the only

instrument; and objective of the law is to make the recorded

instrument open to all and to give notice

thereof to interested parties.

(b) It must be recorded or registered with the

Securities and Exchange Commission.

This objective is achieved from the date the

partnership papers are presented to and

left for record in the Commission. For this

However, failure to comply with the above reason, when the certificate of recording of the

requirements does not prevent the instrument is issued on a date subsequent to

formation of the partnership (Art. 1768.) or the date of presentation thereof, its effectivity

affect its liability and that of the partners to retroacts as of the latter date.

third persons.

In other words, the date the partnership papers

But any of the partners is granted the right by are presented to and left for record in the

the law (see Arts. 1357, 1358.) to compel Commission is considered the effective date of

each other to execute the contract in a registration of the articles of partnership. This

public instrument. This right cannot be conforms with the ordinary rule of

availed of if the partnership is void under jurisprudence that: “Ordinarily, an instrument is

Article 1773. deemed to be recorded when it is deposited

with the proper office for the purpose of being

recorded.”

(2) Purpose of registration.

ART. 1773. A contract of partnership is void, There is nothing to prevent the court from

whenever immovable property is considering the partnership agreement an

contributed thereto, if an inventory of said ordinary contract from which the parties’ rights

property is not made, signed by the parties, and obligations to each other may be inferred

and attached to the public instrument. and enforced.

Partnership with contribution When inventory is not required.

of immovable property

. An inventory is required only “whenever

(1) Requirements. immovable property is contributed.”

Where immovable property, regardless of Hence, Article 1773 does not apply in the case

its value, is contributed, the failure to of immovable property which may be

comply with the following requirements will possessed or even owned by the partnership

render the partnership contract void in so but not contributed by any of the partners.

far as the contracting parties are concerned: Thus, it has been held that a partnership

contract which states that the partnership is

established “to operate a fishpond” (not “to

(a) The contract must be in a public engage in a fishpond business”) is not

instrument; and rendered void because no inventory of the

fishpond was made where it did not clearly and

(b) An inventory of the property contributed positively appear in the articles of partnership

must be made, signed by the parties, and that the real property had been contributed by

attached to the public instrument. anyone of the partners.

(2) As to contracting parties. If personal property, aside from real property,

is contributed, the inventory need not include

the former.

The absence of either formality renders the

contract void. Although Article 1771 does not

expressly state that without the public Importance of making inventory of real

instrument the contract is void, Article 1773 is property in a partnership.

very clear that the contract is void if the

formalities specifically provided therein are Article 1773 complements Article 1771.

not observed, implying that compliance

therewith is absolute and indispensable for

validity. (1) An inventory is very important in a

partnership to show how much is due from

each partner to complete his share in the

(3) As to third persons. common fund and how much is due to each of

them in case of liquidation.

Article 1773 is intended primarily to protect

third persons. With regard to them, a de facto (2) The execution of a public instrument of

partnership or partnership by estoppel may partnership would be useless if there is no

exist. (see Art. 1825.) inventory of immovable property contributed

because without its description and

designation, the instrument cannot be

subject to inscription in the Registry of

Property, and the contribution cannot

prejudice third persons.

This will result in fraud to those who contract

with the partnership in the belief of the efficacy

of the guaranty in which the immovables may

consist. Thus, the contract is declared void by

law when no such inventory is made.

ART. 1774. Any immovable property or an

interest therein may be acquired in the

partnership name. Title so acquired can be

conveyed only in the partnership name.

Acquisition or conveyance of property

by partnership.

Since a partnership has juridical personality

separate from and independent of that of the

persons or members composing it (Art. 1768.),

it is but logical and natural that immovable

property may be acquired in the

partnership name. Title so acquired can,

therefore, be conveyed only in the partnership

name. (see Art. 46.)

The legal effects of conveyance of property

standing in the name of the partnership

executed by a partner in the partnership name

or in his own name are governed by Article

1819, paragraphs one and two.

The right of a partnership to deal in real as well

as personal property is subject to limitations

and restrictions prescribed by the

Constitution (see Art. XIV, Secs. 3, 5, 8, 9, 11

thereof.) and special laws. A partnership is an

“association” within the meaning of the word

as used in the Constitution.

También podría gustarte

- Article 1771Documento1 páginaArticle 1771karl doceoAún no hay calificaciones

- Article 1771 - Classification of PartnershipsDocumento7 páginasArticle 1771 - Classification of PartnershipsMhico MateoAún no hay calificaciones

- Law On Partnership - General Provisions... Art. 1767-1775Documento5 páginasLaw On Partnership - General Provisions... Art. 1767-1775Joe P PokaranAún no hay calificaciones

- Rules For Distribution of Profits and LossesDocumento1 páginaRules For Distribution of Profits and LossesIVY LOUDANIE LOQUERE100% (2)

- Article 1840. Creditors of The Old Partnership Are Still Creditors of The New Partnership WhenDocumento9 páginasArticle 1840. Creditors of The Old Partnership Are Still Creditors of The New Partnership WhenJhean NaresAún no hay calificaciones

- Article 1800: Who Manages The Partnership?Documento9 páginasArticle 1800: Who Manages The Partnership?Mhico MateoAún no hay calificaciones

- Art. 1776. Kinds of PartnershipsDocumento4 páginasArt. 1776. Kinds of PartnershipsJoe P PokaranAún no hay calificaciones

- Property Rights of A PartnerDocumento17 páginasProperty Rights of A Partnererikha_araneta100% (5)

- Partnership 1Documento12 páginasPartnership 1jed_nur86% (7)

- Article 1787-1796Documento23 páginasArticle 1787-1796Baylon RachelAún no hay calificaciones

- Art 1838-1839 (Partnership)Documento2 páginasArt 1838-1839 (Partnership)Mosarah AltAún no hay calificaciones

- Partnership Dissolution Causes and EffectsDocumento13 páginasPartnership Dissolution Causes and EffectsRustom IbanezAún no hay calificaciones

- Partners' obligations to third partiesDocumento15 páginasPartners' obligations to third partiesjalilah gunti50% (2)

- Article 1825Documento11 páginasArticle 1825Alex Buzarang SubradoAún no hay calificaciones

- Law On Partnerships (General Provisions)Documento3 páginasLaw On Partnerships (General Provisions)Citoy LabadanAún no hay calificaciones

- Rights and obligations of partners in a partnershipDocumento3 páginasRights and obligations of partners in a partnershipenliven morenoAún no hay calificaciones

- Obli ART 1232Documento44 páginasObli ART 1232Pearl Angeli Quisido CanadaAún no hay calificaciones

- AlagangWency - Partnersip Dissolution Short QuizDocumento1 páginaAlagangWency - Partnersip Dissolution Short QuizKristian Paolo De LunaAún no hay calificaciones

- Article 1830-1835Documento32 páginasArticle 1830-1835Nathaniel SkiesAún no hay calificaciones

- Law On PartnershipDocumento26 páginasLaw On PartnershipAngelita Dela cruzAún no hay calificaciones

- Article 1767Documento2 páginasArticle 1767Noreen67% (9)

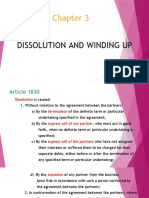

- Chapter 3 Dissolution and Winding UpDocumento5 páginasChapter 3 Dissolution and Winding UpCheriferDahangCoAún no hay calificaciones

- CHAPTER 3 Dissolution and Winding Up CODALDocumento5 páginasCHAPTER 3 Dissolution and Winding Up CODALfermo ii ramosAún no hay calificaciones

- Article 1784 1809Documento21 páginasArticle 1784 1809JUDE ANGELO PAHITAMOSAún no hay calificaciones

- Chapter 2 Obligations of PartnersDocumento35 páginasChapter 2 Obligations of PartnersPhil UriarteAún no hay calificaciones

- Article 1792 To 1997Documento12 páginasArticle 1792 To 1997Sukh Gill100% (1)

- Partnership Formation RequirementsDocumento1 páginaPartnership Formation RequirementsAnonymous t1lbUug0A50% (4)

- Obligations of The Partners With Regard To Third PersonsDocumento61 páginasObligations of The Partners With Regard To Third PersonsNathaniel Skies100% (4)

- Jurado PartnershipDocumento13 páginasJurado PartnershipMoon Beams100% (2)

- PartnershipDocumento7 páginasPartnershipami50% (2)

- Article 1811Documento6 páginasArticle 1811venus mae b caulinAún no hay calificaciones

- Illustrative CaseDocumento11 páginasIllustrative CaseCristine CaringalAún no hay calificaciones

- Partnership 1847 1856Documento32 páginasPartnership 1847 1856Sunhine50% (2)

- Limited Partnership RightsDocumento6 páginasLimited Partnership RightsJovelyn OrdoniaAún no hay calificaciones

- Article 1831-1833Documento4 páginasArticle 1831-1833Jessica Acosta0% (1)

- Article 1822, 1823, and 1824Documento3 páginasArticle 1822, 1823, and 1824maria cruzAún no hay calificaciones

- Partnership obligations when collecting debtsDocumento2 páginasPartnership obligations when collecting debtsJudyAún no hay calificaciones

- Partnership Creditors Preferred Over Individual CreditorsDocumento2 páginasPartnership Creditors Preferred Over Individual CreditorsJanice100% (1)

- ARTICLE 1797: Distribution of Profits and Losses Among PartnersDocumento7 páginasARTICLE 1797: Distribution of Profits and Losses Among PartnersBOEN YATORAún no hay calificaciones

- Article 1860-1867 PartnershipDocumento2 páginasArticle 1860-1867 PartnershipAron Panturilla100% (1)

- Report On Partnership Art. 1784-1789Documento7 páginasReport On Partnership Art. 1784-1789Winona Marie Borla100% (3)

- Article 1815Documento1 páginaArticle 1815Alexandria Evangelista100% (1)

- Obligations and Contributions of PartnersDocumento9 páginasObligations and Contributions of PartnersPopoyAún no hay calificaciones

- Article 1774-1783Documento35 páginasArticle 1774-1783kim che50% (2)

- C. Property Rights of A PartnerDocumento5 páginasC. Property Rights of A PartnerClyde Tan0% (2)

- Prelim With Answer Keys - Law PDFDocumento2 páginasPrelim With Answer Keys - Law PDFheyheyAún no hay calificaciones

- Article 1767 - 1867 SummaryDocumento34 páginasArticle 1767 - 1867 SummaryJanaisa Bugayong Espanto67% (3)

- Partnership and Co OwnershipDocumento6 páginasPartnership and Co Ownershippnim100% (1)

- Article 1828-1867Documento5 páginasArticle 1828-1867ChaAún no hay calificaciones

- Classifications and types of partnerships and joint venturesDocumento2 páginasClassifications and types of partnerships and joint venturesHonnely Palen-Garzon Aponar-Mahilum100% (4)

- Delectus PersonaeDocumento59 páginasDelectus Personaeleahtabs100% (3)

- Magalona v. PesaycoDocumento1 páginaMagalona v. Pesaycotemporiari100% (1)

- Joint Purchase Partition CaseDocumento2 páginasJoint Purchase Partition Caseceilo coboAún no hay calificaciones

- Essential Elements of The Contract ofDocumento12 páginasEssential Elements of The Contract ofjanicetorredaAún no hay calificaciones

- TaxDocumento4 páginasTaxGia Serilla100% (1)

- Law on Business Organizations ReviewerDocumento41 páginasLaw on Business Organizations ReviewerMary Claudette Unabia100% (3)

- Commercial Law - Atty. SubiaDocumento28 páginasCommercial Law - Atty. SubiaJollibee Bida BidaAún no hay calificaciones

- 31 Arts. 1771, 1773Documento2 páginas31 Arts. 1771, 1773Eloise Coleen Sulla PerezAún no hay calificaciones

- PatDocumento6 páginasPatFrances Angelie NacepoAún no hay calificaciones

- Partnership (De Leon Notes)Documento4 páginasPartnership (De Leon Notes)Jhean NaresAún no hay calificaciones

- Case Digests in LEASE 2CDocumento2 páginasCase Digests in LEASE 2CCMLAún no hay calificaciones

- Appeal TableDocumento1 páginaAppeal TableCMLAún no hay calificaciones

- LAW STUDENT SUPERVISIONDocumento2 páginasLAW STUDENT SUPERVISIONCMLAún no hay calificaciones

- People v. Rodriguez Effect on Co-AccusedDocumento4 páginasPeople v. Rodriguez Effect on Co-AccusedCMLAún no hay calificaciones

- Atkins vs. Hian TekDocumento2 páginasAtkins vs. Hian TekCMLAún no hay calificaciones

- Marcelo vs. SBDocumento1 páginaMarcelo vs. SBCMLAún no hay calificaciones

- Family Code Key ProvisionsDocumento23 páginasFamily Code Key ProvisionsCMLAún no hay calificaciones

- Dugs Case Doctrines Tax PDFDocumento7 páginasDugs Case Doctrines Tax PDFCMLAún no hay calificaciones

- Article 12, Sec. 2. All Lands of The Public Domain, WatersDocumento7 páginasArticle 12, Sec. 2. All Lands of The Public Domain, WatersCMLAún no hay calificaciones

- Sales Digest Summary PDFDocumento10 páginasSales Digest Summary PDFCMLAún no hay calificaciones

- People vs. RonderoDocumento1 páginaPeople vs. RonderoCMLAún no hay calificaciones

- Condominium ActDocumento8 páginasCondominium ActCMLAún no hay calificaciones

- Political Law YnahDocumento19 páginasPolitical Law YnahCMLAún no hay calificaciones

- Family Code Key ProvisionsDocumento23 páginasFamily Code Key ProvisionsCMLAún no hay calificaciones

- Marcelo vs. SBDocumento1 páginaMarcelo vs. SBCMLAún no hay calificaciones

- Ysmael Vs SENRDocumento2 páginasYsmael Vs SENRCMLAún no hay calificaciones

- Criminal Law I SyllabusDocumento1 páginaCriminal Law I SyllabusCMLAún no hay calificaciones

- Firestone Case DigestDocumento2 páginasFirestone Case DigestCMLAún no hay calificaciones

- Environmental AnnotationDocumento63 páginasEnvironmental AnnotationIvan Angelo ApostolAún no hay calificaciones

- Carpio MoralesDocumento38 páginasCarpio MoralesCMLAún no hay calificaciones

- Employer-employee relationship at the heart of SC caseDocumento10 páginasEmployer-employee relationship at the heart of SC caseCMLAún no hay calificaciones

- Toward A New Classification of Nonexperimental Quantitative ResearchDocumento11 páginasToward A New Classification of Nonexperimental Quantitative ResearchCMLAún no hay calificaciones

- Pampanga High School Math 10 PDFDocumento2 páginasPampanga High School Math 10 PDFCMLAún no hay calificaciones

- Form 1 Admission Application Sol PDFDocumento2 páginasForm 1 Admission Application Sol PDFJuan Carlo CastanedaAún no hay calificaciones

- "Drugs Take You To Hell, Disguised As Heaven": "I Have Big Plans For My Future That'S Why, I Choose To Be Drug Free"Documento1 página"Drugs Take You To Hell, Disguised As Heaven": "I Have Big Plans For My Future That'S Why, I Choose To Be Drug Free"CMLAún no hay calificaciones

- Mammangi FestivalDocumento1 páginaMammangi FestivalCMLAún no hay calificaciones

- Untitled DocumentDocumento1 páginaUntitled DocumentCMLAún no hay calificaciones

- BP 129Documento16 páginasBP 129Reinald Kurt VillarazaAún no hay calificaciones

- GAARDocumento20 páginasGAARXMBA 24 ITM VashiAún no hay calificaciones

- The Different Classification of Taxes in The PhilippinesDocumento2 páginasThe Different Classification of Taxes in The PhilippinesShane MartinAún no hay calificaciones

- Extra Ex QTTC28129Documento4 páginasExtra Ex QTTC28129Quang TiếnAún no hay calificaciones

- Motilal Oswal Value Strategy FundDocumento27 páginasMotilal Oswal Value Strategy FundFountainheadAún no hay calificaciones

- 00 Syllabus 2024 Investments MS+readingsDocumento5 páginas00 Syllabus 2024 Investments MS+readingsxinluli1225Aún no hay calificaciones

- Ridham Desai Applying Science To The Art of InvestingDocumento2 páginasRidham Desai Applying Science To The Art of InvestingVinayAún no hay calificaciones

- Century Pacific Food Inc Ratios - Key Metrics ReportDocumento8 páginasCentury Pacific Food Inc Ratios - Key Metrics ReportSheena Ann Keh LorenzoAún no hay calificaciones

- Problem 26 2Documento2 páginasProblem 26 2CodeSeekerAún no hay calificaciones

- Currency Derivatives - WorkbookDocumento95 páginasCurrency Derivatives - Workbookapi-19974928100% (1)

- Philippine Financial System OverviewDocumento54 páginasPhilippine Financial System OverviewArnel Olsim100% (1)

- S.E.C. Inspector General's Recommendations 2Documento86 páginasS.E.C. Inspector General's Recommendations 2DealBook100% (1)

- Form PDF 157539400270722Documento41 páginasForm PDF 157539400270722Vidushi JainAún no hay calificaciones

- Form 2B NominationDocumento2 páginasForm 2B NominationSantosh GanjureAún no hay calificaciones

- Foreign Currency Transactions and Hedging ProblemsDocumento6 páginasForeign Currency Transactions and Hedging ProblemsJeann MuycoAún no hay calificaciones

- PROJECT REPORT On "Listing of Securities"Documento63 páginasPROJECT REPORT On "Listing of Securities"murlidharne88% (8)

- Hugh Hendry - MGR CommentaryDocumento12 páginasHugh Hendry - MGR CommentaryworkmanaAún no hay calificaciones

- Business & Management HL Internal AssessmentDocumento11 páginasBusiness & Management HL Internal AssessmentNauman Zaheer50% (2)

- CBS Requirements For UCBsDocumento112 páginasCBS Requirements For UCBsPralay BiswasAún no hay calificaciones

- Book Smart MoneyDocumento136 páginasBook Smart MoneyAden100% (1)

- Equity SolutionsDocumento12 páginasEquity Solutionsanant singhalAún no hay calificaciones

- Tender For Garbage Collection ServicesDocumento41 páginasTender For Garbage Collection ServicesMoses Karanja Mungai50% (2)

- Capital MarketsDocumento696 páginasCapital MarketsSaurabh VermaAún no hay calificaciones

- Chua Kritzman Page 2009 The Myth of DiversificationDocumento10 páginasChua Kritzman Page 2009 The Myth of DiversificationDong SongAún no hay calificaciones

- SAP FI-MM-SD IntegrationDocumento12 páginasSAP FI-MM-SD IntegrationAniruddha ChakrabortyAún no hay calificaciones

- AR18 - Financial Statements and Independent Auditor ReportDocumento57 páginasAR18 - Financial Statements and Independent Auditor ReportKira LimAún no hay calificaciones

- Pepsi Annual ReportDocumento118 páginasPepsi Annual Reportcurtnie bernardoAún no hay calificaciones

- Alr SecuritiesDocumento168 páginasAlr SecuritiesParamita PrananingtyasAún no hay calificaciones

- Sample Partnership DeedDocumento5 páginasSample Partnership DeedAnup RawatAún no hay calificaciones

- Bankruptcy TanneryDocumento11 páginasBankruptcy TanneryBostonBizJournalAún no hay calificaciones

- Investors' Guide to Engro Polymer IPODocumento134 páginasInvestors' Guide to Engro Polymer IPOowais khalidAún no hay calificaciones