Documentos de Académico

Documentos de Profesional

Documentos de Cultura

GSFC Kotak811 Apr17 PDF

Cargado por

ahmad9595Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

GSFC Kotak811 Apr17 PDF

Cargado por

ahmad9595Copyright:

Formatos disponibles

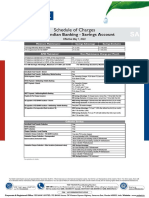

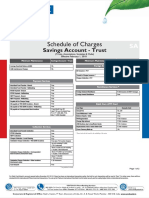

General Schedule of Features and Charges for Kotak 811 Combined

With effect from 15th December 2017

Particulars Kotak 811 Limited KYC Kotak 811 Lite Kotak 811 Full KYC Account

Average monthly Balance Zero Zero Zero

Funds Transfer NEFT / RTGS / Funds Transfers / IMPS NEFT / IMPS: Nil Charges; Outward Funds transfer is NEFT / RTGS / IMPS:

(Through Net / Mobile Banking) (RTGS: Not available) not available Nil Charges

For NEFT: Upto 10000: 2.50;

10001 to 100000:5; 100001 to

NEFT / RTGS done through Branch Not available Not available 200000:15; > 200000 : 25

For RTGS: 200001 to

500000: 25;> 500000: 50

Cash Transactions Nil charges for 1 transaction

Nil charges for 1 Deposit / month upto Nil charges for 1 Deposit / month upto

Cash Transactions at Branch / Cash (Deposit or Withdrawal) / month

Rs. 10,000. Thereafter, charged at Rs. 10,000. Thereafter, charged at

Deposit Machine (Deposit or Withdrawal) upto Rs. 10,000.

Rs. 3.5 / 1000 with minimum Rs. 50. Rs. 3.5 / 1000 with minimum Rs. 50.

Thereafter, charged at Rs. 3.5 / 1000

(Cash Withdrawal: Not available) (Cash Withdrawal: Not available)

with minimum Rs. 50.

Debit Card / ATM Charges Not available

Issuance / Annual Fee / Replacement Nil Charges Nil Charges

(Virtual Debit Card)

Debit Card / ATM Charges Classic Debit Card-Annual Fees Or

(with Physical Debit Card) Replacement of Lost Debit Card 299 p.a. 299 p.a.

(Physical Debit card)

5 Transaction / month @ nil charges, 5 Transaction / month @ nil charges,

Kotak Bank's ATM Financial Transaction /

thereafter Financial Txn. 20.00 / Txn. thereafter Financial Txn. 20.00 / Txn.

Non-Financial Transaction*

Non-Financial Txn. 8.50 / Txn. Non-Financial Txn. 8.50 / Txn.

Not available

Maximum of 5 transactions @ nil charges Maximum of 5 transactions @ nil charges

(incl. financial & non-financial) in a month (incl. financial & non-financial) in a month

Other Domestic ATMS Financial with a cap of Maximum 3 transactions with a cap of Maximum 3 transactions

Transaction / Non-Financial Transaction## / @ nil charges in Top 6#+ Cities, thereafter @ nil charges in Top 6#+ Cities, thereafter

Declined Transactions due to Financial Transaction 20.00 / Txn. Financial Transaction 20.00 / Txn.

insufficient balance Non-Financial Transaction 8.50 / Txn. Non-Financial Transaction 8.50 / Txn.

Txn. declined charges Rs. 25 / instance Txn. declined charges Rs. 25 / instance

Financial Transaction / Non-Financial

150 / Txn. 150 / Txn.

Transaction at International ATM +

DD / Pay order / Cheque book DD / Pay Order Not available Not available 2.5 / 1000 (Min 50 Max 10000)

FCY DD / TT / Cheque Collection /

Revalidation / Cancellation / Not available Not available 500

FCY Cheque Deposited and Return

Chargeable @ Rs. 75 for 25 leaves or

At-par Cheque Book Charges Not available Not available Rs. 150 for 50 leaves

ECS / Cheque Issued & Returned

(due to non-availability of funds) Not available Not available 500 / instance

ECS Mandate Verification Not available Not available 50 / instance

SI Failure Not available Not available 100

Cheque deposited and returned (INR) Not available Not available 100

Branch Requests Duplicate Ad-hoc statement, Balance &

Interest Statement, Foreign Inward

Remittance Certificate, Duplicate

Passbook, TDS Cerificate Through Branch

or any other Record Retrieval, Stop

Payment Single / Range of cheque thru Not available Not available 100 / Request

branch; DD / PO / BC Revalidation /

Cancellation( INR); Tax Collection thru

branch; Annual Combined

Statement Physical;

Monthly Physical Statement

Statements & Alerts Statements Email statement @ nil charges Email statement @ nil charges Email statement @ nil charges

Balances and Transaction & Value added Daily SMS 30 / Qtr. Daily SMS 30 / Qtr. Daily SMS 30 / Qtr.

alerts (Daily / Weekly)

Weekly SMS 15 / Qtr. Weekly SMS 15 / Qtr. Weekly SMS 15 / Qtr.

Other Charges TOD Not available Not available TOD: Rs. 500

Cheque Purchase Charges: 0.5 /1000

Cheque purchase Not available Not available

(Min 50; Max 10000)

Request for PIN generation / re-generation Rs. 100 / Request Rs. 100 / Request Rs. 100 / Request

(sent through courier)

Features of Kotak811 Lite Mobile Account: Aggregate of all credits should not exceed Rs. 10,000 in a calendar month. Balance in the account should not exceed Rs. 10,000 at any point in time. The aggregate of all credits

should not exceed Rs. 1,00,000 in a financial year. Customer won't be allowed to transfer funds before the account is converted to Full KYC account. No cheque book will be issued and cheque deposit will not be allowed to

customers.

Features of Kotak811 Limited KYC Account: Aggregate of all credit should not exceed 2 Lakh in a year and, Account balance at any point should not exceed 1 Lakh. Customer can transfer a maximum amount of 100,000

through online transfers. Customer won't be allowed to transfer funds through branch before the account is converted to Full KYC account. No cheque book will be issued.

##Cash withdrawal limit from other Domestic ATM is Rs. 10000 per transaction.

#+ Top 6 Cities Transactions done in Mumbai, New Delhi, Chennai, Kolkata, Bengaluru and Hyderabad ATMs.

*Financial transaction at ATM will include Cash withdrawal, Non-Financial transaction will include balance enquiry, PIN change, Mini statement request.

Transaction and Value Added SMS alerts would be sent to the customers who have subscribed for Daily / Weekly. Balance Alerts facility. Alerts that have been mandated by RBI as well as alerts which are deemed appropriate by

the Bank, will be sent free of charge, even if Daily / weekly Balance SMS alerts facility has not been subscribed.

#Indo - Nepal Remittance Scheme (NEFT Charges):

If Beneficiary maintains an Account with Nepal SBI Bank Ltd. (NSBL): Rs. 25 per txn. (incl all taxes).

If Beneficiary does not maintain an Account with Nepal SBI Bank Ltd (NSBL): Upto Rs. 5000 Rs. 75 per txn. & beyond Rs. 5000 Rs. 100 per txn. (incl all taxes).

The Bank will charge cross-currency mark-up of 3.5% on foreign currency transactions carried out on Debit Cards. The exchange rate used will be the VISA / Master Card wholesale exchange rate prevailing at the time of

transaction.

Charges are exclusive of the Goods and Service Tax (GST).

With effect from July 1, 2017 the effective Goods and Service tax rate will be 18% on taxable value. The GST rate is subject to change from time to time.

Any rejections in applications made through ASBA mode due to insufficient funds will attract charges of Rs. 350/- per rejection<>

As per RBI guidelines, Business / Commercial transactions are not permitted in the Savings Accounts.

+Additional charges levied by another bank on international ATM transactions will also have to be borne by the card holder.

The above charges are subject to revision with a prior intimation of 30 days to all account holders. Closure of account due to revision of charges will not be subject to account closure charges.

~Any purchase / sale of foreign exchange will attract Service Tax on the gross amount of currency exchanged as per Service Tax on Foreign Currency

Conversion Charges (FCY) table below.

Value of purchase or sale of Foreign Currency Value on which GST rate will be applicable

Up to Rs. 1,00,000 1% of the gross amount of currency exchanges or minimum of Rs. 250/-

Above Rs. 1,00,000 to Rs.10,00,000 1000 + 0.50% of the gross amount of currency exchanged less 1,00,000.

Above Rs. 10,00,000 Rs.5500/- + 0.10% of the gross amount of currency exchanges less 10,00,000 subject to maximum of Rs. 60,000/-

También podría gustarte

- 811 - Kotak Mahindra BankDocumento5 páginas811 - Kotak Mahindra BankVivek EadaraAún no hay calificaciones

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Documento2 páginasService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03Aún no hay calificaciones

- CABCA - SOC - July 22Documento2 páginasCABCA - SOC - July 22anjumAún no hay calificaciones

- General Charges of Kotak BankDocumento2 páginasGeneral Charges of Kotak BankSarafraj BegAún no hay calificaciones

- Casil Soc 01 07 23Documento2 páginasCasil Soc 01 07 23rishisiliveri95Aún no hay calificaciones

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocumento2 páginasSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaAún no hay calificaciones

- Gib Savings Account Wef 01may2022Documento3 páginasGib Savings Account Wef 01may2022Ankur VermaAún no hay calificaciones

- Schedule of Charges Edge Business 1st Feb 20 PDFDocumento2 páginasSchedule of Charges Edge Business 1st Feb 20 PDFRavie S DhamaAún no hay calificaciones

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocumento1 páginaCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanAún no hay calificaciones

- From Kotak WebsiteDocumento20 páginasFrom Kotak WebsiteHimadri Shekhar VermaAún no hay calificaciones

- JIFI Charges PDFDocumento2 páginasJIFI Charges PDFRamesh SinghAún no hay calificaciones

- Nri Schedule of ChargesDocumento4 páginasNri Schedule of ChargesRishiAún no hay calificaciones

- Annexure BDocumento3 páginasAnnexure BMayapur CommunicationAún no hay calificaciones

- Digital Savings Account Effective July 2021Documento3 páginasDigital Savings Account Effective July 2021Nikhil KumarAún no hay calificaciones

- New Dgtca SocDocumento2 páginasNew Dgtca SocchintankantariaAún no hay calificaciones

- Sba 2 0 Ivy PDFDocumento2 páginasSba 2 0 Ivy PDFChandan SahAún no hay calificaciones

- Effective From 1st April, 2020Documento2 páginasEffective From 1st April, 2020SundarAún no hay calificaciones

- Indus Freedom February2017Documento1 páginaIndus Freedom February2017HeartKiller LaxmanAún no hay calificaciones

- One Globe Trade AccountDocumento5 páginasOne Globe Trade AccountKhushi VarshneyAún no hay calificaciones

- Rates and Charges - Fincare Small Finance BankDocumento4 páginasRates and Charges - Fincare Small Finance BankkrishnabhasingikAún no hay calificaciones

- IDFC Startup NewBusinessCA SOCDocumento2 páginasIDFC Startup NewBusinessCA SOCdhruvsaidavaAún no hay calificaciones

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocumento2 páginasSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurAún no hay calificaciones

- GSFC MpowerDocumento2 páginasGSFC Mpowerneerajsibgh434Aún no hay calificaciones

- Regular Savings SOC 2023Documento2 páginasRegular Savings SOC 2023megha90909Aún no hay calificaciones

- Basic and Classic Savings Account Effective September 2020Documento3 páginasBasic and Classic Savings Account Effective September 2020moviejunk97Aún no hay calificaciones

- Glossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteDocumento4 páginasGlossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteAlka RanjanAún no hay calificaciones

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Documento2 páginasMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedAún no hay calificaciones

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Documento2 páginasService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BAún no hay calificaciones

- Annexure2 PDFDocumento2 páginasAnnexure2 PDFMukeshAún no hay calificaciones

- SOC Savings AdityaDocumento2 páginasSOC Savings AdityaDenny PjAún no hay calificaciones

- SOC Indus Multiplier MaxDocumento4 páginasSOC Indus Multiplier Maxmanoj baroka0% (1)

- Comparison of Standard Chartered Bank With Citibank and HSBCDocumento5 páginasComparison of Standard Chartered Bank With Citibank and HSBCarpit_tAún no hay calificaciones

- Schedule of Charges Effective January 1, 2020: Traders Current AccountDocumento3 páginasSchedule of Charges Effective January 1, 2020: Traders Current Accountjpsmu09Aún no hay calificaciones

- Indus Business Account SOC 30.07.2020Documento1 páginaIndus Business Account SOC 30.07.2020Rameshchandra SolankiAún no hay calificaciones

- Chartered Accountant 2 0Documento3 páginasChartered Accountant 2 0RkAún no hay calificaciones

- 9114 Accts-SERVICE CHARGhjgjgnj)Documento5 páginas9114 Accts-SERVICE CHARGhjgjgnj)Girish KumarAún no hay calificaciones

- Schedule of Charges For Nri Accounts PrimeDocumento4 páginasSchedule of Charges For Nri Accounts PrimeSonam SharmaAún no hay calificaciones

- Istartup 2 0Documento3 páginasIstartup 2 0fatrag amloAún no hay calificaciones

- GSFC Revision For Current Account Elegance 1 July 2019Documento1 páginaGSFC Revision For Current Account Elegance 1 July 2019Kim Jong YungAún no hay calificaciones

- Schedule of Charges Yes Bank 5Documento1 páginaSchedule of Charges Yes Bank 5Sayantika MondalAún no hay calificaciones

- Minimum Disclosure of Bank Fees and Charges 2021Documento1 páginaMinimum Disclosure of Bank Fees and Charges 2021Bahati RaphaelAún no hay calificaciones

- Services ProvidedDocumento15 páginasServices ProvidedParul AroraAún no hay calificaciones

- Parameter Au Samriddhi Current AccountDocumento2 páginasParameter Au Samriddhi Current Accounthiteshmohakar15Aún no hay calificaciones

- Burgundy Fees and Charges 01042023Documento7 páginasBurgundy Fees and Charges 01042023Nagaraj VukkadapuAún no hay calificaciones

- Schedule of Charges Effective July 22, 2021Documento3 páginasSchedule of Charges Effective July 22, 2021Vivek DixitAún no hay calificaciones

- Effective From 1st January, 2022: AMB (Average Monthly Balance) Non Maintenance Charges (NMC) - MonthlyDocumento2 páginasEffective From 1st January, 2022: AMB (Average Monthly Balance) Non Maintenance Charges (NMC) - MonthlySavitha EAún no hay calificaciones

- Soc Ca 01.01.22Documento4 páginasSoc Ca 01.01.22Abhishek ShivappaAún no hay calificaciones

- Schedule of Charges For Nri PriorityDocumento4 páginasSchedule of Charges For Nri PriorityAnnuRawatAún no hay calificaciones

- Broking Idirect Linked Savings AccountDocumento7 páginasBroking Idirect Linked Savings Accounttrue chartAún no hay calificaciones

- Schedule of Charges Branchless Banking Apr To Jun 2019 EnglishDocumento2 páginasSchedule of Charges Branchless Banking Apr To Jun 2019 EnglishJahangirAún no hay calificaciones

- Documents Required For Title TransferDocumento2 páginasDocuments Required For Title TransferChaitanya Chaitu CAAún no hay calificaciones

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocumento2 páginasTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreAún no hay calificaciones

- SOC DCB Privilege Current AccountDocumento4 páginasSOC DCB Privilege Current Accountsunilverma202320Aún no hay calificaciones

- Schedule of Benefits & Charges Abacus Digital Savings AccountDocumento3 páginasSchedule of Benefits & Charges Abacus Digital Savings AccountDeepak ThakurAún no hay calificaciones

- Schedule of Charges Yes Bank 6Documento2 páginasSchedule of Charges Yes Bank 6Sayantika MondalAún no hay calificaciones

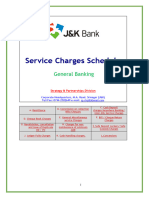

- Service Charges Schedule For General Banking - 27102022Documento18 páginasService Charges Schedule For General Banking - 27102022Zahid DarAún no hay calificaciones

- Regular Salary AccountDocumento3 páginasRegular Salary AccountPrashant KumarAún no hay calificaciones

- Business Essential AccountDocumento4 páginasBusiness Essential Accountshekharsap284Aún no hay calificaciones

- CA Start Up GSFC Wef 01st September 2023Documento5 páginasCA Start Up GSFC Wef 01st September 2023Ankit VishwakarmaAún no hay calificaciones

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsDe EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsAún no hay calificaciones

- 10 StructuresDocumento22 páginas10 Structureskarthip08Aún no hay calificaciones

- FCG CalculationDocumento3 páginasFCG Calculationkarthip08Aún no hay calificaciones

- AE 505 Aircraft Structures-IDocumento2 páginasAE 505 Aircraft Structures-Ikarthip08Aún no hay calificaciones

- AE 304 - Strength of MaterialsDocumento2 páginasAE 304 - Strength of Materialskarthip08Aún no hay calificaciones

- Property, Plant and Equipment Chapter 21Documento15 páginasProperty, Plant and Equipment Chapter 21Dan MichaelAún no hay calificaciones

- Bitsyyloan: Loan AgreementDocumento10 páginasBitsyyloan: Loan Agreementpintukumar rameshbhaiAún no hay calificaciones

- Casino CageDocumento20 páginasCasino CageAngela Brown100% (1)

- Direct Deposit FormDocumento3 páginasDirect Deposit FormSreenivas RaoAún no hay calificaciones

- DTI-DOH-DA Joint Administrative Order No. 001-08Documento35 páginasDTI-DOH-DA Joint Administrative Order No. 001-08Ylmir_1989100% (1)

- Credit Card StatementDocumento4 páginasCredit Card StatementbpraveensinghAún no hay calificaciones

- HSBC Qatar - Premier TariffDocumento16 páginasHSBC Qatar - Premier TariffjoeAún no hay calificaciones

- TCS On Sale of GoodsDocumento16 páginasTCS On Sale of GoodsAshish ModiAún no hay calificaciones

- E Commerce in India Literature ReviewDocumento54 páginasE Commerce in India Literature ReviewShahnoor Hossain50% (2)

- BSP Circulars 2020-2000Documento64 páginasBSP Circulars 2020-2000Miguel BenitezAún no hay calificaciones

- Assingnment of International Trade Law ON Payment of International SalesDocumento15 páginasAssingnment of International Trade Law ON Payment of International SalesManik Singh KapoorAún no hay calificaciones

- Citibank'S Epay: Online Credit Card Payment. From Any BankDocumento2 páginasCitibank'S Epay: Online Credit Card Payment. From Any BankHamsa KiranAún no hay calificaciones

- Report On E-Money and Its Usage (Business Communication)Documento10 páginasReport On E-Money and Its Usage (Business Communication)Piyush PorwalAún no hay calificaciones

- Payment and Tokenization SAP User Guide - Feb 2012-R2Documento152 páginasPayment and Tokenization SAP User Guide - Feb 2012-R22varma100% (1)

- Credit Card StatementDocumento3 páginasCredit Card StatementnagaAún no hay calificaciones

- Dimpal J Trivedi SipDocumento20 páginasDimpal J Trivedi Sipgaurav223barsagadeAún no hay calificaciones

- Bank Account Statement: Summary For Routing AccountDocumento3 páginasBank Account Statement: Summary For Routing AccountSolomon100% (1)

- Icici Bank Visa Signature Credit Card Icici Bank Ascent American Expressâ® Credit Card Icici Bank Platinum Identity Cred CardDocumento1 páginaIcici Bank Visa Signature Credit Card Icici Bank Ascent American Expressâ® Credit Card Icici Bank Platinum Identity Cred CardY.Divakara ReddyAún no hay calificaciones

- The Construction Industry Is Divided Into Two SectorsDocumento12 páginasThe Construction Industry Is Divided Into Two SectorsJoseph FranciscoAún no hay calificaciones

- Plan de Conturi Engleza 2016 PDFDocumento4 páginasPlan de Conturi Engleza 2016 PDFMadalina BogdanAún no hay calificaciones

- FTD Companies Inc. Acquisition of Provide Commerce Supplemental PresentationDocumento12 páginasFTD Companies Inc. Acquisition of Provide Commerce Supplemental PresentationspachecofdzAún no hay calificaciones

- CPW FormsDocumento163 páginasCPW Formssurendra kumarAún no hay calificaciones

- Letter of Intent To PurchaseDocumento3 páginasLetter of Intent To PurchaseMerry GraceAún no hay calificaciones

- Contract of AgencyDocumento11 páginasContract of AgencySaptarshi BhattacharjeeAún no hay calificaciones

- Python Binance Readthedocs Io en StableDocumento226 páginasPython Binance Readthedocs Io en StableAndres1969Aún no hay calificaciones

- Standard Bank Elite Banking 2020Documento7 páginasStandard Bank Elite Banking 2020BusinessTechAún no hay calificaciones

- ACT Guide LMADocumento175 páginasACT Guide LMAMigle BloomAún no hay calificaciones

- IGNOU MCA 3rd Semster Object Oriented AnalysisDocumento17 páginasIGNOU MCA 3rd Semster Object Oriented AnalysisAmrutha Santosh KumarAún no hay calificaciones

- Buyers Procedures For Historic BondsDocumento2 páginasBuyers Procedures For Historic Bondsshahil_4uAún no hay calificaciones

- Funds Transfer Application FormDocumento1 páginaFunds Transfer Application FormAHMAD ALIAún no hay calificaciones