Documentos de Académico

Documentos de Profesional

Documentos de Cultura

F 4466

Cargado por

IRSDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

F 4466

Cargado por

IRSCopyright:

Formatos disponibles

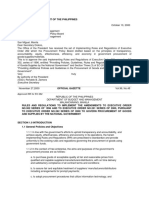

Form 4466

(Rev. December 2006)

Corporation Application for Quick Refund of

Overpayment of Estimated Tax OMB No. 1545-0170

Department of the Treasury

Internal Revenue Service For calendar year 20 or tax year beginning , 20 , and ending , 20

Name Employer identification number

Number, street, and room or suite no. (If a P.O. box, see instructions.) Telephone number (optional)

( )

City or town, state, and ZIP code

Check type of return to be filed (see instructions):

Form 1120 Form 1120-A Form 1120-C Form 1120-F Form 1120-L Form 1120-PC Other ©

1 Estimated income tax paid during the tax year 1

2 Overpayment of income tax from prior year credited to this year’s estimated tax 2

3 Total. Add lines 1 and 2 3

4 Enter total tax from the appropriate line of your tax return

(for example, line 10 of the 2006 Schedule J (Form 1120)) 4

5a Personal holding company tax, if

any, included on line 4 5a

b Estimated refundable tax credit for

Federal tax on fuels 5b

6 Total. Add lines 5a and 5b 6

7 Expected income tax liability for the tax year. Subtract line 6 from line 4 7

8 Overpayment of estimated tax. Subtract line 7 from line 3. If this amount is at least 10% of

line 7 and at least $500, the corporation is eligible for a quick refund. Otherwise, do not file

this form (see instructions) 8

Record of Estimated Tax Deposits

Date of deposit Amount Date of deposit Amount

Under penalties of perjury, I declare that I have examined this application, including any accompanying schedules and statements, and to the best of

my knowledge and belief, it is true, correct, and complete.

Sign

Here

© Signature Date © Title

General Instructions If members of an affiliated group paid their estimated

income tax on a consolidated basis or expect to file a

Section references are to the Internal Revenue Code. consolidated return for the tax year, only the common

Who May File parent corporation may file Form 4466. If members of the

group paid estimated income tax separately, the member

Any corporation that overpaid its estimated tax for the tax who claims the overpayment must file Form 4466.

year may apply for a quick refund if the overpayment is:

Note. Form 4466 is not considered a claim for credit or

● At least 10% of the expected tax liability and refund.

● At least $500.

The overpayment is the excess of the estimated income

When To File

tax the corporation paid during the tax year over the final File Form 4466 before the 16th day of the 3rd month after

income tax liability expected for the tax year, at the time the end of the tax year, but before the corporation files its

this application is filed. income tax return. Do not file Form 4466 before the end

Cat. No. 12836A Form 4466 (Rev. 12-2006)

Form 4466 (Rev. 12-2006) Page 2

of the corporation’s tax year. An extension of time to file Type of Return

the corporation’s tax return will not extend the time for

Check the box for the type of return the corporation

filing Form 4466.

will file.

How To File Other. S corporations that have made protective

Complete and file an original, signed Form 4466 with the estimated tax payments in their first tax year should

applicable Internal Revenue Service Center (see Where check the “Other” box. Corporations that file Forms

To File below). The IRS will act on Form 4466 within 45 1120-FSC, 1120-H, 1120-ND, 1120-REIT, 1120-RIC, or

days from the date it is filed. 1120-SF and tax-exempt corporations that file Form

990-T should also check the “Other” box. Enter the form

The corporation must also file Form 4466 with its

number of the return to be filed in the space to the right

income tax return. Attach either the signed Form 4466 or

of the box.

an unsigned Form 4466 with the same information stated

on the signed Form 4466. If the corporation submits an Line 8. Overpayment of Estimated Tax

unsigned Form 4466, it must retain the original, signed

If the application for refund is approved, the overpayment

Form 4466 in its records.

on line 8 may be credited against any tax the corporation

Disallowance of application. Any application that owes. The balance, if any, will be refunded.

contains material omissions or errors that cannot be Excessive refund or credit. If the refund or credit is later

corrected within the 45-day period may be disallowed. found to be excessive, the corporation is liable for an

addition to tax on the excessive amount. See section

Where To File 6655(h).

File Form 4466 at the applicable address listed below. The excessive amount is the smaller of:

Use the following ● The credit or refund or

With total assests Internal Revenue

at the end of the Service center ● The excess of:

Filers of . . . tax year of . . . address:

a. The corporation’s income tax liability (as defined in

Forms 990-T, 1120-C, 1120-F, section 6425(c)) as shown on its return over

1120-FSC, or 1120-PC Any amount Ogden, UT 84201

b. The estimated tax paid less the refund or credit.

Forms 1120, 1120-A, 1120-H,

1120-L, 1120-ND, 1120-REIT,

The IRS will compute the addition to tax and bill the

1120-RIC, or 1120-SF with the corporation. The addition to tax is figured from the date

corporation’s principal the refund was paid or credited, until the original due date

business, office, or agency

located in a foreign country or

of the corporation’s return. The addition to tax is not

U.S. possession or the state of deductible for income tax purposes.

Alabama, Alaska, Arizona,

Arkansas, California, Colorado, Any amount Ogden, UT 84201

Florida, Georgia, Hawaii, Idaho, Paperwork Reduction Act Notice

Iowa, Kansas, Louisiana,

Minnesota, Mississippi, We ask for the information on this form to carry out the

Missouri, Montana, Nebraska, Internal Revenue laws of the United States. You are

Nevada, New Mexico, North required to give us the information. We need it to ensure

Dakota, Oklahoma, Oregon,

South Dakota, Tennessee, that you are complying with these laws and to allow us to

Texas, Utah, Washington, figure and collect the right amount of tax.

Wyoming

You are not required to provide the information

Forms 1120, 1120-A, 1120-H, requested on a form that is subject to the Paperwork

1120-L, 1120-ND, 1120-REIT,

1120-RIC, or 1120-SF with the Less than $10 million Reduction Act unless the form displays a valid OMB

corporation’s principal (any amounts for Form Cincinnati, OH 45999 control number. Books or records relating to a form or its

business, office, or agency 1120-H) instructions must be retained as long as their contents

located in the state of

Connecticut, Delaware, District

may become material in the administration of any Internal

of Columbia, Illinois, Indiana, Revenue law. Generally, tax returns and return information

Kentucky, Maine, Maryland, are confidential, as required by section 6103.

Massachusetts, Michigan, New

Hampshire, New Jersey, New The time needed to complete and file this form will vary

York, North Carolina, Ohio, $10 million or more Ogden, UT 84201 depending on individual circumstances. The estimated

Pennsylvania, Rhode Island, average time is:

South Carolina, Vermont,

Virginia, West Virginia, Recordkeeping 4 hr., 4 min.

Wisconsin

Learning about the

Specific Instructions law or the form 18 min.

Preparing and sending

Address the form to the IRS 22 min.

Include the suite, room, or other unit number after the If you have comments concerning the accuracy of

street address. these time estimates or suggestions for making this form

If the Post Office does not deliver mail to the street simpler, we would be happy to hear from you. You can

address and the corporation has a P.O. box, show the write to the Internal Revenue Service, Tax Products

box number instead. Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111

Constitution Ave. NW, IR-6406, Washington, D.C. 20224.

Note. If a change in address occurs after the corporation

Do not send the tax form to this office. Instead, see How

files Form 4466, use Form 8822, Change of Address, to

To File and Where To File above.

notify the IRS of the new address.

También podría gustarte

- Tratamentul Total Al CanceruluiDocumento71 páginasTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Documento6 páginasUS Internal Revenue Service: 2290rulesty2007v4 0IRSAún no hay calificaciones

- Tratamentul Total Al CanceruluiDocumento71 páginasTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Objectives Report To Congress v2Documento153 páginas2008 Objectives Report To Congress v2IRSAún no hay calificaciones

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocumento112 páginas2008 Credit Card Bulk Provider RequirementsIRSAún no hay calificaciones

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocumento71 páginasTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocumento71 páginasTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDocumento260 páginas2008 Data DictionaryIRSAún no hay calificaciones

- Tratamentul Total Al CanceruluiDocumento71 páginasTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- District Court - Online Public Records - Remote TerminalDocumento5 páginasDistrict Court - Online Public Records - Remote TerminalSELA - Human Rights Alert - IsraelAún no hay calificaciones

- History Class 9 FRENCH REVOLUTIONDocumento18 páginasHistory Class 9 FRENCH REVOLUTIONAngadAún no hay calificaciones

- Contract of SalesDocumento3 páginasContract of SalesJoyce TenorioAún no hay calificaciones

- Resolution 9371Documento29 páginasResolution 9371Roji Belizar Hernandez100% (2)

- Nab McqsDocumento23 páginasNab McqsIzzat FatimaAún no hay calificaciones

- 106) People vs. Cayat (68 Phil 12, 18 (1939) )Documento10 páginas106) People vs. Cayat (68 Phil 12, 18 (1939) )Carmel Grace KiwasAún no hay calificaciones

- Ernie Allen - NCMEC - Criminal Trial - Doc 2Documento7 páginasErnie Allen - NCMEC - Criminal Trial - Doc 2BrivahoAún no hay calificaciones

- The ProprietorDocumento3 páginasThe ProprietorBernard Nii Amaa100% (1)

- United States v. Bruce Hoover, United States of America v. Michael Tete Simmons, A/K/A Money, 23 F.3d 403, 4th Cir. (1994)Documento3 páginasUnited States v. Bruce Hoover, United States of America v. Michael Tete Simmons, A/K/A Money, 23 F.3d 403, 4th Cir. (1994)Scribd Government DocsAún no hay calificaciones

- Witherspoon v. City of Miami Beach, Et Al - Document No. 93Documento3 páginasWitherspoon v. City of Miami Beach, Et Al - Document No. 93Justia.comAún no hay calificaciones

- Law124 1stsem 12 13outlinerevisedDocumento5 páginasLaw124 1stsem 12 13outlinerevisedClaudineAún no hay calificaciones

- Police Officers For Good Government - 9723 - B - ExpendituresDocumento1 páginaPolice Officers For Good Government - 9723 - B - ExpendituresZach EdwardsAún no hay calificaciones

- Legal Consequences of The Separation of The Chagos Archipelago From Mauritius in 1965 IcjDocumento158 páginasLegal Consequences of The Separation of The Chagos Archipelago From Mauritius in 1965 IcjAnna K.Aún no hay calificaciones

- Taxation Law ReviewerDocumento6 páginasTaxation Law ReviewerAlex RabanesAún no hay calificaciones

- Indian Penal CodeDocumento3 páginasIndian Penal CodeSHRUTI SINGHAún no hay calificaciones

- Executive Secretary: Approved IRR For EO 262Documento27 páginasExecutive Secretary: Approved IRR For EO 262San PedroAún no hay calificaciones

- Innovation and Excellence Reviwer Edjpm Lesson 5 and 6Documento11 páginasInnovation and Excellence Reviwer Edjpm Lesson 5 and 6Edjon PayongayongAún no hay calificaciones

- Broadway Centrum Condominium Corp vs. Tropical HutDocumento9 páginasBroadway Centrum Condominium Corp vs. Tropical HutVeraNataaAún no hay calificaciones

- China Banking Corp V Co GR No. 174569Documento16 páginasChina Banking Corp V Co GR No. 174569Kaye Miranda LaurenteAún no hay calificaciones

- Carlos V AngelesDocumento2 páginasCarlos V AngelesGladys BantilanAún no hay calificaciones

- Labor Cases Jurisdiction: A. Injunction in Ordinary LaborDocumento3 páginasLabor Cases Jurisdiction: A. Injunction in Ordinary LaborWhoopi Jane MagdozaAún no hay calificaciones

- CIR vs UCSFA-MPC VAT ExemptionDocumento2 páginasCIR vs UCSFA-MPC VAT ExemptionJeffrey Magada100% (2)

- Domingo v. Sandiganbayan DigestDocumento2 páginasDomingo v. Sandiganbayan DigestDan Christian Dingcong Cagnan100% (3)

- 516A ApplicationDocumento6 páginas516A ApplicationHassaan KhanAún no hay calificaciones

- College History AnalysisDocumento2 páginasCollege History AnalysisYayen Elivaran Castor100% (1)

- PFR-Franklin Baker Vs AlillanaDocumento5 páginasPFR-Franklin Baker Vs Alillanabam112190Aún no hay calificaciones

- Rule 1 - Part of Rule 3 Full TextDocumento67 páginasRule 1 - Part of Rule 3 Full TextJf ManejaAún no hay calificaciones

- United States v. Vincent Gigante, Vittorio Amuso, Venero Mangano, Benedetto Aloi, Peter Gotti, Dominic Canterino, Peter Chiodo, Joseph Zito, Dennis Delucia, Caesar Gurino, Vincent Ricciardo, Joseph Marion, John Morrissey, Thomas McGowan Victor Sololewski, Anthony B. Laino, Gerald Costabile, Andre Campanella, Michael Realmuto, Richard Pagliarulo, Michael Desantis, Michael Spinelli, Thomas Carew, Corrado Marino, Anthony Casso, 187 F.3d 261, 2d Cir. (1999)Documento4 páginasUnited States v. Vincent Gigante, Vittorio Amuso, Venero Mangano, Benedetto Aloi, Peter Gotti, Dominic Canterino, Peter Chiodo, Joseph Zito, Dennis Delucia, Caesar Gurino, Vincent Ricciardo, Joseph Marion, John Morrissey, Thomas McGowan Victor Sololewski, Anthony B. Laino, Gerald Costabile, Andre Campanella, Michael Realmuto, Richard Pagliarulo, Michael Desantis, Michael Spinelli, Thomas Carew, Corrado Marino, Anthony Casso, 187 F.3d 261, 2d Cir. (1999)Scribd Government DocsAún no hay calificaciones

- Joseph Muller Corporation Zurich v. Societe Anonyme de Gerance Et D'armement, and Petromar Societe Anonyme, 451 F.2d 727, 2d Cir. (1971)Documento4 páginasJoseph Muller Corporation Zurich v. Societe Anonyme de Gerance Et D'armement, and Petromar Societe Anonyme, 451 F.2d 727, 2d Cir. (1971)Scribd Government DocsAún no hay calificaciones