Documentos de Académico

Documentos de Profesional

Documentos de Cultura

T.A.Bill - Form Outer

Cargado por

readsriTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

T.A.Bill - Form Outer

Cargado por

readsriCopyright:

Formatos disponibles

T.A.Bill of Er.C.Nithiya, Asst.Engineer ,M.P Sub.Dn I.

Salem for The Month of

PAYABLE AT THE TREASURY

17. That the claim made for the members of the Government Servants family ( daughters and sons ) is in respect of those who are Voucher No. …………………………. of …………………….

actually residing with him and wholly depend at on him.

18. That the repaid marches for which mileage allowance is claimed in this bill were in the interest of public service. M.T.C.FORM 52

19. Certified that on the days for which daily allowance of full rate or reduced rate is claimed, the Government Servant was not provided ( Subsidiary Rule 16 ( A ) under Treasury Rule 16 )

with free lodging at the cost of Central or State Government or at the cost of Local authorities etc. In which Government have Travelling Allowance Bill for non gazetted establishment

invested fund or in any Circuit House, Inspection Bungalow, Dak Bungalow, Rest House etc., and have paid the rent of hire charges Head of Service

at all such places.

MAJOR HEAD --------------------------------------------------------------------------

20. Certified that the Government Servant was not also provided with free boarding at the case of Central or State Government or Local MINOR HEAD --------------------------------------------------------------------------

authorities, In which Government funds have been invested on the days for which daily allowance either at full or reduced rate SUB - HEAD --------------------------------------------------------------------------

is claimed. DETAILED ACCOUNT HEAD ------------------------------------------------------

TOTAL ( IN WORDS ) OF BILL -------------------------------------------------------------------------

DETAILS OF TRAVELLING ALLOWANCE REFUNDED. HEAD CREDITABLE -----------------------------AMOUNT -----------------------

1. Certified that the amount claimed in the bill was not drawn before

Section of Name Period Amount Section of Name Period Amount 2. Contents received; also Certified that I have satisfied my self that the amounts include in bills drawn 1 month 2 months, 3 months

Establishment Establishment previous to this date with the exception of these detailed below ( of with the totals amount has been refunded by deduction from this

bill ) have been distributed to the Govt. servants there named and their receipts taken the acquittance rolls filled in my office with

Certified that : Rs.P Rs.P receipt stamp duly cancelled for every payment in excess of Rs.20 also that it was necessary for the officers for whom halting

allowance at H.Q. is drawn to keep up the whole or part of their camp equal page during such halt and that the expenses incurred

1) I have traveled beyond 8 KM from my H.Q. on this account was not less than the halting allowance s drawn.

3. That I have taken pain to ascertain the length of the marches by road or boat for which mileage is claimed and have shown them

2)This bill was not prepared and claimed before. accurately to the best of my knowledge and belief.

4. That no travelling allowance has been drawn in any case for days of Casual leave or for Sundays or authorised holidays not actually

spent in camp.

3) No TA Advance have been received by me.

5. (a) That the journey were not performed in a borrowed conveyance or if they were, that either the cost of the use and propulsion

was paid for by the Government servant or the cost of the use and propulsion of his own conveyance which immediately

4) The Bus, Train fare,I.C & Flat rate claimed in this bill are actually incurred by me. proceeded / followed the borrowed conveyance was paid for him and

5) The distance for which Flat rate claimed are more than 0.50 Km and covered the (b) that, in any case the cost of the use and propulsion of the conveyance has not been shared with any one and no part of that

distance by engaging hired vehicle. cost has been recovered from any other person. ( The certificate is to be given only in the case of a claim for mileage under rules

25 of the Madras Travelling Allowance Rules for road journeys. )

6. That the journeys were not made by motor car or motor - cycle. (This certificate is to be given only in the case of a claim for full

6) The journey performed is in the interest of Board only. mileage for road journeys involving no change of camp or from one camp to another by other if so the shortest route.

7. That the journeys were not made by motor cycle \ scooter. (The certificate is to be given in the case of a claim for mileage as 24

paise or 16 paise. )

8. That the road journey was not made by motor car \ motor cycle \ Scooter and that for the journeys between places for which full

mileage is claimed under rule 25 (a) of the Madras Travelling Allowance Rules, the places of not connected by a regular public

motor service. ( The certificate is to be given in the case of a Government Servant of Grade V or below.

9. That the concessional rates were not obtainable for the journeys covered by this bill.

OR

( Head Of Office ) That the concessional rates were not obtainable for the journeys on could not be availed of for the following

reasons ( This certificate is to be given in the case of a claim for full railway allowance for travel by railway. The form of certificate

Passed for Rupees suited so the circumstances should be used )

Please Pay To 10. That for the railway journeys included in this bill, the Government Servant concerned travelled by the class for which travelling

allowance is claimed.

11. That the journey on between places connected by a public motor services \ railway were performed by road in the

Dated ---------------------- ( Controlling Officer ) interest of public service. ( This certificate is to be given in the case of all claims for mileage for a journey performed by a vehicle

other than a regular public motor service between two places connected partly by railway and partly by a regular public motor

Par Rupees ( in words and figures ) -------------------------------------------------------------------------------------------- service.

12. That for valid reasons the personal effects were carried by road or / and and that the sum of Rs. claimed in this

*From ------------------------------------------------------ Sub - Treasury. bill represents the expenses actually incurred there for and is limited to the amount that would be admissible had the maximum

number of kilograms been taken by goods train at the rate of Rs. ( here specify goods rate ) per kilogram.

Examined and Entered.

13. That the claim is further limited to the amount charged by the transport company at owner’s risk.

Accountant.

Dated ----------------------- 20 Treasury Officer 14. That for the railway journeys included in this bill the Government Servant’s family traveled by the class for which travelling allowance

is claimed.

Sub - Treasury Officer.

__________________________________________________________________________________ 15. That the conveyance and personal effects for the transport of which a claim has been made in this bill were actually in the Poisson

*To be filled up when payable from Sub - Treasury. of the Government Servant at the time of receipts of authoritative intimation of transfer.

Note - Certificates not applicable to particular claims should be scored out. 16. That the claim in respect of the members of the Government Servants family represents the actual payment made for the purchase

of tickets.

_____________________________________________________________________________________________________________

También podría gustarte

- PE Claim 1Documento7 páginasPE Claim 1ravindrarao_mAún no hay calificaciones

- Bijaya 1Documento68 páginasBijaya 1Bijay kumar UdaysinghAún no hay calificaciones

- Volume-II R-1 Design ReportDocumento556 páginasVolume-II R-1 Design ReportHimanshuAún no hay calificaciones

- NotingDocumento160 páginasNotingdpkonnetAún no hay calificaciones

- Odisha: Gover) ImentDocumento1 páginaOdisha: Gover) ImentLambodar NaikAún no hay calificaciones

- Deviation StatementDocumento16 páginasDeviation StatementGyanendu DasAún no hay calificaciones

- Tender Procedures 20.06.2023Documento34 páginasTender Procedures 20.06.2023Pavina MAún no hay calificaciones

- Annul Main. PLNDocumento84 páginasAnnul Main. PLNMohammed Shahbaz100% (1)

- Final Project Report - TPQA-NCRMP-Year 1 WORKSDocumento124 páginasFinal Project Report - TPQA-NCRMP-Year 1 WORKSHenRique Xavi Inesta100% (2)

- Ottankadu - Punalvasal - SafeDocumento6 páginasOttankadu - Punalvasal - SafeRenugopalAún no hay calificaciones

- CC Road Estimate RedlawadaDocumento15 páginasCC Road Estimate RedlawadaManiteja Reddy TatipallyAún no hay calificaciones

- Sign PDFDocumento16 páginasSign PDFRanjan Kumar SahooAún no hay calificaciones

- LR& R, Njff:I:,:,Mf." /: Rural Division - Ii Dated LDocumento1 páginaLR& R, Njff:I:,:,Mf." /: Rural Division - Ii Dated LLambodar NaikAún no hay calificaciones

- Kumalghat ReportDocumento117 páginasKumalghat ReportBinod ThapaAún no hay calificaciones

- Sankhuwa Supstr+Substr-Design DwgsDocumento12 páginasSankhuwa Supstr+Substr-Design DwgsPrakash Singh RawalAún no hay calificaciones

- Nagpur Flyover Noise BarrierDocumento2 páginasNagpur Flyover Noise Barrierrohith eticalaAún no hay calificaciones

- Estimate: Public Works DepartmentDocumento7 páginasEstimate: Public Works DepartmentRoopesh ChaudharyAún no hay calificaciones

- MNB & Culverts PDFDocumento3 páginasMNB & Culverts PDFManvendra NigamAún no hay calificaciones

- Department of Roads: 11 Kilo Chhepetaar Bhaluswaara Barpak Road ProjectDocumento14 páginasDepartment of Roads: 11 Kilo Chhepetaar Bhaluswaara Barpak Road ProjectSailesh ThapaAún no hay calificaciones

- Drawing Khata KhediDocumento30 páginasDrawing Khata KhediPRANAB PANDITAún no hay calificaciones

- Nikashi vol-II June2021Documento120 páginasNikashi vol-II June2021Navarun VashisthAún no hay calificaciones

- # Part 2Documento943 páginas# Part 2RITES HW designAún no hay calificaciones

- DR and Gabion WallsDocumento3 páginasDR and Gabion WallsSUJEET DUBEYAún no hay calificaciones

- Design of Reinforced Concrete and Brick Masonry Structures PDFDocumento140 páginasDesign of Reinforced Concrete and Brick Masonry Structures PDFSuyenthan SathishAún no hay calificaciones

- General Arrangement of BridgesDocumento4 páginasGeneral Arrangement of BridgesDeepak Kr GuptaAún no hay calificaciones

- Site Order Book 'M' Books, Bills & Completion ReportDocumento7 páginasSite Order Book 'M' Books, Bills & Completion Reportamresh gunjanAún no hay calificaciones

- Gs Associates: Engineers Highway Designers Valuers Geo-Tech ConsultantsDocumento1 páginaGs Associates: Engineers Highway Designers Valuers Geo-Tech ConsultantsYazer ArafathAún no hay calificaciones

- 2.2 Maximum Longitudinal Moment Case: # ParametersDocumento3 páginas2.2 Maximum Longitudinal Moment Case: # ParametersVasu Deva Rao ChilukuriAún no hay calificaciones

- Maintenance Manual (KW)Documento90 páginasMaintenance Manual (KW)ADC PLAún no hay calificaciones

- Notes:-: BAR Mark Diameter Spacing BAR NO. SR. of Bars Shape Bar DescriptionDocumento1 páginaNotes:-: BAR Mark Diameter Spacing BAR NO. SR. of Bars Shape Bar DescriptionEr Mukesh KumarAún no hay calificaciones

- 2 Abutment and Foundation DesignDocumento16 páginas2 Abutment and Foundation DesignAshmajit MandalAún no hay calificaciones

- BU VOL III Schedule (A-D) - Package-ADocumento44 páginasBU VOL III Schedule (A-D) - Package-AA MAún no hay calificaciones

- Circualr Merged MuncipalitiesDocumento2 páginasCircualr Merged MuncipalitiesObuladas MAún no hay calificaciones

- Office Memorandum No - DGW/MAN/221 Issued by Authority of Director General of WorksDocumento14 páginasOffice Memorandum No - DGW/MAN/221 Issued by Authority of Director General of WorksreddytlnAún no hay calificaciones

- DPR Template.Documento132 páginasDPR Template.Ranjan Kumar SahooAún no hay calificaciones

- BAR ChartDocumento4 páginasBAR ChartRaj Shekhar BarmanAún no hay calificaciones

- 3335168Documento200 páginas3335168Phani PitchikaAún no hay calificaciones

- CC PDFDocumento4 páginasCC PDFRanjan Kumar SahooAún no hay calificaciones

- BT Road From R&B Road Lankalapalli in ButtayagudemDocumento62 páginasBT Road From R&B Road Lankalapalli in Buttayagudempilli hemanthAún no hay calificaciones

- 3.0m Height Retaining Wall Sheet PDFDocumento7 páginas3.0m Height Retaining Wall Sheet PDFRanjan Kumar SahooAún no hay calificaciones

- PWD Code FinalDocumento284 páginasPWD Code FinalSumitKumar100% (1)

- Tender BarrageDocumento70 páginasTender BarrageAditya SuranaAún no hay calificaciones

- Namakkal To Karur (Ns - 2 TN - 3) in The State of Tamil Nadu Vol - IIDocumento192 páginasNamakkal To Karur (Ns - 2 TN - 3) in The State of Tamil Nadu Vol - IIraajesh_cse807Aún no hay calificaciones

- Extra Item AbstrectDocumento2 páginasExtra Item AbstrectDigvijay SinghAún no hay calificaciones

- Pier FinalDocumento24 páginasPier Finalsanjay vermaAún no hay calificaciones

- Tejgyan FoundationDocumento2 páginasTejgyan Foundationpradip2190Aún no hay calificaciones

- Pavement Design IllustrationsDocumento27 páginasPavement Design IllustrationsMadhavpokaleAún no hay calificaciones

- Letter To NHAI - KDLRDocumento2 páginasLetter To NHAI - KDLRJACOB TOMYAún no hay calificaciones

- Schedules A To DDocumento146 páginasSchedules A To DAnonymous x7VY8VF7Aún no hay calificaciones

- Passenger Car Units (PCU) Analysis: Name of Road: Length: 6.5 KMDocumento4 páginasPassenger Car Units (PCU) Analysis: Name of Road: Length: 6.5 KMTarun GuptaAún no hay calificaciones

- Ds Proforma For Deviation Item StatementDocumento74 páginasDs Proforma For Deviation Item StatementVemajala GaneshAún no hay calificaciones

- Schedules A B C D and HDocumento38 páginasSchedules A B C D and HPiyuesh SharmaAún no hay calificaciones

- Para-Wise Replies To The Inspection Report, 2016Documento5 páginasPara-Wise Replies To The Inspection Report, 2016MinlalAún no hay calificaciones

- Best Notes of Surveying by Tarun Sir - Rinchtar-G PDFDocumento68 páginasBest Notes of Surveying by Tarun Sir - Rinchtar-G PDFChetan MeenaAún no hay calificaciones

- SBD Upfdr 146Documento122 páginasSBD Upfdr 146MANISH SINGHAún no hay calificaciones

- P K Jain INPUTS FOR DESIGN OF FLEXIBLE PAVEMENTSDocumento49 páginasP K Jain INPUTS FOR DESIGN OF FLEXIBLE PAVEMENTSMadhavpokaleAún no hay calificaciones

- Technical Schedule A B C DDocumento47 páginasTechnical Schedule A B C DDhiraj PandeyAún no hay calificaciones

- 22.12.2020 BP Khare Sir PPT-LADocumento18 páginas22.12.2020 BP Khare Sir PPT-LADebrahanathAún no hay calificaciones

- Teacher'S Identity Card: Department of School Education Vembakottai Union, Virudhunagar (D.T)Documento1 páginaTeacher'S Identity Card: Department of School Education Vembakottai Union, Virudhunagar (D.T)kingraajaAún no hay calificaciones

- Aptc Form52 (Subsidiary Rules 6 (A) Under Treasury Rule 16) Travelling Allowance Bill For Non-Gazetted EstablishmentDocumento4 páginasAptc Form52 (Subsidiary Rules 6 (A) Under Treasury Rule 16) Travelling Allowance Bill For Non-Gazetted EstablishmentDeputyexecutiveengineer maintainenceplnr220kvAún no hay calificaciones

- AttachmentDocumento20 páginasAttachmentreadsriAún no hay calificaciones

- Revit MEP Training Module - 20190208124829 PDFDocumento65 páginasRevit MEP Training Module - 20190208124829 PDFreadsriAún no hay calificaciones

- FinalsDocumento241 páginasFinalsreadsriAún no hay calificaciones

- Current Affairs January 2019 Monthly Capsule 1 PDFDocumento61 páginasCurrent Affairs January 2019 Monthly Capsule 1 PDFreadsriAún no hay calificaciones

- New Microsoft Word DocumentDocumento5 páginasNew Microsoft Word DocumentreadsriAún no hay calificaciones

- ToDocumento2 páginasToreadsriAún no hay calificaciones

- Analisis Kualitas Lulusan Program Studi Teknik Industri Terhadap Kepuasan Pengguna Menggunakan Metode Servqual PDFDocumento8 páginasAnalisis Kualitas Lulusan Program Studi Teknik Industri Terhadap Kepuasan Pengguna Menggunakan Metode Servqual PDFAndri ApriansahAún no hay calificaciones

- Nigeria SAS 10 and New Prudential GuidelinesDocumento21 páginasNigeria SAS 10 and New Prudential GuidelinesOuedraogo AzouAún no hay calificaciones

- Statement MAR2021 125323533 (1)Documento9 páginasStatement MAR2021 125323533 (1)Bakibillah MollaAún no hay calificaciones

- F-92 Asset Retirement With CustomerDocumento9 páginasF-92 Asset Retirement With CustomerOkikiri Omeiza RabiuAún no hay calificaciones

- 402 Retail-Management GlossaryDocumento30 páginas402 Retail-Management GlossaryMaliniAún no hay calificaciones

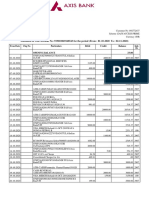

- Statement of Axis Account No:919010069168543 For The Period (From: 01-10-2020 To: 02-11-2020)Documento2 páginasStatement of Axis Account No:919010069168543 For The Period (From: 01-10-2020 To: 02-11-2020)minniAún no hay calificaciones

- Curriculum Vitae OF Munyaradzi Mare Makwate Village, Mahalapye, BotswanaDocumento7 páginasCurriculum Vitae OF Munyaradzi Mare Makwate Village, Mahalapye, BotswanaAnonymous 4RLKj1Aún no hay calificaciones

- Voucher Payable System Report 2Documento10 páginasVoucher Payable System Report 2Krssh Kt DgAún no hay calificaciones

- Module 3Documento127 páginasModule 3nidhi goelAún no hay calificaciones

- ASSIGNMENT RUBRICS FORMAT Front PageDocumento1 páginaASSIGNMENT RUBRICS FORMAT Front Pagesaru priyaAún no hay calificaciones

- PT Global Indonesia Neraca Saldo Per 30 November 2020: No. Akun Account Title November 30, 2020 Debit CreditDocumento32 páginasPT Global Indonesia Neraca Saldo Per 30 November 2020: No. Akun Account Title November 30, 2020 Debit Credit02Adinda NurAún no hay calificaciones

- Adresses ExchangesDocumento4 páginasAdresses ExchangesJulien CryptoAddictAún no hay calificaciones

- CSEC POA January 2008 P2 PDFDocumento11 páginasCSEC POA January 2008 P2 PDFDmitr33% (3)

- Analysis of Capacity and Scalability of The LoRa Low Power Wide Area Network TechnologyDocumento6 páginasAnalysis of Capacity and Scalability of The LoRa Low Power Wide Area Network TechnologyIvana MilakovicAún no hay calificaciones

- System Networking PDFDocumento432 páginasSystem Networking PDFEmmanuel Rodriguez100% (1)

- Individual Health Insurance Marketplace Stabilization ActDocumento13 páginasIndividual Health Insurance Marketplace Stabilization ActU.S. Senator Tim KaineAún no hay calificaciones

- Computer Networks Question Bank With AnswersDocumento17 páginasComputer Networks Question Bank With AnswersBolt FFAún no hay calificaciones

- Client Relationship Summary CRSDocumento4 páginasClient Relationship Summary CRSTrish HitAún no hay calificaciones

- Study - Id41710 - Fintech Report Personal FinanceDocumento25 páginasStudy - Id41710 - Fintech Report Personal FinanceGeorge Youssef MiladAún no hay calificaciones

- Company Profile 2020Documento29 páginasCompany Profile 2020adityaAún no hay calificaciones

- Prepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Documento2 páginasPrepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Daniel GnanaselvamAún no hay calificaciones

- Ncnda-Imfpa Intermediary-IccDocumento11 páginasNcnda-Imfpa Intermediary-Iccmarspublicidadymarketing360Aún no hay calificaciones

- Sistemul Contabil JaponezDocumento28 páginasSistemul Contabil JaponezLina MandarinaAún no hay calificaciones

- LOA Bupe Gideon Kisuse 72573 June 17 2022 Kygdost1Documento5 páginasLOA Bupe Gideon Kisuse 72573 June 17 2022 Kygdost1Mary GideonAún no hay calificaciones

- Ext 62795Documento4 páginasExt 62795Atharva UppalwarAún no hay calificaciones

- Job-Specification - House Officer PDFDocumento2 páginasJob-Specification - House Officer PDFIndika2323Aún no hay calificaciones

- SALEZLIFT Datacard PDFDocumento4 páginasSALEZLIFT Datacard PDFVino DAún no hay calificaciones

- Service Agreement TemplateDocumento3 páginasService Agreement Templateceleste law50% (6)

- AminaDocumento2 páginasAminaKendrick Edwardo100% (1)

- Audit Report 2020 2021Documento18 páginasAudit Report 2020 2021SHIKHA SHARMAAún no hay calificaciones