Documentos de Académico

Documentos de Profesional

Documentos de Cultura

A Brief Profile of The Bank

Cargado por

hasnain572Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

A Brief Profile of The Bank

Cargado por

hasnain572Copyright:

Formatos disponibles

A Brief Profile of the Bank

Widely known for customer centricity, Canara Bank was founded by Shri

Ammembal Subba Rao Pai, a great visionary and philanthropist, in July 1906,

at Mangalore, then a small port in Karnataka. The Bank has gone through the

various phases of its growth trajectory over hundred years of its existence.

Growth of Canara Bank was phenomenal, especially after nationalization in

the year 1969, attaining the status of a national level player in terms of

geographical reach and clientele segments. Eighties was characterized by

business diversification for the Bank. In June 2006, the Bank completed a

century of operation in the Indian banking industry. The eventful journey of

the Bank has been characterized by several memorable milestones. Today,

Canara Bank occupies a premier position in the comity of Indian banks. With

an unbroken record of profits since its inception, Canara Bank has several

firsts to its credit. These include:

Launching of Inter-City ATM Network

Obtaining ISO Certification for a Branch

Articulation of ‘Good Banking’ – Bank’s Citizen Charter

Commissioning of Exclusive Mahila Banking Branch

Launching of Exclusive Subsidiary for IT Consultancy

Issuing credit card for farmers

Providing Agricultural Consultancy Services

Over the years, the Bank has been scaling up its market position to emerge as

a major 'Financial Conglomerate' with as many as nine

subsidiaries/sponsored institutions/joint ventures in India and abroad. As at

June 2010, the Bank has further expanded its domestic presence, with 3057

branches spread across all geographical segments. Keeping customer

convenience at the forefront, the Bank provides a wide array of alternative

delivery channels that include over 2000 ATMs- one of the highest among

nationalized banks- covering 732 centres, 2681 branches providing Internet

and Mobile Banking (IMB) services and 2091 branches offering 'Anywhere

Banking' services. Under advanced payment and settlement system, all

branches of the Bank have been enabled to offer Real Time Gross Settlement

(RTGS) and National Electronic Funds Transfer (NEFT) facilities.

Not just in commercial banking, the Bank has also carved a distinctive mark,

in various corporate social responsibilities, namely, serving national

priorities, promoting rural development, enhancing rural self-employment

through several training institutes and spearheading financial inclusion

objective. Promoting an inclusive growth strategy, which has been formed as

the basic plank of national policy agenda today, is in fact deeply rooted in the

Bank's founding principles. "A good bank is not only the financial heart of the

community, but also one with an obligation of helping in every possible

manner to improve the economic conditions of the common people". These

insightful words of our founder continue to resonate even today in serving the

society with a purpose. The growth story of Canara Bank in its first century

was due, among others, to the continued patronage of its valued customers,

stakeholders, committed staff and uncanny leadership ability demonstrated

by its leaders at the helm of affairs. We strongly believe that the next century

is going to be equally rewarding and eventful not only in service of the nation

but also in helping the Bank emerge as a "Global Bank with Best Practices".

This justifiable belief is founded on strong fundamentals, customer centricity,

enlightened leadership and a family like work culture.

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Q&A Technical SuperintendentDocumento10 páginasQ&A Technical SuperintendentRares Ang0% (1)

- Intel CorporationDocumento1 páginaIntel CorporationAliciaJAún no hay calificaciones

- Tijuana Bronze MachiningDocumento6 páginasTijuana Bronze MachiningSasisomWilaiwanAún no hay calificaciones

- Aloha ConnectDocumento2 páginasAloha ConnectJorgeAún no hay calificaciones

- C C C CCCCCCCCCCCCCCCCCCCCCCCCCC: ccccccccccccccccc0c C CDocumento6 páginasC C C CCCCCCCCCCCCCCCCCCCCCCCCCC: ccccccccccccccccc0c C Chasnain572Aún no hay calificaciones

- Types of PrintersDocumento9 páginasTypes of Printershasnain572Aún no hay calificaciones

- Eligibility CriteriaDocumento4 páginasEligibility Criteriahasnain572Aún no hay calificaciones

- Introduction To Enterprise: Mini Project On Entrepreneur Development and ProgramDocumento26 páginasIntroduction To Enterprise: Mini Project On Entrepreneur Development and Programhasnain57233% (3)

- Mba-Marketing Principles Consumers Needs and WantsDocumento1 páginaMba-Marketing Principles Consumers Needs and WantsMhild GandawaliAún no hay calificaciones

- Delaware Court Ruling on LLC Development DisputeDocumento9 páginasDelaware Court Ruling on LLC Development Disputehancee tamboboyAún no hay calificaciones

- Final Reviewer in TechnopreneurshipDocumento18 páginasFinal Reviewer in TechnopreneurshipJanezah Joyce MendozaAún no hay calificaciones

- Verdhana Sekuritas FREN 2Q21 Ongoing ImprovementsDocumento4 páginasVerdhana Sekuritas FREN 2Q21 Ongoing ImprovementsWira AnindyagunaAún no hay calificaciones

- Value Stream Mapping Future State Design QuestionsDocumento3 páginasValue Stream Mapping Future State Design QuestionsElvisAún no hay calificaciones

- Stylo ProjectDocumento12 páginasStylo ProjectFatima Razzaq100% (1)

- Nike Ad Analysis FinalDocumento4 páginasNike Ad Analysis Finalapi-581969590Aún no hay calificaciones

- Chapter 3Documento66 páginasChapter 3Can BayirAún no hay calificaciones

- Chap 19 AS 5Documento8 páginasChap 19 AS 5Srushti AgarwalAún no hay calificaciones

- Learn To Develop World Class Maintenance Management Systems - UdemyDocumento13 páginasLearn To Develop World Class Maintenance Management Systems - UdemySantosh NathanAún no hay calificaciones

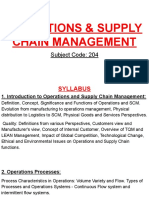

- Operations & Supply Chain ManagementDocumento35 páginasOperations & Supply Chain ManagementAnimesh kumarAún no hay calificaciones

- Business Vocabulary 3Documento7 páginasBusiness Vocabulary 3Tường ThuậtAún no hay calificaciones

- Budgeting NotesDocumento3 páginasBudgeting NotesVivek KavtaAún no hay calificaciones

- Bcom1stsem Allotted Rollnos KCDCC 2020 R1Documento25 páginasBcom1stsem Allotted Rollnos KCDCC 2020 R1Anshu DasAún no hay calificaciones

- Why Should Oganisations Have A Good Filing System: What Do We File?Documento8 páginasWhy Should Oganisations Have A Good Filing System: What Do We File?Mea LuisAún no hay calificaciones

- Circular EconomyDocumento16 páginasCircular EconomyIrina AlexandraAún no hay calificaciones

- Notice of Bid DisqualificationDocumento3 páginasNotice of Bid DisqualificationMelody Frac ZapateroAún no hay calificaciones

- 2023 Q4 Multifamily Houston Report ColliersDocumento4 páginas2023 Q4 Multifamily Houston Report ColliersKevin ParkerAún no hay calificaciones

- FIN20014 Assignment 2015 SP2 - Capital Budgeting AssignmentDocumento3 páginasFIN20014 Assignment 2015 SP2 - Capital Budgeting AssignmentAssignment Consultancy0% (1)

- Back Office Support - Kaya Systems LLCDocumento2 páginasBack Office Support - Kaya Systems LLCkayaseo1Aún no hay calificaciones

- Full Download Solution Manual For Essentials of Business Communication 10th Edition Mary Ellen Guffey Dana Loewy PDF Full ChapterDocumento34 páginasFull Download Solution Manual For Essentials of Business Communication 10th Edition Mary Ellen Guffey Dana Loewy PDF Full Chapterlantautonomyurbeiu100% (20)

- FETTY CAKE LTDDocumento3 páginasFETTY CAKE LTDNGONIDZASHE G MUBAYIWAAún no hay calificaciones

- Credit Card Processing System UML Use Case DiagramDocumento2 páginasCredit Card Processing System UML Use Case DiagramTushar TariAún no hay calificaciones

- Recliners Buy Stargazer Recliner Sofa Online at Best Prices Starting From Rs 20000 WakefiDocumento1 páginaRecliners Buy Stargazer Recliner Sofa Online at Best Prices Starting From Rs 20000 Wakefimansi didwaniaAún no hay calificaciones

- IADC Associate WebDocumento8 páginasIADC Associate WebCarlos ChiAún no hay calificaciones

- Wallfort - 29 April 2022Documento24 páginasWallfort - 29 April 2022Utsav LapsiwalaAún no hay calificaciones