Documentos de Académico

Documentos de Profesional

Documentos de Cultura

China Sells First Dollar Bond in More Than A Decade Financial Times

Cargado por

Alfredo Jalife Rahme0 calificaciones0% encontró este documento útil (0 votos)

493 vistas2 páginasChina sells first dollar bond in more than a decade

Landmark sale comes in same week as Communist party congress

Fuente Financial Times

Título original

China sells first dollar bond in more than a decade; Financial Times

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoChina sells first dollar bond in more than a decade

Landmark sale comes in same week as Communist party congress

Fuente Financial Times

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

493 vistas2 páginasChina Sells First Dollar Bond in More Than A Decade Financial Times

Cargado por

Alfredo Jalife RahmeChina sells first dollar bond in more than a decade

Landmark sale comes in same week as Communist party congress

Fuente Financial Times

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF o lea en línea desde Scribd

Está en la página 1de 2

China sells first dollar bond in more than a

decade

Landmark sale comes in same week as Communist party congress

y f in & as & | saveromyer

OCTOBER 28,2017 by Gabriel illdau in Shanghal

China sold its first bond in dollars for more than a decade in a move the government

hopes will lower borrowing costs for the country’s companies,

Coming a day after the Communist party congress entrenched Xi Jinping’s position

as leader, China sold a combined $2bn of five and 10-year bonds at yields little higher

than US Treasuries.

“The finance ministry will be pretty happy about this,” said Owen Gallimore, Asia

credit strategist at Australia and New Zealand Bank in Singapore, who believes the

bonds merited even lower yields.

“They could have just forced Chinese state investors to buy and held the yield flat to

[US] Treasuries or even below. But by offering more attractive pricing, they can draw

in strong interest from international investors,” said Mr Gallimore.

China issues the majority of its debt in renminbi to onshore investors, so the sale of

the dollar debt in Hong Kong also carried a symbolic value. The finance ministry had.

‘$18bn in foreign debt outstanding at the end of last year, worth only 1 per cent of

total government debt. Of that total, 85 per cent was offshore renminbi debt.

‘The five-year bonds priced at a yield of 15 basis points above Treasuries of the same

maturity and 10-year bonds at 25 bps above, according to a term sheet seen by the

Financial ‘Times. The yield on both tranches was lower than initial guidance in a

further sign of strong demand.

‘The implied yield on the bonds is lower than that of sovereigns with similar credit

ratings. Chilean government dollar bonds maturing in five years yield 2.37 per cent.

Moody's rates Chile at A-plus, the same level as China, while S&P rates Chile one

notch higher but with a negative outlook.

‘The finance ministry said this week that its sale was intended to set a benchmark

against which Chinese companies — prolific issuers in Hong Kong's US dollar debt

market — can price their bonds, potentially allowing them to sell at lower rates. It

also reiterated criticism of western rating agencies for “misunderstanding” China.

China’s sovereign credit ratings were downgraded this year by both Moody's

and Standard & Poor's. China's economy has grown faster than expected this year,

and the country’s debt burden has stabilised — or even fallen by some estimates —

due to slower credit growth and faster inflation.

China sold $6.7bn in US dollar debt in 12 sales between 1993 and 2004, according to

Shenwan Hongyuan Securities, but has not sold non-renminbi debt since then.

HSBC, Standard Chartered, Deutsche Bank, Citibank, China International Capital

Corp, Industrial and Commercial Bank of China, China Construction

Bank, Agricultural Bank of China, and Bank of China were joint lead managers and

book runners on the deal.

“This issuance demonstrates Chin;

commitment to engaging international investors

as it transforms its economy, opens its capital markets and strengthens its global

connections through the Belt and Road Initiative,” Peter Wong, chief executive of

HSBC Asia, said in a statement, referring to China’s ambitious plan to build

infrastructure links throughout the developing world.

También podría gustarte

- America's 12 Demands To Iran Over Alleged Activity FT 21.05.18Documento1 páginaAmerica's 12 Demands To Iran Over Alleged Activity FT 21.05.18Alfredo Jalife RahmeAún no hay calificaciones

- Republicans' Tax Reform Drive Hit by Deficit Projections Financial Times 01.12.17Documento4 páginasRepublicans' Tax Reform Drive Hit by Deficit Projections Financial Times 01.12.17Alfredo Jalife RahmeAún no hay calificaciones

- US Has A Fifth Ace in Its Poker Game With China Fuente Financial Times 07.11.17Documento1 páginaUS Has A Fifth Ace in Its Poker Game With China Fuente Financial Times 07.11.17Alfredo Jalife Rahme100% (1)

- Mueller Charges Pitch US Towards Constitutional Crisis Financial TimesDocumento3 páginasMueller Charges Pitch US Towards Constitutional Crisis Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- The Influence of Stanley Fischer Larry Summers' Blog, Fuente Financial TimesDocumento1 páginaThe Influence of Stanley Fischer Larry Summers' Blog, Fuente Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- Tillerson Sees Closer India Ties As Foil Against China Fuente Financial TimesDocumento3 páginasTillerson Sees Closer India Ties As Foil Against China Fuente Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- Iraq's Seizure of Kirkuk Is Part of A Much Bigger Story Fuente Financial TimesDocumento3 páginasIraq's Seizure of Kirkuk Is Part of A Much Bigger Story Fuente Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- US Senate Approves Sweeping Tax Overhaul Financial Times 01.12.17Documento2 páginasUS Senate Approves Sweeping Tax Overhaul Financial Times 01.12.17Alfredo Jalife RahmeAún no hay calificaciones

- Trump Gives Glimpse of Indo-Pacific' Strategy To Counter China 10.11.17 Financial TimesDocumento5 páginasTrump Gives Glimpse of Indo-Pacific' Strategy To Counter China 10.11.17 Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- Lobbyist Podesta To Resign in Fallout From Mueller Action Financial TimesDocumento2 páginasLobbyist Podesta To Resign in Fallout From Mueller Action Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- The Influence of Stanley Fischer Larry Summers' Blog, Fuente Financial TimesDocumento1 páginaThe Influence of Stanley Fischer Larry Summers' Blog, Fuente Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- At Our Own Peril: DoD Risk Assessment in A Post-Primacy WorldDocumento141 páginasAt Our Own Peril: DoD Risk Assessment in A Post-Primacy WorldAlfredo Jalife Rahme100% (2)

- Chinese Property Boom Props Up Xi's Hopes For The Economy Financial TimesDocumento8 páginasChinese Property Boom Props Up Xi's Hopes For The Economy Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- Stanley Fischer, Fed Vice-Chair, On The Risky Business of Bank Reform, Fuente FTDocumento7 páginasStanley Fischer, Fed Vice-Chair, On The Risky Business of Bank Reform, Fuente FTAlfredo Jalife Rahme100% (1)

- Millions Mired in Poverty As US Upturn Passes Them By, Study Finds Fuente Financial TimesDocumento5 páginasMillions Mired in Poverty As US Upturn Passes Them By, Study Finds Fuente Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- John McCain Is One of The Few Who Can Stand Up To Donald TrumpDocumento3 páginasJohn McCain Is One of The Few Who Can Stand Up To Donald TrumpAlfredo Jalife RahmeAún no hay calificaciones

- China's Xi Hails Belt and Road As Project of The Century' Fuente FTDocumento4 páginasChina's Xi Hails Belt and Road As Project of The Century' Fuente FTAlfredo Jalife RahmeAún no hay calificaciones

- China Launches Renminbi-Denominated Gold Benchmark Fuente: Financial TimesDocumento2 páginasChina Launches Renminbi-Denominated Gold Benchmark Fuente: Financial TimesAlfredo Jalife Rahme100% (1)

- China Lashes Out at US As Trump-Xi Honeymoon Ends Fuente Financial TimesDocumento4 páginasChina Lashes Out at US As Trump-Xi Honeymoon Ends Fuente Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- Value of Stocks On S&P 500 Pushes Through $20tn For First TimeDocumento4 páginasValue of Stocks On S&P 500 Pushes Through $20tn For First TimeAlfredo Jalife RahmeAún no hay calificaciones

- Trump Demands Solution To US Trade Deficits With China and Others 31.03.17Documento4 páginasTrump Demands Solution To US Trade Deficits With China and Others 31.03.17Alfredo Jalife RahmeAún no hay calificaciones

- Xi Jinping's Silk Road Is Under Threat From One-Way Traffic Fuente Financial TimesDocumento3 páginasXi Jinping's Silk Road Is Under Threat From One-Way Traffic Fuente Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

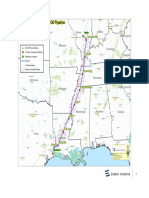

- Energy Transfer Crude Oil Company MapDocumento1 páginaEnergy Transfer Crude Oil Company MapAlfredo Jalife RahmeAún no hay calificaciones

- Trump's $54 Billion Rounding Error Fuente Foreign AffairsDocumento2 páginasTrump's $54 Billion Rounding Error Fuente Foreign AffairsAlfredo Jalife RahmeAún no hay calificaciones

- Trump Hands May Promise of Stronger' Special Relationship Fuente Financial TimesDocumento4 páginasTrump Hands May Promise of Stronger' Special Relationship Fuente Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- Trump To Call Putin As He Considers Lifting Russia Sanctions Fuente Financial TimesDocumento4 páginasTrump To Call Putin As He Considers Lifting Russia Sanctions Fuente Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- François Hollande Calls On Europe To Stand Up To Donald Trump Fuente: Financial TimesDocumento2 páginasFrançois Hollande Calls On Europe To Stand Up To Donald Trump Fuente: Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- Kremlin Says Trump and Putin To Collaborate On Isis Terrorism Fuente Financial TimesDocumento2 páginasKremlin Says Trump and Putin To Collaborate On Isis Terrorism Fuente Financial TimesAlfredo Jalife RahmeAún no hay calificaciones

- Trump Pulls US Out of Pacific Trade PactDocumento3 páginasTrump Pulls US Out of Pacific Trade PactAlfredo Jalife RahmeAún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5782)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)