Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Policy Details Change

Cargado por

Kim Espart CastilloDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Policy Details Change

Cargado por

Kim Espart CastilloCopyright:

Formatos disponibles

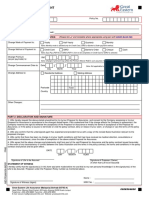

POLICY DETAILS CHANGE

Name of Life Insured (Last, First, MI)

1. General Information

Name of Policy Owner, if different from Life Insured, (Last, First, MI) Policy Number/s

Telephone No. Mobile No. Email Address

2. Details of request

Mode Change Payment modes

Monthly Quarterly Sem-Annual Annual

PDC Auto-Debit Arrangement Credit Card

Plan Change From To

Face Amount Change From To

Increase Decrease

Policy Year Date From To

Change/Addition of Scholar/Payor From To

Dividend Option From To

Accumulate with interest Used to pay future premiums Accumulate with interest Used to pay future premiums

Used to purchase Paid-up Additions Paid in Cash Used to purchase Paid-up Additions Paid in Cash

Premium Default option From To

Automatic Premium Loan Extended Term Insurance Automatic Premium Loan Extended Term Insurance

Reduced Paid-up insurance Reduced Paid-up insurance

Conversion of Term Plan/Rider Partial To be retained

The Conversion is The balance is

Total To be dropped

Supplementary Benefit Supplementary benefit to be added/deleted/increased/decreased:

Addition Deletion Increase Decrease

Adjustment of rating Reason

Occupation Health Avocation

Update of Signatures 1. 2. 3.

Specimen signatures

Others

Manulife agrees to this application for change. Hereafter, the above numbered policy will be deemed to have been changed as set out above upon proper imprinting of the Presidents

facsimile signature. It is agreed that if any additions or amendments are made by the Company, acceptance by the Insured/Planholder or Payor/Owner of the changed or replacing

policy to which a copy of this application for change, so amended, is attached, will ratify such addition or amendments.

IF THE CHANGE IS SUCH THAT THE COMPANY REQUIRES EVIDENCE OF INSURABILITY, IT IS ALSO AGREED THAT:

1. The change will be incontestable after the change or replacing policy has been in force during the lifetime of Insured for two(2) years from the effective date of change, except

for non-payment of premium or any other grounds recognized by law and jurisprudence. This incontestability period will not apply to supplementary contracts relating to

benefits payable in the event of total disability and benefits which grand additional insurance specifically against death by accidental means.

2. If the Life Insured commits suicide within one(1) year from effectivity of the policy change or of its last approved reinsttement, if any, the then pertinent provisions of the

Insurance Code, as amended, will apply. Where suicide is not compensable, the liability of the Company is limited to the refund to the Beneficiary or Payor/Owner of the

premiums actually received by the Company less all indebtedness under this policy.

Date signed Place signed Name and signature of Life Insured/Planholder

3. Signatures

Name and signature of Policyowner/Payor Name and signature of Collateral Assignee

Name and signature of Irrevocable Beneficiary Name and signature of Agent/Witness Agents Code

The Manufacturers Life Insurance Co. (Phils.) Inc.

LKG Tower, 6801 Ayala Avenue, Makati City 1226 Philippines

Tel. No.: (63-2) 88-4-LIFE (884-5433) Customer Care: (63-2) 884-7000 1-800-1-888-6268 (Toll Free) Fax: (63-2) 844-2558 Email: phcustomercare@manulife.com ManulifePH

A Manulife Financial Company, Corporate Headquarters in Toronto, Canada. www.mymanulife.com.ph www.manulife.com.ph

Manulife and the block design are registered service marks and trademarks of the Manufacturers Life Insurance Company

and are used by it and its affiliate including Manulife Financial Corporation.

CS-MP002-2015

También podría gustarte

- AMENDMENTDocumento1 páginaAMENDMENTjohn paul manaloAún no hay calificaciones

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterDe EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterAún no hay calificaciones

- Payout RequestDocumento2 páginasPayout RequestUth NationAún no hay calificaciones

- Surrender / Partial Withdrawal Form SRN No:: Surname First Name Middle Name TitleDocumento2 páginasSurrender / Partial Withdrawal Form SRN No:: Surname First Name Middle Name Titlesofich rosaAún no hay calificaciones

- Dividends PDFDocumento2 páginasDividends PDFAnnalene Ramores OlitAún no hay calificaciones

- Policy Amendment Form FILLABLEDocumento2 páginasPolicy Amendment Form FILLABLEcristina tamonteAún no hay calificaciones

- Futuregensurrenderform 25Documento2 páginasFuturegensurrenderform 25accountsAún no hay calificaciones

- Application For Insurance ChangesDocumento2 páginasApplication For Insurance Changesroodra singh ranawatAún no hay calificaciones

- Policy Details Change Form: General InformationDocumento2 páginasPolicy Details Change Form: General InformationTawfiq4444Aún no hay calificaciones

- Application For Alteration Form 2-UpdateDocumento4 páginasApplication For Alteration Form 2-UpdateShareen TeoAún no hay calificaciones

- QuoteDocumento3 páginasQuoteGulshan KanojiaAún no hay calificaciones

- Request For AmendmentDocumento1 páginaRequest For AmendmentLi XiangAún no hay calificaciones

- GE Amendment FormDocumento1 páginaGE Amendment FormFelix GanAún no hay calificaciones

- Change in Policy DetailsDocumento2 páginasChange in Policy DetailsSumitt SinghAún no hay calificaciones

- GUARANTEEDPENSIONPLANDocumento2 páginasGUARANTEEDPENSIONPLANSatyajeet AnandAún no hay calificaciones

- CandidateDocumento2 páginasCandidateleelamrs48Aún no hay calificaciones

- Pradhan Mantri Suraksha Bima Yojana in DetailDocumento7 páginasPradhan Mantri Suraksha Bima Yojana in DetailRAJ PATELAún no hay calificaciones

- Beneficiary Change: 1. General InformationDocumento1 páginaBeneficiary Change: 1. General InformationAndy De GuzmanAún no hay calificaciones

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocumento2 páginasBenefit Illustration For HDFC Life Sampoorn Samridhi PlussarthakAún no hay calificaciones

- Features of ICICI Pru Saral Jeevan BimaDocumento2 páginasFeatures of ICICI Pru Saral Jeevan BimaKriti KaAún no hay calificaciones

- KFD New E36Documento6 páginasKFD New E36Gaurav ShahAún no hay calificaciones

- IFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASADocumento32 páginasIFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASAkamrangulAún no hay calificaciones

- Features of ICICI Pru Signature: How Does This Plan Work?Documento6 páginasFeatures of ICICI Pru Signature: How Does This Plan Work?Sneha Abhash SinghAún no hay calificaciones

- Candidate 1Documento2 páginasCandidate 1Fascino WhiteAún no hay calificaciones

- With Logo - Policy Document LIC S Bima RatnaDocumento16 páginasWith Logo - Policy Document LIC S Bima RatnaSUSHIL KUMAR PANDEYAún no hay calificaciones

- Illustration - 2024-04-09T114323.972Documento2 páginasIllustration - 2024-04-09T114323.972V.PrasanthAún no hay calificaciones

- BenefitIllustrations 1Documento2 páginasBenefitIllustrations 1vonamal985Aún no hay calificaciones

- Jeevan Labh PDFDocumento17 páginasJeevan Labh PDFIshdeep SinglaAún no hay calificaciones

- Final Policy Doc - LIC S Jeevan Labh PDFDocumento17 páginasFinal Policy Doc - LIC S Jeevan Labh PDFAakritiVermaAún no hay calificaciones

- Request For Contractual ChangesDocumento2 páginasRequest For Contractual ChangesLi XiangAún no hay calificaciones

- Smart Platinum 2lacDocumento8 páginasSmart Platinum 2lacRajkumaar UtcAún no hay calificaciones

- MetLife Endowment Savings Plan PRINT Brochure - 2016 V2 - tcm47-27873Documento4 páginasMetLife Endowment Savings Plan PRINT Brochure - 2016 V2 - tcm47-27873himanshu goyalAún no hay calificaciones

- Week 3 - Life Insurance - ContractsDocumento34 páginasWeek 3 - Life Insurance - ContractsAayushi NaikAún no hay calificaciones

- Illustration Qc5w6uxpu25w3Documento2 páginasIllustration Qc5w6uxpu25w3Sakshi RaghuvanshiAún no hay calificaciones

- Features - Advantages - Benefits For Products: Prepared by Andrew John Wesley. G Am-L&D: Atrl1Documento5 páginasFeatures - Advantages - Benefits For Products: Prepared by Andrew John Wesley. G Am-L&D: Atrl1john_wes8Aún no hay calificaciones

- V167 - Life Policy Transaction Form - Multi-PurposeDocumento2 páginasV167 - Life Policy Transaction Form - Multi-PurposeKathryn RaskinAún no hay calificaciones

- LIC's Jeevan Lakshya (T-933) : Benefit IllustrationDocumento3 páginasLIC's Jeevan Lakshya (T-933) : Benefit IllustrationrajuAún no hay calificaciones

- Bajaj - Group Hospital Cash PolicyDocumento16 páginasBajaj - Group Hospital Cash PolicySWETUAún no hay calificaciones

- 117N096V01-PNB MetLife Guaranteed Savings Plan - tcm47-69773Documento32 páginas117N096V01-PNB MetLife Guaranteed Savings Plan - tcm47-69773chander prakashAún no hay calificaciones

- IllustrationDocumento2 páginasIllustrationraamshankar11Aún no hay calificaciones

- Policy Document - LIC S Bima Jyoti 03 03 2021Documento17 páginasPolicy Document - LIC S Bima Jyoti 03 03 2021Anime worldAún no hay calificaciones

- PNB MetLife Endowment Savings Plan Plus-Policy Doc - tcm47-58256-v0Documento52 páginasPNB MetLife Endowment Savings Plan Plus-Policy Doc - tcm47-58256-v0Amit GuptaAún no hay calificaciones

- Agent's/ Intermediary's /POSP-LI's Code Agent's/ Intermediary's/POSP-LI's Name Agent's/Intermediary's/POSP - LI's Mobile Number/ Landline NumberDocumento17 páginasAgent's/ Intermediary's /POSP-LI's Code Agent's/ Intermediary's/POSP-LI's Name Agent's/Intermediary's/POSP - LI's Mobile Number/ Landline NumberCHITRAKAR (ØÑkäR)Aún no hay calificaciones

- HLA-Policy Change Application FormDocumento4 páginasHLA-Policy Change Application FormJinieAún no hay calificaciones

- E-Term Policy DocumentDocumento23 páginasE-Term Policy DocumentpraveenAún no hay calificaciones

- You Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?Documento23 páginasYou Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?gkAún no hay calificaciones

- MoneyBackPlus BrochureDocumento7 páginasMoneyBackPlus BrochuremanjugnpAún no hay calificaciones

- VL Insurance Policy Withdrawal Surrender Request Form FillableDocumento1 páginaVL Insurance Policy Withdrawal Surrender Request Form FillableNew BossAún no hay calificaciones

- Anjo Paul John FTEDocumento19 páginasAnjo Paul John FTEAnjo Paul JohnAún no hay calificaciones

- 18-Oct-2014 MR VVN Murthy Door No 7-75 4Th Mile Nuvalakula Gardens Nellore 524002 Andhrapradesh India Mob No-9966802424 Ph. No-0 Home No - 0Documento34 páginas18-Oct-2014 MR VVN Murthy Door No 7-75 4Th Mile Nuvalakula Gardens Nellore 524002 Andhrapradesh India Mob No-9966802424 Ph. No-0 Home No - 0Murthy VvnAún no hay calificaciones

- Prev 165896547003461209Documento19 páginasPrev 165896547003461209sososolalalaiiAún no hay calificaciones

- HDFC Life Guaranteed Pension Plan20170517 102654Documento6 páginasHDFC Life Guaranteed Pension Plan20170517 102654Bhavik PrajapatiAún no hay calificaciones

- Job Offer-Gold Loan Relationship Officer-LOANS AGAINST GOLD-Marketing Branches OperationsDocumento3 páginasJob Offer-Gold Loan Relationship Officer-LOANS AGAINST GOLD-Marketing Branches OperationsKarthi selvaAún no hay calificaciones

- Life Insurance Corporation of India Single Premium Endowment PlanDocumento2 páginasLife Insurance Corporation of India Single Premium Endowment Plansantosh kumarAún no hay calificaciones

- PRUlink Withdrawal Form For Corporate PolicyownerDocumento2 páginasPRUlink Withdrawal Form For Corporate PolicyownerMarjorie Clarise MendozaAún no hay calificaciones

- Benefit Illustration Jeevan AnandDocumento3 páginasBenefit Illustration Jeevan Anandkumar kAún no hay calificaciones

- Shriram Life Super Income Plan Website VersionDocumento24 páginasShriram Life Super Income Plan Website VersionPraveen BabuAún no hay calificaciones

- Aditya Birla Sun Life Insurance SecurePlus Plan LeafletDocumento5 páginasAditya Birla Sun Life Insurance SecurePlus Plan LeafletMohanraj GAún no hay calificaciones

- CD R King Taxes and LicensesDocumento16 páginasCD R King Taxes and LicensesKim Espart CastilloAún no hay calificaciones

- Itr Questionnaire 2020Documento1 páginaItr Questionnaire 2020Kim Espart CastilloAún no hay calificaciones

- KyaniDocumento1 páginaKyaniKim Espart CastilloAún no hay calificaciones

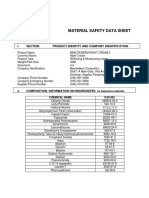

- Material Safety Data Sheet-Beautederm Toner NewDocumento4 páginasMaterial Safety Data Sheet-Beautederm Toner NewKim Espart Castillo50% (2)

- Material Safety Data Sheet-Beautederm Sunblock NewDocumento4 páginasMaterial Safety Data Sheet-Beautederm Sunblock NewKim Espart CastilloAún no hay calificaciones

- Employment Application Form: Eastern Pacific Shipping Pte LTDDocumento7 páginasEmployment Application Form: Eastern Pacific Shipping Pte LTDKim Espart CastilloAún no hay calificaciones

- From: To: Date:: Tax Return Receipt Confirmation Ebirforms-Noreply@bir - Gov.ph Friday, February 26, 2021, 03:53 PM GMT+8Documento1 páginaFrom: To: Date:: Tax Return Receipt Confirmation Ebirforms-Noreply@bir - Gov.ph Friday, February 26, 2021, 03:53 PM GMT+8Kim Espart CastilloAún no hay calificaciones

- Philmotors 2307 3Rd QTR 2020 Date Company Tin ATC Commonwealth Insurance Company 000-445-883 wc120Documento2 páginasPhilmotors 2307 3Rd QTR 2020 Date Company Tin ATC Commonwealth Insurance Company 000-445-883 wc120Kim Espart CastilloAún no hay calificaciones

- Material Safety Data Sheet - Night Cream 1 NewDocumento4 páginasMaterial Safety Data Sheet - Night Cream 1 NewKim Espart Castillo50% (2)

- MSDS Beautederm Night Cream 3Documento4 páginasMSDS Beautederm Night Cream 3Kim Espart Castillo50% (2)

- Natalie Joy TemonDocumento1 páginaNatalie Joy TemonKim Espart CastilloAún no hay calificaciones

- MATERIAL SAFETY DATA SHEET-Night Cream 2 NewDocumento4 páginasMATERIAL SAFETY DATA SHEET-Night Cream 2 NewKim Espart CastilloAún no hay calificaciones

- Luvimar Fire Control Avenue: Rizal Gatuslao ST., Bacolod City Tel. No. 034-476-1566, 708-6185Documento9 páginasLuvimar Fire Control Avenue: Rizal Gatuslao ST., Bacolod City Tel. No. 034-476-1566, 708-6185Kim Espart CastilloAún no hay calificaciones

- Member'S Contribution Remittance Form (MCRF) : Four Stripes Maritime Review CenterDocumento2 páginasMember'S Contribution Remittance Form (MCRF) : Four Stripes Maritime Review CenterKim Espart CastilloAún no hay calificaciones

- TMF190 eSRSEmployerEnrollmentForm V04 PDFDocumento1 páginaTMF190 eSRSEmployerEnrollmentForm V04 PDFKim Espart CastilloAún no hay calificaciones

- 52052annex A1-Rmo56 - 2010 TEKNONDocumento1 página52052annex A1-Rmo56 - 2010 TEKNONKim Espart CastilloAún no hay calificaciones

- TMF190 eSRSEmployerEnrollmentForm V04 PDFDocumento1 páginaTMF190 eSRSEmployerEnrollmentForm V04 PDFKim Espart CastilloAún no hay calificaciones

- Buyer's Information Sheet: Your Personal BackgroundDocumento5 páginasBuyer's Information Sheet: Your Personal BackgroundKim Espart CastilloAún no hay calificaciones

- Inventory Bir FinalDocumento172 páginasInventory Bir FinalKim Espart CastilloAún no hay calificaciones

- Mpu 3353Documento26 páginasMpu 3353herueuxAún no hay calificaciones

- Summer Training ReportDocumento27 páginasSummer Training ReportSidhant kumarAún no hay calificaciones

- Essentials of Life InsuranceDocumento15 páginasEssentials of Life InsuranceAayush AgrawalAún no hay calificaciones

- Aviva Life Insurance: Aviva Mainly Have Two Major Kind of Products: 1. Aviva Individual Products 2. Aviva Group ProductsDocumento33 páginasAviva Life Insurance: Aviva Mainly Have Two Major Kind of Products: 1. Aviva Individual Products 2. Aviva Group ProductsBasavaraja K JAún no hay calificaciones

- Insurance Brokers in RomaniaDocumento10 páginasInsurance Brokers in RomaniaIrina StefanaAún no hay calificaciones

- Unit Ii Life InsuranceDocumento12 páginasUnit Ii Life InsuranceNice NameAún no hay calificaciones

- Customer Buying Behavior With A Focus On Market SegmentationDocumento60 páginasCustomer Buying Behavior With A Focus On Market Segmentationcharlsarora100% (1)

- Krishna Sbi Life Policy Term InsuranceDocumento36 páginasKrishna Sbi Life Policy Term Insurancekrishna_1238Aún no hay calificaciones

- BT Quiz 2Documento5 páginasBT Quiz 2Lou Anthony A. Calibo0% (1)

- Del Val vs. Del Val (G.R. No. L-9374 February 16, 1915) - 4Documento2 páginasDel Val vs. Del Val (G.R. No. L-9374 February 16, 1915) - 4eunice demaclidAún no hay calificaciones

- Government of Andhra PradeshDocumento3 páginasGovernment of Andhra PradeshRDO ONGOLEAún no hay calificaciones

- Business and Transfer Taxation Gross Estate (Students' Handouts)Documento2 páginasBusiness and Transfer Taxation Gross Estate (Students' Handouts)Angelica Jem Ballesterol CarandangAún no hay calificaciones

- Ede Ex13Documento2 páginasEde Ex13Suyash KerkarAún no hay calificaciones

- Life Insurance Corporation of India Vs Raja VasirsDocumento7 páginasLife Insurance Corporation of India Vs Raja VasirsmohitAún no hay calificaciones

- CEMAP Question PaperDocumento7 páginasCEMAP Question Paperash0% (1)

- LIC S Jeevan Akshay VII Sales BrochureDocumento8 páginasLIC S Jeevan Akshay VII Sales Brochureselva.uae8207Aún no hay calificaciones

- TAN V CADocumento2 páginasTAN V CARaven Claire MalacaAún no hay calificaciones

- CFP Exam Handbook en 2013febDocumento45 páginasCFP Exam Handbook en 2013febcnvb alskAún no hay calificaciones

- Report On Investment AvenuesDocumento46 páginasReport On Investment AvenuesRiteshAún no hay calificaciones

- FandI CT5 200504 ExampaperDocumento7 páginasFandI CT5 200504 ExampaperClerry SamuelAún no hay calificaciones

- Unit-V-marketing of Insurance ServicesDocumento18 páginasUnit-V-marketing of Insurance ServicesDr.P. Siva RamakrishnaAún no hay calificaciones

- Tax FinalsDocumento48 páginasTax FinalsAthena SalasAún no hay calificaciones

- A Study On The Brand Image of Bajaj Allianz Life Insurance CDocumento95 páginasA Study On The Brand Image of Bajaj Allianz Life Insurance CDeric deric don100% (2)

- Ma. Faith R. Tan: Payable To A Revocable Beneficiary."Documento1 páginaMa. Faith R. Tan: Payable To A Revocable Beneficiary."Faith Reyna TanAún no hay calificaciones

- OUESTDocumento2 páginasOUESTprabu8888Aún no hay calificaciones

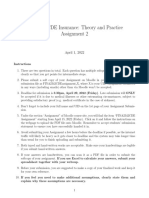

- FINA2342CDE Insurance: Theory and Practice Assignment 2: April 1, 2022Documento7 páginasFINA2342CDE Insurance: Theory and Practice Assignment 2: April 1, 2022New FAún no hay calificaciones

- LIC Case StudyDocumento6 páginasLIC Case StudymayuriAún no hay calificaciones

- Titanium Plus Plan Web FlyerDocumento1 páginaTitanium Plus Plan Web FlyerPooja MishraAún no hay calificaciones

- Internship Report On Chartered LifeDocumento78 páginasInternship Report On Chartered LifeSabila Muntaha TushiAún no hay calificaciones

- Guide To Personal FinanceDocumento36 páginasGuide To Personal FinanceVivek R KoushikAún no hay calificaciones