Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Cost Sheet Analysis

Cargado por

Nahidul Islam IUDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Cost Sheet Analysis

Cargado por

Nahidul Islam IUCopyright:

Formatos disponibles

Prepared by SM Nahidul Islam 1

Dept. of Finance & Banking

1. Definition of cost sheet & state the purposes of cost sheet

Answer: A cost sheet is a statement of cost incurred, or to be incurred, for producing a given volume of

output or for rendering services. Preparation of a cost sheet helps cost control and pricing decisions. It may

be prepared based on absorption costing and marginal costing techniques.

The main purposes or advantages of cost sheet are:

1. It discloses the total cost and the cost per unit of the units produced during the given period.

2. It enables a manufacture to keep a close watch and control over the cost of production.

3. It acts as guide to the manufacturer and helps him in formulating a definite useful production policy.

4. It helps in fixing up the selling price more accurately.

5. It helps the businessman to minimize the cost of production when there is a cut throat competition.

6. It helps the businessman to submit quotations with reasonable degree of accuracy against tenders for

the supply of goods.

2. Describe the classification of costs

Answer: Costs can be classified into the following different types -

1. Historical cost: It is measured by actual cash payments or their equivalent at the time of outlay for

acquiring assets, or goods and services.

2. Estimated cost: It is a predetermined cost.

3. Standard cost: Most scientifically predetermined cost.

4. Total cost: The sum of all costs attributable to a given volume under consideration.

5. Average cost: It is the unit cost which is computed by dividing the total cost by the volume involved.

6. Marginal cost: Measured by the change in cost due to change in output by one unit.

7. Differential cost: Change in total costs at a particular level of activity with respect to another. This

is also known as incremental cost.

8. Replacement cost: This is the current cost of replacing an asset.

9. Opportunity cost: It is the measurable advantage foregone as a result of the rejection of alternative

uses of resources, whether of materials, labour or facilities.

10. Imputed cost: It is a hypothetical cost and does not involve actual cash outlay and, as a

consequence, does not appear in the financial records.

11. Sunk cost: It represents historical cost which is irrecoverable in a given situation.

12. Discretionary costs: They are fixed costs that arise from periodic, usually yearly, appropriation

decisions that directly reflect top management policies.

13. Controllable costs: Costs which can be influenced by the action of an individual in an enterprise

within a given time span are called controllable costs.

14. Relevant costs: Costs appropriate to aiding the making of specific, management decisions. These are

expected future costs that will differ under alternatives.

15. Policy costs: Costs incurred as a result of taking a particular policy decision are called policy costs.

Islamic University, Kustia

Prepared by SM Nahidul Islam 2

Dept. of Finance & Banking

3. Differences between a Cost Centre and a Cost Unit

Answer: The differences between cost Centre and cost unit are given below:

Cost Centre Cost Unit

A cost Centre is the smallest segment or activity or A cost unit is a quantitative unit of product or

area of responsibility for which costs are ascertained. service in relation to which costs are expressed and

ascertained

A cost centre is one segment of the total organization. A cost unit is the unit of expressing cost and is, as

such, a part related to the production or service.

A cost centre helps to determine costs by location, Cost unit is used for the sub-division of costs which

person, etc. may be attributed to the products or services.

A cost centre is devised before applying the cost unit. Application of cost units arise after the functions of

devising cost centres are over.

A concern which even produces only one product or A cost unit is assigned to one distinct product or

renders only one service, may have several cost service.

centres

4. Describe the Elements of Cost

Answer: Following are the four broad elements of cost:

1. Material: The substance from which a product is made is known as material. It may be in a raw or a

manufactured state. It can be direct as well as indirect.

a. Direct Material: Direct materials are the materials that can be specifically identified with the

product.

b. Indirect Material: Indirect materials costs are usually variable because materials are based on the

level of production.

2. Labor: For conversion of materials into finished goods, human effort is needed and such human effort is

called labor. Labor can be direct as well as indirect.

a. Direct Labor: The labor which actively and directly takes part in the production of a particular

commodity is called direct labor.

b. Indirect Labor: The labor employed for the purpose of carrying out tasks incidental to goods

produced or services provided, is indirect labor.

3. Expenses: Expenses may be direct or indirect.

a. Direct Expenses: These are the expenses that can be directly, conveniently and wholly allocated to

specific cost centers or cost units.

b. Indirect Expenses: These are the expenses that cannot be directly, conveniently and wholly

allocated to cost centers or cost units.

4. Overhead: The term overhead includes indirect material, indirect labor and indirect expenses. Thus, all

indirect costs are overheads. Overheads may be incurred in a factory or office or selling and distribution

divisions. Thus, overheads may be of three types:

a. Factory Overheads

b. Office and Administration Overheads

c. Selling and Distribution Overheads

Islamic University, Kustia

También podría gustarte

- Answer To The Case StudyDocumento11 páginasAnswer To The Case StudyNahidul Islam IU100% (3)

- Presentation On Capital BudgetingDocumento15 páginasPresentation On Capital BudgetingNahidul Islam IUAún no hay calificaciones

- De Beers Diamond Industry Case Study AnalysisDocumento6 páginasDe Beers Diamond Industry Case Study AnalysisRitesh ModiAún no hay calificaciones

- Cost Concepts AND Classification: By: Amar Raveendran Debasis BeheraDocumento7 páginasCost Concepts AND Classification: By: Amar Raveendran Debasis BeheraAmar RaveendranAún no hay calificaciones

- Costing in BriefDocumento47 páginasCosting in BriefRezaul Karim TutulAún no hay calificaciones

- Managerial Economics, Mba I SEMDocumento144 páginasManagerial Economics, Mba I SEMHOD MBA HOD MBA100% (1)

- Ca Final - Ama (Costing) Theory Notes: Amogh Ashtaputre @amoghashtaputre Amogh Ashtaputre Amogh AshtaputreDocumento143 páginasCa Final - Ama (Costing) Theory Notes: Amogh Ashtaputre @amoghashtaputre Amogh Ashtaputre Amogh AshtaputreB GANAPATHY100% (1)

- Hotel Costing NotesDocumento23 páginasHotel Costing NotesShashi Kumar C GAún no hay calificaciones

- Ruth Nasdaq Richies StrateyyDocumento20 páginasRuth Nasdaq Richies StrateyyYrn Pelao100% (1)

- Managerial Economics, 5th Edition - Ivan PNGDocumento532 páginasManagerial Economics, 5th Edition - Ivan PNGDiego MartinezAún no hay calificaciones

- MathDocumento3 páginasMathNahidul Islam IU100% (4)

- Business ResearchDocumento35 páginasBusiness ResearchNahidul Islam IUAún no hay calificaciones

- Chinese Fireworks CaseDocumento34 páginasChinese Fireworks CaseIrwan PriambodoAún no hay calificaciones

- Price: Coca-Cola Pricing StrategiesDocumento6 páginasPrice: Coca-Cola Pricing StrategiesP M PeterAún no hay calificaciones

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageDe EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageCalificación: 5 de 5 estrellas5/5 (1)

- Unit 1 Lesson 3Documento4 páginasUnit 1 Lesson 3avan4052asAún no hay calificaciones

- Null 2Documento10 páginasNull 2siddharthsonar9604Aún no hay calificaciones

- Cost Terminology and Classification ExplainedDocumento8 páginasCost Terminology and Classification ExplainedKanbiro Orkaido100% (1)

- E1-E2 - Text - Chapter 6. Cost RecordsDocumento14 páginasE1-E2 - Text - Chapter 6. Cost Recordspintu_dyAún no hay calificaciones

- Week 2 - Lesson 2 Costs in Managerial AccountingDocumento7 páginasWeek 2 - Lesson 2 Costs in Managerial AccountingReynold Raquiño AdonisAún no hay calificaciones

- Managerial Accounting Module: Costs in Managerial AccountingDocumento7 páginasManagerial Accounting Module: Costs in Managerial AccountingReynold Raquiño AdonisAún no hay calificaciones

- Cost Concepts and ClassificationDocumento53 páginasCost Concepts and ClassificationMoshhiur RahmanAún no hay calificaciones

- Cost Concepts.-RDocumento17 páginasCost Concepts.-RSanjay MehrotraAún no hay calificaciones

- Cost Capter FourDocumento11 páginasCost Capter FourAbayineh MesenbetAún no hay calificaciones

- Lecture 1 Cost of ProductionDocumento2 páginasLecture 1 Cost of ProductionSagnikAún no hay calificaciones

- Cost Terms and Classifications ExplainedDocumento11 páginasCost Terms and Classifications ExplainedAkkamaAún no hay calificaciones

- Costing ConceptsDocumento16 páginasCosting ConceptskrimishaAún no hay calificaciones

- Pul075msree005 PDFDocumento13 páginasPul075msree005 PDFSanjeevAún no hay calificaciones

- Cost Accounting and Control Lecture NotesDocumento11 páginasCost Accounting and Control Lecture NotesAnalyn LafradezAún no hay calificaciones

- Cost Concepts & ClassificationDocumento29 páginasCost Concepts & ClassificationDebasis BeheraAún no hay calificaciones

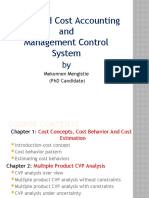

- Advanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Documento62 páginasAdvanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Kalkidan ZerihunAún no hay calificaciones

- Management AccountingDocumento87 páginasManagement AccountingYashveer MachraAún no hay calificaciones

- IPCC Costing Theory Formulas ShortcutsDocumento57 páginasIPCC Costing Theory Formulas ShortcutsCA Darshan Ajmera86% (7)

- FIN600 Module 3 Notes - Financial Management Accounting ConceptsDocumento20 páginasFIN600 Module 3 Notes - Financial Management Accounting ConceptsInés Tetuá TralleroAún no hay calificaciones

- Cost Concepts and MethodsDocumento16 páginasCost Concepts and MethodsTushar BhattacharyyaAún no hay calificaciones

- Unit Vi - Cost Theory and Estimation: C F (X, T, PF)Documento10 páginasUnit Vi - Cost Theory and Estimation: C F (X, T, PF)Bai NiloAún no hay calificaciones

- Cost Ch. IIDocumento83 páginasCost Ch. IIMagarsaa AmaanAún no hay calificaciones

- Cost AccountingDocumento19 páginasCost AccountingDurga Prasad NallaAún no hay calificaciones

- Cost Accounting Concepts ExplainedDocumento7 páginasCost Accounting Concepts ExplainedyebegashetAún no hay calificaciones

- Cost Classification: by Nature of ExpensesDocumento4 páginasCost Classification: by Nature of ExpensesLovenika GandhiAún no hay calificaciones

- Group 2 - RMK 2 - Introduction To Cost Term and ConceptDocumento16 páginasGroup 2 - RMK 2 - Introduction To Cost Term and ConceptSagung AdvaitaAún no hay calificaciones

- COST MANAGEMENT TOOLS FOR STRATEGIC DECISIONSDocumento106 páginasCOST MANAGEMENT TOOLS FOR STRATEGIC DECISIONSPrasannakumar SAún no hay calificaciones

- Cost AnalysisDocumento48 páginasCost AnalysisdrajingoAún no hay calificaciones

- Classifying Costs for Effective ManagementDocumento8 páginasClassifying Costs for Effective ManagementMohamaad SihatthAún no hay calificaciones

- Cost ClassificationDocumento9 páginasCost ClassificationPuneet TandonAún no hay calificaciones

- Chapter 2Documento18 páginasChapter 2Hk100% (1)

- Chapter 2 Cost Concepts AnalysisDocumento8 páginasChapter 2 Cost Concepts AnalysisMaria Elliane Querubin RosalesAún no hay calificaciones

- Chap 003Documento5 páginasChap 003abhinaypradhanAún no hay calificaciones

- Basic Cost Management ConceptsDocumento6 páginasBasic Cost Management Conceptswingsenigma 00Aún no hay calificaciones

- Workshop 1 PreDocumento14 páginasWorkshop 1 PrenahikkarAún no hay calificaciones

- Word MeDocumento15 páginasWord Mepawanijain96269Aún no hay calificaciones

- Cost - Concepts and TermsDocumento4 páginasCost - Concepts and TermsMd Shawfiqul IslamAún no hay calificaciones

- Basic Concepts of Cost AccountingDocumento14 páginasBasic Concepts of Cost AccountinghellokittysaranghaeAún no hay calificaciones

- Cost NotesDocumento16 páginasCost NotesKomal GowdaAún no hay calificaciones

- CHAPTER I Lecture NoteDocumento17 páginasCHAPTER I Lecture NoteKalkidan NigussieAún no hay calificaciones

- Chapter Five Introduction To Managerial AccountingDocumento65 páginasChapter Five Introduction To Managerial AccountinghabtamuAún no hay calificaciones

- Accounting For Managers-Questions - TestDocumento13 páginasAccounting For Managers-Questions - TestIvy TulesiAún no hay calificaciones

- Chapter-Six 6.preparation of Operating Budgets: Financial AccountingDocumento6 páginasChapter-Six 6.preparation of Operating Budgets: Financial AccountingWendosen H FitabasaAún no hay calificaciones

- Cost Classification and Procedures ReportDocumento11 páginasCost Classification and Procedures Reportreyman rosalijosAún no hay calificaciones

- Cost Accounitng NotesDocumento17 páginasCost Accounitng NotesDarlene JoyceAún no hay calificaciones

- CostDocumento33 páginasCostversmajardoAún no hay calificaciones

- Acca Paper 1.2Documento25 páginasAcca Paper 1.2anon-280248Aún no hay calificaciones

- Cost Accounting: Basic Nature and ConceptsDocumento28 páginasCost Accounting: Basic Nature and Concepts9986212378Aún no hay calificaciones

- CA Final AMA Theory Complete R6R7GKB0 PDFDocumento143 páginasCA Final AMA Theory Complete R6R7GKB0 PDFjjAún no hay calificaciones

- Chapter 2 Solutions: Solutions To Questions For Review and DiscussionDocumento31 páginasChapter 2 Solutions: Solutions To Questions For Review and DiscussionAlbert CruzAún no hay calificaciones

- Write Advantages and Disadvantages of Cost AccountingDocumento6 páginasWrite Advantages and Disadvantages of Cost AccountingAditya ManglamAún no hay calificaciones

- Chapter 6 11 12Documento15 páginasChapter 6 11 12wubeAún no hay calificaciones

- Cost and Management Accounting GlossaryDocumento13 páginasCost and Management Accounting Glossaryssistece100% (1)

- Accounting CostingDocumento156 páginasAccounting CostingMorning32100% (1)

- THEORYDocumento6 páginasTHEORYsuduh09Aún no hay calificaciones

- Finance Major MBA LeverageDocumento4 páginasFinance Major MBA LeverageNahidul Islam IUAún no hay calificaciones

- Finance Means Money ManagementDocumento1 páginaFinance Means Money ManagementNahidul Islam IUAún no hay calificaciones

- Exercise of LeverageDocumento1 páginaExercise of LeverageNahidul Islam IUAún no hay calificaciones

- Final Exam - Spring-2020 RevisedDocumento1 páginaFinal Exam - Spring-2020 RevisedNahidul Islam IUAún no hay calificaciones

- C. DFL Or, 1.25 Or, 50% D. DFL Or, 1.25 Or, 8% E. DTL Dol X DFL XDocumento1 páginaC. DFL Or, 1.25 Or, 50% D. DFL Or, 1.25 Or, 8% E. DTL Dol X DFL XNahidul Islam IUAún no hay calificaciones

- Median 3. Mode 4. Standard Deviation 5. Variance 6. Coefficient of VariationDocumento3 páginasMedian 3. Mode 4. Standard Deviation 5. Variance 6. Coefficient of VariationNahidul Islam IUAún no hay calificaciones

- Total Customer of A BankDocumento1 páginaTotal Customer of A BankNahidul Islam IUAún no hay calificaciones

- Buy A Land For TK 10Documento1 páginaBuy A Land For TK 10Nahidul Islam IUAún no hay calificaciones

- Time Value of Money Means TodayDocumento3 páginasTime Value of Money Means TodayNahidul Islam IUAún no hay calificaciones

- Components of Capital StructureDocumento3 páginasComponents of Capital StructureNahidul Islam IUAún no hay calificaciones

- ReturnDocumento1 páginaReturnNahidul Islam IUAún no hay calificaciones

- Time Value of Money Means TodayDocumento3 páginasTime Value of Money Means TodayNahidul Islam IUAún no hay calificaciones

- Finance Major MBA LeverageDocumento4 páginasFinance Major MBA LeverageNahidul Islam IUAún no hay calificaciones

- ReportDocumento2 páginasReportNahidul Islam IUAún no hay calificaciones

- CPMDocumento2 páginasCPMNahidul Islam IUAún no hay calificaciones

- AuditDocumento1 páginaAuditNahidul Islam IUAún no hay calificaciones

- Selected Questions For MBA and BBADocumento1 páginaSelected Questions For MBA and BBANahidul Islam IUAún no hay calificaciones

- The Effect of Macroeconomic Variables On The Financial Performance of Non-Life Insurance Companies in BangladeshDocumento22 páginasThe Effect of Macroeconomic Variables On The Financial Performance of Non-Life Insurance Companies in BangladeshNahidul Islam IUAún no hay calificaciones

- Internee 1Documento4 páginasInternee 1Nahidul Islam IUAún no hay calificaciones

- Strongly AgreeDocumento1 páginaStrongly AgreeNahidul Islam IUAún no hay calificaciones

- THE HISTORY AND DEVELOPMENT OF SUKUKDocumento4 páginasTHE HISTORY AND DEVELOPMENT OF SUKUKNahidul Islam IUAún no hay calificaciones

- Selected Questions For MBA and BBADocumento1 páginaSelected Questions For MBA and BBANahidul Islam IUAún no hay calificaciones

- Final ReportDocumento68 páginasFinal ReportNahidul Islam IUAún no hay calificaciones

- Factors Impacting Deposit Growth of Bangladeshi Private BanksDocumento8 páginasFactors Impacting Deposit Growth of Bangladeshi Private BanksNahidul Islam IUAún no hay calificaciones

- Government FinanceDocumento2 páginasGovernment FinanceNahidul Islam IUAún no hay calificaciones

- Fin 514 Fixed Income SecuritiesDocumento3 páginasFin 514 Fixed Income SecuritiesNahidul Islam IUAún no hay calificaciones

- 10 Principle of EconomicsDocumento4 páginas10 Principle of EconomicsAli RAZAAún no hay calificaciones

- Aggregate Expenditure KeyDocumento4 páginasAggregate Expenditure KeyFebri EldiAún no hay calificaciones

- Research Chapter 1 2Documento8 páginasResearch Chapter 1 2Ashley VertucioAún no hay calificaciones

- Practice Q1Documento14 páginasPractice Q1blgm1031Aún no hay calificaciones

- Blockchain-based protocol for global commerce and supply chainsDocumento67 páginasBlockchain-based protocol for global commerce and supply chainsLorenzo ZuluetaAún no hay calificaciones

- Elasticity: Price Elasticity of Demand TypesDocumento28 páginasElasticity: Price Elasticity of Demand TypesMaggiehoushaimiAún no hay calificaciones

- Agribusiness As An Economic Sector: A. AgricultureDocumento4 páginasAgribusiness As An Economic Sector: A. AgricultureSittie Ahlam G. AlimAún no hay calificaciones

- Classical Growth Theory PPT 2nd ChapterDocumento50 páginasClassical Growth Theory PPT 2nd Chapterchhapoliaa2001Aún no hay calificaciones

- Multilevel Marketing - The Paradox of AutonomyDocumento153 páginasMultilevel Marketing - The Paradox of Autonomyconfleis73Aún no hay calificaciones

- Economics EOQ 2019Documento9 páginasEconomics EOQ 2019Charles AbelAún no hay calificaciones

- Improving Local Food SystemsDocumento5 páginasImproving Local Food SystemsJehan CodanteAún no hay calificaciones

- Elasticity of Demand and Its DeterminantsDocumento34 páginasElasticity of Demand and Its DeterminantsJaskeerat Singh OberoiAún no hay calificaciones

- Chap 10 QuizDocumento29 páginasChap 10 QuizLeneth AngtiampoAún no hay calificaciones

- Hsslive-2.National Income Accounting-SignedDocumento75 páginasHsslive-2.National Income Accounting-SignedNusrat JahanAún no hay calificaciones

- Principles of Microeconomics Course OutlineDocumento9 páginasPrinciples of Microeconomics Course Outline08 Ajay Halder 11- CAún no hay calificaciones

- Assessing Economic and Global ConditionsDocumento17 páginasAssessing Economic and Global ConditionsAudityaErosSiswantoAún no hay calificaciones

- 574-Article Text-1139-1-10-20170930Documento12 páginas574-Article Text-1139-1-10-20170930Jhufry GhanterAún no hay calificaciones

- Tugas ME 5Documento5 páginasTugas ME 5Fachrizal AnshoriAún no hay calificaciones

- 45 Journals Used in FT Research RankDocumento2 páginas45 Journals Used in FT Research RankSzymon KaczmarekAún no hay calificaciones

- Financial Management MST PaperDocumento18 páginasFinancial Management MST Papermeenalindore19Aún no hay calificaciones

- Data Extract From World Development IndicatorsDocumento15 páginasData Extract From World Development IndicatorsIzaniey IsmailAún no hay calificaciones

- Food Sim 2002 ProcDocumento220 páginasFood Sim 2002 Procabd elheq zeguerrouAún no hay calificaciones

- Indifference CurveDocumento63 páginasIndifference CurveManish Vijay100% (1)

- Unit 7 Global Cost of Capital and Capital Structure: Sanjay Ghimire Tu-SomDocumento27 páginasUnit 7 Global Cost of Capital and Capital Structure: Sanjay Ghimire Tu-SomMotiram paudelAún no hay calificaciones