Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Sales Tax2

Cargado por

pjadhav37Descripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Sales Tax2

Cargado por

pjadhav37Copyright:

Formatos disponibles

Sales tax in India

Sales Tax in India is a form of tax that is imposed by the government on the sale or purchase of a particular

commodity within the country. Sales Tax is imposed under both, Central Government (Central Sales Tax)

and State Government (Sales Tax) Legislation. Generally, each state follows its own sales tax act and levies

tax at various rates. Apart from sales tax, certain states also imposes additional charges like works contracts

tax, turnover tax and purchaser tax. Thus, sales tax acts as a major revenue-generator for the various State

Governments.

Sales tax is an indirect form of tax, wherein it is the responsibility of the seller of the commodity to collect

and recover the tax from the purchaser. Generally, sale of imported items and sales by way of export are not

included in the range of commodities which requires payment of sales tax. Moreover, luxury items (like

cosmetics) are levied heavier sales tax rates. Central Sales Tax (CST) Act that falls under the direction of

the Central Government takes into account all the interstate sales of commodities.

Thus, sales tax is to be paid by every dealer on the sale of any commodity, made by him during inter-state

trade or commerce, irrespective of the fact that no liability to pay tax on the sale of goods arises under the

tax laws of the appropriate state. He is to pay sales tax to the sales tax authority of the state from which the

movement of the commodities commences. However, from April 01, 2005, most of the states in India have

supplemented sales tax with a new Value Added Tax (VAT).

The practice of VAT executed by State Governments is applied on each stage of sale, with a particular

apparatus of credit for the input VAT paid. VAT in India can be classified under the following tax slabs:

• 0% for essential commodities

• 1% on gold ingots and expensive stones

• 4% on industrial inputs, capital merchandise and commodities of mass consumption

• 12.5% on other items

• Variable rates (state-dependent) are applicable for petroleum products, tobacco, liquor etc.

81/4%

Sales and Use Tax Chart

Includes any applicable local tax.

Rate = .0825

Through Tax

.06 .00

.18 .01

.30 .02

.42 .03

.54 .04

.66 .05

.78 .06

.90 .07

1.03 .08

1.15 .09

1.27 .10

1.39 .11

1.51 .12

1.63 .13

1.75 .14

1.87 .15

1.99 .16

2.12 .17

2.24 .18

2.36 .19

2.48 .20

2.60 .21

2.72 .22

2.84 .23

2.96 .24

3.09 .25

3.21 .26

3.33 .27

3.45 .28

3.57 .29

3.69 .30

3.81 .31

3.93 .32

4.06 .33

4.18 .34

4.30 .35

4.42 .36

4.54 .37

4.66 .38

4.78 .39

4.90 .40

5.03 .41

5.15 .42

5.27 .43

5.39 .44

5.51 .45

5.63 .46

5.75 .47

Through Tax

5.87 .48

5.99 .49

6.12 .50

6.24 .51

6.36 .52

6.48 .53

6.60 .54

6.72 .55

6.84 .56

6.96 .57

7.09 .58

7.21 .59

7.33 .60

7.45 .61

7.57 .62

7.69 .63

7.81 .64

7.93 .65

8.06 .66

8.18 .67

8.30 .68

8.42 .69

8.54 .70

8.66 .71

8.78 .72

8.90 .73

9.03 .74

9.15 .75

9.27 .76

9.39 .77

9.51 .78

9.63 .79

9.75 .80

9.87 .81

9.99 .82

10.12 .83

10.24 .84

10.36 .85

10.48 .86

10.60 .87

10.72 .88

10.84 .89

10.96 .90

11.09 .91

11.21 .92

11.33 .93

11.45 .94

11.57 .95

Through Tax

11.69 .96

11.81 .97

11.93 .98

12.06 .99

12.18 1.00

12.30 1.01

12.42 1.02

12.54 1.03

12.66 1.04

12.78 1.05

12.90 1.06

13.03 1.07

13.15 1.08

13.27 1.09

13.39 1.10

13.51 1.11

13.63 1.12

13.75 1.13

13.87 1.14

13.99 1.15

14.12 1.16

14.24 1.17

14.36 1.18

14.48 1.19

14.60 1.20

14.72 1.21

14.84 1.22

14.96 1.23

15.09 1.24

15.21 1.25

15.33 1.26

15.45 1.27

15.57 1.28

15.69 1.29

15.81 1.30

15.93 1.31

16.06 1.32

16.18 1.33

16.30 1.34

16.42 1.35

16.54 1.36

16.66 1.37

16.78 1.38

16.90 1.39

17.03 1.40

17.15 1.41

17.27 1.42

17.39 1.43

Through Tax

17.51 1.44

17.63 1.45

17.75 1.46

17.87 1.47

17.99 1.48

18.12 1.49

18.24 1.50

18.36 1.51

18.48 1.52

18.60 1.53

18.72 1.54

18.84 1.55

18.96 1.56

19.09 1.57

19.21 1.58

19.33 1.59

19.45 1.60

19.57 1.61

19.69 1.62

19.81 1.63

19.93 1.64

20.06 1.65

20.18 1.66

20.30 1.67

20.42 1.68

20.54 1.69

20.66 1.70

20.78 1.71

20.90 1.72

21.03 1.73

21.15 1.74

21.27 1.75

21.39 1.76

21.51 1.77

21.63 1.78

21.75 1.79

21.87 1.80

21.99 1.81

22.12 1.82

22.24 1.83

22.36 1.84

22.48 1.85

22.60 1.86

22.72 1.87

22.84 1.88

22.96 1.89

23.09 1.90

23.21 1.91

Through Tax

23.33 1.92

23.45 1.93

23.57 1.94

23.69 1.95

23.81 1.96

23.93 1.97

24.06 1.98

24.18 1.99

24.30 2.00

24.42 2.01

24.54 2.02

24.66 2.03

24.78 2.04

24.90 2.05

25.03 2.06

25.15 2.07

25.27 2.08

25.39 2.09

25.51 2.10

25.63 2.11

25.75 2.12

25.87 2.13

25.99 2.14

26.12 2.15

26.24 2.16

26.36 2.17

26.48 2.18

26.60 2.19

26.72 2.20

26.84 2.21

26.96 2.22

27.09 2.23

27.21 2.24

27.33 2.25

27.45 2.26

27.57 2.27

27.69 2.28

27.81 2.29

27.93 2.30

28.06 2.31

28.18 2.32

28.30 2.33

28.42 2.34

28.54 2.35

28.66 2.36

28.78 2.37

28.90 2.38

29.03 2.39

También podría gustarte

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- W9Documento4 páginasW9pall2509Aún no hay calificaciones

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Case-Study Starbucks - Tax EvasionDocumento18 páginasCase-Study Starbucks - Tax Evasionrinkweijs88% (8)

- Special Audit PDFDocumento0 páginasSpecial Audit PDFVasantha NaikAún no hay calificaciones

- CTC AssignmentDocumento5 páginasCTC AssignmentAbhishek VermaAún no hay calificaciones

- Allotment of Ira and Share of Lgu in The National WealthDocumento2 páginasAllotment of Ira and Share of Lgu in The National WealthRio AlbaricoAún no hay calificaciones

- HSC Business Studies Operation1Documento36 páginasHSC Business Studies Operation1Uttkarsh AroraAún no hay calificaciones

- Protecting Legacy The Value of A Family OfficeDocumento25 páginasProtecting Legacy The Value of A Family OfficeRavi BabuAún no hay calificaciones

- Offer: Computer Consultancy Ref: TCSL/DT20184254932/Chennai Date: 22/08/2018Documento17 páginasOffer: Computer Consultancy Ref: TCSL/DT20184254932/Chennai Date: 22/08/2018shilpa100% (1)

- Digest Cir v. Asalus CorpDocumento2 páginasDigest Cir v. Asalus CorpJan Veah CaabayAún no hay calificaciones

- City of Rochester F22 Proposed Budget June 3 Version PDFDocumento599 páginasCity of Rochester F22 Proposed Budget June 3 Version PDFNews 8 WROCAún no hay calificaciones

- EPZ SROs PDFDocumento82 páginasEPZ SROs PDFfaizan009Aún no hay calificaciones

- ME Problem Set-3-2017 BatchDocumento6 páginasME Problem Set-3-2017 BatchsrivastavavishistAún no hay calificaciones

- Make in India - Data - V1 - 18.08.2019 PDFDocumento30 páginasMake in India - Data - V1 - 18.08.2019 PDFPratap DasAún no hay calificaciones

- Manning Centre Report On Calgary City CouncilDocumento41 páginasManning Centre Report On Calgary City CouncilCalgary HeraldAún no hay calificaciones

- Nurpur HotelDocumento1 páginaNurpur Hotelsumit kumarAún no hay calificaciones

- Prospectus Mod en YQFFpDocumento421 páginasProspectus Mod en YQFFpSalvator LevisAún no hay calificaciones

- Cost Records and Cost Audit Under Companies Act, 2013Documento6 páginasCost Records and Cost Audit Under Companies Act, 2013Purushotham MysoreAún no hay calificaciones

- Integrated Profit and Loss, Balance Sheet & Cash Flow Financial Model For HotelsDocumento67 páginasIntegrated Profit and Loss, Balance Sheet & Cash Flow Financial Model For HotelsHa TruongAún no hay calificaciones

- Amount Chargeable (In Words) E. & O.EDocumento1 páginaAmount Chargeable (In Words) E. & O.EManish JaiswalAún no hay calificaciones

- In Partial Fulfilment For The Award of The Degree ofDocumento15 páginasIn Partial Fulfilment For The Award of The Degree ofnithyaAún no hay calificaciones

- Ratio Analysis of TATA MotorsDocumento7 páginasRatio Analysis of TATA MotorsyashlathaAún no hay calificaciones

- Philippines, Plaintiff, Versus Quirico Ungab, Accused " and To RestrainDocumento5 páginasPhilippines, Plaintiff, Versus Quirico Ungab, Accused " and To RestrainLeBron DurantAún no hay calificaciones

- Ivan Gyulai Natural Resource Use Management PDFDocumento28 páginasIvan Gyulai Natural Resource Use Management PDFatushemeza clinton tcoupAún no hay calificaciones

- Canadapost - Ca-Canada Post - Find A Rate - Business - Results ListDocumento4 páginasCanadapost - Ca-Canada Post - Find A Rate - Business - Results ListAnonymous pFLQw6JAún no hay calificaciones

- Invoice 7538177918Documento1 páginaInvoice 7538177918Venu Gopal ReddyAún no hay calificaciones

- 3.7 Cash Flow Practice QuestionsDocumento2 páginas3.7 Cash Flow Practice QuestionsJavi MartinezAún no hay calificaciones

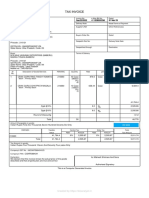

- Tax Invoice: Created by Https://bizanalyst - inDocumento1 páginaTax Invoice: Created by Https://bizanalyst - inSavera DixitAún no hay calificaciones

- Week 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGDocumento23 páginasWeek 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGfernan opeliñaAún no hay calificaciones

- Problems 1st PartDocumento17 páginasProblems 1st PartValentin JallaisAún no hay calificaciones

- Sensex Crashes 1,000 Pts On Mounting Inflation Worries: Ruling Authority For Direct Tax Cases On CardsDocumento16 páginasSensex Crashes 1,000 Pts On Mounting Inflation Worries: Ruling Authority For Direct Tax Cases On CardsRahulMIBAún no hay calificaciones