Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Su Marry

Cargado por

rahul0 calificaciones0% encontró este documento útil (0 votos)

2 vistas1 página111111111111111

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documento111111111111111

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

2 vistas1 páginaSu Marry

Cargado por

rahul111111111111111

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 1

CHAPTER V

SUMMARY, CONCLUSION AND RECOMMENDATION

5.1 Summary

This research work entitled EFFECTIVENESS OF RESOURCE

MOBILIZATION THROUGH VAT IN NEPAL, has been carried

out to ponder into the theoretical knowledge of VAT and to examine the

administration system of VAT especially in the Kathmandu valley, to

assess the post-implementation period of VAT as compared to

the period before the implementation in connection with generating

revenue, to examine whether VAT is superior to sales tax. To achieve

those objectives, different analysis has been done with the help of 26

years data (i.e. from the fiscal year 1990/1991 to 2015/2016) and

questionnaire developed by the researcher.

VAT is most recent innovation in the field of taxation system. VAT is

tax based on goods and services. The base of VAT is the value

addition that takes place during process of production and

distribution. Since this tax is based on consumption the burden

of this tax must be borne by the consumer. VAT is based on

self- assessment system. Under the self-assessment system, a

taxpayer is required to keep a proper account of his all business

transaction. Therefore, the returns files by the taxpayers by assessing

their tax liability must be accepted by the tax administration not

only in

principle but also in practice. VAT has done away with administrative

procedures such as taking approval of price for purpose of sales tax,

submission

of annual statement of accounts tax assessment by the tax officers

stamping of invoices, submission of invoices to the tax office along with

the tax returns etc.

VAT is transparent tax system that is based on taxpayer's transaction. VAT is

not only transparent but also demands transparency in other tax system as well

76

También podría gustarte

- Khutauna Pokhari 2078-079Documento276 páginasKhutauna Pokhari 2078-079rahulAún no hay calificaciones

- Pages From Standard Specifications For Road and Bridge Works - 20732Documento1 páginaPages From Standard Specifications For Road and Bridge Works - 20732rahulAún no hay calificaciones

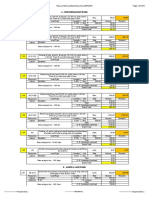

- Quantity in Boq Rate in BOQ Amount As Per Vo Unit Quantity in VO Rate in Estimate Description in BOQ Dor Specification S.NDocumento1 páginaQuantity in Boq Rate in BOQ Amount As Per Vo Unit Quantity in VO Rate in Estimate Description in BOQ Dor Specification S.NrahulAún no hay calificaciones

- 3g ZX/L Tyf Ejg LGDF (0f Cfof) HGFDocumento1 página3g ZX/L Tyf Ejg LGDF (0f Cfof) HGFrahulAún no hay calificaciones

- Ministry of Physical Infrastructure Development: Invitation For Online Bid (Ifb)Documento1 páginaMinistry of Physical Infrastructure Development: Invitation For Online Bid (Ifb)rahulAún no hay calificaciones

- Pages From Standard Specifications For Road and Bridge Works - 2073Documento2 páginasPages From Standard Specifications For Road and Bridge Works - 2073rahulAún no hay calificaciones

- Ministry of Urban Development Department of Urban Develeopment and Building Construction Federal Project Implementation Unit, Dhanusha, JanakpurdhamDocumento1 páginaMinistry of Urban Development Department of Urban Develeopment and Building Construction Federal Project Implementation Unit, Dhanusha, JanakpurdhamrahulAún no hay calificaciones

- Agreement PDFDocumento1 páginaAgreement PDFrahulAún no hay calificaciones

- Work Schedule FinalChainpurDocumento2 páginasWork Schedule FinalChainpurrahulAún no hay calificaciones

- Compensation DetailDocumento2 páginasCompensation DetailrahulAún no hay calificaciones

- MDAC report on key health indicators in IndiaDocumento1 páginaMDAC report on key health indicators in IndiarahulAún no hay calificaciones

- AgreementDocumento1 páginaAgreementrahulAún no hay calificaciones

- Karyadesh BegaDocumento2 páginasKaryadesh BegarahulAún no hay calificaciones

- Bhautik Sachib Quater by PradipDocumento39 páginasBhautik Sachib Quater by PradiprahulAún no hay calificaciones

- MDAC report on key health indicators in IndiaDocumento1 páginaMDAC report on key health indicators in IndiarahulAún no hay calificaciones

- Janki Consultancy and ConstructionDocumento2 páginasJanki Consultancy and ConstructionrahulAún no hay calificaciones

- Generator House Near Niti Aayog by SanjibDocumento24 páginasGenerator House Near Niti Aayog by SanjibrahulAún no hay calificaciones

- A One Engineering Design and Construction Pvt. LTD.: Hatiban Chowk, Lalitpur - 23Documento1 páginaA One Engineering Design and Construction Pvt. LTD.: Hatiban Chowk, Lalitpur - 23rahul100% (2)

- B) Lgs Tyf E - D0F VR (SF) LJN: Ef) Lts K"JF (WF/ LJSF Dgqfno, HGSK'/WFD - Wg'IffDocumento8 páginasB) Lgs Tyf E - D0F VR (SF) LJN: Ef) Lts K"JF (WF/ LJSF Dgqfno, HGSK'/WFD - Wg'IffrahulAún no hay calificaciones

- Final TOR CorridorDocumento7 páginasFinal TOR CorridorrahulAún no hay calificaciones

- Gorkha Travels booking details for Kathmandu to Delhi flightDocumento1 páginaGorkha Travels booking details for Kathmandu to Delhi flightrahulAún no hay calificaciones

- Business Reg CerDocumento1 páginaBusiness Reg CerrahulAún no hay calificaciones

- Room of Sachib Sir JyuDocumento120 páginasRoom of Sachib Sir JyurahulAún no hay calificaciones

- Technical Evaluation of Bids for Sarre Khola Bridge ProjectDocumento5 páginasTechnical Evaluation of Bids for Sarre Khola Bridge ProjectrahulAún no hay calificaciones

- New WorkDocumento1 páginaNew WorkrahulAún no hay calificaciones

- Design of Isolated FootingDocumento13 páginasDesign of Isolated FootingrahulAún no hay calificaciones

- Ministry of Physical Infrastructure DevelopmentDocumento25 páginasMinistry of Physical Infrastructure DevelopmentrahulAún no hay calificaciones

- Design of Isolated FootingDocumento13 páginasDesign of Isolated FootingrahulAún no hay calificaciones

- Z+ G+ G+ G+ : STR & DwawingDocumento1 páginaZ+ G+ G+ G+ : STR & DwawingrahulAún no hay calificaciones

- Design of Isolated FootingDocumento13 páginasDesign of Isolated FootingrahulAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)