Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Curled Metal Inc

Cargado por

Deepesh MoolchandaniDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Curled Metal Inc

Cargado por

Deepesh MoolchandaniCopyright:

Formatos disponibles

Curled Metal Inc./Adam 1 and Co.

/Section 13

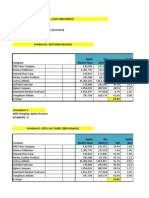

Decision: Curved Metal Incorporated should price the new 11.5-inch CMI cushion pad at $267.00 and

market only to existing distributors of construction equipment in order to share business risk while

offering them a fair profit margin. CMI should produce only 250 cushion pads per month by utilizing

existing capacity, and delay the acquisition of the specialized tooling machine and advertising expenses

until a future period when accurate demand forecasts become available. As CMI will be using existing

capacity, overhead should be allocated at a fixed rate. The success of CMIs new cushion pad requires a

controlled entrance into the market therefore aggressive expansion must be avoided in the short-term.

Evidence: Pricing the new 11.5-inch CMI cushion pad at $267.00 serves two purposes. It allows CMI to

realize the required 50% contribution margin on the sale of each cushion pad, and it allows CMIs

distribution partners to realize a 50% profit margin. While the ultimate selling price (assuming

distributors sell at a price of $534 per pad or $3200 per set of six) is considerably higher than the average

$10 charge per conventional pad, the cost savings to ultimate customers is $2,275.20 per pad or

$13,651.20 per set over conventional pads (assuming a 300-pile job).

Delaying the purchase of the specialized tooling machine until a later date when demand is more

determinable avoids costly depreciation expense of $15,000 per year (assuming a conservative 10 year

economic life) related to the tooling machine while the cost savings realized on direct labor ($52.20) and

overhead ($185.33) totals only $237.53. This small amount of savings does not justify the acquisition of

an asset that requires such a large yearly cost allocation. By delaying acquisition of additional capacity,

CMI does expose itself to the risk of not being able to meet demand should it rise rapidly. The risk of

purchasing excess capacity without the requisite demand, however, is a far larger risk therefore delaying

the purchase of additional capacity is the best course of action. By using existing idle capacity for the

manufacture of the new pads, allocating fixed costs on a variable rate is not appropriate and results in

over-costing, thus overhead should be fixed. Additionally as a result of existing capacity utilization, CMI

assumes substantially lower risk associated with the ability to sell these new pads since fixed costs are not

relevant and the company will only have to commit itself to the cost of direct materials and labor. The

same reasoning applies to advertising expenses. CMI should not commit itself to advertising expenses

until demand is more predictable.

Action Plan: In one week, CMI, in order to satisfy the existing demand for cushions from Kendrick

Company, will accept a one-time special order, priced at $267.00 per pad. Further sales shall be

conducted through construction-oriented manufacturers representatives, who will market CMIs new

cushion pad to existing distributors and supply houses. To select proper distribution outlets, CMI will

need to select distribution partners that will offer the most exposure to ultimate customers. For example,

distribution partners could be selected on the criterion that a majority of their revenue comes from piling

equipment rental and sales.

Based on the outcome of Dr. McCormacks research and initial sales by key distributors, CMI can

begin to create preliminary demand forecasts for its new cushion pads in the near term. Depending on the

level of demand, purchases of specialized tooling machines and additional capacity can be made as

appropriate. The primary risk associated with bringing the new pads to market will be the inability to sell

the new pads to distributors or the inability of distributors to sell the pads to ultimate customers. CMIs

exposure to this risk is minimized from the outset because the company can ultimately walk way from the

new pads with minimal capital loses.

In the long term, after demand can be predicted with reasonable accuracy, CMI should begin to

target existing and potential distributors with advertizing that emphasizes the effectiveness and enhanced

safety of the new pads. Potential effective advertising venues include trade magazines and informational

displays at the Amalgamated Pile and Fitting Corporation Piletalk seminars.

También podría gustarte

- Cumberland Metal IndustriesDocumento15 páginasCumberland Metal IndustriesGAURAV KHOUSLAAún no hay calificaciones

- Curled Metal, Inc. - Case Analysis Report: 1. Key Issues/ProblemsDocumento6 páginasCurled Metal, Inc. - Case Analysis Report: 1. Key Issues/ProblemsAkaash HegdeAún no hay calificaciones

- Curled Metal - Case Write Up - 105634845Documento3 páginasCurled Metal - Case Write Up - 105634845btharun2008Aún no hay calificaciones

- Case 4 - Curled MetalDocumento4 páginasCase 4 - Curled MetalSravya DoppaniAún no hay calificaciones

- Curled Metal IncDocumento3 páginasCurled Metal IncNiharika padmanabhanAún no hay calificaciones

- Case Analysis - CumberlandDocumento3 páginasCase Analysis - CumberlandShrijaSriv50% (2)

- CMI CaseDocumento4 páginasCMI CaseSaurabh BoseAún no hay calificaciones

- Curled Metals IncDocumento6 páginasCurled Metals Inc3vickishAún no hay calificaciones

- CMI Vs Conventional Pads: Curled Metal Inc. Group - 15Documento2 páginasCMI Vs Conventional Pads: Curled Metal Inc. Group - 15Malini RajashekaranAún no hay calificaciones

- Curled Metal Inc.-Case Discussion Curled Metal Inc. - Case DiscussionDocumento13 páginasCurled Metal Inc.-Case Discussion Curled Metal Inc. - Case DiscussionSiddhant AhujaAún no hay calificaciones

- Curled Metal IncDocumento7 páginasCurled Metal IncRiya3Aún no hay calificaciones

- Kendrick Test Data: Conventional Pads CMI PadsDocumento15 páginasKendrick Test Data: Conventional Pads CMI Padsbessy yangAún no hay calificaciones

- Curled Metals CaseDocumento7 páginasCurled Metals CaseQuinta Sol100% (1)

- Group4 CMIDocumento5 páginasGroup4 CMIMonika_22Aún no hay calificaciones

- Case Analysis Overview - Cumberland MetalDocumento13 páginasCase Analysis Overview - Cumberland MetalKushagra VarmaAún no hay calificaciones

- Calculate customer willingness to pay for CMI cushion padsDocumento4 páginasCalculate customer willingness to pay for CMI cushion padsShelton NazarethAún no hay calificaciones

- CumberlandDocumento12 páginasCumberlandmadhavjoshi63Aún no hay calificaciones

- CmiDocumento10 páginasCmiSanket GhelaniAún no hay calificaciones

- Marketing Introduction to the Markstrat ChallengeDocumento35 páginasMarketing Introduction to the Markstrat ChallengeMuskaanAún no hay calificaciones

- CMI's Strategic Launch of New Cushion PadsDocumento20 páginasCMI's Strategic Launch of New Cushion PadsNivedita SharmaAún no hay calificaciones

- Classic Knitwear Case (Section-B Group-1)Documento5 páginasClassic Knitwear Case (Section-B Group-1)Swapnil Joardar100% (1)

- Should CSC Offer One Version? Which One at What Price? or Both at What Prices?Documento17 páginasShould CSC Offer One Version? Which One at What Price? or Both at What Prices?SJAún no hay calificaciones

- Curled Metal Inc.: By: Sheetal Gwoala Jisun Hong Jacquiline Njiraine Gabriela Silva Betel SolomonDocumento12 páginasCurled Metal Inc.: By: Sheetal Gwoala Jisun Hong Jacquiline Njiraine Gabriela Silva Betel SolomonRahul GandhiAún no hay calificaciones

- Curled Metal CaseDocumento5 páginasCurled Metal CaseNathan YanskyAún no hay calificaciones

- Curled Metal Inc - Group 10Documento18 páginasCurled Metal Inc - Group 10Richa Pandey75% (8)

- CMI CUSHION PAD PRICINGDocumento13 páginasCMI CUSHION PAD PRICINGParikshit ModyAún no hay calificaciones

- Singapore Metal CaseDocumento5 páginasSingapore Metal Caseshreyabatra100% (1)

- Cambridge Software Corporation: Case AnalysisDocumento11 páginasCambridge Software Corporation: Case AnalysisMilind GuptaAún no hay calificaciones

- Curled Metal PriceDocumento1 páginaCurled Metal PricepmblourencoAún no hay calificaciones

- Cumber Land Metal IndustriesDocumento9 páginasCumber Land Metal IndustriesJoaoCarlosRamosAún no hay calificaciones

- Salesand Distribution Management: Eco7: Launching A New Motor OilDocumento16 páginasSalesand Distribution Management: Eco7: Launching A New Motor OilAbhishek GautamAún no hay calificaciones

- Cumberland Case Study SolutionDocumento2 páginasCumberland Case Study SolutionPranay Singh RaghuvanshiAún no hay calificaciones

- Curled Metal Inc. Engineered Product DivisionDocumento11 páginasCurled Metal Inc. Engineered Product DivisionPaul Campbell100% (2)

- Curled Metal Inc CalculationDocumento3 páginasCurled Metal Inc CalculationOnal Raut50% (2)

- Group 7 Epgp 28sep PDocumento8 páginasGroup 7 Epgp 28sep PPuneet AgarwalAún no hay calificaciones

- Curled Metal Inc. Determines Customers' Willingness to Pay for Innovative Pile PadsDocumento9 páginasCurled Metal Inc. Determines Customers' Willingness to Pay for Innovative Pile PadsGarima SinghAún no hay calificaciones

- Cumberland Case Analysis - DraftDocumento6 páginasCumberland Case Analysis - Draftrichat.21Aún no hay calificaciones

- MKT414 Home Assignment 4 (A.b)Documento9 páginasMKT414 Home Assignment 4 (A.b)Trang Hong TrinhAún no hay calificaciones

- Niche vs Mainstream ImpactDocumento2 páginasNiche vs Mainstream ImpactSalil AggarwalAún no hay calificaciones

- Group3 Spacemaker PlusDocumento3 páginasGroup3 Spacemaker PlusSabyasachi SahuAún no hay calificaciones

- ECO7 WorksheetDocumento9 páginasECO7 WorksheetSaswat Kumar DeyAún no hay calificaciones

- Q1) Based On The Data Provided How Much Do You Think One of These Pads Is Worth To A Customer?Documento5 páginasQ1) Based On The Data Provided How Much Do You Think One of These Pads Is Worth To A Customer?Kushagra VarmaAún no hay calificaciones

- Worksheet 240357970 Case Analysis Soren ChemicalsDocumento8 páginasWorksheet 240357970 Case Analysis Soren Chemicalsmahesh.mohandas3181Aún no hay calificaciones

- Assignment 1Documento10 páginasAssignment 1AkshitaAún no hay calificaciones

- Natureview Case StudyDocumento3 páginasNatureview Case StudySachin KamraAún no hay calificaciones

- Springfield Nor'easters - Group SubmissionDocumento5 páginasSpringfield Nor'easters - Group Submissionsambit halderAún no hay calificaciones

- B2B - Group4 - Signode Industries IncDocumento14 páginasB2B - Group4 - Signode Industries IncTanmay YadavAún no hay calificaciones

- Rohm N Hass Group 2Documento12 páginasRohm N Hass Group 2anupamrc100% (1)

- Hyrule Cinemas optimal pricing and locationDocumento5 páginasHyrule Cinemas optimal pricing and locationAkash VettavallamAún no hay calificaciones

- Natureview FarmDocumento2 páginasNatureview FarmBen Hiran100% (1)

- Assignment 2Documento5 páginasAssignment 2Vishal Gupta100% (1)

- CMI's New Cushion Pad Pricing StrategyDocumento3 páginasCMI's New Cushion Pad Pricing StrategyAlexander Klocke75% (4)

- Sign OdeDocumento8 páginasSign OdeParsva SaikiaAún no hay calificaciones

- Cost-Plus Pricing for Atlantic TRONN Server and PESA BundleDocumento4 páginasCost-Plus Pricing for Atlantic TRONN Server and PESA BundlewiwoapriliaAún no hay calificaciones

- Nestlé Refrigerated Foods Contadina Pasta and Pizza Case Analysis - Adam Madacsi HRYRTQDocumento7 páginasNestlé Refrigerated Foods Contadina Pasta and Pizza Case Analysis - Adam Madacsi HRYRTQmadadam880% (1)

- Mars IncorporatedDocumento11 páginasMars IncorporatedSanthosh Kumar Setty100% (2)

- Eco 4Documento5 páginasEco 4SamidhaSinghAún no hay calificaciones

- Case OverviewDocumento9 páginasCase Overviewmayer_oferAún no hay calificaciones

- 6 32Documento2 páginas6 32Achmad Faizal AzmiAún no hay calificaciones

- Full Report - Freezing Out ProfitsDocumento15 páginasFull Report - Freezing Out ProfitsSurainiEsaAún no hay calificaciones

- The Bass Model - Marketing EngineeringDocumento8 páginasThe Bass Model - Marketing EngineeringNecula Amalia100% (1)

- SamAdams LightbeerDocumento12 páginasSamAdams LightbeerAnonymous fjgmbzT100% (1)

- Office Snapshot Q2 2017: MarketbeatDocumento2 páginasOffice Snapshot Q2 2017: MarketbeatDeepesh MoolchandaniAún no hay calificaciones

- Motiv ReadingDocumento7 páginasMotiv ReadingDeepesh MoolchandaniAún no hay calificaciones

- Postmes, Spears, Cihangir - 2001 - Quality of Decision Making and Group Norms PDFDocumento13 páginasPostmes, Spears, Cihangir - 2001 - Quality of Decision Making and Group Norms PDFDeepesh MoolchandaniAún no hay calificaciones

- Facebook Case - Post SessionDocumento14 páginasFacebook Case - Post SessionDeepesh MoolchandaniAún no hay calificaciones

- Alko Case Study - HaksozDocumento7 páginasAlko Case Study - HaksozDeepesh MoolchandaniAún no hay calificaciones

- A Strategists Guide To The Digital GroceryDocumento8 páginasA Strategists Guide To The Digital GroceryDeepesh MoolchandaniAún no hay calificaciones

- Problem Statement: The Need of Effective Marketing For Evolving ConsumerDocumento3 páginasProblem Statement: The Need of Effective Marketing For Evolving ConsumerDeepesh MoolchandaniAún no hay calificaciones

- Schulz-Hardt Et Al. - 2006 - Group Decision Making in Hidden Profile Situations Dissent As A Facilitator For Decision Quality PDFDocumento14 páginasSchulz-Hardt Et Al. - 2006 - Group Decision Making in Hidden Profile Situations Dissent As A Facilitator For Decision Quality PDFDeepesh MoolchandaniAún no hay calificaciones

- Levine Et Al. - 2005 - Identity and Emergency Intervention How Social Group Membership and Inclusiveness of Group Boundaries Shape HelpiDocumento11 páginasLevine Et Al. - 2005 - Identity and Emergency Intervention How Social Group Membership and Inclusiveness of Group Boundaries Shape HelpiDeepesh MoolchandaniAún no hay calificaciones

- Midland Energy Group A5Documento3 páginasMidland Energy Group A5Deepesh Moolchandani0% (1)

- Imitation of Christ by Thomas A KempisDocumento143 páginasImitation of Christ by Thomas A KempisgreatgeniusAún no hay calificaciones

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Science of Self RealizationDocumento233 páginasThe Science of Self RealizationLakshmi811Aún no hay calificaciones

- Vedic MathsDocumento9 páginasVedic MathsPreeti PatwaAún no hay calificaciones

- Visual Basic - Primer On Creating Macros For VBA - ExcelDocumento13 páginasVisual Basic - Primer On Creating Macros For VBA - ExcelRamis GuadalupeAún no hay calificaciones

- Heckscher-Ohlin Model: Factor Endowments & Comparative AdvantageDocumento7 páginasHeckscher-Ohlin Model: Factor Endowments & Comparative Advantagehellothere999Aún no hay calificaciones

- Fundamental analysis of ACC Ltd and India's cement industryDocumento5 páginasFundamental analysis of ACC Ltd and India's cement industryDevika SuvarnaAún no hay calificaciones

- UNILEVER-Company ProfileDocumento4 páginasUNILEVER-Company ProfileAsad Nizam ButtAún no hay calificaciones

- SITE VISIT REPORTDocumento2 páginasSITE VISIT REPORTTuan KamalAún no hay calificaciones

- Cash Budgeting Notes and QuestionsDocumento39 páginasCash Budgeting Notes and Questions邹尧Aún no hay calificaciones

- Group19 Mercury AthleticDocumento11 páginasGroup19 Mercury AthleticpmcsicAún no hay calificaciones

- 10ec73 Power Electronics Vtu SyllabusDocumento2 páginas10ec73 Power Electronics Vtu SyllabusYaichenbaPebamAún no hay calificaciones

- This Study Resource Was Shared Via: My CoursesDocumento6 páginasThis Study Resource Was Shared Via: My CoursesJOHNSON KORAIAún no hay calificaciones

- The Great Depression: A Primer in Macroeconometrics: Daniel Shestakov January 24, 2013Documento10 páginasThe Great Depression: A Primer in Macroeconometrics: Daniel Shestakov January 24, 2013Daniel ShestakovAún no hay calificaciones

- 16 Kristia WOngso GiamtoDocumento2 páginas16 Kristia WOngso GiamtoBoyke SitompulAún no hay calificaciones

- IMFDocumento28 páginasIMFfujimukazuAún no hay calificaciones

- ArsenalDocumento13 páginasArsenalسليمان بن علي البلوشيAún no hay calificaciones

- GRE Quantitative Section 2: Test Question 3Documento4 páginasGRE Quantitative Section 2: Test Question 3Jia Yuan ChngAún no hay calificaciones

- Report 1Documento2 páginasReport 1Atia MahmoodAún no hay calificaciones

- Measuring The Cost of Living: Test BDocumento7 páginasMeasuring The Cost of Living: Test Bmas_999Aún no hay calificaciones

- Pocket ClothierDocumento30 páginasPocket ClothierBhisma SuryamanggalaAún no hay calificaciones

- Britannia Analysis 2018-19Documento32 páginasBritannia Analysis 2018-19Hilal MohammedAún no hay calificaciones

- Founders Pie Calculator FinalDocumento3 páginasFounders Pie Calculator FinalSayyad Wajed AliAún no hay calificaciones

- Bahan Matrikulasi MMDocumento28 páginasBahan Matrikulasi MMAhmad HidayatAún no hay calificaciones

- How To Be A Freelance Creative - Jonny Elwyn - Free SampleDocumento21 páginasHow To Be A Freelance Creative - Jonny Elwyn - Free SamplesolomojoAún no hay calificaciones

- Responsibilities of a Business Development ManagerDocumento2 páginasResponsibilities of a Business Development ManagerBhagwati ChaudharyAún no hay calificaciones

- Exercise CH3Documento10 páginasExercise CH3loveshareAún no hay calificaciones

- FINS 3635 Short Computer Assignment-2017-2Documento1 páginaFINS 3635 Short Computer Assignment-2017-2joannamanngoAún no hay calificaciones

- The Price Revolution in The 16th Century: Empirical Results From A Structural Vectorautoregression ModelDocumento17 páginasThe Price Revolution in The 16th Century: Empirical Results From A Structural Vectorautoregression Modelbabstar999Aún no hay calificaciones

- Maharashtra Public Holidays 2015Documento10 páginasMaharashtra Public Holidays 2015My NameAún no hay calificaciones

- Kakatiya University Mba 4th Sem Viva Voce April 2015 Exam Time Table 26032015Documento2 páginasKakatiya University Mba 4th Sem Viva Voce April 2015 Exam Time Table 26032015SonuKhaderAún no hay calificaciones

- Chapter 1 Concepts of BusinessDocumento28 páginasChapter 1 Concepts of Businessopenid_XocxHDCP100% (2)

- VPP 3170 Prac02 Sem I 2015-2016Documento14 páginasVPP 3170 Prac02 Sem I 2015-2016David AntonitoAún no hay calificaciones

- ASE3017 Revised Syllabus - Specimen Paper Answers 2008Documento7 páginasASE3017 Revised Syllabus - Specimen Paper Answers 2008luckystar2013Aún no hay calificaciones

- Case Study 2Documento15 páginasCase Study 2Arush BhatnagarAún no hay calificaciones