Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Indian Derivatives Market - A Perspective

Cargado por

RishabhMundhadaDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Indian Derivatives Market - A Perspective

Cargado por

RishabhMundhadaCopyright:

Formatos disponibles

C O V E R STORY

Indian Derivatives Market:

A Perspective

Ravi Madapati

Introduced with a view to refashion the capital

markets to attract foreign investment, the trading

volumes in the derivatives segment have shown dismal

results when compared to its compatriot, the cash

markets. Some of the reasons for the lack of depth in

these markets happen to be poor understanding and

awareness among the investors about these

instruments and lack of clarity on the accounting and

taxation related issues. What are the other reasons

for decline in volumes in these markets? Is there a

need for developing a clear-cut action plan to ensure

vibrancy in these markets?

T

he introduction of index futures Both hedgers and speculators are was mixed; There were a few,

trading on NSE at the beginning required for efficient markets. doubting the future for derivatives in

of 2000 was described as Equity derivatives could begin with India. But many predicted a great boom

Indias derivatives explosion. Much index futures. in derivatives trading and involvement

of that hoopla has died now. Contrary Derivatives market must be with them. All that excitement died

to their initial promise, derivatives developed in phased manner. out prematurely as the trading volumes

never really picked up in the country. Index options and options on in derivatives are not as vibrant as

What went wrong? shares will be introduced at a later thought to be expected earlier.

Derivative instruments hedge risk stage.

Regulatory emphasis will be at the Current Scenario

in transactions and bring depth and

vibrancy to the capital markets. There exchange-level. The NSE and the BSE are the two

are numerous variants of derivatives Derivatives market will have exchanges on which financial

currently traded in the world. Table 1 stricter governance by SEBI derivatives are traded. The combined

gives a brief profile of the global compared to cash segment. notional value of the daily volumes

derivatives industry. The entry into the derivatives on both the bourses stand at around

markets will be stringent. Rs. 400 cr. In developed markets

Background Note Mutual funds should be allowed trading volume in the derivatives

The L C Gupta Committee was to hedge their positions using segment are thrice as large as in the

appointed in November 1996 to derivatives. cash market. In India, the figure is

develop the appropriate regulatory Derivatives should be declared as hardly 20% of cash market. Quite

framework for derivatives trading. The securities. clearly our derivatives markets have a

committees main focus was on The committee has also suggested long way to go.

financial derivatives and in particular, that the notification in June 1969 According to the Executive

equity derivatives. In March 1998, the under Section 16 of SCRA banning Director of Association of NSE

committee submitted its report, which forward trading be revoked in March Members of India (Anmi), Vinod Jain1,

was approved by SEBI in May and 2000. Derivatives trading in India Volumes in derivatives segment are

circulated in June 1998. The important finally got under way in 2000. The stagnating due to lack of growth in the

findings of the report were: response from the investor community number of market participants.

1

As quoted in The Financial Express March 13, 2002.

ICFAI Press. All Rights Reserved.

Treasury Management February 2003 32

options also declined from Rs. 463 cr

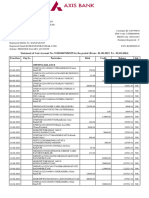

Table 1: The Global Derivatives Industry: Outstanding Contracts

in May to Rs. 389 cr in June.

(in $ billion)

1995 1996 1997 1998 1999 2000 Derivatives on BSE

Exchange traded instruments 9283 10018 12403 13932 13522 14302 Things are so bad that BSE is now

looking at the option of terminating its

Interest rate futures and options 8618 9257 11221 12643 11669 12626 derivatives trading. In the past two

Currency futures and options 154 171 161 81 59 96 years, the BSE has invested over

Stock Index futures and options 511 591 1021 1208 1793 1580 Rs. 10 cr in derivatives business. In

addition, it has also incurred annual

Some OTC instruments 17713 25453 29035 80317 88201 95199

expenses of around Rs. 2-3 cr. With

Interest rate swaps and options 16515 23894 27211 44259 53316 58244 the NSE capturing the bulk of the

Currency swaps and options 1197 1560 1824 5948 4751 5532 volumes in the derivatives segment,

the BSE has been left with virtually no

Other instruments - - - 30110 30134 31423

business. Consequently, the

Total 26996 35471 41438 94249 101723 109501 exchange is finding it difficult to sustain

Source: Bank for International Settlements itself and hence is looking at the option

of withdrawing from the derivatives

Besides, these products are still to These highly speculative stock segment and leveraging its advantages

catch up with the masses who are futures instruments accounted for in the cash segment.

keeping away from this segment due about 69% of the total turnover. This According to a senior BSE official3,

to lack of understanding of the may lead to price manipulations. things have come to this state of affairs

products and high contract price. Meanwhile, option contracts are owing to the inability of SEBI to permit

Other reasons for the lack of depth in witnessing a decline in trading interest. the exchange to expand its operations

derivatives markets have also been The turnover in individual stock to other cities for almost four years.

identified. options plunged to Rs. 4,642 cr in Meanwhile, rival NSE has been

Problems regarding infrastructure June compared with Rs. 5,133 cr in permitted to increase its reach. More

No clarity on the taxation and May. Similarly, the turnover in index than 60% of NSEs derivatives

accounting front.

Minimum contract size of Rs. 2 Table 2: The Derivatives Lexicon

lakhs, which is beyond the means Derivatives is a common name given to a class of instruments whose value is

of a typical investor. derived from another asset called the underlying asset. The three most popular

Bearing trends in the stock classes of derivative instruments are options, futures and swaps.

markets. Forwards: A forward contract is a customized contract between two entities,

Faulty regulatory framework, for where settlement takes place on a specific date in the future at todays

example, FIs are allowed to invest pre-agreed price.

only in index futures and no other Futures: A futures contract is an agreement between two parties to buy or

derivatives. There are stringent sell an asset at a certain time in the future at a certain price. Futures contracts

disclosure requirements for MFs are standardized exchange-traded contracts unlike forwards, which are

if they want to invest in customized OTC instruments. Index futures are the future contracts for

derivatives. which underlying is the cash market index.

Like our stock markets, the Indian Options: These instruments give the buyer the right but not the obligation to

derivatives markets are also becoming buy or sell an asset. Options are of two typescalls and puts. Calls give the

heavily dependent on a few buyer the right but not the obligation to buy a given quantity of the underlying

instruments. For instance, futures in asset, at a given price on or before a given future date. Puts give the buyer the

three blue-chip companies such as right, but not the obligation to sell a given quantity of the underlying asset at

Satyam Computers, Reliance a given price on or before a given date.

Industries and Infosys Technologies, Derivatives markets are made up of the following players:

have accounted for as much as 42% Hedgers: These are operators, who want to transfer a risk component of

of the total turnover in the derivatives their portfolio and thus, hedge it with the buying or selling of other instruments.

segment of the National Stock

Speculators: These are operators, who intentionally take the risk from

Exchange in June, 2002. Stock futures

hedgers in pursuit of profit.

of Satyam Computers, Infosys

Technologies and HPCL accounted Arbitrageurs: These are operators who operate in different markets

for 37% of the total turnover in May simultaneously, in pursuit of profit and eliminate mis-pricing in securities

2002, 35% in April 2002 and 34% in across different markets.

March 20022.

2

Source: The Financial Express, August 05, 2002.

3

Source: The Business Standard, December 13, 2002.

RISK INDIAN DERIVATIVES MARKET: A PERSPECTIVE

Table 3: Business Growth of Futures and Options Market: NSE Turnover in equity options on most stocks

(Rs. cr) for even the next month is non-

existent.

Month Index Stock Index Stock

Total Daily op tion price variations

Futures Futures options options

suggest that traders use derivatives

June-00 35 - - - 35 as a less risky alternative (read

July-00 108 - - - 108 substitute) to generate profits

August-00 90 - - - 90 from the stock price movements.

The fact that the option

September-00 119 - - - 119

premiums tail intra-day stock

October-00 153 - - - 153

prices is an evidence to this.

November-00 247 - - - 247 Calls on Satyam fall, while puts

December-00 237 - - - 237 rise when Satyam falls intra-day.

January-01 471 - - - 471 If calls and puts are not looked as

February-01 524 - - - 524 just substitutes for spot trading,

the intra-day stock price variations

March-01 381 - - - 381

should not have a one-to-one

April-01 292 - - - 292 impact on the option premiums.

May-01 230 - - - 230

Commodity Derivatives4

June-01 590 - 196 - 785

Trading in futures contracts in pepper,

July-01 1309 - 326 396 2031

turmeric, gur (jaggery), hessian (jute

August-01 1305 - 284 1107 2696 fabric), jute sacking, castor seed, potato,

September-01 2857 - 559 2012 5281 coffee, cotton, and soyabean and its

October-01 2485 - 559 2433 5477 derivatives is done in 18 commodity

November-01 2484 2811 455 3010 8760 exchanges located in various parts of

the country. Futures trading in other

December-01 2339 7515 405 2660 12919

edible oils, oilseeds and oil-cakes have

January-02 2660 13261 338 5089 21348 also started. The sugar industry is

February-02 2747 13939 430 4499 21616 exploring the merits of introducing

March-02 2185 13989 360 3957 20490 futures contracts. Meanwhile,

Government of India has constituted

2001-02 21482 51516 3766 25163 101925

a committee to evaluate issues

Source: National Stock Exchange relevant to the establishment of the

business comes from outside index. Typically, options are proposed national commodity

Mumbai. considered more valuable when exchange for the nationwide trading

the volatility of the underlying asset of commodity futures contracts. The

Derivatives on NSE (in this case, the index) is high. A Government is also studying issues

The following are some of the major related issue is that, brokers do not relating to warehousing and clearing

trends in derivatives trading on NSE: earn high commissions by houses.

Single-stock futures continue to recommending index options to

account for a sizable proportion Concluding Remarks

their clients.

of the trading. These instruments Put volumes in the index options Derivatives have been in use for many

constituted 70% of the total and equity options segment have decades in sophisticated markets such

turnover during June 2002. increased since January 2002. as the US. When compared to the

Traders seem to be more The ratio call-put volumes in millions of investors there and the

comfortable with single-stock index options have decreased number of institutional investors,

futures than equity options, as the from 2.86 in January, 2002 to India is far behind. Some of the

former closely resembles the 1.32 in June. The fall in call-put reasons for the poor performance of

erstwhile badla system. volumes ratio suggests that the derivatives in India have been

On relative terms, volumes in the traders are increasingly becoming discussed in this article.

index options segment continue pessimistic in the market. A few important steps that will

to remain poor. This may be due Farther, month futures contracts help the growth of derivatives markets

to the low volatility of the spot are still not actively traded. Trading in India are summarized below5.

4

This section draws from the study Financial Derivatives Market and its Development in India by Anuj Thakur, Rahul Karkun, Sameer Kalra, IIM, Calcutta which can be

found at www.iimcal.ac.in/community/FinClub/art16-idm.pdf.

5

This section draws from the interview with Vinnet Bhatnagar, MD, Refco India Pvt. Ltd., appeared in The Financial Express, March 24, 2002.

34 Treasury Management February 2003

INDIAN DERIVATIVES MARKET: A PERSPECTIVE C O V E R STORY

Participation of Mutual Funds Reduce in the minimum contract Government. More clarity is required

in Derivativ es: The biggest size from Rs. 200,000 to say, in the areas of accounting and taxation

stumbling block for this is the Rs. 100,000. of derivatives. SEBI should promote

definition of the term portfolio Introduce options and futures on the use of derivatives and educate the

balancing. To encourage sector indices like the BSE IT investors on how derivatives can

participation by financial index, BSE Pharma index, etc. reduce risk if used wisely. New trading

institutions in derivatives, SEBI Introduce options on futures. exchanges for derivative instruments

must clearly specify what the term Derivatives bring vibrancy to the should be promoted. Proper

portfolio hedging and rebalancing capital markets. They help investors infrastructure for clearing and

means. Currently, the term is settlement is needed. Marked to market

across industry to hedge their risk.

defined vaguely and this is mechanisms need sophisticated IT

They eliminate mis-pricing in

impeding the investors from platforms. A committed action plan is

transactions. Indian investors can

badly necessary to ensure the

investing in derivatives. benefit tremendously from a much

long-term vibrancy of derivatives

Increase the limits on trading of vibrant derivatives market. Hence,

markets in India.

derivatives by foreign institutional derivatives markets should be

investors. nurtured and supported. Ravi Madapati is Faculty at ICFAI

Increase the number of stocks on Infrastructural issues in derivatives Knowledge Center. His area of interest

which options and futures are should be addressed immediately by is Financial Economics and he can be

traded. the regulatory bodies and the reached at ravi_m@icfai.org.

Reference # 5-03-02-03

Treasury Management February 2003 35

También podría gustarte

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- 4100 Indian Stock DetailsDocumento1236 páginas4100 Indian Stock DetailspanchalglAún no hay calificaciones

- Finolex Cables LTDDocumento6 páginasFinolex Cables LTDAditiAún no hay calificaciones

- FYBBA - Maths Project - Yash KhairnarDocumento31 páginasFYBBA - Maths Project - Yash KhairnarYash KhairnarAún no hay calificaciones

- Daily trigger countsDocumento35 páginasDaily trigger countsshivaji patilAún no hay calificaciones

- Total BCs-1Documento360 páginasTotal BCs-1naina saxenaAún no hay calificaciones

- iON Digital Exams: Conduct An Efficient Exam ProcessDocumento4 páginasiON Digital Exams: Conduct An Efficient Exam ProcessSandesh GajmalAún no hay calificaciones

- Comparative Study of Capital MarketDocumento80 páginasComparative Study of Capital MarketHassan Ali KhanAún no hay calificaciones

- Transaction Statement Account: 0358104000134996 From: 26/09/2020 To: 10/03/2023Documento14 páginasTransaction Statement Account: 0358104000134996 From: 26/09/2020 To: 10/03/2023vijay bauriAún no hay calificaciones

- Investment Analysis and Portfolio ManagementDocumento7 páginasInvestment Analysis and Portfolio ManagementrossAún no hay calificaciones

- Mahindara Katak BankDocumento40 páginasMahindara Katak BankKunal JagadAún no hay calificaciones

- Full Projecte EditedDocumento131 páginasFull Projecte Editedshabin_aliAún no hay calificaciones

- CMDM Module For NCFM ExamsDocumento261 páginasCMDM Module For NCFM ExamsmhussainAún no hay calificaciones

- Angel Broking Draft Red Herring ProspectusDocumento470 páginasAngel Broking Draft Red Herring ProspectusSangram JagtapAún no hay calificaciones

- Get AmiBroker for Trading AnalysisDocumento4 páginasGet AmiBroker for Trading Analysisnatarajan_arulAún no hay calificaciones

- NSE GUIDANCE ON INSPECTING SUB-BROKER RECORDSDocumento4 páginasNSE GUIDANCE ON INSPECTING SUB-BROKER RECORDSHARISH GROVERAún no hay calificaciones

- Analysis of Indian Stock Market and Comparision of Stock BroakersDocumento56 páginasAnalysis of Indian Stock Market and Comparision of Stock BroakersmadhuAún no hay calificaciones

- Nitesh Pandurang Pangle: GOTS / Approved ZDHC Gateway / RegisteredDocumento325 páginasNitesh Pandurang Pangle: GOTS / Approved ZDHC Gateway / RegisteredContra Value BetsAún no hay calificaciones

- Comparing Derivatives Markets in India and USADocumento52 páginasComparing Derivatives Markets in India and USANikhilChainani100% (1)

- DFPCL CompanyPresentation 141113Documento36 páginasDFPCL CompanyPresentation 141113pkm_77Aún no hay calificaciones

- Ankit Dua 1073900342Documento74 páginasAnkit Dua 1073900342Ankit DuaAún no hay calificaciones

- Statement of Axis Account No:911010047456925 For The Period (From: 01-08-2023 To: 02-02-2024)Documento12 páginasStatement of Axis Account No:911010047456925 For The Period (From: 01-08-2023 To: 02-02-2024)shekhar17042012Aún no hay calificaciones

- Internship Weekly Report 1Documento2 páginasInternship Weekly Report 1Chinmay TatiwalaAún no hay calificaciones

- 1 Apparel & TextileDocumento1 página1 Apparel & TextileAakashAún no hay calificaciones

- NCMP certification levels for NCFM modulesDocumento4 páginasNCMP certification levels for NCFM modulesRonak Mathur100% (1)

- External Income Outsourcing (1) - 1Documento100 páginasExternal Income Outsourcing (1) - 1kunal.gaud121103Aún no hay calificaciones

- A Project ReportDocumento67 páginasA Project ReportShyam KendreAún no hay calificaciones

- Factsheet Nifty Alpha50Documento2 páginasFactsheet Nifty Alpha50SUMITAún no hay calificaciones

- Stock Market in IndiaDocumento9 páginasStock Market in IndiaAnimesh SalhotraAún no hay calificaciones

- Bharat Bijlee India Daily Stock PerformanceDocumento26 páginasBharat Bijlee India Daily Stock PerformancePravesh RaoAún no hay calificaciones

- Market Trend AnalysisDocumento5 páginasMarket Trend AnalysisHrishika NetamAún no hay calificaciones