Documentos de Académico

Documentos de Profesional

Documentos de Cultura

LPS Mortgage Monitor May 2010 Final

Cargado por

Foreclosure FraudDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

LPS Mortgage Monitor May 2010 Final

Cargado por

Foreclosure FraudCopyright:

Formatos disponibles

LPS Mortgage Monitor

June 2010 Mortgage Performance Observations

Data as of May, 2010 Month-end

June 2010 Mortgage Performance Package

Data as of May 31, 2010

Data released June 15, 2010

Outline / Agenda

• Delinquency and Foreclosure: Inventory figures for May 2010 including longer-term trend analysis.

• Geographic Analysis: Inventories and trends at the state level.

• Newly delinquent loans and delinquency migrations (roll rates) – focus on first time delinquent

borrowers with historical trends and static pool performance.

• Cure rates and performance post-cure.

• Modification and other loss mitigation activity – volumes and recidivism rates

• Foreclosure trends: Covering foreclosure starts and foreclosure sales, volumes and percentages.

• Origination analysis – Attributes / performance with FHA and Jumbo focus

Lender Processing Services 2

Total Delinquencies increased from April to May

Total Delinquencies (excluding Foreclosures) = 9.20%

Month over Month Increase of 2.3%, Year over Year Increase of 7.9%

Lender Processing Services 3

Foreclosure inventories remained stable in May

May Foreclosure Rate = 3.18%

Year over Year Increase of 13.5%

Lender Processing Services 4

Delinquent and Foreclosure inventories continue to stabilize but have yet to show

annual declines

Lender Processing Services 5

Stabilization in delinquencies and foreclosures is at extremely high historical rates

Lender Processing Services 6

90 Day Default % increased slightly from March/April level level of 0.49% to 0.50%

Lender Processing Services 7

LPS Servicing Database 1st liens – Non-Performing Loan Counts

Extrapolated Assuming Market Share = 70% Servicing and 40% REO

Early stage delinquencies are back on the rise

Lender Processing Services 8

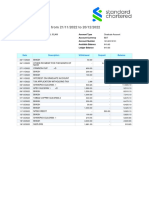

Delinquency and Foreclosure Rate Table

Ranked based on Non-Current %

Lender Processing Services 9

Total Non-Current (including Delinquencies and Foreclosures) by State

National Average = 12.38%

Lender Processing Services 10

Change in Total Non-Current by State in the last 6 months: Decline of 6.49% nationally

Alaska is the only state that experienced an increase (2.5%) – 27 states are performing

worse than national.

Lender Processing Services 11

Volume of loans rolling into early stage delinquency has increased with “New 30s”

reverting back to 2009 levels

New REOs declined from all time highs

Loan counts are not extrapolated

Lender Processing Services 12

Approximately 583k loans were current at the beginning of January and are at least 60

days delinquent or in foreclosure as of May month end

(Prior years are: 873k in 2009, 543k in 2008, 235k in 2007 and 136k in 2006)

Extrapolated to the US market using 70% coverage ratio.

Lender Processing Services 13

New problem loans are still elevated in Nevada, Arizona, Florida and California

Lender Processing Services 14

First-time 60 day delinquencies have declined significantly from 2009 levels

Lender Processing Services 15

Far more loans are still in late stage delinquency or foreclosure 12 months after a first-

time 60 day default

Lender Processing Services 16

Overall volume of loans curing to current declined to a 6 month low

Loan counts are not extrapolated

Lender Processing Services 17

Cure rates from all stages of delinquency declined, with the exception of 6+ month

delinquent cures which are dominated by HAMP conversions

Loan counts are not extrapolated

Lender Processing Services 18

A higher percentage of loans that cured in February and March remained current vs.

prior month cures

Lender Processing Services 19

Deterioration rates continue to increase after the sharp decline in March while

improvement rates dropped back to the range experienced over the last 5 years

4.1% of loans deteriorated in status vs. 1.7% that improved

Lender Processing Services 20

After a 2 month drop in February and March, deterioration ratios rapidly reverted back

to 2008 to 2009 levels

Approximately 2.5 Loans deteriorated for every 1 Improved

Lender Processing Services 21

OCC and OTS Mortgage Metrics Report shows modification activity back on the rise as

HAMP Trial Period Plans are converted to permanent modifications

Data from Q1 2010 OCC and OTS Mortgage Metrics Report

http://www.occ.treas.gov/ftp/release/2010-69a.pdf

Lender Processing Services 22

90+ Delinquency Rate by Modification Quarter: The performance of modifications is

steadily improving

Data from Q1 2010 OCC and OTS Mortgage Metrics Report

http://www.occ.treas.gov/ftp/release/2010-69a.pdf

Lender Processing Services 23

Short-sale activity is on the rise but Deeds in Lieu remain limited

Data from Q1 2010 OCC and OTS Mortgage Metrics Report

http://www.occ.treas.gov/ftp/release/2010-69a.pdf

Lender Processing Services 24

Foreclosure starts increased slightly in May.

Total foreclosure starts for 2010 are at 767k (vs. 851k for the same period in 2009 and

596k in 2008)

Loan counts are not extrapolated

*As servicers continue to identify ways to assist borrowers there may be instances where the

process impacts the month to month figures.

Lender Processing Services 25

Foreclosure Starts – Nevada and Florida are still the hot spots

Lender Processing Services 26

Foreclosure sale rate (as a percent of total loans) = 0.21%

Lender Processing Services 27

Production by Origination Month – January 2007 to December 2009 by Product

FHA is 28.4% of origination for 2009 vs. 24.0% for 2008 and 5.7% in 2007

Loan counts are not extrapolated

Lender Processing Services 28

The percentage of originations relative to active loans has declined drastically in

Florida and Michigan

Lender Processing Services 29

May 2010 Month-end data: Conclusions

• Delinquencies and Foreclosures remain stable, but elevated vs. historical levels.

• Early stage delinquencies are on the rise again as the seasonal improvement period has expired.

• First time 60 day delinquencies have declined from the extreme levels of 2009 with higher percentages

remaining in serious delinquent status after 12 months.

• Cure rates (most notably, early stage cures) have dropped back down to the levels experienced over

the prior 2 years, though higher percentages are remaining current in the immediate term post-cure.

• OCC and OTS Mortgage Metrics Report shows that modification activity remains high with

performance improving by vintage of modification.

• Foreclosure starts increased slightly in May with the total for the year still significantly higher than

experienced in 2008.

• Foreclosure sales declined from historic highs, but as with all other delinquency statistics, still remain

elevated.

• Originations increased slightly in May but still remain very low – viewed as a percentage of total active

loans, regional differences are becoming apparent.

Lender Processing Services 30

También podría gustarte

- Class Action V Invitation HomesDocumento17 páginasClass Action V Invitation HomesForeclosure Fraud100% (4)

- 2011 11 22 China BridgewaterDocumento12 páginas2011 11 22 China Bridgewaternicholas.khuu492100% (3)

- Business Bank Statement Lloyds Bank Bank - 231213 - 200928Documento2 páginasBusiness Bank Statement Lloyds Bank Bank - 231213 - 200928snelu1178100% (1)

- Ocwen ComplaintDocumento39 páginasOcwen ComplaintForeclosure Fraud100% (3)

- Complaint CD Cal La Eviction MoratoriumDocumento27 páginasComplaint CD Cal La Eviction MoratoriumForeclosure Fraud100% (1)

- Not For Publication Without The Approval of The Appellate DivisionDocumento9 páginasNot For Publication Without The Approval of The Appellate DivisionForeclosure FraudAún no hay calificaciones

- Out Reach: The High Cost of HousingDocumento284 páginasOut Reach: The High Cost of HousingForeclosure Fraud100% (1)

- Fhfa Hud Mou - 8122021Documento13 páginasFhfa Hud Mou - 8122021Foreclosure FraudAún no hay calificaciones

- Bills 115s2155enrDocumento73 páginasBills 115s2155enrForeclosure FraudAún no hay calificaciones

- Mortgage Banking and Residential Real Estate FinanceDe EverandMortgage Banking and Residential Real Estate FinanceAún no hay calificaciones

- Honda Accord 2003 2008 Workshop ManualDocumento22 páginasHonda Accord 2003 2008 Workshop Manualnaluhywe100% (15)

- Response in OppositionDocumento36 páginasResponse in OppositionForeclosure FraudAún no hay calificaciones

- Robo Witness DestroyedDocumento8 páginasRobo Witness DestroyedForeclosure Fraud100% (4)

- D C O A O T S O F: Merlande Richard and Elie RichardDocumento5 páginasD C O A O T S O F: Merlande Richard and Elie RichardDinSFLAAún no hay calificaciones

- Best Foot Forward Contest: Competitor Analysis in The Mortgage Servicer Market - Trends For Last 5 YearsDocumento9 páginasBest Foot Forward Contest: Competitor Analysis in The Mortgage Servicer Market - Trends For Last 5 YearsAmanBhatnagarAún no hay calificaciones

- MSJ MotionDocumento66 páginasMSJ MotionDinSFLAAún no hay calificaciones

- 201503 - Hsbc-中国债券市场手册Documento55 páginas201503 - Hsbc-中国债券市场手册Jaa Nat CheungAún no hay calificaciones

- Jones Electrical DistributionDocumento5 páginasJones Electrical DistributionAsif AliAún no hay calificaciones

- Foreclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Documento50 páginasForeclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Foreclosure FraudAún no hay calificaciones

- Securitizing SuburbiaDocumento105 páginasSecuritizing SuburbiaForeclosure FraudAún no hay calificaciones

- Payment Receipt 0015491365 PDFDocumento1 páginaPayment Receipt 0015491365 PDFNilay GandhiAún no hay calificaciones

- 2006891000138441-Sep-2022 3Documento5 páginas2006891000138441-Sep-2022 3Nooraesnirah Juleman100% (1)

- LPS Mortgage Monitor February 2011Documento42 páginasLPS Mortgage Monitor February 2011Foreclosure FraudAún no hay calificaciones

- LPS Lender Processing Services Mortgage Monitoring Report Feb 2010Documento41 páginasLPS Lender Processing Services Mortgage Monitoring Report Feb 2010Foreclosure FraudAún no hay calificaciones

- Mortgage Release QTR 1Documento42 páginasMortgage Release QTR 1jbulogAún no hay calificaciones

- Failing Foreclosure Prevention EffortsDocumento27 páginasFailing Foreclosure Prevention EffortsthecynicaleconomistAún no hay calificaciones

- 2017 Trends FinanceDocumento54 páginas2017 Trends FinanceGreater Baton Rouge Association of REALTORS® Commercial Investment DivisionAún no hay calificaciones

- Atlanta Fed Weekly Highlights 1-20-2010Documento8 páginasAtlanta Fed Weekly Highlights 1-20-2010Naufal SanaullahAún no hay calificaciones

- US Banks Break Revenue Records in Q2'22Documento4 páginasUS Banks Break Revenue Records in Q2'22Fatima NoorAún no hay calificaciones

- FHFA Q1 2012 Foreclosure Prevention ReportDocumento48 páginasFHFA Q1 2012 Foreclosure Prevention ReportMartin AndelmanAún no hay calificaciones

- 2010 February HFCDocumento13 páginas2010 February HFCAmol MahajanAún no hay calificaciones

- Municipal Bond Market Commentary PDFDocumento9 páginasMunicipal Bond Market Commentary PDFAnonymous Ht0MIJAún no hay calificaciones

- Household Debt and Credit: Quarterly Report OnDocumento33 páginasHousehold Debt and Credit: Quarterly Report OnTBP_Think_TankAún no hay calificaciones

- Household Debt and Credit: Quarterly Report OnDocumento30 páginasHousehold Debt and Credit: Quarterly Report OnDinSFLAAún no hay calificaciones

- Household Debt and Credit: Quarterly Report OnDocumento31 páginasHousehold Debt and Credit: Quarterly Report OnZerohedgeAún no hay calificaciones

- Consumer Default, Credit Reporting, and Borrowing ConstraintsDocumento38 páginasConsumer Default, Credit Reporting, and Borrowing ConstraintsNazmul H. PalashAún no hay calificaciones

- Final Main Pages ProjectDocumento103 páginasFinal Main Pages ProjectJeswin Joseph GeorgeAún no hay calificaciones

- 3Q11 JPM Epr FinalDocumento16 páginas3Q11 JPM Epr FinalpowerpanAún no hay calificaciones

- Credit Opinion:: North Bay, City ofDocumento8 páginasCredit Opinion:: North Bay, City ofNorthbaynuggetAún no hay calificaciones

- Report Servicers ModifyDocumento60 páginasReport Servicers ModifyTammy SallamAún no hay calificaciones

- Hmda2015 - 6 20 16Documento68 páginasHmda2015 - 6 20 16ScovilleAún no hay calificaciones

- Congressional Research Service Capstone Research ReportDocumento31 páginasCongressional Research Service Capstone Research ReportFrank AnthonyAún no hay calificaciones

- Moody's Upgrades San Diego County (CA) Issuer Rating To Aaa: New IssueDocumento7 páginasMoody's Upgrades San Diego County (CA) Issuer Rating To Aaa: New Issuesteve_schmidt1053Aún no hay calificaciones

- Soumik Sen 12PGDM055 Section ADocumento15 páginasSoumik Sen 12PGDM055 Section ASoumik SenAún no hay calificaciones

- Day 1 S1 ButeauDocumento16 páginasDay 1 S1 ButeauDetteDeCastroAún no hay calificaciones

- Report Highlights Nearly 1.3 Million Homeowner Assistance Actions Taken Through Making Home AffordableDocumento18 páginasReport Highlights Nearly 1.3 Million Homeowner Assistance Actions Taken Through Making Home AffordableForeclosure FraudAún no hay calificaciones

- Statement of Edward J. Demarco Acting Director Federal Housing Finance AgencyDocumento30 páginasStatement of Edward J. Demarco Acting Director Federal Housing Finance Agency83jjmackAún no hay calificaciones

- Home Mortgage Disclosure Act: JUNE 30, 2017Documento68 páginasHome Mortgage Disclosure Act: JUNE 30, 2017ScovilleAún no hay calificaciones

- Mortgage Process As A ServiceDocumento21 páginasMortgage Process As A ServiceCognizantAún no hay calificaciones

- 2019 07 14 09 20 44 AmDocumento21 páginas2019 07 14 09 20 44 AmmeronAún no hay calificaciones

- U.K. Mortgage Borrowers' Rising Remortgage Incentive Could Increase RMBS Payment RatesDocumento8 páginasU.K. Mortgage Borrowers' Rising Remortgage Incentive Could Increase RMBS Payment Ratesapi-228714775Aún no hay calificaciones

- Banking Sector Roundup Q1fy24 BCGDocumento52 páginasBanking Sector Roundup Q1fy24 BCGSumiran BansalAún no hay calificaciones

- Hamilton (County Of) OH: Aa3 Rating Applies To $124.7 Million of Go Debt, Including Current OfferingDocumento5 páginasHamilton (County Of) OH: Aa3 Rating Applies To $124.7 Million of Go Debt, Including Current OfferingdeanAún no hay calificaciones

- Loan Delinquency in Banking Systems - How Effective Are Credit Reporting Systems - Ghosh2018Documento17 páginasLoan Delinquency in Banking Systems - How Effective Are Credit Reporting Systems - Ghosh2018Suresh GautamAún no hay calificaciones

- Plutus Ias Current Affairs Eng Med 25 Sep 2023Documento7 páginasPlutus Ias Current Affairs Eng Med 25 Sep 2023VikasAún no hay calificaciones

- Servicing Overview and Recent Regulatory Developments: Krista Cooley K&L Gates LLP 202-778-9257Documento25 páginasServicing Overview and Recent Regulatory Developments: Krista Cooley K&L Gates LLP 202-778-9257Cairo AnubissAún no hay calificaciones

- Finamn 1Documento11 páginasFinamn 1michean mabaoAún no hay calificaciones

- Omkar RaneDocumento10 páginasOmkar Ranemfin.omkarrane243Aún no hay calificaciones

- Mortgaging The FutureDocumento13 páginasMortgaging The FutureGrant BosseAún no hay calificaciones

- Credit Bureau Activity 2019 ReportDocumento30 páginasCredit Bureau Activity 2019 ReportFuaad DodooAún no hay calificaciones

- Daily News Simplified - DNS: SL. NO. Topics The Hindu Page NoDocumento11 páginasDaily News Simplified - DNS: SL. NO. Topics The Hindu Page NoVinayak ChaturvediAún no hay calificaciones

- Jpmorgan Chase & Co. 270 Park Avenue, New York, Ny 10017-2070 Nyse Symbol: JPMDocumento17 páginasJpmorgan Chase & Co. 270 Park Avenue, New York, Ny 10017-2070 Nyse Symbol: JPMwompyfratAún no hay calificaciones

- ModelingDocumento25 páginasModelingSemaus LuiAún no hay calificaciones

- HMDA 2017 Report 08 31 18Documento83 páginasHMDA 2017 Report 08 31 18ScovilleAún no hay calificaciones

- Enforcement and Litigation Update: MBA Regulatory Compliance Conference Washington, D.CDocumento10 páginasEnforcement and Litigation Update: MBA Regulatory Compliance Conference Washington, D.CCairo AnubissAún no hay calificaciones

- Statistical Analysis On The Loan Repayment Efficiency and Its Impact On The BorrowersDocumento22 páginasStatistical Analysis On The Loan Repayment Efficiency and Its Impact On The BorrowersChan AyeAún no hay calificaciones

- Municipal Bond Market CommentaryDocumento8 páginasMunicipal Bond Market CommentaryAnonymous Ht0MIJAún no hay calificaciones

- Vol 1 Iss 3 Paradise Infocreative Project Developing CenterDocumento21 páginasVol 1 Iss 3 Paradise Infocreative Project Developing CenterParadise InfocreativeAún no hay calificaciones

- Trust Fund Solvency UpdateDocumento4 páginasTrust Fund Solvency UpdateNathan MartinAún no hay calificaciones

- FHA Mortgage Insurance Premium Flash SurveyDocumento7 páginasFHA Mortgage Insurance Premium Flash SurveyNational Association of REALTORS®Aún no hay calificaciones

- From Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsDe EverandFrom Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsAún no hay calificaciones

- The Ultimate Guide to Repairing Your Credit QuicklyDe EverandThe Ultimate Guide to Repairing Your Credit QuicklyAún no hay calificaciones

- Think Successfully: The Ultimate Credit Repair GuideDe EverandThink Successfully: The Ultimate Credit Repair GuideAún no hay calificaciones

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesDe EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesAún no hay calificaciones

- Navigating the Mortgage Modification Mess ¡V a Cautionary Tale: A Cautionary TaleDe EverandNavigating the Mortgage Modification Mess ¡V a Cautionary Tale: A Cautionary TaleAún no hay calificaciones

- SCOTUS Docket No. 21A23Documento16 páginasSCOTUS Docket No. 21A23Chris GeidnerAún no hay calificaciones

- Sixth Circuit Rent MoratoriumDocumento13 páginasSixth Circuit Rent Moratoriumstreiff at redstateAún no hay calificaciones

- Alabama Association of Realtors, Et Al.,: ApplicantsDocumento19 páginasAlabama Association of Realtors, Et Al.,: ApplicantsForeclosure FraudAún no hay calificaciones

- Alabama Association of Realtors, Et Al.,: ApplicantsDocumento52 páginasAlabama Association of Realtors, Et Al.,: ApplicantsForeclosure FraudAún no hay calificaciones

- Hyper Vac AnyDocumento41 páginasHyper Vac AnyForeclosure FraudAún no hay calificaciones

- ResponseDocumento27 páginasResponseForeclosure FraudAún no hay calificaciones

- Et Al. Plaintiffs-Appellees v. Et Al. Defendants-AppellantsDocumento18 páginasEt Al. Plaintiffs-Appellees v. Et Al. Defendants-AppellantsForeclosure FraudAún no hay calificaciones

- Eviction MoratoriumDocumento20 páginasEviction MoratoriumZerohedgeAún no hay calificaciones

- Ny Tenant Scot Us RLG 081221Documento5 páginasNy Tenant Scot Us RLG 081221Foreclosure FraudAún no hay calificaciones

- MFPO AlbertelliDocumento13 páginasMFPO AlbertelliForeclosure Fraud100% (3)

- Et Al.,: in The United States District Court For The District of ColumbiaDocumento8 páginasEt Al.,: in The United States District Court For The District of ColumbiaRHTAún no hay calificaciones

- D C O A O T S O F: Caryn Hall Yost-RudgeDocumento6 páginasD C O A O T S O F: Caryn Hall Yost-RudgeForeclosure Fraud100% (1)

- Order Granting in Part Denying in Part MSJDocumento11 páginasOrder Granting in Part Denying in Part MSJDinSFLA100% (1)

- Filing# 60827161 E-Filed 08/23/2017 06:54:56 PMDocumento47 páginasFiling# 60827161 E-Filed 08/23/2017 06:54:56 PMForeclosure FraudAún no hay calificaciones

- Earnings Release: AND Supplemental InformationDocumento35 páginasEarnings Release: AND Supplemental InformationForeclosure FraudAún no hay calificaciones

- Cfa Letter Fidelity Stewart MergerDocumento3 páginasCfa Letter Fidelity Stewart MergerForeclosure FraudAún no hay calificaciones

- Fox SuitDocumento33 páginasFox Suitmlcalderone100% (1)

- 4 Hire Purchase Material9018311258494236503Documento15 páginas4 Hire Purchase Material9018311258494236503Prabin stha100% (2)

- Test Bank For Personal Finance 5 e 5th Edition Jeff MaduraDocumento22 páginasTest Bank For Personal Finance 5 e 5th Edition Jeff MaduraRobert Booth100% (35)

- DOPrintPage - 2024-01-17T124056.130Documento2 páginasDOPrintPage - 2024-01-17T124056.130sahresh.officialAún no hay calificaciones

- JAVADOVDocumento1 páginaJAVADOVSadiq PenahovAún no hay calificaciones

- EcdfDocumento1 páginaEcdfzaydabbassi99Aún no hay calificaciones

- HDFC Board ResolutionDocumento2 páginasHDFC Board ResolutionLaxminarayana PallapuAún no hay calificaciones

- FIP 3Qtr2013Documento8 páginasFIP 3Qtr2013Karol Mikhail Ra NakpilAún no hay calificaciones

- Chapter 7Documento18 páginasChapter 7Raven Vargas DayritAún no hay calificaciones

- Tentative ChapterisationDocumento13 páginasTentative ChapterisationNikhil kumarAún no hay calificaciones

- Home Improvement Loan-618: NF-546 NF - 964 NF-990 NF-967 NF-482 NF-803Documento3 páginasHome Improvement Loan-618: NF-546 NF - 964 NF-990 NF-967 NF-482 NF-803Santosh KumarAún no hay calificaciones

- Finance Questions and SolutionsDocumento58 páginasFinance Questions and SolutionsMoloto REBONEAún no hay calificaciones

- Mathematics of FinanceDocumento25 páginasMathematics of FinanceJulianna CortezAún no hay calificaciones

- DRE Broker Compliance Short GuideDocumento28 páginasDRE Broker Compliance Short GuideScott RoyvalAún no hay calificaciones

- HRMM GuidenceDocumento6 páginasHRMM GuidencenadliesaAún no hay calificaciones

- Card Scheme RID Product PIX AIDDocumento1 páginaCard Scheme RID Product PIX AIDkeyemAún no hay calificaciones

- Salary SlipDocumento2 páginasSalary Slipnitinmittal05100% (8)

- P403FSA4332740 Statement of AccountDocumento5 páginasP403FSA4332740 Statement of AccountANANDARAJ KAún no hay calificaciones

- Tally NotesDocumento3 páginasTally NotesArchana DeyAún no hay calificaciones

- LI 01 Vetting ChecklistDocumento1 páginaLI 01 Vetting ChecklistAsyraf WajdiAún no hay calificaciones

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento6 páginasDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepra09031888Aún no hay calificaciones

- Account StatmentDocumento1 páginaAccount StatmentNavidul IslamAún no hay calificaciones

- Statement of Account: Brought Forward 12580.30crDocumento31 páginasStatement of Account: Brought Forward 12580.30cr4ccrstkyddAún no hay calificaciones

- AlDocumento2 páginasAlsean gladimirAún no hay calificaciones

- KYC Form For PLI Existing PortfolioDocumento2 páginasKYC Form For PLI Existing PortfolioShakir Muhammad100% (1)

- Details of Proof Submission For The Financial Year 2018 - 2019Documento3 páginasDetails of Proof Submission For The Financial Year 2018 - 2019Akshay ShettyAún no hay calificaciones

- 01.06.2021 SIE Failed Credits & T 24 Adjustment Journal $114 215.50Documento3 páginas01.06.2021 SIE Failed Credits & T 24 Adjustment Journal $114 215.50Sarah ManiwaAún no hay calificaciones