Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Exchange Rates: Factors Affecting Exchange Rate

Cargado por

TheOnlyNamelessTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Exchange Rates: Factors Affecting Exchange Rate

Cargado por

TheOnlyNamelessCopyright:

Formatos disponibles

Exchange Rates

Exchange rate: the price of one currency expressed in the terms of other currencies.

Fixed: the price is set/pegged to another currency

Floating: Not fixed, exchange rate is determined by the forces of supply and demand

Flo1ting system: the value of the exchange rate is determined by the supply and demand of the

currency on the foreign exchange market.

Appreciation: an increase in the value of the exchange rate in comparison to other currencies operating

within a floating exchange rate system.

Difference between devaluation vs depreciation:

Both mean the currency looses value, but devaluation is when the government decides to decrease the

value

Factors affecting Exchange rate

Demand

Demand for domestic products

Interest rate (People want to save money in places where they receive the most interest)

Inflation rate (People want to save money where currency does not depreciate

Investment prospects

Speculation

Supply

When a currency has high demand, people buy more of it, and there is less left for others to buy.

Therefore the factors for supply are the opposite as those for demand

Advantages of a high exchange rate

Downward pressure on inflation

More imports can be bought for a lower price

Increases competitiveness of the domestic industries

Disadvantages of a high exchange rate

Damage to domestic industries employment can decrease since imported products are cheaper

can affect balance of paymentsnota

Advantages of a low exchange rate

Greater employment and development for domestic industries

Disadvantages of a low exchange rate

Higher levels of inflation, since imported products are more expensive (cost push inflation)

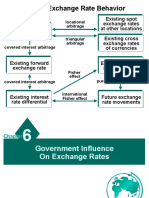

Methods for the government to affect exchange rate

Foreign reserves the government buys reserves in foreign currencies and things like gold to

that they can use to buy/sell their own currency, to affect the demand and supply for their

currency.

By changing interest rates

Advantages of a fixed exchange rate

Could reduce uncertainty businesses in the economy

Inflation has a higher impact on the demand for exports and imports (The rate is not self

adjusting)

Should reduce speculation if it is set at the correct level

Disadvantages of fixed exchange rates

Cannot use Interest rates to influence other macroeconomic objective

Have to maintain high foreign reserves

It is difficult to determine the correct rate to set the exchange rate to

Can cause international disagreement if the exchange rate is too low, since this can make a

countrys exports more competitive

Advantages of a floating exchange rates

Interest rates can be used to influence other macroeconomic objectives

Exchange rate should adjust itself to ensure the current account is balanced

It isnt necessary to keep foreign reserves

Disadvantages of a floating exchange rate

Can create uncertainty for domestic businesses and in foreign markets

Floating exchange rates may be affected by external factors

Floating exchange rate may worsen existing levels of inflation due to cost-push inflation

También podría gustarte

- Forex Trading Strategy: Trade Market Imbalance Using Supply and Demand StrategyDe EverandForex Trading Strategy: Trade Market Imbalance Using Supply and Demand StrategyCalificación: 4 de 5 estrellas4/5 (10)

- Currency War - Reasons and RepercussionsDocumento15 páginasCurrency War - Reasons and RepercussionsRaja Raja91% (11)

- ITP - Foreign Exchange RateDocumento29 páginasITP - Foreign Exchange RateSuvamDharAún no hay calificaciones

- EnglishDocumento7 páginasEnglisharibahamjad8129Aún no hay calificaciones

- Exchange Rate Definition and Types in 40 CharactersDocumento16 páginasExchange Rate Definition and Types in 40 CharactersRahul PurmananAún no hay calificaciones

- EXCHANGE RATE DETERMINATIONDocumento21 páginasEXCHANGE RATE DETERMINATIONMariya JasmineAún no hay calificaciones

- ITF Unit 5Documento13 páginasITF Unit 5Nandhini PrabakaranAún no hay calificaciones

- Exchange Rate DeterminationDocumento21 páginasExchange Rate Determinationdeepika singhAún no hay calificaciones

- Exchange Rate MBA-2Documento28 páginasExchange Rate MBA-2SREYASHI KHETUAAún no hay calificaciones

- 2020 International Fin Syst PrintDocumento31 páginas2020 International Fin Syst PrintAndrea RodriguezAún no hay calificaciones

- Econs Notes Chapter 26Documento6 páginasEcons Notes Chapter 26Thalia VladimirouAún no hay calificaciones

- International financial forces impacting businessDocumento29 páginasInternational financial forces impacting businessY.h. TariqAún no hay calificaciones

- Basics of Exchange RatesDocumento6 páginasBasics of Exchange RatesSushant MalveAún no hay calificaciones

- Exchange RateDocumento10 páginasExchange RateSteeeeeeeephAún no hay calificaciones

- Exchange RateDocumento10 páginasExchange RateSteeeeeeeephAún no hay calificaciones

- Inflation: by Hunar, Grade XII EconomicsDocumento14 páginasInflation: by Hunar, Grade XII EconomicsHUNAR LODHA Suchitra AcademyAún no hay calificaciones

- Exchange Rates-MinDocumento17 páginasExchange Rates-MinHoang Minh HienAún no hay calificaciones

- The Balance of Payments, ExchangeDocumento16 páginasThe Balance of Payments, ExchangeMoazzam AzadAún no hay calificaciones

- Exchange RatesDocumento8 páginasExchange RatesSushma GAún no hay calificaciones

- The Evolution of Exchange Rate MechanismsDocumento34 páginasThe Evolution of Exchange Rate MechanismsSimoAún no hay calificaciones

- L22 Inflation Causes and ConsequencesDocumento21 páginasL22 Inflation Causes and ConsequencesPrajay GAún no hay calificaciones

- Exchange Rate Determination FactorsDocumento21 páginasExchange Rate Determination FactorsArun MishraAún no hay calificaciones

- The Advantages and Disadvantages of Fixed Exchange RatesDocumento2 páginasThe Advantages and Disadvantages of Fixed Exchange RatesMoud Khalfani100% (1)

- Revision - Exchange Rates: What Factors Shift The Demand For, and Supply Of, A Currency?Documento4 páginasRevision - Exchange Rates: What Factors Shift The Demand For, and Supply Of, A Currency?Jasmine LiAún no hay calificaciones

- L2 Exchange Rate DeterminationDocumento25 páginasL2 Exchange Rate DeterminationKent ChinAún no hay calificaciones

- Exchange Rate Movements: Changes in ExportsDocumento11 páginasExchange Rate Movements: Changes in ExportsamitAún no hay calificaciones

- International Monetary Systems and Exchange RatesDocumento23 páginasInternational Monetary Systems and Exchange RatesGrace Avilla IlaganAún no hay calificaciones

- Exchange Rate DeterminationDocumento18 páginasExchange Rate DeterminationBini MathewAún no hay calificaciones

- Module No. 4: International Parity Relationships & Forecasting Foreign Exchange rateDocumento24 páginasModule No. 4: International Parity Relationships & Forecasting Foreign Exchange rateManjunath BVAún no hay calificaciones

- Foreign ExchangeDocumento3 páginasForeign Exchangeatharva1760Aún no hay calificaciones

- Foreign Exchange RateDocumento11 páginasForeign Exchange Ratebhavin726Aún no hay calificaciones

- Fixed and Floating Exchange RatesDocumento22 páginasFixed and Floating Exchange Ratesmeghasingh_09Aún no hay calificaciones

- Exchange Rate - TheoryDocumento10 páginasExchange Rate - TheoryHieptaAún no hay calificaciones

- Chapter 4 The Interntional Flow of Funds and Exchange RatesDocumento14 páginasChapter 4 The Interntional Flow of Funds and Exchange RatesRAY NICOLE MALINGI100% (1)

- Foreign Exchange RatesDocumento13 páginasForeign Exchange RatesShrey GoelAún no hay calificaciones

- Inflation's Impact on Asset Values, Firm Cash Flows and Discount RatesDocumento11 páginasInflation's Impact on Asset Values, Firm Cash Flows and Discount RatesShashank MadimaneAún no hay calificaciones

- Foreign Exchange RateDocumento14 páginasForeign Exchange RateIzma HussainAún no hay calificaciones

- Exchange RateDocumento5 páginasExchange RateOng Wei Ling100% (1)

- Government DebtDocumento23 páginasGovernment DebtAnand SinghAún no hay calificaciones

- Inflation and DeflationDocumento7 páginasInflation and Deflationelle06Aún no hay calificaciones

- Economic Influences: Learning ObjectivesDocumento40 páginasEconomic Influences: Learning Objectivessk001Aún no hay calificaciones

- Rates of Exchange: Radhakishan V Karthik S Jaichander Yasser FarookDocumento15 páginasRates of Exchange: Radhakishan V Karthik S Jaichander Yasser FarookKarthik SankarAún no hay calificaciones

- Exchange Rates: Quick ReviseDocumento8 páginasExchange Rates: Quick ReviseScorpions StingAún no hay calificaciones

- Exchange Rates: Advantages of Floating Exchange RateDocumento2 páginasExchange Rates: Advantages of Floating Exchange RatesannnnnAún no hay calificaciones

- Exchange Rates: Understanding Devaluation, Appreciation, and ParityDocumento8 páginasExchange Rates: Understanding Devaluation, Appreciation, and ParityOnella GrantAún no hay calificaciones

- Foreign Exchange Rates ExplainedDocumento23 páginasForeign Exchange Rates ExplainedAanyaAún no hay calificaciones

- Currency and FinancialsDocumento38 páginasCurrency and FinancialsSammy MosesAún no hay calificaciones

- Exchange Rate Determination and PolicyDocumento33 páginasExchange Rate Determination and PolicyJunius Markov OlivierAún no hay calificaciones

- Business Finance AssignmentDocumento2 páginasBusiness Finance AssignmentTian Tianz OpallazAún no hay calificaciones

- Exchange Rate System: Flexible Exchange Rate System Fixed Exchange Rate System Linked Exchange Rate SystemDocumento81 páginasExchange Rate System: Flexible Exchange Rate System Fixed Exchange Rate System Linked Exchange Rate SystemAbhee RajAún no hay calificaciones

- RevaluationDocumento2 páginasRevaluationChelsea DizonAún no hay calificaciones

- The Impact of The Devaluation of CurencyDocumento25 páginasThe Impact of The Devaluation of CurencycooldudeakhilAún no hay calificaciones

- The Determination of Exchange Rate: BY Annisa Ramadhani Bertha Muhammad Karina Fitri Zahira SalsabellaDocumento25 páginasThe Determination of Exchange Rate: BY Annisa Ramadhani Bertha Muhammad Karina Fitri Zahira SalsabellaRatu ShaviraAún no hay calificaciones

- Exchange Rates and Open EconomiesDocumento50 páginasExchange Rates and Open Economiesbanjorene100% (1)

- MBADocumento17 páginasMBAKrishnamoorthy Ramakrishnan100% (1)

- Inflation and Its TypesDocumento12 páginasInflation and Its TypesUP 16 GhaziabadAún no hay calificaciones

- Exchange Rate and Current AccountDocumento27 páginasExchange Rate and Current AccountBezalel OLUSHAKINAún no hay calificaciones

- Part II Exchange Rate Behavior: Locational Arbitrage Triangular Arbitrage Covered Interest ArbitrageDocumento53 páginasPart II Exchange Rate Behavior: Locational Arbitrage Triangular Arbitrage Covered Interest ArbitrageTompelGEDE GTAún no hay calificaciones

- Fixed Rates Macro PolicyDocumento10 páginasFixed Rates Macro PolicyJelenaJovanovicAún no hay calificaciones

- Plants Life Cycles and PartsDocumento5 páginasPlants Life Cycles and PartsseemaAún no hay calificaciones

- MMH Dan StoringDocumento13 páginasMMH Dan Storingfilza100% (1)

- 4 DiscussionDocumento2 páginas4 DiscussiondreiAún no hay calificaciones

- Alpha Phi Omega National Service Fraternity Strategic PlanDocumento1 páginaAlpha Phi Omega National Service Fraternity Strategic Planlafay3tteAún no hay calificaciones

- JTIL Purchase Requisition for Plasma Machine SparesDocumento3 páginasJTIL Purchase Requisition for Plasma Machine Sparesshivam soniAún no hay calificaciones

- Government of The Punjab Primary & Secondary Healthcare DepartmentDocumento3 páginasGovernment of The Punjab Primary & Secondary Healthcare DepartmentYasir GhafoorAún no hay calificaciones

- 2 Case StudyDocumento8 páginas2 Case Studysehrish khawerAún no hay calificaciones

- Study Quran Online - The Online Quran Teaching Academy UK - QutorDocumento9 páginasStudy Quran Online - The Online Quran Teaching Academy UK - QutorQutor co ukAún no hay calificaciones

- Digestive System Song by MR ParrDocumento2 páginasDigestive System Song by MR ParrRanulfo MayolAún no hay calificaciones

- Case Study - Help DocumentDocumento2 páginasCase Study - Help DocumentRahAún no hay calificaciones

- Research PaperDocumento15 páginasResearch PapershrirangAún no hay calificaciones

- Mapeflex Pu50 SLDocumento4 páginasMapeflex Pu50 SLBarbara Ayub FrancisAún no hay calificaciones

- Eating and HealingDocumento19 páginasEating and HealingMariana CoriaAún no hay calificaciones

- CM Template For Flora and FaunaDocumento3 páginasCM Template For Flora and FaunaJonathan Renier Verzosa0% (1)

- p2 - Guerrero Ch13Documento40 páginasp2 - Guerrero Ch13JerichoPedragosa88% (17)

- Cats - CopioniDocumento64 páginasCats - CopioniINES ALIPRANDIAún no hay calificaciones

- Citation GuideDocumento21 páginasCitation Guideapi-229102420Aún no hay calificaciones

- Trabajo de Investigación FormativaDocumento75 páginasTrabajo de Investigación Formativalucio RAún no hay calificaciones

- Clinical Indications, Treatment and Current PracticeDocumento14 páginasClinical Indications, Treatment and Current PracticefadmayulianiAún no hay calificaciones

- Rpo 1Documento496 páginasRpo 1Sean PrescottAún no hay calificaciones

- Maturity Mode Agile BookDocumento110 páginasMaturity Mode Agile BookSai VenkatAún no hay calificaciones

- Module 7 - Assessment of Learning 1 CoursepackDocumento7 páginasModule 7 - Assessment of Learning 1 CoursepackZel FerrelAún no hay calificaciones

- 1 s2.0 S0959652619316804 MainDocumento11 páginas1 s2.0 S0959652619316804 MainEmma RouyreAún no hay calificaciones

- 6.standard CostingDocumento11 páginas6.standard CostingInnocent escoAún no hay calificaciones

- Chapter One: Business Studies Class XI Anmol Ratna TuladharDocumento39 páginasChapter One: Business Studies Class XI Anmol Ratna TuladharAahana AahanaAún no hay calificaciones

- MP & MC Module-4Documento72 páginasMP & MC Module-4jeezAún no hay calificaciones

- Past Paper Booklet - QPDocumento506 páginasPast Paper Booklet - QPMukeshAún no hay calificaciones

- Module 2 What It Means To Be AI FirstDocumento85 páginasModule 2 What It Means To Be AI FirstSantiago Ariel Bustos YagueAún no hay calificaciones

- Sceduling and Maintenance MTP ShutdownDocumento18 páginasSceduling and Maintenance MTP ShutdownAnonymous yODS5VAún no hay calificaciones

- 8086 Microprocessor: J Srinivasa Rao Govt Polytechnic Kothagudem KhammamDocumento129 páginas8086 Microprocessor: J Srinivasa Rao Govt Polytechnic Kothagudem KhammamAnonymous J32rzNf6OAún no hay calificaciones