Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Bad Accounting by Shabih Kazmi - 1.0 PDF

Cargado por

Anonymous W1qGuoXWpTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Bad Accounting by Shabih Kazmi - 1.0 PDF

Cargado por

Anonymous W1qGuoXWpCopyright:

Formatos disponibles

BAD ACCOUNTING

SHABIH KAZMI

I dedicate this work to the innocent accountants who

have, unknowlingly or unintentionally, been a part

of worst accounting scandals of world history. So, a

heartfelt thanks to Mr. Jeff Skilling, for giving us the

Enron Scandal (2001), Mr. Hank Greenberg, for his

contribution in AIG Scandal (2005) and our own

Indian inspiration Mr. Ramalinga Raju, for his best

practices in Satyam Scandal (2009).

Without the likes of these gentlemen the world

would have never got the privilege of knowing the

dubious terminologies in accounting.

BAD ACCOUNTING

SHABIH KAZMI

Table of Contents

Preface..04

Introduction.05

Top Scandals

Waste Management Scandal (1998).....06

Enron Scandal (2001)07

WorldCom Scandal (2002)..08

Tyco Scandal (2002).09

HealthSouth Scandal (2003)10

Freddie Mac (2003)11

American International Group (AIG) Scandal (2005)..12

Lehman Brothers Scandal (2008)...13

Bernie Madoff Scandal (2008)....14

Satyam Scandal (2009).15

The 7 Gimmicks......16

New Born Terminologies

Accounting Noise..18

Aggressive Accounting19

Backdating..20

Big Bath21

Black Box Accounting...23

Cook the Book....23

Cookie Jar Accounting.....24

Voodoo Accounting..26

How to Figure Out Scandals27

Your Own Methodology30

About The Author...31

BAD ACCOUNTING

SHABIH KAZMI

Preface

In the recent past we have witnessed at least a dozen scandals involving the corporates, big

and small both, which has changed our thought processes. Here, in this book we will study

and discuss these corporates. Ever since these incidents took place the accounting pundits

have given birth to some new terminologies in accounting. What are these terminologies and

how they could be detected? What are the signs of bad accounting?

The purpose of this book is to make you aware of the bad practices which were adopted in

past, the result of their bad practices and its effect on a common man. As a manager or

accounts person you must know about these practices.

There is no particular reason for writing on such a subject. The simplest reason is that I was

reading some facts for myself, asked a few questions to people around me, realised that they

do not have a clue about what happened and I felt people around me must also know. After

an hour I wanted the all interested people to know what had happened in these scandals. I

can only say that this subject is very close to my heart, right now.

Most of the material in this book has been inspired by Wikipedia and Google searches,

however I have tried my best not to copy paste except for a few tables and facts which I did

not wanted to be changed.

Honestly, while writing this book, I as a common man must admit that running a business is

not an easy job. But then, playing with investors/shareholders money is even worse crime to

commit. At the end of this book I would require inputs from you, write to me and suggest

your experiences as well.

BAD ACCOUNTING

SHABIH KAZMI

Introduction

Until now, much of your academics revolved around the best of accounting practices in which

you simply follow what has been written or taught by the author or the professor. But in

practice you might find some situation where you are requested to change a few facts and

present the balance sheet as expected by the company. This may or may not be an instance

of bad accounting technique but how would you know. How would you know whether if you

conceal a particular fact how bad it is going to hit the stakeholders?

The way corporates have been hit by bad accounting in the recent past gives us a clear

understanding of existence of malpractices in big corporates. Enron, AIG, Satyam, there are

almost a dozen scandals starting from the year 1998 till date. After so many scandals the

account pundits have come up with new terminologies with in the process of accounting. The

concept of these terminologies are not new and you as an accountant must have thought of

it many times. It is only these concepts are being christened now.

Before starting I would like you to list down some expectations from this book. And at the end

of this book give you feedback. I really want to listen from you.

....

....

....

....

BAD ACCOUNTING

SHABIH KAZMI

Top Scandals That Shook the World

I just wanted to start with some examples of companies which were found involved in bad

accounting techniques. Although there could be many companies involved but I choose the

below 10 companies which were really shocking and literally took the world by storm.

1. Waste Management Scandal (1998)

In 1987, the US government accused Waste Management of violating antitrust laws by

colluding with other waste haulers to allocate customers in two Florida counties.

Revelations of irregular accounting led to a major drop in stock price and to the replacement

of top executives after a new CEO ordered a review of the company's accounting practices in

1998. The company had augmented the depreciation time length for their property, plant, and

equipment, artificially inflating the company's after-tax profits by US$1.7 billion. On July 8,

1999, a class action lawsuit was filed against WMI and its certains officers for issuing false

statements. Waste Management paid US$457 million to settle a shareholder class-action suit

in 2003. The SEC fined Waste Management's independent auditor, Arthur Andersen, US$7

million for its role.

6

BAD ACCOUNTING

SHABIH KAZMI

2. Enron Scandal (2001)

Enron's complex financial statements were confusing to shareholders and analysts. In

addition, its complex business model and unethical practices required that the company use

accounting limitations to misrepresent earnings and modify the balance sheet to indicate

favorable performance.

The combination of these issues later resulted in the bankruptcy of the company, and the

majority of them were perpetuated by the indirect knowledge or direct actions of Lay, Jeffrey

Skilling, Andrew Fastow, and other executives. Lay served as the chairman of the company

in its last few years, and approved of the actions of Skilling and Fastow although he did not

always inquire about the details. Skilling constantly focused on meeting Wall Street

expectations, advocated the use of mark-to-market accounting (accounting based on market

value, which was then inflated) and pressured Enron executives to find new ways to hide its

debt. Fastow and other executives "created off-balance-sheet vehicles, complex financing

structures, and deals so bewildering that few people could understand them.

BAD ACCOUNTING

SHABIH KAZMI

3. WorldCom Scandal (2002)

On November 4, 1997, WorldCom and MCI Communications announced their US$37 billion

merger to form MCI WorldCom, making it the largest corporate merger in U.S. history. On

September 15, 1998, the new company, MCI WorldCom, opened for business, after MCI

divested itself of its successful "internet MCI" business to gain approval from the U.S.

Department of Justice.

On July 21, 2002, WorldCom filed for Chapter 11 bankruptcy protection in the largest such

filing in United States history at the time (since overtaken by the bankruptcies of both Lehman

Brothers and Washington Mutual in a span of eleven days during September 2008). The

WorldCom bankruptcy proceedings were held before U.S. Federal Bankruptcy Judge Arthur

J. Gonzalez, who simultaneously heard the Enron bankruptcy proceedings, which were the

second largest bankruptcy case resulting from one of the largest corporate fraud scandals.

None of the criminal proceedings against WorldCom and its officers and agents was

originated by referral from Gonzalez or the Department of Justice lawyers. By the bankruptcy

reorganization agreement, the company paid $750 million to the SEC in cash and stock in the

new MCI, which was intended to be paid to wronged investors.

8

BAD ACCOUNTING

SHABIH KAZMI

4. Tyco Scandal (2002)

Former chairman and chief executive Dennis Kozlowski and former chief financial officer Mark

H. Swartz were accused of the theft of more than $150 million from the company. During their

trial in March 2004, they contended the board of directors authorized it as compensation.

On June 17, 2005, after a retrial, Kozlowski and Swartz were convicted on all but one of the

more than 30 counts against them. The verdicts carry potential jail terms of up to 25 years in

state prison. Kozlowski himself was sentenced to no less than eight years and four months

and no more than 25 years in prison. Swartz received the same sentence. Then in May 2007,

New Hampshire Federal District Court Judge Paul Barbadoro approved a class action

settlement whereby Tyco agreed to pay $2.92 billion (in conjunction with $225 million by

Pricewaterhouse Coopers, their auditors) to a class of defrauded shareholders represented by

Grant & Eisenhofer P.A., Schiffrin, Barroway, Topaz & Kessler, and Milberg Weiss & Bershad.

BAD ACCOUNTING

SHABIH KAZMI

5. HealthSouth Scandal (2003)

HealthSouth, the largest U.S. operator of rehabilitation-hospitals, is under investigation by the

Securities and Exchange Commission and the Justice Department for allegedly overstating

earnings by $2.5 billion since 1999.

Fifteen HealthSouth employees, including all five former chief financial officers, have pleaded

guilty to criminal charges. Former CEO Richard M. Scrushy has denied wrongdoing. He will

appear before the House Energy and Commerce Committee on Oct. 16, but is expected to

invoke his Fifth Amendment right against self-incrimination.

Former HealthSouth CEO Richard Scrushy, 50, was a self-made son of the new South, a

former teenage parent who hauled himself up from a menial job to become an emperor of

the new economy. (Steve Barnette - AP)

Scrushy has refused the company's request for his resignation and remains a non-active

board member of HealthSouth.

10

BAD ACCOUNTING

SHABIH KAZMI

6. Freddie Mac (2003)

This case is fascinating for another reason. The SEC continues to give miscreants a slap on

the wrist while hitting the innocents with a massive fine. The SEC continues to dote on the

bad guys by only slapping their wrist. The largest fine plus disgorgement is only $400,000.

For the salaries and stock options and perquisites that these guys got while working at Freddie

Mac, the fines plus disgorgement amounts to a speeding ticket for those mortals with at most

six-digit incomes. The fines are trivial. If the SEC wants to dissuade managers from

committing accounting frauds, then they must impose meaningful and enormous fines and

prison sentences. Petty and insubstantial fines imply that the SEC no longer cares for investors

and creditors. And managers at other entities surely take notice.

11

BAD ACCOUNTING

SHABIH KAZMI

7. American International Group (AIG) Scandal (2005)

What began as an investigation into two reinsurance transactions has mushroomed into a

growing scandal that has tarnished the reputation of one of America's premier corporations.

On Mar. 30, AIG acknowledged that it had improperly accounted for the reinsurance

transaction to bolster reserves, and detailed numerous other examples of problematic

accounting. It also announced the delay of its annual 10-K filing, and said the moves may have

inflated its net worth by up to $1.7 billion. While AIG says it does not yet know if the review

will force a restatement of prior results, its stock dropped 2.1% on the news; all together, AIG

shares have dropped 22%, to $57 apiece, since the company was served with subpoenas by

state and federal regulators six weeks ago.

But AIG remains a powerhouse in the industry. It has a diverse mix of industry-leading

insurance and financial-services businesses. Moreover, it's a global force with a particularly

strong foothold in fast-growing Asian markets, especially China.

12

BAD ACCOUNTING

SHABIH KAZMI

8. Lehman Brothers Scandal (2008)

In 2003 and 2004, with the U.S. housing boom (read, bubble) well under way, Lehman

acquired five mortgage lenders, including subprime lender BNC Mortgage and Aurora Loan

Services, which specialized in Alt-A loans (made to borrowers without full documentation).

Lehman's acquisitions at first seemed prescient; record revenues from Lehman's real estate

businesses enabled revenues in the capital markets unit to surge 56% from 2004 to 2006, a

faster rate of growth than other businesses in investment banking or asset management. The

firm securitized $146 billion of mortgages in 2006, a 10% increase from 2005. Lehman

reported record profits every year from 2005 to 2007. In 2007, the firm reported net income

of a record $4.2 billion on revenue of $19.3 billion.

Lehman's collapse roiled global financial markets for weeks, given the size of the company

and its status as a major player in the U.S. and internationally. Many questioned the U.S.

government's decision to let Lehman fail, as compared to its tacit support for Bear Stearns,

which was acquired by JPMorgan Chase & Co.

13

BAD ACCOUNTING

SHABIH KAZMI

9. Bernie Madoff Scandal (2008)

In 1992, Bernard Madoff explained his purported strategy to The Wall Street Journal. He said

the returns were really nothing special, given that the Standard & Poors 500-stock index

generated an average annual return of 16.3% between November 1982 and November 1992.

"I would be surprised if anybody thought that matching the S&P over 10 years was anything

outstanding." The majority of money managers actually trailed the S&P 500 during the 1980s.

The Journal concluded Madoff's use of futures and options helped cushion the returns against

the market's ups and downs. Madoff said he made up for the cost of the hedges, which could

have caused him to trail the stock market's returns, with stock-picking and market timing.

The scheme began to unravel in December 2008, when the general market downturn

accelerated. However, Markopolos later wrote Madoff was on the brink of insolvency as early

as June 2005, when his team learned he was seeking loans from banks. At least two major

banks were no longer willing to lend money to their customers to invest it with Madoff. In

June 2008six months before the scheme implodedMarkopolos' team uncovered evidence

that Madoff was accepting leveraged money. To Markopolos' mind, Madoff was running out

of cash and needed to increase his promised returns to keep the scheme going.

14

BAD ACCOUNTING

SHABIH KAZMI

10. Satyam Scandal (2009)

The case, which is also called the Enron of India, dates back to 2009. Six years ago, Raju wrote

a letter to the Securities and Exchange Board of India (SEBI) and his companys shareholders,

admitting that he had manipulated the companys earnings, and fooled investors. Nearly $1

billionor 94% of the cashon the books was fictitious. In an immediate reaction to the

confession, investors lost as much as Rs14,000 Crore ($2.2 billion) as Satyams shares tanked.

Raju explained his reasons for inflating earning in the letter thus: As the promoters held a

small percentage of equity, the concern was that poor performance would result in a takeover,

thereby exposing the gap.

What started as a marginal gap between actual operating profit and the one reflected in the

books of accounts continued to grow over the years, Raju said in the letter. It has attained

unmanageable proportions as the size of the company operations grew significantly.

Raju was once the poster boy of Indias IT revolutionrubbing shoulders with top CEOs and

politicians across the world, including Bill Clinton.

15

BAD ACCOUNTING

SHABIH KAZMI

The 7 Gimmicks

The pundits has identified thirty techniques, grouped in to 7, that companies use to trick

investors and other stakeholders. They are:

Gimmic#1. Recording Revenue Too Soon or of Questionable Quality

There are six tricks commonly used under this category. They are:

Recording revenue when future services remain to be provided.

Recording revenue before shipment or before the customer's unconditional

acceptance.

Recording revenue even though the customer is not obligated to pay.

Selling to an affiliated party.

Giving the customer something of value as a quid pro quo.

Grossing up revenue.

Gimmic#2. Recording Bogus Revenue

There are five techniques commonly used under this category. They are:

Recording sales that lack economic substance

Recording cash received in lending transactions as revenue

Recording investment income as revenue

Recording as revenue supplier rebates tied to future required purchases

Releasing revenue that was improperly held back before a merger

Gimmick#3. Boosting Income with One-Time Gains

There are four techniques commonly used under this category. They are:

Boosting profits by selling undervalued assets

Including investment income or gains as part of revenue

Reporting investment income or gains as a reduction in operating expenses

Creating income by reclassification of balance sheets accounts

16

BAD ACCOUNTING

SHABIH KAZMI

Gimmick#4. Shifting Current Expenses to a Later or Earlier Period

There are five techniques commonly used under this category. They are:

Capitalizing normal operating costs, particularly if recently changed from expensing

Changing accounting policies and shifting current expenses to an earlier period

Amortizing costs too slowly

Failing to write down or write off impaired assets

Reducing asset reserves

Gimmick#5. Failing to Record or Improperly Reducing Liabilities

There are five gimmicks commonly used under this category. They are:

Failing to record expenses and related liabilities when future obligations remain

Reducing liabilities by changing accounting assumptions

Releasing questionable reserves into income

Creating sham rebates

Recording revenue when cash is received, even though future obligations remain

Gimmick#6. Shifting Current Revenue to a Later Period

There are two tactics commonly used under this category. They are:

Creating reserves and releasing them into income in later period

Improperly holding back revenue just before an acquisition closes

Gimmick#7. Shifting Future Expenses to the current Period as a special Charge

There are three tactics commonly used under this category. They are:

Improperly inflating amount included in a special charge

Improperly writing off in-process R&D costs from an acquisition

Accelerating discretionary expenses into current period

17

BAD ACCOUNTING

SHABIH KAZMI

New Born Terminologies

1. Accounting Noise

The distortion that is caused in a company's financial statements due to accounting

rules and regulations that must be followed. Accounting noise makes it difficult for

investors to easily ascertain a company's true financial condition. Accounting noise

can make a company's financial reports look better or worse.

Accounting noise can be the result of the implementation of the necessary accounting

principles that come under the Generally Accepted Accounting Principles and must be

implemented in order to make accurate and legal financial statements of a company.

On the other hand it can be an attempt from the management of the company to put

a brighter and the rosier picture of the company's financial statements in front of

investors and credit companies. Investors can scrutinize the foot notes of the financial

statements to identify the accounting noise and to get a clear and transparent picture

of the financial condition of a company.

Breaking down - Accounting Noise

Accounting noise can be seen as either a consequence of necessary rules regarding

generally accepted accounting principles (GAAP) or a result of management's attempts

to massage the numbers to present a rosier financial picture of the firm. Paying

attention to the footnotes can help an investor cut through the accounting noise and

get the real story.

For example, a company that has recently undergone a significant merger may look

very unprofitable on the income statement because the merger may cause serious

one-time charges for the company; it may be useful for investors to cut through the

accounting noise to get a more accurate picture of the company's prospects.

Conversely, an underperforming company could engage in earnings manipulation,

creating accounting noise to hide its poor performance.

18

BAD ACCOUNTING

SHABIH KAZMI

2. Aggressive Accounting

The practice of misreporting income statement and balance sheet items to make a

company appear more attractive to investors. Although some forms of aggressive

accounting are illegal, others are not. Regardless of the legality, however, aggressive

accounting practices are universally frowned upon, as they are clearly designed to

deceive. Aggressive accounting is also known as "creative" or "innovative" accounting

and in the worst, most fraudulent cases, is referred to as "cooking the books."

For a private company, one of its goals is to pay less tax. This equates to lowering

revenue by taking deductions and expensing items in order to qualify for a lower tax

bracket.

A public company on the other hand, is more inclined to use aggressive accounting

policies in order to over report earnings in order to meet analysts' expectations, meet

debt covenants or meet stock option performance bonuses based on stock price.

This has led to numerous accounting scandals and blowups in corporate America as

well as the rest of the world. In order to better understand what aggressive revenue

recognition is.

Breaking down - Aggressive Accounting

Though aggressive accounting has been an issue for a long time, the problem didn't

come to a head until the dotcom era in the late 1990s and early 2000s. Following the

bankruptcy of Enron Corporation (formerly traded as "ENE" on the New York Stock

Exchange) in 2001, Congress and the Senate passed the Sarbanes-Oxley Act. Sarbox,

or SOX, set new or enhanced standards for all U.S. public companies, as well as public

accounting firms, and was named after the bill's sponsors, U.S. Senator Paul Sarbanes

(D-MD) and U.S. Representative Michael G. Oxley (R-OH).

19

BAD ACCOUNTING

SHABIH KAZMI

3. Backdating

Backdating is dating any document by a date earlier than the one on which the

document was originally drawn up. Under most circumstances, backdating is seen as

fraudulent and illegal, although there are some situations in which backdating can be

used in a legal and beneficial way, such as backdating a claim for a past period.

For example, let's assume that Anthony Gonzales is the CEO of Company XYZ. When

he was hired, the Company XYZ board of directors offered Anthony an attractive salary

as well as an annual grant of 1,000 Company XYZ stock options. Those options give

Anthony the right but not the obligation to purchase 1,000 shares of Company XYZ

stock at the market price on the date of the grant. The board formally grants the stock

options to John every year at its January board meeting.

Typically, the grant date of the stock options is the same as the date of the board

meeting. This is important to note, because the grant date is what determines the

exercise price on the options. For instance, if the board meeting is on January 3, 2012,

and Company XYZ stock closes at 45 per share that day, then the exercise price of

Anthony's 2012 stock option grant is 45 per share. That is, he has the right but not the

obligation to purchase 1,000 shares of Company XYZ stock for 45 per share.

If, however, Company XYZ decides to backdate the options, it could change the

paperwork to state that it actually granted those stock options to John on, say, June

15, 2008, when the stock was only trading at 15 per share. This would mean that

Anthony's 2012 stock option grant would have an exercise price of 15 per share

instead of 45 per share.

Let's say that Anthony now decides to exercise his stock options. On the day he

decides to exercise his options, Company XYZ shares are trading at 50. Under normal

circumstances, he pays the 45 per share exercise price and can turn around and sell

those shares on the exchange for 50 each, netting a profit of 5 per share, or 5,000

total.

20

BAD ACCOUNTING

SHABIH KAZMI

But if John's options are backdated, then his exercise price is only 15 per share. He

pays the 15 per share exercise price and can turn around and sell those shares on the

exchange for 50 each, netting a profit of 35 per share, or 35,000.

Breaking down Backdating

Sometimes certain claims (such as insurance claims) can be backdated if they could

not be completed at an earlier date, although there must be good reason for neglecting

to claim in advance. If your backdated claim is approved, you will be able to receive

benefits from a certain date in the past.

4. Big Bath

A big bath is the strategy of manipulating a company's income statement to make poor

results look even worse. The big bath is often implemented in a bad year to enhance

artificially next year's earnings. The big rise in earnings might result in a larger bonus

for executives. New CEOs sometimes use the big bath so they can blame the

company's poor performance on the previous CEO and take credit for the next year's

improvements.

One of the hardest accounting frauds to spot is big bath accounting. When a company

is doing really bad and has no chance of meeting earning expectations, unscrupulous

management would begin writing-off every expense and asset they could imagine. As

a result, future expenses are reduced significantly and naturally earnings increase. In

other words, the company is taking a big bath in the worst year so it can wipe its slate

clean. This almost always guarantees record-breaking earnings in subsequent years,

likewise performance bonuses.

The reasoning behind taking a big bath is quite simple: We already look bad, so let's

make ourselves look as bad as we can. Needless to say, management wouldn't take

the blame for the fall. They would either blame it on previous management or the

challenging economic conditions. The sweet-talking CEO never fails to wrap up with a

21

BAD ACCOUNTING

SHABIH KAZMI

personal assurance that the company is well poised to seize the opportunities when

the market returns to more favorable conditions.

Breaking down - Big Bath

For example, if a CEO concludes that the minimum earnings targets can't be made in

a given year, he/she will have an incentive to move earnings from the present to the

future since the CEO's compensation doesn't change regardless if he/she misses the

targets by a little or a lot. By shifting profits forward - by prepaying expenses, taking

write-offs and/or delaying the realization of revenues - the CEO increases the chances

of getting a large bonus the following year.

In a big bath, management would write-down substantial assets, that don't occur under

normal operating conditions, in order to maximize future benefits. So, pay close

attention to special one-time charges. Sale of discontinued operations, accelerated

depreciation of inventory, plant and equipment, write-off of an investment gone south

and restructuring charges are some of the most common one-time charges.

Because one-time charges could very well be valid, sniffing out the smell of big bath

accounting is not easy. One thing to look out for is the frequency of big baths. If onetime charges begin to show up every other year, this becomes a worrisome pattern. It

is, therefore, crucial for an investor to not just look at the current year financial reports.

Unfortunately, apart from spotting patterns of one-time charges, without adequate

disclosure voluntarily offered by management, there is no sure way to determine

whether or not management has taken a big bath.

22

BAD ACCOUNTING

SHABIH KAZMI

5. Black Box Accounting

The use of complex bookkeeping methodology in order to make interpreting financial

statements time-consuming or difficult. Black box accounting is more likely to be used

by companies seeking to hide information that they do not want investors to readily

see, such as large amounts of debt, as the information would negatively affect the

company's shares or ability to gain access to funding. Accounting showing income

and expenses in a not normal way. This is done to bury financial issues.

Breaking down - Black Box Accounting

Black box accounting is not illegal, as long as it adheres to GAAP or IAS guidelines,

depending on the location. But is generally considered unethical, as it is designed to

obscure a simple and accurate picture of a company's financial health. The use of

complex formulas also creates skepticism about the accuracy of the numbers

displayed in financial statements.

6. Cook the Books

Cook the books is an idiom describing fraudulent activities performed by corporations

in order to falsify their financial statements. Typically, cooking the books involves

augmenting financial data to yield previously nonexistent earnings. Examples of

techniques used to cook the books involve accelerating revenues, delaying expenses,

manipulating pension plans and implementing synthetic leases.

A company might use credit sales to cook the books. Sales made on credit are booked

as sales even if the company allows the customer to postpone payments for six

months. In addition to in-house financing, companies can extend credit terms on

current financing programs.

Channel stuffing is a method some manufacturers use to cook the books.

Manufacturers engaged in channel stuffing ship unordered products to distributors at

the end of the quarter. These transactions are recorded as sales, even though the

company fully expects the distributors to send back the products, especially those that

23

BAD ACCOUNTING

SHABIH KAZMI

did not sell. To avoid confusion, manufacturers should book products sent to

distributors as inventory until the distributors record sales, otherwise, the amount of

sales reported is inflated.

One of the most common issues is with nonrecurring expenses. Nonrecurring

expenses are meant to be one-time charges classified as extraordinary events, which

artificially increase net income. These items are excluded from net income. The issue

is that some companies have the same nonrecurring event happen every year, which

means it is not extraordinary.

Another way that companies can manipulate earnings is with stock buybacks.

Breaking down - Cook the Books

During the first years of the new millennium, Fortune 500 companies such as Enron

and WorldCom were found to have cooked the books to improve their financial figures.

The resulting scandals gave investors and regulators a rude awakening concerning the

reality that companies were capable of hiding the truth between lines of financial data.

To rally investor confidence, the Sarbanes-Oxley Act of 2002 was created. The act of

Congress created policies to protect investors against future incidents of corporate

fraud. Even with Sarbanes-Oxley in place, there are still numerous ways companies

cook the books.

7. Cookie Jar Accounting

A disingenuous accounting practice in which periods of good financial results are used

to create reserves that shore up profits in lean years. "Cookie jar accounting" is used

by a company to smooth out volatility in its financial results, thus giving investors the

misleading impression that it is consistently meeting earnings targets. This reliable

earnings performance is generally rewarded by investors, who assign the company a

premium valuation. Regulators frown on the practice since it misrepresents a

company's performance, which may be very different in reality from what it purports

to be.

24

BAD ACCOUNTING

SHABIH KAZMI

The term may be derived from the fact that a company which employs this practice

dips into the "cookie jar" of reserves whenever it feels like it. But the company may

have to pay a steep price if it is caught with its hand in the proverbial cookie jar.

Breaking down - Cookie Jar Accounting

One-time charges and special items are a couple of areas where a company can

manipulate numbers to create cookie jar reserves. Potential investors should therefore

scrutinize these numbers carefully before committing investment capital to the stock.

One of the best-known cases of cookie jar accounting in recent years was that of

computer giant Dell, which in July 2010 agreed to pay a $100 million penalty to the

Securities and Exchange Commission (SEC) to settle SEC allegations that it used

cookie jar reserves. The SEC maintained that Dell would have missed analysts'

earnings estimates in every quarter between 2002 and 2006 had it not dipped into

these reserves to cover shortfalls in its operating results. The cookie jar reserves were

created through undisclosed payments that Dell received from chip giant Intel in return

for agreeing to use Intel's CPU chips exclusively in its computers. (Intel made these

payments to Dell to lock out rival chipmaker Advanced Micro Devices from Dell

computers.)

The SEC also said that Dell did not disclose to investors that it was drawing on these

reserves. The Intel payments made up a huge chunk of Dell's profits, accounting for as

much as 72% of its quarterly operating income at the peak. Dell's quarterly profits fell

significantly in 2007 after it ended the arrangement with Intel. The SEC alleged that

while Dell said the decline in profitability was due to an aggressive product-pricing

strategy and higher component prices, the real reason was that it was no longer

receiving the payments from Intel.

25

BAD ACCOUNTING

SHABIH KAZMI

8. Voodoo Accounting

Voodoo accounting refers to any accounting practices that artificially inflate the profits

reported on a company's financial statements.

Creative rather than conservative accounting practices. Voodoo accounting employs

numerous accounting gimmicks to artificially boost the bottom line by inflating

revenue or concealing expenses or both. The origin of the term "voodoo accounting"

probably lies in the fact that once the accounting gimmicks come to light, the

purported profits disappear like magic. Investor reaction to news that a company has

been engaged in voodoo accounting depends on the magnitude of the offense. While

minor, one-time accounting gimmicks may be ignored by investors, substantial repeat

offenses would affect the company's market value and reputation.

Breaking down - Voodoo Accounting

Some of the voodoo accounting practices identified by former SEC chairman Arthur

Levitt at the height of the dot-com bubble in September 1998 include:

"Big bath charges," in which a company improperly reports a one-time loss by

taking a huge charge to mask lower-than-expected earnings.

"Cookie jar reserves" used by a company for income smoothing.

Recognizing revenue before it is actually collected.

"Merger magic," whereby a company writes off all or most of an acquisition's

price as "in process" research and development.

26

BAD ACCOUNTING

SHABIH KAZMI

How to Figure Out Scandals

This sounds very interesting to figure out scandals in big corporates. But actually this starts

at lower level and then rises to the top. If there is something fishy about accounting or fraud

going on in an organisation the roots are with the people who do these things for the

corporates. I shall give you some of the traits for people and the practices. So here they are

as below:

1. Unusual Behavior - The perpetrator will often display unusual behavior, that when

taken as a whole is a strong indicator of fraud. The fraudster may not ever take a

vacation or call in sick in fear of being caught. He or she may not assign out work even

when overloaded. Other symptoms may be changes in behavior such as increased

drinking, smoking, defensiveness, and unusual irritability and suspiciousness.

2. Complaints - Frequently tips or complaints will be received which indicate that a

fraudulent action is going on. Complaints have been known to be some of the best

sources of fraud and should be taken seriously. Although all too often, the motives of

the complainant may be suspect, the allegations usually have merit that warrant further

investigation.

3. Stale Items in Reconciliations - In bank reconciliations, deposits or checks not included

in the reconciliation could be indicative of theft. Missing deposits could mean the

perpetrator absconded with the funds; missing checks could indicate one made out to

a bogus payee.

4. Excessive Voids - Voided sales slips could mean that the sale was rung up, the

payment diverted to the use of the perpetrator, and the sales slip subsequently voided

to cover the theft.

5. Missing Documents - Documents which are unable to be located can be a red flag for

fraud. Although it is expected that some documents will be misplaced, the auditor

should look for explanations as to why the documents are missing, and what steps

were taken to locate the requested items. All too often, the auditors will select an

alternate item or allow the auditee to select an alternate without determining whether

or not a problem exists.

27

BAD ACCOUNTING

SHABIH KAZMI

6. Excessive Credit Memos - Similar to excessive voids, this technique can be used to

cover the theft of cash. A credit memo to a phony customer is written out, and the

cash is taken to make total cash balance.

7. Common Names and Addresses for Refunds - Sales employees frequently make

bogus refunds to customers for merchandise. The address shown for the refund is

then made to the employee's address, or to the address of a friend or co-worker.

8. Increasing Reconciling Items - Stolen deposits, or bogus checks written, are frequently

not removed, or covered, from the reconciliation. Hence, over a period of time, the

reconciling items tend to increase.

9. General Ledger Out-of-Balance - When funds, merchandise, or assets are stolen and

not covered by a fictitious entry, the general ledger will be out of balance. An inventory

of the merchandise or cash is needed to confirm the existence of the missing assets.

10. Adjustments to Receivables or Payables - In cases where customer payments are

misappropriated, adjustments to receivables can be made to cover the shortage.

Where payables are adjusted, the perpetrator can use a phony billing scheme to

convert cash to his or her own use.

11. Excess Purchases - Excess purchases can be used to cover fraud in two ways:

Fictitious payees are used to convert funds.

Excessive purchases may indicate a possible payoff of purchasing agent.

12. Duplicate Payments - Duplicate payments are sometimes converted to the use of an

employee. The employee may notice the duplicate payment, then he or she may

prepare a phony endorsement of the check.

13. Ghost Employees - Ghost employee schemes are frequently uncovered when an

auditor, fraud examiner, or other individual distributes paychecks to employees.

Missing or otherwise unaccounted for employees could indicate the existence of a

ghost employee scheme.

14. Employee Expense Accounts - Employees frequently conceal fraud in their individual

expense account reimbursements. These reimbursements should be scrutinized for

reasonableness and trends, especially in the area of cash transactions on the expense

account.

28

BAD ACCOUNTING

SHABIH KAZMI

15. Inventory Shortages - Normal shrinkage over a period of time can be computed

through historical analysis. Excessive shrinkage could explain a host of fraudulent

activity, from embezzlement to theft of inventory.

16. Increased Scrap - In the manufacturing process, an increased amount of scrap could

indicate a scheme to steal and resell this material. Scrap is a favorite target of

embezzlers because it is usually subject to less scrutiny than regular inventory.

17. Large Payments to Individuals - Excessively large payments to individuals may indicate

instances of fraudulent disbursements.

18. Employee Overtime - Employees being paid for overtime hours not worked by altering

time sheets before or after management approval.

19. Write-off of Accounts Receivable - Comparing the write-off of receivables by

customers may lead to information indicating that the employee has absconded with

customer payments.

20. Post Office Boxes as Shipping Addresses - In instances where merchandise is shipped

to a post office box, this may indicate that an employee is shipping to a bogus

purchaser.

Let me also make this very clear that these traits are only indicative and if any of these situation

is encountered, it is to be probed before the accusations begin. We have seen some of the

above points in real life also, like the ghost employees of Municipal Corporation of Delhi or

like the case of a Member of Parliament from Rajasthan laundering money through fictitious

firm and so on.

29

BAD ACCOUNTING

SHABIH KAZMI

Your Own Methodology

As a man who keeps his commitments I would like to know about your views and

methodologies on bad accounting. You may write your notes below or share with me through

e-mail. Here you go:

Your views on Corporate Scandals:.

.

.

.

Your views on Accounting Gimmicks: ..

Your views on Bad Accounting Terminologies:..

Your Suggestions or new Terminology:

30

BAD ACCOUNTING

SHABIH KAZMI

31

También podría gustarte

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Entrepreneurship12q2 Mod8 Computation of Gross Profit v3Documento22 páginasEntrepreneurship12q2 Mod8 Computation of Gross Profit v3Marc anthony Sibbaluca80% (10)

- Maf Case StudyDocumento13 páginasMaf Case Studynuraerissa fadzilAún no hay calificaciones

- AMC Theatres Case StudyDocumento1 páginaAMC Theatres Case StudyKOUSTUBH UBHEGAONKERAún no hay calificaciones

- Chapter 13 Property Plant and Equipment Depreciation and deDocumento21 páginasChapter 13 Property Plant and Equipment Depreciation and deEarl Lalaine EscolAún no hay calificaciones

- The Garment Industry Problems 2165 8064.1000168Documento1 páginaThe Garment Industry Problems 2165 8064.1000168nicoleAún no hay calificaciones

- Cips L4M3Documento34 páginasCips L4M3Mohamed ElsirAún no hay calificaciones

- Nyakundi - Procurement Best Practices and Procurement Performance of Smes in Nairobi CountyDocumento51 páginasNyakundi - Procurement Best Practices and Procurement Performance of Smes in Nairobi CountyShaira VelasquezAún no hay calificaciones

- PKSB UasDocumento87 páginasPKSB UasMalika DhahanaAún no hay calificaciones

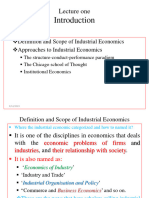

- Economics of Industry PPT Lecture 1Documento62 páginasEconomics of Industry PPT Lecture 1rog67558Aún no hay calificaciones

- Fundamental vs Technical Analysis Key DifferencesDocumento12 páginasFundamental vs Technical Analysis Key DifferencesShakti ShuklaAún no hay calificaciones

- Answers Practice - Questions - Chapters - 1 - and - 2 - GSCMDocumento4 páginasAnswers Practice - Questions - Chapters - 1 - and - 2 - GSCMHardeep SinghAún no hay calificaciones

- Questions: Reproduced or Transmitted Without Publisher's Prior Permission. Violators Will Be ProsecutedDocumento11 páginasQuestions: Reproduced or Transmitted Without Publisher's Prior Permission. Violators Will Be ProsecutedMaZZZAún no hay calificaciones

- The Nirma Story: How an Indian Detergent Brand Achieved Success Through Cost LeadershipDocumento18 páginasThe Nirma Story: How an Indian Detergent Brand Achieved Success Through Cost Leadershipnavalgarg1410Aún no hay calificaciones

- Essay Part 2Documento58 páginasEssay Part 2Silvia alfonsAún no hay calificaciones

- MD Wasim Ansari, Paytm, PPTDocumento20 páginasMD Wasim Ansari, Paytm, PPTMd WasimAún no hay calificaciones

- Cambridge IGCSE: 0450/12 Business StudiesDocumento62 páginasCambridge IGCSE: 0450/12 Business StudiesZaidhamidAún no hay calificaciones

- Wells Technical Institute (WTI), A School Owned by Tristana Wells, Provides Training To Individuals Who Pay Tuition Directly To The School. Part 2Documento2 páginasWells Technical Institute (WTI), A School Owned by Tristana Wells, Provides Training To Individuals Who Pay Tuition Directly To The School. Part 2Fanny SosrosandjojoAún no hay calificaciones

- Targeted Banner Buys on Small and Large SitesDocumento85 páginasTargeted Banner Buys on Small and Large SitesTimur KhasanovAún no hay calificaciones

- A Study On The Effectiveness of Inventory Management at Ashok Leyland Private Limited in ChennaiDocumento9 páginasA Study On The Effectiveness of Inventory Management at Ashok Leyland Private Limited in ChennaiGaytri AggarwalAún no hay calificaciones

- CAMESCO Meeting ReportDocumento50 páginasCAMESCO Meeting Reportchaolisa1Aún no hay calificaciones

- Month Demand January 1,000 February 1,100 March 1,000 April 1,200 May 1,500 June 1,600 July 1,600 August 900 September 1,100 October 800 November 1,400 December 1,700Documento4 páginasMonth Demand January 1,000 February 1,100 March 1,000 April 1,200 May 1,500 June 1,600 July 1,600 August 900 September 1,100 October 800 November 1,400 December 1,700Sthepani7Aún no hay calificaciones

- Soft Drink IndustryDocumento9 páginasSoft Drink IndustryJinson RajagopalanAún no hay calificaciones

- MARU BATTING CENTER CRM CASE STUDYDocumento9 páginasMARU BATTING CENTER CRM CASE STUDYAbsar HashmiAún no hay calificaciones

- History CamelDocumento2 páginasHistory CamelSumi PgAún no hay calificaciones

- Progress Test 1Documento17 páginasProgress Test 1Huế ThùyAún no hay calificaciones

- ITC Auditing - Notes - FINAL PDFDocumento167 páginasITC Auditing - Notes - FINAL PDFLubabalo MapipaAún no hay calificaciones

- 02 Competitiveness, Strategy, and Productivity-1Documento41 páginas02 Competitiveness, Strategy, and Productivity-1scorpionrockAún no hay calificaciones

- Olivarez College: Learning InsightDocumento17 páginasOlivarez College: Learning InsightTricia JavierAún no hay calificaciones

- HSBC Bank India's Annual ReportDocumento40 páginasHSBC Bank India's Annual ReportRavi RajaniAún no hay calificaciones

- Chap 009Documento5 páginasChap 009charlie simoAún no hay calificaciones