Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Gann, W D - New Stock Trend Detector PDF

Cargado por

fantikomed0 calificaciones0% encontró este documento útil (0 votos)

354 vistas52 páginasTítulo original

Gann, W D - New Stock Trend Detector.pdf

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

354 vistas52 páginasGann, W D - New Stock Trend Detector PDF

Cargado por

fantikomedCopyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF o lea en línea desde Scribd

Está en la página 1de 52

MAREEL

With New Rules and Charts for Detecting Trend

of Stocks

BY

WILLIAM D. GANIN

‘MIAME, FLORINA

FOREWORD

‘Acmian ‘writes the best and does the most good for others

wher, his. object in wiiting is not to make money or gratily

fon oF gain publicity, but to help others who anced hefp

and appteciate lis efforts.

‘When T wrote TRUTH OF THE STOCK TAPE iv

1923, It wat because there was a demand for a book of that

kind.’ People necdéd the help that T could give them, am

the benefit of my experience and knowledge, Ini that

I gave the best 1 had and received my reward. People ap-

preciated my cflorts. They bought the book chen and they

are still buying it. “They say it is a good book and more

than worth the money. That is very gratifying to me

‘After the 1929 bull market culminated there was 8 de-

mand for a new book to meet changed conditions under the

so-called “New Tira," so I wrote WALL STREET STOCK

SELECTOR in thie Spring af 1930. I gave freely of my

knowledge anid the benefit of years of experience, This book

helped others to protect their principal

People who read the book pronowaced it

Ie is still selling, antl again I have been rewarded.

No man can learn all there is to know abyut forecasting

the trend of stocks in 3, 5, 10, or 20 years, hut if he is

deep student and hard worker, he leans more and know

edge comes easicr after years of expericace, I knew more

about determining the trend of stacka in 1923 than |

in rgrt. Seven more years of expericnce gave m= more

knowledge and cnabled me to write the WALL STREET

STOCK SELECTOR in 1930 and give my readers the

Benefit af my inerensed knowledge. Now, after fire more

years have elapsed, my experience and practical test of acer

rules have enabled me to lenrn mare of value since 1930.

FOREWORD

The 1929-1932 panic and what has followed since, guve

me valuable experience tn

id F have pained more knowledge

tecting the right stocks to buy and sell. I cannot

T pass this knowledge on to those who will appre-

of people who have read my books have asked

me to write anew book, Again, T answer the call and meet

the popular demand with NEW STOCK TREND DE-

ll help others to avoid

of the pitfalls of reckless speculation, Tf T can lead

a few more to the field of knowledge, [ shall agsin be amply

repaid for my efforts,

W. D. Gann

January 5, 199%,

23 Wall Sineet; New Yorks

csvset iabeaaF OSES san

mean totter ined ttn

NEW STOCK TREND DETECTOR

CONTENTS

Bel

Hietory Repeats. i aaa

dual Stocks v3. Averaues ‘ pene

¥. New Rules to Dect Trond of Stucke See

‘VIL Volume of Sales ; a eee ar

YIT, A Practical Trading Method. Ses fer

VIM. Future Trend of Stocks... a on

i

|

i

4

}

‘cies eet cnet erect aliments

a. Ujtited Fruit—Werlly High and Tar:

je Cam Products—Weekly High and J

36. Com Producte--Weelly High and Law: 1934-1935

icing Monthly High and Low: 1924-1933...

5. National Distllere—Momthly High and Low: 1925-1939. 57

6. United Fruit and Chrysler Motors Comparison: 1935-..-. 62

NEW STOCK TREND

DETECTOR

CHAPTER I

A NEW!DEAL IN WALL STREET

Since writing TRUTH 0 THE STOCK TAPI

ay23 and WAT,L STREET STOCK SI SLO in 1939,

the greatest panic that the world has ever secit has tnker

place, culminating with thé greatest stuck decline in history,

reaching extreme low levels on July 8; 1932. €o

ave changed since 1939 and riew laws have heen passed af-

‘The passing of the law

ing stork ext de a great change in the

a stock market and "

late new rules to meet the The Bible

01d things pass away und new oncs come to tuke their

places.'(EYA wise mat changcs his mind; a foul never."" The

see the new way of doing things is doomed to failure.

This is an age of progress. We move farward not back

ward, We cam We must go ahead with

progress or retrograde into the list of the “has beens.

Henry Ford made hundreds ms of the

Tt was a good car in its day and Ford

with it, hut timie and conditions cl The

changed ‘and demanded an up-to-dare, better car

Ford, heing a wise man, saw the “han

and changed his rm dst of

greatest depression, Ford closes! and sper

$10,000,000 to develop a new and better ear, or as the

t

a NEW STOCK TREND DETECTOR

boys say, “He made a lady out of ‘Lizzie.’ He was not

actuated hy the desire fot mpre roney when he developed

this new car, It sas pride and ambition and not greed

hat urged him to keep the public's ood will by giving them

a better car at a lower price. The public reepunded quickly

and the new Ford became s leader. Hach year Ford has

the 1936 Madel is the best car yct

produced,

Politicians with scliish motives ave always preached

way business is handled on the New York Stock Exchange

and the type of men who handle it. “There is no business

in the world whe er type of honor exists than among

the men who are members of the New York Stock Exchange,

No business men in the world live up to their contracts like

the brokers on the flaor of the New York Stuck Fxchange,

ines uf business-cuntracts are miade for future de-

livery of different classes of gonds, lumber, textiles and mer.

cantile products of various kinds. In cases of this kind,

when prices advance, the buyer calls on the seller to. make

delivery of the products, but whem prices decline he cancel:

Jhis coutract and leaves the seller to get out the best way

fhe can, L quote from a letter received from a prominent

‘After trading there ten eau it fz my aplolon there fs probably no place

‘be business an fre of repuintons et se a dlshonesy.

Such a thing as a member of the New York Stock Ex.

change ever attempting ta cancel his contract for a stuck

*

i

}

mie

Sis rennaent irene eer ieeni es mee

A NEW DEAL IN WALL STRELT 8

he buys or sells is waheard of. When a broker buys av sells

stocks ofi the New York Stork Exchange by raising his hand

or nodding: his head, he is bound by hi

act and he does. No matter how much the stuck

the logs is, be never welches, He

not attempt to cancel his contract. He minkes his de

The brokers and the managers of the New York

Stock Exchange are honest and reliable men. ‘The public

‘has beew confused ay to the position of the New York Stock

Exchange, which is but the means and the am ery for

carrying un transactions between buyer and seller. The

brokers on the Huur of the New, York Stock Exchange are

in no way responsible for the actions of pools or outside

deals, which at times have been handled by unscru

manipulators in the pst, but the public has been isd to

Believe that the Stock xchange and its imembers were work-

jing against them. The brokers ly buy and sell for a

mmission and give the beet service possible to their cuse

tomers, The New York Stack Exchange serves a useful

purpose, ‘The greater part of the manufacturers af this

country have their stucks listed on’the New Yurk Stack Lis:

change and every buyer and seller can know every day wh

the prices are. Without Stock Exch:

there would be no Cl

who need money could ins

cash. The fact that the New Yark Stock Tixchange has heen

in existence site 1792 proves that It fills an economic acd,

cr it would have long since'been ont af business,

For years Wall Street and the New Yark Stock Ex

change and its rules and way of doing business were com

sidered the best and necded no changes, “Then en

“New Deal’! and the Securities Exchange Lew which

pelled changes in rules, Before these iaws were pr

effect, the New York Stock Exchange saw the need

now way of duing bus

oughly inforn

4 NEW si10CK TREND DETECTOR

Wor Brame Wat Sigexr ano 1H New Yous Srock

CHANGE T

Phe man who makes profits never ives credit to Wall

Strest brokers oe any dne cise for his profits. He taker

credit for makisig them himself. Then, why should he blame

his Inesen on someone else?

Tr you make a trade it storks and lose money, do not let

politicians Iead you to believe that pool managers, manip

laters, Il Street, or the Net York Stock Exchange are

the cause

; therefore, don't play the

if you lose. If you had carelessly ran ia

automobile and were injured, would you blame the aulo-

wr the driver far your carélessiesa? Just because

ears is no reason why laws should

iobiles off the roads and streets.

mobile

people have been killed 6

be passed to keep auto

Politicians have (ried to pass laws for years to restrict the

tiseful operations of the Stnck Exchange and Commodity

Tixchanges just because peaple’ who Tost maney have com

serve

plaisied ty Congressmen against the Exchanges w'

a uscful purpose.

‘Taw Law or Surrey anv Denman

New York Stock Exchange, New York

Cotton Exchange and the Chicago Board of Trade are

governed by Supply and Demand, No matter whether the

by the public, by pools, or by manipu-

latorg, prices decline when there are more sellers than buy

tre and prices advance when stocks are scarce and when

there are more buyers than sellers, The members of these

Tixcligniges do not make the markets; they only do.the buy-

ing and selling for the public and large operators. | The

fpovle and large operators in the past have manipulated

pe prices ani the

buying or

EAI ee Shs tien nc onnarci

‘A NEW DEAL IN WALL STREET 5

prices, but no bhune-should be placed on the Exchanges

which merely act as 4 ¢learing house for the transactions

Li you could find out the rules the master market makers

use tu make money, you would buy and sell when they do

and make profits, woulda’t you? Tf you knew what che big

operators were doing, you certainly would follow

People ultei ‘How can | make some casy money?”

or “Loe can L y quick?” There is no way

ny way to make money

Jedige yourself, You muse

pay for whatever y

paying for. Getting,

Unan good,

You can learn what the big operators are cl

a guud Wall Street detective. You can detect wl

, “wers that he’ are doing, by a study of Supp

nand, ‘Lhe records of the total sales and

low prices of every stock are published daily in the news:

papers throughout the country. ‘There is no soeret alt

it. Te is just up t0 you to Collow rules.

ty and Demand and apply n

trend and make money.

changed stork trading so far ag the public is concerned

Washed sales under the Securities Exchange Law are m

longer permitted. The specialist Is restricted on lrarles that

self. Short selling bas been cureailed.

fn reyuired lo carey

xes have been

1 the amount of

, both income t

raders and investors to hold on longer and not sell out t!

stacks because they would have ta pay such a large amount

This changes the tech.

times but

tite ye RGN See ete. on Me RR

6 NEW STOCK TREND DETECTOR

uch weaker and stocks will decline

short interest in the future will be

be smaller, and the support

wach smaller than it

eventually will mak

muck faster because

limited, pool operations

in the marker by che specialist will be

has been in the past.

Pheee will come a timc when the tnatket.will rum into

vy selling; bids and offers will bo far apart. It

h everybody wants to sell and

‘Another thing, heavy margins will

work against the market and cause a greater decline, because

when people put up 40 to 60% margin, they

fonger, or until the nearly exhausted,

bouy will want to sell at the same time and there will be few

s It is my opinion that the lars passed to regulate the

Stack Exchange will not prove beneficial tw the public in the

future, just as many laves already passed by the Administra-

thon under President Roosevelt have already proved ta be

dletrimental und the Supreme Court has found it necessary

constitutional

to declare them

CHAPTER IL

Have you ever stopped to thine and make a careful

analysis why you have lust money in stocks or why you

heen wrong when you made a trade? If you have, you have

probably found that you traded on hope, bankers’ opinions,

brokers’ upinions, or relied on tips, ar you guessed yourself

Another reason, because you did uot admit to yourself thet

you could he wrong and did not protect yourself when you

made the trade, But regardless of how you made the mis:

take and had the loss, the fault was your own, because you

had no definite rule or plan or way to know just when tu

buy and sell.

You should learn to trade on knowledge, which will

climinate fear and hope. Then, when hope or fear no

longer influence you, knowledge will give you nerve ta trade

and make profits. You should learn the truth about « stock,

then learn hove to- apply: all the rules that I have given in

my books T RUTH OF THE STOCK TAPE, WALL

STREET STOCK SELECTOR and in this book, NEW

STOCK TREND DETECTOR. Then you will have 2

knowledge of trading and an education that you never had

Before, and when you make a trade, it will be for a

and aufficiefit reason and on definite rules. You w’

hope nor fear then. You will trade on facts. You

tece your capital and profits by the use of stop loss orders

and will make profits

“There isonc way to alyrays correct a mistake if you buy or

7

WGK TREND DETECTOR

sell a stuck against the trend, and that is to place a sup loss

ander, A stop loss order protects you in many ways. When

you buy a stock, place a stop lust order 1, 2 of 3 polis away,

you are out af rown or out of reach of your broker

and sore sudden, unexpected event happens to cause a sharp

decline and the stack reaches your stop tuss arcer, you att

automatically sald ont.. “The stock might go 19 points lower

the same day before they could reach you. Yet, you are pro

tected because you! had your order with the broker to sell

You did not have to he there to watch it and did not have

tu be where the broker could reach yo

“There is nothing that will give you more valuable in-

formation ve enable you to (ell more what a stock is going

to do than to study itg past actions and apply the rules that 1

i Tf you know what a stock hs done in the

¢ what it will do in che

ig recorded. und reuis-

fluenced by Supply

studied correctly, will tell

you more about the stock than

papers or any other kind of so-called

Learn To Be IyperenDENT

The greatest helps that one man can give another is to

show him haw to help himself, “The man or woman who

depends on others for advice, for inside information or whut

others think rbout the stock market, will never, make 2 suc.

cess of speculation ar anything else. You must lenrn to be

pendent. Learn to do hy doing end to know by study

and application. ‘Then you will have eonfidence and courage

na one else can give you.

not fallow blindly the opinion of

what their opinion is based on, but

when he himself sees understands and knows the rules that

sreeast stock market trends, then he becomes a good Wall

Street detective, He detects the future trends and follow

FOUNDATION FOR SUCCESSFUL TRADING 9

polongersays, “LE Lkwesr the infor

mation T get on Chrysler was right, I would buy 5e0 shares

instead of 109.” When he sees and. unde

Chrysler gives a definite indication of an advan

has no fear and no hope, but has co

buy s00 shares.

No matter what business you are

you cia about it, The mast important t

your health, for yon to protect is your

take time to study and prepare y

money yourself and do not depend forever and entirely upon

others.

lence and

ug outside of

Therefore,

A Drristre Pras

Make up your mind now tu have a definite plan or

the future, Decide to [ollow rules when you buy or sell

stocks, but first 3 are good

hey will work.

ales given ini my books are good practical rules.

You can prove them to your, own satisfaction in a short

peried of rime. Many men and women who

ny books, TRUTH OF THE STOCK TAPE and WALL

STREET STOCK SELECTOR, have learned the rules,

followed them and made a success, and you can do the samme

if you will werk and study hard.

Lhave studied and improved my Methods every

for the past thirty-ive years. Tam still learning. Some of

ny greatest discuveries-were made between 1932

After Jong years of study and research, I have si

and made my 1 al so that others ean a

as easily as I can.

have cut down the work eo you can get re:

have made profits by following strictly the samc rules.

Kwowsebor BriNes Success

The door that opens to big profits has but une key to

unlock it and that key is Knowledge, You cannot get that

0 NEW STOCK TREND DETECTOR

knowledge without work. have made a success by hard

work and you, toa, can make plenty of money out of the stock

market if you study and work hard enough. Work is the

sin Wall Street.

il not go for his hank-roll or jewelry.

at she sought, and his great wisdom won her. luye, so

Arthur Brisbane says, and T have a great respect for Mr

Brisbane's opinion. TV you yet practical knowledge on stocks

and commodities you will have no trouble in getting capi

to make nore money with. Money always cymes to know

Knowledge money is worthless. You can in-

money and make wise investments when you

red knowledge,

Quatarications ror Success

15

First and most important —You must get Knowledge.

Jed co spend thirty minutes ta one hau

studying stack market movements for the next five

Then you will ger knowledge of how to detect stack

ends and will make money, You will not be look«

4 quick and easy way to make money, You will

in advance swith time and stndy. The more ti

getting knowledge, the more Maney you

KNOWLEDGE

make later.

END; PATIENCE

cations for suc

‘his is one of the very important qual

cess. When you buy or sell you must have the patience ta

wait for oppor bt. Then, you must have

the patience to wait untilthere is a change in trend hefore

‘you close a trade vt take profits

|

FOUNDATION FOR SUCCESSFUL TRADING 11

gape NERVE

1 can give @ man tl

hasn't the necve to pull the trigger, he wi

game, You can have all the knowledge in the world and

if you haven't the nerve to t make

any money, b makes

him bold and enables him to act at the right time,

41H; Coop HEAL

‘Alter you have gained knowledge, acquired patience and

developed nerve, the next important quality is good healt!

No man can have patience and nerve und do his best unless

his health is goud, If you are ia bad health, you becomte

desponilent, you lose hope, you have too much fear, and you

will be unable to act. I have been through the game for

all these years; have tried to trade when T have been in bad

health and have scen others try to trade, but I never saw 9

rman yet make a success speculating when his health was bad.

7

_The thing to do if your health gets bad is ta quit business,

quit speculating and get your health back, for health

wealth,

STW; CAPITAL

With all of these qualifications fur acess,

you must bave capital, but ave knowledge and

id make a fot

patience, you can start with a small capital

GE money, provided. you usé stop Foss orders, take small

and do not overtrade,

ick the trend: after you detect the

trend, go with it regardless of what you think, bope or fear

aid you will make « success. Read and follow the "twenty:

four Never-failing Rules” om pages 18-19 of WALT:

STREET STOCK SELECTOR

losses

Remember, never

CHAPTER III

HISTORY REPEATS

le market moveinents can be

study of past history and past movements. By knowing t

preateot advances Bave taken place and the

rimes whion the greatest panies and ue

afd the time periods'to watch for major and

jn Wend, you can detect what to expect

vemember une thing, whatever bas happened in

the stock matket and Wall Street will

vances and bnil markets will come in the ft

rey Just as they have in the past.

st of a hatural law and the balanc

nc with price, [Tt is medion In one dircorion sind reacti

the opposite direction. Tn order to make profits, you must

learn to fallave the trend and change when the trend changes:

War in the past has always had a great ellect upan stocks

ices. ‘The starting of wars often has pro-

harp decline’ followed by booms, and after

as another sharp decline «ar

: boom with probably higher levels than

ng the war days, Tt is important, therefor,

to study the action of stucks and commoditics around the he-

inning of war periods and after the ending of wars

to detect what may happen in the future when these

repeat.

It is important to study the time that has elapsed between

bottoms and tops and the greatest duration of any bull «

ag the greatest duration of any panic or decline.

rH

me

cae et

HISTORY REPEATS 18

W. D. Ganw Avaraces

1856-3874

1fs6—If you will refer to my averages

SIREET STOCK SELECTOR, you wi

n February, 1856, storks reached a high of 93 14-

Then followed 9 period of distribution,

4857—In January, the last high was reached at 92, fi

which a panicky de 1 was the 1857

panic, which culminated in October, 1857, with rhe

‘Averages down 58 points in a period of six m

1858—A rally followed to March, 18,8, lasting ive mos

wed andl miade Ie

je market dec Juné, down

15 montl

1860°—Tn September, the high was made ugain, 15 months

up.

1861—Last low on the Averages at a8 in March

the last low before

to compare with other war booms.

1864—In April the Averages reach:

46 tconths {rom the last battor

they decline mute than two consecutive 1

1865-—-March, low #8, dow

hier, high 121; time, 7 months:

1866—February, low roo; ti

12g, 8 months

8. From

186g—July, high 181; time, 27 months from Ap!

‘50 months from March, 1865 low; and 99

from March, 1861 ch wes the most impoc-

tant time periadl to

3 months, ‘The

1a Nrw STock TEEND DETECTOR

months. This ended the great after-war boom, and

a panic followed

1873—November, low 84, 2 decline of 96 points from the

of 1869. ‘Time of bear calapaign, 52 months,

it from August, 170 to May, ©871, there was a

rally of 9 months and from January to June, 1872,

a ally of 6 ma ind from November, 1872 law,

a rally to January, 1873, a two months! rally, which

cated & weak market, just as we hed in 1931 and

1932

riyq--Fabrunry, h

In June and October

4 months and 8

May, 1875.

12 Inpusteis. Stock AVERAGES

175-1896

Here we begin with 12 Industrial Stocks which were

ahout the same as the Day-Jones Averages, which started

in t8yy.

1875—March, high §33 October, low 48.

1876 February, high 52.

1877—October, lay 36, a decline of 16 munths witho

in August, 1879 and tasted

of a2. months.

1881, a pel

72, an advance of 47 months with «

notion in 1978 and 1879,-und 2 t 3

reaction several times. :

1881—June,

G-amonth

0

re)

From June, 1881 to June, 884, there was an cx:

rome bear exinpaign with the Averages down from

72 to 42. The Bear Campaign lasted 36 months

trith only & 2 months’ eally, like the rally from July

to September, 1942, Then, from the top of a rally

in August, 1884, there was a decline to

pees eee

FUSTORY REFEATS: 7

1885, inaking a double hattom at 42 ax

cof Tune, 188

1885--Noveinber, high 57, up 10 months.

1886—Mj

1887—End uf bull + tiene, 34 months from

1884 low and 27 months from the secondary bots

tom of January, 1885.

1888—April, low of hear market at 51. Time, 11 2

1890—A third top at 63 was Fi January, 189,

snaking this almost 2 triple top and selling level

41888—1890—The time from April, 1888 to January, 190

was 2 months,

18go-—Detember, Low of decline

from last high of January, 1899.

189a-—January, high of bull marker. at

months from 18g, “Then ful

1893. August, 1893, hoteom of bear market at 4%

down 32 points in 7 months. %

ring —t camipai

mantis. was really 2 ral

far the rain trond was still dor.

1896-—Bryn Silver Panic:

‘August, 196, low of the Dow-Jones Averages at 29

‘Time, 14 months from: the top of 1895, and 43

snonths from January, 1993 top, After this panicky

ne was over, the McKinley boom started,

lasted for seweral years.

Dow.Jones IspusreiaL AVERA

£B97-1935

1897—September, high: 55-1

1898—March, low 42. ‘Time, 6

top.

rfigg——April, high 78. ‘Time, 13 mor

12 month

jonths frov

A sharp de

16 NEW STOCK TREND DETECTOR

followed in May; then a slow advance, Sept

high 78, same ag the April inne, from 1396,

37 months and from March, 1898, 18 mor

Eoprember, low 53, Time, 12 months.

the end of the bull market. December, low 62.

Time, 6 ioonthe.

tge2 April, high 69. Time, 4 month

t9og—Octoher ant Navember, low 4214. Time, 28 to 29

m from 1go1 top; 8 months from top of last

rally in February, 1903. After 1903, the Indust

Averages “became more active and were leaders,

whereas previous to this time the railroads were the

ctive and leading stocks. The rails did

18y6 tm 1906, which was the Last

continue wi

1906 h 103, Time, 27 months from 1903

ted more than’? months, an

ation of a strong bull market. Low of reaction xt

86 in August. ‘Time, 6 8. October, high 97.

1goj—January, high 97, from which a big decline started,

‘March 14, 1g07, 9 panicky decline known as t

Ssilerit pa Stocks deelined 20 points that day.

Low of the Averages was 76. Rallied eo 85 in Ma

then declined to 43 in November. ‘Time, 22 months

from January, 1996 high, Accumulation took place

and a bull market started fram Noverber.

}—October, high rox, top of bull campaign. Time, 23

months, Never reaeted more then 3 months.

1910 July, low 73, bottom of dei Time, 9 1

1gt1—June, high 87. Time, r1 months

followed. September, law 73,

1910.

Jow and never rei

HISTORY REPEATS "

high 94, top of bull wave, ‘Time, 13

the third tire

‘ways indicates that an advance shou!

as the third bottom is not liroke, September, high

83. ‘Time, 3 months, December, low 76.

agiq—March, high 83, same as September, 191g. War

was declared in Europe in the early part of July

and the Stock Exchange dlosed at the end of July

and remained closed until December, Alter

the Exchange opened id December, 1914, the 1

trial Averages declined tu $374; the sine low level

reached in 1907. ‘Time from October, 1912, 26

month

191s —December, high 9974, just under the tup uf 1909.

12 months from 1914 low.

1916—Aprily low 85. ‘Time of reaction, 4 months. No-

vember, high 119, top of bull campaign.

a new high level for the Dow-Jones Indu:

ages, ‘Time, 23 months from December, 194

1gt7—Hebruary, low By. June;

Then a big panicky decline followed. December, low

66, hottam of bear campaign. ‘Time, 13 month

1919—November, high r1g 4, top of bull. eaenpa

24 months from December, 1917 low. No reset

lasted more than 3 months.

1g20-—Deceimher, low 66, same low as 1917.

top, 13 mon!

ige1—May, high 79. August, low 64, not 3 points under

the rr7 and 1920 lows, which was a sig of good

support and indicated that 2 bull market wauld fol-

low. ‘Time from 4919 top, 21 months.

1 NEW STOCK TREND DETECTOR

192 1—t9ay Buit Camraicn

followed the preatest

ninatimg

m. the low in August, 192

bull market in the history of the ‘United States,

1923—Top

ached in March, 1923,

ne, 1g anonths, Low of reaction at 86 in Oxto-

‘Time, 7 months.

fy, 105, From which a 3 menths

May, low 89. May, 1924 was

je real beginning of the Coolidge Bull Market.

1gag—In January the Dow-Jones Averages crossed 120,

1c high of t9x9, which indicated much higher

prices hecause the valuite of trading was heavy and

stocks were very active.

rozh—February, high 162 from last low, 20

jonths, March, bettom of a sharp decline, the

Averages declining to 136 and some stocks declining

100 points in this short period. “The Averages held

for a few months in a.narrow trading cange and then

started up again. After that no reaction fasted more

than x months until 1929.

1929--On September 3, 1929, when final top was reached

the Indust wrages made 386, up 322 points

fram the 1g low and 300 points from the 1923

low ow to 1g20 high, 97 months.

(Refer to 1861-1869 and you will see how this com-

pares. The Tull Campaign at that time lasted 99

‘unl was one af-the greatest in history until

1929.) The time [rom the 1923 low to 1929 high was

n the 1924 low, 64 months: from

cd Fron the Inst low

of October, r926, 35 months.

Te is before and after wars that you cam determine the

greatest Jength of time a bull market may run and the great:

HISTORY REPEATS w

icky decline may run.

September, 1929 was

ch began

tion of the bull market

regule of a longetrend business cycle: w

1lig6 and continued for 33 years, with each ca

market making higher prices, which showed that the long

hat after the greatest

in histos

was up, Tt was only, natural

I market in history, the greatest

must follow, and ce deterrvine how long

jght run, you would Look mack te sce

after previaus war booms!

1869-18 1 1Big to 1873 We

period was 53 months and chat the market id 4 9

ear mat

bear campail

rally, a @ months" rally and a 2 rally dh

period.

1871-1873: May, 1871 top to November, 1873 low,

imc, go: months. S

3881-1884; ‘Then we refer tu 1881 to 1884 and find

at the bear market lasted 36 months.

1893-1896: Then we refer to 1893 to August, 1896

and find that the bear market !nsted 43 months.

Going hack over all the cecords, we find that th

est bear market bad lasted not more than 43 mont

the smallest had been as short as 12 months of th

had culminated around 27

and in extreme declines, anywhere from 36 t 43 7

Therefore, fram 1929, based on past records, wre would

begim to watch for bottom around the goth tm the 36th

ronth aid then again around the 4oth to 43rd month.

1929-1932 BEAR MARKET

First Section of The Great Fear Market Sept

1929 to November 13. 1929-

The Dow-Jones 30 Industrial Averages declined from #

1 of $86 an September 3, 1929 to n low of 198 on No

nber 13, 1929, 4 decline af 188 days the

Be

20 NEW STOCK TREND DETECLOR

jiecatest decline in the history of the New York Stock Fx-

‘change in the shortest périod uf time,

‘A sceondaty rally ‘culminated on April v7, 1930 with

the averages al 297, ub.a§ points in 155 days.

of sales decreased in April. “The top of a secondary rally

is always an important point ro watch.

Second Section of ‘The Great eat Market— Ap

to December 17, 1930:

Fram the top on Ap

tw December 19, t93a, The averages declined from 297

nc of 142 po age days or §

1d rally carried prices to top on February 24,

93 @ averages af 196, up 41 points in 69 days.

Th .¢ period and smaller number of points indi

cated weakness and showed main trend dorm.

‘Third Section of ‘The Great Bear Market—February 24,

Logi to January 5) 19925

After wp in

started and i

f December, 1930.

ued to 120, the top of November,

1gtg. My rule is. thar old tops became buttons and old

tums later become tops; therefore, from the old tap level

iy coll be expected. From June and to June 27th the

in ag days. 7

was a quick rally in a bear market and showed weakness

since stocks could not rally oi full month. After this rally

ere was a decline to October §, ty31, with the Averages

rat 8554, clowa 72 points in too days, A quiek rally followed

to November 9, 1941, with the price at 119, up to the bot-

2, 1931. Here we would expect selling under

according te my rule of old bottoms beeam-

"Chia was a rally-of 35 points in 35 days. The

id down was resumed and on December 17, 193%,

just one year fram the low of December, 1930, the Averages

Ap

Qa June'2, 1938 de

|

j

\

|

\Satseprelpartmnsynntenerttsiernnl thet eer

HISTORY REPEATS 2

reached 72; had a quick rally ta 83 on Dece! rgth and.

declined to 7a on January §, 1932, down 4yJ4 from the last

high of November g, 1931. This decline lasted 57 days,

but was 192 days frorti June 27, 1931 end was really the

end of the Third Scetion of the Great Bear Market because

altar the low of Jamary 5, 1932, the market rallied to

March 9, 1932. 1c Averages reached 8934, up 1944

points in 64, very frehle rally for the time required,

ich showed that Iiquidation had not run its course.

Fourth Section of The Great Bear Market—March 9 tw

July 3 1932

The fourth and last section of the great Hear Market

lasted four months, from March g, 1932 to July 8, 1932,

49. points

1c from Nowe

g to July 8, 1932,

quidati the greatest rally «

ages was ‘7 points, and each deci

gat shorter and the volume of s#les Tess, which showed

im was about over. ‘The last decline from June 16th

y 8th was 11 points, Then the Great Bear Market

ended and the trend turned up.

On July 8, 1932, the Dow Jones Averages

4034, down 34 months from the 1929 top and 27 mu

from April, 1939 top, which were time peciods when we

would expeet a sharp, panicky decline to end, espee!

decline which had carried the Averages down 345 pi

34. months and wiped ont the gains of 33 ye

stocks,

Note thar in April, 1897, the lust low wa

which the real bull

Averages reached this.same level, 4034. a

a diferent number af stacks.

Previous to the bottom ia July, 1932, the volume of sales

sinn

4078, [ro

ret started, and in July, 1932 the

jagh there waa

CK TREND DRTECYOR

8 NEW

and time periods all indicated that the market was near the

eid of the bear campaign.

1932-1935 BULL MARKET

First Section of Bull Market—July 8 to September 8 1932:

From the low of 4034 on July 8, 1932 the Dow-Jones 30

Averages rallied to 81 on Seprember 8

‘This was a fast advance

but when stocks

could not hold and go higher in the third mond

indication of lower prices. The large voltine also made

this was only the first rally in the bull campaign,

decline must follow.

the Bear Marker had a sec

an November, 1929 to April, 1930, s0 after

the market had given a signal that the Bear Market was

aver, there was a secondary decline, whieh lasted until Feb-

ruary 274 1933. with the Averages at 4934, down 31 points

from the top of September 8, 1932 in 172 days, but g points

above the 1932 lows, Ac this time President Roosevelt was

inaugurated and banks closed. The New Yorke Stuck The

change closed for one week. The valume of sales was very

small, which indicated liquidation was over. When news is

the worst, itis time to buy stocks, as a Bull Market bepins

ia gloom and ends ie glory weich mothing but good news.

it was an

Secund Section of Bull Market—Feb:

July 17, 1933

The averages advanced from the low at 4934 in Rebru-

ary, 1923 to a high of 10% on July 17, 1933, up 6 points

in 141 days, ‘Time, 12 moaths trom July, 1932 low and 5

months from February, 1933 low. My rule tells you to

always watch for a change in trend-one year, two years, etc.

fi nportant top and bottom. ‘The sales during Ma:

June, and July were larger than at the end of the Bull Ma

ry 27, 1933 to

HISTORY REPEALS 28

ket in 1929. This enormous ¥

the mazket-was reaching a culmination and a sign of top.

Arreaction followed. The Averages reached bottom at

425 on October atat, 1933, down 28 points in 96

The volume of sales was small.” In view of the fuct that

the: Avetageedeclined only » paints under the Inw puint af

July 21, 1933 and did.not decline to the top of B1}4 made

con September 8, 1932, indicated that the main trend was

still up.

Third Section of Bull Market—Oetober 21, 1939 to Feb-

wary 5, 19942

Fram the low at $244 on etuber 21, 1943s the Aver-

ages worked up to 11134 on February 5, 1934,

ove the top of July r7, 1933. « double top on large

volume of s million shares per day. This was an advance

of 29 points in roy'daya. Tit, 1 months from July, 1932

low and 4: months from October, 193, nce the Avers

dito go through t12, the market indicated ap.

a renction to July 26, 1934, wil

Averages declining to 8435, 4 de i

days, the same length of time us the reaction from Septetnber

.8, 1932 to February 27, 1933. ‘Time, from February, 1934

top, § months. The volume of sales om July 26 was 3 mil

shares and the Averages were 2 points above the low

This Inege volume and

jon of hottorn.

Fourth Section of Bull Market—July 26, 1934 Mov

her 20, 193!

The 30

July 26, 1934 to 14934 on Navember 20, 1935,

of 6s paints in nearly 16 months. Time, 40 months from

July, 1932 low; 39 months from February, 1933 low; 25

months from October, 1933 low.

‘The greatest reactions were from August a5, 1934 to

September 17, 1934, a decline of 12 points, and from

the

trial Averages advanced from 8434 on

advance

a8 NEW STOCK TREND DETECTOR

Kebruary 18, 1945 to March 18,1935, 2 of 12 points

on the averages, and as this ly one month,

it showed as still up. Alter March 18, 1935

‘here was no reaction of over 8 puints aftd none lasted

more than 9 weeks until top was-reached on November 20,

1935. ‘Then a roaction followed to December r9, lasting

cone month, a decline of 11 paints, The volume-of seles

Octaber and Nuvember were 104,000,000 shares, whieh: in

(Feast temporary top, with the Averages up 109

om 193 low, and np 5334 paints (rom March 16,

period of 247 days,

ossibly 112, the old top of 1933

before, follow the trend of ine

I go op

vysq, but as | have §

dividual stocks when you trade as many of them »

trend of the ¥

az Penrous To Waren rox Furyxe Cuawcrsin Trane

il be 42 months from 1932. low; Mareh,

mnths from February, 1933 low; July,

vn the 1933 top and 48 months

herefore, these months will be very

ie

f 1932 low.

importentin 1936 to wateh for chaages in t

Cause oF THE 1929-1932 Panic

« from 1929 to ayj2 was so drastic

becauge people wh bought at high levels held on anil hoped

and bought more to average on the way down. They were

wrong at the ey bought the first stock and continued

ta be wrong by bucklng the trend and buying more ta aver

age, the worst thing that any trader can do. Remember,

average your profits, but never average a los

‘Alter stocks hacl declined too points or more, other peo:

ple began to buy stocks, because they thought they were

cheap--and the only reason they thought they were cheap

HISTORY REPEATS 25

was because they were down r00 points compared with high

levels, ‘his was the worst reason of all for buying, stocks

Later, when-stocks were down around 150, 250 and 4

points from 1929 top levels, wiher people baught for the

same reason, that they were a long distance dows fram

top and looked cheap. They were wrong beeause there I

been no change in trend. ‘The time pe ad hiad not ren out

and the macket had not given buying signals

If these buyers had only waited, and had known how to

follow the rules laid down in my books, WALI. SYTRETET

STOCK SELECTOR and TRUTH OF THE STOCK

TAPE, they could have determined when the trend chenged

and could have ought stocks at low levels and made

profits, but mast of them were buying on guesswork and ho)

fg thar the stocks would go wp. Many of chese people, no

doubt, made up their minds to sell out when a rally came,

but fixed a price wt which stocks never rallied to.

hoped for a it the hope was nut based on any sound

reasons and there was ao sound reason for expecting a rally

ur an advance thet would Let themout.

Hope Gives Way to Despai

Finally, in the Spring and Summer of 1932, when stocks

bad declined (o what lonked like ridiculously low levels, they

continued to decline from2g te $0 points more. This caused

ers and investors to lose hope, Their

‘They saw things in

grew’ sick.

the very worst way and all sok

‘were forced to sell, because they could nor put up mar

gins to carry theie stocks; others sold berause they fea

stocks would go lower, which was no reason for selling

more than when they bought because they hoped they w

go up, which was no reason for

Id

“wn Boucirr Stocks 1 THs PaNic?”

Many people ask this question. The people whd bought:

stocks at low levels were those wise oncs who sold out in

Pe ee ere nn

a6 NEW STOCK TREND DETECTOR

1928 or early 1929, or sold after the first hreak in Sep

tember, 1929, when the signs wert plain that the trend had

turned down. These people kept their moncy and waited,

until conditions Iooked the worst; then bought stocks when

they were far below their actual value. They received 2

rich reward for their patience, knowledge and nerve, for it

took nerve to buy when everything looked the worse, just

as it took nerve to sell in-1y2g when everything looked the

at ancl one could hear nothing but «optimistic talk

WiLL Stocks Go Back re 1929 Hhons?”

anuther question that 1 haye. hee asked from

ne to time, Why do people. ask this question? Because

ity of them held stocks bought at very high levels and hope

that they will go up sv they-can get out without « loss, Tam

ial Averages will

ver sell at 380 again. [am also confident that the Rail-

road Averages will never sell at 189, the high uf 1929, and

hat many of the pe

tgzo levels again. W

at

¢ utility stocks will never reach the

7 Riecause at the time they sold

abnormally high levela, their selling price was nut

2 power. Prives were forced to

reason that everybody wa

gambling mad end buying regardless of price or valuc. They

will not buy stocks again like that for @ Jong time to come

operations.

‘While 1 do not expect the Averages and old-time Te

1935 Bull’ Market new leaders developed that went [ur

ove the 1929 lhighs. In another chapter we give you ex

amples of stocks that crossed 1929 highs and show you their

position and hove plain the Indications were that they were

i higher and the omes-to buy. Other stocks, later on,

ge above their 199 highs, as will be explained in the

ring chapters.

CHAPTER IV

INDIVIDUAL STOCKS vs. AVERAGTS

For years the Dow Jones Industrial Averages, Uailraad

Ltiliey Averages have been # reliable

market. Years ago when there

were representative, they

ial stocks, When Rail-

road Averages

91200

Averages, and Pul

guide the trend of tt

were 12 Industrial Stocks

were a guid’ to the trend 0

roads were the Headers dnd active, the 20 It

were a good trend ator, Bit now.

rere ave listed on the New York Stods Exchange, the 20

Railroad Averages and the 30 Industrial Averages are no

Jonger representative or a guide to the average te! dl of the

entire market.

Various industr

changing conditions and.

tions im forcign countries. One i

pering and making money while another one is oink

Fito bankruptey and out of business. Cross-curtents the

stack market, due to various flu cause some stocks to

decline while others advance. These chat

gaan in 1928 and 1929, but bave been more pron!

storks made low in July, 1932- “Therefore, in

wroney trading ithe stock market, you rmust study and apply

ules to individual stocks and not depead on iAverages

We do not have « universal bull market any more, when

we time. We have a mixed trend,

ly down

pw levels

are affected b

a throughout the coun

algo affected

the rain tvend being up on sume stocks andl dist

‘ward on others, ‘The majority of stocks reached

mn July, 1932, and started working higher.

ge Industrials made Yow in July, +932-

2

28 NEW STOCK TREND DETECTOR

Averages made lows in June and July, 1932. In 1935, at

the time the Dow-Jones 30 Industrial Averages were up 80

points, the Public Utility Averages reached a new low level.

‘This was brought about by adverse legislation

Ry studying and applying the rules to the individual

stacks, you would have found that the Public Utility stocks

nuvend while other stocks advanced. A. study

{of American ‘Telephone & Telegraph, which

held up becter thin the other Public Ui

wan in a stronger positi

$9 a share per year, while ather Public Utility stocks passed

their di Du 1@ boom, whieh culminated in

1929, the Public Utility stacks had been watered; stack divi-

dlends had heen dtclared; there had been numerous splitups.

e beat atock to buy by fullowing the

averages of any group of stocks. Soime. of the stocks in

p vill make new highs every year in bull markers while

warkets or go into-receive

ur be tuken off the Exchange. For example: In 1932

when the average of all airplane stocks showed uptrend,

you had arlveted Curtiss Wright “A" as the Best ait

stock just because it had been a leader

ina previous campaign, you wold have made a mistake. In

August, 1932, Curtiss Wright “A suld as low as 134, i

1934, made a high of 12. Now compare Douglas

“Airerait and make a smdy of its position. In r932, Douglas

made a low of 54 in February, 1934 reached a high of 2836+

ber, 1934 declined to 1434, a decline of abaut sof

ctop. In July, 1935, when Curtiss Wright “A” was

: 4 points under the 1934 high, Douglas crossed

its 1934 top, which showed that it was in a strong position

and much hetter to buy, even at 2834, than Curtiss Wright

INDIVIDUAL, STOGRS vs, AVERAGES Ey

A” In December, 1935, Déuglas crossed 4534, the ry29

high, and advanced to 58 while Curtiss Wright “AA” only

advanced to 1234. Curtiss Wright "A" never showed the

or power to advance 24 Douglas and sume other ait-

plane stocks. Douglas was making higher bottoms snd

higher tops right along while Curtiss Wright "A" wa

ing in a narrow trading range, 8> Dougla was the stack

this group ta buj.. This is proof that you must study each

individual stoxk in a group in order to detect its (rane!

Tw

‘To make a success, you

old theories and old ideas when they become obsolete and

follow new

ling in the stock market.

Daring recent years the Dow Theory has speead

the country. People Inve hegun to regard it as very value

able and infallible, but in fact, it is'now practically of ne

ie ta.a trader. With sa many stucks listed ow the New

York Stock Exchange, 30 stocks or 20 stocks are no lunger

fn representative of the trend. Tiesides, you cannot trade

averages. You m the trend of

arder to make

Dow Tron ORSOLETE

must disca

fl

les and new stocks in urder ta make x success

ever

the World War cha

changed from an ne

country, In 1916, when the Dow-Jones 30 Induste

ages advanced! to new high levels, wich was 7 p

the highs of rg06, the Railroad Averages at that &

ints under the 1906 record high. ‘TI

4 to confirm the upward trend in. ndustrials cer

es ant probably

vere

waite

money.

Tn 1917 the Government tau!

in December, 1917. the Dow-Jones 20 Railroad Averages

over the Raifreads, and

i made a

declined to 69. ‘The Industrials at the sume

ee ee i See. ee

ECTOR

a NEW STOCK TREND DE

is was the first time that the Rails were as

low us they were in 1897, while the Industrials were 13

points abyve the 1907 panic lows.

In 1918 and:1919 the Rails failed to follow the Indus-

Is and were no good as a ghide or confirmation according,

¢ Dow Theory July, t919, the Industrials made

a new high record while ‘the Rails were-making new low

Jevels. Tn Noveihber, 1919. the Industzinls reached a now

high at 11934. In the same month’ the Railroad Averages

ached low of che year, only 3 points above the 1907 lows.

Rails were going exactly opposite (9 the trend of In-

«the Dow Theory was not worl

Jone, 1921, the Railroad Averapes reached a low of

In August, cg2, the Industrial Averages reached the

of 64 ‘The Industrial Averages were only 2

points under the 1907 lows. Then followed a big ball mar-

ket in Industrial stocks andl the Rails were laggards.

In Jamuary, 1925, the Industrial Averages crossed 120,

¢ record high of 1919 and the Rails were still 38 p

below the 1908

Tf you had waited for the Rails to confirm the Indus

low of 665 “L

dissed big opporn

1927 when the Rails crassed

al Averages, at that time, were 63

s and 80 points above the 1906

nil Ju

in 1yo6.. “The Indus!

ts above the 1909

Averages

dl a high of 189. After the panicky decline to No.

vember, 1929, the Industrial Averages rallied

points. ‘The Rails rallied on ints, After April, 1930,

Is were weaker th:

In November, 193 the Rails brake 42, the low made

in August, 1896. In June, 1932, the Rails declined to 138,

|

i

t

i

|

i

i

(

i

t

{

t

i

|

t

|

t

INDIVIDUAL STOCKS vs. AVERAGES aL

while the 3@ Industrial Averages declined te 40%

dustrials were 12 points above the 1896 lows, while 1

were 29 points 1896 lows. :

In July, 1983, th js rallied to x10 and the Rails

rallied to 58.

w

In October, 1933, the Industrial Averages react

8234 and the Rails ta 43. The Industrials never broke the

1933 lows until they advanced to 149% in November, 1935

‘in March, 1935, the Rolls sold at 27 while the Industrials

were at 96. ‘The Industrials were 13 points above the lows

of Oetaber, 1933, while che Rail

ain proved that you could

Theory,

From March, 1935 to Movember, 1935 the I

the Rails rallied only 12 pointe.

were 6 points below. ‘This

jot depend upon the Do}

Rails made new highs

‘This is plenty of proof that

obsolete and that you cannot depend upon i€ ti wark

the future

Cuaxee wrrn THR Times

In order to make money under the changed cane!

you must study individual stocks and follow theic

Don't let the Averages fool you. Whan ane stock shows

change in trend, go with it regardless of the action of

in the game yroup and régardless of the action of the

Averages.

‘Years ago Stage Coach Stacks advanced

have made:money buying them, but stage cs

of husiness and so didl the stocks. ‘Then there were Canal

Stocks that advanced and you could have imade money buy:

ing thera, hut other modes of transportation reduced the

business on canals, The automobiles came along and to

business away from the railroads. Now the airplane is co

ae NEW STOCK TREND DETECTOR

ug business from the railroads and wil

we automobiles and trucks, The lane

ode of transportation, You will havé ta

swatch airplanes in fulure for a puide, the same as you

watched automobile stocks a few years ago, because the

money will be made trading iv alrplane stocks rather than

Is ur automobiles

Keep up to-date; be progressive. Do nut cling eo

theories or ideas: Learn tof

stocks and you will make profits.

ing along and ex

take it ft

CHAPTER V

NEW RULES-TO DETECT TREND OF. STOCKS

hich I give in my books, TRUTH OF THE

STOCK TAPE and WALT. STREET STOCK SELEC-

TOR, are all good. They will work in future market moves

for 100 years -but under the changed conditions stocks will

moye up slower the greater part of the (ime and on a smaller

volume. "(Compare present volume of U.S, Stecl and Gen-

eral Motors.with volume of former years.) ‘The rules in my

ks aré based upon Supply and Demand; have been tried

and tested. Whether stotks advance on buying by the public,

pools or investurs, it is after all the result of Supply and

Demand. When buying pawer is greater than selling power,

it forces stocks highier right along. ‘Then when the reverse

takes place anil the selling pressiire is greater thon the buy-

ing, sticks work lower.

‘The new rules that I give you in this hook, if used wi

the rules in my other books, will help you to make 2 success

st dy detectives learn the habils of a contain gang nf

ale from the clues that they leave behind them, sa can

Strect detective find a clue to what the “powers that

he" or master market manipulators intend.to d

stocks. The movement.of a.stock, up or do

ds who buy. or sell it with th

later at profit, What ane mi

vise, another mind can figure out, for after all, human nature

never changes. By studying indi stocks and fallovwing

the rules for deteeting and determining the trend, you will

be able ro make large amourits of inoney.

=

a NEW STOCK TREND Di'TECTOR

Besr Way to Derecr TREND

Years of experience have convinced me that the trend

canbe detceted by a study of charts.

Monthly Chart: The best chart tv use for detecting the

main trend of a stuck is thé Moptlily high and low Chart.

h and low Chart is the

_nest best guide te the real trend

Daily Chart: When « market is moving very fast and is

very active on large volume, the Daily high and low Chart

is a good guide and trend detector

To detect when a stock is getting into a strong position

and ready to advance, look ‘up the Monthly Chart, TF there

is good support and go ng, then the stuck will gradu-

ally be absorbed and as it grows scarcer and the demand

increases, it will work highsr and feceive support at a highet

evel, tnaking higher battoms and higher tops.

‘When a stock is getting ready to change trend to the

sill start making lower tops and luwer botea

hen when it breaks below the point fro

fast run up to the-fop, it-will be an indication that che mm

trend has turned down.

Kinw or Socks To Trane my

¢ kind of stocks to trade ia arc those that, are active

and those that Follow the rules and a definite trend. There

cc always queer acting storks and some stocks that don't

fullow the rules, ‘These stocks should be left alone. Stocks

that hold ja a nartow trading range for a long time should

not he traded in until they break out on the upside or break.

the downside and show increased volume of sales.

and activity,

Wuers 10 Bur arp Sexe

You should buy a stock near a single bottom, a double

ution, or & triple bottom and place a stup loss order not

more (han 3 points away. By buying near a single battom, T

jean that after a reacts it until @ stock holds

‘ns ee mand

NEW RULES TO DETKCT TREND OF STOCKS 85

around a level for 2 to 3 weeks, then buy and protect with

1 stap loss order 3 points under the lowest week, or in active

markets if a stack reacts and then holds around a level Lor

2 ta days, buy and protect with a atop lust order not more

than 3 points under the lowest day. When a stock sells

around the same price level several weeks, several months

or a yenr or more apart, it forms x dauble bottom and is a

boy. If it sclis around the same lewel the third time, it Is

a triple bottom,

When a stock advances to a new high le

former old top by 4 points then if it is going h

not react back 3 points below the former eld! hi

‘you should buy on a slight reaction of 1 to 3 ps

place a stop loss order g polnts under the old top.

‘After a bull anarket gets started, buy action

place a stop loss order 3 points under the pr

level.

"After 4 stuck crosses the top af a previous year by 3

points, itis a buy an any little réaction, “For ext

Douglas Aircraft: 1932 high 1958-1939 h

In 1934 when, it erussed. this double top, accor

rule you would buy: Refer ta Chart No. 1 on page 36. The

stock advanced to 28 4 in r9ga. Thenin 1935 after Douglas

‘Aircraft erossed 2634, it never renicted lower than 26%5

Therefore, when it reacted hack below 28, it was a buy

a stop at 2533. Itis Dow

crossed the old high of a8 44, it never reacted! 3 days (the re

actions only lasting about 2 days) before the stock resumed

ils upward trend, When it crossed the 1925

you would buy agaia and cuntinue eo pyramid as Tong as

showed uptrand. The stock advanced to 5844

1935.

Reverse the above rules on the sell

sell against single tops, double tops, or triple tops, er at

sume point where you can place a stop loss order nut more

than. 3 poi ‘or wait until a stock shows

crosses

LL

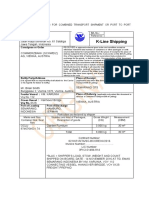

CHART fo. 1 DOUGIAS ATRCRANT

Moznir Elias ane Lom: 1920-1935

38 NEW STOCK TREND DETECTOR

and breaks the last important bottom by 3 points, then sell

short on a small rally_and.place a stop loss order 3. poines

above the yl bottoni. After a stnck breaks the bottom of «

nis yeat by 3 points, itis a short sale

fa bear market when a stock deelines and breaks am

ts or more, then if it is going lowery

rally 3 Points shove the bottom before it goes

atock iniade a low of 8436. in May,

1935 and a low of 8434 in June, 1935% vallled to go34 in

Joly, and after it brake 81 or 3 previous

never rallied 3 points above then untilit declined

6054 in Octuber, 1935. Refer to Chart Na. 2 on page 37

Whatever you do, it should be according to a definite

rule and after the market shows a defi

ag sure an indication to sell as

Don't get imputione and jump into #

you want to make a trade, Remember, a stock is never tov

trend is up, provided you place

jer {ur protection in case the trentl reverses

A gtock fs a short sale at any tine and at any price so: long

as the trend is down, regatdlleds af how high it bas been

previously.

Paice ax Wancn Fast Moves Sraet

The highcr the price, the faster a stock moves and the

wider the ductuations, Stucks'move-up. faster alter they

sell above so and even faster after they sell above 100, a

when they get above 150 and 200 per share the finctuations

dare very wide and rapid. You can prove this to yourself by

‘going ayer any of the stocks that have been active and had

big advances and see what happened aftér they

También podría gustarte

- What Squirt Teaches Me about Jesus: Kids Learning about Jesus while Playing with FidoDe EverandWhat Squirt Teaches Me about Jesus: Kids Learning about Jesus while Playing with FidoAún no hay calificaciones

- Extreme Rhyming Poetry: Over 400 Inspirational Poems of Wit, Wisdom, and Humor (Five Books in One)De EverandExtreme Rhyming Poetry: Over 400 Inspirational Poems of Wit, Wisdom, and Humor (Five Books in One)Aún no hay calificaciones

- Bruce the Fire Dog and His North Pole Friends Say HelloDe EverandBruce the Fire Dog and His North Pole Friends Say HelloAún no hay calificaciones

- Birds: Our Fine Feathered Friends: Seen by Sue and DrewDe EverandBirds: Our Fine Feathered Friends: Seen by Sue and DrewAún no hay calificaciones

- Strangers' Voices In My Head: A Journey Through What Made Me Who I Am from My MindDe EverandStrangers' Voices In My Head: A Journey Through What Made Me Who I Am from My MindAún no hay calificaciones

- Special and Different: The Autistic Traveler: Judgment, Redemption, & VictoryDe EverandSpecial and Different: The Autistic Traveler: Judgment, Redemption, & VictoryAún no hay calificaciones

- If I Were Born Here Volume II (Greece, India, Kenya, Mexico, Israel)De EverandIf I Were Born Here Volume II (Greece, India, Kenya, Mexico, Israel)Aún no hay calificaciones

- IRDA Handbook 2013-14Documento502 páginasIRDA Handbook 2013-14Amit Desai PredictorAún no hay calificaciones

- WWW - Sscnaukari.in 2014-08-100 Golden Rules of Sentence CorrectionDocumento8 páginasWWW - Sscnaukari.in 2014-08-100 Golden Rules of Sentence CorrectionAnil DudaniAún no hay calificaciones

- CommDocumento2 páginasCommAmanpreet SinghAún no hay calificaciones

- Exam Notice CGLE 12-02-2016Documento54 páginasExam Notice CGLE 12-02-2016Saicharan BashabathiniAún no hay calificaciones

- SAS Online BriefDocumento2 páginasSAS Online BriefkethavarapuramjiAún no hay calificaciones

- 7th CPC Cag MemoDocumento40 páginas7th CPC Cag MemoAnil DudaniAún no hay calificaciones

- Political Philosophies& Their Effect On SocietyDocumento5 páginasPolitical Philosophies& Their Effect On SocietyAnil DudaniAún no hay calificaciones

- Geodesic Limited 2012Documento155 páginasGeodesic Limited 2012Anil DudaniAún no hay calificaciones

- Biogas Bottling Project Based On 740 GoatsDocumento2 páginasBiogas Bottling Project Based On 740 GoatsAnil DudaniAún no hay calificaciones

- Hello Friends Welcome To Download Zone Free SSC Exam E-Books Books - HTML Free SSC Notes Join No. 1 SSC Exam GroupDocumento13 páginasHello Friends Welcome To Download Zone Free SSC Exam E-Books Books - HTML Free SSC Notes Join No. 1 SSC Exam GroupAnil DudaniAún no hay calificaciones

- Onion Futures AnnexDocumento21 páginasOnion Futures AnnexAnil DudaniAún no hay calificaciones

- Sulalitha Economics EMDocumento74 páginasSulalitha Economics EMrakeshsi563100% (1)

- Partnership Q3Documento2 páginasPartnership Q3Lorraine Mae RobridoAún no hay calificaciones

- COTO Full Document - Oct 2020Documento1320 páginasCOTO Full Document - Oct 2020Danie100% (11)

- BKash ProfileDocumento10 páginasBKash ProfileAshik Md Siam100% (1)

- CCC-1628 DrillingBro A4Documento12 páginasCCC-1628 DrillingBro A4Joao AraujoAún no hay calificaciones

- Bullying Behaviour in Corporate: What Is Workplace Bullying?Documento5 páginasBullying Behaviour in Corporate: What Is Workplace Bullying?prabhuhateAún no hay calificaciones

- Presentation On Industrial Training ProjectDocumento38 páginasPresentation On Industrial Training ProjectBHAWANACHAWLA100% (1)

- PhilipsVsMatsushit Case AnalysisDocumento7 páginasPhilipsVsMatsushit Case AnalysisGaurav RanjanAún no hay calificaciones

- Igc1 Element 2 - Rev 0Documento5 páginasIgc1 Element 2 - Rev 0VickyJee50% (2)

- Orgman LT# 1&2 Week 6Documento2 páginasOrgman LT# 1&2 Week 6RanielJohn GutierrezAún no hay calificaciones

- Mobile Services: Your Account Summary This Month'S ChargesDocumento2 páginasMobile Services: Your Account Summary This Month'S ChargesShahidAún no hay calificaciones

- Human SecurityDocumento10 páginasHuman Securitykrish_7Aún no hay calificaciones

- Chapter 2 Service Operations Management-BediDocumento17 páginasChapter 2 Service Operations Management-BediSanket ShetyeAún no hay calificaciones

- International Accounting Standard With ExamplesDocumento15 páginasInternational Accounting Standard With ExamplesAmna MirzaAún no hay calificaciones

- Sample Complaint Against California Insurance Company For Bad FaithDocumento3 páginasSample Complaint Against California Insurance Company For Bad FaithStan Burman80% (5)

- Annual Report 2011Documento41 páginasAnnual Report 2011Moinul HasanAún no hay calificaciones

- Kolkatta 5Documento38 páginasKolkatta 5amitmulikAún no hay calificaciones

- Journal of Cleaner ProductionDocumento11 páginasJournal of Cleaner ProductionJaya HermawanAún no hay calificaciones

- Real Estate Investment Business Plan ExampleDocumento49 páginasReal Estate Investment Business Plan ExampleAllan K WalusimbiAún no hay calificaciones

- Problem 5-19Documento5 páginasProblem 5-19Phuong ThaoAún no hay calificaciones

- Guidelines For National RolloutDocumento84 páginasGuidelines For National Rolloutsumit.aryanAún no hay calificaciones

- Microeconomic Theory - 2 (2023)Documento15 páginasMicroeconomic Theory - 2 (2023)Mudassir HanifAún no hay calificaciones

- Chiefdissertation 161006221902 PDFDocumento59 páginasChiefdissertation 161006221902 PDFManoj Kumar100% (1)

- Leadership ActivityDocumento2 páginasLeadership ActivityCecilia Arreola ArceoAún no hay calificaciones

- Bill of Lading AustriaDocumento2 páginasBill of Lading AustriaTitik KurniyatiAún no hay calificaciones

- AML Presentation & KYC Ver 1.9Documento58 páginasAML Presentation & KYC Ver 1.9nehal10100% (1)

- Construction Material Haulage CapacityDocumento2 páginasConstruction Material Haulage CapacityMahesh ShindeAún no hay calificaciones

- Bentley Civil User Accreditation: Program OverviewDocumento9 páginasBentley Civil User Accreditation: Program OverviewRenukadevi RptAún no hay calificaciones

- Topic 1 - Creating Customer Value and EngagementDocumento27 páginasTopic 1 - Creating Customer Value and EngagementZhi YongAún no hay calificaciones

- Commissioner Vs Manning Case DigestDocumento2 páginasCommissioner Vs Manning Case DigestEKANGAún no hay calificaciones