Documentos de Académico

Documentos de Profesional

Documentos de Cultura

015 - Taxability - Ambedkar Institute of Hotel Management

Cargado por

Reshmi VarmaTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

015 - Taxability - Ambedkar Institute of Hotel Management

Cargado por

Reshmi VarmaCopyright:

Formatos disponibles

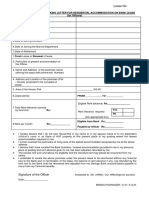

AMBEDKAR INSTITUTE OF HOTEL MANAGEMENT Vs CCE & ST-TIOL

Page 1 of 3

2015-TIOL-1593-CESTAT-DEL

IN THE CUSTOMS, EXCISE AND SERVICE TAX APPELLATE TRIBUNAL

WEST BLOCK NO 2, R K PURAM, NEW DELHI

COURT NO 1

Service Tax Stay Application Nos. 51876 & 51923 of 2014 with

Service Tax Appeal Nos. 51574 & 51635 of 2014

Arising out of Order-in-Original No.CHD-CEX-001-COM-039-40, Dated: 5.12.2013

Passed by the Commissioner, Central Excise And Service Tax, Chandigarh

Date of Hearing: 15.6.2015

Date of Decision: 15.6.2015

M/s AMBEDKAR INSTITUTE OF HOTEL MANAGEMENT

Vs

COMMISSIONER OF CENTRAL EXCISE AND SERVICE TAX, CHANDIGARH

Appellant Rep by: Shri Rakesh Khanna, CA

Respondent Rep by: B B Sharma, DR

CORAM: G Raghuram, President

Rakesh Kumar, Member (T)

ST - Assessee are preparing meals as per fixed menu which are to be served in various

schools of Chandigarh Administration under mid day Meal Scheme of Government - There

is neither any allegation nor any evidence to show that assessee had prepared meals at

schools where same were to be served or was in any manner involved in serving the

meals - Meals prepared by them are simply supplied at pre-determined rates to Education

Department - Since the assessee are preparing mid day meals in their Institute and not in

schools where the meals are served are not involved in serving of meals in any manner,

they are not covered by definition of "outdoor caterer" and hence their activity of

preparing and supplying meals for mid day scheme would not be covered by definition of

taxable service under Section 65(106(zzt) of FA, 1994: CESTAT

Appeals allowed

FINAL ORDER NOS. 51955-51956/2015

Per: Rakesh Kumar:

The facts leading to these appeals and stay applications are in brief as under:

1.1 The appellant are an autonomous body registered under the Societies Act, 1860. They

are a part of the Ministry of Tourism and are managed by the Board of Governors

consisting of representatives from Central Government and Union Territory

Administration, Chandigarh. The appellant Institute, in terms of its memorandum of

Association and as per the objectives listed therein, is associated, among other things,

with the nutritional extension and developmental work and provides mid day meal to the

schools of Chandigarh Administration under the Government scheme. The appellant

Institute prepares cooked food as per the fixed menu and supplies the same to various

schools for which they received payment at certain rates. The Department was of the

view that this activity of the appellant is outdoor catering service taxable under Section

65(105)(zzt) of the Finance Act, 1994 read with Section 65 (77a) and Section 65(24) ibid.

Besides this the appellant were also making available the space in their premises to

various persons for their functions. The Department was of the view that this activity of

http://www.taxindiaonline.com/RC2/printCase.php?QoPmnXyZ=MTA1MTY1

8/11/2015

AMBEDKAR INSTITUTE OF HOTEL MANAGEMENT Vs CCE & ST-TIOL

Page 2 of 3

the appellant is taxable under the Mandap Keeper Service. It is on this basis that show

cause notice dated 12.03.2012 was issued for demand of Service tax amounting to Rs.

56,93,305/- for the period from October 2006 to March 2007 alongwith interest on it

under Section 75 and for imposition of penalty on the appellant under Section 76, 77 and

78 ibid and another show cause notice dated 17.04.2013 were issued to the appellant for

demand of service tax amounting Rs.12,57,899/- for the period from 2011-12 alongwith

interest under Section 75 ibid and also for imposition of penalty on them under Section

76, 77 and 78 of the Act.

1.2. The above show cause notices were adjudicated by the Commissioner by a common

order-in-original dated 06.12.2013 by which while in respect of show cause notice dated

12.03.2012 service tax demand of Rs.37,38,222/- was confirmed after adjusting the

cenvat credit of Rs. 19,55.083/- and service tax demand of Rs. 7,83,131/- was confirmed

in respect of second show cause notice dated 17.04.2013 after adjusting the cenvat credit

of Rs.4,74,768/-. Thus, the total service tax demand confirmed against the appellant is

Rs.45,21,353/- alongwith interest. The Commissioner also imposed penalty of Rs.

45,21,353/- on the appellant under Section 78 besides imposition of penalty of Rs.

10,000/- under Section 77 of the Act. Against this order of the Commissioner these

appeals alongwith stay applications are preferred.

2. Heard both the sides.

3. Though, the appeals are listed for hearing of the stay applications only, after hearing

the matter for some time, the Bench was of the view that the matter can be heard for

final disposal. Accordingly, the requirement of pre-deposit is waived and with the consent

of both the sides, the matters are heard for final disposal.

4. Shri Rakesh Khanna, Chartered Accountant, ld. Counsel for the appellant, pleaded that

the appellant Institute only prepares the cooked meal as per the fixed menu to be

supplied to various schools of Chandigarh Administration; that the meals served in the

schools are prepared only in the Institute and not in the schools where the same are to be

served, that the appellant are not involved in serving of the meals in any manner; that in

terms of Section 65(105) (zzt), taxable service means any service provided or to be

provided to any person, by an outdoor caterer, that under Section 65(76a) outdoor

caterer means any person engaged in providing services in connection with catering at a

place other than his own but including a place provided by way of tenancy or otherwise by

the person receiving such services, that under Section 65(24), a 'caterer' means any

person who supplies, either directly or indirectly, any food, edible preparations, alcoholic

or non-alcoholic beverages or crockery and similar articles or accoutrements for any

purpose or occasion; that what is taxable is the service provided by an outdoor caterer

and for this purpose the outdoor caterer must provide the service at a place other than

his own; that since the appellant was neither preparing the meals at the schools nor are

supplying any crockery etc. for this purpose nor they are not involved in serving of the

meals in the schools, their activity is not covered by the Section 65(zzt); that as regards

Mandap Keeper service, they are covered by the definition of mandap keeper, but during

the period of dispute their turnover on account of this service is well within the exemption

limit of Notification No. 6/2005-ST and that in view of this the demand on account of this

service is also not sustainable. It was, therefore, pleaded that the impugned order is not

sustainable.

5. Shri B. B. Sharma, ld. DR defended the impugned order by reiterating the findings of

the Commissioner.

6. We have considered the submissions of both the sides and perused the record. From

the facts stated in the show cause notice as well as in the order-in-original, it is seen that

the appellant are preparing the meals as per the fixed menu which are to be served in

various schools of Chandigarh Administration under the mid day Meal Scheme of the

Government. Neither there is any allegation nor there is any evidence to show that the

appellant had prepared the meals at the schools where the same were to be served or

was in any manner involved in serving the meals. Meals prepared by them are simply

supplied at the pre-determined rates to Education Department. The service which is

covered under Section 65(105)(zzt) is the service provided or to be provided to any

http://www.taxindiaonline.com/RC2/printCase.php?QoPmnXyZ=MTA1MTY1

8/11/2015

AMBEDKAR INSTITUTE OF HOTEL MANAGEMENT Vs CCE & ST-TIOL

Page 3 of 3

person by an "outdoor caterer" and not by any caterer. The outdoor caterer as defined in

Section 65(76a) means a caterer engaged in providing services in connection with

catering at a place other than his own but including a place provided by way of tenancy or

otherwise by the person receiving such services. Since the appellant are preparing mid

day meals in their Institute and not in the schools where the meals are served are not

involved in serving of the meals in any manner, in our view they are not covered by the

definition of "outdoor caterer" and hence their activity of preparing and supplying meals

for mid day scheme would not be covered by the definition of taxable service under

Section 65(106(zzt). Accordingly the duty demand on this count would not be sustainable.

7. As regards the mandap keeper service alleged to have been provided by them during

the period of dispute, we find that during each financial year during the period of dispute

its turnover is well within the threshold limit of Notification No. 6/2005-ST and therefore

they will be exempted from service tax.

8. In view of the above discussion, the impugned order is not sustainable. The same is set

aside. The stay applications as well as the appeals are allowed.

(DISCLAIMER: Though all efforts have been made to reproduce the order correctly but the

access and circulation is subject to the condition that Taxindiaonline are not responsible/liable for

any loss or damage caused to anyone due to any mistake/error/omissions.)

http://www.taxindiaonline.com/RC2/printCase.php?QoPmnXyZ=MTA1MTY1

8/11/2015

También podría gustarte

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2102)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Mortgage KillerEXDocumento53 páginasMortgage KillerEXAndyJackson75% (4)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- What Is The Role of An ExecutorDocumento2 páginasWhat Is The Role of An ExecutorSpongebob57Aún no hay calificaciones

- Habit Canvas 3.0 Personilized PDFDocumento4 páginasHabit Canvas 3.0 Personilized PDFReshmi Varma100% (1)

- Parent Perspectives On Their Mobile Technology Use-The Excitement and Exhaustion of Parenting While Connected PDFDocumento8 páginasParent Perspectives On Their Mobile Technology Use-The Excitement and Exhaustion of Parenting While Connected PDFReshmi VarmaAún no hay calificaciones

- White Paper On Mumbai Pune Expressway: Submitted By: Ashish Chanchlani (07) VesimsrDocumento18 páginasWhite Paper On Mumbai Pune Expressway: Submitted By: Ashish Chanchlani (07) VesimsrAshish chanchlaniAún no hay calificaciones

- Policyloanapplicationform PDFDocumento2 páginasPolicyloanapplicationform PDFEdgar Compala100% (1)

- 23 - Gonzales v. PCIBDocumento1 página23 - Gonzales v. PCIBeieipayadAún no hay calificaciones

- Express V BayantelDocumento7 páginasExpress V BayanteleieipayadAún no hay calificaciones

- Republic Glass Corp Vs Qua 144413Documento19 páginasRepublic Glass Corp Vs Qua 144413JamesAnthonyAún no hay calificaciones

- Lumanti Housing ProjectDocumento141 páginasLumanti Housing ProjectKiran BasuAún no hay calificaciones

- Of Pelagia Vda. de Madarieta, 576 SCRA 109 Lasquite vs. Victory Hills, Inc.Documento18 páginasOf Pelagia Vda. de Madarieta, 576 SCRA 109 Lasquite vs. Victory Hills, Inc.Ludivina Michelle Aquino Orduña100% (2)

- PledgeDocumento9 páginasPledgeMel Manatad100% (1)

- The Influence of Culture Upon Consumers' Desired Value PerceptionsDocumento26 páginasThe Influence of Culture Upon Consumers' Desired Value PerceptionsReshmi VarmaAún no hay calificaciones

- Mdes - Final CaseDocumento7 páginasMdes - Final CaseReshmi VarmaAún no hay calificaciones

- Consumer Perceptions and Marketing EthicsDocumento16 páginasConsumer Perceptions and Marketing EthicsReshmi VarmaAún no hay calificaciones

- Reshmi - Business Studies - Product To Brand Module TestDocumento7 páginasReshmi - Business Studies - Product To Brand Module TestReshmi VarmaAún no hay calificaciones

- 6 Life Skills Kids Need For The Future - Scholastic - ParentsDocumento6 páginas6 Life Skills Kids Need For The Future - Scholastic - ParentsReshmi VarmaAún no hay calificaciones

- Value Proposition Canvas PDFDocumento1 páginaValue Proposition Canvas PDFReshmi VarmaAún no hay calificaciones

- The Value Proposition Canvas Instruction Manual PDFDocumento8 páginasThe Value Proposition Canvas Instruction Manual PDFariri79@yahoo.co.id100% (1)

- Assignment 2 PDFDocumento1 páginaAssignment 2 PDFReshmi VarmaAún no hay calificaciones

- Assignment 7 PDFDocumento1 páginaAssignment 7 PDFReshmi VarmaAún no hay calificaciones

- Phase 1-Categories That Would and Wouldn't Survive Post Covid and Why?Documento2 páginasPhase 1-Categories That Would and Wouldn't Survive Post Covid and Why?Reshmi VarmaAún no hay calificaciones

- Blue Ocean Strategy: A Case by W. Chan Kim and Renée MauborgneDocumento15 páginasBlue Ocean Strategy: A Case by W. Chan Kim and Renée MauborgneReshmi VarmaAún no hay calificaciones

- Assignment 1 PDFDocumento1 páginaAssignment 1 PDFReshmi VarmaAún no hay calificaciones

- Final Assigment PDFDocumento1 páginaFinal Assigment PDFReshmi VarmaAún no hay calificaciones

- Executive Insights:: The Korean Automobile Industry-Challenges and Strategies in The Global MarketDocumento12 páginasExecutive Insights:: The Korean Automobile Industry-Challenges and Strategies in The Global MarketReshmi VarmaAún no hay calificaciones

- Effectiveness and Efficiency - The Role of Demand Chain ManagementDocumento22 páginasEffectiveness and Efficiency - The Role of Demand Chain ManagementReshmi VarmaAún no hay calificaciones

- Children's Views On Child-Friendly Environments in Dofferent Geographical, Cultural and Social NeigbhourhoodsDocumento16 páginasChildren's Views On Child-Friendly Environments in Dofferent Geographical, Cultural and Social NeigbhourhoodsReshmi VarmaAún no hay calificaciones

- Board Games Play MattersDocumento17 páginasBoard Games Play MattersReshmi VarmaAún no hay calificaciones

- FinalJournalspring Version11 PDFDocumento118 páginasFinalJournalspring Version11 PDFReshmi VarmaAún no hay calificaciones

- The Influence of School Architecturre On Academic AchievementDocumento25 páginasThe Influence of School Architecturre On Academic AchievementReshmi Varma100% (1)

- Dyads and Triads: Buying A Laptop For Higher StudiesDocumento5 páginasDyads and Triads: Buying A Laptop For Higher StudiesReshmi VarmaAún no hay calificaciones

- Fly On The Wall: Observing The Journey of A Vendor at A Vegetable MarketDocumento5 páginasFly On The Wall: Observing The Journey of A Vendor at A Vegetable MarketReshmi VarmaAún no hay calificaciones

- Brainstorming: Creating An Ideal AnganwadiDocumento5 páginasBrainstorming: Creating An Ideal AnganwadiReshmi VarmaAún no hay calificaciones

- The Most Valuable Brand and What Does It Mean To MeDocumento1 páginaThe Most Valuable Brand and What Does It Mean To MeReshmi VarmaAún no hay calificaciones

- Workshops As A Research MethodologyDocumento12 páginasWorkshops As A Research MethodologyReshmi VarmaAún no hay calificaciones

- Reshmi - Week 3Documento5 páginasReshmi - Week 3Reshmi VarmaAún no hay calificaciones

- Workshops As A Research Methodology PDFDocumento12 páginasWorkshops As A Research Methodology PDFReshmi VarmaAún no hay calificaciones

- Trends and Technology Timeline 2010Documento1 páginaTrends and Technology Timeline 2010Lynda KosterAún no hay calificaciones

- Cognitive Vs Hierarchical TADocumento30 páginasCognitive Vs Hierarchical TAReshmi VarmaAún no hay calificaciones

- Internship Report On Bank of AJK PDFDocumento8 páginasInternship Report On Bank of AJK PDFazharrashid100% (1)

- Mathematics - Banking For Icse Grade 10 ProjectsDocumento24 páginasMathematics - Banking For Icse Grade 10 ProjectsFluffy Worm31% (16)

- Corporate Governance ReportDocumento17 páginasCorporate Governance ReportIqbal LalaniAún no hay calificaciones

- Theory of Accounts - Exam2Documento1 páginaTheory of Accounts - Exam2Enges FormulaAún no hay calificaciones

- David Graeber InterviewDocumento7 páginasDavid Graeber InterviewOccupyEconomicsAún no hay calificaciones

- The Philippine Laws On Housing: A. The Urban Development and Housing Act (Ra 7279)Documento7 páginasThe Philippine Laws On Housing: A. The Urban Development and Housing Act (Ra 7279)Christen CaliboAún no hay calificaciones

- mcq1 PDFDocumento15 páginasmcq1 PDFjack100% (1)

- Leased Accommodation ApplicationDocumento5 páginasLeased Accommodation ApplicationSumit Kumar PanditAún no hay calificaciones

- Dividend Policy: Saurty Shekyn Das (1310709) BSC (Hons) Finance (Minor: Law) Dfa2002Y (3) Corporate Finance 20 April 2015Documento9 páginasDividend Policy: Saurty Shekyn Das (1310709) BSC (Hons) Finance (Minor: Law) Dfa2002Y (3) Corporate Finance 20 April 2015Anonymous H2L7lwBs3Aún no hay calificaciones

- Presentation On Indian Debt MarketDocumento14 páginasPresentation On Indian Debt MarketDensil PintoAún no hay calificaciones

- RFJPIA 04 Quiz Bee - P1 and TOA (Clincher)Documento1 páginaRFJPIA 04 Quiz Bee - P1 and TOA (Clincher)Dawn Rei DangkiwAún no hay calificaciones

- Personal Loan AgreementDocumento2 páginasPersonal Loan AgreementFebb RoseAún no hay calificaciones

- Power and Process of Distrain - Case Study of Lagos State Internal Revenue ServiceDocumento14 páginasPower and Process of Distrain - Case Study of Lagos State Internal Revenue ServiceSamuel OyenitunAún no hay calificaciones

- European Conference For Education Research, University of HamburgDocumento18 páginasEuropean Conference For Education Research, University of HamburgMano ShehzadiAún no hay calificaciones

- Dairy Farm (25 Animal)Documento38 páginasDairy Farm (25 Animal)Ali HasnainAún no hay calificaciones

- Bank LiquidityDocumento17 páginasBank Liquidityahsan habibAún no hay calificaciones

- Functions of Central BankDocumento3 páginasFunctions of Central Banknirav1988Aún no hay calificaciones

- 05-29-13 EditionDocumento28 páginas05-29-13 EditionSan Mateo Daily JournalAún no hay calificaciones

- Overview of IFSDocumento21 páginasOverview of IFSMaiyakabetaAún no hay calificaciones

- CCAC SUMMER 2016 Academic CalendarDocumento2 páginasCCAC SUMMER 2016 Academic CalendarStephen RobledoAún no hay calificaciones