Documentos de Académico

Documentos de Profesional

Documentos de Cultura

FATCA

Cargado por

sumitece87Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

FATCA

Cargado por

sumitece87Copyright:

Formatos disponibles

FATCA / CRS Declaration for Individual Accounts

Note The information in this section is being collected because of enhancements to Kotak Securities Limiteds new account

on-boarding procedures in order to fully comply with Foreign Account Tax Compliance Act (FATCA) requirements and the Common

Reporting Standards (CRS) requirements pursuant to amendments made to Income-tax Act,1961 read with Income-tax Rules, 1962.

For more information refer: http://www.incometaxindia.gov.in/dtaa/other%20agreements/india_iga_final-_india_english.pdf

http://www.oecd.org/ctp/exchange-of-tax-information/automatic-exchange-financial-account-information-common-reporting-standard.pdf

(We are unable to provide advice about your tax residency. If you have any questions about your tax residency, please contact your tax advisor)

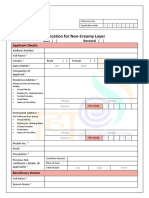

Part A (All fields are mandatory)

Section I

1

Trading code:

Client ID (To be provided only if demat account is with KSL):

Name of Account Holder

Address for Tax Residence

(include City, State, Country and Pin code)

Address Type(Tick whichever applicable)

Do you satisfy any of the criteria mentioned below? Yes

Residential

Business

Registered Office

No

a. Citizen of any country other than India

(dual / multiple) [including Greencard]

b. Country of birth is any country other than India

c. Tax resident of ANY country / ies other than India

d. POA or a mandate holder who has an address outside India

e. Address or telephone number outside India

If your answer to any of the above questions is a YES, please fill Section II of the form,else go to declaration & acknowledgment

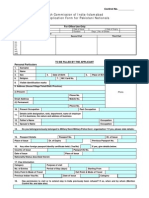

Section II - Other information (Please fill in BLOCK LETTERS)

Fathers name______________ (If PAN not available, then mandatory)

Country of Birth ________________________

Place within the country of birth_____________________

Source of Wealth ____________________

Nationality ____________________

Please list below the details, confirming ALL countries of tax residency/ permanent residency/ citizenship and ALL Tax Identification Numbers

Country of Tax residency

Tax identification no$ Tax identification document (TIN or functional equivalent)

It is mandatory to supply a TIN or functional equivalent (in case TIN not available )if the country in which you are tax resident issues

such identifiers. If no TIN /functional equivalent is yet available or has not yet been issued, please provide an explanation below.

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Declaration & Acknowledgement

I _________________________ being the beneficial owner of the account opened / to be opened with Kotak Securities

Limited(KSL) and the income credited therein, declare that the above information and information in the submitted documents to

be true, correct and updated, and the submitted documents are genuine and duly executed.

I acknowledge that towards compliance with tax information sharing laws, such as FATCA / CRS, the KSL may be required to seek

additional personal, tax and beneficial owner information and certain certifications and documentation from the account holder.

Such information may be sought either at the time of account opening or any time subsequently. In certain circumstances

(including if the KSL does not receive a valid self-certification from me) KSL may be obliged to share information on my account

with relevant tax authorities. Should there be any change in any information provided by me I ensure that I will advise

KSL promptly, i.e., within 30 days.

Towards compliance with such laws, the KSL may also be required to provide information to any institutions such as withholding

agents for the purpose of ensuring appropriate withholding from the account or any proceeds in relation thereto. As may be

required by domestic or overseas regulators/ tax authorities, the KSL may also be constrained to withhold and pay out any sums

from my account or close or suspend my account(s).

I also understand that the account will be reported if any one of the aforesaid FATCA / CRS criteria for any of the account holders

i.e. primary or joint (in case of demat account) are met.

Customer Signature

Office Use Section:

c

Signature Verified

Name of the Employee

Employee Code

Date

Instructions to the Form

In case customer has the following Indicia pertaining to a foreign country and yet declares self to be non-tax resident in the respective

country, customer to provide relevant Curing Documents as mentioned below:

FATCA/ CRS Indicia observed (ticked)

Documentation required for Cure of FATCA/ CRS indicia

U.S. place of birth

1. Self-certification that the account holder is neither a citizen of

United States of America nor a resident for tax purposes;

2. Non-US passport or any non-US government issued document

evidencing nationality or citizenship (refer list below);AND

3. Any one of the following documents:

. Certified Copy of Certificate of Loss of Nationality or

. Reasonable explanation of why the customer does not have such

certificate despite renouncing US citizenship; or

. aReason

the customer did not obtain U.S. citizenship at birth

Residence/mailing address in a country other than India

1. Self-certification that the account holder is neither a citizen of

United States of America nor a tax resident of any country other

than India; and

or

Telephone number in a country other than India

2. Documentary evidence (refer list below)

Standing instructions to transfer funds to an account maintained in 1. Self-certification that the account holder is neither a citizen of

United States of America nor a tax resident of any country other

a country other than India (other than depository accounts)

than India; and

2. Documentary evidence (refer list below)

POA granted to a person with an address in a country outside India 1. Self-certification that the account holder is neither a citizen of

United States of America nor a tax resident for tax purposesof any

country other than India; OR

2. Documentary evidence (refer list below)

List of acceptable documentary evidence needed to establish the residence(s) for tax purposes:

1.

Certificate of residence issued by an authorized government body*

2.

Valid identification issued by an authorized government body* (e.g. Passport, National Identity card, etc.)

* Government or agency thereof or a municipality of the country or territory in which the payee claims to be a resident.

También podría gustarte

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- CIL Admit Card PDFDocumento3 páginasCIL Admit Card PDFPriyank VishnoiAún no hay calificaciones

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Biometric Authentication: A Comprehensive StudyDocumento12 páginasBiometric Authentication: A Comprehensive StudyAman KumarAún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- HR R&RDocumento4 páginasHR R&RShrushti NayaniAún no hay calificaciones

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- U.are.U SDK Developer Guide 20130521Documento102 páginasU.are.U SDK Developer Guide 20130521mrshakalAún no hay calificaciones

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Documento2 páginasIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)NARAYANANAún no hay calificaciones

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- State Bank of India: Re Cruitme NT of Clerical StaffDocumento3 páginasState Bank of India: Re Cruitme NT of Clerical StaffthulasiramaswamyAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- What Is Tolimo ExamDocumento5 páginasWhat Is Tolimo ExamanvarAún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Controlling Database Management Systems: Access ControlsDocumento6 páginasControlling Database Management Systems: Access ControlsCillian ReevesAún no hay calificaciones

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Non-Creamy Layer ApplicationDocumento4 páginasNon-Creamy Layer ApplicationHanamant BhanseAún no hay calificaciones

- Mid Sem Hall TicketDocumento1 páginaMid Sem Hall TicketAasheesh Chander Agrawal100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Jee Mains 2020Documento1 páginaJee Mains 2020shashankAún no hay calificaciones

- NPMP Parivar Proposal FormDocumento8 páginasNPMP Parivar Proposal Formpradip nathujiAún no hay calificaciones

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Call Letter For Online Examination For Recruitment For Various PostsDocumento4 páginasCall Letter For Online Examination For Recruitment For Various PostsLekhraj MeenaAún no hay calificaciones

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Indian Visa FormDocumento2 páginasIndian Visa FormBilal ArshadAún no hay calificaciones

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- Processing of Examination Application (Career Service Examination-Paper and Pencil Test) (Professional or Subprofessional Test)Documento3 páginasProcessing of Examination Application (Career Service Examination-Paper and Pencil Test) (Professional or Subprofessional Test)Michael Louise Decena GleanAún no hay calificaciones

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Hall Ticket: Current Session: Exam Type: Registration No.: Exam Roll No.: Name: Father's Name: Course Name: AddressDocumento1 páginaHall Ticket: Current Session: Exam Type: Registration No.: Exam Roll No.: Name: Father's Name: Course Name: Addressamit111Aún no hay calificaciones

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Smart Card - Introduction To Smart Card TechnologyDocumento126 páginasSmart Card - Introduction To Smart Card TechnologyBalin Lusby100% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- 16824/anantapuri Exp Sleeper Class (SL) : WL WLDocumento2 páginas16824/anantapuri Exp Sleeper Class (SL) : WL WLASIF ANVAR BSc. ANAESTHESIA TECHNOLOGYAún no hay calificaciones

- Standards for Bharat BillPay Brand and GovernanceDocumento47 páginasStandards for Bharat BillPay Brand and Governanceniraj sharanAún no hay calificaciones

- 11302/UDYAN EXP Third Ac (3A)Documento2 páginas11302/UDYAN EXP Third Ac (3A)Saloni DograAún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- School Forms Grade III 014Documento87 páginasSchool Forms Grade III 014HannahSanchezAún no hay calificaciones

- DISORDERS AND DEVELOPMENTDocumento12 páginasDISORDERS AND DEVELOPMENTParmod GodaraAún no hay calificaciones

- CBAP HandbookDocumento19 páginasCBAP HandbooktcsjyotirAún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Date: 10-Dec-2015 Delhi Dear BarkhaDocumento3 páginasDate: 10-Dec-2015 Delhi Dear BarkhaGraphic Era Deemed UniversityAún no hay calificaciones

- Industry 4.0: Example: Office ScissorsDocumento4 páginasIndustry 4.0: Example: Office ScissorsAndrésFloresAún no hay calificaciones

- Employees' State Insurance General Regulations 1950Documento102 páginasEmployees' State Insurance General Regulations 1950P VenkatesanAún no hay calificaciones

- Notice For Offline Classes and Physical Document Verification.Documento5 páginasNotice For Offline Classes and Physical Document Verification.Vaibhav BamraraAún no hay calificaciones

- Path To FreedomDocumento132 páginasPath To FreedomMelinda Owens100% (3)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- SLOCPI Death Claimant Statement 10may2016 2Documento3 páginasSLOCPI Death Claimant Statement 10may2016 2Marc Benedict TalamayanAún no hay calificaciones

- Modified KRA SBIsmartDocumento1 páginaModified KRA SBIsmartShiftinchargeengineer dadri coal0% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)