Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Amalgamation & Absorption Workbook Teachers

Cargado por

smartyTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Amalgamation & Absorption Workbook Teachers

Cargado por

smartyCopyright:

Formatos disponibles

1

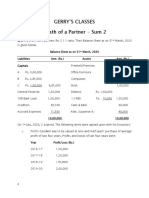

ACCOUNTING FOR AMALGAMATIONS

1. Transfer Co. Beena Ltd

Transferee Co. Heena Ltd

Method of PC Net Asset Method

Nature of Amalgamation Purchase

Step 1: Calculation of Goodwill (Super profit method)

No.

Particulars

Rs.

Average Profits of past 5 years

30,100

Share capital + Reserves (2,00,000 + 20,000)

8% of share Capital & Reserves (B x 8%)

17,600

Super profit (A-C)

12,500

Goodwill Super Profit x 4 years of purchase

50,000

220,000

Step 2: Calculation of purchase Consideration (Net Assets Method)

Sr. No

A

Particulars

Rs

Rs

Assets

Goodwill (Step - 1)

50,000

Land & Building (1,00,000-10%)

90,000

Plant & Machinery (1,45,000-10%)

130,500

Stock (55,000- 10%)

Debtors

(-)Provision for bad debts @ 10%

Total (A)

49,500

65,000

6,500

58,500

378,500

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Liabilities

Creditors (80,000-5%)

76,000

Total (B)

76,000

Net Assets Taken over i.e Purchase consideration

302,500

Step 3: Discharge of purchase consideration

Sr.No.

Particulars

Amount

Cash

150,000

Equity shares in Heena Ltd.

Mode of Discharge

Cash

12,200 Equity Shares of Rs 10

(302,000-150,000)

152,500 each, Issued at Rs12.50 each

Total

302,500

Step 4:

Realisation A/c

Dr.

Cr.

Particulars

Rs

To Goodwill

Rs

Particulars

25,000 By 5% Debentures

Rs

100,000

To Land & Building

100,000 By Loan From A

40,000

To Plant & Machinery

145,000 By Sundry Creditors

80,000

To Stock

55,000 By Heena Ltd A/c (PC)

To Debtors

65,000 By Equity Shareholders

To Bank

5% Debentures

1.2

A/c (Loss)

302,500

11,500

100000

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Loan from A

Anand R Bhangariya 86003 20000

40000

Liquidation Expenses

4000

144,000

Total

534,000 Total

534,000

Heena Ltd A/c

Dr.

Cr.

Particulars

To Realisation A/C

Rs

Particulars

302,500 By Cash A/C

150,000

By Equity Shares in Heena Ltd.

Total

302,500

Rs

Total

152,500

302,500

Equity Shareholders A/c

Dr.

Cr.

Particulars

Rs

Particulars

Rs

To Realisation A/C

11,500 By share Capital

200,000

To Cash & Bank A/C

56,000 By Reserve fund

20,000

To Equity Shares in Heena Ltd

152,500

Total

220,000

Total

220,000

Cash & Bank A/c

Dr.

Cr.

Particulars

1.3

Rs

www.cavidya.com

Particulars

Rs

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

To Balance b/d

Anand R Bhangariya 86003 20000

50,000 By Realisation A/C

To Heena Ltd

144,000

150,000 By Equity Shareholders A/C

Total

200,000

56,000

Total

200,000

Equity Shares in Heena Ltd A/c

Dr.

Cr.

Particulars

Rs

To Heena Ltd

Total

Particulars

Rs

152,500 By Equity Shareholders A/C

152,500

152,500

152,500

Total

Step 5:

In the books of Heena Ltd. (Transferee co.)

Nature of Amalgamation- Amalgamation in nature of purchase

Method of Accounting Purchase Method

Journal Entries

Sr.No

1

Particulars

Business Purchase A/C

L.F

Dr

Dr.Rs

Cr.Rs

302,500

To Liquidator of Beena Ltd

302,500

(Being Purchase Consideration due to Beena Ltd)

2

1.4

Goodwill A/C

Dr

50,000

Land & Building A/C

Dr

90,000

Plant & Machinery A/C

Dr

130,500

Stock A/C

Dr

49,500

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Debtors A/C

Anand R Bhangariya 86003 20000

Dr

65,000

To Provision for Bad debts

6,500

To Sundry Creditors

76,000

To Business Purchase

302,500

(Assets & Liabilities Taken over from Beena

Ltd. Recorded at fair value in books)

3

Liquidator of Beena Ltd Ac

Dr

302,500

To Cash & Bank A/C

150,000

To Equity share Capital A/C (12,200x10)

122,000

To Securities Premium A/C (12,200x2.5)

30,500

(Discharge of PC in form of Cash & Shares)

4

Sundry Creditors A/C

Dr

20,000

To Sundry Debtors A/C

20,000

(Elimination of intercompany dues)

5

Goodwill A/C

Dr

To Stock A/C (10,000/40,000X25000)

6,250

6,250

(Being elimination of unrealised profit on stock)

1.5

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

2. Transfer Co. X Ltd

Transferee Co. Y Ltd

Method of PC Net Asset Method

Nature of Amalgamation Purchase

Step 1: Calculation of Intrinsic Value per share

No

Particulars

X Ltd

Y Ltd

Transferor

Transferee

ASSETS

Fixed Assets (8,00,000 40,000)

760,000

1,600,000

Current Assets

900,000

860,000

1,660,000

2,460,000

500,000

Unsecured Loan

200,000

Creditors

310,000

360,000

Total (B)

510,000

860,000

1,150,000

1,600,000

10,000

80,000

115

20

Total (A)

B

Liabilities

Secured Loan

Net Assets (A-B)

No. of shares

Intrinsic value per share (C/D)

Step 2: Cash to be paid for every two shares held in X Ltd.

No

A

1.6

Particulars

Intrinsic value of 2 shares of X Ltd (2 x 115)

www.cavidya.com

Rs

230

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Intrinsic value of 10 shares of Y Ltd (10 x 20)

Cash to be paid for every 2 shares (A-B)

200

30

Step 3: Calculation of purchase Consideration

No.

Particulars

Rs

Mode of Discharge

Cash (30 x 10,000) 2

150,000 Cash

Equity shares in Y Ltd

500,000 Issue of 50,000 shares of

No of Shares to be issued x Rs.10

Rs 10 each issued at par

(10/2 x 10,000) x Rs.10

C

Total Purchase Consideration (A+B)

650,000

Step 4: Calculation of Goodwill or Capital Reserve

No

Particulars

Purchase consideration (Step 3)

Net Assets taken over (Step 1)

Capital Reserve (PC < Net asset)

Rs

650,000

1,150,000

500,000

Balance Sheet of Y Ltd (After Absorption)

(Amalgamation in nature of Purchase)

No

Particulars

Note

Rs

Rs

Equity & Liabilities

1

Shareholders Fund

1.7

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Share Capital

1,300,000

Reserves & Surplus

1,300,000

Non current liabilities

Long term borrowing

2,600,000

700000

Current Liabilities

Trade Payable

X Ltd

310,000

Y Ltd

360,000

Total (A)

B

Assets

Non current Assets

Fixed Assets

Tangible Assets

Current Assets

Cash & Cash equivalents

670,000

3,970,000

Bank (2,00,000 1,50,000)

2,360,000

50,000

Other Current assets

X Ltd

900,000

Y Ltd

660,000

Total (B)

1,610,000

3,970,000

Note1 Share Capital

No

Particulars

Authorised : 2,00,000 Eq. shares of Rs 10 each

1.8

www.cavidya.com

Rs

2,000,000

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Issued, Subscribed & Paid up

1,30,000 eq. shares of Rs 10 each fully paid (80,000 + 50,000)

1,300,000

(Out of above 50,000 shares were issued

without consideration being recd in cash)

1,300,000

Note 2 Reserves & Surplus

No

particulars

Rs

General Reserve

800,000

Capital Reserve (Step 4)

500,000

1,300,000

Note 3 Long Term Borrowing

No

Particulars

Rs

Secured loan

500,000

Unsecured loan

200,000

700,000

Note 4 Tangible Fixed Assets

No

Particulars

Y Ltd

Rs

1,600,000

Acquired from X Ltd

760,000

2,360,000

1.9

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

3. Transferor Co. B Ltd

Transferee Co. A Ltd

Method of PC Net Asset Method

Nature of Amalgamation Purchase

Step 1 Calculation of P & L Account balance on 30-9-2011

No.

Particulars

B Ltd.

Opening Balance

187,500

150,000

Add : Profit for six months

420,000

204,000

607,500

354,000

225,000

150,000

22,500

15,000

247,500

165,000

360,000

189,000

Dividend paid (15 % share capital)

Tax on dividend paid (10% of C)

A Ltd.

Balance as on 30.09.2011

Step 2 Balance Sheet as on 30.09.2011

No

Particulars

A Ltd.

B Ltd.

Equity & Liabilities

1

Shareholders Fund

Share Capital

Reserves & Surplus

Reserves

1,500,000

1,000,000

390,000

243,500

360,000

189,000

A Ltd. (Rs.4,15,000 - Rs. 25,000)

B Ltd. (Rs.2,56,000 - Rs.12,500)

P & L Account (Step 1)

1.10

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Current Liabilities

Trade Payable

Total (A)

Assets

Non current Assets

Fixed Assets

Opening WDV

93,750

75,000

2,343,750

1,507,500

1,250,000

875,000

62,500

43,750

1,187,500

831,250

237,500

187,500

390,000

256,000

528,750

232,750

2,343,750

1,507,500

(-) Depreciation @ 5 %

Tangible Assets

Current Assets

Stock in Trade

Debtors

Cash & Cash equivalents

(Balancing Figure)

Total (B)

Step 3 Calculation of Intrinsic value of shares of Company

No.

A

Particulars

A Ltd.

B Ltd.

Assets

Goodwill (Given)

120,000

Fixed other assets

Stock

1.11

www.cavidya.com

1,187,500

831,250

237,500

225,000

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

B Ltd. (1,87,500 7,500) + 25%

Debtors

390,000

256,000

Bank

528,750

232,750

2,343,750

1,665,000

Creditors

93,750

75,000

Total (B)

93,750

75,000

2,250,000

1,590,000

150,000

100,000

15

15.90

Total

B

Liabilities

Net Assets (A-B)

No. of equity shares

Intrinsic Value per share

Step 4 Share Exchange Ratio and Purchase Consideration

Particulars

No.

A

Existing no. of shares of B Ltd.

No. of shares to be issued (A x B)

Rs.

.

1.06

100,000

106,000

Purchase Consderation

D

1,590,000

(Issue of 1,06,000 shares of Rs.10 each issued @ Rs.15 each)

Step 5

Balance Sheet of A Ltd after absorption (as on 01-10-11)

Nature of Amalgamation Amalgamation in nature of Purchase

No.

1.12

Particulars

Note No.

www.cavidya.com

Rs.

Rs.

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Equity & Liabilities

1

Share holders Fund

Share Capital

2,560,000

Reserves & Surplus

1,280,000

Current Liabilities

3,840,000

Trade payable

A Ltd.

93,750

B Ltd.

75,000

Total

4,008,750

Non Current Assets

Fixed Assets

i)

Tangible Assets

ii

Intangible assets Goodwill

Current Assets

Inventories

1.13

168,750

2,018,750

120,000

A Ltd.

237,500

B Ltd.

225,000

2,138,750

462,500

Trade Receivables

A Ltd.

390,000

B Ltd.

256,000

646,000

Cash & Cash equivalents

A Ltd.

528,750

B Ltd.

232,750

www.cavidya.com

761,500

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Total (B)

4,008,750

Note1 Share Capital

No

Particulars

Rs.

Authorised

.. Eq shares of Rs 10 each

Issued subscribed & paid up

2,56,000 Equity Shares of Rs 10 each, fully paid

2,560,000

(Out of above 1,06,000 shares were issued without

consideration being received in cash)

2,560,000

Note 2 Reserves & Surplus

No

Particulars

Rs.

Securities Premium (106,000 shares x 5)

530,000

Reserves

390,000

Profit & Loss A/c

360,000

1,280,000

Note 3 Tangible Fixed Assets

No

Particulars

1)

A Ltd

2)

Add : Acquired from B Ltd

Rs

1,187,500

831,250

2,018,750

1.14

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

4. Transferor Co. Vibham

Transferee Co. Shubham

Method of PC Net Asset Method

Nature of Amalgamation Merger

Step 1: Computation of intrinsic value per share

No.

A

Particulars

Vibham Ltd.

Shubham Ltd.

Fixed Assets

200

429

Current Assets

200

200

Goodwill

40

75

Total (A)

440

704

100

100

Assets

Liabilities

Loans secured

Preference share capital

60

Total (B)

100

160

Net Assets (A-B)

340

544

No. of shares

Intrinsic value per share (C/D)

68

136

Step 2 Share Exchange Ratio and Purchase Consideration

No.

A

Particulars

Existing no. of equity shares of Vibham Ltd.

No. of shares to be issued ( x 5)

1.15

www.cavidya.com

Rs.

.

1:2

5

2.5 crore

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Purchase consideration

D

25 crores

(Issue of 2.5 crores equity shares of Rs 10 each issued at par)

Step 3: Calculation of Capital Reserve arising on absorption

(Nature of Amalgamation :- Merger)

Sr.No.

Particulars

Rs. In crores

Purchase Consideration incorporated in books

25

Paid-up capital of Vibham Ltd

50

Capital Reserve

25

Step 4: Balance sheet of Shubham Ltd. as on 1-4-2012

(Rs crores)

No.

Particulars

Note No.

Rs.

Rs.

Equity & Liabilities

1

Shareholders Fund

Share Capital

125

Reserves and Surplus

375

Non Current Liabilities

Long Term borrowings

Secured loan

500

200

Total

700

Assets

1

1.16

Non Current Assets

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Fixed Assets

(i)

Tangible

300

Current Assets

400

Total

700

Note 1 - Share Capital

No

Particulars

Rs. in crore

Authorised

.. Eq shares of Rs 10 each

.. 10% Preferencce Shares of Rs 100 each

Issued subscribed & paid up

6.5 Eq shares of Rs 10 each fully paid up

65

(Out of above 2.5 equity shares were issued

without consideration being received in cash)

0.6, 10% Preferencce Shares of Rs 100 each

Total

60

125

Note 2 - Reserves and Surplus

No

Particulars

Rs. in crore

Capital Reserve (WN-3)

Other Reserves & Surplus (200+150)

350

Total

375

1.17

25

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

5. Transferor Co. V Ltd.

Transferee Co. P Ltd.

Method of PC Pooling of Interest Method

Nature of Amalgamation Merger

Step 1: Calculation of Purchase consideration

(Net Payment Method)

No

Particulars

Share Exchange Ratio

Existing shares of V Ltd. (In Lakhs)

Rs

3:2

600

No of shares to be issued (In Lakhs)

900

(3/2 x 600)

10

Issue price per share (given)

Purchase consideration (C X D) (In Lakhs)

9,000

In the books of P Ltd (Transferee Co.)

Journal entries

No

1

Particulars

Business Purchase a/c

L.F

Dr

Debit

9,000

To Liquidator of V Ltd

2

9,000

Plant & Machine

Dr

5,000

Furniture

Dr

1,700

Stock

Dr

4,041

Drs

Dr

1,020

1.18

www.cavidya.com

Credit

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Bank

Dr

609

Bills Receivable

Dr

80

General Reserve a/c

Dr

3,000

(PC 9000 lakh Paid up 6000 of V Ltd)

To Foreign Project Reserve

310

To General Reserve

3,200

To P & L a/c (825 50)

775

To 12 % Deb.

1,000

To Sundry Crs

463

To Sundry Provisions

702

To Business Purchase

9,000

(Being assets, liabilities & reserves taken over

from V Ltd & the diff between P & C & Paid

up capital of V Ltd is adjusted against

general reserve)

3

Liquidator of V Ltd a/c

Dr

9,000

To Eq share Cap. a/c

4

9,000

Bills payable a/c

Dr

80

To Bills Receivable

80

(Elimination of inter-company dues)

5

12% Deb. a/c

Dr

To 13% Deb. a/c

1,000

1,000

(Being 12% deb. converted into

1.19

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

13% deb. in V Ltd)

6

Reserve (GR) a/c

Dr

To Bank a/c

(Being expenses of amalgamation

borne by P Ltd)

Balance Sheet of P Ltd (After absorption)

Nature of Amalgamation Amalgamation in nature of Merger

Sr

Particulars

Note

Rs

Rs

Equity & Liabilities

Shareholders Fund

Share capital

24,000

Reserves & Surplus

16,654

Non current liabilities

40,654

Long term borrowing

13 % Debentures

3

1,000

Current liabilities

Trade payables

Bills Payable (Rs. 120 - Rs. 80)

40

Creditors (Rs. 1080 + Rs. 463)

1,543

Short term provisions

2,532

Sundry Provisions (Rs. 1830 + Rs.702)

Total (A)

1.20

4,115

45,769

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

ASSETS

1

Non current Assets

Fixed Assets

Tangible Assets

Current Asset

Inventories (7862 + 4041)

Trade Receivables (2120 + 1020)

3,140

Cash & Cash equivalent

1,722

29,004

11,903

(1114 + 609 1)

16,765

Total (B)

45,769

Note 1 - Share Capital

No

Particulars

Rs

Authorised .. Eq shares of Rs 10 each

Issued, subscribed & paid up

2400 lakhs eq shares of Rs 10 each fully paid (1500 + 900)

24,000

Note Out of above, 900 lakh shares were issued

without consideration being recd in cash)

24,000

Note 2 - Reserves and Surplus

No

Particulars

(a)

Securities Premium

(b)

Foreign Project Reserve

(c)

General Reserve

1.21

Rs

Rs

3,000

310

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

P Ltd.

9,500

V Ltd.

3,200

12,700

Less : Adjustment for diff in PC & paid up capital

Less : Amalgamation exp

(d)

-3,000

-1

9,699

Profit & Loss Account

P Ltd.

2,870

V Ltd.

775

3,645

16,654

Note 3 - Tangible Fixed Assets

No

Particulars

Land and Building

Rs

6,000

Plant & Machinery (14000 + 5000)

Furniture (2304 + 1700)

19,000

4,004

29,004

1.22

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

6.

W Note 1

Consideration payable to preference shareholders of P Ltd.

Sr.No.

Particulars

Existing preference dividend

Add : 10% increase

Required preference dividend after absorption

Face value of 8% preference shares to be issued

Rs.

40,000

4,000

44,000

550,000

( 44,000 8 )

W Note 2

Calculation of EPS

Sr. No.

Particulars

Profit before Tax

R Ltd

P Ltd

1,064,000

480,000

Less Tax

400,000

200,000

Profit after Tax

664,000

280,000

Less : Preference dividend

64,000

40,000

Earning available to ESH

600,000

240,000

No. of equity shares

240,000

120,000

EPS

2.5

W Note 3

Calculation of Price Earning Ratio of R Ltd.

PE Ratio = Market Price per Share / Earning per Share

= 40 2.5 = 16

1.23

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

W Note 4

Calculation of Market price of P Ltd

Sr.No.

Particulars

Rs.

EPS of P Ltd.

PE Ration (75% x 16)

12

Market price share (AxB)

24

W Note 5

Calculation of no. of equity shares to be issued

Particulars

Sr.No.

A

Rs.

.

Existing as of shares of P Ltd.

No. of equity shares to be issued (AxB)

Issue of 72,000 equity shares @ Rs 40 each

0.6

120,000

72,000

2,880,000

W Note 6

Calculation of PS to be issued to Equity Shareholders of P Ltd.

Sr.No.

Particulars

Existing equity dividend of P Ltd (Given)

Rate of equity dividend of R Ltd

Rs.

192,000

12%

(288,000 24,00,000 x 100)

C

Equity dividend received by shareholders of P Ltd

86,400

after absorption (72,000 x Rs 10 EV x 12%)

1.24

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Loss of equity dividend (A-C)

Face Value of 8% preference shares to be issued

105,600

to compensate for loss of eq. dividend

1,320,000

Total Purchase consideration

Sr. No.

Particulars

Consideration payable to preference shareholders

Rs.

Rs.

550,000

(55,000 8 % P.S. of Rs 10 each)

B

Consideration payable to Eq shareholders

(i)

72,000 eq shares of Rs 10 each would @ 40

2,880,000

(ii)

1,32,000 8% preference share of Rs 10 each

1,320,000

Total (A+B)

4,200,000

4,750,000

Calculation of Goodwill

No.

A

Particulars

Assets

Fixed Assets (27,00,000 + 1,00,000)

Current Assets (23,00,000 - 2,00,000)

Total (A)

C

1.25

Rs.

2,800,000

2,100,000

4,900,000

Liabilities

Current Liabilities (10,00,000 - 40,000)

960,000

Total (B)

960,000

Net Assets

3,940,000

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Purchase Consideration

Goodwill ( D - C )

Anand R Bhangariya 86003 20000

4,750,000

810,000

Balance Sheet as on 31-3-10

Sr. No.

Particulars

N. No.

Rs.

Rs.

EQUITY & LIABILITIES

1

Shareholders Fund

Share Capital

5,790,000

Reserve & Surplus

5,160,000

Non Current Liabilities

Long Term Borrowings

Current Liabilities (18,00,000 + 9,60,000)

2,760,000

Total

13,710,000

10,950,000

ASSETS

1

Non Current Assets

Fixed Assets

(i)

(ii)

2

Tangible Assets

(55,00,000 +27,00,000 + 1,00,000)

Intangible Assets Goodwill

Current Assets

(25,00,000 + 23,00,000 + 2,00,000)

Total

1.26

www.cavidya.com

8,300,000

810,000

9,110,000

4,600,000

13,710,000

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Note 1 - Share Capital

No

Share Capital

Rs.

Authorised

.. Eq shares of Rs 10 each

Issued, subscribed & paid up

3,12,000 Eq. shares of Rs 10 each fully paid

3,120,000

(Out of above 72,000 shares are issued for

consideration other than cash)

2,67,000 Pref shares of Rs 10 each fully paid

Total

2,670,000

5,790,000

Note 2 - Reserves and Surplus

No

Particulars

Reserves

Rs.

3,000,000

Securities Premium (40-10) x 72,000

2,160,000

5,160,000

1.27

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

7. Transfer Co. Indicate Ltd & Syndicate Ltd

Transferee Co. Sipiem Ltd

Method of PC Net Asset Method

Nature of Amalgamation Purchase

W Note 1 Calculation of Goodwill

No

Particulars

Avg. profits of last 3 years

Capital employed

Indikat (Rs)

Syndikat (Rs)

82,500

62,500

500,000

350,000

(share capital + P & L a/c)

C

Normal profit @ 10% on capital employed

50,000

35,000

Super profit (A-C)

32,500

27,500

Goodwill (D x 2.5)

81,250

68,750

150,000

W Note 2 Calculation of Purchase consideration, Nos of shares to be issued &

Share Exchange ratio

No

A

Particulars

Syndikat

(Rs)

ASSETS

Goodwill (Step 1)

Indikat (Rs)

81,250

68,750

Fixed Assets

450,000

290,000

Current Assets

250,000

610,000

Total (A)

781,250

968,750

Liabilities

1.28

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Current Liabilities

200,000

550,000

Total (B)

200,000

550,000

Net Assets (A-B)

581,250

418,750

Issue price per share (10 + 2.5)

12.50

12.50

No of shares to be issued (C/D)

46,500

33,500

Existing shares of Transferor Co.

31,000

33,500

Share Exchange Ratio (E/F)

1.5

1.0

Balance Sheet of Sipiem Ltd as on 01-07-13

Nature Amalgamation in nature of Purchase

Sr

Particulars

Equity & Liabilities

Shareholders funds

Share Capital

Reserves & Surplus

Note

Rs

Rs

1,000,000

Securities Premium

250,000

(1,00,000 x 2.5)

2

Current liabilities

750,000

Total (A)

B

Assets

Non current assets

Fixed assets

Tangible assets

1.29

2,000,000

740,000

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

ii

Intangible Goodwill

Current Assets

Cash & Cash Equivalents

Anand R Bhangariya 86003 20000

150,000

Cash at Bank (20,000 x 12.5)

250,000

Other Current Asset

860,000

Total (B)

890,000

1,110,000

2,000,000

Note 1 - Share Capital

No

Particulras

Authorised 5,00,000 Eq. shares of Rs 10 each

Rs

5,000,000

Issued, subscribed & paid up

1,00,000 eq. shares of Rs 10 each fully paid

1,000,000

(Note Out of above 80,000 shares were

issued without consideration recd in cash)

1,000,000

1.30

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

8. Transfer Co. Payal Ltd

Transferee Co. Dipti Ltd

Method of PC Net Payment Method

Nature of Amalgamation Purchase

W Note 1 Calculation of Purchase consideration

Sr.No.

A

Particulars

Rs.

Equity shares in Dipti Ltd

4,00,000 eq. shares of Rs 10 each issued at par

Cash

Total Purchase consideration

4,000,000

300,000

4,300,000

In the books of Payal Ltd.

Realisation A/c

Particulars

To land & building

To Goodwill

To Sundry Debtors

(3,98,400 40,000)

To Stock

Rs

Particulars

3,568,200 By 10% debentures

Total

1,000,000

500,000 By Creditors

436,200

By Bank O/D

200,000

358,400

By Dipti Ltd (PC)

785,200 By Shareholders A/c

To Plant & Machinery

Rs

1,643,900 (Loss on realization)

6,855,700

Total

4,300,000

919,500

6,855,700

Shareholders A/c

1.31

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Particulars

Anand R Bhangariya 86003 20000

Rs

To Unpaid Calls

Particulars

Rs

10,000 By eq. share capital A/c

To Bank

5,000,000

300,000 By P & L A/c

To Eq. shares in Dipti Ltd

4,000,000 (269,500 40,000)

To Realisation A/c

229,500

919,500

Total

5,229,500

Total

5,229,500

In the books of Dipti Ltd. (Transferee Ltd)

Nature of amalgamation Purchase

Method of accounting Purchase

Journal Entries

No.

1

Particulars

Business Purchase A/c

L.F

Dr

Dr Rs.

4,300,000

To Liquidator of Payal Ltd.

4,300,000

(Being Purchase Consideration due)

2

Land & Building A/c

Dr

3,568,200

Sundry Debtors (3,98,400 40,000)

Dr

358,400

Stock A/c

Dr

785,200

Plant & Machinery A/c

Dr

1,643,900

To 10 % Debentures

1,000,000

To Sundry Creditors

436,200

To Bank O/D

200,000

To Business Purchase

1.32

Dr Rs.

www.cavidya.com

4,300,000

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

To Capital Reserve (B/F)

419,500

(Being assets & liabilities taken over)

3

Liquidator of Payal Ltd A/c

Dr

4,300,000

To Equity Share Capital A/c

4,000,000

To Bank A/c

300,000

(Being discharge of Purchase Consideration)

4

Capital Reserve A/c

Dr

140,000

To Bank

140,000

(Being liquidation expenses paid)

Balance Sheet of Dipti Ltd.

No.

Particulars

Note No.

Rs.

Rs.

EQUITY & LIABILITIES

1

Shareholders Fund

Share Capital

18,950,000

Reserves & Surplus

1,268,000

Non Current Liabilities

Long Term borrowings

Secured Loans

6,000,000

10% Debentures (50 L + 10 L)

Current Liabilities

Short term borrowings

Bank overdraft

1.33

20,218,000

200,000

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Trade Payables

1,270,400

Total

1,470,400

27,688,400

ASSETS

1

Non Current Assets

Fixed Assets

(i)

Tangible

(ii)

Intangible

Goodwill

19,421,900

3,000,000

Current Assets

Inventories (17,92,600 + 7,85,200)

2,577,800

Trade Receivables (7,24,000 + 3,58,400)

1,082,400

Cash & Cash equivalents

(i)

Bank

(1684,200 3,00,000 140,000)

Other Current Assets

(i)

Bills Receivables

1,244,200

362,100

Total

22,421,900

5,266,500

27,688,400

Note 1 - Share Capital

No.

Particulars

Authorised : 20,00,000 eq. shares of Rs 10 each

Rs.

20,000,000

Issued, Subscribed & paid up

1)

19,00,000 eq. shares of Rs 10 each (15 Lakhs + 4 Lakhs)

2)

Less : Calls in arrears

1.34

19,000,000

-50,000

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

(Out of above 4,00,000 eq. shares were issued without

Consideration being received in cash)

18,950,000

Note 2 - Reserve & Surplus

No.

Particulars

Rs.

1)

Profit & Loss A/c

988,500

2)

Capital Reserve (4,19,500 1,40,000)

279,500

Total

1,268,000

Note 3 - Tangible Assets

No.

1)

2)

Particulars

Rs.

Land & Building

Dipti Ltd.

10333000

Payal Ltd.

3568200

13,901,200

Plant & Machinery

Dipti Ltd.

3876800

Payal Ltd.

1643900

Total

1.35

Rs.

www.cavidya.com

5,520,700

19,421,900

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

9. W Note 1 Calculation of Purchase consideration

Sr.No

Particulars

A Ltd

Consideration paid to Preference Shareholders

i)

A Ltd (3 lakh, 15 % P.S. of Rs 100 each issued @ Rs 150 each)

ii)

B Ltd (2 lakh, 15 % P.S. of Rs 100 each issued @ Rs 150 each)

Consideration paid to Equity Shareholders

i)

A Ltd (8 lakh x 5) i.e. 40 lakh

Equity shares of Rs 10 each issued @ Rs 30

ii)

B Ltd

450

300

1,200

B Ltd (7.5 lakh x 4) i.e. 30 lakh

900

Equity shares of Rs 10 each issued @ Rs 30

C

1,650

Total Purchase consideration (A + B)

1,200

2,850

Note : As per AS 14, Purchase consideration means consideration payable to

shareholders of Transferor Co. Therefore, consideration paid to deb. holders

will not form part of Purchase Consideration. Deb. holders will be taken over

and discharged separately.

W Note 2 Consideration paid to debenture holders

No

A

B

Particulars

A Ltd B Ltd -

1.36

Rs in lakhs

10% 60

15%

10% 30

15%

www.cavidya.com

40

20

Total

60

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

W Note 3 Securities Premium

No

Particulars

A)

Preference share capital (5 lakh x 50)

B)

Equity share Capital (70 lakh x 20)

Rs

250

1,400

Total

1,650

W Note 4

Calculation of Goodwill / Capital Reserve

No

Particulars

Purchase consideration

Assets

Rs

2,850

Assets taken over (2000 + 1500)

3,500

Total (B)

3,500

Liabilities

Debenture Holders (W Note 2)

60

Creditors (270 + 120)

390

Bills Paayable (150 + 70)

220

Total (C)

670

Net Assets Taken Over (A-B)

Goodwill : (PC > Net asset) (A-D)

2,830

20

Balance Sheet as on 01-04-11

1.37

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Nature Amalgamation in nature of Purchase

Sr

Particulars

Note

Rs

Rs

Equity & Liabilities

Shareholders funds

Share Capital

1,200

Reserves & Surplus

1,670

Non current liabilities

Long term borrowing

15 % Debentures (W Note 2)

Current liabilities

Trade payables

60

Creditors (270 + 120)

390

Bills Payable (150 + 70)

220

Total

610

3,540

Assets

Non Current Assets

Fixed Assets

Tangible assets

ii

Intangible assets (W Note 4)

Non current investment

Unamortised exp.

1,550

20

1,570

200

Amalgamation Adjustment

2

2,870

20

Current Asset

1.38

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Inventories (350 + 250)

Trade Receivables

Anand R Bhangariya 86003 20000

600

Debtors (250 + 300)

550

Bill Receivable (50 + 50)

100

Cash & cash equivalent

Cash at Bank (300 + 200)

500

1,750

3,540

Total

Note 1 Share Capital

No

Particulars

Rs in lakh

Authorised Eq. shares of Rs 10 each

.. 15% P.S. of Rs 100 each

Issued, Subscribed & Paid up

70 lakh Eq. shares of Rs 10 each fully paid

700

5 lakh 15% P.S. of Rs 100 each fully paid

500

(Note All the above shares were issued

without consideration being recd. in cash)

1,200

Note 2 Reserves & Surplus

No

Particulars

Securities Premium (WN 3)

Foreign Project Reserve (Statutory Reserve)

1.39

www.cavidya.com

Rs in lakh

1,650

20

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

1,670

Note 3 Tangible Assets

No

Particulars

Rs

Land & Bldg (550 + 400)

950

Plant & Machine (350 + 250)

600

1,550

1.40

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

10. W Note 1 Calculation of Purchase consideration

No

Particulars

Consideration paid to Preference Shareholders

i)

Alpha Ltd (4 lakh; 15% P.S. of Rs 100 each)

ii)

Beta Ltd (3 lakh; 15% P.S. of Rs 100 each)

Consideration paid to Equity Shareholders

i)

Alpha Ltd 10 lakh x 1.5 i.e. 15 lakh Equity shares

Alpha Ltd

Beta Ltd

400

300

1,500

15 lakh Equity shares of Rs 100 each

ii)

Beta Ltd 8 lakh x 1 i.e. 8 lakh Equity shares

800

8 lakh Equity shares of Rs 100 each

C

Total Purchase consideration

1,900

1,100

3,000

Note : As per AS 14, Purchase consideration means consideration payable to

shareholders of Transferor Co. Therefore, consideration paid to deb. holders

will not form part of Purchase Consideration. Deb. holders will be taken over

and discharged separately.

W Note 2 Consideration paid to debenture holders

No

A

B

Particulars

Alpha Ltd Beta Ltd -

1.41

Rs in lakhs

12% 96

16%

12% 80

16%

www.cavidya.com

72

60

Total

132

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

In the books of Gamma Ltd (Transferee Co.)

Journal entries

Nature Amalgamation in nature of merger

No

1

Particulars

Business Purchase A/c

L.F

Dr

Debit (Rs.)

Credit (Rs.)

3,000

To Liquidator of Alpha Ltd

1,900

To Liquidator of Beta Ltd

1,100

Fixed Assets A/c

Dr

2,200

Current assets A/c

Dr

1,445

General Reserve A/c

Dr

350

P&L A/c (456 350)

Dr

106

To Deb. Holders of Transferor A/c

132

To Current liabilities A/c

299

To Revaluation Reserve A/c

180

To General Reserve A/c

350

To P & L A/c

140

To Business Purchase

3,000

(Being assets, liabilities & reserves of Alpha

& Beta Ltd taken over)

3

Liquidator of Alpha Ltd A/c

Dr

1,900

Liquidator of Beta Ltd A/c

Dr

1,100

To 15% P.S. Capital A/c (400 +300)

To Eq. share cap. A/c

1.42

www.cavidya.com

700

2,300

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

(Being discharge of liquidator)

4

Deb. holders of transferor co. A/c

Dr

132

To 16% Deb. A/c

132

(Being discharge of deb. holders)

Balance Sheet as on 01-04-11

Sr

Particulars

Note

Rs

Rs

Equity & Liabilities

Shareholders funds

Share Capital

3,000

Reserves & Surplus

214

Non current liabilities

Long term borrowing

3,214

16 % Debentures (W Note 2)

132

Current liabilities

299

Total

3,645

Assets

Non Current Assets

Fixed Assets

2,200

Current Asset

1,445

Total

3,645

Note 1 Share Capital

No

1.43

Particulars

www.cavidya.com

Rs in lakh

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Authorised Eq. shares of Rs 100 each

.. 15% P.S. of Rs 100 each

Issued, subscribed & paid up

23 lakh Eq. shares of Rs 100 each fully paid

7 lakh 15% P.S. of Rs 100 each fully paid

2,300

700

3,000

All the above shares were issued without consideration being received in cash

Note 2 Reserves & Surplus

No

Particulars

Profit and Loss A/c (140 106)

Revaluation Reserve

Rs in lakh

34

180

214

1.44

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

11. Calculation of Net Assets excluding goodwill

No.

A

Particulars

Fixed Assets

400,000

100,000

Current Assets

230,000

220,000

630,000

320,000

200,000

140,000

200,000

140,000

430,000

180,000

Liabilities

Current Liabilities

Total (B)

B Ltd.

Assets

Total (A)

B

A Ltd.

Net Assets (A-B)

WN-2 Calculation of G/W (Super Profit Method)

No.

Particulars

Average Profits of last 3 years

Net Assets excluding G/W (WN-1)

Required Rate of Return

A Ltd.

B Ltd.

45,400

20,733

430,000

180,000

8%

8%

Normal Profit (B x C)

34,400

14,400

Super Profit (A - D)

11,000

6,333

Goodwill (E x 4 years)

44,000

25,333

Rounded off

44,000

25,330

WN-3 Calculation & discharge of PC

Particulars

No.

A

Net Assets excluding G/W (WN-1)

G/W (WN-2)

1.45

www.cavidya.com

A Ltd

B Ltd

430,000

180,000

44,000

25,330

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Total PC (A + B)

Issue Price per share

Number of Shares (C/D)

Anand R Bhangariya 86003 20000

474,000

205,330

Rs 10

Rs 10

47,400

20,533

In the books of A Ltd (Transferor Co.)

Journal Entries

No.

1

Particulars

Realisation A/c

L.F

Dr

Dr Rs

Cr Rs

630,000

To Fixed Assets A/c

400,000

To Current Assets A/c

230,000

(Transfer of assets to realization A/c)

2

Current Liabilities A/c

Dr

200,000

To Realisation A/c

200,000

(Transfer of Liability to realization A/c)

3

Equity Share Capital A/c

Dr

150,000

General Reserve A/c

Dr

160,000

P & L A/c

Dr

120,000

To Equity Shareholders A/c

4

AS Ltd.

430,000

Dr

474,000

To Realisation A/c

474,000

(PC due)

5

Equity Shares in AS Ltd

Dr

To AS Ltd.

1.46

474,000

474,000

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

(Being PC received)

6

Realisation A/c

Dr

44,000

To Equity Shareholders A/c

44,000

(Profit on realization A/c

Transferred to Equity Shareholders A/c)

7

Equity Shareholders A/c

Dr

474,000

To Equity shares in AS Ltd

474,000

(Being dividend under liquidation paid

in forms of eq. shares in AS Ltd.)

Journal Entries in the books of B Ltd. (Transferor Co.)

No.

1

Particulars

Realisation A/c

Dr Rs

Dr

Cr Rs

410,000

To Fixed Assets

100,000

To Current Assets

220,000

To Goodwill

90,000

(Transfer of assets of realization A/c)

2

Current Liabilities A/c

Dr

140,000

To Realisation A/c

140,000

(Transfer of liability to realization A/c)

3

Equity Share Capital A/c

Dr

P & L A/c

Dr.

To Equity Shareholders A/c

1.47

www.cavidya.com

200,000

70,000

270,000

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

(Transfer of Capital & reserves

to Equity Shareholders A/c)

4

AS Ltd. A/c

Dr

205,330

To Realisation A/c

205,330

(PC due)

5

Equity shares in AS Ltd A/c

Dr

205,330

To AS Ltd A/c

205,330

(PC received)

6

Equity Shareholders A/c

Dr

64,670

To Realisation A/c

64,670

(Loss on realization)

7

Equity Shareholders A/c

Dr

To Equity shares in AS Ltd.

205,330

205,330

(dividend under liquidation paid)

1.48

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

12. WN-1 Shareholding Patterns of T Ltd

No.

Particulars

Number

No. of Shares before bonus issue

10,000

(+) Bonus Shares (1:2)

Total no. of shares after bonus

No. of shares held by A (2000 + 1000) bonus

Shares held by outside shareholders (C-D)

5,000

15,000

3,000

12,000

WN-2 Calculation of PC & discharge of PC (Net payment)

No.

Particulars

Rs

Consideration payable to outsider

1

Shareholders

Form of discharge

8,000 shares of A Ltd. of Rs

1,200,000 100 each valued at Rs 150 each

12,000 Shares x Rs.100

2

Consideration payable to A Ltd

300,000

3,000 Shares x Rs.100

Total

Mutual Set off

1,500,000

Ledger Accounts in the books of T Ltd.

Realisation A/c

(Rs. In Lakhs)

Particulars

To Fixed Assets

To Current Assets

1.49

Rs.

Particulars

15 By Current Liabilities

5 By A Ltd (PC due)

www.cavidya.com

Rs.

2

15

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

By Equity Shareholders

(Loss on Realisation)

20

20

Equity Shareholders A/c

Particulars

Rs.

Particulars

Rs.

To Realisation A/c

3 By Equity Share Capital

15

To A Ltd

3 By Reserves & Surplus

To Eq. shares in A Ltd

12

18

18

A Ltd A/c

Particulars

Rs.

To Realisation A/c

Particulars

Rs.

15 By equity shares in A Ltd

12

By Equity Shareholders

(Mutual Set Off)

15

15

Equity Shares in A Ltd A/c

Particulars

To A Ltd

Rs.

12

Particulars

By Equity Shareholders

12

Rs.

12

12

Equity Share Capital A/c

1.50

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Particulars

Rs.

To Equity Shareholders

15

Particulars

Rs.

By Balance b/d

10

By Reserves and Surplus

(Bonus)

Total

15

Total

15

Particulars

Rs.

Reserves and Surplus A/c

Particulars

Rs.

To Equity Share Capital A/c

To Equity Shareholders A/c

By Bal b/d

In the books of A Ltd. (Transferee Co.)

Journal Entries

Nature of Amalgamation Merger

Method of Accounting Pooling of Interest

No.

1

Particulars

Business Purchase A/c

L.F

Dr

Dr Rs

Cr Rs

15

To liquidator of T Ltd.

2

15

Fixed Asset A/c

Dr

15

Current Asset A/c

Dr

1.51

To Current Liabilities

To Reserves & Surplus

To Business Purchase

15

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Liquidator of T Ltd A/c

Anand R Bhangariya 86003 20000

Dr

15

To Equity Share Capital (8000 shares x 100)

To securities Premium (8000 shares x 50)

To Investment in shares of T Ltd.

(Discharge of liquidator of T Ltd.

& cancellation of investment)

4

Current Liability A/c

Dr

To Current Assets

(Elimination of inter company due)

5

Reserves & Surplus A/c (25 / 125 x 50,000)

To Stock (Current Asset)

(elimination of unrealised profit on stock)

1.52

www.cavidya.com

Dr

0.1

0.1

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

13. W Note 1 Calculation of Intrinsic value of shares

Sr.

A

Particulars

SHO

THAM

AN

ASSETS

Land (Book value + 100%)

200

100

20

Building (Book value + 50%)

600

150

300

Machinery (Book value + 20%)

960

600

600

Other fixed Assets

100

200

50

Investment in AN Ltd

1,010

(40 lakh shares x 25.25)

Net Current Assets

1,040

1,240

740

2900

3300

1710

Liabilities : Loans

900

1000

700

Total (B)

900

1000

700

2000

2300

1010

100

80

40

(1252 60% x 20)

Total (A)

B

Net Assets (A-B)

No of shares (in lakhs)

Intrinsic value of shares

20.00

28.75

25.25

(in Rs) (C/D)

W Note 2 Calculation & Discharge of Purchase consideration

Sr.

Particulars

SHO

THAM

Total no of shares (in lakhs)

100

80

Shares held by Puru Ltd (in lakhs)

40

20

1.53

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Shares held by outsiders

60

60

Intrinsic value per share (WN 1) (in Rs)

20

28.75

Consideration payable to outside Sh. holders(CxD)

1200

1725

Nos of shares to be issued @ Rs 20/Sh.(E 20)

60

86.25

Consideration payable to Puru Ltd (BxD)

to be mutually set off

800

575

Total purchase consideration (E+G)

2000

2300

In the books of Puru Ltd (Transferee Co.)

Nature of amalgamation In nature of purchase

Journal Entries

No.

1

Particulars

Investment in shaes of Sho Ltd A/c

L.F

Dr Rs

Dr

300

Dr

275

Cr Rs

(800 500) WN 2

Investment in shares of Tham Ltd A/c

(575 300) WN 2

To capital reserve

575

(Revaluation of investment in shares

of Sho Ltd & Tham Ltd)

2

Business Purchase A/c

Dr

4,300

To Liquidator of Sho Ltd

2,000

To Liquidator of Tham Ltd

2,300

(Being P.C. due)

1.54

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Land A/c (200 + 100)

Dr

300

Building A/c (600 + 150)

Dr

750

Machinery (960 + 600)

Dr

1560

Other Fixed assets (100 + 200)

Dr

300

Investment in shares of AN Ltd

Dr

1,010

Net current asset (1040 + 1240 (40% x 20)

Dr

2,272

Capital Reserve A/c (Bal fig.)

Dr

8*

To Loans A/c (900 +1000)

1,900

To Business Purchase

4,300

(Being assets & liabilities of Sho Ltd &

Tham Ltd recorded in books at fair value)

4

Liquidator of Sho Ltd A/c

Dr

2,000

Liquidator of Tham Ltd A/c

Dr

2,300

To Eq. share cap. (160 + 86.25 x 10)

1462.5

To Securities Prem. (146.25 x 10)

1462.5

To Investment in shares of Sho Ltd

800

To Investment in shares of Tham Ltd

575

(Being discharge of liquidators of Sho &

Tham and investments are cancelled)

5

1.55

Land A/c

Dr

20

Building A/c

Dr

300

Machinery A/c

Dr

600

Other Fixed asset A/c

Dr

50

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Net Current asset A/c

Anand R Bhangariya 86003 20000

Dr

740

To Loans A/c

700

To Investment in shares in AN Ltd

1010

(Being assets & liabilities of AN Ltd

recorded)

Balance Sheet of Puru Ltd (After absorption) as on 01-04-2012

Rs in lakhs

No.

Particulars

N. No.

Rs.

Rs.

Equity & Liabilities

1

Shareholders funds

Share Capital

2962.5

Reserves & Surplus

4029.5

Non current liabilities

Long term borrowings

Loans (900 + 1000 + 700 + 1600)

6,992

4200

Total

11,192

ASSETS

1

Non current assets

Fixed Assets

i)

Tangible

Non current investment

Others

1.56

6,480

100

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Net Current assets

4,612

(1600 + 1040 + 1240 + 740 8*)

Total

11,192

Note 1 Share Capital

No

Particulars

Rs.

Authorised . Eq. shares of Rs 10 each

Issued, subscribed & paid up

(150 + 146.25) 296.25 lakhs equity

shares of Rs 10 each fully paid up

2962.5

(Out of above,146.25 lakh equity shares

were issued without consideration being

received in cash)

2962.5

Note 2 Reserves & Surplus

No

Particulars

Reserves

Rs.

2,000

Securities Premium

1,462.50

Capital Reserve (575 8)

567

Total

4029.5

WN3 Tangible Fixed Assets

1.57

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Sr.No.

Anand R Bhangariya 86003 20000

Particulars

Land (200 + 200 + 100 + 20)

520

Building (500 + 600 + 150 + 300)

1,550

Machinery (1500 + 960 + 600 + 600)

3,660

Other (400 + 100 + 200 + 50)

750

Total

1.58

Rs.

www.cavidya.com

6,480

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

14. W Note 1 Calculation of Purchase consideration

Sr. No.

Particulars

Assets (FA + Net working capital)

Liabilities 10% Debentures

Net Assets i.e. PC (A B)

Rs Cr.

130

25

105

W Note 2 Shareholding Pattern

Sr. No.

Particulars

No of Shares

Total Shares of H Ltd

Total 2.5 Cr Shares

Shares held by S Ltd.

2 Cr shares

Shares held by Outside shareholders

0.5 Cr share

W Note 3 Discharge of PC

Sr. No.

A

B

C

Particulars

Rs

Consideration payable to outside

shareholders (0.5 / 2.5 x 105)

Consideration payable to S Ltd.

(2 / 2.5 x 105)

Total

21

84

Form of discharge

21 lakh shares of Rs 10 @

Rs 100 each

Mutual set off

105

In the books of S Ltd. (Transferee Co.)

Journal Entries

Nature of Amalgamation : Purchase

1.59

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Sr. No.

1

Anand R Bhangariya 86003 20000

Particulars

L.F

Investment in eq. shares of H Ltd A/c

Dr

(84 32) (WN 3)

Dr Rs

52

To Capital Reserve

52

(Being upward revaluation of shares in H Ltd)

2

Business Purchase A/c

Dr

105

To liquidator of H Ltd. (PC due)

3

105

FA A/c

Dr

30

CA A/c

Dr

300

To Current Liabilities

200

To 10 % debentures

25

To Business Purchase

105

Liquidator of H Ltd. A/c

Dr

105

To Eq. share capital (21 L shares x 10)

2.1

To securities Premium (21 L X Rs 90)

18.9

To Investment in eq. shares of H Ltd.

(Discharge of

investment)

5

Cr Rs

liquidator

&

cancellation

10 % debenture A/c

84

of

Dr

To Investment in 10% deb of H Ltd.

25

24

To Capital Reserve A/c

(Being investment in debentures cancelled & the

difference between FV & cost transferred to CR)

1.60

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Balance Sheet of S Ltd (After absorption) as on 01-07-2012

Rs in Crores

No.

Particulars

N. No.

Rs.

Rs.

Equity & Liabilities

1

Shareholders funds

Share Capital

82.1

Reserves & Surplus

471.90

Non current liabilities

Current Liabilities

554

120

(356+200)

556

Total

1,230

ASSETS

1

Non current assets

Fixed Assets

i)

Tangible (100 + 30)

130

Net Current assets

1,100

(800 + 300)

Total

1,230

Note 1 Share Capital

No

Particulars

Rs.

Authorised . Eq. shares of Rs 10 each

Issued, subscribed & paid up

1.61

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

8.21 crs equity shares of Rs 10 each

fully paid

82.10

(Out of above, 21 lakh equity shares

were issued without consideration being

received in cash)

82.10

Note 2 Reserves & Surplus

No

Particulars

Capital Reserve

Rs.

53

Reserves & Surplus

400

Securities Premium

18.90

Total

1.62

www.cavidya.com

471.90

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

15.

W Note 1 Calculation of Average Profits

Particulars

Rs. (lakhs)

Calculation of Average Profits of last 3 years

45

[(30 + 40 + 65) 3]

W Note 2 Calculation of yield

Particulars

Rs. (lakhs)

Calculation of yield

18

Yield = 45 x 40%

W Note 3 Capitalised value of yield

Particulars

Capitalised value of yield

Rs. (lakhs)

120

Yield 15% = 18 15%

W Note 4 Consideration payable to Foreign Collaborating Co.

Particulars

Consideration payable to Foreign Collaborating Co.

(24 % x 120)

Rs. (lakhs)

28.80

W Note 5 Amount to be treated as unsecured loan from foreign collaborating

company

Sr.

Particulars

PC payable (WN 4)

Cost of acquisition of foreign company

1.63

Rs. Lakhs

28.80

www.cavidya.com

2.40

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Capital Gain (A-B)

26.40

Tax @ 30%

Net amount payable to foreign co. (A-D)

20.88

Amount payable in cash (50%)

10.44

Amount to be treated as unsecured loan

10.44

7.92

In the books of Variety Ltd. (Transferee Co.)

Journal Entries

Nature of Amalgamation Purchase

No.

1

Particulars

L.F

Investment in Eq. shares of VR Ltd

Dr Rs

Cr Rs

28,80,000

To cash & Bank (W Note 45)

10,44,000

To unsecured loan from foreign co.

10,44,000

To TDS payable

(Being purchase of 24% shares of VR

7,92,000

Ltd. from foreign collaborating co.)

2

TDS payable A/c

Dr

7,92,000

To Bank A/c

7,92,000

(Being TDS paid to Government)

3

Investment in Eq. shares of VR Ltd

To Capital Reserve

(Being upward revaluation of shares of VR Ltd)

1.64

www.cavidya.com

Dr

83,80,000

83,80,000

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Business Purchase A/c

Dr

1,20,00,000

To liquidator of VR Ltd

5

1,20,00,000

Fixed Assets (35 5%)

Dr

33,25,000

Debtors A/c

Dr

10,00,000

Inventories A/c

Dr

50,00,000

Cash & Bank A/c

Dr

5,00,000

Capital Reserve A/c (B/F)

Dr

41,75,000

To Current Liabilities A/c

20,00,000

To Business Purchase

6

1,20,00,000

Liquidator of VR Ltd. A/c

Dr

1,20,00,000

To Investment in eq shares of VR Ltd

(Discharge of liquidator &

investment)

7

1,20,00,000

cancellation of

Current Liabilities A/c

Dr

1,50,000

To Debtors A/c

1,50,000

(Being inter co dues eliminated)

Balance Sheet of Variety Ltd (as on 01-04-2012)

Sr

Particulars

Note

Rs

Equity & Liabilities

Shareholders funds

Share Capital

80,00,000

Reserves & Surplus

2,02,05,000

Non Current liabilities

1.65

www.cavidya.com

Rs

2,82,05,000

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Long term borrowings

Unsecured loan from foreign

10,44,000

collaborating company

Secured loan

2

40,00,000

50,44,000

Current liabilities

(60lac + 20lac 1.50lac)

78,50,000

Total

B

Assets

Non Current Assets

Fixed Assets

i)

Tangible Assets

4,10,99,000

1,53,25,000

(120 lac + 33.25 lac)

2

Current Asset

Inventories

11000000

(60 lac + 50 lac)

b

Trade Receivables

78,50,000

(70lac + 10lac 1.50lac)

c

Cash & cash equivalents

69,24,000

2,57,74,000

(82,60,000+5,00,00010,44,0007,92,000)

Total

4,10,99,000

Note 1 Share Capital

No

1.66

Particulars

www.cavidya.com

Rs

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Authorised Eq. shares of Rs 100 each

Issued, subscribed & paid up

8 lakhs equity shares of Rs 10 each fully paid up

80,00,000

80,00,000

Note 2 Reserves & Surplus

No

Particulars

Capital Reserves (83,80,000 41,75,000)

Other reserves (variety limited)

Rs

42,05,000

1,60,00,000

2,02,05,000

1.67

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

16. W Note 1 Profit & Loss A/c for 6 month ended 30-9-2012

Particulars

Brett Ltd

To Pref Dividend

(10% of 2,00,000)

To Equity dividend

Shane Ltd

20,000

1,20,000

1,91,500

Total

3,11,500

Shane

Ltd

Ltd

By Balance B/d

2,00,000

1,00,000

By Profit for 6

months

1,02,500

54,000

9000

3,11,500

1,54,000

45,000 By dividend recd

(15% of 8

Lakhs)

To Balance c/d

Brett

Particulars

(15% of 3

from Shane Ltd

Lakhs)

(45000

x

89,000

6000/30,000)

1,54,000

Total

Note:

It is assumed that Shane Ltd had not paid preference dividend. Therefore before

paying equity dividend, Shane Ltd will pay PD.

It is assumed that, profit for 6 months of Shane Ltd. doesnt include dividend recd

from Brett Ltd.

W Note 2

Balance Sheet as on 30-9-2012 (Before absorption)

Liabilities

ESC

10% PSC

Brett

Shane

Ltd

Ltd

8,00,000

3,00,000 Building

2,00,000

GR

3,00,000

1,00,000

P & L A/c (WN1)

1,91,500

Crs

1,80,000

1.68

Assets

(-) Depr @ 5%

for 6 M

89,000 Machinery

2,10,000

www.cavidya.com

(-) Depr @ 15%

for 6 M

Brett

Shane

Ltd

Ltd

2,00,000

1,00,000

5,000

2,500

1,95,000

97,500

5,00,000

3,00,000

37,500

22,500

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

4,62,500

2,77,500

1,00,000

60,000

5,000

3,000

95,000

57,000

60,000

Stock

1,20,000

1,50,000

Debtors

3,80,000

2,50,000

1,09,000

37,000

50,000

30,000

14,71,500

8,99,000

Furniture

(-) Depr @ 10%

for 6 M

Investment in

Shares of Shane

Cash&

(B/F)

Bank

Preliminary exp

Total

14,71,500

8,99,000

Total

W Note 3

Calculation of Net Assets

No.

A

Particulars

Assets

Goodwill Given

50,000

Building (110% of 100,000)

1,10,000

Machinery (110% of 3,00,000)

3,30,000

Furniture (110% of 60,000)

66,000

Stock

1,50,000

Debtors

2,50,000

Cash & Bank

1.69

Rs

37,000

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Total (A)

B

9,93,000

Liabilities

Creditors (B)

2,10,000

Net Assets i.e. PC (A-B)

7,83,000

W Note 4

Calculation of PC

Sr.No.

A

Particulars

Consideration payable to PSH

(2000, 10% PS of Rs 100 each)

Rs

2,00,000

Consideration payable to outside SH

24000 x (783000 200000) 30000 = 4,66,400

B

No. of eq. shares to be issued = (4,66,400 / 15) = 31093.33

4,66,400

i.e. issue of 31093 shares @ Rs 15 = 466,395

Cash for fractional share (0.33 x 15) = 5

Consideration payable to Brett Ltd

C

(6000 x (783000 200000) 30000 = 1,16,600

1,16,600

To be mutually set-off

D

Total PC

7,83,000

W Note 5 Calculation of Net Capital Reserve

No.

A

1.70

Particulars

Rs.

Capital Reserve arising an revaluation of

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Investment in Shane Ltd (116,600 60,000)

56,600

Goodwill

50,000

Net Capital Reserve (A-B)

6,600

Balance Sheet of Brett Ltd as on 30-09-2012 (After Absorption)

Sr

Particulars

Note

Rs

Equity & Liabilities

Shareholders funds

Share Capital

13,10,930

Reserves & Surplus

6,03,565

Current liabilities

Trade Payables

Rs

19,14,495

3,90,000

(1,80,000 + 2,10,000)

Total

B

Assets

Non Current Assets

Fixed Assets

i)

Tangible Assets

ii)

Intangible Assets

Current Asset

Inventories

23,04,495

12,58,500

270000

(1,20,000 + 1,50,000)

b

Trade Receivables

1.71

630000

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

(3,80,000 + 2,50,000)

c

Cash & cash equivalents

145995

10,45,995

(1,09,000 + 37,000 5)

Total

23,04,495

Note 1 Share Capital

No

Particulars

Rs

Authorised Eq. shares of Rs 100 each

.. P.S. of Rs 100 each

Issued, subscribed & paid up

(80,000 + 31,093) 1,11,093 Eq. shares of Rs 100 each fully paid

2000, 10 % Pref shares of Rs 100 each

11,10,930

2,00,000

(out of above, 31093 of shares & 2000 P.S. are issued for

consideration other than cash)

13,10,930

Note 2 Reserves & Surplus

No

Particulars

Rs

Securities Premium (31,093 x Rs 5)

1,55,465

General Reserve (WN 2)

3,00,000

Profit and Loss Account

1,91,500

Capital Reserve

6,600

Preliminary Expenses

1.72

(50,000)

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

6,03,565

Note 3 Tangible Assets

No

Particulars

Rs

Building (1,95,000 + 1,10,000)

3,05,000

Machinery (4,62,500 + 3,30,000)

7,92,500

Furniture (95,000 + 66,000)

1,61,000

12,58,500

1.73

www.cavidya.com

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

17. W Note 1 Calculation of Purchase consideration

Sr.No

Particular

Rs

Assets

Goodwill

80,000

Block Assets (6,00,000 x 110%)

6,60,000

Stock and Debtors

4,00,000

Cash and Bank

1,33,000

(A)

Liabilities

Net Assets

(B)

(A-B)

12,73,000

2,00,000

10,73,000

Discharge of Purchase consideration

No

A

Particulars

Consideration payable to preference shareholders

10 % 30,000 preference share of Rs. 10 each

Rs

3,00,000

consideration payable outside equity shareholders

(10,73,000 - 3,00,000) x 300000 4,00,000

5,79,750

57975 equity shares of Rs. 10 each

C

consideration payable to M. Ltd. (Mutually Set Off)

( 7,73,000 x 1,00,000 4,00,000)

1,93,250

Goodwill or capital reserve to be appeared in balance sheet

Sr.No

A

1.74

Particular

Agreed Purchase Consideration

www.cavidya.com

Rs

1,93,250

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

Value of investment appearing in books

1,00,000

Capital Reserve

93,250

Goodwill in book

80,000

Capital Reserve

13,250

In the Books of H Ltd. Balance sheet as at 30.09.2012 (Before Absorption)

Liabilities

Rs.

Assets

Block Assets (6,00,000 32,500)

Rs.

Equity share capital

4,00,000

10 % preference share capital

3,00,000 Stock and Debtors

4,00,000

General Reserve

1,00,000 Cash and Bank (Bal. Figure)

1,33,000

Profit and Loss A/c

1,00,500

Creditors

2,00,000

Total

11,00,500

Total

5,67,500

11,00,500

Profit and Loss A/c for period 1.4.2012 - 30.09.2012

Particulars

Rs.

Particulars

To dividend on Equity shares

40,000 By Balance b/d

preference shares

30,000 By profit earned for period

To balance c/d

1,00,000

70,500

1,00,500

Total

1.75

Rs.

1,70,500

www.cavidya.com

Total

1,70,500

AT Academy

CA Final Financial Reporting

Accounting for Amalgamation Workbook

Anand R Bhangariya 86003 20000

18. Calculation of Intrinsic value / share

No.

Particulars

Geeta

Kiran

Assets

Goodwill

3,00,000

1,50,000

Fixed assets

5,00,000

10,00,000

Investment in Geeta Ltd

(1000 x 103)

1,03,000

Other investments

2,50,000

77,000

Current assets

2,80,000

2,00,000

Total (A)

13,30,000

15,30,000

Liabilities

3,00,000

5,00,000

Net Assets

10,30,000

10,30,000

No. of shares

10,000

5,000