Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Supply Chain Management For Big Bazaar - CIA1Component1 - Group9

Cargado por

Anindya BiswasTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Supply Chain Management For Big Bazaar - CIA1Component1 - Group9

Cargado por

Anindya BiswasCopyright:

Formatos disponibles

Supply Chain Management for Big Bazaar Hit or Miss

A Channel Analysis Report

As part of CIA I Component I

In

Distribution & Supply Chain Management (MBA441)

To be submitted to:

Prof. A. S. Suresh

Prepared By: Group 9

Anindya Biswas (1527605)

Arjun Thomas (1527607)

Ashwin Kumar C (1527608)

Praneet A K (1527616)

Sachin R (1527619)

Anushree Choudhary (1527634)

Shamayita Guha (1527651)

List of Contents

Page 2 of 31

CUIM 2015 2017

S. NO.

Description

Pages

1.

2.

3.

4.

5.

6.

7

8

9

10

11

12

13

14

15

16

17

18

Company History

Chapter 1: Products and Services

Chapter 2: Industry Eco System

Chapter 3: Type of Market

Chapter 4: Levels of Channels

Chapter 5: Strategic Partners/ Alliances/ Integration

Chapter 6: Multi-Channel, Omni Channel. Channel cost as a percentage of sales

Chapter 7: Market Coverage

Chapter 8: Commission and Pricing Strategies

Chapter 9: Credit Availability

Chapter 10: Approximation of Channel ROI

Chapter 11: Storage Requirements & Visual Merchandising at the POS

Chapter 12: Floor Stock Management

Chapter 13: Shrinkage Management

Chapter 14: Channel Promotions ATL & BTL

Chapter 15: Effectiveness of Channel

Chapter 16: Conclusion

Bibliography

3~4

5

6

7~8

9 ~ 10

11 ~ 12

13 ~14

15 ~ 17

18 ~ 20

21

21

22 ~ 24

25

25

26

27

28

29 ~30

Company History

One of the most widely recognized chain of hypermarkets in India with almost 165 outlets in

existence nationally (STAFF REPORTER, 2014), is a subsidiary of the Future Retail Group. It

was established in 2001 by its managing director Mr. Kishore Biyani and is currently riding on a

profit after tax of 74.06 Crores (Future Retail, 2015). Its business model is apparently based on

the business model of the hugely successful U.S. based Wal-Mart. Let us have a lance at some of

the major milestones achieved by Indias first Hypermarket:

2001: Three Stores launched within a 22-day span in Kolkata, Bengaluru and Hyderabad.

2002: Food Bazaar beomes a part of Big Bazaar with its first store launch at High Street

Phoenix.

2003:

o Enters tier II cities with first store launch in Nagpur.

o Welcomes 10 millionth customer at the new store in Gurgaon.

2004:

o Food Bazaar & Big Bazaar awarded most admired retailer award in value

retailing and food retailing segment at the India Retail Forum.

o A day before Diwali, the store at Lower Parel, touches INR 10 million turnover in

a single day.

Supply Chain Management for Big Bazaar Hit or Miss

Page 3 of 31

CUIM 2015 2017

2005:

o Implementation of SAP and Pilot testig of RFID at the central warehouse in

Tarapur.

o Launch of Big Bazaar Exchange Offer, Electronic Bazaar and Furniture Bazaar.

2006:

o Mohan Jadhav set a national record at Big Bazaar Sangli with a Rs 137,367

shopping bill. The Sangli farmer becomes Big Bazaars largest ever customer.

o Launch of Shakti, Indias first credit card program designed specially for

housewives.

o Launch of Shop-in-Shop Jewellry Store Navaras.

Supply Chain Management for Big Bazaar Hit or Miss

Page 4 of 31

CUIM 2015 2017

2007:

o Launch of the 50th Big Bazaar Store in Kanpur.

o Partnership with FutureBazaar.com

2008:

o Launch of FBB (Fashion@Big Bazaar).

o Initiation of the Monthly Bachat Bazaar campaign

2009:

o Initiation of the Maha Annasantarpane program in South India an initiative to

offer meals to visitors and support local social organizations

o Launch of the Great Exchange Offer

Supply Chain Management for Big Bazaar Hit or Miss

Page 5 of 31

CUIM 2015 2017

2010:

o Ranked at the 6th Position among the Top 50 Service Brands in India

2011:

o Enters the Wholesale and distribution business through Aadhar Wholesale store

at Kalol, Gujarat.

o Comes up with the new tagline: Naye India ka Bazaar

o Opening of the 200th Store in India.

Supply Chain Management for Big Bazaar Hit or Miss

Page 6 of 31

CUIM 2015 2017

1. Products & Services

In terms of Products and Services Big Bazaar has a varied range of product offerings some of

which are:

Apparels

Food

Farm Products

Furniture

Electronics and Electrical Appliances

Personal Care Products

Child Care and Toys etc.

Of various brands like Levis, Allen Solly, Pepsico, Coca-Cola, Hindustan Unilver Ltd., ITC,

P&G, Samsung, LG etc. Apart from the above Big Bazaar is also known to promote severa of its

in-house brands such as, DJ & C. Tasty Treat, Clean Mate, Sensei, Care Mate, Koryo and 44

other such brands.

In termsof Services Big Bazaar makes Customer Satisfaction makes it their highest priority. As

such they made their online presence visible with the help of FutureBazaar.com, which is an

online business venture from Future Group. The website sells a wide assortment of products

ranging from fashion apparel for men and women, mobile accessories, elcetronic appliances like

home theaters, LCD TVs, Kitchen Appliances and many more. As per website statistics

evaluation website webstatvalue.com, FutureBazaar.com has around 11,660 pageviews per day

with around 2,915 unique views and has an estimated worth of around $ 17, 820.00 (which is

around INR 1,209,772.18) with a daily income of $ 33.00 ( almost INR 2240.32). Thus their

online presence has helped them to reach a greater customer base and helped to provide a better

customer retail experience

It also makes sure of customer security when they make visits to their physical stores with the

help of alarm systems as well as with the help of Electronic Article Surveillance System which

detects whether products being taken out of the store have tags attached to them or not.

2. Industry Eco System

Supply Chain Management for Big Bazaar Hit or Miss

Page 7 of 31

CUIM 2015 2017

Big Bazaar which is typically a Hypermarket-Supermarket falls under the organized retail chain.

As per reports, the Indian Hypermarket scenario 1.99% of the organized reatil scenario and as

such ranks 5th on the global retail development index. This segment was having an estimated

worth of INR 7.28 billion as of 2005-06 growing by 37.21% over 2004-05 and would almost

grow with a CAGR of 32.8% by end of 2016(Cygnus Research, 2007, ibef.org, 2016). It is

believed that this sector which accounts for almost about 21% of the total retail space will be

almost worth $1,011 million by the end of 2017. There is also the trend of hypermarkets going

online with predictions being that the online retail will be at par with the physical stores within

the next 5 years.

The growth drivers for the organized retail sector in India are mainly: Rise in income and

purchasing power and brand consciousness leading to a favorable demographics also leading to a

change in the consumer mindset. Couple this with the easy consumer credit and the rise in

quality products.

In the hypermarket scenario, Pantaloons Retail is the market leader with 512 Big Bazaar shops

and online franchisees. HyperCITY (16 stores), Trent, Spencers (Spencers Retail), Aditya Birla

Retail and Reliance Retail are the other players in this sector. In this scenario, if we are to look at

the Future Group, their revenues increased at a rate of 2.4% during FY08-15. The hypermarket

supermarket formats have a network of nearly 319 stores having an area coverage of 10 million

square feet. Big Bazaar itself is ranked the third most trusted brand and the mot trusted retailer of

2014 for providing the most quality services. Below we have some of the major hypermarket

competitios in terms of number of stores and their parent Brands:

Table 2.1: Leading Hypermarket Chains in India

Parent Company

Hypermarket Chains

Future Group

RP-SG Group

Reliance Retail

Aditya Birla

Tata Trent

K Raheja Corp. Group

Big Bazaar

Spencer's Hyper

Reliance Mart

More Hyper

Star Bazaar

Hypercity

No. of Stores

Source: Compiled from the official websites of the parent companies

3. Type of market

Supply Chain Management for Big Bazaar Hit or Miss

200+

36

8

15

11

13

Page 8 of 31

CUIM 2015 2017

The retail market was at INR 23 Lakh crore in 2011-12 and organized retail comprised only 7%

of the retail market at that time. However, research says that it was supposed to grow at a CAGR

of 24% to attain 10.2% of the total retail sector by FY2016-17 (Shine.com, 2015). Even in terms

of organized retail space it has grown by 78% from 2.5 million square feet in 2012 to 4.7 million

square feet in 2013.

The retail market structure in India is widely divided into two categories: the organized retail

sector which is slowly penetrating the retail sector and has a market share of 8% and the

remaining 92% is the unorganized retail sector dominated by the mom and pop shops. In general

if we are to speak the organized Hypermarket sector is almost a collaborated market with the

majority of the market share being taken up by Big Bazaar.

The major players in the Hypermarket sceanrio in India, according to Wikipedia are as follows:

More

Big Bazaar

Spencers Hyper

HyperCITY

Lulu Hypermarket

D-Mart

Star Bazaar

Vishal Megamart

Spar Hypermarket (originally part of the Auchan group of hypermarkets)

Reliance Fresh and many other small scale players

The market structure in the hypermarket retail scenario is highly oliogopolic in nature with

almost 62% of the hypermarket scenario being captured by Big Bazaar, followed by 23% by

Spencers Hypermarket, 6% by More chain of hypermarkets and the rest 7% by other

players. The same has been shown below graphically in the foloowing page:

Supply Chain Management for Big Bazaar Hit or Miss

Page 9 of 31

CUIM 2015 2017

Figure 3.1 Hyper Market Shares

Others ; 7%

More ; 8%

Spencer's ; 23%

Big Bazaar; 62%

Furthermore, according to the report, /Winning India Retail Sector 2011 published by

PricewaterhouseCoopers, if we are to look at the Key Success Factors of Hypermarkets in India

we can attribute the success to these 3:

Securing the right real estate

Localizing products to excite and delight the consumers

Mastering the Supply Chain to drive competitive advantage

Supply Chain Management for Big Bazaar Hit or Miss

Page 10 of 31

CUIM 2015 2017

4. Level of Channels

The supply chain model for Big Bazaar is almost similar to what other retail shops follow,

wherein the material is procured from the manufactuers, sent to the central processing unit and

therein the product is sent to the Big Bazaar outlets. However, we shall look at these steps in

detail in terms of inventory management, the supply chain elements as well.

The basic model for the Supply chain for Big Bazaar is as follows with all the levels displayed

below:

Supplier Factory Distribution Center Retailer Customer

In Big Bazaar the supply chain starts off with the supplier providing the raw materials to the

factory manufacturer who then provides the goods to the CDC (Central Distribution Center) who

then provides the finished goods to the retailer from wherein it goes to the customers. One thing

to be noted is the fact that even if Big Bazaar is built on the lines of Wal-Mart, the primary

difference between Wal-Mart and Big Bazaar lies in the fact that the CDCs themselves act as

warehouses unlike in Wal-Mart whose CDCs act more or less like the developers for the

suppliers products.

Another point of difference between the two is in terms of order mechanism. In Big Bazaar, there

is no pull mechanism in order generation as it is largely dependent on the decisions by the

individual category managers whereas in Wal-Mart there is a daily pull mechanism in place. And

whatever sales has been made the information flows back to the CDC which helps them make

forecasts on the demand of the product for the next replenishment cycle.

The Procurement Cycle: The Supply chain management cycle in Big Bazaar is very detailed.

The warehouses in Big Bazaar are not too big as the fast moving perishable items are always

replenished on a weekly basis and the slow moving items are replenished on a bi-weekly basis.

Items such as vegetables are usually bought on a day-to-day demand basis.

What needs to be noted is that the stocks in Big Bazaar are managed by the Auto Replenishment

System (ARS) and the Central Distribution Centers are located strategically so as to facilitate

ease of access. Once the Purchase Order (PO) has been generated by the ARS, it is received by

Supply Chain Management for Big Bazaar Hit or Miss

Page 11 of 31

CUIM 2015 2017

the vendor. Vendor then supplies the goods. Once the product reaches the warehouse, the inward

checklist is then filled appropriately. This checklist or the Inward Register Note (IRN) includes

parameters such as:

Purchase Order Number

Vendor Name

Invoice Number

Date, Quantity & Amount

For non-perishable packed items further parameters included are:

Date of Manufacturing and Expiry

Batch Number

Presence of ISI mark or not.

Post this a stock tally is done. It is done to make sure that the stock tally matches up to the

purchase made, if not a discrepancy note is generated. Otherwise, the Goods Received Note

(GRN) is generated. Post this the stock is either piled up in the ware house or send to the floor

for sale. The scenario is that suppliers who would be the local vendors (when the products

supplied are perishable items) would provide their supplies to the retail outlets of Big Bazaar at a

price less than 30% to 40% than the MRP, which when they sell to the customer at a price that is

5% to 10% less than the MRP.

The procurement at the retail outlet from the warehouse is as follows: As dependent on the

Auto Replenishment system, the reorder points are being set based on the demands of the

previous 3 months and hence the ARS generates the demand. In case of unexpected demands, the

outlets try to contact the nearby sister outlet so as to not lose out on their customers.

The modes of transportation for the purpose of logistics are mainly trucks & the railways,

however, Big Bazaar might use flights if the situation is deemed to be urgent. The transport by

Big Bazaar is mainly outsourced and the primary carriers for Big Bazaar Are Quick & Safe, Gati,

Deluxe Roadways and TNT. Apart from these the Future Group also has Future Logistics Supply

Chain created in 2009, which has under itself a fleet of around 1050+ leased trucks visiting

around 214 routes on a daily basis visiting around 13,000+ pin codes across India.

5.Strategic Partners/ Alliances/ Integration

Supply Chain Management for Big Bazaar Hit or Miss

Page 12 of 31

CUIM 2015 2017

In an age when the organized retail players have a mandate of having an online presence in order

to maintain a sustained survival in the cut throat retail market, Big Bazaar has made strategic

alliances with Amazon, Oxigen Services, MTS Services to expand their consumer base and

thereby generate even greater revenue.

Future Group and Bharti Airtel have come together combining retail business to create one of

Indias largest business conglomerate and are planning to create a chain of around 570 stores in

243 cities pan India in the next 3-5 years (ibef.org, 2016).

Apart from all the above the future group has also tied up with Bajaj Finance Limited to enable

and empower the custoemers such that they would be able to convert all their purchases from any

Future Group Brands into easy EMIs thereby bringing in a new era of cashless and smart

transactions into the Indian retail scenario.

Apart from in the hypermarket retail scenario Future Groups sub brand Future Consumer

Enterprise Limited (FCEL) has also tied up with one of its major competitors Tata & TESCO

Enterprise venture Star Bazaar to launch a wide range of food and non-food products across the

Star Bazaar Stores. This was a strategy used by Star Bazaar as it aims to launch close to 148

SKUs across 10 FCEL brands with an intention to provide their customers with a unique value

proposition.

A major alliance was also of Big Bazaar and the now famous Patanjali Brands in Oct 09,2015

whose products are now seen in all Big Bazaar outlets with an ever increasing demand. The

demand is so much that the Big Bazaar outlets now have a specific counter for these fast moving

itmes from Patanjali.

On the online front, Big Bazaar has also tied up with MobiKwik, Indias leading mobile wallet.

With this tie-up, MobiKwik users can pay through their mobile wallet at any Big Bazaar

payment counter, by sharing their MobiKwik registered mobile number and the OTP generated

for the transaction verification. This system of cashless purchase for offline retail purchase was

set into immediate effect across 240+ Big Bazaar stores across India. It is expected to bring

around 150 million transactions annually for the parties involved.

Supply Chain Management for Big Bazaar Hit or Miss

Page 13 of 31

CUIM 2015 2017

In terms of Technology Integration, Big Bazaar has also opened up the Big Bazaar Gen Nxt at

the DLF Mall of India, in Noida, New Delhi. It was done so as to provide the youngr generation

a more pleasant shopping experience and boasts of LED Lighting, large digital screens,

experience zones for multi sensorial experiences of food products, digital shelf-talkers as well as

energy-saving technologies that moderate and control the air-conditioning, humidity, lightning,

ambience and music levels within the store.

Supply Chain Management for Big Bazaar Hit or Miss

Page 14 of 31

CUIM 2015 2017

6. Multi-Channel, Omni Channel. Channel Cost as a percentage of Sales

Big Bazaar has recently moved into the Omni Channel Retailing strategy with the launch of the

Big Bazaar app across multiple mobile platforms. This is quite an advantage for the company as

now it would be able to combat the rapid adoption of the growing e-commerce sector in India as

well as make an attempt to beat the online retailers with the help of their price cutting strategy.

This was something that a lot of the brick-and-mortar shops have been struggling to achieve for a

long time.

The Big Bazaar app would allow the customers to make comparison of a product by pitching the

price offered both by online as well as offline retailers thereby allowing them to make an

informed purchase decision. The Customers would have a week from the date of purchase to

make price comparisons and decide whether to keep the product or return it.

The Big Bazaar app which is currently functional in Mumbai only is an effective strategy

towards omni channel retailing considering a target crowd that is very much price sensitive. It

looks like as shown below:

Figure 6.1: The Big Bazaar App

Supply Chain Management for Big Bazaar Hit or Miss

Page 15 of 31

CUIM 2015 2017

In the fiscal year 2015 2016, Big Bazaar had an annual revenue of 11,149.87 crores of

which approximately 4% to 5% is the cost of the channel members which is almost 446 ~

557.50 crores. This data is however variable based on the commissions as well as the late

deliveries made by the channel member and the ranking of the suppliers in the top managements

eyes and is a mere approximation.

Supply Chain Management for Big Bazaar Hit or Miss

Page 16 of 31

CUIM 2015 2017

7. Market Coverage

In a country, where if customer wants something for his home, he/she thinks of purchasing it

from the nearest bazaar. This is because, the bazaar is a place from wherein one ould get almost

anything for his/her house at a very affordable price. This was held true not only across

Bangalore but across India as well.

Thus when the idea of Big Bazaar was concretized, the strategy was to provide the customers

with a one stop shopping destination, which would provide them with a wide range of products

at a very affordable price along with a good deph and width in teerms of product range.

Thus if we are to look at Store Location as a part of Market Coverage Strategies, it can be

considered important because:

Affects the amount of customer footfall

Affects the volume of productc sold

It is however, a major cost factor also, as

It involves a large initial cost investment

Affects transportation costs

Affects the HR costs such as hiring, wages etc.

The main concern that Big Bazaar was facing was whether the low margin of products would

help it to maintain a sustainable growth in the retail sector. Thus with this they had initially

opened the stores in Kolkata, Hyderabad and Bangalore in three different locations (in Kolkata

it was a suburban market, in Hyderabad it was in the heart of the market, in Bangalore a

market residential area) so as to be able to formulate an efficient location strategy.

What came out as a learning for the organization was that for any store a large catchment area

was required. The business model of having stores located outside the city as was with Wal-Mart

in US, would not really work in India and thus would reduce market coverage as well as

visibility. People would not want to travel far to purchase daily use products but would rather

want to buy from somewhere close. The cost of time spent on travel and cost of period in India

would actually dig deep into the savings made.

Supply Chain Management for Big Bazaar Hit or Miss

Page 17 of 31

CUIM 2015 2017

Thus it was with this learning the stores were retained and future property deals were negotiated.

Now if we are to look at retail advertising as a means of increasing of increasing market

coverage we should first look at the components of advertising, which are:

Advertising Strategy

Creative Idea & Execution

Media Planning

What is helps to attract a larger customer response and also gives the organization an idea of the

potential areas where stores can be opened as well as it is a low cost per contract option. Not

only that it also provides multiple alternatives to the organization.

Some of the retail strategies employed by Big Bazaar and their respective Market Coverage

results are as shown below. This was keeping the price conscious middle class and the lower

middle class consumers in mind:

1. Daily Papers such as Times of India

a. Market Coverage: Entire Bengaluru

2. Direct Mail which can be controlled by the Retailers

3. Radio Ads in around the areas where stores are present to continue capturing the market.

4. Transit: So as to capture customers coming in from distant locations

5. Flyers/Circulars designed to capture immediate neighborhoods near the stores

These are some of the strategies that Big Bazaar regularly employs to continue capturing the

market from its other hypermarket competitors. What is important to be noted that the choice of

location of Big Bazaar speaks a lot of what it is trying to essentially tell the customers they can

adapt themselves to the tastes and preferences of the customers as per the location so as to get

maximum awareness. This is also portrayed through the fact that all their stores are easily

accessible to the customers.

As of now, our preliminary data has shown that in terms of market coverage though the Big

Bazaar at Hosur Road, which was the first one of its kind in Bangalore, is not doing well in terms

of revenue generation.

The Table toppers in terms of coverage as well as in terms of revenue generation, the Big Bazaar

outlets at Banashankari 3rd Stage and Mahalakshmi Layout near Iskon are the leaders in

Bangalore. This might be due to the fact that both of these areas are considered to be developing

Supply Chain Management for Big Bazaar Hit or Miss

Page 18 of 31

CUIM 2015 2017

areas with the middle class income category density higher than the one in Hosur Road. They are

then followed by the Outlets near Malleshwaram, Kengeri and Whitefield.

8. Commissions and Pricing Strategies

Supply Chain Management for Big Bazaar Hit or Miss

Page 19 of 31

CUIM 2015 2017

For Big Bazaar the commissions given to its suppliers mainly depends on the volume of the

products that they receive from the suppliers. On a one-to-one conversation with a Big Bazaar

employee has revealed that, for Big Bazaar if the volume is low the commissions that the

suppliers or the intermediaries in the supply chain receive is 4% - 5%, whereas if the supply is

able to meet the demand or exceed it then the supplier or intermediaries get a commission of 6%

- 7%, with 7% being the highest.

The main objective of Big Bazaar while setting its pricing in place is to get Maximum Market

Share. Some of the pricing strategies that Big Bazaar has and follows or its customers are as

follows:

1.

2.

3.

4.

5.

Value Pricing

Promotional Pricing

Differentiated Pricing

Bundle Pricing and,

Psychological Pricing

Let us look at them in a detailed format:

Value Pricing (EDLP Every Day Low Pricing) What Big Bazaar does is promising

its customer the lowest prices without coupon clipping or having to wait for the discount

promotion season or comparison shopping.

Promotional Pricing Big Bazaar offers the financing to its customers at a lowered rate

of interest. The pricing strategy is used in such a way such that it promotes the product to

the customer. Under the Promotional Pricing strategy, we have the following pricing

strategies followed:

Low Interest Financing Pricing which caters to the Isse sasta aur achcha aur

kaha which typically targets the Low Interest Financing segment of customers.

Special Event Pricing Big Bazaar also caters to special event pricing strategy to

grab more eyeballs. The organization does follows this strategy to gain more revenue

as well as footfalls, thereby reducing the gap in sales

Differentiated Pricing Big Bazaar also follows a Differentiated Pricing strategy. This

type of pricing strategy is used in the market, where the multiple customer segments exist

to avoid confusion about the different prices of the displayed products. What is unique is

Supply Chain Management for Big Bazaar Hit or Miss

Page 20 of 31

CUIM 2015 2017

customers buying products from these type of markets cannot resell them at a higher

price in the market. However, it can also be based on the peak and the non-peak hours or

days of shopping in which case it will be known as the Time-based Differentiated

Pricing. An example of this is the Wednesday Bazaar format.

Bundle Pricing Refers to packaging together two or more complimentary products and

selling them to the customers at a price reduced the sum of the individual prices. In case

of Big Bazaar, it lays a lot of importance on this pricing strategy and examples of this are

when it tries to sell 5kg rice + 5kg oil +5kg sugar for INR 599 which is also a play on the

psychological pricing. Another example would be the 3 Good Day Family Packs at a

price of INR 60 where an individual pack comes in at INR 22 thereby effectively saving

INR 6 of the customer. This kind of pricing strategy helps to add value to the customer

and thereby increase sales for the organization.

Apart from the above as mentioned earlier, Big Bazaar also follows psychological

discounting pricing strategy wherein it offers customers products at INR 99, INR 599

and so on. The rationale behind this is that it drives greater demand than it would have if

it was expressed in rounded figures. This strategy aims to stir up feelings of prestige with

a high end item or that a thrifty note with a bargain.

Not only Pricing Policy, Big Bazaar also has a very simple 15-day return policy in place as well.

If a customer has brought a product and then he/she feels that the product is not up to the

expectations, then he/she can return the product to the store within 15 days of purchase in

undamaged condition.

Alternatively, he customer can contact the Big Bazaar Support system and have their

representative come to the customers home and have the package picked up at the customers

convenience. This simple 15-day return policy, which eases the purchase process of the customer

is also one of the reasons that the target segment come back to Big Bazaar every time.

Supply Chain Management for Big Bazaar Hit or Miss

Page 21 of 31

CUIM 2015 2017

9. Credit Availability

Like most of its competitors, Big Bazaar gives a credit period of 30 days in general. However,

there is a slight variation when it comes to products that are perishable. For example, for the

perishable products that are placed at the Shop-in-Shop counters in Food Bazaar, the credit

period is calculated on a day to day basis whereas in general if we are to look at credit period

with the help of the product movement, then for fast moving products the credit period is on a

weekly basis, whereas for the slow moving products, the credit period is either 2 weeks or 3

weeks.

Supply Chain Management for Big Bazaar Hit or Miss

Page 22 of 31

CUIM 2015 2017

10. Approximate ROI of the channel members

Big Bazaar provides a platform for over 15,000 small, medium and large producers and

manufacturers to sell their products to Indian consumers. If we are to look at the Approximate

ROI of these channel members, it is something that no employee of the organization is willing to

reveal as such a breakdown of the ROI was not possible and we were only able to gather an

approximation of the ROI along with the Profit margin of the channel members.

The ROI is mainly dependent on the Channel Member himself, in terms of delivery timing

adherence of the products as well as quality of the product, and the volume of the product sold to

Big Bazaar. If all the criterion is met, then the supplier has a profit margin of 7% - 8% and the

return on investment is an approximate of 20% - 22% if the product is of superior quality

elsewise it is around 17% - 18%.

11. Storage Requirements and Visual Merchandising at the Point of Sales

Indias temperature controlled logistics sector is valued at almost INR 12,000 to INR 15,000

crore with almost 90% being carried out by the regional operators. To capture this opportunity

Future Supply Chain (FSC) has launched cold storage facilities at Mehsana, Gujarat. Currently

these cold storage warehouse facilities are present in Delhi, Kashipur, Mehsana, Mumbai,

Chennai, Bengaluru and Tumkur. FSC has planned further expansion of capacities in Delhi,

Hyderabad and Mumbai. These warehouses are capable of deploying 3 lakh tonnes per month

and have an average floor space of around 3.6 million sq. feet across India. These warehouses are

Supply Chain Management for Big Bazaar Hit or Miss

Page 23 of 31

CUIM 2015 2017

temperature controlled ranging from -30C to +25C and have the best in class equipment for

temperature monitoring and control.

The company reported income from operations of 408 crores with EBIDTA of 66 crores and

PAT of 25 crores for FY 2014-15, an increase of 23.6% in Income, 127.6% in EBIDTA and

485.1% in PAT (Future Groups, 2015).

In terms of store space Big Bazaar stores across India occupy almost 45-50,000 sq. feet of space

each of which apparel takes up about 35% which is almost 15,750 17,500 sq. feet of space wih

the rest going to Food Bazaar, Furniture Bazaar etc.

Almost 80% of our first impressions of anything is based on sight and as such it is worth a

thousand words. The base objective of visual merchandising is to attract customers to the point

of purchase in order to sell the merchandise. Visual Merchandising is offered to the customer

through the exterior as well as the interior presentation which then should be collaborated with

the companys overall theme.

Visual Merchandising comprises of the following components:

Store Design: The Store design reflects the corporate image of the organization as well as

reinforces it. For Big Bazaar the store design is mostly a planogram store design. It was

created with the thought that the customers entering the shop should feel like that they are

shopping in a local market (i.e. to give them the feel of a local convenience store).

Furthermore, for the fruits & vegetables section the store had a shop-in-shop design

which was then handled by external vendors.

Store Name: The name Bazaar is something that people associate with a commonplace

market which is one of the main reasons that the economy downfall of 2008-2009 did not

affect Big Bazaar, as Big Bazaar continued to reign in the Indian Hypermarket Scenario

with the promotional strategies of Sabse Saste Teen Din (2006), Hafte ka Sabse Sasta

Din (2007) and The Great Exchange Offer (2008).

Store Color: The Big Bazaar Logo has Orange, Blue and White which is used to invoke

the feeling of warmth, calmness and trust among its customers.

Supply Chain Management for Big Bazaar Hit or Miss

Page 24 of 31

CUIM 2015 2017

Store Ambience: The store ambience in Food Bazaar is like a convenience store. It

follows a grid or gondola pattern to allow the customer to select their products with ease

as well as to come back to their favorite aisle to make a last minute purchase.

The ambience at Fashion @ Big Bazaar matches it tagline, Isse sasta aur achcha kahin

nahi with apparels being placed in different sections for women and men often in

different corners of the store thereby segmenting the consumers as per gender. The colors

used are pastel colors that can be used to have a soothing effect on the customers mind

and the music is also in a similar line. However, what the fashion @ Big Bazaar lacks are

enough of trial rooms that sometimes cause the consumers to return empty handed as they

are not able to try out their products due to heavy traffic. Also the music being played

sometimes becomes very repetitive with the store interior color palette being unchanged.

Space Productivity: Big Bazaar is known for its maximum utilization of the store space.

It is usually measured by sales per square feet of selling space, therefore it was from here

that we came to know that it was designed in a logical manner so as to allow ease of

consumers. To make the store more wall merchandisable, the apparels as well as nonfood products are also put on display with the help of Shelving, Hanging and Stacking.

Signage: Big Bazaar has always used signage for its promotions. The signboards are

hung at locations of high traffic where people would stop and look at the offer. It has also

been done through full page advertisements as well as ads in magazines. Inside the stores,

the use of signage at each floor entrance to show what categories of products are there at

that floor has also helped in the ease of purchase for the customers.

Thus this planogram styled store design not only shows the placement of the retail products on

the shelves, but aids in providing an aesthetic shopping experience to the customers. It also helps

in better inventory management and reduces the out of stock situation. Apart from this it aids in

improving sales as well as it assigns selling potential to every inch of the retail space and it is

considered as an effective tool for staff produced display.

Supply Chain Management for Big Bazaar Hit or Miss

Page 25 of 31

CUIM 2015 2017

12. Floor Stock Management

In all Big Bazaar Retail Outlets, there is floor stock management which is essentially a part of

the Inventory Management Process. The Floor Stock Management in Big Bazaar is as follows:

The stocks entering the floor can only come out with a customer unless verified that is

perished or physically damaged or it is an expired product.

The stock management on the floor is automated with the help of the Auto Replenishment

System and is dependent on the footfalls on that particular section.

Supply Chain Management for Big Bazaar Hit or Miss

Page 26 of 31

CUIM 2015 2017

The Stocks on the floor are calculated on a day-to-day basis to analyze the future

demand. If the demand or the sales of a product is deemed to be high, then the

Department Manager would request to the CDC to replenish the product.

Accordingly, the replenishment of that product occurs.

13. Shrinkage Management

In recent times the Big Bazaar Store is incurring huge losses due to shrinkage of the store

inventory. Despite high security at the store, they are facing difficulties in shrinkage management

owing to the large product portfolios available.

What the company has done now is that they have installed high range security cameras at the

high demand non-food sections of the stores as well as tying up hard tags and soft tags on the

products when if not removed can be detected by the RFID scanners at the store entrance.

Frisking at the store entrance is also done at times. Apart from this what Big Bazaar has also

done is to manually count each and every product of the store every quarter. This process is also

known as stock take.

This is done so as to continue the main objective of never allowing the customer to return empty

handed.

14. Channel Promotions Above the Line and Below the Line

Promotional Strategies are a part and parcel of this company and as such Big Bazaar has

employed both Above the Line (ATL) as well as Below the Line (BTL) promotional measures to

increase the footfall of the customers in its stores.

Some of the Above the Line promotional measures undertaken by Big Bazaar included giving

online advertisements in its corporate partner websites as well as promotional advertisements. Of

these the most recent ones are the Great Indian Kitchen Festival as well as the Crazy Weekend

Deals.

Supply Chain Management for Big Bazaar Hit or Miss

Page 27 of 31

CUIM 2015 2017

Apart from this Big Bazaar gives advertisements in the leading dailies such as Times of India as

well as on the TV regarding discounts and purchase schemes. Also a major promotional as well

as an effective scheme was done by Big Bazaar, a decade back in 2006, when they had launched

a housewife only credit card program Shakthi.

In terms of Below the Line promotional strategies, Big Bazaar has employed countless methods

to increase store revenues. Some of these strategies include Coupons, Discounts, Buy More Save

More, Live Competitions which included Lottery draws, Money back offers, Exchange Offers

and special Occasions.

Apart from this back in 2010, Big Bazaar had also tied-up with Star India Pvt. Ltd. To launch a

new apparel brand under the name of Star Parivaar which showcased apparel worn by the

customers favorite Telly stars from Star Plus.

Some other Below the Line promotional strategies followed by Big Bazaar are as follows:

Low Prices on Wednesday (Hafte ka sabse sasta din)

Concept of Big Day

Promotional Offers such as

o School Jao Khushi Khushi

o Khushi ki Baraat

o Happy Fathers Day

15. Evaluation of the Channel Effectiveness

Big Bazaar still doesnt have the tracking information for their goods, which were delivered by

their supplier for them. They have to rely on their truck drivers only for exact position of their

goods. This made them to fall behind from their competitors. This is one area where Big Bazaar

in terms of channel effectiveness has fallen short.

Apart from this, Big Bazaar has its own transportation vehicles for transportation on road. Once

again the geographical location and how fast the goods have to be delivered are the factors for

the final selection of modes of transportation. The concept of economies of scale and economics

of distance are both take into consideration in case of larger consignment where Big Bazaar

Supply Chain Management for Big Bazaar Hit or Miss

Page 28 of 31

CUIM 2015 2017

provides an appropriate logistical solution, which helps in reducing the overall cost for them.

And this is something that Big Bazaar has fine-tuned to a large extent.

Apart from this Big Bazaar has a fine system in place for delivery by suppliers. Any supplier

who would be delivering the supply to the warehouse by a delay of more than 1 hour than the

stipulated time would be charged a fee which would be around 10% of the amount they were to

receive. Not only this they would even be receiving a commission which would be reduced by

1% - 2% of what they normally receive.

As a result of all this Big Bazaar suppliers of raw materials who do not have very high

bargaining powers always make sure to deliver on time and as such is very effective in nature.

Also to motivate the suppliers, Big Bazaar has a ranking order of suppliers in place that is

changeable on a monthly basis. The criteria for the same is timely adherence, volume and quality

supplied and past performance. The reward for the same is an increased commission from Big

Bazaar.

16. Conclusion

In conclusion, Big Bazaar should continue with the Making India Beautiful strategy which

brought newer class of customers to the store as well as continue with the ranking system among

the suppliers so as to maintain the competitive advantage position within the industry as well as

remain the preferred company to supply the product to among the suppliers.

The Future Group has already introduced Future Logistics into the market in 2009, but with other

retail giants diversifying their portfolio, both Big Bazaar and Future Group has a long way to go.

It should definitely consider moving into the packaging, labelling and the Reverse Logistics

Services as the current transport service is only limited to and from the warehouse.

Supply Chain Management for Big Bazaar Hit or Miss

Page 29 of 31

CUIM 2015 2017

We know, that Big Bazaar does not have a technology based product tracking system and as such

investing in technology integration to provide just in time delivery at the retail outlet is highly

necessary. Furthermore, it should follow up with the government to make sure that there is a

sound and safe policy in place that would safeguard the interest of the logistic companies and

suppliers.

Bibliography

Bhasin, H. (n.d.). Marketing Mix of Big Bazaar 7p of Big Bazaar. Retrieved from

Marketing91.com: http://www.marketing91.com/marketing-mix-big-bazaar/

Cygnus Research. (2007, June). Indian Hypermarkets Report. Retrieved from

researchandmarkets.com:

http://www.researchandmarkets.com/reports/509220/indian_hypermarkets_re

port.pdf

ETTelecom.com. (2013, Nov 25). MTS partners with Big Bazaar for retail expansion

in Kolkata. Retrieved from ETTelecom:

http://telecom.economictimes.indiatimes.com/news/3g-4g/mts-partners-withbig-bazaar-for-retail-expansion-in-kolkata/26358905

Supply Chain Management for Big Bazaar Hit or Miss

Page 30 of 31

CUIM 2015 2017

Future Groups. (2015). Annual Report 2014-2015. Retrieved from Future retail.in:

http://www.futureretail.in/pdf/Annual_Report_2014_2015.pdf

Future Retail. (2015). Future Retail Annual Report 2014-2015. Retrieved from

www.futureretail.in:

http://www.futureretail.in/pdf/Annual_Report_2014_2015.pdf

Guy, V. (2006, July 4). List of hypermarkets. Retrieved from wikipedia.org:

https://en.wikipedia.org/wiki/List_of_hypermarkets#.C2.A0India

ibef.org. (2016, January). Retail January 2016. Retrieved from ibef.org:

http://www.ibef.org/download/Retail-January-2016.pdf

Jyoti, D. (2012, April 02). Report on the inventory management of BIG BAZAAR.

Retrieved from pptpdf.in: http://pptpdf.in/file_details.php?fid=120214

Mysidia. (2005, Oct 22). Big Bazaar. Retrieved from Wikipedia:

https://en.wikipedia.org/wiki/Big_Bazaar

Nitisha. (2015). Various Pricing Strategies Explained - With Diagrams. Retrieved

from EconomicsDiscussion.net:

http://www.economicsdiscussion.net/price/various-pricing-strategiesexplained-with-diagram/3867

Perarasu, M. (2016, July 7). Channel Cost and ROI of Channel Members for Big

Bazaar. (M. A. Chandramohan, Interviewer)

PricewaterhouseCoopers. (2011). Winning India Retail Sector 2011. Retrieved from

Rasci.in: http://rasci.in/downloads/2011/Winning_India_Retail_Sector_2011.pdf

Reuters. (2014, Oct 13). Amazon, Big Bazaar owner Future Group ink deal to sell

goods online. Retrieved from The Times of India:

http://timesofindia.indiatimes.com/tech/tech-news/Amazon-Big-Bazaar-ownerFuture-Group-ink-deal-to-sell-goods-online/articleshow/44798343.cms

Roy, N. (2015, May 07). Big Bazaar to launch an app, move towards omni-channel

retailing. Retrieved from IndianRetailer.com:

http://retail.franchiseindia.com/article/whats-hot/investments/Big-Bazaar-tolaunch-an-app-move-towards-omni-channel-retailing.a3351/

Shine.com. (2015). Retail Industry. Retrieved from Shine.com:

http://info.shine.com/industry/retail/7.html

STAFF REPORTER. (2014, January 7). Future upbeat on future. Retrieved from The

Telegraph:

http://www.telegraphindia.com/1140107/jsp/business/story_17760281.jsp

Supply Chain Management for Big Bazaar Hit or Miss

Page 31 of 31

CUIM 2015 2017

Suman, D. (2012, Feb 14). Big Bazaar. Retrieved from Slideshare.net:

http://www.slideshare.net/dhirendrasuman/big-bazaar-11558166

TheHansIndia.com. (2016, Feb 18). Oxigen Services partners with Big Bazaar Direct

to Expand Assisted e-commerce across India. Retrieved from TheHansIndia:

http://www.thehansindia.com/posts/index/Business/2016-02-18/OxigenServices-partners-with-Big-Bazaar-Direct-to-Expand-Assisted-e-commerceacross-India/208158

Varghese Matthew, M. (2011, Nov 9). 4 P's followed at Big Bazaar. Retrieved from

SlideShare: http://www.slideshare.net/manojvarghesemathew/4-ps-followedat-big-bazaar

webstatvalue.com. (n.d.). Futurebazaar.com : 3,709 unique visitors per day.

Retrieved from webstatvalue.com: http://webstatvalue.com/futurebazaar.com

Supply Chain Management for Big Bazaar Hit or Miss

También podría gustarte

- MRP Mid Review ReportDocumento69 páginasMRP Mid Review ReportHarshil LimbaniAún no hay calificaciones

- Top Retailers Worldwide Ranking & India's Changing Retail LandscapeDocumento69 páginasTop Retailers Worldwide Ranking & India's Changing Retail LandscapeMonalisa MunniAún no hay calificaciones

- Customer Satisfaction in Retail Sector With Reference To BigBazarr and EasydayDocumento25 páginasCustomer Satisfaction in Retail Sector With Reference To BigBazarr and EasydayKaran VermaAún no hay calificaciones

- Gian Jyoti Intitute of Information Technology, MohaliDocumento70 páginasGian Jyoti Intitute of Information Technology, MohaliRichi SinghAún no hay calificaciones

- A Project Study ReportDocumento41 páginasA Project Study Reportnishesh99Aún no hay calificaciones

- Big Bazaar ReportDocumento43 páginasBig Bazaar ReportShobhit PatelAún no hay calificaciones

- Apparel Retail in IndiADocumento8 páginasApparel Retail in IndiAmozenrat20Aún no hay calificaciones

- Dissertation On Future GroupDocumento30 páginasDissertation On Future GroupTushar Patel100% (1)

- Comparative Analysis of Organized Retailing in India: A Case Study of Big Bazaar and Vishal Mega MartDocumento84 páginasComparative Analysis of Organized Retailing in India: A Case Study of Big Bazaar and Vishal Mega MartprashantAún no hay calificaciones

- Shoppers Stop Campus Guru CaseDocumentDocumento10 páginasShoppers Stop Campus Guru CaseDocumentumeshAún no hay calificaciones

- MKT103 REPORTDocumento13 páginasMKT103 REPORTSahil NarayaniAún no hay calificaciones

- Retail DistributionDocumento68 páginasRetail DistributionMba ProjectsAún no hay calificaciones

- Q1. Carry Out A PESTLE Analysis For The Business Environment It Operates in Analyzing Each Factor Political and Legal FactorsDocumento11 páginasQ1. Carry Out A PESTLE Analysis For The Business Environment It Operates in Analyzing Each Factor Political and Legal FactorsSutapa BanerjeeAún no hay calificaciones

- Operations of Big Bazaar: Vansikajalan Varun Kayal Vishakha Gupta Vishal AgarwalDocumento15 páginasOperations of Big Bazaar: Vansikajalan Varun Kayal Vishakha Gupta Vishal AgarwalVansika JalanAún no hay calificaciones

- Training Report - Big Bazaar LudhianaDocumento41 páginasTraining Report - Big Bazaar LudhianaSarah GallowayAún no hay calificaciones

- Market Analysis of Skin Care ProductsDocumento121 páginasMarket Analysis of Skin Care ProductsSanjay NgarAún no hay calificaciones

- Food Supply Chain of Big BazaarDocumento15 páginasFood Supply Chain of Big BazaarSayantan NandiAún no hay calificaciones

- B.P.Collage of Business Administration/ Ty Bba-Sem ViDocumento63 páginasB.P.Collage of Business Administration/ Ty Bba-Sem Vimohan ksAún no hay calificaciones

- Summr ProjectDocumento55 páginasSummr ProjectSaurav GoyalAún no hay calificaciones

- MM1 Term Project Guidelines - Group6 - Big BazaarDocumento3 páginasMM1 Term Project Guidelines - Group6 - Big BazaarsakethAún no hay calificaciones

- Marketing Tools and Customer Satisfaction of Reliance FreshDocumento10 páginasMarketing Tools and Customer Satisfaction of Reliance FreshseemaAún no hay calificaciones

- Buying Behaviour of Big Bazar Profit Club Card.Documento89 páginasBuying Behaviour of Big Bazar Profit Club Card.Ankesh AnandAún no hay calificaciones

- A) Executive Summary: Bazaar Mysore Road Bangalore' Helps To Know The Effectiveness of Promotional StrategyDocumento43 páginasA) Executive Summary: Bazaar Mysore Road Bangalore' Helps To Know The Effectiveness of Promotional StrategyPariAún no hay calificaciones

- Indian Retail Industry FinalDocumento21 páginasIndian Retail Industry FinalhadpadravindraAún no hay calificaciones

- Customer Attitude Towards The Private BrandsDocumento80 páginasCustomer Attitude Towards The Private BrandsŠtÿłổ ÁtŤïtüdẽ Swati Sharma100% (1)

- Indian Retail Industry FinalDocumento21 páginasIndian Retail Industry FinalDeepak ImmaculateAún no hay calificaciones

- Group 19 - Analysis of Distribution Channel of AmulDocumento36 páginasGroup 19 - Analysis of Distribution Channel of AmulTAHJAún no hay calificaciones

- Retail Management Model Questions - To Mba StudentsDocumento6 páginasRetail Management Model Questions - To Mba Studentslekshmipriya9Aún no hay calificaciones

- CP On Big Bazaar Vs D-MartDocumento63 páginasCP On Big Bazaar Vs D-MartKeyur RajparaAún no hay calificaciones

- Case Study of SnapdealDocumento13 páginasCase Study of SnapdealVk GuptaAún no hay calificaciones

- Interdependence and Supply Chain Management in RetailDocumento5 páginasInterdependence and Supply Chain Management in RetailHimesh KuraniAún no hay calificaciones

- FMCG Industry ResearchDocumento13 páginasFMCG Industry Researchdipanjan dharAún no hay calificaciones

- Mini Project of Project and Operations Research ManagementDocumento11 páginasMini Project of Project and Operations Research ManagementSagar KattimaniAún no hay calificaciones

- Analysis of Distribution Channel of AmulDocumento36 páginasAnalysis of Distribution Channel of AmulTAHJAún no hay calificaciones

- RETAIL MANAGEMENT TRENDS: CHALLENGES, TECHNOLOGY, AND THE EVOLVING INDIAN MARKETDocumento10 páginasRETAIL MANAGEMENT TRENDS: CHALLENGES, TECHNOLOGY, AND THE EVOLVING INDIAN MARKETMalathi Meenakshi SundaramAún no hay calificaciones

- FMCG in IndiaDocumento4 páginasFMCG in IndiaAAKASH RANGARAJANAún no hay calificaciones

- India's Retail Industry Led by DMARTDocumento29 páginasIndia's Retail Industry Led by DMARTVansh JainAún no hay calificaciones

- Consumer Perception Toward Big BazaarDocumento49 páginasConsumer Perception Toward Big BazaarVikash Bhanwala68% (25)

- Sales & Distribution of Products of Hindustan Uni Lever Ltd.Documento76 páginasSales & Distribution of Products of Hindustan Uni Lever Ltd.AshutoshSharmaAún no hay calificaciones

- Executive Summary: Big BazaarDocumento33 páginasExecutive Summary: Big BazaarNikhil Soni80% (5)

- RelianceDocumento99 páginasRelianceruchikapareekAún no hay calificaciones

- Consumer Behaviour and Perception Towards Big Bazaar in ChennaiDocumento64 páginasConsumer Behaviour and Perception Towards Big Bazaar in ChennaiRahul PandeyAún no hay calificaciones

- Big BazaarDocumento91 páginasBig BazaarMohan AgarwalAún no hay calificaciones

- Subhiksha MICA SochDocumento41 páginasSubhiksha MICA SochChiranjiv KarkeraAún no hay calificaciones

- To Study The Growth of Retail Sector in India: A Case of Big BazaarDocumento45 páginasTo Study The Growth of Retail Sector in India: A Case of Big BazaarNaman JainAún no hay calificaciones

- A Study On The Customers Perception About The Growth of Retail Industries in BangaloreDocumento3 páginasA Study On The Customers Perception About The Growth of Retail Industries in BangaloreInternational Journal of Application or Innovation in Engineering & ManagementAún no hay calificaciones

- CUSTOMER SATISFACTION BIG BAZAARDocumento36 páginasCUSTOMER SATISFACTION BIG BAZAARNikhil SoniAún no hay calificaciones

- BIG BAZAAR MERCHANDISING REPORTDocumento21 páginasBIG BAZAAR MERCHANDISING REPORTchakri5555Aún no hay calificaciones

- Xaviers Institute of Business Management Studies - Retail Management Case Study on Margin Free Market Private LtdDocumento5 páginasXaviers Institute of Business Management Studies - Retail Management Case Study on Margin Free Market Private LtdJay KrishnaAún no hay calificaciones

- MBA Project KLE 2Documento19 páginasMBA Project KLE 2Siddanna ChoudhariAún no hay calificaciones

- Project On Shopping MallDocumento138 páginasProject On Shopping MallAnitha SweetaAún no hay calificaciones

- Objective: Customer Reach StrategiesDocumento31 páginasObjective: Customer Reach StrategiesHrishikesh RumdeAún no hay calificaciones

- Operations AssignmentDocumento12 páginasOperations AssignmentChinmayee ParchureAún no hay calificaciones

- A Study On Effectiveness of Advertisement and Promotional Offers at Big BazaarDocumento10 páginasA Study On Effectiveness of Advertisement and Promotional Offers at Big BazaarAditya HinduraoAún no hay calificaciones

- A Report ON Analysis of Wal-Mart and Bharti: Transforming Retail in IndiaDocumento7 páginasA Report ON Analysis of Wal-Mart and Bharti: Transforming Retail in IndiaSaurav RoyAún no hay calificaciones

- Appetite for Convenience: How to Sell Perishable Food Direct to ConsumersDe EverandAppetite for Convenience: How to Sell Perishable Food Direct to ConsumersAún no hay calificaciones

- India's Store Wars: Retail Revolution and the Battle for the Next 500 Million ShoppersDe EverandIndia's Store Wars: Retail Revolution and the Battle for the Next 500 Million ShoppersAún no hay calificaciones

- RARBGDocumento1 páginaRARBGAnindya BiswasAún no hay calificaciones

- Format of Log Book : Dat e Time in Time Out Brief Description of Job Done Signature of Supervisor RemarksDocumento1 páginaFormat of Log Book : Dat e Time in Time Out Brief Description of Job Done Signature of Supervisor RemarksAnindya BiswasAún no hay calificaciones

- MindTree's Community-Driven Culture Powers GrowthDocumento10 páginasMindTree's Community-Driven Culture Powers GrowthAnindya BiswasAún no hay calificaciones

- Case SummaryDocumento10 páginasCase SummaryAnindya BiswasAún no hay calificaciones

- Course Plan For Academic Standards Week ZeroDocumento1 páginaCourse Plan For Academic Standards Week ZeroAnindya BiswasAún no hay calificaciones

- Creating An Indian MNCDocumento35 páginasCreating An Indian MNCAnindya BiswasAún no hay calificaciones

- Digital Marketing OverviewDocumento1 páginaDigital Marketing OverviewAnindya BiswasAún no hay calificaciones

- Code of Ethics at ITCDocumento15 páginasCode of Ethics at ITCAnindya BiswasAún no hay calificaciones

- Social Concerned Project in QUEST Alliance For Generating LeadsDocumento36 páginasSocial Concerned Project in QUEST Alliance For Generating LeadsAnindya BiswasAún no hay calificaciones

- MNC UpdatedDocumento12 páginasMNC UpdatedAnindya BiswasAún no hay calificaciones

- Binary Logistic Regression - Assignment ANINDYA BISWAS 1527605 - M1Documento7 páginasBinary Logistic Regression - Assignment ANINDYA BISWAS 1527605 - M1Anindya BiswasAún no hay calificaciones

- Marketing Analytics Case 3 ANOVA Assignment ANINDYA BISWAS 1527605 M1Documento6 páginasMarketing Analytics Case 3 ANOVA Assignment ANINDYA BISWAS 1527605 M1Anindya BiswasAún no hay calificaciones

- Valence Scale With ScoringDocumento1 páginaValence Scale With ScoringAnindya BiswasAún no hay calificaciones

- Binary Logistic Regression - Assignment ANINDYA BISWAS 1527605 - M1Documento7 páginasBinary Logistic Regression - Assignment ANINDYA BISWAS 1527605 - M1Anindya BiswasAún no hay calificaciones

- Marketing Analytics Case 4 Discriminant Analysis Assignment ANINDYA BISWAS 1527605 M1Documento9 páginasMarketing Analytics Case 4 Discriminant Analysis Assignment ANINDYA BISWAS 1527605 M1Anindya BiswasAún no hay calificaciones

- Literature Review On Customer Attitude To Cheese and Similar Dairy ProductsDocumento6 páginasLiterature Review On Customer Attitude To Cheese and Similar Dairy ProductsAnindya Biswas100% (1)

- Laura Ashley Holdings PLC - Group9Documento13 páginasLaura Ashley Holdings PLC - Group9Anindya BiswasAún no hay calificaciones

- The FMCG Sector in India Has Been Seeing Interesting Times Which Mostly Has Been in Line With The Recessionary Economic Environment in IndiaDocumento26 páginasThe FMCG Sector in India Has Been Seeing Interesting Times Which Mostly Has Been in Line With The Recessionary Economic Environment in IndiaAnindya BiswasAún no hay calificaciones

- A Study On The Perception of Photo Gallery Apps Present in The MarketDocumento6 páginasA Study On The Perception of Photo Gallery Apps Present in The MarketAnindya BiswasAún no hay calificaciones

- A Data Analysis of User Perception Towards Credit CardsDocumento4 páginasA Data Analysis of User Perception Towards Credit CardsAnindya BiswasAún no hay calificaciones

- A Study On The Perception of Photo Gallery Apps Present in The MarketDocumento6 páginasA Study On The Perception of Photo Gallery Apps Present in The MarketAnindya BiswasAún no hay calificaciones

- The Onida ChallengeDocumento7 páginasThe Onida ChallengeAnindya BiswasAún no hay calificaciones

- Enhanced cash flow analysis of replacement printing pressesDocumento37 páginasEnhanced cash flow analysis of replacement printing pressesRiangelli Exconde100% (1)

- 1 PGBPDocumento83 páginas1 PGBPkashyapAún no hay calificaciones

- Financial Accounting MCQ 4Documento25 páginasFinancial Accounting MCQ 4Akash GangulyAún no hay calificaciones

- Arhl Report - Indo MiningDocumento228 páginasArhl Report - Indo MiningAndika PerdanaAún no hay calificaciones

- Phuket CaseDocumento4 páginasPhuket Casejperez1980100% (1)

- Closing X Post Closing ActivitiesDocumento9 páginasClosing X Post Closing ActivitiesJasmine ActaAún no hay calificaciones

- Practical Accounting 2Documento12 páginasPractical Accounting 2jaysonAún no hay calificaciones

- Payment of Bonus Form A B C and DDocumento13 páginasPayment of Bonus Form A B C and DAmarjeet singhAún no hay calificaciones

- CRM Program Using Oracle EBS - Student GuideDocumento589 páginasCRM Program Using Oracle EBS - Student GuideShakti NaiduAún no hay calificaciones

- AssignmentDocumento30 páginasAssignmentPrincy JohnAún no hay calificaciones

- Assignment 02 Correction of Errors Answer KeyDocumento1 páginaAssignment 02 Correction of Errors Answer KeyDan Andrei BongoAún no hay calificaciones

- Types of CompensationDocumento9 páginasTypes of CompensationthuybonginAún no hay calificaciones

- Evaluating The Effect of Financial Performance On Dividend Payout of Deposit Money Banks in NigeriaDocumento20 páginasEvaluating The Effect of Financial Performance On Dividend Payout of Deposit Money Banks in NigeriaEditor IJTSRDAún no hay calificaciones

- Group 2 employee detailsDocumento20 páginasGroup 2 employee detailsReeja Mariam MathewAún no hay calificaciones

- Petroleum Accounting PDFDocumento18 páginasPetroleum Accounting PDFDania SuarezAún no hay calificaciones

- 2017 Form 760 InstructionsDocumento56 páginas2017 Form 760 InstructionsicanadaaAún no hay calificaciones

- Customs Duty Explained: Rates, Types, Objectives & DefinitionsDocumento24 páginasCustoms Duty Explained: Rates, Types, Objectives & DefinitionsSoujanya NagarajaAún no hay calificaciones

- Cima f7 dvanced-Financial-Reporting PDFDocumento590 páginasCima f7 dvanced-Financial-Reporting PDFAamir Saeed100% (1)

- TUTORIAL SOLUTIONS (Week 4A)Documento8 páginasTUTORIAL SOLUTIONS (Week 4A)Peter100% (1)

- SWOT AnalysisDocumento2 páginasSWOT Analysisapi-3710417100% (1)

- Pacific Group Spice Company Fin300 ReportDocumento9 páginasPacific Group Spice Company Fin300 ReportMinh HàAún no hay calificaciones

- Capital GainsDocumento25 páginasCapital GainsanonymousAún no hay calificaciones

- CA Amit Goyal-ResumeDocumento2 páginasCA Amit Goyal-ResumeKanu ShreeAún no hay calificaciones

- Explaining tax doctrines and assessing tax liability issuesDocumento4 páginasExplaining tax doctrines and assessing tax liability issuesSheena PalmaresAún no hay calificaciones

- Authority Delegation and Decentralization ExplainedDocumento22 páginasAuthority Delegation and Decentralization Explaineddynamo vjAún no hay calificaciones

- Leasing RossDocumento15 páginasLeasing Rosstinarosa13Aún no hay calificaciones

- Disclosure in Financial Statements NotesDocumento25 páginasDisclosure in Financial Statements Noteseknath2000Aún no hay calificaciones

- Ebook IOP PDFDocumento125 páginasEbook IOP PDFamruta ayurvedalayaAún no hay calificaciones

- Addams&Family IncDocumento16 páginasAddams&Family IncKim KoalaAún no hay calificaciones

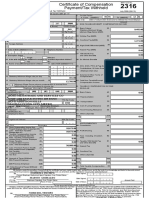

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocumento2 páginasGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoAún no hay calificaciones