Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Montezuma & Porto: Entrevista en TowerXchange

Cargado por

NiuboxDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Montezuma & Porto: Entrevista en TowerXchange

Cargado por

NiuboxCopyright:

Formatos disponibles

The legal and regulatory

environment for MNOs and

towercos in Peru

Useful insights on the current state of telecom and tower regulation and what could change

Jos Miguel Porto, Partner,

Montezuma & Porto

Jos Miguel Porto is an expert in the telecom arena thanks to its sixteen

years of activity within NII Holdings in Peru and in the United States.

In this interview, he shares with TowerXchange some priceless insights

into the current regulatory framework and how it could change

in the imminent future, with new laws concerning environmental

limitations, rural enablers as well as possible further taxations all

pending approval. Furthermore, he analyses Law N. 29022 and its

applicability to both MNOs and towercos, which has considerably sped

up the permitting process across Peru. Lastly, Porto discloses his views

with regards to the creation of Telxius and its impact on the Peruvian

tower market and discusses the rationale behind tower sales from the

operators perspective.

Keywords: 4G, American Tower Corporation, Americas, Americas Insights, Capex, Carve Out, Claro, Entel,

Exit Strategy, Insights, Investment, Lawyers & Advisors, Market Forecasts, Market Overview, Ministry of

Transport and Communications, Montezuma & Porto, NII Holdings, Network Rollout, New License, Nextel

Peru, OSIPTEL, Peru, QoS, Regulation, Sale & Leaseback, South America, Telefnica, Telxius, Universal Access

Read this article to learn:

< Montezuma & Porto: a boutique law firm with very specific telecom expertise

< The current regulatory framework and various laws pending approval

< The regime for towercos and details about Law N. 29022

< Insights into the 700MHz auction and MNOs future plans

< Why do MNOs sell their towers? And which practical challenges do they face?

XX | TowerXchange Issue 17 | www.towerxchange.com

TowerXchange: Please introduce yourself and

your professional background.

Jos Miguel Porto, Partner, Montezuma & Porto:

After my law degree from the University of Chicago,

I pursued various roles in the telecommunications

industry and over the past sixteen years, I acted as

Chief Commercial Counsel for Nextel Peru and later

on as Director and Senior Counsel for NII Holdings,

Inc., based in Virginia, United States.

As counsel for Nextel Peru I was responsible for

network deployment in-country while at NII

Holding, Inc. I acted as lead counsel for all major

tower transactions for Nextel in Latin America

and for the renegotiation of legacy tower deals.

During that time, I represented Nextel in the

evaluation and negotiation of tower deals in several

jurisdictions including Argentina, Brazil, Chile,

Mexico and Peru.

Amongst the most interesting tower transactions,

I recall the sale and leaseback deal of 1,666 towers

in Mexico and 2,790 towers in Brazil to American

Tower Corporation for an aggregate amount of close

to US$810mn.

Following a successful career within Nextel,

Oscar Montezuma and I founded Montezuma

& Porto, a boutique law firm focused in the

telecommunications and technology practice in

Peru.

TowerXchange: Tell us about Montezuma &

Porto and its role in the telecom ecosystem.

www.towerxchange.com | TowerXchange Issue 17 |

XX

Jos Miguel Porto, Partner, Montezuma & Porto:

In light of the many changes happening in the

Peruvian telecom space, we serve clients with

legal, regulatory and policy advice to support them

in their network deployment plans and in other

aspects of their business growth.

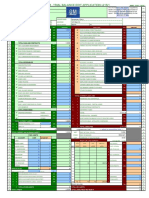

Over the past few years, the Ministry of Transport

and Communications (MTC) has been heavily

focused on expanding national telecommunications

networks and increasing the penetration of

broadband services with several key projects such

as shown in table one.

To foster innovation and technology, the Production

Ministry (PRODUCE) has recently launched a

productivity diversification program for the

promotion of non-extracting industries such as

technology with the provision of non-reimbursable

grants to start-ups and incubators.

As a consequence of the government funding, Peru

is now witnessing the growth of a technology startup ecosystem fed by public funds, angel investors

and venture capital firms. These start-ups are being

created with the principles of the democratisation

of entrepreneurship and permissionless innovation

in mind, which have been promoted by the internet

and the wider access to information. And while the

model is quite fluid, there are still plenty of legal

requirements to comply with and this is where our

law firm can help, by offering a variety of advisory

services to start-up companies, from incorporation

to business model validation, financing rounds and

exits.

XX | TowerXchange Issue 17 | www.towerxchange.com

Table one: Peruvian latest public telecom projects

National Fibre-Optic

Backhaul (Red Dorsal

Nacional de Fibra

ptica):

13,000km of fibre to cover

22 regional capitals and

180 provincial capital

Regional fibre optic

projects:

700MHz spectrum

auction:

Complementing the

national project with fibre

to the main district capitals

and other localities

Enhancing 4G coverage in

rural and dense urban areas

We share the opinion that to the extent the MTC

and PRODUCE, or another Ministry, are capable

of articulating a common agenda and goals, the

path towards the creation of a digital society

can be accomplished. And this will have a deep

transformational effect, bringing welfare and

social inclusion to developing markets such as

Peru.

In this context, we believe that the telecom

ecosystem is one portion of a broader picture

moving towards the creation of a Peruvian digital

society. We like to think that our current role in

this ecosystem is to foster such permissionless

innovation and to continue our path towards

building a digital society thanks to our academic

and professional work.

TowerXchange: Can you share some details

about the current state of the telecom

regulation in Peru? What is likely to change if

new regulations get approved?

Jos Miguel Porto, Partner, Montezuma & Porto:

During the current administration there has

been increased pressure on consumer protection,

service pricing and Quality of Service regulations.

In fact, MNOs have been charged severe penalties

for breaching the existing regulation and

minimum QoS standards.

Additionally, since the entrance of Virgin

Mobile in Peru, MVNO and rural enabler

regulations have been passed in order to increase

competition and the level of penetration.

However, further regulations looking at access

and termination for rural enablers as well as the

environmental impact of network deployment are

still pending.

In the short term, the regulatory pipeline includes

further pricing and net neutrality regulations

that may adversely affect certain commercial

plans and provide less flexibility to the MNOs

commercial offering. In addition, although

unofficial, the OSIPTEL is supposedly looking at

increasing certain financial contributions that, if

passed, might further squeeze MNO margins.

www.towerxchange.com | TowerXchange Issue 17 |

XX

TowerXchange: Is there a specific regime in

place for towercos? And if so, what can towercos

operating in Peru expect in terms of permitting,

licensing et cetera?

Jos Miguel Porto, Partner, Montezuma &

Porto: MNOs have the right to deploy their own

infrastructure or to pursue co-locations. With the

introduction of towercos in Peru, MNOs have been

embracing co-locations and the regulation has

acknowledged such sharing activities as beneficial

and went as far as granting towercos with certain

benefits originally reserved to MNOs. I am

referring to the applicability of Law N. 29022 which

establishes a Municipal automatic approval for the

deployment of telecom infrastructure.

According to Law N. 29022, an expedited

automatic approval procedure should be followed

to obtain a Municipal authorisation for the

deployment of telecom infrastructure. Once the

required documentation is submitted within

the Municipality, an automatic authorisation is

granted. Exceptionally, certain Municipalities

have established further requirements to be met

in order to obtain the automatic approval, which

could hinder the deployment ability of MNOs and

towercos. For example, they have set further rules

in terms of zoning and have gone as far as banning

deployments in certain sensitive areas.

Under the General Administrative Law,

Municipalities can declare null and void any

administrative act ex oficio, including the

automatic approval for the deployment of telecom

XX | TowerXchange Issue 17 | www.towerxchange.com

infrastructure, if and when the act presents

material defects or contravenes applicable laws.

So whenever there are social uprisings associated

with the installation of a new cell site, its not

uncommon for the Municipality to look for minor

or non-material defects in the automatic approval

proceeding (given its ex-post ability to supervise

the proceeding), and in the absence of such minor

or non-material defects create one, to declare

the proceeding and automatic approval of the

infrastructure null and void, given that (i) certain

requirement(s) were not met and (ii) because the

installation of the infrastructure is adverse to the

public interest.

TowerXchange: What is likely to change in the

mobile market in light of the recent 700MHz

auction?

Jos Miguel Porto, Partner, Montezuma & Porto: The

Peruvian government recently awarded Telefnica,

Claro and Entel with 30MHz each within the

700MHz band. However, Vietnamese-backed Bitel

was left out of the auction. Due to its propagation

characteristics, the 700MHz band is customarily

used to complement higher bands with 4G services

in rural areas and to improve indoor coverage in

dense urban areas. The fact that Bitel has been left

out of the auction raises concerns on its ability to

compete in the 4G market, especially since there

isnt any other available spectrum with similar

characteristics.

Each of the awarded companies paid around

US$300mn per block and have committed to the

obligation to clean their respective blocks from

harmful interference, mainly from broadcasting

companies providing services in such bands, and

to provide coverage in certain rural areas.

The amount paid for each block plus the

additional cost that operators will deal with

to remove harmful interference as well as to

increase their footprints will certainly bring

lots of pressure on their capex. So I believe that

operators will rely heavily on co-locations on

theirs or third party infrastructure which is good

news for the sharing model. However, concerns

remain with regards to the possible increase in

consumer prices as a result of the added pressure

on operators capex.

TowerXchange: Telefnica has recently

transferred some of its assets to Telxius - its

infrastructure company. What is the impact of

Telxius entering the Peruvian market and is it

likely to have any effect on how the regulator

treats and deals with towercos?

Jos Miguel Porto, Partner, Montezuma &

Porto: Based on publicly available information,

Telefnica has divested certain tower and fibreoptic assets into Telxius and is seeking to float

40% of Telxius shares. As long as Telefnica

retains a controlling stake within Telxius, these

vertical integrations could potentially raise

concerns whether co-location agreements

between the two are at arms-length and on

similar terms with third party carriers.

www.towerxchange.com | TowerXchange Issue 17 |

XX

in exchange for payment, unless there are

technical, legal or economic constraints and (iv)

apply tax transfer-pricing regulations to affiliated

transactions.

The current disclosure

requirements applicable to

towercos preclude the ability

of Telxius to enter into non

arms-length dealings with

affiliated companies. And I

dont foresee the regulations

being affected by the entrance

of Telxius in Peru

The current disclosure requirements applicable to

towercos preclude the ability of Telxius to enter into

non arms-length dealings with affiliated companies.

And I dont foresee the regulations being affected

by the entrance of Telxius in Peru.

The existing regulation requires towercos to (i)

notify MNOs of their commercial offers and access

conditions; (ii) submit to the regulators a copy of

all executed co-location and use arrangements;

(iii) make their infrastructure available to MNOs

XX | TowerXchange Issue 17 | www.towerxchange.com

TowerXchange: In light of your experience

within Nii Holdings, can you tell us what are

the key drivers that push an operator to select

a tower sale versus another form of financing?

And which challenges and limitations do

operators face while divesting their assets?

Jos Miguel Porto, Partner, Montezuma & Porto:

MNOs are constantly in need of financing sources

to deploy, optimise and upgrade networks, run

operations efficiently (including backhaul costs),

procure handsets and devices and to purchase

spectrum to sustain commercial operations and

growth. Given that telecoms is a capital intensive

industry, MNOs customary financing sources

are the capital markets, vendor financing, debt

financing and export financing. In recent times, the

tower industry has made available a new source

of financing through the monetisation of non-key

assets such as towers.

Whenever an MNO decides its time to raise capital,

a decision making process requires to explore

each and every available financing resource to

determine which path to follow. When cheaper

financing resources have been exhausted, due to

financial covenant constraints, liquidity or credit

issues, the monetisation of tower assets might

have additional benefits such as a lesser impact on

EBITDA, financial covenants and earning per share.

But this is true when and if the deal is correctly

structured.

Some of the challenges that operators face during a

tower deal include the possible lack of all required

paperwork and documentation, since MNOs tend

to collect what is needed to operate a network

which might not be sufficient to sell a tower to an

independent towerco. Depending on the quality

of the information and the amount of sites in the

portfolio, the process to complete a data room prior

to the tower sale might take several months and

can result in an expensive procedure that requires

dedicated in-house and external resources.

Additionally, operators need to obtain ground lessor

consents to assign ground leases which is another

expensive and time consuming procedure. And

some assets might not even be sellable due to lack

of permits or other environment issues.

Internally, operators have to deal with a decision

making process involving several stakeholders in

order to determine the best deal structure. Among

the factors to discuss, stakeholders will need to

define the minimum standards in terms of required

operational flexibility so to be able to continue their

business as usual even after the tower sale and

whether theyd prefer to maximise proceeds for

higher rents or go with lower proceeds for lower

rents.

All of the above need to occur while making sure

that the total cost of the deal makes financial sense

if compared with other comparable sources of

financing

www.towerxchange.com | TowerXchange Issue 17 |

XX

También podría gustarte

- Telecommunications in Our CountryDocumento21 páginasTelecommunications in Our CountryPasde KadfesAún no hay calificaciones

- New Technologies and Their Impact On RegulationDocumento5 páginasNew Technologies and Their Impact On RegulationNtsane MoleAún no hay calificaciones

- 03 - Overview of Telecom Industry in IndonesiaDocumento28 páginas03 - Overview of Telecom Industry in IndonesiaDarmawan SulehAún no hay calificaciones

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyDe EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyAún no hay calificaciones

- Chapter 1Documento6 páginasChapter 1Darya AhmadovaAún no hay calificaciones

- Asia Internet Coalition Aic Industry Submission On Nepal Ott Regulation Framework - 29may2023Documento6 páginasAsia Internet Coalition Aic Industry Submission On Nepal Ott Regulation Framework - 29may2023hrvaultAún no hay calificaciones

- PTCL - Market Structure and Regression AnalysisDocumento21 páginasPTCL - Market Structure and Regression AnalysisSanya Tiwana100% (1)

- The Evolution of Voip: A Look Into How Voip Has Proliferated Into The Global Dominant Platform It Is TodayDocumento48 páginasThe Evolution of Voip: A Look Into How Voip Has Proliferated Into The Global Dominant Platform It Is TodayBradley SusserAún no hay calificaciones

- Telecom SectorDocumento7 páginasTelecom SectorJayati SinghAún no hay calificaciones

- Telecommunications in ArgentinaDocumento3 páginasTelecommunications in ArgentinaLucas Quiroga ZubreskiAún no hay calificaciones

- HRM RelianceDocumento78 páginasHRM Reliancemanwanimuki12Aún no hay calificaciones

- Future Telco: Successful Positioning of Network Operators in the Digital AgeDe EverandFuture Telco: Successful Positioning of Network Operators in the Digital AgePeter KrüsselAún no hay calificaciones

- 2nd Business Análisis MOVISTARDocumento6 páginas2nd Business Análisis MOVISTARRicardo BazanteAún no hay calificaciones

- Nigeria's Reaction To ICT ConvergenceDocumento4 páginasNigeria's Reaction To ICT ConvergenceAfolabi LagunjuAún no hay calificaciones

- On The Economics of 3G Mobile Virtual Network Operators (Mvnos)Documento14 páginasOn The Economics of 3G Mobile Virtual Network Operators (Mvnos)Tran Quoc TamAún no hay calificaciones

- OECD-APEC Global Forum: Policy Frameworks For The Digital Economy Honolulu, Hawaii 15 January 2003Documento6 páginasOECD-APEC Global Forum: Policy Frameworks For The Digital Economy Honolulu, Hawaii 15 January 2003dukongsohotAún no hay calificaciones

- 1 - 1946 - B7 - NTC AmendmentsDocumento13 páginas1 - 1946 - B7 - NTC AmendmentsVilma Santos RectoAún no hay calificaciones

- PTCL Pestel AnalysisDocumento5 páginasPTCL Pestel AnalysisKoja Aabii100% (1)

- Save Telecom With A Reprise of NTP-99-Shyam Ponappa-January 2, 2020Documento5 páginasSave Telecom With A Reprise of NTP-99-Shyam Ponappa-January 2, 2020SP1Aún no hay calificaciones

- Telecommunications Media and Technology Myanmar Update 2017Documento24 páginasTelecommunications Media and Technology Myanmar Update 2017marcmyomyint1663Aún no hay calificaciones

- Project Report-Reliance Communications-Customer SatisfactionDocumento57 páginasProject Report-Reliance Communications-Customer Satisfactionyash mittal82% (49)

- Spectrum Allocation in IndiaDocumento14 páginasSpectrum Allocation in IndiaSayak BhattacharyaAún no hay calificaciones

- Telecom Separation BrochureDocumento4 páginasTelecom Separation BrochureaikianoAún no hay calificaciones

- Dict 2022Documento16 páginasDict 2022GHEIST INC.Aún no hay calificaciones

- Legal Tech and Digital Transformation: Competitive Positioning and Business Models of Law FirmsDe EverandLegal Tech and Digital Transformation: Competitive Positioning and Business Models of Law FirmsAún no hay calificaciones

- Report - "Reforms in The Indian Telecom Industry"Documento13 páginasReport - "Reforms in The Indian Telecom Industry"Anakha RadhakrishnanAún no hay calificaciones

- World Telecom Industry Is An Uprising Industry, Proceeding Towards A Goal of Achieving TwoDocumento52 páginasWorld Telecom Industry Is An Uprising Industry, Proceeding Towards A Goal of Achieving Twomanwanimuki12Aún no hay calificaciones

- From 8 To 80 Million Subscribers in 80 MonthsDocumento11 páginasFrom 8 To 80 Million Subscribers in 80 MonthsShahid AbbasAún no hay calificaciones

- BT S ResponseDocumento7 páginasBT S ResponsepackiaaAún no hay calificaciones

- Telecommunications Regulation: An Introduction: Neconomi@stern - Nyu.eduDocumento45 páginasTelecommunications Regulation: An Introduction: Neconomi@stern - Nyu.eduNagabhushanaAún no hay calificaciones

- CASBAA - A Tilted Playing Field - Asia Pacific Pay TV & OTTDocumento52 páginasCASBAA - A Tilted Playing Field - Asia Pacific Pay TV & OTTsaharshdAún no hay calificaciones

- Consultation Paper Final 23072022-1Documento6 páginasConsultation Paper Final 23072022-1Abrar Ul HaqAún no hay calificaciones

- Actions Taken by The Government To Address The Intermittent Internet ConnectionDocumento7 páginasActions Taken by The Government To Address The Intermittent Internet ConnectionAsnairah DICUNUGUNAún no hay calificaciones

- Economic 3rd TrimesterDocumento15 páginasEconomic 3rd TrimesterKapil KaroliyaAún no hay calificaciones

- 9b4e4strategy Case Study Assignments 2Documento19 páginas9b4e4strategy Case Study Assignments 2amitmbhandari25Aún no hay calificaciones

- Telecom at A GlanceDocumento20 páginasTelecom at A GlanceParas GalaAún no hay calificaciones

- New America Foundation Berkman Comments in FCC GN 09 47 Filed 11-16-2009Documento12 páginasNew America Foundation Berkman Comments in FCC GN 09 47 Filed 11-16-2009StimulatingBroadband.comAún no hay calificaciones

- Before The F C C WASHINGTON, D.C. 20554: Ederal Ommunications OmmissionDocumento11 páginasBefore The F C C WASHINGTON, D.C. 20554: Ederal Ommunications OmmissionCompetitive Enterprise InstituteAún no hay calificaciones

- 9b4e4strategy Case Study Assignments 2Documento19 páginas9b4e4strategy Case Study Assignments 2Homework PingAún no hay calificaciones

- Customer Satisfaction On JioDocumento75 páginasCustomer Satisfaction On JioPrince Kumar0% (1)

- m2 Case MetroDocumento9 páginasm2 Case Metrorohith06Aún no hay calificaciones

- Commission Adopts Regulatory Proposals For A Connected ContinentDocumento26 páginasCommission Adopts Regulatory Proposals For A Connected ContinentJerzy OzAún no hay calificaciones

- Ildts Policy 2010Documento25 páginasIldts Policy 2010misr19720% (1)

- Information and Communications Technology Procurement: Best Practices Guide For Customs AdministrationsDocumento40 páginasInformation and Communications Technology Procurement: Best Practices Guide For Customs AdministrationsasfafwwwwwAún no hay calificaciones

- Fintech Regulatory Landscape PDFDocumento12 páginasFintech Regulatory Landscape PDFShekinahAún no hay calificaciones

- A Study On The Impact of Telecommunications Regulation On The Development of Digital Infrastructure in IndiaDocumento9 páginasA Study On The Impact of Telecommunications Regulation On The Development of Digital Infrastructure in IndiaAaina VaishAún no hay calificaciones

- 0211 Bourreau Regulation and InnovationDocumento38 páginas0211 Bourreau Regulation and InnovationHamis RamadhaniAún no hay calificaciones

- Telecom Industry Value Chain - enDocumento2 páginasTelecom Industry Value Chain - ennarayan_umallaAún no hay calificaciones

- Customer Satisfaction On Reliance Infocomm: A Summer Training Project Report ONDocumento41 páginasCustomer Satisfaction On Reliance Infocomm: A Summer Training Project Report ONTripta SainiAún no hay calificaciones

- PB2018-03 Open Access RegimeDocumento34 páginasPB2018-03 Open Access RegimeNana BananaAún no hay calificaciones

- Eu Us TradeprinciplesDocumento2 páginasEu Us TradeprinciplesCláudio LucenaAún no hay calificaciones

- Internet Global Growth Lessons For The Future Analysys MasonDocumento65 páginasInternet Global Growth Lessons For The Future Analysys Masonbimbolo8904Aún no hay calificaciones

- Unit-24 Telecom Policy A Case Study of IndiaDocumento17 páginasUnit-24 Telecom Policy A Case Study of IndiaRavi SinghAún no hay calificaciones

- Nepal TelecomDocumento4 páginasNepal TelecomShishir PokharelAún no hay calificaciones

- 2014 Industry ReportDocumento6 páginas2014 Industry ReportOvie OvieAún no hay calificaciones

- Project Base On Study of Telecomm SectorDocumento10 páginasProject Base On Study of Telecomm SectortimmyjimmyAún no hay calificaciones

- SAPM Punithavathy PandianDocumento22 páginasSAPM Punithavathy PandianVimala Selvaraj VimalaAún no hay calificaciones

- 10 Info SheetDocumento6 páginas10 Info Sheetdungnv151Aún no hay calificaciones

- Special Resident Retirees Visa SRRV InfoDocumento6 páginasSpecial Resident Retirees Visa SRRV InfoMary Heide H. AmoraAún no hay calificaciones

- 2Documento52 páginas2JDAún no hay calificaciones

- Agriculture: Myanmar Accounting Standard 41Documento14 páginasAgriculture: Myanmar Accounting Standard 41Kyaw Htin WinAún no hay calificaciones

- Q44 46 SolutionDocumento7 páginasQ44 46 SolutiontaikhoanscribdAún no hay calificaciones

- P2 Workbook Q PDFDocumento91 páginasP2 Workbook Q PDFShelley ThompsonAún no hay calificaciones

- Feasibility StudyDocumento3 páginasFeasibility StudyShielle Azon100% (1)

- Evaluation of Portfolio Performance PDFDocumento2 páginasEvaluation of Portfolio Performance PDFDerrickAún no hay calificaciones

- Assignment BTech 2019 EEE, CSEDocumento4 páginasAssignment BTech 2019 EEE, CSEPritam DasAún no hay calificaciones

- 825.01: General Information (03/29/2010) : Section 820 Section 805.09Documento13 páginas825.01: General Information (03/29/2010) : Section 820 Section 805.09apittermanAún no hay calificaciones

- Problem Session-2 - 15.03.2012Documento44 páginasProblem Session-2 - 15.03.2012markydee_20Aún no hay calificaciones

- Deresky Chapter1Documento41 páginasDeresky Chapter1IUSAún no hay calificaciones

- Glossary of Ocean Cargo Insurance TermsDocumento57 páginasGlossary of Ocean Cargo Insurance TermsDimitrios PhilippopoulosAún no hay calificaciones

- F1099R RCPSDocumento2 páginasF1099R RCPSherbs22225847Aún no hay calificaciones

- Century Plyboards - Kahalgaon BiharDocumento6 páginasCentury Plyboards - Kahalgaon Biharreltih18Aún no hay calificaciones

- E-Commerce: Sadiq M. Sait, PH.DDocumento68 páginasE-Commerce: Sadiq M. Sait, PH.DVishal RohithAún no hay calificaciones

- GM OEM Financials Dgi9ja-2Documento1 páginaGM OEM Financials Dgi9ja-2Dananjaya GokhaleAún no hay calificaciones

- Alan Andrews Course 1Documento47 páginasAlan Andrews Course 1Paul Celen100% (4)

- YTC Effective Session ReviewDocumento13 páginasYTC Effective Session ReviewelisaAún no hay calificaciones

- E3Documento155 páginasE3suvarnaashriAún no hay calificaciones

- Feasibility About Aloe Vera OilDocumento61 páginasFeasibility About Aloe Vera Oilgabbacvillacorta100% (2)

- Feasibility Study of Hydroxypropyl Methyl Cellulose ProductionDocumento3 páginasFeasibility Study of Hydroxypropyl Methyl Cellulose ProductionIntratec SolutionsAún no hay calificaciones

- The Beneficial OwnerDocumento15 páginasThe Beneficial OwnerDevaughn Immanuel Corrica-El100% (1)

- CSEC Economics June 2016 P1Documento12 páginasCSEC Economics June 2016 P1Sachin Bahadoorsingh50% (4)

- Cherie Mae F. AguinaldoDocumento2 páginasCherie Mae F. AguinaldoAnonymous SBT3XU6IAún no hay calificaciones

- Saide NikkarDocumento2 páginasSaide NikkarSaideNikkarAún no hay calificaciones

- Capital Expenditure Decisions: Answers To Review QuestionsDocumento11 páginasCapital Expenditure Decisions: Answers To Review QuestionsMJ YaconAún no hay calificaciones

- Question Bank ICSE Class 10th MathematicsDocumento7 páginasQuestion Bank ICSE Class 10th MathematicsAshwin0% (1)