Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Section 90A of Indian Income Tax Act

Cargado por

Sushil GuptaDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Section 90A of Indian Income Tax Act

Cargado por

Sushil GuptaCopyright:

Formatos disponibles

Section90A,IncometaxAct,19612015

56[Adoption by Central Government of agreement between specified associations for double

taxationrelief.

90A.(1)AnyspecifiedassociationinIndiamayenterintoanagreementwithanyspecifiedassociation

in the specified territory57 outside India and the Central Government may, by notification in the

Official Gazette, make such provisions as may be necessary for adopting and implementing such

agreement

(a) forthegrantingofreliefinrespectof

(i) incomeonwhichhavebeenpaidbothincometaxunderthisActandincometaxin

anyspecifiedterritoryoutsideIndiaor

(ii) incometax chargeable under this Act and under the corresponding law in force in

thatspecifiedterritoryoutsideIndiatopromotemutualeconomicrelations,tradeand

investment,or

(b) fortheavoidanceofdoubletaxationofincomeunderthisActandunderthecorresponding

lawinforceinthatspecifiedterritoryoutsideIndia,or

(c) for exchange of information for the prevention of evasion or avoidance of incometax

chargeableunderthisActorunderthecorrespondinglawinforceinthatspecifiedterritory

outsideIndia,orinvestigationofcasesofsuchevasionoravoidance,or

(d) forrecoveryofincometaxunderthisActandunderthecorrespondinglawinforceinthat

specifiedterritoryoutsideIndia.

(2)WhereaspecifiedassociationinIndiahasenteredintoanagreementwithaspecifiedassociationof

anyspecifiedterritoryoutsideIndiaundersubsection(1)andsuchagreementhasbeennotifiedunder

thatsubsection,forgrantingreliefoftax,orasthecasemaybe,avoidanceofdoubletaxation,then,in

relationtotheassesseetowhomsuchagreementapplies,theprovisionsofthisActshallapplytothe

extenttheyaremorebeneficialtothatassessee.

(2A)58[***]

Followingsubsection(2A)shallbeinsertedaftersubsection(2)ofsection90AbytheFinance

Act,2013,w.e.f.142016:

(2A)Notwithstandinganythingcontainedinsubsection(2),theprovisionsofChapterXAoftheAct

shallapplytotheassesseeevenifsuchprovisionsarenotbeneficialtohim.

(3)AnytermusedbutnotdefinedinthisActorintheagreementreferredtoinsubsection(1)shall,

unless the context otherwise requires, and is not inconsistent with the provisions of this Act or the

agreement, have the same meaning as assigned to it in the notification issued by the Central

GovernmentintheOfficialGazette59inthisbehalf.

60[(4)Anassessee,notbeingaresident,towhomtheagreementreferredtoinsubsection(1)applies,

shallnotbeentitledtoclaimanyreliefundersuchagreementunless 61[acertificate62 of his being a

resident] in any specified territory outside India, is obtained by him from the Government of that

specifiedterritory.]

63[(5)

The assessee referred to in subsection (4) shall also provide such other documents and

information,asmaybeprescribed64.]

Explanation1.Fortheremovalofdoubts,itisherebydeclaredthatthechargeoftaxinrespectofa

companyincorporatedinthespecifiedterritoryoutsideIndiaataratehigherthantherateatwhicha

domestic company is chargeable, shall not be regarded as less favourable charge or levy of tax in

respectofsuchcompany.

Explanation2.Forthepurposesofthissection,theexpressions

(a) "specified association" means any institution, association or body, whether incorporated or

not,functioningunderanylawforthetimebeinginforceinIndiaorthelawsofthespecified

territoryoutsideIndiaandwhichmaybenotified64aassuchbytheCentralGovernmentfor

thepurposesofthissection

(b) "specified territory" means any area outside India which may be notified64a as such by the

CentralGovernmentforthepurposesofthissection.]

65[Explanation3.Fortheremovalofdoubts,itisherebydeclaredthatwhereanytermisusedinany

agreemententeredintoundersubsection(1)andnotdefinedunderthesaidagreementortheAct,but

isassignedameaningtoitinthenotificationissuedundersubsection(3)andthenotificationissued

thereunder being in force, then, the meaning assigned to such term shall be deemed to have effect

fromthedateonwhichthesaidagreementcameintoforce.]

56.InsertedbytheFinanceAct,2006,w.e.f.162006.SeealsoInstructionNo.1/2013,dated171

2013andPressRelease,dated132013.

57. For specified association and specified territory, see Taxmann's Master Guide to Incometax

Act.

58.OmittedbytheFinanceAct,2013,w.e.f.142013.Priortoitsomission,subsection(2A),as

insertedbytheFinanceAct,2012,w.e.f.142013,readasunder:

"(2A)Notwithstandinganythingcontainedinsubsection(2),theprovisionsofChapterXAof

theActshallapplytotheassessee,evenifsuchprovisionsarenotbeneficialtohim."

59.Forrelevantnotifications,seeTaxmann'sMasterGuidetoIncometaxAct.

60.InsertedbytheFinanceAct,2012,w.e.f.142013.

61.Substituted for "a certificate, containing such particulars as may be prescribed, of his being a

resident"bytheFinanceAct,2013,w.e.f.142013.SeeRule21ABandFormNos.10FA and

10FBprescribedtherequisitecertificate.

62.Seerule21AB(3)and(4)andFormNos.10FAand10FB.

63.InsertedbytheFinanceAct,2013,w.e.f.142013.

64.Seerule21AB(1)to(2A)andFormNo.10F.

64a.Forspecifiedterritory/association,seeTaxmann'sMasterGuidetoIncometaxAct.

65.InsertedbytheFinanceAct,2012,w.r.e.f.162006.

También podría gustarte

- Special Suit PauperDocumento13 páginasSpecial Suit PauperjamilaAún no hay calificaciones

- National IncomeDocumento38 páginasNational IncomeManish SinghaniaAún no hay calificaciones

- National IncomeDocumento7 páginasNational IncomeShrikant YadavAún no hay calificaciones

- Family CourtDocumento14 páginasFamily CourtPriyal ParikhAún no hay calificaciones

- Constitutional SupremacyDocumento11 páginasConstitutional SupremacyTuan NurhanisahAún no hay calificaciones

- Handley V Baxendale 1854 Remoteness of DamagesDocumento6 páginasHandley V Baxendale 1854 Remoteness of DamageshannabreyerAún no hay calificaciones

- Income Tax Act GopikaDocumento20 páginasIncome Tax Act Gopikaapi-277928355Aún no hay calificaciones

- Define Contract of IndemnityDocumento1 páginaDefine Contract of IndemnityKai VaipheiAún no hay calificaciones

- Bba Land IntroDocumento8 páginasBba Land IntroAbhushkAún no hay calificaciones

- 2 Doctrine of Arbitrariness and Legislative Action A Misconceived ApplicationDocumento13 páginas2 Doctrine of Arbitrariness and Legislative Action A Misconceived ApplicationBeing IndianAún no hay calificaciones

- 1876 (EC-10) Brogden V Metropolitan Rly Co (Acceptance by Conduct of Parties)Documento2 páginas1876 (EC-10) Brogden V Metropolitan Rly Co (Acceptance by Conduct of Parties)Mehreen AkmalAún no hay calificaciones

- Indian Judicial Doctrines - Principles of Constitutional Law ExplainedDocumento5 páginasIndian Judicial Doctrines - Principles of Constitutional Law ExplainedDivyanshu ShuklaAún no hay calificaciones

- 1862 (EC-5) Felthouse V Bindley - Wikipedia (No Communication - No Contract - Horse CaseDocumento3 páginas1862 (EC-5) Felthouse V Bindley - Wikipedia (No Communication - No Contract - Horse CaseMehreen AkmalAún no hay calificaciones

- guidelineforHR - Our Rights When Arrested in Police CustodyDocumento11 páginasguidelineforHR - Our Rights When Arrested in Police CustodyNaliniAún no hay calificaciones

- GDP, GNP, NDP & NNPDocumento2 páginasGDP, GNP, NDP & NNPfdfjhhdddAún no hay calificaciones

- Trial Before CourtDocumento33 páginasTrial Before CourtShivraj PuggalAún no hay calificaciones

- Carllil v. Carbolic SmokeDocumento2 páginasCarllil v. Carbolic SmokeDhruv MathurAún no hay calificaciones

- Basis and Nature of Pious ObligationDocumento15 páginasBasis and Nature of Pious ObligationMayank MishraAún no hay calificaciones

- Essentials of A Sound Banking System PDFDocumento2 páginasEssentials of A Sound Banking System PDFAtmaja BandyopadhyayAún no hay calificaciones

- Types of WritsDocumento1 páginaTypes of WritstoddwshortAún no hay calificaciones

- Writs in Indian Constitution PDF For UPSC, Banking & SSC ExamsDocumento4 páginasWrits in Indian Constitution PDF For UPSC, Banking & SSC ExamsAarav TripathiAún no hay calificaciones

- Indian Council Act 1861Documento8 páginasIndian Council Act 1861ananuj0% (1)

- Meaning of National Income or National DividendDocumento5 páginasMeaning of National Income or National DividendDeepika ThakurAún no hay calificaciones

- CRPC Sections For Registering FIR With Police Station, Superintendent of Police or MagistrateDocumento4 páginasCRPC Sections For Registering FIR With Police Station, Superintendent of Police or MagistrateTanvee VasudevanAún no hay calificaciones

- Balfour V BalfourDocumento1 páginaBalfour V BalfourNurul Shahira Idayu100% (1)

- First Information ReportDocumento4 páginasFirst Information ReportAmirul Islam SujonAún no hay calificaciones

- Jurisprudence and Its ValueDocumento2 páginasJurisprudence and Its ValueAnant ThakkarAún no hay calificaciones

- Transfer by Ostenible Owner 2Documento4 páginasTransfer by Ostenible Owner 2Shashikant SauravAún no hay calificaciones

- Income Tax PPT Revised 130617182402 Phpapp01Documento184 páginasIncome Tax PPT Revised 130617182402 Phpapp01Avengers endgameAún no hay calificaciones

- Clubbing of IncomeDocumento6 páginasClubbing of IncomechitkarashellyAún no hay calificaciones

- National IncomeDocumento21 páginasNational IncomeMurali Krishna Pavan PappuAún no hay calificaciones

- Determinants of National Income PDFDocumento8 páginasDeterminants of National Income PDFRichiRich13Aún no hay calificaciones

- Viability of Class Division While Accessing Tax - An Appraisal Dr. Ram Manohar Lohia National Law UniversityDocumento16 páginasViability of Class Division While Accessing Tax - An Appraisal Dr. Ram Manohar Lohia National Law UniversityHimanshumalikAún no hay calificaciones

- Appeal Before The Commissioner of IncomeDocumento10 páginasAppeal Before The Commissioner of IncomemarlinahmurungiAún no hay calificaciones

- Amity Law School, Noida: Project For Law of Evidence Presumptions Under Indian Evidence ActDocumento9 páginasAmity Law School, Noida: Project For Law of Evidence Presumptions Under Indian Evidence ActdivijAún no hay calificaciones

- Ostensible OwnerDocumento3 páginasOstensible OwnerzeeshanAún no hay calificaciones

- Growth of State Bank of IndiaDocumento8 páginasGrowth of State Bank of IndiaAkchat JainAún no hay calificaciones

- Caveat EmptorDocumento2 páginasCaveat Emptorparthyadav92100% (1)

- Income Tax IndiaDocumento226 páginasIncome Tax IndiaSreejith RajmohanAún no hay calificaciones

- 2-Doctrine of Arbitrariness and Legislative Action-A Misconceived ApplicationDocumento14 páginas2-Doctrine of Arbitrariness and Legislative Action-A Misconceived ApplicationShivendu PandeyAún no hay calificaciones

- Growth of Administrative Law in IndiaDocumento2 páginasGrowth of Administrative Law in IndiaAkhil SinghAún no hay calificaciones

- Procedure To Be Adopted in Warrant Cases Instituted On Police ReportDocumento3 páginasProcedure To Be Adopted in Warrant Cases Instituted On Police ReportRachna YadavAún no hay calificaciones

- Blood Donation Camp Organized in My Society by Our RWADocumento6 páginasBlood Donation Camp Organized in My Society by Our RWARahul Sharma100% (1)

- Eco 121Documento4 páginasEco 121Arpit Bajaj100% (1)

- Mohori Bibee & Anothr V Dharmodas GhoseDocumento10 páginasMohori Bibee & Anothr V Dharmodas GhoseRohitashw Kajla50% (2)

- Ostensible OwnerDocumento2 páginasOstensible OwnerSiddharth Priyam GautamAún no hay calificaciones

- Income Tax Deductions From SalaryDocumento34 páginasIncome Tax Deductions From SalaryPaymaster Services100% (2)

- Residential Status: Vaibhav BanjanDocumento14 páginasResidential Status: Vaibhav BanjanAnmolAún no hay calificaciones

- Ex Turpi Causa Non Oritur ActioDocumento25 páginasEx Turpi Causa Non Oritur ActioMerlin KAún no hay calificaciones

- Chapter 5 Income of Other Persons Included in Assessee S Total IncomeDocumento8 páginasChapter 5 Income of Other Persons Included in Assessee S Total IncomeRaj Pati SundiAún no hay calificaciones

- The Golden TriangleDocumento9 páginasThe Golden TrianglePuneet DhupparhAún no hay calificaciones

- Administrative Law: History and Growth of Administrative Law in IndiaDocumento9 páginasAdministrative Law: History and Growth of Administrative Law in IndiaAnimesh GuptaAún no hay calificaciones

- National IncomeDocumento8 páginasNational IncomeDeepak Tyagi100% (11)

- International TaxationDocumento46 páginasInternational TaxationsridhartksAún no hay calificaciones

- Double Taxation ReliefDocumento2 páginasDouble Taxation Reliefs4sahithAún no hay calificaciones

- CT Part 7-Double Taxation ReliefDocumento6 páginasCT Part 7-Double Taxation ReliefSHAURYA VERMAAún no hay calificaciones

- Chapter IX Double Taxation ReliefDocumento4 páginasChapter IX Double Taxation ReliefKia GuptaAún no hay calificaciones

- 31175sm DTL Finalnew-May-Nov14 Cp15Documento9 páginas31175sm DTL Finalnew-May-Nov14 Cp15gvcAún no hay calificaciones

- Income Tax Act, 1961 90. Agreement With Foreign Countries or Specified Territories. - (1) The Central Government MayDocumento12 páginasIncome Tax Act, 1961 90. Agreement With Foreign Countries or Specified Territories. - (1) The Central Government MayParth AgarwalAún no hay calificaciones

- It Bare ActDocumento4 páginasIt Bare ActAbhinav SwarajAún no hay calificaciones

- CLAT 2016 Question Paper & Answer KeyDocumento41 páginasCLAT 2016 Question Paper & Answer Keyanuragchoubey1Aún no hay calificaciones

- Rubber Udyog Vikas (P.) Ltd. P&HDocumento4 páginasRubber Udyog Vikas (P.) Ltd. P&HSushil GuptaAún no hay calificaciones

- Ruling: Before The Authority For Advance Rulings (Income Tax) New Delhi PresentDocumento31 páginasRuling: Before The Authority For Advance Rulings (Income Tax) New Delhi PresentSushil GuptaAún no hay calificaciones

- Section 115JBDocumento7 páginasSection 115JBSushil GuptaAún no hay calificaciones

- GST Provision On Stock TransferDocumento3 páginasGST Provision On Stock TransferSushil GuptaAún no hay calificaciones

- Section 54ED, Income Tax Act, 1961 2015: Explanation.-For The Purposes of This Sub SectionDocumento2 páginasSection 54ED, Income Tax Act, 1961 2015: Explanation.-For The Purposes of This Sub SectionSushil GuptaAún no hay calificaciones

- Draft Indian GST LawDocumento190 páginasDraft Indian GST LawpitchiAún no hay calificaciones

- Modelconcessionagreement PDFDocumento50 páginasModelconcessionagreement PDFSushil GuptaAún no hay calificaciones

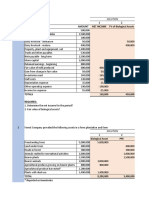

- Ias 41 - Agriculture 1 2 1 Amount Net Income FV of Biological AssetsDocumento2 páginasIas 41 - Agriculture 1 2 1 Amount Net Income FV of Biological Assetslet me live in peaceAún no hay calificaciones

- Cir v. LancasterDocumento2 páginasCir v. LancasterGlyza Kaye Zorilla PatiagAún no hay calificaciones

- Capital Gains Tax - ArticleDocumento6 páginasCapital Gains Tax - ArticleMr RizviAún no hay calificaciones

- Francia vs. IAC, G.R. No. L-67649, June 28, 1988Documento8 páginasFrancia vs. IAC, G.R. No. L-67649, June 28, 1988KidMonkey2299Aún no hay calificaciones

- Exercixe1-Consultant PO 1Documento6 páginasExercixe1-Consultant PO 1Saima SharifAún no hay calificaciones

- Group 5 Toyota Motor in Vietnam Market: International SchoolDocumento25 páginasGroup 5 Toyota Motor in Vietnam Market: International SchoolLinh Tùng NguyễnAún no hay calificaciones

- Chapter 4 For FilingDocumento9 páginasChapter 4 For Filinglagurr100% (1)

- Oakland Howard Terminal Waterfront Project ATTACHMENTS 1 Through 6Documento152 páginasOakland Howard Terminal Waterfront Project ATTACHMENTS 1 Through 6Zennie AbrahamAún no hay calificaciones

- Accounting For Employee Use of Company VehiclesDocumento12 páginasAccounting For Employee Use of Company VehiclesMike KarlinsAún no hay calificaciones

- Financial Ratios Analysis Project at Nestle and Engro Foods: Executive SummaryDocumento9 páginasFinancial Ratios Analysis Project at Nestle and Engro Foods: Executive SummaryMuhammad Muzamil HussainAún no hay calificaciones

- BBA.5 (Unit.1 Introduction To Direct Tax, Residential Status and Income Under The Head of SalariesDocumento66 páginasBBA.5 (Unit.1 Introduction To Direct Tax, Residential Status and Income Under The Head of SalariesMihir AsnaniAún no hay calificaciones

- Form 15 GDocumento2 páginasForm 15 GAmit BhatiAún no hay calificaciones

- Business Plan 1Documento42 páginasBusiness Plan 1mark platinoAún no hay calificaciones

- Rent Agreement PDFDocumento12 páginasRent Agreement PDFAshish MajithiaAún no hay calificaciones

- Management Information 3 (ICAI)Documento88 páginasManagement Information 3 (ICAI)Rajib HossainAún no hay calificaciones

- Attendance Sheet in ExcelDocumento14 páginasAttendance Sheet in ExcelsalmanAún no hay calificaciones

- E-Tender 04 PDFDocumento18 páginasE-Tender 04 PDFSaiprasad GanganeAún no hay calificaciones

- Application For Registration As A Vendor: Next PageDocumento4 páginasApplication For Registration As A Vendor: Next PageMark KAún no hay calificaciones

- G.R. No. 96016 October 17, 1991 Commissioner of Internal Revenue, Petitioner, vs. The Court of Appeals and Efren P. Castaneda, RespondentsDocumento1 páginaG.R. No. 96016 October 17, 1991 Commissioner of Internal Revenue, Petitioner, vs. The Court of Appeals and Efren P. Castaneda, RespondentsCristy Yaun-CabagnotAún no hay calificaciones

- Financial Perspective: Doing Business in IndiaDocumento21 páginasFinancial Perspective: Doing Business in India26702741Aún no hay calificaciones

- Dawood KhanDocumento2 páginasDawood KhanRana Sunny KhokharAún no hay calificaciones

- EPC Is Here To StayDocumento8 páginasEPC Is Here To Stayamitkjha.mba5211Aún no hay calificaciones

- IGCSE Economics RevisionDocumento51 páginasIGCSE Economics RevisionZahra AliAún no hay calificaciones

- Supplier Payments SampleDocumento19 páginasSupplier Payments SampleEngg. Gurpreet jammu singhAún no hay calificaciones

- XtolDocumento2 páginasXtolsujal JainAún no hay calificaciones

- TX - Mock Test - Đáp ÁnDocumento12 páginasTX - Mock Test - Đáp ÁnPhán Tiêu Tiền100% (1)

- Jackson-Pettigrew Presentation - 10-16-2017Documento24 páginasJackson-Pettigrew Presentation - 10-16-2017SarahAún no hay calificaciones

- Robert E. KernDocumento3 páginasRobert E. KernRiverheadLOCALAún no hay calificaciones

- Townsend 1979Documento28 páginasTownsend 1979api-534238122Aún no hay calificaciones

- 2010 Taxation Law Bar Examination QuestionsDocumento5 páginas2010 Taxation Law Bar Examination QuestionsMowan100% (1)