Documentos de Académico

Documentos de Profesional

Documentos de Cultura

1-5 Trading Stock

Cargado por

oddsey0713Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

1-5 Trading Stock

Cargado por

oddsey0713Copyright:

Formatos disponibles

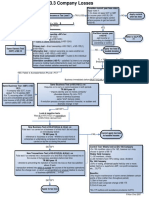

1.

5 Trading Stock: Div 70

Satisfy Trading Stock (TS) Definition? s70-10

-anything produced, manufactured or acquired that is

held for purposes of manufacture, sale or exchange

in the ord course of business and livestock

Other Notes

s70-15(3) denies deduction for

prepayment of TS

Water facilities not classified as TS

ON HAND? s70-10

- power of dispossession, possess risk of

TS

Farnsworth v FCT

not on hand

All States Frozen Foods v FCT; FCT v

Suttons Motors

on hand

NOT capital s70-25

- avoid ambiguity

Yes

No

General deduction s8-1(1)

Note: case law has established TS is a revenue

expense (s8-1 applies to purchases, refer next step)

Need to satisfy on hand before you can deduct

Valuing TS s70-45(1)

For each item, you can value at (changed yrly):

1) cost price

2) market selling value

3) replacement cost

(s70-50 allows lower value in cases of obsolete, becoming obsolete, special

circumstance)

Phillip Morris Ltd v FCT

- Used full absorption method to value TS w/ allocated fixed cost

Other acceptable valuation methods:

1) FIFO

2) Average Cost

3) Standard Cost (needs regular review)

4) Retail inventory method

*LIFO not acceptable

Specific Deduction for OS vs

CS? s70-35(1)

CS>OS AI s70-35(2)

CS<OS D s70-35(3)

Change in OWNERSHIP/INTEREST of TS

s70-100(1)-(3)

deemed disposal @ market value

-ORs70-100(4)

election to dispose at cost if:

1) TS is an asset in new business

2) former owners retain 25% interest in TS

3) MV @ disposal is greater than cost

Disposal of TS

S118-25(1) disregard CGT effects of

TS

OWNERSHIP/INTEREST

Disposal OUTSIDE

market value of item on day of disposal is

included in AI

s30-15

gifts (>$2) receive a deduction NOTE: net effect

= 0 may NOT be true! Refer to table in s30-15

s70-90

OUTSIDE

What is your business?

-nature of business

-characteristics of transactions

falling within that business

-character of the disputed

transaction

WITHIN

STOPPED HOLDING

No arms length? s70-20

- substitutes arms length value as amt

deducted (s8-1) or the valuation option

chosen (s70-40)

NO

Normal disposal of TS

under s6-5

-include proceeds in AI

Stopped holding it as TS?

s70-110

TP is deemed to have sold it for cost and

immediately reacquired it for the same amount

Affects Div 40-C (depn), and cost base in CGT

CAPITAL

TS

s70-30

CAPITAL ASSET

TS

deemed disposal of capital asset @ cost

OR MV (CGT event K4)

Ken Choi 2007

También podría gustarte

- 1-8 GST - GST Payable or ITC AvalDocumento2 páginas1-8 GST - GST Payable or ITC Avaloddsey0713Aún no hay calificaciones

- 2-3 Capital AllowancesDocumento1 página2-3 Capital Allowancesoddsey0713Aún no hay calificaciones

- Does FBT Apply?: Div 13 ExclusionsDocumento1 páginaDoes FBT Apply?: Div 13 Exclusionsoddsey0713Aún no hay calificaciones

- 3-3 Company LossesDocumento1 página3-3 Company Lossesoddsey0713Aún no hay calificaciones

- 4-3 Part IVA General AntiAvoidanceDocumento1 página4-3 Part IVA General AntiAvoidanceoddsey0713Aún no hay calificaciones

- 3-3 Div 7A Deemed Divs - VLDocumento1 página3-3 Div 7A Deemed Divs - VLoddsey0713Aún no hay calificaciones

- 2-4,5 Capital WorksDocumento1 página2-4,5 Capital Worksoddsey0713Aún no hay calificaciones

- 3-3 Franking AccountDocumento1 página3-3 Franking Accountoddsey0713Aún no hay calificaciones

- Case Summaries 1 193Documento54 páginasCase Summaries 1 193oddsey0713100% (1)

- T6 Chapter 5 Solutions To The Essential ActivitiesDocumento12 páginasT6 Chapter 5 Solutions To The Essential Activitiesoddsey0713Aún no hay calificaciones

- T7 Chapter 6 Solutions To The Essential ActivitiesDocumento26 páginasT7 Chapter 6 Solutions To The Essential Activitiesoddsey0713Aún no hay calificaciones

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1091)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)