Documentos de Académico

Documentos de Profesional

Documentos de Cultura

3-3 Company Losses

Cargado por

oddsey07130 calificaciones0% encontró este documento útil (0 votos)

32 vistas1 páginaDerechos de autor

© © All Rights Reserved

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

32 vistas1 página3-3 Company Losses

Cargado por

oddsey0713Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 1

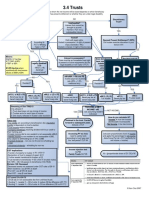

3.

3 Company Losses

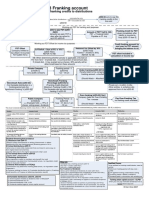

Taxable Income or Tax Loss?

TAXABLE INCOME

Applying for prior year losses

TAX LOSS

TL = 100k

AI = 300k

Same Owners Test Period

s165(1)

Consider current year loss rules:

Apply rules if:

1) Co does not pass SOT or SBT

for income year s165-35, OR

2) Where person begins control

where purpose to get tax benefit

s165-40

YES

Was change in ownership >50% for:

1) Voting rights (s165-12(2))

2) Rights to dividend (s165-12(3))

3) Rights to capital distributions (s165-12(4))

Same Owners Test

(SOT) s165-12

YES: Failed

Apply current

year tax loss

NO

Primary test direct ownership s165-150(1), s165-155(1),

s165-160(1),

Alternative test indirect ownership (co owns another co)

s165-150(2), s165-155(2), s165-160(2)

Family trust concession s165-207 trustee is the individual

holding the interest

Alternative condition (165-F) satisfied if a) there is no change

in persons holding fixed entitlements b) every non-fixed trust that

holds a fixed interest satisfies ownership test itself

Partition income year

s165-45

-split income yr

according to change in

ownership or control

NO

Refer to CLP 7677

Apply tax loss to

taxable income

TL = 100k

Breached SOT

AI = 300k

Same Business

Test Period

Avondale Motors Pty Ltd v FCT

Business immediately before MUST EQUAL business in the year you are claiming deduction

Same Business Test (SBT) s16513(1)

- if company fails SOT, it can

deduct TL if it satisfies SBT

-For TL occurring after 1/07/2005,

cos and consolidated groups with

total income (s165-212B) >$100M

cannot satisfy SBT s165-212A

Same Business Test (s165-210(1)) +ve

Requires co to carry on same business in both periods

TR 99/9 para 13

- imports identity and not merely similarity

(Avondale Motors Pty Ltd v FCT)

-sense of identical business

- same kind (lecture notes)

- if evolution process changes essential character, or sudden and

dramatic change

fail!

SATISFY

Look at negative tests.

Was AI (s165-210(2)) or expenditure

(s165-210(4)) derived from:

New Business Test (s165-210(2)(a) & (4)(a)) -ve

Fails test if co carried on a business of a kind that it did not carry

on immediately before

TR 99/9 para 14

- reference to business of a kind Refers to each kind of

enterprise or undertaking comprised in the overall business

carried on by the co during the period

SATISFY

New Transactions Test (s165-210(2)(b) &(4)(a)) -ve

Fails test if co entered into a transaction of a kind that it had not entered into in

the course of its business operations before test time

TR 99/9 para 15

- directed to preventing the injection of income into loss co that has satisfied

above 2 tests

- transaction entered into which is outside the course of the business operations

before the change over, or which us extraordinary or unusual relative to course

of business operations

Fail!

SATISFY

Apply to tax loss

FAIL

Cannot apply tax loss

to taxable income

Control Test: Widely held co/Div 166 Company

-Div 166 modifies rules in Div 165, however cos may

choose to ignore s166-15

Widely Held Company

1) >50 members, unless:

a)<20 members have 75% voting, value, dividend

Div 166 Company

>50% of voting, dividends/capital held by one or more:

widely held cos, superfund, ADF, non-profit companies

etc CLP73

Benefits:

Only require maintenance of same owners between certain

points of time (rather than throughout period)

1) Start of loss year

2) End of each corporate change s166-175

3) End of loss year

*Div 175 outlines anti-avoidance provisions CLP74

Ken Choi 2007

También podría gustarte

- CPA Review Notes: Audit 2022De EverandCPA Review Notes: Audit 2022Calificación: 4.5 de 5 estrellas4.5/5 (7)

- Defining Heads of Charge and Deductions S10(1Documento2 páginasDefining Heads of Charge and Deductions S10(1Jean Pingfang Koh100% (3)

- CS Executive Tax LawsDocumento236 páginasCS Executive Tax Lawsneeraj yadav100% (1)

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosDe EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosAún no hay calificaciones

- CPA Review Notes 2019 - Audit (AUD)De EverandCPA Review Notes 2019 - Audit (AUD)Calificación: 3.5 de 5 estrellas3.5/5 (10)

- 3-4 TrustsDocumento1 página3-4 Trustsoddsey0713Aún no hay calificaciones

- Income TaxatioDocumento78 páginasIncome TaxatioHoney BiAún no hay calificaciones

- Taxation Vol. IIDocumento364 páginasTaxation Vol. IISaibhumi100% (2)

- 2011 Bec Text Book - With CoverDocumento409 páginas2011 Bec Text Book - With Coveryouarewangbadan50% (2)

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)De EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)Aún no hay calificaciones

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018De EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Aún no hay calificaciones

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementDe EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementAún no hay calificaciones

- Set Off Carried Forward of LossesDocumento32 páginasSet Off Carried Forward of Lossesabhirocks_bigjAún no hay calificaciones

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosDe EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosAún no hay calificaciones

- Mastering Tally PRIME: Training, Certification & JobDe EverandMastering Tally PRIME: Training, Certification & JobAún no hay calificaciones

- Tax LectureDocumento14 páginasTax LecturevyaskushAún no hay calificaciones

- CO5120 Taxation Module 5Documento35 páginasCO5120 Taxation Module 5John PhAún no hay calificaciones

- Topic 5 - CompaniesDocumento35 páginasTopic 5 - Companiesmichael krueseiAún no hay calificaciones

- Sky High Institute: Important - Tax Sem 5Documento46 páginasSky High Institute: Important - Tax Sem 5Harsh JainAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAún no hay calificaciones

- Null 2Documento12 páginasNull 2Kaif UddinAún no hay calificaciones

- Steps for carry forward and set off of lossesDocumento23 páginasSteps for carry forward and set off of lossessankymahadik1120Aún no hay calificaciones

- TWDV Remaininguseful Lifeof Asset: A. PMA Test - Income vs. Capital Receipt (Tree or Fruit)Documento3 páginasTWDV Remaininguseful Lifeof Asset: A. PMA Test - Income vs. Capital Receipt (Tree or Fruit)Kelvin Lim Wei LiangAún no hay calificaciones

- 20 05 30 - BULAW5916 - RevisionDocumento22 páginas20 05 30 - BULAW5916 - RevisionPurnima Sidhant BabbarAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2012 (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderAún no hay calificaciones

- CA INTER TEST SERIES FOR MAY 2023Documento8 páginasCA INTER TEST SERIES FOR MAY 2023Sayyed Altamash Akbar AliAún no hay calificaciones

- Tax Advance IndexDocumento38 páginasTax Advance IndexLan TranAún no hay calificaciones

- Gurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesDocumento16 páginasGurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesBhavin PathakAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Tax Planning For Shut Down or ContinueDocumento4 páginasTax Planning For Shut Down or ContinueDr Linda Mary Simon75% (4)

- Business & Profession Theory-AY0910Documento52 páginasBusiness & Profession Theory-AY0910Vijaya MandalAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Income Tax Ready Reckoner - Budget 2023-1Documento14 páginasIncome Tax Ready Reckoner - Budget 2023-1ಸೊಹನ್ ಕಲಂಗುಟ್ಕರ್Aún no hay calificaciones

- Chapter 2: Corporations: Introduction and Operating RulesDocumento22 páginasChapter 2: Corporations: Introduction and Operating RulesAvneet KaurAún no hay calificaciones

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- CA FINAL CHAPTER WISE TEST SERIESDocumento8 páginasCA FINAL CHAPTER WISE TEST SERIESManjari ReddyAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Audit CA Final (New) Block Test Series: Total Marks: 30 Time: 1 HourDocumento4 páginasAudit CA Final (New) Block Test Series: Total Marks: 30 Time: 1 HourbhaveshAún no hay calificaciones

- Submitted Towards The Partial Fulfillment of The Requirements For The Certificate of TheDocumento12 páginasSubmitted Towards The Partial Fulfillment of The Requirements For The Certificate of TheATSIMSAún no hay calificaciones

- IB BM Paper 1-MSDocumento13 páginasIB BM Paper 1-MSDANIYA GENERALAún no hay calificaciones

- Chapter 06Documento40 páginasChapter 06Faisal JiwaniAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- 010 Deferred-RevenueDocumento5 páginas010 Deferred-Revenuecaparvez25Aún no hay calificaciones

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results For December 31, 2015 (Result)Documento3 páginasFinancial Results For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Standalone Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Documento3 páginasStandalone Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Shyam SunderAún no hay calificaciones

- L-27, Set Off and Carry Forward of LossesDocumento20 páginasL-27, Set Off and Carry Forward of LosseswhoreAún no hay calificaciones

- Set Off and Carry Forward of The Losses-IMISDocumento23 páginasSet Off and Carry Forward of The Losses-IMISMegha MoonkaAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento7 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- On Tax AuditDocumento148 páginasOn Tax AuditAnmol KumarAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Profits and Gains Tax CalculationDocumento18 páginasProfits and Gains Tax CalculationSurya MuruganAún no hay calificaciones

- ApplicabiliTY of ProvisionsDocumento3 páginasApplicabiliTY of ProvisionsNikhil KasatAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Endowment Type: Plan 133Documento7 páginasEndowment Type: Plan 133Sarath ChandranAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Return of Income: (Date in Connection With Assessment Order Is Ignored From All Sections)Documento6 páginasReturn of Income: (Date in Connection With Assessment Order Is Ignored From All Sections)omar zohorianAún no hay calificaciones

- CTPDocumento10 páginasCTPpoonammadan0001Aún no hay calificaciones

- Translate: Powered byDocumento3 páginasTranslate: Powered byannnoyynnmussAún no hay calificaciones

- 1-4 Deductions FlowchartDocumento2 páginas1-4 Deductions Flowchartoddsey0713Aún no hay calificaciones

- 1-8 GST - GST Payable or ITC AvalDocumento2 páginas1-8 GST - GST Payable or ITC Avaloddsey0713Aún no hay calificaciones

- 3 5 PartnershipsDocumento1 página3 5 Partnershipsoddsey0713Aún no hay calificaciones

- 4-3 Part IVA General AntiAvoidanceDocumento1 página4-3 Part IVA General AntiAvoidanceoddsey0713Aún no hay calificaciones

- 1-3 Assessable IncomeDocumento2 páginas1-3 Assessable Incomeoddsey0713Aún no hay calificaciones

- Does FBT Apply?: Div 13 ExclusionsDocumento1 páginaDoes FBT Apply?: Div 13 Exclusionsoddsey0713Aún no hay calificaciones

- 1-5 Trading StockDocumento1 página1-5 Trading Stockoddsey0713Aún no hay calificaciones

- 2-3 Capital AllowancesDocumento1 página2-3 Capital Allowancesoddsey0713Aún no hay calificaciones

- Restrictions on franking creditsDocumento1 páginaRestrictions on franking creditsoddsey0713Aún no hay calificaciones

- 3-3 Div 7A Deemed Divs - VLDocumento1 página3-3 Div 7A Deemed Divs - VLoddsey0713Aún no hay calificaciones

- 2-4,5 Capital WorksDocumento1 página2-4,5 Capital Worksoddsey0713Aún no hay calificaciones

- Creating Effective Ads PPT 4 MGMTDocumento22 páginasCreating Effective Ads PPT 4 MGMToddsey0713Aún no hay calificaciones

- Executing-The-Creative Design Elements and Layout Styles With ADS As ExamplesDocumento47 páginasExecuting-The-Creative Design Elements and Layout Styles With ADS As Examplesoddsey0713Aún no hay calificaciones

- T5 Chapters 4 and 8 Solutions To The Essential ActivitiesDocumento18 páginasT5 Chapters 4 and 8 Solutions To The Essential Activitiesoddsey0713Aún no hay calificaciones

- Case Summaries 1 193Documento54 páginasCase Summaries 1 193oddsey0713100% (1)

- T7 Chapter 6 Solutions To The Essential ActivitiesDocumento26 páginasT7 Chapter 6 Solutions To The Essential Activitiesoddsey0713Aún no hay calificaciones

- T6 Chapter 5 Solutions To The Essential ActivitiesDocumento12 páginasT6 Chapter 5 Solutions To The Essential Activitiesoddsey0713Aún no hay calificaciones

- T8 Chapters 9 and 7 Solutions To The Essential ActivitiesDocumento12 páginasT8 Chapters 9 and 7 Solutions To The Essential Activitiesoddsey0713Aún no hay calificaciones

- 2006 Planning EvalDocumento33 páginas2006 Planning EvalSanjay SahooAún no hay calificaciones

- Complaint-Affidavit: Office of The City ProsecutorDocumento7 páginasComplaint-Affidavit: Office of The City ProsecutorMark LojeroAún no hay calificaciones

- NRA TaxDocumento58 páginasNRA TaxIanAún no hay calificaciones

- Foreign Investments in US REDocumento25 páginasForeign Investments in US RETony ZhengAún no hay calificaciones

- May 2019 Salary Payslip for Arpit KumarDocumento1 páginaMay 2019 Salary Payslip for Arpit KumarArPit GuptaAún no hay calificaciones

- LLC Agreement Template for External ManagerDocumento22 páginasLLC Agreement Template for External ManagerRamon De LeonAún no hay calificaciones

- Taxation Vietnam (F6) : Nguyễn Thị Thanh Hoài November 29, 2023Documento118 páginasTaxation Vietnam (F6) : Nguyễn Thị Thanh Hoài November 29, 2023minhnguyennhat2003Aún no hay calificaciones

- Deduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToDocumento169 páginasDeduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToRajAún no hay calificaciones

- Business Income, Deductions, and Accounting MethodsDocumento37 páginasBusiness Income, Deductions, and Accounting MethodsMo ZhuAún no hay calificaciones

- Payslip Feb 2023Documento1 páginaPayslip Feb 2023rk41001Aún no hay calificaciones

- The Punjab Sales Tax On Services Act 2012Documento77 páginasThe Punjab Sales Tax On Services Act 2012Muhammad imran LatifAún no hay calificaciones

- November 7, 2014 Strathmore TimesDocumento32 páginasNovember 7, 2014 Strathmore TimesStrathmore TimesAún no hay calificaciones

- Compilation of Relevant Court of Tax AppDocumento30 páginasCompilation of Relevant Court of Tax Appcy legaspiAún no hay calificaciones

- Individual Taxpayers Tax Filing ExercisesDocumento3 páginasIndividual Taxpayers Tax Filing ExercisesKIM RAGAAún no hay calificaciones

- Prelim Laboratory Exercises - JavaDocumento5 páginasPrelim Laboratory Exercises - JavaJhayar BucayanAún no hay calificaciones

- Taxation Review BarDocumento10 páginasTaxation Review Barjemgutierrez82Aún no hay calificaciones

- Test Bank Chapter15 Capital Budgeting2Documento29 páginasTest Bank Chapter15 Capital Budgeting2nashAún no hay calificaciones

- Five J Taxi and Armamiento vs. NLRC 235 SCRA 556 RulingDocumento1 páginaFive J Taxi and Armamiento vs. NLRC 235 SCRA 556 RulingNikko SterlingAún no hay calificaciones

- UTAR TAXATION DEDUCTION GUIDEDocumento60 páginasUTAR TAXATION DEDUCTION GUIDEKeat Eing WongAún no hay calificaciones

- Unit 2 Income From Salary Meaning of SalaryDocumento34 páginasUnit 2 Income From Salary Meaning of SalaryrahulahujaAún no hay calificaciones

- PGBP Expense AdjustmentDocumento23 páginasPGBP Expense AdjustmentVaishAún no hay calificaciones

- AIA SmartRewards Saver (II) 55345 20140824113002 CR25RBR9Documento11 páginasAIA SmartRewards Saver (II) 55345 20140824113002 CR25RBR9Lim Zer YeeAún no hay calificaciones

- TaxDocumento22 páginasTaxAashutosh RathodAún no hay calificaciones

- Researchwork NishaDocumento50 páginasResearchwork NishaRose QueenAún no hay calificaciones

- Income Tax TableDocumento6 páginasIncome Tax TableCristle ServentoAún no hay calificaciones

- The Payment of WagesDocumento17 páginasThe Payment of WagesChirag RajawatAún no hay calificaciones

- Income Tax Law and PracticesDocumento148 páginasIncome Tax Law and PracticesUjjwal KandhaweAún no hay calificaciones