Documentos de Académico

Documentos de Profesional

Documentos de Cultura

1-3 Assessable Income

Cargado por

oddsey0713Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

1-3 Assessable Income

Cargado por

oddsey0713Copyright:

Formatos disponibles

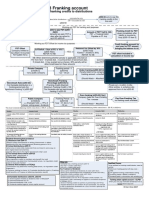

1.

3 Assessable Income (s6-5, 6-10)

Ordinary Concepts

Amts received from

property

Eisner v Macomber

-rents, royalties,

interest, div

Regular,

recurrent,

periodic amt

FCT v Dixon

Amts incidental to

employment or

services rendered

Kelly v FCT;FCT v

Smith; Scott v FCT

Gain from isolated transaction

FCT v Myer Emporium

Conditions:

1) Course of carrying on a business

2) Profit making purpose

Amts received in

replacement of

income is income

Liftronic PL v FCT

Amt not convertible into money is not income

FCT v Cooke & Sherden

-s21A rectifies this problem for business benefits

(arms length value)

exceptions:1) otherwise ded s21A(3);2) non-ded

entertainment s21A(4);3) <$300 s23L(2)

-captured by s26(e) for employment relationships

subject to FBT

Capital Receipts

Once-off/nonrecurring

transaction

Transaction represents realisation

or sterlisation of an asset

- exceptions when undetaking

business in buying/selling property

(Scottish Australian Mining)

Usually received in lump sum

- instalments still capital

(Californian Oil Products)

-interest component income

Single unallocated amts

for compensation

- McLaurin v FCT

Compensation

leading to end of

business

Statutory Income

Disposal of leased car for profit (s20-110)

Amt included in AI is the lesser of:

1) Total allowable deductions for lease pmt

(factor business use)

2) Diff btwn purchase price+capital improv

and proceeds

3) Notional depn dif btwn cost to lessor

and terminal value

Dividends

Dividends included

s44(1)

Gross-up of AUS dividend

s207-20(1)

[individuals], s207-35(1) [partnership/trust]

Gross-up of foreign dividend

s6AC

Imputation credit for domestic

s207-20(2)

s6AC

Imputation credit for foreign

ETP

Refer to CLP42 for

worked example

and Activity 4

More specific provision will prevail s6-25

ESS

Issue must be:

1) Related to employment (s139C(1))

2) Share must be qualifying share or

right (s139CD)

[CCH Note: The following amounts are the upper limits for income years commencing with 1989/90:

Income year

Upper limit

1989/90

$64,500

1990/91

$68,628

1991/92

$73,776

1992/93

$76,949

Yes

1993/94

$77,796

1994/95

$79,975

1995/96

$83,574

Election to include

1996/97

$86,917

discount in AI @

1997/98

$90,916

year of acquisition

1998/99

$94,189

(s139E)

1999/2000 $97,109

Yes

No

2000/01

$101,188

2001/02

$105,843

Exempt concession s139BA

Deferral concession

2002/03

$112,405

1) Discount based on MV of

(s139B(3)

2003/04

$117,576

shares at acquisition,

-discount is incl in AI @ cessation time

2004/05

$123,808

2) cost base incl full

1) discount based on MV at cessation time

2005/06

$129,751

consideration paid by TP

2) Consideration on subsequent sale is

2006/07

$135,590]

-entitled to $1000 discount

based on MV @ cessation (s130-83)

Ken Choi 2007

1.3 Assessable Income (s6-5, 6-10) p2

Non-assessable non-exempt income

Exempt income

Exempt because

of the nature of

recipient entity

(s11-5)

Exempt because

type of income

s11-10

-FBT exempt

s23L(1A)

Type of income in

hands of recipient

s11-15

-social sec pmt

Div52

Derivation of income Cash v Accruals TR98/1

calculated to give a

substantially correct

reflex of TPs true

income

- Cardens Case

Principle of

constructive

receipt

-s6-5(4), s6-10(3)

Cash Basis

- Services based on his/her

personal skill & expertise

(Firstenberg, Dunn)

Accruals Basis

-larger the coy,

more likely accrual

(Hendersons)

Income not considered

derived until services

have been rendered

(Arthur Murray)

When income is derived

Ken Choi 2007

También podría gustarte

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- 1-8 GST - GST Payable or ITC AvalDocumento2 páginas1-8 GST - GST Payable or ITC Avaloddsey0713Aún no hay calificaciones

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Restrictions on franking creditsDocumento1 páginaRestrictions on franking creditsoddsey0713Aún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- 1-4 Deductions FlowchartDocumento2 páginas1-4 Deductions Flowchartoddsey0713Aún no hay calificaciones

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

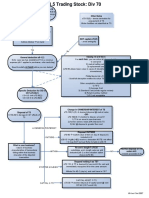

- 1-5 Trading StockDocumento1 página1-5 Trading Stockoddsey0713Aún no hay calificaciones

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- 3-3 Div 7A Deemed Divs - VLDocumento1 página3-3 Div 7A Deemed Divs - VLoddsey0713Aún no hay calificaciones

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- 2-3 Capital AllowancesDocumento1 página2-3 Capital Allowancesoddsey0713Aún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Does FBT Apply?: Div 13 ExclusionsDocumento1 páginaDoes FBT Apply?: Div 13 Exclusionsoddsey0713Aún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

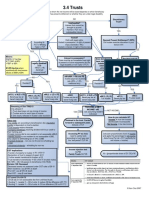

- 3-4 TrustsDocumento1 página3-4 Trustsoddsey0713Aún no hay calificaciones

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- 3 5 PartnershipsDocumento1 página3 5 Partnershipsoddsey0713Aún no hay calificaciones

- 4-3 Part IVA General AntiAvoidanceDocumento1 página4-3 Part IVA General AntiAvoidanceoddsey0713Aún no hay calificaciones

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- 3-3 Company LossesDocumento1 página3-3 Company Lossesoddsey0713Aún no hay calificaciones

- T6 Chapter 5 Solutions To The Essential ActivitiesDocumento12 páginasT6 Chapter 5 Solutions To The Essential Activitiesoddsey0713Aún no hay calificaciones

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- 2-4,5 Capital WorksDocumento1 página2-4,5 Capital Worksoddsey0713Aún no hay calificaciones

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Executing-The-Creative Design Elements and Layout Styles With ADS As ExamplesDocumento47 páginasExecuting-The-Creative Design Elements and Layout Styles With ADS As Examplesoddsey0713Aún no hay calificaciones

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- Creating Effective Ads PPT 4 MGMTDocumento22 páginasCreating Effective Ads PPT 4 MGMToddsey0713Aún no hay calificaciones

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Case Summaries 1 193Documento54 páginasCase Summaries 1 193oddsey0713100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- T8 Chapters 9 and 7 Solutions To The Essential ActivitiesDocumento12 páginasT8 Chapters 9 and 7 Solutions To The Essential Activitiesoddsey0713Aún no hay calificaciones

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- T5 Chapters 4 and 8 Solutions To The Essential ActivitiesDocumento18 páginasT5 Chapters 4 and 8 Solutions To The Essential Activitiesoddsey0713Aún no hay calificaciones

- 2006 Planning EvalDocumento33 páginas2006 Planning EvalSanjay SahooAún no hay calificaciones

- T7 Chapter 6 Solutions To The Essential ActivitiesDocumento26 páginasT7 Chapter 6 Solutions To The Essential Activitiesoddsey0713Aún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

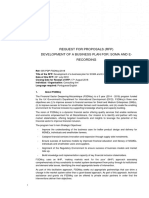

- Business Plan SOMAe Recording TOR FINAL ENG WebsiteDocumento4 páginasBusiness Plan SOMAe Recording TOR FINAL ENG WebsiteHigino IceBirdAún no hay calificaciones

- Dr. Mahalee's Meeting with Sophia CostaDocumento22 páginasDr. Mahalee's Meeting with Sophia CostaManoj Kumar100% (3)

- India's Cost of Capital: A Survey: January 2014Documento16 páginasIndia's Cost of Capital: A Survey: January 2014Jeanette JenaAún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Cheat Sheet TaxDocumento6 páginasCheat Sheet TaxShravan NiranjanAún no hay calificaciones

- Hrm380 Case Gfs ChinaDocumento42 páginasHrm380 Case Gfs Chinasleepy_owlAún no hay calificaciones

- Assignment On JournalDocumento4 páginasAssignment On JournalNIKHIL GUPTAAún no hay calificaciones

- Bse and NseDocumento15 páginasBse and NseChinmay P Kalelkar50% (2)

- Reg Flash CardsDocumento3562 páginasReg Flash Cardsmohit2ucAún no hay calificaciones

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Executive SummaryDocumento3 páginasExecutive SummarykdamuAún no hay calificaciones

- Past PaperDocumento6 páginasPast PaperNadineAún no hay calificaciones

- United States Court of Appeals, Seventh Circuit.: No. 05-3730. No. 05-3742Documento11 páginasUnited States Court of Appeals, Seventh Circuit.: No. 05-3730. No. 05-3742Scribd Government DocsAún no hay calificaciones

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Thanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooDocumento33 páginasThanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooEva LopenaAún no hay calificaciones

- Company Name-"AK Capital Services LTD.": Group MembersDocumento6 páginasCompany Name-"AK Capital Services LTD.": Group MembersYashashvi RastogiAún no hay calificaciones

- Make in IndiaDocumento22 páginasMake in IndiaHimanshijain100% (2)

- Working Capital 1Documento19 páginasWorking Capital 1Raj SinghAún no hay calificaciones

- 599327636153soa23032020193129 PDFDocumento2 páginas599327636153soa23032020193129 PDFSuresh DhanasekarAún no hay calificaciones

- Sipchem AR2010Documento70 páginasSipchem AR2010Rajiv BishnoiAún no hay calificaciones

- Sun Life Final PaperDocumento53 páginasSun Life Final PaperAnonymous OzWtUOAún no hay calificaciones

- Distressed Debt Investing - Trade Claims PrimerDocumento7 páginasDistressed Debt Investing - Trade Claims Primer10Z2Aún no hay calificaciones

- Solman SOAL 1 Asis CHP 15 Options MarketDocumento4 páginasSolman SOAL 1 Asis CHP 15 Options MarketfauziyahAún no hay calificaciones

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Credit Risk Management in South Indian BankDocumento73 páginasCredit Risk Management in South Indian BankHeema Nimbeni0% (1)

- Formulate An Offer: Stephen Lawrence and Frank MoyesDocumento13 páginasFormulate An Offer: Stephen Lawrence and Frank Moyesvkavtuashvili100% (2)

- FDI in SBR-PublicDocumento9 páginasFDI in SBR-PublicflexrajanAún no hay calificaciones

- A Brief Presentation On Rbi and Pfrda: Group 7Documento19 páginasA Brief Presentation On Rbi and Pfrda: Group 7Prateek ChauhanAún no hay calificaciones

- Vanguard Currency Hedging 0910Documento24 páginasVanguard Currency Hedging 0910dave_cb123Aún no hay calificaciones

- LMRC Project OverviewDocumento20 páginasLMRC Project OverviewShivangi ChaudharyAún no hay calificaciones

- Indiafirst Smartsaveplan Onepager 19122013Documento2 páginasIndiafirst Smartsaveplan Onepager 19122013N-1397-10 KANISHKA Y HARDASANIAún no hay calificaciones

- BFS1001 - Session 2 - Resume Templates To Help You For Your Assignment - Uploaded Onto IVLEDocumento3 páginasBFS1001 - Session 2 - Resume Templates To Help You For Your Assignment - Uploaded Onto IVLEJavier ThooAún no hay calificaciones