Documentos de Académico

Documentos de Profesional

Documentos de Cultura

NG Gan Zee vs. Asian Crusader Life Assurance Corporation

Cargado por

Earl Larroder0 calificaciones0% encontró este documento útil (0 votos)

499 vistas1 páginaKwong Nam took out a 20-year life insurance policy with Asian Crusader Life Assurance, naming his wife Ng Gan Zee as the beneficiary. When Kwong Nam died of cancer, Asian Crusader refused to pay out the policy, claiming Kwong Nam had concealed that a previous application to reinstate a lapsed life insurance policy with another company had been declined. The Insurance Commissioner found no material concealment. The court also ruled that Asian Crusader did not provide sufficient evidence that Kwong Nam had fraudulent intent in his answers, which is required to invalidate a policy based on misrepresentation. The court ordered Asian Crusader to pay out the full policy amount to Ng Gan Zee.

Descripción original:

Ng Gan Zee vs. Asian Crusader Life Assurance Corporation

Título original

Ng Gan Zee vs. Asian Crusader Life Assurance Corporation

Derechos de autor

© © All Rights Reserved

Formatos disponibles

DOC, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoKwong Nam took out a 20-year life insurance policy with Asian Crusader Life Assurance, naming his wife Ng Gan Zee as the beneficiary. When Kwong Nam died of cancer, Asian Crusader refused to pay out the policy, claiming Kwong Nam had concealed that a previous application to reinstate a lapsed life insurance policy with another company had been declined. The Insurance Commissioner found no material concealment. The court also ruled that Asian Crusader did not provide sufficient evidence that Kwong Nam had fraudulent intent in his answers, which is required to invalidate a policy based on misrepresentation. The court ordered Asian Crusader to pay out the full policy amount to Ng Gan Zee.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOC, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

499 vistas1 páginaNG Gan Zee vs. Asian Crusader Life Assurance Corporation

Cargado por

Earl LarroderKwong Nam took out a 20-year life insurance policy with Asian Crusader Life Assurance, naming his wife Ng Gan Zee as the beneficiary. When Kwong Nam died of cancer, Asian Crusader refused to pay out the policy, claiming Kwong Nam had concealed that a previous application to reinstate a lapsed life insurance policy with another company had been declined. The Insurance Commissioner found no material concealment. The court also ruled that Asian Crusader did not provide sufficient evidence that Kwong Nam had fraudulent intent in his answers, which is required to invalidate a policy based on misrepresentation. The court ordered Asian Crusader to pay out the full policy amount to Ng Gan Zee.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOC, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 1

Ng Gan Zee vs.

Asian Crusader Life Assurance Corporation

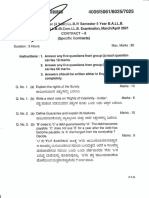

FACTS: Kwong Nam applied for a 20-year endowment insurance on his life for the sum of P20, 000.00, with

his wife, appellee Ng Gan Zee as beneficiary.

Kwong Nam died of cancer of the liver with metastasis. All premiums had been religiously paid at the time of

his death. When the widow, Gan Zee claimed for benefits, it was declined on the ground that the answers given

by the insured to the questions appealing in his application for life insurance were untrue:

Has any life insurance company ever refused your application for insurance or for reinstatement of a lapsed

policy or offered you a policy different from that applied for? If, so, name company and date Kwong

Answered in the negative.

According to Asian Crusader, Kwong Nam applied for reinstatement of his lapsed life insurance policy with the

Insular Life Insurance Co., Ltd, but this was declined by the insurance company, although later on approved for

reinstatement with a very high premium. CFI said that he did not file for a new insurance but merely an

amendment.

When the case was brought before the Insurance Commissioner, he found no material concealment on the part

of the insured and that, therefore, appellee should be paid the full face value of the policy but Asian Crusader

still did not pay the insurance policy.

CFI ordered Asian Crusader to pay the face value of the insurance policy issued in favour of Kwong Nam, the

deceased husband of petitioner Ng Gan Zee.

ISSUE: WON appellant (Asian Crusader), because of insured's aforesaid representation, misled or deceived

into entering the contract or in accepting the risk at the rate of premium agreed upon?

HELD: NO. Insurance Code Sec. 28 states that Such party a contract of insurance must communicate to the

other, in good faith, all facts within his knowledge which are material to the contract, and which the other has

not the means of ascertaining, and as to which he makes no warranty Thus, "concealment exists where the

assured had knowledge of a fact material to the risk, and honesty, good faith, and fair dealing requires that he

should communicate it to the assurer, but he designedly and intentionally withholds the same." It has also been

held "that the concealment must, in the absence of inquiries, be not only material, but fraudulent, or the fact

must have been intentionally withheld."

Assuming that the aforesaid answer given by the insured is false, as claimed by the appellant. Sec. 27 of the

Insurance Law, above-quoted, nevertheless requires that fraudulent intent on the part of the insured be

established to entitle the insurer to rescind the contract. And as correctly observed by the lower court,

"misrepresentation as a defense of the insurer to avoid liability is an 'affirmative' defense. The duty to establish

such a defense by satisfactory and convincing evidence rests upon the defendant. The evidence before the Court

does not clearly and satisfactorily establish that defense."

También podría gustarte

- Rental AgreementDocumento4 páginasRental AgreementEle A Noel86% (7)

- Motor Vehicle & Taxi Permit Sale / Purchase AgreementDocumento5 páginasMotor Vehicle & Taxi Permit Sale / Purchase AgreementKrishneet Jenny Ram100% (1)

- Digest of Sun Insurance Office, Ltd. v. CA (G.R. No. 89741)Documento2 páginasDigest of Sun Insurance Office, Ltd. v. CA (G.R. No. 89741)Rafael Pangilinan100% (1)

- Sps. Cha v. CA (Digest)Documento1 páginaSps. Cha v. CA (Digest)Tini GuanioAún no hay calificaciones

- Vda. de Maglana v. Hon. ConsolacionDocumento1 páginaVda. de Maglana v. Hon. ConsolacionBinkee VillaramaAún no hay calificaciones

- FILIPINAS COMPAÑÍA A DE SEGUROS Vs .TAN CHAUCODocumento3 páginasFILIPINAS COMPAÑÍA A DE SEGUROS Vs .TAN CHAUCORenz Aimeriza AlonzoAún no hay calificaciones

- Collateral WarrantiesDocumento4 páginasCollateral WarrantiesKarthiktrichyAún no hay calificaciones

- Bac 309Documento63 páginasBac 309WINFRED KYALOAún no hay calificaciones

- Philamcare Health Systems Vs CA and JulitaTrinos, GR No. 125678Documento1 páginaPhilamcare Health Systems Vs CA and JulitaTrinos, GR No. 125678rengieAún no hay calificaciones

- Qua Chee Gan v. Law Union Rock - Breach of WarrantyDocumento8 páginasQua Chee Gan v. Law Union Rock - Breach of WarrantyRegina AsejoAún no hay calificaciones

- Great Pacific Life Assurance Company Vs CADocumento2 páginasGreat Pacific Life Assurance Company Vs CAJenny Ruth GorgonioAún no hay calificaciones

- Vda. de Maglana vs. Hon. ConsolacionDocumento1 páginaVda. de Maglana vs. Hon. ConsolacionZaira Gem GonzalesAún no hay calificaciones

- Pandiman V Marine ManningDocumento2 páginasPandiman V Marine ManningEmmanuel OrtegaAún no hay calificaciones

- American Home Lns. V Chua, GR 130421 DigestDocumento2 páginasAmerican Home Lns. V Chua, GR 130421 DigestJade Marlu DelaTorreAún no hay calificaciones

- Makati Tuscany Condominium Corporation Vs Court of AppealsDocumento1 páginaMakati Tuscany Condominium Corporation Vs Court of AppealssappAún no hay calificaciones

- Malayan vs. Arnaldo - DigestDocumento2 páginasMalayan vs. Arnaldo - Digestdamp_pradg100% (1)

- Bachrach v. British Americaan Ass. Co Digested CaseDocumento2 páginasBachrach v. British Americaan Ass. Co Digested CaseMan2x SalomonAún no hay calificaciones

- American Home Assurance Co. v. Chua, 1999Documento2 páginasAmerican Home Assurance Co. v. Chua, 1999Randy SiosonAún no hay calificaciones

- Young Vs Midland Textile Insurance CoDocumento2 páginasYoung Vs Midland Textile Insurance CoMykee NavalAún no hay calificaciones

- 52 - Andres v. Crown Life InsuranceDocumento1 página52 - Andres v. Crown Life InsuranceperlitainocencioAún no hay calificaciones

- Pan Malayan Insurance Corporation V CADocumento2 páginasPan Malayan Insurance Corporation V CAAna Karina Bartolome100% (1)

- 60 - Tan v. CA (1989)Documento2 páginas60 - Tan v. CA (1989)perlitainocencioAún no hay calificaciones

- Fortune Medicare Inc V AmorinDocumento2 páginasFortune Medicare Inc V AmorinRoms RoldanAún no hay calificaciones

- Sun Insurance V CADocumento3 páginasSun Insurance V CAChanel GarciaAún no hay calificaciones

- Geagonia V CA G.R. No. 114427 February 6, 1995Documento2 páginasGeagonia V CA G.R. No. 114427 February 6, 1995Lolph ManilaAún no hay calificaciones

- Andrew Palermo Vs PyramidDocumento2 páginasAndrew Palermo Vs PyramidEmily EstrellaAún no hay calificaciones

- Stronghold Insurance Vs Pamana Case DigestDocumento7 páginasStronghold Insurance Vs Pamana Case DigestHazelGarciaAún no hay calificaciones

- Landicho Vs GsisDocumento2 páginasLandicho Vs GsisAngie DouglasAún no hay calificaciones

- Palileo V CosioDocumento1 páginaPalileo V CosiokennerAún no hay calificaciones

- Finman VS CaDocumento2 páginasFinman VS Camario navalezAún no hay calificaciones

- Del Rosario v. Equitable Insurance & Casualty Co.Documento2 páginasDel Rosario v. Equitable Insurance & Casualty Co.Bigs BeguiaAún no hay calificaciones

- Malayan Insurance Co. Vs ArnaldoDocumento2 páginasMalayan Insurance Co. Vs ArnaldoRenz AmonAún no hay calificaciones

- South Sea Surety v. CADocumento1 páginaSouth Sea Surety v. CAAlec VenturaAún no hay calificaciones

- Sunlife Assurance Company of Canada vs. CA (1995)Documento1 páginaSunlife Assurance Company of Canada vs. CA (1995)PMVAún no hay calificaciones

- Insurance - Perla Compania V AnchetaDocumento1 páginaInsurance - Perla Compania V AnchetaAndrea TiuAún no hay calificaciones

- TAN Vs CADocumento3 páginasTAN Vs CAMariz GalangAún no hay calificaciones

- Travellers Insurance v. CADocumento4 páginasTravellers Insurance v. CAAngelie Maningas100% (1)

- Calanoc Vs CA GR NoDocumento6 páginasCalanoc Vs CA GR NolazylawstudentAún no hay calificaciones

- Development Ins. Corp. v. IACDocumento1 páginaDevelopment Ins. Corp. v. IACIldefonso HernaezAún no hay calificaciones

- American Home Assurance vs. ChuaDocumento3 páginasAmerican Home Assurance vs. ChuaMan2x SalomonAún no hay calificaciones

- 44 - Ma. Lourdes S. Florendo v. Philam Plans, Inc., Perla Abcede, Ma. Celeste AbcedeDocumento2 páginas44 - Ma. Lourdes S. Florendo v. Philam Plans, Inc., Perla Abcede, Ma. Celeste AbcedeKris GaoatAún no hay calificaciones

- Vda de Canilang v. CADocumento2 páginasVda de Canilang v. CAJellynAún no hay calificaciones

- Andrew Palermo VsDocumento2 páginasAndrew Palermo VsAliyah SandersAún no hay calificaciones

- Philamcare Health Systems V CADocumento3 páginasPhilamcare Health Systems V CAsmtm06100% (1)

- Concealement PolicyDocumento15 páginasConcealement PolicypogsAún no hay calificaciones

- CD - 11. Edillon vs. Manila Bankers Life InsuranceDocumento2 páginasCD - 11. Edillon vs. Manila Bankers Life InsuranceAlyssa Alee Angeles JacintoAún no hay calificaciones

- Qua Chee Gan Vs Law UnionDocumento3 páginasQua Chee Gan Vs Law UnionanailabucaAún no hay calificaciones

- South Sea Surety v. CADocumento2 páginasSouth Sea Surety v. CAglecie_co12Aún no hay calificaciones

- 02 - Qua Chee Gan v. Law UnionDocumento1 página02 - Qua Chee Gan v. Law UnionperlitainocencioAún no hay calificaciones

- Geagonia vs. Court of Appeals DigestDocumento2 páginasGeagonia vs. Court of Appeals DigestKaren Jane Palmiano100% (2)

- White Gold Marine Services, Inc Vs Pioneer Insurance (Summary)Documento2 páginasWhite Gold Marine Services, Inc Vs Pioneer Insurance (Summary)Coyzz de Guzman100% (1)

- Vda de Consuegra v. GsisDocumento3 páginasVda de Consuegra v. GsisDominique PobeAún no hay calificaciones

- Canilang vs. CADocumento2 páginasCanilang vs. CAPreciousAún no hay calificaciones

- Insular Life Assurance Company Vs FelicianoDocumento1 páginaInsular Life Assurance Company Vs FelicianoKayzer SabaAún no hay calificaciones

- Sps. Antonio Tibay and Violeta Tibay Et. Al. v. Court of Appeals G.R. No. 119655, 24 May 1996, 257 SCRA 126Documento28 páginasSps. Antonio Tibay and Violeta Tibay Et. Al. v. Court of Appeals G.R. No. 119655, 24 May 1996, 257 SCRA 126Paul EsparagozaAún no hay calificaciones

- Bachrach v. British American InsuranceDocumento3 páginasBachrach v. British American InsuranceDominique PobeAún no hay calificaciones

- Biagtan v. Insular Life Assurance Co., Ltd.Documento2 páginasBiagtan v. Insular Life Assurance Co., Ltd.wuplawschoolAún no hay calificaciones

- Case Digest ConcealmentDocumento5 páginasCase Digest ConcealmentMadeleine Flores Bayani0% (1)

- Manila Mahogany Manufacturing v. CA and Zenith Insurance Case DigestDocumento2 páginasManila Mahogany Manufacturing v. CA and Zenith Insurance Case DigestYodh Jamin OngAún no hay calificaciones

- NG GAN ZEE, Plaintiff-Appellee, vs. ASIAN CRUSADER LIFE ASSURANCE CORPORATION, Defendant-AppellantDocumento2 páginasNG GAN ZEE, Plaintiff-Appellee, vs. ASIAN CRUSADER LIFE ASSURANCE CORPORATION, Defendant-AppellantTiff DizonAún no hay calificaciones

- NG GAN ZEE V ACLACDocumento2 páginasNG GAN ZEE V ACLACArtemisTzyAún no hay calificaciones

- NG Gan Zee v. Asian Crusader Life Assurance CorpDocumento7 páginasNG Gan Zee v. Asian Crusader Life Assurance Corpmisty-sunAún no hay calificaciones

- Insurance, Case Digest and ESCRA, Chapter VIDocumento17 páginasInsurance, Case Digest and ESCRA, Chapter VIJohn Paul GarciaAún no hay calificaciones

- NG Gan Zee v. Asian Crusader Life InsuranceDocumento2 páginasNG Gan Zee v. Asian Crusader Life InsuranceJellynAún no hay calificaciones

- Change Status - 11.08.21Documento24 páginasChange Status - 11.08.21Earl LarroderAún no hay calificaciones

- JA Arresting OfficerDocumento3 páginasJA Arresting OfficerEarl LarroderAún no hay calificaciones

- DLCD Forms Revised 2012Documento46 páginasDLCD Forms Revised 2012Earl LarroderAún no hay calificaciones

- Civil Law Reviewer 2022Documento12 páginasCivil Law Reviewer 2022Earl LarroderAún no hay calificaciones

- Civil Law Reviewer 2022Documento12 páginasCivil Law Reviewer 2022Earl LarroderAún no hay calificaciones

- Request Powder DustingDocumento1 páginaRequest Powder DustingEarl LarroderAún no hay calificaciones

- Receipt - Inventory of Seized ItemsDocumento2 páginasReceipt - Inventory of Seized ItemsEarl LarroderAún no hay calificaciones

- Director of Prisons v. Ang Cho KioDocumento1 páginaDirector of Prisons v. Ang Cho KioEarl LarroderAún no hay calificaciones

- Personal Data Sheet: Filipino Dual Citizenship by Birth by NaturalizationDocumento4 páginasPersonal Data Sheet: Filipino Dual Citizenship by Birth by NaturalizationEarl LarroderAún no hay calificaciones

- Sixto Chu vs. Mach Asia Trading Corp. (GR 184333, April 1 2013)Documento1 páginaSixto Chu vs. Mach Asia Trading Corp. (GR 184333, April 1 2013)Earl LarroderAún no hay calificaciones

- Marcos v. ManglapusDocumento1 páginaMarcos v. ManglapusEarl LarroderAún no hay calificaciones

- Article 14. Sec. 1. Pierce v. Society of SistersDocumento1 páginaArticle 14. Sec. 1. Pierce v. Society of SistersEarl LarroderAún no hay calificaciones

- PT Profile (Editable) AFMARVELSDocumento8 páginasPT Profile (Editable) AFMARVELSEarl LarroderAún no hay calificaciones

- White Light Corp v. City of Manila, GR No. 122846, January 20, 2009Documento1 páginaWhite Light Corp v. City of Manila, GR No. 122846, January 20, 2009Earl LarroderAún no hay calificaciones

- Ateneo de Zamboanga University: Law LibraryDocumento1 páginaAteneo de Zamboanga University: Law LibraryEarl LarroderAún no hay calificaciones

- PotatoDocumento1 páginaPotatoEarl LarroderAún no hay calificaciones

- Duterte V Rallos (2 P 509) Duterte (Plaintiff-Appellant) Claimed That RallosDocumento26 páginasDuterte V Rallos (2 P 509) Duterte (Plaintiff-Appellant) Claimed That RallosEarl LarroderAún no hay calificaciones

- Critique of Piagetian TheoryDocumento2 páginasCritique of Piagetian TheoryEarl LarroderAún no hay calificaciones

- Ang Tibay Vs CADocumento2 páginasAng Tibay Vs CAEarl LarroderAún no hay calificaciones

- Pantaleon V AsuncionDocumento1 páginaPantaleon V AsuncionEarl LarroderAún no hay calificaciones

- Fleumer vs. HixDocumento1 páginaFleumer vs. HixEarl LarroderAún no hay calificaciones

- Contract of Agency ProjectDocumento5 páginasContract of Agency Projectdhingra cafeAún no hay calificaciones

- Registration of A Company in Tanzania, Frequent Asked QuestionsDocumento5 páginasRegistration of A Company in Tanzania, Frequent Asked QuestionsMnangoAún no hay calificaciones

- Ortha, George II O. Corporation and Securities LawDocumento2 páginasOrtha, George II O. Corporation and Securities LawCinja ShidoujiAún no hay calificaciones

- CRS Report On Basel EndgameDocumento22 páginasCRS Report On Basel EndgameMitul PatelAún no hay calificaciones

- B. T/T After ShipmentDocumento79 páginasB. T/T After ShipmentThùy Linh Vũ NguyễnAún no hay calificaciones

- Prudential Bank vs. AlviarDocumento16 páginasPrudential Bank vs. AlviarUfbAún no hay calificaciones

- Accomplishment Report 1 - Asetre, K - ParalegalDocumento3 páginasAccomplishment Report 1 - Asetre, K - ParalegalKristoffer AsetreAún no hay calificaciones

- Azcona v. JamandreDocumento1 páginaAzcona v. JamandreAnsai Claudine Calugan100% (1)

- Derivatives MarketDocumento18 páginasDerivatives MarketJishnuPatilAún no hay calificaciones

- Insolvency of Non-Corporates: Persons Who Can Be Adjudged InsolventDocumento9 páginasInsolvency of Non-Corporates: Persons Who Can Be Adjudged InsolventFa Kin NoowanAún no hay calificaciones

- Letter of Intent - TransasiaDocumento3 páginasLetter of Intent - TransasiakirkoAún no hay calificaciones

- Assessment # 2 True/FalseDocumento3 páginasAssessment # 2 True/FalseJacie TupasAún no hay calificaciones

- HW For M8 - Hedging With OptionsDocumento3 páginasHW For M8 - Hedging With OptionsNiyati ShahAún no hay calificaciones

- 7.loan Capital - Jan18Documento30 páginas7.loan Capital - Jan18Eileen OngAún no hay calificaciones

- Partnership AgreementDocumento19 páginasPartnership AgreementWei ChingAún no hay calificaciones

- CONTRACT - LL March April 2021Documento3 páginasCONTRACT - LL March April 2021205Y046 Rakshith K GowdaAún no hay calificaciones

- Draft SBLC Icbc Akhir-2Documento2 páginasDraft SBLC Icbc Akhir-2PT ANUGRAH ENERGY NUSANTARAAún no hay calificaciones

- Banking SecuritiesDocumento19 páginasBanking SecuritiesASWATHY100% (1)

- Pledge AgreementDocumento9 páginasPledge AgreementjosefAún no hay calificaciones

- DJ Contract: Page 1 of 3Documento3 páginasDJ Contract: Page 1 of 3Richard FernandezAún no hay calificaciones

- LF Certificate - 75679 - 1069485 - LADY IN BLUE - LCC-PA-P&I - 01Documento4 páginasLF Certificate - 75679 - 1069485 - LADY IN BLUE - LCC-PA-P&I - 01Andrew SelvagiAún no hay calificaciones

- Land Law 9 - LeaseDocumento2 páginasLand Law 9 - Leaserenisasllani769Aún no hay calificaciones

- Interest Rate and Currency SwapsDocumento29 páginasInterest Rate and Currency Swapssheetal221237269Aún no hay calificaciones

- IFRS 17 Insurance Contracts - SummaryDocumento8 páginasIFRS 17 Insurance Contracts - SummaryEltonAún no hay calificaciones

- MTP 1 Suggested Answers AADocumento9 páginasMTP 1 Suggested Answers AAYash RankaAún no hay calificaciones

- Uganda Management Institute Master of Business Administration (MBA)Documento5 páginasUganda Management Institute Master of Business Administration (MBA)Mwesigwa DaniAún no hay calificaciones