Documentos de Académico

Documentos de Profesional

Documentos de Cultura

A Multi-Process Actors Strategic Analysis PDF

Cargado por

Oliver RubioTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

A Multi-Process Actors Strategic Analysis PDF

Cargado por

Oliver RubioCopyright:

Formatos disponibles

Chea et al.

Value Networks Configuration for Flexible E-Business Model

A Multi-process Actors Strategic Analysis Model

for Flexible E-business Proposition

based on Value Networks Configuration Framework

Sophea Chea

University of Hawaii at Manoa

Sophea@hawaii.edu

Tung X. Bui

University of Hawaii at Manoa

tbui@cba.hawaii.edu

ABSTRACT

How to select the most strategically appropriate partners for e-business venture according to the value networks configuration

is the research question that we attempt to answer. In this paper we content that for a multi-partners e-business venture to

succeed the structural arrangements of the value network must take into consideration strategic factor of critical business

processes possessed by each partner, the power structure of players in the industry, and the level of fit between partners. We

propose a multi-players and multi-processes model adapted from negotiation literature to quantify and modeling the power

structure of actors based on the value network framework. The model is based on two design premises. First, in order for

partners in a value network to cooperate effectively, there must exist a satisfactory level of convergence of their business

processes capability and objectives. Second, the level of technological and operational fits should be incorporated to optimize

the value.

Keywords

e-business model, value networks, value chain, e-business process, value configuration, strategic partnership

INTRODUCTION AND LITERATURE REVIEW

Creating value for customers is the raison dtre of business in todays hypercompetitive and dynamic environment

that is characterized by; intensified competition, more demanding customers, the internet and digital technology, and

globalization. Strategic alliances, collaborative commerce, virtual corporation, and value chain integration are among other

responses of businesses to this dynamic environment. To be successful these strategic moves must rely upon a business

design that configure the value proposition to ensure the satisfaction of customers needs that is the only way firms can

maintain their relevancy in the market.

Porters value chain (internal to firm) and value system (inter-firm) concepts (1985) that are based on the activitybased view of businesss value creation is more appropriated for analyzing the value of manufacturing firm and process

driven enterprise due to its sequential and linear nature. In todays networked world where firms rely more and more on the

core competencies of their partners along the supply chain to create value, they have to extend the value chains and integrate

them with those of suppliers, customers, complementors and competitors (Brandenburger and Nalebuff, 1996). This new

model of value creation is called value network. Value network refers to the network of value chains of players in an industry

or cross-industries including customers and competitors. Bovet and Martha (2000) define value network or value net as a

business design that uses digital supply chain concepts to achieve both superior customer satisfaction and company

profitability. It is a fast, flexible system that is aligned with and driven by new customer choice mechanism. According to

this definition value networks involve the integration the best of value chains to form value networks of partnerships between

business partners for achieving competitive advantage. Value constellation was also proposed as a new logic of value

creation. Value is created not in sequential chains but in complex constellations. Business is value-creating systems that

should be kept malleable, fresh and responsive through the dialogue between firms competencies and customers needs.

The goal is not to create value for customers but to mobilize customers to create their own value from the companys

various offerings. As a result, the value that is packed in each offering is dense in terms of amount of information,

knowledge and other resources. No single firm can deliver such value, the key is to co-produce with business partners in the

Proceedings of the Tenth Americas Conference on Information Systems, New York, New York, August 2004

2544

Chea et al.

Value Networks Configuration for Flexible E-Business Model

value constellation and a companys strategic task is the reconfiguration of its relationships and business systems (Normann

and Ramrez, 1993). In the network age, value tends to be created at the ends (the core of the firms and the users), in common

infrastructure (shared and integrated infrastructure), in modularity (self-contained modules of processes), in orchestration (by

coordinating among partners). As a result a key success factor for companies will be the ability to form (and re-form) value

network alliances. (Copacino, 1999; Mohanbir, 2001) The capability to identify, cultivate, and manage a network

partnership is an essential condition for survival and success.(Larson, 1991)

All in all the business models of value creation in the network era tend to stress on two important variables, the network of

actors or business partners and the self-contained modules of business processes. Manage the two variables effectively is the

key to success in the new economy. However, it is not a new idea, the Uppsala model of industrial networks also argued

about the important of managing three interwoven basic groups of variables that are related to each other: actors, resources,

and activities (Hakansson and Johanson, 1994). Another observation is; all aforementioned models agree that the value chain

concept does not fit well in the networked world. However, their arguments are qualitative at best. They stop short of

providing any concrete tool to deal with the myriad actors and business processes that are potentially involved in configuring

the new e-business proposal. How to select the most strategically appropriate partners for e-business venture according to the

value networks configuration is the research question that we attempt to answer. We propose a multi-actors and multiprocesses model adapted from negotiation literature to quantify and modeling the power structure in e-tourism industry based

on the value network framework.

MASAM Model

Multi-issue Actor Strategic Analysis Model or MASAM is a decision support tool for large scale negotiation that involves

many actors on numerous issues. It merges the advantages of two negotiation model; Godets MACTOR model (1991) and

another negotiation model by Allas and Georgiades (2001). The model is based on the multi-issue actor model of negotiation

under the premise that negotiation is a game between participants (i.e. actors) that have divergence of interests (i.e. position,

and salience) in a set of key issues and try to influence the negotiation outcomes toward their personal preference using all

means at their disposal. The model uses four inputs in matrix format; position, salience, clout, and influence matrices. The

model use matrix algebra to transform the data that is stored in the matrices to analyze the structure of the negotiation battle

field. (Bendahan, Camponovo, and Pigneur; 2003)

The position of an actor on an issue represents the preferred outcome that the actor has on the issue.

Salience represents the relative utility that an actor gains if the expected outcomes go closer to its position.

An actors clout on an issue represents the percentage of direct control that the actor has on the issue.

The influence represents the control that an actor has on oneself (auto-determination) and the control that other actors can

exert on the actor. The total influence that an actor can receive is 100%.

Once the inputs have been collected from experts and standardized by using Excel spreadsheet, the following can be

analyzed: 1) Direct and indirect influence among actors; 2) Analysis of the importance of each issues to each actor; and 3)

alliance determination. (Bendahan et al., 2003) The determination of the alliance partners is facilitated by a visualization tool

called OMEN. It is a kind of dash board that analyst can see the whole structure of the playing field. (see Monzani, Bendahan

& Pigneur; 2003 for detail formulas)

MASAM MODEL APPLIED TO E-BUSINESS VALUE NETWORK (MASAM-VN)

Proceedings of the Tenth Americas Conference on Information Systems, New York, New York, August 2004

2545

Chea et al.

Value Networks Configuration for Flexible E-Business Model

From previous section we see that managing the two variables of value creation in e-business; actors and business processes

is the key to succeed in todays business. In MASAM there are also two variables; actors and issues. We propose to use

MASAM analytical framework as a decision support tool for business actors engaging in an e-value network. Potential ebusiness partners are comparable to actors in MASAM model; while business processes and strategic position of the actors

are comparable to issues in MASAM. Each actor has to reduce the uncertainty to streamline their business processes with

those of the most appropriate partners when business opportunities emerge. Hence, we propose the MASAM-VN, or Multiprocess Actor Strategic Analysis Model for Value Network. We shall describe the four input matrices of the MASAM-VN as

the following:

Position Matrix: Traditionally the role of firms in the market determines how firm compete and collaborate. In value network

the role of firms is becoming less important because, opportunity is the deterministic factor in firms collaboration.

Brandenburger and Nalebuff (1996) who coined the term coopetition categorize players in value network into five strategic

roles; focal firm, supplier, competitor, complementor (whose products is synergic with those of focal firm), and customer. All

six can be active players in a value network with different level of synergy and value adding. We use this categorization to

identify potential partners position in the position matrix of MASAM-VN.

Based on the five-dimension (structural flexibility, collaborative relationship, coordinated planning, operational alignment,

and technology integration) extended enterprise model of Bowersox at Michigan research team; Edward, Peters and Sharman

(2001) develop a framework to classify enterprise into three categories reflecting the level of sophistication of the extension

of an enterprise; extended enterprise, coordinated enterprise, and cooperated enterprise. Enterprise in the extended enterprise

category is the most extended and ready to interconnect its business processes with partners. The level of extension of the

partners influence the degree of alliance success because two partners being at the same level of extension will have less

difficulty to link together their business processes. They are technologically and operationally fit. From strategic alliance

literature, the level of success of alliance partner increases when the level of fit increases.

Salience Matrix: The inputs in salience matrix are the answer to the question; how important is each process to the strategic

survival of the actor? When the process is viewed to be very important by an actor, it is likely that they want to safeguard

their core competencies and try to stay as competitive as possible. As a result the actor can be a valuable partner.

Clout Matrix: The inputs in salience matrix are the answer to the question; how competent are the actors in delivering the

processes? It is likely that if they are competent in the process, they can deliver the best result that help to enhance the total

value of the network.

Influence Matrix: From strategic alliance literature, firms select partners that will provide complementary resources and

capabilities. (Hagedoorn, 1993) and they are more likely to enter into alliances with those firms with whom they have prior

ties due to higher level of trust that they have on each other (Gulati, 1995b; Garcia-Pont and Nohria, 1997). In supply chain

integration literature, level of ties among enterprises can be categorized into four level; information integration (info access

and sharing), synchronized planning (collaborative planning, joint design), workflow coordination (coordinated production

planning) and new business model (mass customization for economy of scale, virtual resource, new services). (Lee and

Whang, 2001) When two enterprises has new business model together, it indicates the highest level of ties (integration).

Other forms of ties should also be taken into consideration; interlocking board directorates, corporate ownership, contractual

agreement, Joint Venture, and Franchise Arrangement. The stronger the tie an enterprise has with another enterprise the more

influential it become because of long term strategic commitment.

From Social Network Analysis literature the centrality level of an actor defines his level of influence in the network. The

simplest measures of network centrality are degree, closeness, and betweenness. Vasara et al. (2002) use the three measures

to distinguish between basic player and dominant players in a market. Similarly, we content that firm with higher level of the

three measures is more influential than firm with smaller measures of centrality. In innovation literature, it has also been

proved that firm with higher centrality has higher level of innovation than those with less centrality level.

Proceedings of the Tenth Americas Conference on Information Systems, New York, New York, August 2004

2546

Chea et al.

Value Networks Configuration for Flexible E-Business Model

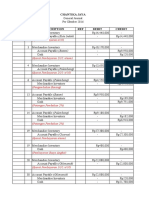

Identify CVC

1- Define Business Model

Value Network Roles

2- Define Critical Value

Components:

resources,

Focal Firm

Supplier

Complementor

Customers

Intermediary

Competitor

MASAM-VN

Analysis

Position Matrix

1-Structural

Flexibility

2-Collaborative

Relationship

3-Coordinated

Planning

4-Operational

Alignment

Degree of

(Focal

Vs.

Partners)

Extension

Potential

Fits

Extended Enterprise

Coordinated Enterprise

Cooperated Enterprise

Actor x CVC

1-Actor Analysispower

repartition

Salience Matrix

2-CVC Analysisarea of

convergence

and

divergence

Actor x CVC

Clout Matrix

Actor x CVC

Influence Matrix

Previous Ties (Frequency

strength of ties)

and

3-Influence

Analysis

relationship

of

power

among potential partners

4- Alliance Analysisthe

proximity map

Actor x Actor

Trust/

Power

Information Integration

Synchronized Planning

Workflow Coordination

New Business Model

Legend:

Ego-centric

Centrality

Network

Degree (0-1)

Closeness (0-1)

Betweenness (0-1)

CVC: Critical Value Competencies

MASAM-VN: Multi-issue Actor

Strategic Analysis Model for

Value Network

Figure 1: Behavioral Model of MASAM-VN

METHODOLOGY AND MODELING STEPS

The following steps are to be undertaken by the focal firm or researcher in using the MASAM-VN model. The main

methodology of generating the input is expert opinion.

STEP 1Define business opportunities and business model: in this step the focal firm identify the business

opportunities and try to define the business model that is appropriate for the opportunity.

STEP 2Identify and select potential alliance partners to include in the extended value chain network: they could

be partners or competitor (concept of cooperation and competition co-opetition) and they should be active

Actors in the market. For the case of e-tourism the actors could be airport, airline companies, tour operators, travel

agencies, etc

STEP 3Identify critical value components for the business model strategy: Porters framework of identifying the

value chain activities can be used here (Porter, 1985). Critical Value Component could be resources, knowledge,

skills, and technology that is necessary to configure the value offers. For example, web-based technology,

Information Synthesizing capability, Information Distribution Capability, etc...

STEP 4Input Generation: This step involves the generation of inputs to the four input matrices. Expert opinion

will be solicited regarding the following aspects.

Degree of integration of each partner.

Proceedings of the Tenth Americas Conference on Information Systems, New York, New York, August 2004

2547

Chea et al.

Value Networks Configuration for Flexible E-Business Model

Network structure of ties among actors in the market

History of tie with focal firm (different ties, frequency and strength of ties)

Define Strategic Roles of actors in value network

STEP 5 Plug all input in the matrices; position, salience, clout, and influent (refer to the discussion of the four

matrices in the previous section.)

STEP 6Computation and Analyses

Actor Analysispower repartition. Which actor are the most influential and capable in most of the value

components for the business model in question.

Value Component Analysisarea of convergence and divergence of actor on each value component. Firms

with convergence of most value component that the focal firm needs should be the most appropriate

partners.

Influence Analysisrelationship of power among potential partners on graph of passive influence on

OMEN Visualization tool.

Alliance Analysisthe proximity map of all or chosen actors.

We intend to use this model to study the structure and potential alliance of a focal firm in e-tourism industry. E-tourism is

emerging as the leading online B2C industry in terms of revenue. By applying the model to the industry we expect the focal

firm to get the following benefits: (1) understanding the existing structure of value networks of the industry, (2) identifying

appropriate business model based on value network configuration to best take advantage of the structure, and (3) monitoring

the ongoing structure changes and deciding on the best course of actions accordingly.

REFERENCES

1.

Amit, R. and Zott, C. (2001) Strategic Management Journal, 22, 493-520.

2.

Bendahan, S., Camponovo, G. and Pigneur, Y. (2003) Journal of Decision Systems.

3.

Bovet, D. and Martha, J. (2000) Value Nets: Breaking the Suply Chain to Unlock Hidden Profits, John Wiley &

Sons.

4.

Brandenburger, A. M. and Nalebuff, B. J. (1996) Co-opetition, Doubleday, New York.

5.

Copacino, W. C. (1999).

6.

Edwards, P., Peters, M. and Sharman, G. (2001) Journal of Business Logistics, 22.

7.

Forsgren, M. and Johanson, J. (1992) Managing Networks in International Business, Gordon and Breach Science.

8.

Larson, A. (1991) Journal of Business Venturing, 6, 173-188.

9.

Lee, H. L. and Whang, S. (2001) In Stanford Global Supply Chain Management Forum.

10. Monzani, J.-S., Bendahan, S. and Pigneur, Y. (2003) In Hawaii International Conference on System Sciences(Ed,

Sprague, R.) Institute of Electrical and Electronics Engineers, Big Island, Hawaii.

11. Normann, R. and Ramrez R. (1993) Designing Interactive Strategy: from value chain to value constellation, John

Wiley & Sons.

12. Porter, M. E. (1985) Competitive Advantage, Free Press

13. Vasara, P., Krebs, V., Peuhkuri, L. and Eloranta, E. (2002) Computers in Industry.

Proceedings of the Tenth Americas Conference on Information Systems, New York, New York, August 2004

2548

También podría gustarte

- Della Corte - Resource Integration Management in Networks Value Creation An Empirical Analysis of High Quality Tourist Offer in Southern ItalyDocumento16 páginasDella Corte - Resource Integration Management in Networks Value Creation An Empirical Analysis of High Quality Tourist Offer in Southern ItalyBhodzaAún no hay calificaciones

- Outcome Based ContractsDocumento26 páginasOutcome Based ContractsScribdAskanaAún no hay calificaciones

- On-Line Profiling, Service Quality, Satisfaction & Loyalty Role in CRMDocumento8 páginasOn-Line Profiling, Service Quality, Satisfaction & Loyalty Role in CRMsenthilrajanesecAún no hay calificaciones

- Sta Bellsa 1998Documento54 páginasSta Bellsa 1998Bahar D'citizensAún no hay calificaciones

- Final AMTDocumento16 páginasFinal AMTTamerZakiFouadAún no hay calificaciones

- Configuring Value For Competitive Advantage: On Chains, Shops, and NetworksDocumento25 páginasConfiguring Value For Competitive Advantage: On Chains, Shops, and NetworksAmri Nur IchsanAún no hay calificaciones

- Business Model Design: Conceptualizing Networked Value Co-CreationDocumento18 páginasBusiness Model Design: Conceptualizing Networked Value Co-CreationNgo Ngoc Quynh NhuAún no hay calificaciones

- Co CreationDocumento17 páginasCo CreationGulshan BajajAún no hay calificaciones

- Analysis of Beneficial Result of Supply Chain Management Within Partner Relationship ManagementDocumento9 páginasAnalysis of Beneficial Result of Supply Chain Management Within Partner Relationship Management翁慈君Aún no hay calificaciones

- 2016 - 2016 - Value Chain in A Networking OrganizationDocumento12 páginas2016 - 2016 - Value Chain in A Networking OrganizationWAN MUHAMMAD AZIM BIN WAN ABDUL AZIZAún no hay calificaciones

- Expert System Classifies Customer Value via RFM Model and Rough Set TheoryDocumento9 páginasExpert System Classifies Customer Value via RFM Model and Rough Set TheoryalAún no hay calificaciones

- Value Co-Creation Attributes Which Influence On E-Services: The Case of UTM Institutional RepositoryDocumento5 páginasValue Co-Creation Attributes Which Influence On E-Services: The Case of UTM Institutional RepositoryIJERDAún no hay calificaciones

- Implementing Value Strategy Through The Value ChainDocumento19 páginasImplementing Value Strategy Through The Value ChainnaymarkAún no hay calificaciones

- A Comparative Analysis Study of Data Mining Algorithm in Customer Relationship ManagementDocumento9 páginasA Comparative Analysis Study of Data Mining Algorithm in Customer Relationship ManagementDjango BoyeeAún no hay calificaciones

- Competitive Equilibrium in E-Commerce: Pricing and OutsourcingDocumento19 páginasCompetitive Equilibrium in E-Commerce: Pricing and OutsourcingMohammad PourzaferanyAún no hay calificaciones

- Corporate Valuation of Saas Companies: A Case Study Of: ISM International School of Management, Paris, FranceDocumento15 páginasCorporate Valuation of Saas Companies: A Case Study Of: ISM International School of Management, Paris, FranceМаксим ЧернышевAún no hay calificaciones

- The Value ChainDocumento3 páginasThe Value ChainRICARDO PRADA OSPINAAún no hay calificaciones

- Waardeketen Van PorterDocumento2 páginasWaardeketen Van PorterMajd KhalifehAún no hay calificaciones

- Case 3 Rent A CarDocumento11 páginasCase 3 Rent A Carmkadawi770100% (1)

- A Systemic Approach in Modeling and Analysis of Interactions in Virtual EnterprisesDocumento14 páginasA Systemic Approach in Modeling and Analysis of Interactions in Virtual Enterprisesmohsindalvi87Aún no hay calificaciones

- Case Study 1Documento6 páginasCase Study 1RIBABIRAún no hay calificaciones

- A Study of Role and Impact of Cloud Computing in Supply Chain ManagementDocumento5 páginasA Study of Role and Impact of Cloud Computing in Supply Chain ManagementYOGEESWAR BHARATHAún no hay calificaciones

- Ssrn-Id1012643 Strategic Cost ManagementDocumento33 páginasSsrn-Id1012643 Strategic Cost Managementapi-285650720100% (1)

- Strategic Capability Response Analysis: The Convergence of Industrié 4.0, Value Chain Network Management 2.0 and Stakeholder Value-Led ManagementDe EverandStrategic Capability Response Analysis: The Convergence of Industrié 4.0, Value Chain Network Management 2.0 and Stakeholder Value-Led ManagementAún no hay calificaciones

- Framework Design Efficient Value ChainsDocumento12 páginasFramework Design Efficient Value ChainsLaura Kristina She-nagaAún no hay calificaciones

- E Business Enablement:: Abstract: in The Emerging Global Economy, e Commerce and e BusinessDocumento13 páginasE Business Enablement:: Abstract: in The Emerging Global Economy, e Commerce and e Businessash1toshAún no hay calificaciones

- Gupta et al. study finds KAM network combinations impact profitabilityDocumento4 páginasGupta et al. study finds KAM network combinations impact profitabilityIsmael Pizarro MedinaAún no hay calificaciones

- BRP - Supply Chain ModellingDocumento15 páginasBRP - Supply Chain ModellingNikit Chaudhary100% (1)

- 2005 Evaluate BPDocumento15 páginas2005 Evaluate BPBo UlziiAún no hay calificaciones

- Modelling Business Scenarios For Electronic BrokerageDocumento6 páginasModelling Business Scenarios For Electronic Brokeragemorne81Aún no hay calificaciones

- Value Chain Analysis Explained in 40 CharactersDocumento6 páginasValue Chain Analysis Explained in 40 Charactersayantika1989Aún no hay calificaciones

- 1 s2.0 S1877050915023315 Main PDFDocumento9 páginas1 s2.0 S1877050915023315 Main PDFAnonymous JmeZ95P0Aún no hay calificaciones

- IT Strategic Approach for Increasing Customer Participation in Online BankingDocumento28 páginasIT Strategic Approach for Increasing Customer Participation in Online BankinglengocthangAún no hay calificaciones

- Expert Systems With Applications: Ching-Hsue Cheng, You-Shyang ChenDocumento9 páginasExpert Systems With Applications: Ching-Hsue Cheng, You-Shyang Chensharat1984Aún no hay calificaciones

- Roadmap for Adopting Emerging E-Business TechDocumento23 páginasRoadmap for Adopting Emerging E-Business TechIrfan DarmawanAún no hay calificaciones

- The Role of E-Commerce in Supply Chain Management: AbstractDocumento21 páginasThe Role of E-Commerce in Supply Chain Management: AbstractDurga PrasadAún no hay calificaciones

- VickyDocumento11 páginasVickyDr S Selvakani KandeebanAún no hay calificaciones

- A Comparative Study of Recommendation Algorithms in E-Commerce ApplicationsDocumento23 páginasA Comparative Study of Recommendation Algorithms in E-Commerce Applicationswill_19Aún no hay calificaciones

- Networkingin Marketingand Advertising Companies ASoft System Methodology ApproachDocumento16 páginasNetworkingin Marketingand Advertising Companies ASoft System Methodology ApproachChuen HuiAún no hay calificaciones

- Market-Enabled Supply ChainsDocumento2 páginasMarket-Enabled Supply ChainsNikhil MalhotraAún no hay calificaciones

- Developing Dynamic Business ModelDocumento15 páginasDeveloping Dynamic Business ModelwahyanAún no hay calificaciones

- How IOIS Impact Enterprise CompetitivenessDocumento5 páginasHow IOIS Impact Enterprise CompetitivenessetAún no hay calificaciones

- Conceptual Framework of Online Customer Service ExperienceDocumento41 páginasConceptual Framework of Online Customer Service ExperienceNaveen KAún no hay calificaciones

- E-Supply Chain Management (1to5)Documento23 páginasE-Supply Chain Management (1to5)Abhishek SinghAún no hay calificaciones

- Applying The Value Grid Model in Airline IndustryDocumento11 páginasApplying The Value Grid Model in Airline IndustryKarim AdamAún no hay calificaciones

- Impact of SCM and ERP - AnisahDocumento23 páginasImpact of SCM and ERP - AnisahRhodlotul AnisahAún no hay calificaciones

- Setting Up An Ontology of Business ModelsDocumento6 páginasSetting Up An Ontology of Business ModelsmheskolAún no hay calificaciones

- Chatain 2017Documento40 páginasChatain 2017david herrera sotoAún no hay calificaciones

- Development of An Intelligent Decision Support System For Benchmarking Assessment of Business PartnersDocumento20 páginasDevelopment of An Intelligent Decision Support System For Benchmarking Assessment of Business PartnersSalmanyousafbandeshaAún no hay calificaciones

- CRM in Non-Banking E-Commerce Payment GatewaysDocumento20 páginasCRM in Non-Banking E-Commerce Payment GatewaysVinay NarulaAún no hay calificaciones

- Jurnal Inter 1Documento20 páginasJurnal Inter 1daryatimartonoAún no hay calificaciones

- Experiencing MIS Notes On Chapters 1 - 7Documento10 páginasExperiencing MIS Notes On Chapters 1 - 7Andy Jb50% (4)

- Measuring Performance at The Supply Chain Level - The Role of The Chain DirectorDocumento21 páginasMeasuring Performance at The Supply Chain Level - The Role of The Chain DirectorFernando JarixAún no hay calificaciones

- Icsoft Act4soc2009 Camera ReadyDocumento8 páginasIcsoft Act4soc2009 Camera ReadyrodrigomantovaneliAún no hay calificaciones

- Unchained Value (Review and Analysis of Cronin's Book)De EverandUnchained Value (Review and Analysis of Cronin's Book)Aún no hay calificaciones

- Summary: Creating Value in the Network Economy: Review and Analysis of Tapscott's BookDe EverandSummary: Creating Value in the Network Economy: Review and Analysis of Tapscott's BookAún no hay calificaciones

- Technology Business Management: The Four Value Conversations Cios Must Have With Their BusinessesDe EverandTechnology Business Management: The Four Value Conversations Cios Must Have With Their BusinessesCalificación: 4.5 de 5 estrellas4.5/5 (2)

- Value Nets (Review and Analysis of Bovet and Martha's Book)De EverandValue Nets (Review and Analysis of Bovet and Martha's Book)Aún no hay calificaciones

- Document and Knowledge Management InterrelationshipsDe EverandDocument and Knowledge Management InterrelationshipsCalificación: 4.5 de 5 estrellas4.5/5 (2)

- Articulo PublicadoDocumento26 páginasArticulo PublicadoOliver RubioAún no hay calificaciones

- Session 3 - 5 - Logistics - Fraunhofer IML - Akinlar PDFDocumento20 páginasSession 3 - 5 - Logistics - Fraunhofer IML - Akinlar PDFOliver RubioAún no hay calificaciones

- The Design MethodDocumento6 páginasThe Design MethodOliver RubioAún no hay calificaciones

- Engineering Materials and Design: Fatigue Analysis and Gearbox DesignDocumento9 páginasEngineering Materials and Design: Fatigue Analysis and Gearbox DesignOliver RubioAún no hay calificaciones

- Take ShapeDocumento8 páginasTake ShapeOliver RubioAún no hay calificaciones

- Evolution of Radial Drilling MachineDocumento52 páginasEvolution of Radial Drilling MachineHari Krishna75% (4)

- Drilling ProblemsDocumento3 páginasDrilling ProblemsOliver RubioAún no hay calificaciones

- Learn English with fun units on vocabulary, grammar, skillsDocumento2 páginasLearn English with fun units on vocabulary, grammar, skillsOliver RubioAún no hay calificaciones

- Mechanical Measurements and Measuring Devices 6-25-08Documento58 páginasMechanical Measurements and Measuring Devices 6-25-08Oliver RubioAún no hay calificaciones

- B WEEbio 13Documento2 páginasB WEEbio 13Oliver RubioAún no hay calificaciones

- PLM07 - Full Book July 2007Documento844 páginasPLM07 - Full Book July 2007Oliver RubioAún no hay calificaciones

- Activate A 2Documento11 páginasActivate A 2Oliver Rubio100% (1)

- A Preamble 13Documento1 páginaA Preamble 13Oliver RubioAún no hay calificaciones

- Automotive PLM for Supplier IntegrationDocumento8 páginasAutomotive PLM for Supplier IntegrationOliver RubioAún no hay calificaciones

- A Multi-Process Actors Strategic AnalysisDocumento5 páginasA Multi-Process Actors Strategic AnalysisOliver RubioAún no hay calificaciones

- Plant Simulation Basics Tutorial English Andersson AslamDocumento40 páginasPlant Simulation Basics Tutorial English Andersson AslamOliver RubioAún no hay calificaciones

- PLM Implementation Effects in Aerospace IndustryDocumento9 páginasPLM Implementation Effects in Aerospace IndustryOliver RubioAún no hay calificaciones

- Holistic Understanding For Design - Theory of Technical SystemsDocumento6 páginasHolistic Understanding For Design - Theory of Technical SystemsOliver RubioAún no hay calificaciones

- DFR IntroDocumento58 páginasDFR IntroOliver RubioAún no hay calificaciones

- Wee2013 P175Documento7 páginasWee2013 P175Oliver RubioAún no hay calificaciones

- Application EVOP Paper 2013Documento11 páginasApplication EVOP Paper 2013Oliver RubioAún no hay calificaciones

- Hospital SimulationDocumento11 páginasHospital SimulationOliver RubioAún no hay calificaciones

- Concrete Construction Article PDF Strategic Planning For ContractorsDocumento4 páginasConcrete Construction Article PDF Strategic Planning For ContractorsMohammed NizamAún no hay calificaciones

- Political Internet Memes On Corruption Issue Surrounding The Philippine Health Insurance CorporationDocumento9 páginasPolitical Internet Memes On Corruption Issue Surrounding The Philippine Health Insurance CorporationFeline Joy SarinopiaAún no hay calificaciones

- Segment Reporting NotesDocumento2 páginasSegment Reporting NotesAshis Kumar MuduliAún no hay calificaciones

- Ruskin Bond's Haunting Stories CollectionDocumento5 páginasRuskin Bond's Haunting Stories CollectionGopal DeyAún no hay calificaciones

- PT Amar Sejahtera General LedgerDocumento6 páginasPT Amar Sejahtera General LedgerRiska GintingAún no hay calificaciones

- Internship Contract AppendixDocumento3 páginasInternship Contract AppendixSheAún no hay calificaciones

- See Repair Manual PDFDocumento1050 páginasSee Repair Manual PDFJorge MonteiroAún no hay calificaciones

- Alternate Sources OF Finance: FOR RBI Grade B ExamDocumento9 páginasAlternate Sources OF Finance: FOR RBI Grade B ExamAadeesh JainAún no hay calificaciones

- Actividad 3-Semana2-DécimoDocumento7 páginasActividad 3-Semana2-DécimoAmaury VillalbaAún no hay calificaciones

- Nadig Reporter Newspaper Chicago June 19 2013 EditionDocumento20 páginasNadig Reporter Newspaper Chicago June 19 2013 EditionchicagokenjiAún no hay calificaciones

- NFL 101 Breaking Down The Basics of 2-Man CoverageDocumento10 páginasNFL 101 Breaking Down The Basics of 2-Man Coveragecoachmark285Aún no hay calificaciones

- Flexi Wcdma BtsDocumento25 páginasFlexi Wcdma BtsSyed Ashfaq HussainAún no hay calificaciones

- Domestic Ro Price List 2021Documento6 páginasDomestic Ro Price List 2021den oneAún no hay calificaciones

- To Revision of DDPMAS-2002: Centre For Military Airworthiness and Certification (CEMILAC)Documento11 páginasTo Revision of DDPMAS-2002: Centre For Military Airworthiness and Certification (CEMILAC)Jatinder Singh100% (1)

- Disaster Risk Reduction and LivelihoodsDocumento178 páginasDisaster Risk Reduction and LivelihoodsFeinstein International Center100% (1)

- Tinbridge Hill Overlook Final PlansDocumento22 páginasTinbridge Hill Overlook Final PlansEzra HercykAún no hay calificaciones

- China Identity Verification (FANTASY TECH)Documento265 páginasChina Identity Verification (FANTASY TECH)Kamal Uddin100% (1)

- Living in The It Era Module 4Documento13 páginasLiving in The It Era Module 4Verielyn DormanAún no hay calificaciones

- Smartaisle Containment Brochure EnglishDocumento32 páginasSmartaisle Containment Brochure EnglishAsad NizamAún no hay calificaciones

- 1 ComplaintDocumento6 páginas1 ComplaintIvy PazAún no hay calificaciones

- Principles of Home Pres PPT 1416cDocumento14 páginasPrinciples of Home Pres PPT 1416ckarleth angelAún no hay calificaciones

- Barbara S. Hutchinson, Antoinette Paris-Greider Using The Agricultural, Environmental, and Food Literature Books in Library and Information Science 2002Documento491 páginasBarbara S. Hutchinson, Antoinette Paris-Greider Using The Agricultural, Environmental, and Food Literature Books in Library and Information Science 2002Paramitha TikaAún no hay calificaciones

- Intro To HCI and UsabilityDocumento25 páginasIntro To HCI and UsabilityHasnain AhmadAún no hay calificaciones

- The Puppet Masters: How The Corrupt Use Legal Structures To Hide Stolen Assets and What To Do About ItDocumento284 páginasThe Puppet Masters: How The Corrupt Use Legal Structures To Hide Stolen Assets and What To Do About ItSteve B. SalongaAún no hay calificaciones

- QuestionsDocumento96 páginasQuestionsvikieeAún no hay calificaciones

- Wagga Wagga Health and Knowledge Precinct Final ReportDocumento102 páginasWagga Wagga Health and Knowledge Precinct Final ReportDaisy HuntlyAún no hay calificaciones

- Bank StatementDocumento23 páginasBank StatementKundan Kumar JaiswalAún no hay calificaciones

- CMC Internship ReportDocumento62 páginasCMC Internship ReportDipendra Singh50% (2)

- Knowledge Mgmt in BPO: Capturing & Sharing Valuable InsightsDocumento3 páginasKnowledge Mgmt in BPO: Capturing & Sharing Valuable InsightsameetdegreatAún no hay calificaciones

- Win Server 2008 Manual Installation PDFDocumento20 páginasWin Server 2008 Manual Installation PDFFery AlapolaAún no hay calificaciones