Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Standalone Financial Results, Auditors Report For March 31, 2016 (Result)

Cargado por

Shyam SunderDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Standalone Financial Results, Auditors Report For March 31, 2016 (Result)

Cargado por

Shyam SunderCopyright:

Formatos disponibles

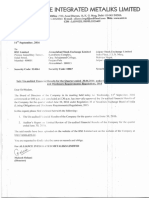

CIN r L271 09TG1989P1C01 0654

ISPAT

LIMITED

SATHAVAHANA

i505.

H.O.

Block 1, Divyashaklr Complex Ameerpel, Hyderabad-500 016

Phones : 237308'12.3.4 Fax : +91-40-23730566 E-mail rsathavahana@eth.nel

web : www.sathavahana cofi

REI: SIL/SEC/l 6l

0/201 6

Dated: 30th May, 2016

To

BSE Limited

Corporate Relationship DePartment

New Trading Ring, P J Towers

Rotunda Building, Dalal Street

MUMB AI - 400 001

Ph. No. 022-227 23 t2U2O37 /39.

COMPANY CODE NO. 526093.

Dear Sir,

SUB: I) SUBMISSION OF AUDITED FINANCIAL RESULTS

FNDFD ] IST MARCH. 20I6.

FOR THE YEAR

2) SUBMISSION OF INDEPENDENT AUDITORS' REPORT

ofSEBI (Listing Obligations and Disclosure Requirements) Regulations

for the

ilois,, *" *uriit f,*"with a statement ofinnuaiAudit"d Finuncial Results ofthe Company

on

laken

and

,.,.

.]I., March. 2016 as revieued b) the Audit Committee and approred

Mav' 2016 and also a

;;;; BoJ;ibi,..ioo or rn" co,ianv at its meetins held on.301h

i;;; "nded

Auditors

*pV oiit" "fna"p"nOent Auditors' Repon dated lOn May, 2016 issued by the Statutorv2016 duly

oi','rr" cornpuny'on the Audited Financial Results for the year ended il't.March'

ff,. co.puny declares that Auditor's Report ofeven date is of unmodified opinion

Pursuant to Regulation 33

"".tii"a.

members ofthe

This may please be noted and taken on record and relay the same to the esteemed

stock exchange.

Thanking you,

Yours

For SA

u llv

AHANA ISPAT LIMITIID

(K.V. KRISHNA RAO)

COMPANY SECRETARY

Encl: As above

Nole

R.gd. Orlice

Works

..

Ploase address ali the correspondonco to had oflice

: 3'14, Sri Rama Krishna Towers, Nagariuna Nagar, Hyderabad - 500 073.

(1) Haresamudram Village, Eommanahal Mafldal, Ananlapur Dist. (2) Kudith niVillag, Xuruoodu Road, Bellary Disl. Karnataka Slate

Bellety Oflice Phones :242355, 242455, 242655 Fax 08392 - 242955

SATHAVAHANA ISPAT LIMITED

Reld

ofie

3r4 snRamatushnaT0@6 Naqalune

Cit

Em.il

Nagar, 8yder3b6d . 500 073

:L27109TG1gAgPLCO1O65a

-lh.vah...@.th n.t

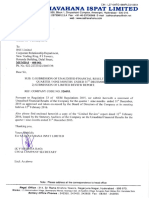

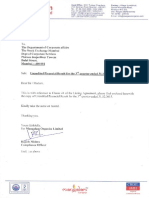

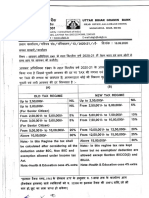

FINANCIAL RESUITS FOR IHE YEAR ENDEO 31ST MARCH 2016

s&. / r@t ttu oF..t d (..i .. .*t .

OtroF..ri.c rm

Totl llgE rrs ffitiE li.o

(.) lr.r

duty)

(h)

31032016

31 12 2A15

31032015

31032016

3420513

g02h 57

2077613

11792506

1129

.l Cd .. Lr.'- du,i.d

b) Pudr- d d.t in.!*b

c) orrE6 h imrdi. ol ftd.ll.d c..d.. Etn-n e6 .rn

aod.

.) t!.cctri$ rn l8I!.tin o9.rE (R.ll N.r. 5 !.5r)

D fdiqt.dEt. nErrdor (d! 0D dE d.r* - fr,l.@ c..t)

ti6 oe.rirB

226X

007

10515

013

20116 20

118030 81

9796112

12a9108

t2{t9

73

1653440

5617006

6318946

6814 o0

1@7

5a

31 91

35250 04

114{6 A7

8a29 a6

(336 90)

129125)

9rr3 99

3a08.29

a)

llEc, lrr.6 6r

G6) tm ddhry .dirnir ba6 fioE 6E .rt

Prmt /

lnr.r6r ..d of'.r bdlxine

b) Nd

bs m rqci|.

PEfrr /

llo)

P6fil /

@rcrcy

116 cdiDry

102151

540 75

{@5 02

2m192

112425)

1575 73

577 99

a598 08

21il t9

148 76

2126I

(3.3 98)

2245 01

1527 07

229176

2258.16

19305 33

219914

147082

2901a

19136

30109

908 62

1232 95

2390 50

2351 87

2424 62

3327661

h.ioo Oth..

&

.rrtiml

ct

hn

21452

176 50

.dtiii.

.lbr

lld.l li6 Odi..ry .cuvnr6

frMr qa

b.r6r. ur

nn b.roG

t?+31

(130142)

(136 31)

Pdlit /

llo.sl irm Odi..ry

EnEodrn.ry

fths

(n.t ol Ex

.cuvnr6 .it.r Trr l9-r0l

.@.$ k N'D

yfr 11r-r 2l

(F.e v.re

R.@.

or

rlf rh.G

R3 10r

o.drdm! Rd.r@ii6

(LB)

P.r ShrE

4sr338

35 09

599 21

(s93060)

2807 ss

000

F301.2)

{135.31)

599.21

(5940 60)

93 49

t2545 7A\

000

000

000

s090 00

224 42

258313

504 72

(1rr3.92)

5090 00

70053

1013 23

000

509000

R.s.. ..

.ftd

42

000

000

(343]t.90)

258313

509000

5090 00

11760 95

1519535

..cn)

Emi.3 / (16) Pq Sh.G b.LG

E.mrnCc /

1ga

000

123612

6295 08

90924 2A

oo0

1236 42

Nt tofit r {16.) lo. irr r,iod/

Pad-up equq sh.E dp br

1r23a 19

000

12537 34)

t.i

97960 99

3005120

d) End.!6 td'.ltB

Pldl / (t@)

3103 2015

p..

b.LM .h6r

.xfsdrnry i.m.

.nedh.ry i.m.

or

or

R.

R.

oi

10/-

1o/-

..ch

.&h

243

243

rh. tii a nclar ..suri3

(0 28)

(0 23)

098

093

{675)

507

(028)

(023)

098

093

(6 75)

(6 75)

507

(6 7s)

507

SEG[/1ENT REPORTING:

31032016

el

(b) Mel. lurg

Less nl& /

Coke

wih

PMr

Co enerar on

nrra S.am6nt Rerenue

Net Sares / Incom lrom O@ntion3

Seoment Resu[s (Prciit / (Loss) brore

(b)

lrbllullietcok

(ii) Orher

Totlr P6flr

wi$' co

2251879

10673 32

1141322

5550290

1562381

3S14260

392313

2179415

3541201

1475635

2616957

81848 06

137350 96

5120 87

30051 20

5393 37

20176 20

1932015

34219 42

s.neElio. Po*r

170619

2126.04

\724 7A)

629 94

90.71

1796 90

101057

313665

192362

193310

773 21

Un-.nMue Exend tuc (n0

{k..)

(se9m6nt.sds

b.tore

r.r

31 12 2415 31032015 31 032016

011

(130142)

11303031

3330 79

11552 49)

59921

22267 73

(1497 45)

13290 34

43

7U1A 2A

4256.4

119042 63

21081.51

97961 12

316949

5693 00

4362!9

21 15

(136 31)

31 03 2015

(593060)

3302 36

2152 5A

2AA7 55

segment labild6c)

1676063

(b) Metllurg@lCoke wlth

Cc!6ne6ron

PMr

(358 29)

16350 95

33210

1315238

418313

1676063

(358 29)

354 03

2243155

18290 34

418313

354 03

16350 95

2243155

31032016

31032015

5090 00

11760.95

16350 95

1519585

24285 35

36340 55

36103 33

STATEMENT OF ASSETS ANO I]ABILITIES

EOUITY AIID LIAB]LITIES

(.) shr spit

(b) R6efres and surPus

SuEtor.r SharehordeB runds

(.) L6nebm bominss

t r ri.birities (nd)

(c)Loist m povisons

(b) ocrercd

5090 00

000

214 20

37058 75

38828.6

(a) shodreh bo.Binog

(b) IEd p.y.bles

2122714

26346 63

(c) orher

1321145

2303912

303 20

79513 72

133423.42

257.59

79654 87

13A769.13

83716 51

62 41

1097 11

332 s6

35203 65

85971 53

sub rtut , Non-@.Enr riabriies

rcnl lla bitit s

(d) shod-lm povsirns

cu

SuElobt Curcnl abililes

TOTA! . EQUITY AIID LIAEILITIES

(a) Fix.d As.t

(b) Non-ornt inwshenls

(c) Lons rem bans .nd .dvane

(d) orher nd{ure as*c

SuEror. Nokumnl ass.rs

(a) rnv.nlories

(b) TEd6 eivabbs

(.) cash and b.ik balane3

(d) shon-tem b.ns .nd advanes

(6) otlEr tuftnr assls

surlobt currcntas*ls

TOTAL . ASSEIS

3001093

62 63

1119 30

310 25

2133364

1890961

3244 03

233 62

44214 77

133423,42

16120l9

5064 52

333 77

5130547

13876313

.d im R.r..r.a5 $!m-L !! . F.ru Pftdrds rd lilburstl c6l. w$ co{mrro. Per

.60 frDdd G.d. la tE qu.ls / rsr endsd oi r/hr 2016 eytsred b, $. arril cdtrrftG .nd lpld,.a ad hrn M ,B{ .t

n .lin! ol nl 8..{ ol DidG rrld o 30n' May ,016

Trr. ardr.d rlbd.r ntr . li( ln. ,u

by tu sbrdory Aldm or nr colo.ny ut ,! @nvrt d.dra

lE stnrry

R.cd or .g d.r. a d uhd.f.d opiion

h t. .!..M^ldr6'

h.t h.. h... ru.oci!.d

d vfr! dr.rry. d.Ltrd h .* d tu

or mt6d!.d dQ.dirrin an !ffi

clmp-tt b'tdr. odc.l'

Th.

c.rt d.ortl.cta

oi

d.rdr.d

rE']dftdtu!dd.@E

.!ad*.ab.'dFtlg,Dq.fu

c.ltdd.r,hetr.tlz.d!

iu r.a*y

tB,ftb{.7o9l.6Edd.gEeeh

ghndd.n,t

gtd.dn.d!u.2

-It llcm o. b qtlli .id.. 3r.l ,r.dr 2or 3 nd dEspdrdro qErs sied 3l c Md ml5 ft trE bcrE o 606 b.t-a ud.d fioE

Grpddtrmn'nJF

r'd 0E uErdi.d aar.lE( F to dd. r5o'G upto h did atrortu 6.p.dis rEEJ yEr

T,l prlsl|t.u drri'o l qrdr / F atd.d rdrd6 FrrllllE fa Dlld* ro Pr. ph, s.r, ard rn ..Bd nEn po. d.r

rrcd.d p..l.d d erE

c,'or o!-d.6

0t rct 6 rr/s$tr /Fr ard.. Fldlllre

(r) tu bq 6l Fdd o6.loprd rd (FDT) t

rE ellcry rrqEiio' m odEr n6! ddi, b.rft uE nonlk uion can o. ffib

,Iltr d ,!, ..4 ot rn ch Ir! 8.n!a r * b i'rsed itr 1502m1c h.5 sd.d p.rd

G{din or Kttrt GolO io dun h FDr c.&d.d .zr- ao&,rE rr do.rEd oE dpoy h* d

.pcinrk' Gn torr2u573r.

co..E dx:fu&fnmmrbc@rlpctmle

d +.r b.rm 0r lh.nl. s4om cd.oid fr.Do rn9.rEr . Pd't'o rsrc, or h 4.d. tr 6frp{y h.. d ruo9rE d rr

nn n*nhr.!or.ol@rh

e n adn or oflaf, ra ,ror l@nExrd rt drrr&d rb. or nflrc y., 20M6 h vi.r 6r ,i od rld d b..- ,rd - rqra io

rt y d dr ndb.. d.drro rt c'/l-id - ,uldfi h,r Cds.i6 rd m13

l0 th. rt@ ,I{ h.gqr.d / dDg.d l.M

sy$slodr.drrohq'k/r...rrd6ari.

Fd

!n o h.rl{

or

Bd{

oa

orloh.t

PVR.K. Nageswara Rao & Co.,

Chartered Accountants

Independent Auditor's RePort

To

The Members ofSATHAVAHANA ISPAT LIMITED

Report oD the Fi[aDcirt Strtemeirts

audited the accompanying financial statements of SATIIAV. AHANA ISPAT

lUUfffO 1"tt Companl'), whiih comprise the Balance Sheet as at 3l'r.March' 2016' the

" una iois and the cash Flow statement for the year then ended' and a

stu,"r"nt oi p-nt

summary ofsignificant accounting policies and other explanatory information'

we have

Matrlgement's Responsibility for the Finttrcial Ststemeuts

134(5) of the

The Company's Board of Directors is responsible for the mafters stated in Section

-o.puniir ,L"t, 2013 ('1he Act") with r;spect to the preparation of these financial statements

t.r" -a r"li vie* ofihe financial position, fi'ancial perform.ance and cash flows of

in lndia'

"

ii"-'Co.p-y in accordance with the accounting principles generally accepted Rule

7 of

with

i""frairg',h" a"-r",ing Standards specified under Section 133 ofthe Act read

iii" C",fp-1". (Accouis) Rules, iota ml, responsibility also includcs m^aintenance of

the

adeqrote accounting.ecords in accordance wilh the provisions ofthe Act for safeguarding

selection

irregula'ities;

c"-pi'v and for preventing and detelting frauds and other

*t"-ri

judgments and- estimates that are

"i,f"

unJ application oi uip.opriut" u."ounting policies; making

,"*orijUf" -a p-dent;'und design, imllimentation and mainlenance o[ adequate intemal

tf," *ere operati-ng effectively for ensuring the accuracy and completeness of

ii"*"i"]

""rii"fi,

records, relevant to the preparation and presentation of the financial statements

the accounting

iii"t glr" t -a f"ir view and are free from material misslatemenl, whether due to ftaud or

" "

r"lu"

Auditor's Responsibility

on our audit'

Our responsibility is to express an opinion on these financial statements based

standards and

We have take[ into account the provisions ofthe Act, the accounting and auditing

under the provisions of the Act and

;"tt.e-rs;;;;-r"qrtied to be'included in the audit

the Rules made thereunde..

'epon

weconductedourauditinaccordancewiththestandardsonAuditingspecifiedunderSection

l"t. ff,ose Standards require that we comply with ethicakequirements and plan

iaiffoJ

"fif,"

the financial statements are

and ieiform the auait to obtain reasonable assurance about whether

fiee from material misstatement.

BA!

Residency 6-3-1247, Rajbhavan Boad I Khar.atabad, Hyderatad ' 5oo oa2 | lndia.

@ Ofl. : +91-40-23.31 1609, +91'40'23312269 (Dir) I Far : +91-40-23319591 I E-mail : pvrk@pvrk.com

109, Melro

PV.R.K. Nageswara Rao &

Co.,

Continuation Sheet

Chartered Accountanrs

An audit involves performing procedures to obtain audit evidenc about the amounts and the

disclosures in the financial statements. The procedures selected depend on the auditor's

judgrnent, including the assessment of the risks of material misstatement of the financial

statemelts, whether due to ftaud ol eror. ln making those risk assessments, the auditor

considers intemal financial contlol relevant to the Company's preparation of the financial

statements that give a true and fair view in order to design audit procedures that are appropriate

in the circumslances. An audit also includes evaluating the appropriateness of the accounting

policies used and the reasonableness of the accounting estimates made by the Company's

Directors, as well as evaluating the overall presentation ofthe financial statements.

We blieve that the audit evidence we have obtained is sumcient and apptopriate to provide a

basis for our audit opinion on the financial slatements

Opitrior

In our opinion and to the best ofour informalion and according to the explanations given to us,

the aforesaid financial statements give the information required by the Act in the manner so

required and give a true and fair view in conformity with the accounting principles generally

accepted in lndia, of the state of affairs of the Company as at 3lst March, 2016, and its profit

and its cash flows for the year ended on that date.

Repo

l.

on Other Legrl and Regulatory Requirements

As required by the Companies (Auditor's Report) Order, 2016 ('1he Otdei'), issued by

the Central Govemment of India in terms of Sub-section (l l) ofsection 143 ofthe Act, we

give in the "Annexure A" a statement on the matters specified in paragnphs 3 and 4 ofthe

Order, to the extent applicable.

2. As required by Section 143 (3) ofthe Act, we repo.t that:

(a) We have sought and obtained all the info.mation and exPlanations which to the best ofour

knowledge and beliefwere necessary for the purposes ofour audit.

(b) In our opinion proper books of account as required by law have been kept by the Company

so far as it appears from our exemination ofthose books.

(c) The Balarce Shee! the Statement of Profit and Loss, and the Cash Flow Statement dealt

with by this Repon are in agreement with the books ofaccount.

(d) In our opinion, the aforesaid financial statemeots comply with the Accounting stardards

specified under Section 133 of the Act, read with Rule 7 ofthe Companies (Accounts)

Rules, 2014.

PV.R.K. Nageswara Rao &

Co.,

Continuation Sheer

Chartered Accountants

(e) on the basis of the wfiften representations received fiom the directors as on 3l!t March,

2016 taken on record by the Board of Directors, none ofthe directoE is disqualified as on

3l'1March, 2016 fiom being appointed as a director in terms of Section 164 (2) ofthe Act

respect to the adequacy ofthe intemal financial controls over financial reporting ofthe

Company and the operating effectiveness of such controls, refer to our sepaEte report in

"Affrexure 8".

(0 with

(g) with respect to the other matterc to be included in the Auditor's Repon in accordance with

Rule I I ofthe Companies (Audit and Auditors) Rules, 2014, in our opinion and to the best

ofour information and according to the explanations given to us:

i.

The Compa.ny has disclosed the impact of pending litigations on its financial

position in its financial statements - Refer Note No.27 (U) (3) to the financial

stalements:

ii.

The Company did not have any long-term contracts with material foreseeable

losses and did not have any long'term derivative contracts as at

iii.

3 I

rt

March' 20 I 6;

in fansfening arnounts, required to be transferred, to the

There has ben no delay

-Protection

FunJ by the Company during the year ended 3 I'r

lnvestor Education arld

March,2016.

For P.V.R.K. NAGESWARA RAO & CO.,

Chrrtered Accountants

EJS

tirm's Rcgislr:rtion \

fl

HYDERABAD

30.05.2016

N. ANKA

Partner

Mmbership Number:

HYDERABID

PV.R.K. Nageswara Rao & Co.,

Continuation Sheet

Chartered Accountants

An erurc A h l lepe det /luditt,r's Reporl

h" hpodino of'ReDort on Other L"aol ofld

Re[e ed lo in

RPoulatoh-

Reouiremenls' ofour reoorl ofeven dole

(a)

The company has maintained proper records showing full padiculals including

quarfitative details and situation ofFixed Assets.

2.

(b)

The fixed assets have been physically verified by the management according to the

phased progamme designed to cover all the fixed assets on rctation basis. [n respect of

fixed assets verified according to this programrne, which is considered reasonable, no

material discrepancies were noticed on such verification.

(c)

According to the information and explanations given to us and on the basis of our

examination ofthe records of the Company, the title deeds of immovable properties are

held in the name ofthe Company.

The inventories of the company have been physically verified at the year end by the

Management except stocks lying with others which have been verified with reference to

confirmations, certificates and other relevant documents where available. The discrepancies

noticed on physical verification 6f stocks as compared to book records, which in our opinion

were not material, have been properly dealt with in the books ofaccount.

3.

The Company has not granted any loans, secured or unsecured, to compaDies, firms, limited

liability partnerships or other panies covered in the registe. maintained under Section 189 of

the Companies Act, 2013 ('1he Act"). Therefore, the provisions ofClause 3(iii), (iiiXa), (iiiXb)

and (iii)(c) ofthe Order are not applicable to the Company.

4.

The Company has not granted any loans ot made any investments, or provided any guarantees

or security to the parties covered under Section 185 and 186 of the Act. Therefore,

provisions ofClause 3(iv) ofthe Order are not aPPlicable to the Company.

the

5.

The Company has not accepted any deposits from the public within the meaning of Seclions

73,74,75 and76 of the Act and the rules framed there under to the extent notified.

6.

we have broadly reviewed the book of account maintained by the company in respect of

products where, pursuaot to the Rules made by the Cenral Govemment of lndi4 the

maintenance of cost records has ben prescribed under Sub-section (1) of Sectio[I48 of the

Act and are of the opinion that prima facie, the prescribed accounts and records have been

maintained and are being made up. We have no! however, made a detailed examination ofthe

records with a view to determine whether they are accuate or complete

1. (a\

According to the records ofthe Company and as per the information and explanations

given to us, the Company is generally regular in depositing undisputed statutory dues

including provident fund, employees state insurance, income tax, sales tax, service tax,

duty of customs, duty of excise, value added tax, cess and any other statutory dues

applicable to it with appropriate authorities though there have been delays in few cases

and in respect ofthese statutory dues, there are no outstanding dues as on 31 03 2016

which are outstanding for a period ofmore than six months from the date they became

payable.

PVR.K. Nageswara Rao & Co.,

Continuation Sheet

Chartered Accountants

(b)

According to the records ofthe Company and as per the information and explanations

given to us, there are no dues of service tax, value added tax and cess which have not

been deposited on account ofany dispute as on 31.03.2016 except income tax, sales

ta.\, duty ofcustoms and duty ofexcise the details ofwhich are as given below:

S.No.

Name

of

Nature

the Statute

I

of

the dues

Central

Excise d(ny February,2007

Excise Act,

and penalty

to

AmountRs.

Forum where dispute

is pending

19,07,2t6

The Customs, Excise

and Service Tax

Appellate Tribunal,

October,

2009

1944

Period to

which it relates

Bangalore

Sales Ta-\ Appellate

Tribunal, Hyderabad.

Sales ta-\

2005-06

20t2-t3

10,47,95,907

Act,1962

Custom duty

and penalty

Income Tax

lnterest

2009-10

13,79,100

Act

Dividend

Distribution

Central

Sales Tax

Act,

3

1956

Customs

1961

on

The Customs. Excise

and Service Tax

Appellate Tribunal,

Hyderabad.

Rectification of

mistake filed with

Deputy

Ta-x

Commissioner of

lncome Tax, Circle

Excise duty September,20l I

The

3(l),

8.

Central

Excise Act,

1944

and penalty

to May, 2015

66,80,087

Hyderabad.

Commissioner

(Vizag Appeal-ll),

Cuntur.

on our audit procedures and as per the information and explanations given by the

management, the Company has delayed in repayment of principal and interest to Canara Bank

Rs.5i40,32,171-, state Bank of Hyderabad Pis.44,42,39,4071- and Andhra Bank

Based

Rs.38,24,95,628/- during the year aggregating to Rs. 135,07,6?,812/- and no such dues were in

ar.earc as on the Balance Sheet date. There was no amount raised by the Company through the

issue ofDebenfures.

1.

ABAD

PVR.K. Nageswara Rao & Co.,

Continuation Sheet

Chartered Accountants

9.

The Company has not Eised any moneys by way of initial public offer and further public offer

(including debt instruments). ln our opinion, and according to the information and explanations

given to us, the term loans have been applied for the puposes for which they were obtained.

ng the course of our examination of the books and records of the Company, canied out in

accordance with the generally accepted auditing practices in India, and according to the

information and explanations given to us, we have neither come across any instance ofmaterial

liaud by the Company or on the Company by its olficers or employees! noticed or reported

during the year, nor have we been informed of any such case by the Management.

10. Du

l.

The Company has paid/ prcvided for managerial remunemtion in accordance with the requisite

approvals mandated by the provisions of Section 197 read witlt Schedule V to the Act.

12.

As the Company is not a Nidhi Company and the Nidhi Rules, 2014 are not applicable to it, the

prcvisions ofClause 3(xii) ofthe Order are not aPplicable to the Company.

13

The Company has entered into hansactions with related parties in compliance with the

provisions of Sections 177 and 188 ofthe Act. The details ofsuch related party hansactions

have been disclosed in the financial statements as requiled under Accounting Standard (AS) 18,

Related Party Disclosures specified under Section 133 of the Act, read with Rule 7 of the

14

15

Companies (Accounts) Rules, 2014.

The Company has not made any prefetential allotment or private placement ofshares or

fully or

provisions

of

the

Accordingly'

year

review.

the

under

partly convertible debentures during

Clause 3(xiv) ofthe Order are not applicable to the Company.

The Company has not entered into any non cash transactions with its directors or persons

connected with him. Accordingly, the provisions ofclause 3(xv) ofthe Order are not applicable

to the Company.

16

The Company is not required to be registered under Section 45-IA ofthe Reserve Bank of India

Act, 1934. Accordingly, the provisions ofClause 3(xvi) of the Order are not applicable to the

Company.

ForP VRKNAGESWARA RAO & CO.,

Chaftered Accoutrtants

Firm's

83S

,l

HYDERABAD

rI1,I)ERABAI)

30.0s.20t6

N. ANKA RAO

Partner

Membrship Number:

6:

P.V.R.K. Nageswara Rao

& Co.,

Continuation Sheet

Chartered Accountants

Annerure B lo Independenl Auditor's Repofl

Referred to in Parasraph 2(fl under the heoding of'Reporl on Olher Lesdl and Resulalorll

Reouirerfle s' ofour reoort ofewn dale

Report on the lntrnal Financial Controls undr CIause (i) ofSub-section 3 ofSection l,l3

ofthe Compaoies Act,20l3 ("the Acl")

We have audited the intemal financial controls over financial reponing of SATHAVAEANA

ISPAT LII{ITED Cthe Company") as of313'March, 2016 in conjunction with our audit ofthe

standalone financial statements ofthe Company for the year ended on that date.

M{nrgemeot's Rspotrsibility for IItertral Fitratrcirl Cotrlrols

The Company's management is responsible for establishing and maintaining intemal financial

confols based on the intemal control over financial .eporting criteria established by the

Company considering the essential componenls of intemal control stated in the Guidance Note

on Audit of Intemal Financial Controls Over Financial Reporting issued by the Institute of

Chartered Accountants of lndia ('ICAI'). These responsibilities include the design,

implementation and maintenance of adequate intemal financial controls that were oprating

effectively for ensuring the orderly and eflicient conduct of its business, including adherence to

company's policies, the safeguarding of its assets, the prcvention and detection of frauds and

erors, the accumcy and completehess of the accounting records, and the timely prepalation of

reliable financial information, as required under the Companies Act, 2013.

Auditors' Responsibility

Our responsibility is to express an opinion on the Company's intemal financial controls ovea

financial reporting based on our audit. we conducted our audit in accordance with the Guidance

Note on Audit of Intemal Financial Controls over Financial Reporting (the "Cuidance Note")

and the Standards on Auditing, issued by lCAl and deemed to be prescribed under section

143(10) ofthe Companies Act,2013, to the extent applicable to an audit of intemal financial

controls, both applicable to an audit of Intemal Financial Controls and, both issued by the

Institute ofChartered Accountants of India. Those Standards and the Guidance Note require that

we comply with ethical requirements and plan and perform the audit to obtain reasonable

assurance about whether adequate intemal financial controls over financial reporting v"as

established and maintained and ilsuch controls operated effectively in all material respects.

Our audit involves performing procedures to obtain audit evidence about the adequacy of the

intemal financial controls system over financial reponing and their operating effectiveness. Our

audit ofintemal financial controls over financial reporting included obtaining an understanding

ofintemal financial controls over financial reporting, assessing the risk that a material weakness

exists, and testing and evaluating the design and operating effbctiveness of internal control

based on the assessed risk. The procedures selected depend on the aud itor's judgment, including

the assessment ofthe risks ofmaterial misstatement ofthe financial statements, whether due to

fraud or error.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a

basis for our audit opinion on the Company's intemal financial controls system over financial

repoding.

ni*rrt AD ol

PVR.K. Nageswara Rao & Co.,

Continuation Sheet

Chartered Accountants

Meanitrg oflnternal Financial Conlrols over Financial Reporting

A company's intemal flnancial control over financial rcporting is a process desigred to provide

rcasonable assumnce regarding the reliability of financial reporting and the preparation of

financial statements for extemal purposes in accordance with generally accepted accounting

principles. A company's intemal financial control over financial reporting includes those

policies and procedures that (1) pertain to the maintenance ofrecords that, in reasonable detail,

accurately and fairly reflect the transactions and dispositions ofthe assets ofthe company; (2)

provide reasonable assurance that transactions are recorded as necessary to permit preparation of

financial statements in accordance with generally accepted accounting principles, and that

receipts and expenditures ofthe co.mpany are being made only in accordance with authorisations

of management and directors of the company; and (3) provide reasonable assurance regarding

prevention or timely detection of unauthorised acquisition, use, or disposition ofthe company's

assets that could have a material effect on the financial statements.

Inherent Limitations oflnternal Financial Controls Over Financial Reportitrg

Because of the inherent limitations of intemal financial controls over financial reporting,

including the possibility of collusion or improper management override of controls, material

misstatements due to error or ftaud may occur and not be detected. Also, projections of any

evaluation ofthe internal financial controls over financial reporting to future periods are subject

to the risk that the intemal financial control over financial reportjng may become inadequate

because of changes in conditions, or that the degree of compliance with the policies or

procedures may deteriorate.

Opinion

In our opinion, the Company has, in all material respects, an adequate intemal financial controls

system over financial reporting and such intemal financial controls over financial reporting were

operating effectively as at 3l'i March, 2016, based on the intemal control over financial

reporting criteria established by the Company considering the essential components of intemal

control stated in the Guidance Note on Audit of Intemal Financial Controls Over Financial

Reporting issued by the [nstitute ofchartered Accountants oflndia.

For P.V.R.K. NAGESWARA RAO & CO.,

Chartered Accountants

Firm's Registration N

,r

4.4^

RAO---

ITYDERABAI)

N. ANKA

30.05.2016

Partner

Membership Number:

hYDERABAD

También podría gustarte

- Vietnam's Economic Development in The Period Since Doi MoiDocumento7 páginasVietnam's Economic Development in The Period Since Doi MoiNgọc LâmAún no hay calificaciones

- CIMA P3 Notes - Performance Strategy - Chapter 1Documento14 páginasCIMA P3 Notes - Performance Strategy - Chapter 1Mark Horance HawkingAún no hay calificaciones

- L2M2-Slide-deck V2Documento48 páginasL2M2-Slide-deck V2deepak0% (1)

- 股权代持协议英文版Documento4 páginas股权代持协议英文版sununilabAún no hay calificaciones

- Revised Financial Results For March 31, 2016 (Result)Documento8 páginasRevised Financial Results For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento7 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento9 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Documento9 páginasStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento7 páginasStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Updates (Company Update)Documento3 páginasUpdates (Company Update)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Form A, Auditors Report, Results Press Release For March 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Form A, Auditors Report, Results Press Release For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Announces Q4 & FY16 Results (Standalone & Consolidated), Form A (Standalone & Consolidated) & Auditors Report (Standalone & Consolidated) For The Period Ended March 31, 2016 (Result)Documento20 páginasAnnounces Q4 & FY16 Results (Standalone & Consolidated), Form A (Standalone & Consolidated) & Auditors Report (Standalone & Consolidated) For The Period Ended March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento15 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Documento5 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Atrair!,: TMT Oiredo6 N The of The For The of ofDocumento17 páginasAtrair!,: TMT Oiredo6 N The of The For The of ofSuhasAún no hay calificaciones

- Salaf/0078 Note Net.: LVNN 'Documento4 páginasSalaf/0078 Note Net.: LVNN 'Karthick SriAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Annual ReportDocumento34 páginasAnnual ReportBhagwan BachaiAún no hay calificaciones

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Scrutinizer's Report (Company Update)Documento4 páginasScrutinizer's Report (Company Update)Shyam SunderAún no hay calificaciones

- Revised Standalone & Consolidated Financial Results For September 30, 2016 (Result)Documento4 páginasRevised Standalone & Consolidated Financial Results For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- NG - @ry - I@I: Zol15I1" '.."""Er+Uor Qry-G-,U-ADocumento10 páginasNG - @ry - I@I: Zol15I1" '.."""Er+Uor Qry-G-,U-AMaya AnilkumarAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- P.1"1.lll: Udd GNW S of Cot) Re.eDocumento20 páginasP.1"1.lll: Udd GNW S of Cot) Re.eAayushAwathiAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Documento8 páginasStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- TWI Welding Inspector Enrolment FormDocumento3 páginasTWI Welding Inspector Enrolment FormEcha R CrewAún no hay calificaciones

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Documento6 páginasAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Grant of Year-End Bonus and Cash Gift for CY 2019Documento7 páginasGrant of Year-End Bonus and Cash Gift for CY 2019Maricel M. AlmeroAún no hay calificaciones

- 9 718" X 7" Production Casing: ?: +,il. T,' ,,"':..,-.FR W#.?, - 3, Wi ?t#yrDocumento12 páginas9 718" X 7" Production Casing: ?: +,il. T,' ,,"':..,-.FR W#.?, - 3, Wi ?t#yrOSDocs2012Aún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Harshaben Jagdishbhai Lathigara Balance Sheet 2013-14 /TITLEDocumento14 páginasHarshaben Jagdishbhai Lathigara Balance Sheet 2013-14 /TITLEbhattpiyush93Aún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Income Tax Circular F.Y. 2020-21Documento10 páginasIncome Tax Circular F.Y. 2020-21Rohit SinhaAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Cotton University: $/i/.dn!ru!/dlr4ioDocumento2 páginasCotton University: $/i/.dn!ru!/dlr4ioBISTIRNA BARUAAún no hay calificaciones

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento7 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento6 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results For September 30, 2016 (Result)Documento7 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Mutual Fund Holdings in DHFLDocumento7 páginasMutual Fund Holdings in DHFLShyam SunderAún no hay calificaciones

- JUSTDIAL Mutual Fund HoldingsDocumento2 páginasJUSTDIAL Mutual Fund HoldingsShyam SunderAún no hay calificaciones

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 páginasSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 páginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderAún no hay calificaciones

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 páginasFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderAún no hay calificaciones

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 páginasSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderAún no hay calificaciones

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 páginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderAún no hay calificaciones

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 páginasOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderAún no hay calificaciones

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 páginasExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results For Mar 31, 2014 (Result)Documento2 páginasFinancial Results For Mar 31, 2014 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 páginasFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderAún no hay calificaciones

- Financial Results For September 30, 2013 (Result)Documento2 páginasFinancial Results For September 30, 2013 (Result)Shyam SunderAún no hay calificaciones

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAún no hay calificaciones

- Financial Results For Dec 31, 2013 (Result)Documento4 páginasFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAún no hay calificaciones

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAún no hay calificaciones

- Housing Delivery Process & Government AgenciesDocumento29 páginasHousing Delivery Process & Government AgenciesPsy Giel Va-ayAún no hay calificaciones

- Reporting and Analyzing Operating IncomeDocumento59 páginasReporting and Analyzing Operating IncomeHazim AbualolaAún no hay calificaciones

- Konkola Copper MinesDocumento6 páginasKonkola Copper MinesMohsin Nabeel100% (1)

- Tuesday, January 07, 2013 EditionDocumento16 páginasTuesday, January 07, 2013 EditionFrontPageAfricaAún no hay calificaciones

- Scope Statement: Project Name Date Project Number Project ManagerDocumento3 páginasScope Statement: Project Name Date Project Number Project ManagerKamal BhatiaAún no hay calificaciones

- Working Capital Management of Nepal TelecomDocumento135 páginasWorking Capital Management of Nepal TelecomGehendraSubedi70% (10)

- Weeks 3 & 4Documento46 páginasWeeks 3 & 4NursultanAún no hay calificaciones

- Financial Management ObjectivesDocumento36 páginasFinancial Management ObjectiveschandoraAún no hay calificaciones

- Order in The Matter of Pancard Clubs LimitedDocumento84 páginasOrder in The Matter of Pancard Clubs LimitedShyam SunderAún no hay calificaciones

- Measuring Effectiveness of Airtel's CRM StrategyDocumento82 páginasMeasuring Effectiveness of Airtel's CRM StrategyChandini SehgalAún no hay calificaciones

- 2 4ms of ProductionDocumento31 páginas2 4ms of ProductionYancey LucasAún no hay calificaciones

- CSR Activities of Coca ColaDocumento19 páginasCSR Activities of Coca ColaAjay Raj Singh94% (16)

- ASEAN Sustainable Urbanisation Strategy ASUSDocumento248 páginasASEAN Sustainable Urbanisation Strategy ASUStakuya_eekAún no hay calificaciones

- Practice Questions CH08-AnswersDocumento3 páginasPractice Questions CH08-AnswersyuviAún no hay calificaciones

- Commodity Trading: An OverviewDocumento15 páginasCommodity Trading: An OverviewvijayxkumarAún no hay calificaciones

- 2016 Arkan Roa Der PerDocumento14 páginas2016 Arkan Roa Der PerBunga DarajatAún no hay calificaciones

- Lecture 5 - Technology ExploitationDocumento21 páginasLecture 5 - Technology ExploitationUsmanHaiderAún no hay calificaciones

- Impacts of The COVID-19 Pandemic On Food Trade in The CommonwealthDocumento32 páginasImpacts of The COVID-19 Pandemic On Food Trade in The CommonwealthTú NguyễnAún no hay calificaciones

- 6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDocumento2 páginas6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDeopito BarrettAún no hay calificaciones

- ISO 9004:2018 focuses on organizational successDocumento3 páginasISO 9004:2018 focuses on organizational successAmit PaulAún no hay calificaciones

- SchmidtCo ERP Case AnalysisDocumento8 páginasSchmidtCo ERP Case Analysisnitesh sharmaAún no hay calificaciones

- Umw 2015 PDFDocumento253 páginasUmw 2015 PDFsuhaimiAún no hay calificaciones

- Difference Between Economic Life and Useful Life of An AssetDocumento3 páginasDifference Between Economic Life and Useful Life of An Assetgdegirolamo100% (1)

- Printing Works Standard AgreementDocumento5 páginasPrinting Works Standard Agreementbrucesky3493Aún no hay calificaciones

- Conflict Between NPV and IRRDocumento11 páginasConflict Between NPV and IRRSuseelaAún no hay calificaciones

- Retail Technology Management: Presented by Kumar Gaurav Harshit KumarDocumento19 páginasRetail Technology Management: Presented by Kumar Gaurav Harshit KumarKumar GauravAún no hay calificaciones