Documentos de Académico

Documentos de Profesional

Documentos de Cultura

TT 0202

Cargado por

stockDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

TT 0202

Cargado por

stockCopyright:

Formatos disponibles

Fibonacci Retracements:

To use the worksheet you will need to find three prices; A, B, C.

These can be either two peaks with a valley between or a peak between two valleys

Price A=

Inputs

112.20000

Retracement Percentage=

Price B=

110.90000

Risk Point=

Price C=

112.00000

Entry Point=

Current Price=

111.90000

Momentum Objective=

Contract Size=

Unit Size=

Req'd. Margin=

Equity at Risk=

Risk Tolerance=

100,000

0.03125

5.700%

$5,700.00

5.00%

Trailing Stop=

The ideal retracement

percentage will fall

between 0% & 100%. If the

retracement is outside of

these two boundaries you

will get an "Out of Bounds"

message. Trading based

on the worksheet numbers

is not recommended when

an "Out of Bounds"

message occurs.

Some quick

notes: This

sheet is set

up for $

Contracts. If

you are

trading a

quantity

Contract (bu.,

lbs, etc.),

input that

figure in

'Contract Size'

Reward/Risk Ratio=

'Unit Size'

equals

how the

Contract

quantity is

priced

(points, $,

cents,

etc.). If

the

Contract

is based

on a

quantity,

use the

formula

[=B12*B13

*B14] in

cell B15.

The 'Risk

Point' is

equal to

Price C

from the

input

column.

The 'Entry

Point' is

calculated

to insure a

trend in the

preferred

direction

has been

established.

The

'Momentum

Objective' is

your target

price. Here is

where you

close your

trade or; if

you want to

let it run, you

may.

to find three prices; A, B, C.

a valley between or a peak between two valleys.

ement Percentage=

Trade

84.62%

112.00000

111.63333

entum Objective=

110.70000

0.09120

14.25

The 'Trailing

Stop' is

calculated

based on a

percentage of

your Equity at

Risk in the

position

multiplied by

your Risk

Tolerance.

to 1

The

'Reward/Risk

Ratio' shows

you the amount

of gain

possible if the

'Momentum

Objective' is

reached versus

the amount of

the 'Trailing

Stop'.

Fibonacci Retracements:

To use the worksheet you will need to find three prices; A, B, C.

These can be either two peaks with a valley between or a peak between two valleys.

Price A=

Inputs

36.50

Retracement Percentage=

Price B=

38.25

Risk Point=

Price C=

37.75

Entry Point=

Current Price=

38.00

Momentum Objective=

Equity to Risk=

Shares=

Risk Tolerance=

10000.00

260.00

2.00%

Trailing Stop=

Reward/Risk Ratio=

Shares to buy or short will be calculated.

The ideal retracement

percentage will fall

between 0% & 100%. If the

retracement is outside of

these two boundaries you

will get an "Out of Bounds"

message. Trading based

on the worksheet numbers

is not recommended when

an "Out of Bounds"

message occurs.

Some

quick

notes:

The 'Risk

Point' is

equal to

Price C

from the

input

column.

The 'Entry

Point' is

calculated

to insure a

trend in the

preferred

direction

has been

established.

The

'Momentum

Objective' is

your target

price. Here is

where you

close your

trade or; if

you want to

let it run, you

may.

to find three prices; A, B, C.

a valley between or a peak between two valleys.

ement Percentage=

Trade

28.57%

37.75

37.92

entum Objective=

39.50

0.77

2.28

The 'Trailing

Stop' is

calculated

based on a

percentage of

your equity at

risk divided

by the

number of

shares in the

position.

to 1

The

'Reward/Risk

Ratio' shows

you the amount

of gain

possible if the

'Momentum

Objective' is

reached versus

the amount of

the 'Trailing

Stop'.

También podría gustarte

- Call Total CW Time Change in Oi Strike Price: Bank Nifty Intraday OI Data AnalysisDocumento6 páginasCall Total CW Time Change in Oi Strike Price: Bank Nifty Intraday OI Data AnalysisDisha ParabAún no hay calificaciones

- Safal Niveshaks Stock Analysis ExcelDocumento26 páginasSafal Niveshaks Stock Analysis ExcelKrishnamoorthy SubramaniamAún no hay calificaciones

- Wave CalculatorDocumento2 páginasWave CalculatorArun VinodAún no hay calificaciones

- Amba Canslim1Documento9 páginasAmba Canslim1api-266993521Aún no hay calificaciones

- Forecasting Volatility in Stock Market Using GARCH ModelsDocumento43 páginasForecasting Volatility in Stock Market Using GARCH ModelsramziAún no hay calificaciones

- Reward To Risk Ratio WorkbookDocumento2 páginasReward To Risk Ratio WorkbookPrathik RaiAún no hay calificaciones

- Trading Journal BeginnersDocumento48 páginasTrading Journal BeginnersadelinAún no hay calificaciones

- Cell D2 Cell D1: Maximum Point Is The Maximum "Closing" ValueDocumento106 páginasCell D2 Cell D1: Maximum Point Is The Maximum "Closing" ValuersdprasadAún no hay calificaciones

- Payoff Calculator For OptionDocumento11 páginasPayoff Calculator For OptionSantosh ThakurAún no hay calificaciones

- Week 9. Problems - OptionDocumento16 páginasWeek 9. Problems - OptionMarissa MarissaAún no hay calificaciones

- BONUS CalculatorDocumento2 páginasBONUS Calculatorudhaya kumarAún no hay calificaciones

- Robinhood Trailing Stop LossDocumento3 páginasRobinhood Trailing Stop Lossj39jdj92oijtAún no hay calificaciones

- Share Khan Option CalculatorDocumento2 páginasShare Khan Option Calculatorabhi1nema0% (1)

- Trend Equation: Investopedia SaysDocumento3 páginasTrend Equation: Investopedia SaysMahesh SavaliyaAún no hay calificaciones

- Naked OptionsDocumento5 páginasNaked OptionsstockAún no hay calificaciones

- For Ex CalculatorDocumento5 páginasFor Ex CalculatorArvind ChaudharyAún no hay calificaciones

- Nifty Technical AnalysisDocumento136 páginasNifty Technical Analysisapi-3728932Aún no hay calificaciones

- Month Deposit (USD) Profit WD USD Realisasi MAXDocumento23 páginasMonth Deposit (USD) Profit WD USD Realisasi MAXditaAún no hay calificaciones

- Trade PlanDocumento2 páginasTrade PlanYangon TraderAún no hay calificaciones

- Traders CalculatorsDocumento542 páginasTraders Calculatorspatelpratik1972Aún no hay calificaciones

- New Age Wealth AlgoDocumento12 páginasNew Age Wealth AlgoAnsh SinghAún no hay calificaciones

- Trading Qty Decider Based On Money Management RuleDocumento15 páginasTrading Qty Decider Based On Money Management RulexenonvideoAún no hay calificaciones

- Options Greeks CalculatorDocumento6 páginasOptions Greeks CalculatorpraschAún no hay calificaciones

- Stock Option Trading Calculations Including Brokerage and Taxes ForDocumento6 páginasStock Option Trading Calculations Including Brokerage and Taxes Formerc2Aún no hay calificaciones

- BANKNIFTY OAT V.10 OCT - XLSMDocumento34 páginasBANKNIFTY OAT V.10 OCT - XLSMKalpesh ShahAún no hay calificaciones

- Accord Capital Equities Corporation:: First Philippine Holdings, Inc (Pse: FPH)Documento1 páginaAccord Capital Equities Corporation:: First Philippine Holdings, Inc (Pse: FPH)JC CalaycayAún no hay calificaciones

- 3X5EMADocumento57 páginas3X5EMAAkash NathAún no hay calificaciones

- Candle Stick AnalysisDocumento6 páginasCandle Stick AnalysisSudershan ThaibaAún no hay calificaciones

- Fibonacci CalculatorDocumento3 páginasFibonacci Calculatorlolr2Aún no hay calificaciones

- Share Hold SellDocumento4 páginasShare Hold SellIshwor sharmaAún no hay calificaciones

- Trading Setups (Observable)Documento2 páginasTrading Setups (Observable)Mohd IzwanAún no hay calificaciones

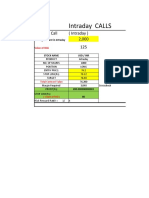

- Intraday CALLS: For Long Call (Intraday) 2,000 125Documento12 páginasIntraday CALLS: For Long Call (Intraday) 2,000 125DNYANESH MASKEAún no hay calificaciones

- Bloomberg: C S L M - S G/BLP CDocumento20 páginasBloomberg: C S L M - S G/BLP CvaibkalAún no hay calificaciones

- NESCODocumento45 páginasNESCOPositive ThinkerAún no hay calificaciones

- Total Amount To Invest:: Moderate Risk ToleranceDocumento3 páginasTotal Amount To Invest:: Moderate Risk ToleranceElaineAún no hay calificaciones

- Fibonacci Buy Sell Zones: Close Degree 22.5Documento11 páginasFibonacci Buy Sell Zones: Close Degree 22.5Krishnamoorthy SubramaniamAún no hay calificaciones

- Deepak NitriteDocumento45 páginasDeepak NitritedndsohamAún no hay calificaciones

- Previous Day'S Price: Projection For TodayDocumento5 páginasPrevious Day'S Price: Projection For TodaycratnanamAún no hay calificaciones

- Trading JournalDocumento18 páginasTrading Journalsivaraja kAún no hay calificaciones

- Call and Put Vs Strike Call and Put Vs StockDocumento27 páginasCall and Put Vs Strike Call and Put Vs StockjatingediaAún no hay calificaciones

- Folio Dashboard: PolarisDocumento28 páginasFolio Dashboard: PolarisJeniffer RayenAún no hay calificaciones

- Stock Price Calculator TWIDocumento14 páginasStock Price Calculator TWIicdiazAún no hay calificaciones

- Introduction To Technical Analysis: Andrew WilkinsonDocumento37 páginasIntroduction To Technical Analysis: Andrew WilkinsonsmslcaAún no hay calificaciones

- Option Calc v1.0Documento2 páginasOption Calc v1.0mr_gauravAún no hay calificaciones

- VolatilityDocumento5 páginasVolatilityRam AnishAún no hay calificaciones

- Options Probability Calculator: Step OneDocumento8 páginasOptions Probability Calculator: Step OneDebayan Sen0% (1)

- Boh Philippines Black Box - 2019.07.31Documento289 páginasBoh Philippines Black Box - 2019.07.31Phi Consistent TraderAún no hay calificaciones

- Fibo Nacchi and Gaann Degree CalculationDocumento2 páginasFibo Nacchi and Gaann Degree CalculationVijay ShahAún no hay calificaciones

- GANN Square of 9 and Price Angle CalulatorDocumento5 páginasGANN Square of 9 and Price Angle CalulatorparmeshwarAún no hay calificaciones

- 9 - 30 Trading Setup - A Simple Moving Average StrategyDocumento3 páginas9 - 30 Trading Setup - A Simple Moving Average StrategybhushanAún no hay calificaciones

- Nifty Options IntradayDocumento65 páginasNifty Options Intradayswapnil koreAún no hay calificaciones

- Strategy Guide: Bull Call SpreadDocumento14 páginasStrategy Guide: Bull Call SpreadworkAún no hay calificaciones

- Fibonacci CalculatorDocumento2 páginasFibonacci CalculatorKumarappan SambamurthyAún no hay calificaciones

- Plan of Action: Entry Stop Loss TargetDocumento2 páginasPlan of Action: Entry Stop Loss TargetAnbarasu PonnuchamyAún no hay calificaciones

- Hester Bio-Sciences StockDocumento2 páginasHester Bio-Sciences Stockdrsivaprasad7Aún no hay calificaciones

- XLSXDocumento8 páginasXLSXKennyAún no hay calificaciones

- Intrinsic Value Discounted Cash Flow CalculatorDocumento18 páginasIntrinsic Value Discounted Cash Flow CalculatorAndrew LeeAún no hay calificaciones

- Compounding SheetDocumento4 páginasCompounding SheetMouzam AliAún no hay calificaciones

- Fibonacci Method in ForexDocumento6 páginasFibonacci Method in ForexArief AminAún no hay calificaciones

- Breakeven AnalysisDocumento11 páginasBreakeven Analysisshariq_extcAún no hay calificaciones

- LLPputpricingmodelDocumento2 páginasLLPputpricingmodelstockAún no hay calificaciones

- TT 0802Documento2 páginasTT 0802stockAún no hay calificaciones

- Naked OptionsDocumento5 páginasNaked OptionsstockAún no hay calificaciones

- Stock Dashboard - BSEDocumento40 páginasStock Dashboard - BSEstock0% (2)

- Optionstar EZ Single Calls or Puts: PL atDocumento19 páginasOptionstar EZ Single Calls or Puts: PL atstockAún no hay calificaciones

- Naked OptionsDocumento5 páginasNaked OptionsstockAún no hay calificaciones

- Man 02111508 Me DNDocumento1 páginaMan 02111508 Me DNstockAún no hay calificaciones

- Dcat2014 - Simulated Set B - Section 3 - Reading Comprehension - Final v.4.7.2014Documento6 páginasDcat2014 - Simulated Set B - Section 3 - Reading Comprehension - Final v.4.7.2014Joice BobosAún no hay calificaciones

- Adult Consensual SpankingDocumento21 páginasAdult Consensual Spankingswl156% (9)

- Far 1 - Activity 1 - Sept. 09, 2020 - Answer SheetDocumento4 páginasFar 1 - Activity 1 - Sept. 09, 2020 - Answer SheetAnonn100% (1)

- Eco - Module 1 - Unit 3Documento8 páginasEco - Module 1 - Unit 3Kartik PuranikAún no hay calificaciones

- FR-A800 Plus For Roll To RollDocumento40 páginasFR-A800 Plus For Roll To RollCORTOCIRCUITANTEAún no hay calificaciones

- Hoaxes Involving Military IncidentsDocumento5 páginasHoaxes Involving Military IncidentsjtcarlAún no hay calificaciones

- Adjective Clauses: Relative Pronouns & Relative ClausesDocumento4 páginasAdjective Clauses: Relative Pronouns & Relative ClausesJaypee MelendezAún no hay calificaciones

- A Financial History of The United States PDFDocumento398 páginasA Financial History of The United States PDFiztok_ropotar6022Aún no hay calificaciones

- Media Kit (Viet)Documento2 páginasMedia Kit (Viet)Nguyen Ho Thien DuyAún no hay calificaciones

- 7A Detailed Lesson Plan in Health 7 I. Content Standard: Teacher's Activity Students' ActivityDocumento10 páginas7A Detailed Lesson Plan in Health 7 I. Content Standard: Teacher's Activity Students' ActivityLeizel C. LeonidoAún no hay calificaciones

- Iml601 Week 4 AbsDocumento69 páginasIml601 Week 4 AbsNur Nazurah NordinAún no hay calificaciones

- Jain Gayatri MantraDocumento3 páginasJain Gayatri MantraShil9Aún no hay calificaciones

- 400 Series Turbo App Chart 2Documento5 páginas400 Series Turbo App Chart 2Abi ZainAún no hay calificaciones

- FBFBFDocumento13 páginasFBFBFBianne Teresa BautistaAún no hay calificaciones

- Indicator For Meridian Diagnosis AGNIS BAT 02 (User's Manual) AGNISDocumento5 páginasIndicator For Meridian Diagnosis AGNIS BAT 02 (User's Manual) AGNISssmaddiAún no hay calificaciones

- Cluster University of Jammu: Title: English Anthology and GrammarDocumento2 páginasCluster University of Jammu: Title: English Anthology and GrammarDÁRK GAMINGAún no hay calificaciones

- Grunig J, Grunig L. Public Relations in Strategic Management and Strategic Management of Public RelationsDocumento20 páginasGrunig J, Grunig L. Public Relations in Strategic Management and Strategic Management of Public RelationsjuanAún no hay calificaciones

- 1574 PDFDocumento1 página1574 PDFAnonymous APW3d6gfd100% (1)

- Lolita Enrico Vs Heirs of Spouses Eulogio Medinaceli and Trinidad MedinaceliDocumento3 páginasLolita Enrico Vs Heirs of Spouses Eulogio Medinaceli and Trinidad Medinacelichatmche-06Aún no hay calificaciones

- CH 13 ArqDocumento6 páginasCH 13 Arqneha.senthilaAún no hay calificaciones

- Doloran Auxilliary PrayersDocumento4 páginasDoloran Auxilliary PrayersJosh A.Aún no hay calificaciones

- Case Digest: Pedro Elcano and Patricia Elcano Vs - Reginald Hill and Marvin HillDocumento5 páginasCase Digest: Pedro Elcano and Patricia Elcano Vs - Reginald Hill and Marvin Hillshirlyn cuyongAún no hay calificaciones

- Operations Management and Operations PerformanceDocumento59 páginasOperations Management and Operations PerformancePauline LagtoAún no hay calificaciones

- People V Galano, Caubang v. PeopleDocumento2 páginasPeople V Galano, Caubang v. PeopleHermay Banario50% (2)

- Si493b 1Documento3 páginasSi493b 1Sunil KhadkaAún no hay calificaciones

- Graduation Ceremony 2013Documento7 páginasGraduation Ceremony 2013Angelie Hermoso RoldanAún no hay calificaciones

- May Be From Interval (1,100) .The Program Output May Be One of The Following (Scalene, Isosceles, Equilateral, Not A Triangle) - Perform BVADocumento3 páginasMay Be From Interval (1,100) .The Program Output May Be One of The Following (Scalene, Isosceles, Equilateral, Not A Triangle) - Perform BVAsourabh_sanwalrajputAún no hay calificaciones

- Examination of Conscience Ten Commandments PDFDocumento2 páginasExamination of Conscience Ten Commandments PDFAntonioAún no hay calificaciones

- Young Learners Starters Sample Papers 2018 Vol1Documento15 páginasYoung Learners Starters Sample Papers 2018 Vol1Natalia García GarcíaAún no hay calificaciones

- Isolasi Dan Karakterisasi Runutan Senyawa Metabolit Sekunder Fraksi Etil Asetat Dari Umbi Binahong Cord F L A Steen S)Documento12 páginasIsolasi Dan Karakterisasi Runutan Senyawa Metabolit Sekunder Fraksi Etil Asetat Dari Umbi Binahong Cord F L A Steen S)Fajar ManikAún no hay calificaciones