Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Cargado por

Shyam SunderTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Cargado por

Shyam SunderCopyright:

Formatos disponibles

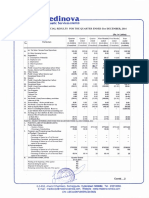

NITIN SPINNERS LIMITED

Regd.Office: 16-17Km. Stone, Chittor Road, Hamirgarh,Bhilwara- 311 025 (Rajasthan)CIN L17111RJ1992PLC006987

Tel. : +91 1482286110; Fax: 91 1482286117.Website: www.nitinspinners.comE-Mail-nsl@nitinspinners.com

UN-AUDITED

FINANCIAL

RESULTS FOR THE QUARTER ENDED 30TH SEPTEMBER,

2014

::ir.

No.

Particulars

r--

1. (a) NetSales/Incomefrom Operations

(b) Other OperatingIncome

Total Income from operations (Net)

2 Expenses

a. Cost of materials consumed

b. Purchaseof Traded Goods

c. Changesin inventoriesof FinishedGoods,WIP & Stock in Trade

d. Employeesbenefitexpenses

e. Power& Fuel

f. Depreciationand amortisationexpenses

g. Other Expenses

h. Total Expenses

3 Profit from operations before Other Income, Finance Cost and

Exceptional items (1-2)

4 Other Income/(Loss)

5 Profit before Finance Cost and Exceptional items (3+4)

6 Finance Cost

7 Profit after Finance Cost but before Exceptional items (5-6)

8 Exceptionalitems

9 Profit from Ordinary Activities before Tax (7-8)

10 Tax Expenses - CurrentTax

- DeferredTax Charge/(Credit)

11 Profit/CLoss) from Ordinary Activities after Tax (9-10)

12 ExtraordinaryItem

13 Net Profit for the period (11-12)

14 Paid-up Equity Share Capital(FaceValue of Rs. 10/-each)

15 ReservesexcludingRevaluationReserve

16 (a) Basic & diluted EPS not annualised(beforeextraordinaryitems)

(b) Basic& diluted EPS not annualised(after extraordinaryitems)

17 Public Shareholding

- Numberof Shares

- Percentageof Shareholding

18 Promoters & Promoter Group Shareholding

a) Pledged/Encumbered - Numberof Shares

% of Sharesto total Shareholdingof Promoters& PromotersGroup

% of Sharesto total Sharecapitalof the Company

b) Non Encumbered- Numberof Shares

% of Sharesto total Shareholdingof Promoters& PromotersGroup

% of Sharesto total Share capitalof the Company

Quarter ended

30.09.2014

30.06.2014

13571.06

13.75

13584.81

9144.32

-

30.09.2013

Unaudited

13263.66

11966.62

10.96

6.88

13270.54

11977.58

26834.72

20.63

26855.35

23669.53

17.01

23686.54

(Rs. in Lacs)

Year Ended

31.03.2014

Audited

48834.02

34.76

48868.78

Half Year ended

30.09.2014

30.09.2013

(594.28)

753.87

1154.73

628.50

1041.44

12128.58

7658.54

173.96

489.14

692.29

1054.07

628.35

957.62

11653.97

7034.51

275.98

(224.16)

599.36

896.95

610.80

900.46

10093.90

16802.86

173.96

(105.14)

1446.16

2208.80

1256.85

1999.06

23782.55

13951.54

487.64

(282.80)

1195.68

1718.26

1212.95

1804.56

20087.83

29354.21

1023.60

(592.13)

2460.21

3495.81

2486.58

3689.54

41917.82

1456.23

1616.57

1883.68

3072.80

3598.71

6950.96

71.57

1527.80

455.19

1072.61

76.70

1693.27

496.16

1197.11

(3.30)

1880.38

465.53

1414.85

148.27

3221.07

951.35

2269.72

(3.30)

3595.41

973.49

2621.92

(9.14)

6941.82

1746.35

5195.47

1072.61

1197.11

133.95

938.66

320.46

876.65

1414.85

97.27

411.78

905.80

2269.72

454.41

1815.31

2621.92

119.92

790.21

1711.79

5195.47

262.36

1455.04

3478.07

3478.07

4583.39

8572.20

7.59

7.59

938.66

4583.39

876.65

4583.39

905.80

4583.39

1815.31

4583.39

1711.79

4583.39

2.05

2.05

1.91

1.91

1.98

1.98

3.96

3.96

3.73

3.73

16600118

36.22

16600118

36.22

29233827

100.00

63.78

29233827

100.00

63.78

16738940

36.52

29095005

100.00

63.48

16600118

36.22

16738940

36.52

29233827

100.00

63.78

29095005

100.00

63.48

16617184

36.26

29216761

100.00

63.74

STATEMENT

OF ASSETS

PARTICULARS

& LIABILITIES

AS AT 30TH SEPTEMBER,

2014

(Rs. in Lacs)

As at

30.09.2014 I 31.03.2014

EQUITY AND LIABILITIES

1 SHAREHOLDERS'FUNDS:

(a) Share Capital

(b) Reserve and Surplus

4583.39

8572.20

13155.59

24628.56

13070.59

2569.08

281.60

2114.67

27479.24

15420.86

394.43

1342.35

NON-CURRENT LIABILITIES

(a) Long - Term Borrowings

(b) Deferred Tax Liabilities (Net)

(c) Long-Term Provisions

4583.39

10387.51

14970.90

235.60

CURRENT LIABILITIES

(a) Short - Term Borrowings

(b) Trade Payables

1212.86

1069.93

(c) Other Current Liabilities

4039.22

3892.57

139.92

517.17

5786.43

6822.02

48236.57

35398.47

(a) Fixed Assets

17189.63

19121.43

(b) Capital Work in Progress

16475.53

2117.64

4471.12

38136.28

2997.65

24236.72

(a) Inventories

3602.10

7069.84

(b) Trade Receivables

4135.29

2489.31

(d) Short Term Provisions

TOTAL - EQUITY AND LIABILITIES

B

ASSETS

1 NON-CURRENT ASSETS

(c) Long - Term Loans & Advances

2

CURRENT ASSETS

(c) Cash and Cash Equivalents

(d) Short Term Loans and Advances

(e) Other Current Assets

TOTAL - ASSETS

38.79

6.37

588.21

469.15

1735.90

1127.08

10100.29

11161.75

48236.57

35398.47

Notes:1 The expansion project of Spinning & Knitting facilities is under implementation as per schedule and trial run has been commenced.

2 The Provision of Current Tax is net of MAT credit entitlement.

3 No investors' complaint was pending at the beginning & end of the Quarter and no complaint was received during the Quarter.

4 The company's business activities falls within a single business segment (Textiles), in terms of Accounting Standard - 17 of ICAI.

5 The figures of previous year/quarter have been regrouped/rearranged, wherever required.

6

The above financial results have been approved

by the Audit Committee and Board of Directors at their meeting held on 30th October, 2014.

For and on behalf of Board of Directors

For

Date:

30.10.2014

Place:

Bhilwara

(R.L.

Nolkha)

Chairman & Managing Director

R S Dani & Co.

CHARTEREDACCOUNTANTS

Kothari Complex, Near G. P.O., BHILWARA- 311'001

Ph. 512100, 231500(0),513100{R)

Review Report

Review Report

"We

have

of MIs. Nitin Spinners L~ited,

reviewed

the

Financial Results of MIs

accompanying

.

statement

of

un-audited

Nitin Spinners Limited, Bhilwara for

the period ended 30th September, 2014 except for the disclosures

regarding 'Public Shareholding' and 'Promoter and Promoter Group

Shareholding' which have been traced from disclosures made by the

management and have not been audited by us. This statement is the

responsibili ty of the Company's Management and has been approved

by the Board of Directors.

Our responsibility

is to issue a

report on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review

Engagement (SRE) 2400, Engagemen~ to Review Financia~ S~a~ements

issued by the Institute of Chartered Accountants

of India. This

standard requires that we plan and perform the review to obtain

moderate assurance

as to whether the financial

statements are

free of material misstatement. A review is limited primarily to

inquiries of company personnel and analytical procedures applied

to financial data and thus provides less assurance than an audit.

We have not performed an audit and accordingly, we do not express

an audit opinion.

Based on our review conducted as above, nothing has come to our

attention that causes us to believe that the accompanying

statement of un-audited financial results prepared in accordance

with applicable Accounting Standards and other recognized

accounting practices and policies has

not

disclosed the

information required to be disclosed in terms of Clause 41 of the

Listing Agreement including the manner in which it is to be

disclosed, or that it contains any material misstatement".

For:

Place:

Date:

--

R.

Bhilwara

30.10.2014

-----

También podría gustarte

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento7 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- 28 Consolidated Financial Statements 2013Documento47 páginas28 Consolidated Financial Statements 2013Amrit TejaniAún no hay calificaciones

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2013 (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento6 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results For September 30, 2016 (Result)Documento1 páginaStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Third Quarter March 31 2014Documento18 páginasThird Quarter March 31 2014major144Aún no hay calificaciones

- Auditors Report and Audited Financial StatementsDocumento45 páginasAuditors Report and Audited Financial Statementszahir2020Aún no hay calificaciones

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Auditors Report Financial StatementsDocumento57 páginasAuditors Report Financial StatementsSaif Muhammad FahadAún no hay calificaciones

- Afm PDFDocumento5 páginasAfm PDFBhavani Singh RathoreAún no hay calificaciones

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results For March 31, 2016 (Result)Documento2 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionDe EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionAún no hay calificaciones

- Mutual Fund Holdings in DHFLDocumento7 páginasMutual Fund Holdings in DHFLShyam SunderAún no hay calificaciones

- JUSTDIAL Mutual Fund HoldingsDocumento2 páginasJUSTDIAL Mutual Fund HoldingsShyam SunderAún no hay calificaciones

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 páginasOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderAún no hay calificaciones

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 páginasSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderAún no hay calificaciones

- Financial Results For Mar 31, 2014 (Result)Documento2 páginasFinancial Results For Mar 31, 2014 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 páginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderAún no hay calificaciones

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 páginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderAún no hay calificaciones

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 páginasExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderAún no hay calificaciones

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 páginasFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderAún no hay calificaciones

- Financial Results For Dec 31, 2013 (Result)Documento4 páginasFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 páginasSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderAún no hay calificaciones

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAún no hay calificaciones

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAún no hay calificaciones

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 páginasFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Financial Results For September 30, 2013 (Result)Documento2 páginasFinancial Results For September 30, 2013 (Result)Shyam SunderAún no hay calificaciones

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results For June 30, 2016 (Result)Documento2 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAún no hay calificaciones

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAún no hay calificaciones

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAún no hay calificaciones

- Reliability Centered Maintenance ExplainationDocumento6 páginasReliability Centered Maintenance Explainationambuenaflor100% (1)

- IES VE Parametric Tool GuideDocumento7 páginasIES VE Parametric Tool GuideDaisy ForstnerAún no hay calificaciones

- Telecommunication Group-8Documento20 páginasTelecommunication Group-8Manjunath CAún no hay calificaciones

- Keyin MaterialsDocumento17 páginasKeyin MaterialsH.GorenAún no hay calificaciones

- Problem 1 (MTM Corp.)Documento5 páginasProblem 1 (MTM Corp.)Kyle Vincent SaballaAún no hay calificaciones

- 9706 w12 Ms 23Documento7 páginas9706 w12 Ms 23Diksha KoossoolAún no hay calificaciones

- Manual Videoporteiro Tuya Painel de Chamada 84218Documento6 páginasManual Videoporteiro Tuya Painel de Chamada 84218JGC CoimbraAún no hay calificaciones

- Labprograms 1A2A3ADocumento11 páginasLabprograms 1A2A3ARajiv SethAún no hay calificaciones

- AppoloDocumento2 páginasAppoloRishabh Madhu SharanAún no hay calificaciones

- Copyright WorksheetDocumento3 páginasCopyright WorksheetJADEN GOODWINAún no hay calificaciones

- MAN ProgrammeDocumento260 páginasMAN Programmedimas kukuhAún no hay calificaciones

- The Development Cultural Studies in BritishDocumento6 páginasThe Development Cultural Studies in BritishIeie HollyAún no hay calificaciones

- Telemecanique: Altivar 11Documento29 páginasTelemecanique: Altivar 11Ferenc MolnárAún no hay calificaciones

- Volvo Penta AQ150-A-B Workshop Manual PDFDocumento40 páginasVolvo Penta AQ150-A-B Workshop Manual PDFUmar ShamsudinAún no hay calificaciones

- Facebook Ads Defeat Florida Ballot InitiativeDocumento3 páginasFacebook Ads Defeat Florida Ballot InitiativeGuillermo DelToro JimenezAún no hay calificaciones

- Business Environment Notes For MbaDocumento34 páginasBusiness Environment Notes For Mbaamrit100% (1)

- Importance of Bus Rapid Transit Systems (BRTSDocumento7 páginasImportance of Bus Rapid Transit Systems (BRTSAnshuman SharmaAún no hay calificaciones

- Nexus FP PDFDocumento48 páginasNexus FP PDFPeter MkamaAún no hay calificaciones

- Today's Court Decision on Land Registration AppealDocumento6 páginasToday's Court Decision on Land Registration AppealJohn Lester TanAún no hay calificaciones

- Emergency procedures for shipboard fire suppression systemsDocumento1 páginaEmergency procedures for shipboard fire suppression systemsImmorthalAún no hay calificaciones

- CostingDocumento3 páginasCostingAarti JAún no hay calificaciones

- AP School Education Rules SummaryDocumento17 páginasAP School Education Rules SummaryThirupathaiahAún no hay calificaciones

- The Works of Lord Byron, Vol. 3 - Hebrew Melodies, PoemsDocumento361 páginasThe Works of Lord Byron, Vol. 3 - Hebrew Melodies, Poemszpervan1Aún no hay calificaciones

- Astrology and Athrishta K P 12 KS KrishnamurthiDocumento401 páginasAstrology and Athrishta K P 12 KS Krishnamurthiaaditya80% (5)

- B361-08 Standard Specification For Factory-Made Wrought Aluminum and Aluminum-Alloy Welding FittingsDocumento6 páginasB361-08 Standard Specification For Factory-Made Wrought Aluminum and Aluminum-Alloy Welding FittingsmithileshAún no hay calificaciones

- GKB Data Analytics Mandate Part 2Documento9 páginasGKB Data Analytics Mandate Part 2Vilma TejadaAún no hay calificaciones

- List of Computer Science Impact Factor Journals: Indexed in ISI Web of Knowledge 2015Documento7 páginasList of Computer Science Impact Factor Journals: Indexed in ISI Web of Knowledge 2015ppghoshinAún no hay calificaciones

- 2015 Quikrete Product Guide PDFDocumento28 páginas2015 Quikrete Product Guide PDFTushar PatelAún no hay calificaciones

- Integral University Study & Evaluation Scheme B.Tech. CSE/ITDocumento16 páginasIntegral University Study & Evaluation Scheme B.Tech. CSE/ITQwt YwtwAún no hay calificaciones

- AS1684 Timber Framing GuideDocumento37 páginasAS1684 Timber Framing GuidemanoliAún no hay calificaciones