Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Platts PVC 23 Sept 2015

Cargado por

mcontrerjDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Platts PVC 23 Sept 2015

Cargado por

mcontrerjCopyright:

Formatos disponibles

This Weeks Highlights:

Asian EDC/VCM: Flat to $10/mt lower

Asian PVC: Prices mixed as market stirs on emergence of Oct offers

R

A

S

INDEX:

Platts International Prices

Polymerupdate Indian Domestic Producer Price

Platts Polymer Shipping Costs (USD/MT)

Polymerupdate CIF India Prices

Polymerupdate Indian Open Market Price Table

Polymerupdate Indian Producer Posting Price Comparison

Heard in PVC Market

Platts International Market Commentary & Analysis

Polymerupdate - PVC Market Supply Scenario

Platts Price Analysis Of PVC Chain Processing Margins

Currency Rates

Crisil Research Macroeconomics & Currency Monthly Analysis

Point of Contact

Polymerupdate - About us & Copyright

Platts - About us & Copyright

AS

UD

Week 38 September 23, 2015

POLYMERUPDATE

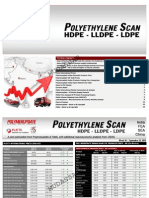

PLATTS INTERNATIONAL PRICES (USD/MT)

Product

India Crude basket:

Naphtha:

(USD/b)

(MOP West India)

Sept 16

(WK 37)

Sept 23

(WK 38)

44.83

46.01

+1.18

419.80

428.99

+9.19

INDIA DOMESTIC PRODUCER PRICE - RIL (Ex Hazira)

Price Change

on Week

Product

Suspension

CFR Far East Asia

229-231

219-221

- 10

CFR South East Asia

289-291

289-291

CFR Far East Asia

688-690

688-690

CFR South East Asia

704-706

704-706

S

A

D

PVC :

MU

- 05

789-791

- 10

849-851

+ 10

PVC Suspension CFR China

799-801

794-796

PVC Suspension CFR SEA

799-801

PVC Suspension CFR India

839-841

Specifications:

Cargoes of 100-500mt delivered 15-30 days forward from date of publication with up to 30 days credit, basis

CFR Far East Asia: China main ports (Shanghai, Shenzhen, Ningbo, Shantou, Hong Kong); CFR South East Asia: Indonesia (Jakarta,

Surabaya), Singapore, Philippines (Manila Bay), Malaysia (Port Kelang), Thailand (Bangkok, LaemChabang, Map Ta Phut), Vietnam (Ho

Chi Minh). Platts prices reflect spot market values on the day of publication.

India Crude Import Basket Calculation: ( (Dubai + Oman) / 2 * 65.2% ) + (Dated Brent * 34.8%)

MOP West India : Mean of Platts FOB West India naphtha export price

China Domestic

(YUAN/MT EX-WORK)

Ethylene Based

5690-5710

5690-5710

Carbide Based

5340-5360

5340-5360

INR/KG

USD/MT

INR/KG

USD/MT

63.50

860

64.50

875

Price Change on Week

INR/KG

+01

*Domestic Indian producer prices are quoted in INR/kg basic (Nett of all taxes) ; equivalent USD/MT price is

calculated at current US/INR rate. *Lot Size:

1 Truck Load (10 to 16 MT)

- Price assessments are based on information gathered from a cross section of the industry that includes resin

producers, processors, traders and distributors.

- Standard repeatable orders (based on confirmed market deals) form the basis of the prices.

R

A

S

VCM :

Sept 23 (WK 38)

PVC Grade

EDC :

Sept 16 (WK 37)

PLATTS Polymer shipping costs (USD/MT)

From:

To:

East China

South China

India

Southeast Asia

NW Europe

Turkey

US Gulf

Latin America

Middle East

25 100 MT

20 25

15 25

45 50

30 35

55 65

50 70

130 140

165 175

Middle East

> 100 MT

10 15

10 15

30 40

25 30

50 60

40 60

120 130

160 165

NOTES:

Polymers refer to polyethylene, polypropylene, polystyrene, ABS, and PVC.

1) Middle East loadings refer to products coming from Jebel Ali (Dubai), Khalifa (Abu Dhabi), Jubail (Saudi Arabia), Shuaiba (Kuwait),

Rabigh (Saudi Arabia), Mesaieed (Qatar), Assaluyeh and Bandar Imam Khomeini (Iran) ports. The assessments are normalized between

these ports.

2) East China deliveries refer to products coming into Zhangjiagang, Shanghai, Jiangyin, Nantong, Ningbo, Nanjing, Zhenjiang ports.

3) South China deliveries refer to products coming into Shenzhen, Shantou, Hong Kong, Xiamen, Zhuhai ports.

4) India deliveries refer to products coming into Kolkata, Mumbai and Chennai ports.

5) South East Asia deliveries refer to products coming into Indonesia (Jakarta, Surabaya), Singapore, Philippines (Manila Bay), Malaysia

(Port Kelang), Thailand (Bangkok), Vietnam (Ho Chi Minh) ports.

6) Northwest Europe deliveries refer to products coming into Antwerp port. Deliveries into Rotterdam and Amsterdam ports will be

normalized to Antwerp.

7) Turkey deliveries refer to products coming into Istanbul and Mersin ports.

8) US Gulf deliveries refer to products coming into Houston port. No deliveries from the Persian Gulf.

9) Latin America deliveries refer to products coming into mainports in Brazil, Chile, Uruguay.

Contact Details: 344, A to Z Indl. Estate, G. K. Marg, Lower Parel (w), Mumbai 400013, INDIA | Email:info@polymerupdate.com | Tel: +91-22-61772000 (25lines) | Fax: +91-22-61772025

Week 38 September 23, 2015

POLYMERUPDATE (CIF INDIA PRICES)

CIF INDIA BY ORIGIN (NhavaSheva Port)

South Korea

Thailand

WK 37

WK 38

Sep 16

Sep 23

Suspension

820

820

Emulsion

960

960

Price Change

on Week

Taiwan

WK 37

WK 38

Sep 16

Sep 23

820

820

--

--

--

Price Change on Week

--

WK 37

WK 38

Sep 16

Sep 23

830

850

+20

970

970

Price Change on Week

- All prices are in USD/MT CIF India (NhavaSheva)

- For South Korea, Singapore, Thailand and Saudi Arabia :

Cargo size of 50-100mt delivered within 30 days.

- Price assessments are based on information gathered from a cross section of the industry that includes resin producers, processors, traders and distributors.

- Standard repeatable orders (based on confirmed market deals) form the basis of the prices.

R

A

S

AS

POLYMERUPDATE - Indian Open Market Price Table

Product

Ethylene Based PVC

Mumbai

Delhi

73 - 73.5

78 - 78.5

UD

Kolkata

77 - 77.5

Note: All prices are in INR/kg levels.

Bangalore

Indore

74 - 74.5

76.5 - 77

Chennai

73 - 74

(Incl. of VAT)

Ahmedabad

Hyderabad

76 - 77

76 - 76.5

POLYMERUPDATE - INDIAN PRODUCER POSTING PRICE COMPARISON (GRADE WISE)

PVC SUSPENSION K-67w.e.f 18 Sept-2015

Producer

Grade No.

*INR/MT

USD/MT

RIL

67GER01 (Ex-Gandhar)

64500

875

RIL

67.01 (Ex-Hazira)

64500

875

RIL

57GER01 (Ex-Gandhar)

66500

903

RIL

57.11 (Ex-Hazira)

66500

903

*Domestic Indian producer prices are quoted in INR/MT basic (Nett of all taxes) ; equivalent USD/MT price is calculated at current US/INR rate. *Lot Size:

1 Truck Load(10 to 16 MT)

- USD Price calculation: INR/MT Aprox. Clearing and Forwarding Charges / Basic Duty / Exchange Rate = USD/MT (For example: 82330 2500 / 1.075 / 54.24 = 1396)

Contact Details: 344, A to Z Indl. Estate, G. K. Marg, Lower Parel (w), Mumbai 400013, INDIA | Email:info@polymerupdate.com | Tel: +91-22-61772000 (25lines) | Fax: +91-22-61772025

Week 38 September 23, 2015

Currency rates equivalent to 1 US Dollar :

Countries

Currency Rates

Countries

Indian Rupees (INR)

65.95

Japan Yen (JPY)

Pakistan Rupees (PKR)

Currency Rates

120.08

104.31

Indonesia Rupiahs (IDR)

14,633.29

China Yuan Renminb (CNY)

6.37

Malaysia Ringgits (MYR)

4.30

Bangladesh Taka (BDT)

77.66

Singapore Dollars (SGD)

1.41

Sri Lanka Rupees (LKR)

140.73

South Korea Won (KRW)

1185.84

Thailand Baht (THB)

36.07

Saudi Arabia Riyals (SAR)

3.75

Taiwan New Dollars (TWD)

32.90

United Arab Emirates Dirhams (AED)

3.67

R

A

S

Heard in PVC MARKET

Platts:

S

A

D

Asian PVC: Oct heard traded at $850-855/mt CFR India, Korean origin

Polymerupdate:

22-9-2015: Taiwan producer offers PVC Suspension at $850/mt in India (CIF Nhava Sheva port)

MU

Asian PVC: Oct heard traded at $810-820/mt CFR China, Korean origin

Asian PVC: Oct heard traded at $790/mt CFR Southeast Asia, Korean origin

Asian PVC: Oct buying ideas heard at $780/mt CFR Southeast Asia

Contact Details: 344, A to Z Indl. Estate, G. K. Marg, Lower Parel (w), Mumbai 400013, INDIA | Email:info@polymerupdate.com | Tel: +91-22-61772000 (25lines) | Fax: +91-22-61772025

Week 38 September 23, 2015

PLATTS INTERNATIONAL MARKET COMMENTARY & ANALYSIS

Asian EDC/VCM: Flat to $10/mt lower

Asian PVC: Prices mixed as market stirs on emergence of Oct offers

- EDC under pressure in FEA on higher deepsea supply

- Formosa raises Oct offers to Indian markets

- VCM flat ahead of Oct PVC discussions

- Ethylene feedstock costs spike $45/mt on week

EDC: CFR Far East Asia ethylene dichloride fell $10/mt week on week Thursday. The Asian EDC market

Asian spot prices for polyvinyl chloride were mixed Wednesday as activity picked up after Taiwan's

remained under pressure this week amid persisting deepsea supplies from the US. A market source said

Formosa released its offers for October-loading parcels on Tuesday. Its offers stood at $860/mt CFR

that US producers would continue to export EDC for the rest of this year to clear their stocks by the end

India, up $20/mt from September, $800/mt CFR China, unchanged on month, and $770/mt FOB

of December before account closing. Trading activity was rather limited as market participants held back

Taiwan, also flat from September. The flat to firmer offers for October were attributed to low PVC

ahead of the US Federal Reserve Bank's decision on interest rates. Also, upstream crude oil futures were

stocks, a source close to the company said. Also, ethylene feedstock costs were higher at $880/mt CFR

volatile. November ICE Brent futures rose $0.82/barrel week on week to be assessed at $49.50/b at 4:30

Northeast Asia Wednesday, a gain of $45/mt from $835/mt a week ago. Formosa expects to export

pm Singapore time (0830 GMT) Thursday.

less than 60,000 mt of PVC in October, down from about 65,000 mt in September, which is its typical

VCM: Asian vinyl chloride monomer was assessed unchanged Thursday from the previous week. Most

SS

AR

market participants decided to take a wait-and-see stance this week as there were no fresh offers for

downstream PVC for October. On Wednesday, CFR China PVC was assessed at $800/mt, down $10/mt

DA

from a week earlier. PVC producers are likely to increase their offers for October from a month earlier

amid firmer demand, especially in India. Some market sources said, however, that it might be difficult,

MU

citing weak demand in China as well as ample supply in the region. Spot VCM was also reported to be

tight amid plant turnarounds, which limited trading activity in the Asian market.

monthly export volume. Following the offers from Formosa, other PVC producers followed suit. South

Korean PVC was heard offered at over $845-$855/mt CFR India, depending on volume. One South

Korean PVC producer plans to shut its plant about mid-October for about 10 days of planned

maintenance. A China-based trader said Formosa was trying to place more volumes in India through

its representatives. Although trades were heard concluded, buyers in India were holding back,

awaiting offers from Japan, which was shut Monday-Wednesday for public holidays. In other news,

China imported 53,655 mt of PVC in August, up 6% from 49,463 mt in July.

RATIONALE:

RATIONALE:

The CFR India PVC marker was assessed at $850/mt, up $10/mt on week. Offers for October-loading

EDC: The CFR Far East Asia EDC price fell $10/mt week on week to be assessed at $220/mt Thursday.

parcels emerged at $860/mt CFR India for Taiwan-origin material. PVC from South Korea was heard

Some deals were reported to have been done at $210-220/mt CFR FEA. A buying idea was reported at

traded at $850-$855/mt CFR India. The CFR China marker was assessed $5/mt lower on week at

$200/mt CFR FEA. CFR Southeast Asia EDC was assessed unchanged at $290/mt during the same period,

$795/mt. Offers stood at $800/mt CFR China for Taiwan cargoes. Over in Southeast Asia, assessments

with no bids and offers heard.

fell $10/mt to $790/mt CFR SEA. A trade was heard concluded at $790/mt CFR SEA.

VCM: CFR Far East Asia VCM was assessed at $689/mt Thursday, unchanged from a week earlier. An

offer was heard at $700/mt CFR FEA, while no bids were reported. Meanwhile, CFR Southeast Asia VCM

was also assessed unchanged at $705/mt. Deals were heard done in a range of $690-710/mt CFR SEA

this week.

Contact Details: 344, A to Z Indl. Estate, G. K. Marg, Lower Parel (w), Mumbai 400013, INDIA | Email:info@polymerupdate.com | Tel: +91-22-61772000 (25lines) | Fax: +91-22-61772025

Week 38 September 23, 2015

POLYMERUPDATE - PVC MARKET SUPPLY SCENARIO

R

A

S

S

A

D

MU

PVC plant to be restarted by Suzhou Huasu Plastics

Suzhou Huasu Plastics is likely to resume production at its polyvinyl chloride (PVC) plant. The plant was shut was taken off-stream in mid-September 2015 for a maintenance turnaround. The company is expected to

restart operations at its PVC plant by this weekend. Located in Jiangsu province, China, the plant has a production capacity of 130,000 mt/year.

PVC plant ilkely to be shut by Formosa

Formosa Plastics Corp (FPC) is in plans to shut its polyvinyl chloride (PVC) plant for a maintenance turnaround. The plant is expected to be taken off-stream in end-October 2015. It is planned to remain shut for

around 7 days Located at Ningbo in Zhejiang province of China, the plant has a production capacity of 400,000 mt/year.

Contact Details: 344, A to Z Indl. Estate, G. K. Marg, Lower Parel (w), Mumbai 400013, INDIA | Email:info@polymerupdate.com | Tel: +91-22-61772000 (25lines) | Fax: +91-22-61772025

Week 38 September 23, 2015

PLATTSPrice Analysis of PVC Chain Processing Margins

Naphtha to Ethylene

Naphtha to PVC

R

A

S

Typical North East Asian $/mt margin for producing ethylene

from naphtha using a conversion cost of $350/mt

Ethylene to PVC

MU

S

A

D

Premium or discount of CFR FE Asia PVC prices compared to ethylene

Premium or discount of CFR FE Asia PVC prices over naphtha

PVC : VCM Ratio

CFR FE Asia PVC prices as a ratio to VCM

Contact Details: 344, A to Z Indl. Estate, G. K. Marg, Lower Parel (w), Mumbai 400013, INDIA | Email:info@polymerupdate.com | Tel: +91-22-61772000 (25lines) | Fax: +91-22-61772025

Week 38 September 23, 2015

CRISIL ResearchMacroeconomics & Currency Monthly Analysis

Overview: The commodity blessing

The global downturn, particularly the sharp slowdown in the resource-intensive Chinese economy, has depressed the prices of many

commodities. The decline is broad-based, including metals, oil and agricultural commodities. Although there are pockets of stress

within India due to low commodity prices, the overall economy stands to gain as the country is a net importer of a majority of these

commodities. The recent depreciation of currency has pared some gains from the drop in commodity prices. Yet, decline in commodity

prices has been much sharper than currency depreciation. Net-net, imports are cheaper. The fall in international commodity prices,

especially of crude oil, has helped improve India's key macroeconomic parameters, such as fiscal deficit, current account deficit and

inflation. Low crude prices have also provided an opportunity to reform the fuel subsidy regime. Industries dependent on oil, such as

auto, also get a boost from lower fuel prices. Lower international prices of edible oil have proved a blessing this year. However, weak

monsoons are expected to take a toll on acreage, yields and output of oilseeds. A drop in international non-coking coal prices will

reduce input costs for sectors such as power. India is a significant exporter of agricultural products and is trade surplus in the

segment. The exports include 11.6% of total rice production, 4% of total wheat production and also cotton. The slump in global prices

hurts the export income of farmers already reeling under consecutive monsoon failure. Metal companies also stand to lose, particularly

given a drop in aluminum and steel prices.

R

A

S

S

A

D

MU

IIP splutters in July as factory wheels jam

Industrial production growth moderated to 4.2% in July from 4.4% in June. On a month-on-month basis also growth remained weak.

The picture for manufacturing was also less positive with growth slowing to 4.7% in July. That said, the numbers did throw up a

bright spot - for one, the capital goods sub-index rose 10.6%. It was disappointing to see the consumer-oriented sectors lose

momentum seen in July (1.3%), signalling that consumption demand remains fragile. Unseasonal rains early this year and the weak

progress of monsoon so far are telling on demand. As a result, low capacity utilisation is a key challenge faced by most industrial

sectors.

Contact Details: 344, A to Z Indl. Estate, G. K. Marg, Lower Parel (w), Mumbai 400013, INDIA | Email:info@polymerupdate.com | Tel: +91-22-61772000 (25lines) | Fax: +91-22-61772025

Week 38 September 23, 2015

Inflation resists a drop in August

Consumer price inflation (CPI) stood at 3.7% in August, unchanged from the previous month. July inflation was revised down from 3.8% released

earlier. In August, core inflation continued to ease, but a further fall in overall inflation was contained by a pick-up in the food and fuel related

inflation. Food inflation, at 2.2%, was 10 basis points (bps) higher than in July, whereas fuel inflation (fuel and light), at 5.7%, was up 30 bps.

Wholesale price index data continued to be in the negative zone, but the extent of decline slowed. Meanwhile, with rising rainfall deficiency, food

inflation in some commodities is firming up, and if not contained, can lower some gains from falling fuel prices. Core inflation (CPI excluding food

price index, fuel and light, and petrol and diesel) fell to 5.2% in August, down 10 bps over July - its second consecutive monthly decline. Much of

this fall came from lower inflation in health, personal care effects and education. The continued decline in core reflects sluggish demand conditions

in the economy.

FII outflows drag rupee under

The rupee lost ground against most major currencies in August as foreign institutional investors made a beeline out of the emerging markets following a

devaluation of the yuan. China devalued the yuan by 4%, announcing a change to its peg against the US dollar. The move, coming at a time when the

Chinese economy is in the throes of a slowdown, pulled down commodity prices and created jitters in currency and stock markets worldwide. The rupee hit a

low of 66.7/$ on August 25 before recovering a tad (it has depreciated 3% since the announcement of the Chinese devaluation). It averaged 65.1/$ for the

month, weaker than 63.6/$ in July. Against the euro and the pound, it dropped on average 3.5% and 2.4%, respectively.

R

A

S

S

A

D

MU

About CRISIL Research

CRISIL Research is India's largest independent and integrated research house. We provide insights, opinions, and analysis on the Indian economy, industries, capital markets and companies. We are India's most credible

provider of economy and industry research. Our industry research covers 70 sectors and is known for its rich insights and perspectives. Our analysis is supported by inputs from our network of more than 4,500 primary

sources, including industry experts, industry associations, and trade channels. We play a key role in India's fixed income markets. We are India's largest provider of valuations of fixed income securities, serving the mutual

fund, insurance, and banking industries. We are the sole provider of debt and hybrid indices to India's mutual fund and life insurance industries. We pioneered independent equity research in India, and are today India's largest

independent equity research house. Our defining trait is the ability to convert information and data into expert judgements and forecasts with complete objectivity. We leverage our deep understanding of the macroeconomy

and our extensive sector coverage to provide unique insights on micro-macro and cross-sectoral linkages. We deliver our research through an innovative web-based research platform. Our talent pool comprises economists,

sector experts, company analysts, and information management specialists.

Contact Details: 344, A to Z Indl. Estate, G. K. Marg, Lower Parel (w), Mumbai 400013, INDIA | Email:info@polymerupdate.com | Tel: +91-22-61772000 (25lines) | Fax: +91-22-61772025

Week 38 September 23, 2015

POLYMERUPDATE

PLATTS

Editorial Contact:

Global Editorial Director, Petrochemicals: Simon Thorne

Director, Editorial: JwalantOza

Managing Editor:PremaViswanathan

Senior Editors: Harsh Nadkarni, Feroz Khan

Singapore Editors: Gustav Holmvik, Ng Bao Ying, Michelle Kim, HengHui, Genevieve Soong,

MaithreyiRamdas, Pamela Sumayao, Jennifer Lee

Sales Contact:

Marketing Managers:Reshma Jadhav, Tausif Siddiqi, Nilesh Shah

Tokyo Editors:FumikoDobashi, Anton Ferkov

About Polymerupdate: Polymerupdate is a destination for global players seeking plastics and petrochemical intelligence. We are a world renowned provider of real time news and price alerts spanning a whole spectrum of

products including Crude oil, Naphtha, Aromatics, Olefins, Polyolefins and Petrochemical Intermediates.

R

A

S

Credible, neutral and regular reporting has attracted over a thousand subscribers who include most of the regions leading resin producers, processors, distributors, traders, consultant firms, investment bankers, credit rating

agencies, as well as front runners in the international information services, news and media companies.

To further facilitate its readers, Polymerupdate recently launched the World's 1st Android & Blackberry Applications for daily polymer news & prices. Polymerupdate through it's daily alerts helps companies worldwide increase

their revenues and their profits, by providing them with real time, quality, valuable and business critical information. With its well appointed stringers and channel partners from across the world, Polymerupdate is rapidly

extending its reach within the industry, as it strives toward its goal of becoming the number one player in its space globally. Additional information available on http://www.polymerupdate.com .

S

A

D

MU

Copyright (C) 2015 Shalimar Infotech Pvt. Ltd. ALL RIGHTS RESERVED:Shalimar Infotech Pvt. Ltd. makes no warranties as to the accuracy of information, or results to be obtained from use. No portion of this

publication may be photocopied, reproduced, retransmitted, put into a computer system or otherwise redistributed without prior written authorization from Polymerupdate.com. Polymerupdate.com is a TRADEMARK of Shalimar

Infotech Pvt. Ltd.

About Platts: Founded in 1909, Platts is a leading global provider of energy, petrochemicals and metals information and a premier source of benchmark prices for the physical and futures markets. Platts' news, pricing,

analytics, commentary and conferences help customers make better-informed trading and business decisions and help the markets operate with greater transparency and efficiency. Customers in more than 150 countries

benefit from Platts coverage of the carbon emissions, coal, electricity, oil, natural gas, metals, nuclear power, petrochemical, and shipping markets. A division of The McGraw-Hill Companies (NYSE: MHP), Platts is

headquartered in New York with approximately 900 employees in more than 15 offices worldwide. Additional information is available at www.platts.com.

Platts content copyright 2015: Copyright 2015 The McGraw-Hill Companies. All rights reserved. No portion of this publication may be photocopied, reproduced, retransmitted, put into a computer system or otherwise

redistributed without prior written authorization from Platts. Platts is a trademark of The McGraw-Hill Companies Inc. Information has been obtained from sources believed reliable. However, because of the possibility of human

or mechanical error by sources, McGraw-Hill or others, McGraw-Hill does not guarantee the accuracy, adequacy or completeness of any such information and is not responsible for any errors or omissions or for results obtained

from use of such information. See back of publication invoice for complete terms and conditions.

About The McGraw-Hill Companies: McGraw-Hill announced on September 12, 2011, its intention to separate into two companies: McGraw-Hill Financial, a leading provider of content and analytics to global financial

markets, and McGraw-Hill Education, a leading education company focused on digital learning and education services worldwide. McGraw-Hill Financials leading brands include Standard & Poors Ratings Services, S&P Capital

IQ, S&P Dow Jones Indices, Platts energy information services and J.D. Power and Associates. With sales of $6.2 billion in 2011, the Corporation has approximately 23,000 employees across more than 280 offices in 40

countries. Additional information is available at http://www.mcgraw-hill.com/.

Contact Details: 344, A to Z Indl. Estate, G. K. Marg, Lower Parel (w), Mumbai 400013, INDIA | Email:info@polymerupdate.com | Tel: +91-22-61772000 (25lines) | Fax: +91-22-61772025

También podría gustarte

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Board Resolution - Annual MeetingDocumento4 páginasBoard Resolution - Annual MeetingAljohn Sebuc100% (1)

- Polymer Additive Reference StandardsDocumento36 páginasPolymer Additive Reference StandardsvasucristalAún no hay calificaciones

- Polymerscan: Americas Polymer Spot Price AssessmentsDocumento28 páginasPolymerscan: Americas Polymer Spot Price AssessmentsmcontrerjAún no hay calificaciones

- Article 1232-1235Documento3 páginasArticle 1232-1235Dianna Rose Vico100% (1)

- Dynisco Extrusion Handbook C0d23eDocumento293 páginasDynisco Extrusion Handbook C0d23eSimas Servutas50% (2)

- Extruder Screw Desing Basics PDFDocumento54 páginasExtruder Screw Desing Basics PDFAlvaro Fernando Reyes Castañeda100% (6)

- Sổ tay thuế 2023 PWCDocumento45 páginasSổ tay thuế 2023 PWCDuc PhamAún no hay calificaciones

- Public Sector Accounting: Mr. Evans AgalegaDocumento35 páginasPublic Sector Accounting: Mr. Evans AgalegaElvis Yarig100% (1)

- Po 20140924Documento29 páginasPo 20140924mcontrerjAún no hay calificaciones

- Po 20140910Documento30 páginasPo 20140910mcontrerjAún no hay calificaciones

- Platts PP 27 May 2015Documento11 páginasPlatts PP 27 May 2015mcontrerjAún no hay calificaciones

- Polymerscan: Americas Polymer Spot Price AssessmentsDocumento29 páginasPolymerscan: Americas Polymer Spot Price AssessmentsmcontrerjAún no hay calificaciones

- Aditivo AglomeranteDocumento11 páginasAditivo AglomerantemcontrerjAún no hay calificaciones

- ScrewDocumento9 páginasScrewmcontrerjAún no hay calificaciones

- Belgian Punishment Novel Explores WWII Era SocietyDocumento5 páginasBelgian Punishment Novel Explores WWII Era SocietymcontrerjAún no hay calificaciones

- Platts Pe 24 June 2015Documento12 páginasPlatts Pe 24 June 2015mcontrerjAún no hay calificaciones

- Platts PVC 24 June 2015Documento10 páginasPlatts PVC 24 June 2015mcontrerjAún no hay calificaciones

- Platts PVC 29 July 2015Documento10 páginasPlatts PVC 29 July 2015mcontrerjAún no hay calificaciones

- Platts PP 24 June 2015Documento11 páginasPlatts PP 24 June 2015mcontrerjAún no hay calificaciones

- Platts PE 29 July 2015Documento14 páginasPlatts PE 29 July 2015mcontrerjAún no hay calificaciones

- Platts Pe 24 June 2015Documento12 páginasPlatts Pe 24 June 2015mcontrerjAún no hay calificaciones

- Platts PP 29 July 2015Documento11 páginasPlatts PP 29 July 2015mcontrerjAún no hay calificaciones

- Platts PVC 26 August 2015Documento10 páginasPlatts PVC 26 August 2015mcontrerjAún no hay calificaciones

- Platts PP 23 Sept 2015Documento11 páginasPlatts PP 23 Sept 2015mcontrerjAún no hay calificaciones

- Platts PE 26 August 2015Documento13 páginasPlatts PE 26 August 2015mcontrerjAún no hay calificaciones

- SAP 120-200 MeshDocumento1 páginaSAP 120-200 MeshmcontrerjAún no hay calificaciones

- Platts PP 26 August 2015Documento11 páginasPlatts PP 26 August 2015mcontrerjAún no hay calificaciones

- Major Application Areas of BentoniteDocumento125 páginasMajor Application Areas of BentoniteApsari Puspita AiniAún no hay calificaciones

- NW 15092014 000000 PDFDocumento11 páginasNW 15092014 000000 PDFmcontrerjAún no hay calificaciones

- Platts PE 23 Sept 2015Documento14 páginasPlatts PE 23 Sept 2015mcontrerjAún no hay calificaciones

- Role of Rheology in ExtrusionDocumento25 páginasRole of Rheology in Extrusionmshussein2009Aún no hay calificaciones

- Role of Rheology in ExtrusionDocumento25 páginasRole of Rheology in Extrusionmshussein2009Aún no hay calificaciones

- Taylor Scientific ManagementDocumento6 páginasTaylor Scientific ManagementMondayAún no hay calificaciones

- International Financial Management: Bapuji B-Schools Lake View Campus, SS Layout Davangere-577004Documento3 páginasInternational Financial Management: Bapuji B-Schools Lake View Campus, SS Layout Davangere-577004Arun NijaguliAún no hay calificaciones

- Ark Innovation Etf Arkk HoldingsDocumento2 páginasArk Innovation Etf Arkk Holdingshkm_gmat4849Aún no hay calificaciones

- Worksheet - Accounting For Share CapitalDocumento6 páginasWorksheet - Accounting For Share CapitalPrisha SharmaAún no hay calificaciones

- Birth of The CISG - Its Applicability and NatureDocumento12 páginasBirth of The CISG - Its Applicability and NatureAshi JainAún no hay calificaciones

- Pipeline Material ProcurementDocumento19 páginasPipeline Material ProcurementTejas KadamAún no hay calificaciones

- Fintech PresentationDocumento6 páginasFintech PresentationStudent Placement CoordinatorAún no hay calificaciones

- Studio Policy - Melody Piano EatonDocumento2 páginasStudio Policy - Melody Piano Eatonapi-551533832Aún no hay calificaciones

- I-Bytes Travel & Transportation February Edition 2021Documento70 páginasI-Bytes Travel & Transportation February Edition 2021IT ShadesAún no hay calificaciones

- 14.54 International Economics Handout 6: 1 A Monetary ModelDocumento7 páginas14.54 International Economics Handout 6: 1 A Monetary ModelMartin ZapataAún no hay calificaciones

- Adam Kleen's Profit and Loss for 2020Documento4 páginasAdam Kleen's Profit and Loss for 2020Kharul AzharAún no hay calificaciones

- Advanced Financial Management Test 1 May 2024 Solution 1701932012Documento15 páginasAdvanced Financial Management Test 1 May 2024 Solution 1701932012shauryagupta20013007Aún no hay calificaciones

- Advantages of GlobalizationDocumento8 páginasAdvantages of GlobalizationKen Star100% (1)

- VN STEEL INDUSTRY ANALYSISDocumento2 páginasVN STEEL INDUSTRY ANALYSISThanh Nguyen NgocAún no hay calificaciones

- Chapter 7 CaseDocumento3 páginasChapter 7 CaseCHÂU TRẦN MINHAún no hay calificaciones

- Chapter 1 Economic Way of ThinkingDocumento78 páginasChapter 1 Economic Way of ThinkingKathleen Kaye De MesaAún no hay calificaciones

- CSR Activities in Banking Sector PDFDocumento40 páginasCSR Activities in Banking Sector PDFkismat yadav100% (1)

- Surendar ReportDocumento35 páginasSurendar Reportsnekanvns344Aún no hay calificaciones

- M-2 Boq - Rakesh RDocumento16 páginasM-2 Boq - Rakesh RNidhi MehtaAún no hay calificaciones

- IEHE Bhopal Online PaymentDocumento1 páginaIEHE Bhopal Online Paymentraja20005tiwariAún no hay calificaciones

- Tahi - HatiDocumento53 páginasTahi - HatiZhanra Therese Arnaiz100% (1)

- Hiwriters - Free Final Year Project Topics - Download Research Project MaterialsDocumento15 páginasHiwriters - Free Final Year Project Topics - Download Research Project MaterialsEmmanuel prince NoryaaAún no hay calificaciones

- GIN - 05820402 - Priyadarshan Hasigala Narayanaswamy - STA - Passport and US VisaDocumento5 páginasGIN - 05820402 - Priyadarshan Hasigala Narayanaswamy - STA - Passport and US VisaALexAún no hay calificaciones

- Journal 8 Yong112Documento10 páginasJournal 8 Yong112Lisa AmruAún no hay calificaciones

- Workflow Automation Engine and Its Impact On B2B Ecommerce Digital TransformationDocumento25 páginasWorkflow Automation Engine and Its Impact On B2B Ecommerce Digital TransformationahmadAún no hay calificaciones

- Business Organisation ProjectDocumento8 páginasBusiness Organisation ProjectGAME SPOT TAMIZHANAún no hay calificaciones