Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Plea For Strategic IR - The IRO Role - Mouthpiece or Strategic Advisor?

Cargado por

MSLTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Plea For Strategic IR - The IRO Role - Mouthpiece or Strategic Advisor?

Cargado por

MSLCopyright:

Formatos disponibles

Plea for Strategic IR

The IRO rolemouthpiece or strategic advisor?

W W W.CNC- COMMUNICATIONS.COM

Plea for Strategic IR

The IRO rolemouthpiece or strategic advisor?

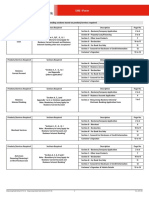

TABLE OF CONTENT

The IRO rolemouthpiece or strategic advisor? .............................................................................. 3

Two-way communications .................................................................................................................. 3

Chicken and egg .................................................................................................................................. 3

Reporting lines ................................................................................................................................... 3

Looking management in the eye ........................................................................................................ 4

Shareholder activism ......................................................................................................................... 5

The strategic IRO the ideal profile ................................................................................................. 5

Combining a rare set of skills ............................................................................................................. 6

Conclusion .......................................................................................................................................... 8

About CNCCommunications & Network Consulting .................................................................... 8

W W W.CNC- COMMUNICATIONS.COM

Plea for Strategic IR

The IRO rolemouthpiece or strategic advisor?

THE IRO ROLEMOUTHPIECE OR STRATEGIC ADVISOR?

An increasingly complex global capital markets environment and the growing willingness of

institutional shareholders to become active, if not activist, investors have amplified demands

on how companies interact with shareholders, and put significant pressure on IR teams. Today

more than ever, making full use of the IR role means deploying it as a strategic asset that gauges

market sentiment and helps Board members to decide, market andwhere necessarydefend

corporate actions and strategy. For many listed companies, this means upgrading the IR role

by adding strategic responsibilities, hiring or developing strategic thinkers into their IR teams,

and rethinking organisational structures and reporting lines. Importantly, a highly effective and

strategic IR capability frees up management time and creates greater reach for the CEO and CFO.

TWO-WAY COMMUNICATIONS

Investor Relations has been a discrete function for some 50 years in the US and for about

30 years in Europe. Corporate Communications was traditionally one-way communication with the

media and the same was initially the case with many IR teams. Even today with the rapid growth in

social media channels, many listed companies evidently continue to feel most comfortable with

the tradition of one-way traffic, outbound only. This narrow focus ignores an extremely important

second aspect to the IR role: the participation in, and constant analysis of, the debate that the

market conducts about the company. The ebb and flow of this debate can radically increase or limit

a companys strategic options, and therefore should inform the way the company communicates.

Ultimately, the quality of communication and engagement influences valuation.

CHICKEN AND EGG

Many Board members agree with this line of reasoning in principle, but argue that while they would

be quite willing to give the Investor Relations Officer (IRO) the leeway to conduct an active, strategic

dialogue with the market and to offer his or her opinions at Board level, they do not believe that

their IROs have the breadth of experience to warrant a seat at the top table in their own right. And

many IROs are perceived to lack the wherewithal and the confidence to operate at that altitude. At

the same time, ironically, many IROs voice their frustration, in separate conversations of course, at

being reduced to mouthpieces as they are denied the opportunity to engage internally in shaping

the message; nor do they contribute to forming strategy.

So either the Board, despite assurances, isnt truly willing to give otherwise perfectly capable IROs

the benefit of the doubt, or individuals with insufficient strategic skills, or perhaps communications

skills, are occupying the IR role. A classic chicken-and-egg situation: the right people have to be

in place if the full range of IR services is to be delivered, but they will not be attracted to the role if

they are not given a sufficiently wide, strategic brief.

REPORTING LINES

The first step is to consider the internal organisational set-up of the IR team. Today, most Heads

of Communications report to the CEO and, typically, Heads of IR report to the CFO. (A few notable

exceptions report to the CEOusually to good effect). This traditional arrangement leaves one of

the communications mantras, corporate one-voice-policy, exposed to the quality of the relationship

Plea for Strategic IR

The IRO rolemouthpiece or strategic advisor?

between CEO and CFO, and to the ability and willingness of the Heads of Communications and IR

to cooperate and coordinate. An IR reporting line into the CFO also signals, prima facie, that the

role sits firmly within the finance function but does not necessarily carry strategic responsibilities.

Having said this, we generally feel comfortable with the Head of IR reporting into the CFO.

Nonetheless, to address the risk of mixed messages to the market, including about the importance

of IR, we envisage at least two potential options:

Firstly, an expanded remit for IR and a seat on the Executive Committee. We also see examples

of IR reporting directly to the CEO, for example both BASF and Volkswagen have worked with this

structure. At Commerzbank, the Head of IR sits on the Executive Committee.

Secondly, we also see some IR Directors taking over the broader Communications role while

retaining their IR responsibility, for example Wolseley plc and Experian plc in the UK. This second

option is that of a strategic communications superhead, who typically sits on the Executive

Committee and embraces IR within a full range of communications activities.

The superhead role should ideally report to the CEO with a strong dotted line to the CFO. This is

the case at Rheinmetall AG in Dsseldorf, for instance. The risk with this structure is that IR becomes

too far removed from the decision-making body. However, we recognise that, driven by digital

advances, the interaction between all communications disciplines has to become much closer

and more collegiate. Moreover, because clearly such a superhead could not personally engage

directly with all stakeholder groups, he or she would have to adopt a coordinating background role

for the various functions, taking on frontline duties only in his or her field of expertise. Beyond

that, the individual would have a strong incentive to attract and recruit, and/or develop, suitable

individuals to report to him or her for the other communications disciplines. Well executed, this setup would ensure one voice, but it would also achieve a direct financial goal: the communications

superhead would have one single budget to allocate across the entire communications remit. This

may well serve to recalibrate what we consider to be currently a budgetary imbalance in favour of

Communications and to the detriment of IR which, after all, looks after the group of stakeholders

that ultimately own the company and control its strategic direction: i.e. the shareholders.

LOOKING MANAGEMENT IN THE EYE

Regardless of the IR reporting line, it is understandable that investors want to speak to the

decision-makers in target companies: the CEO and the CFO. Investors are also increasingly building

relationships with the Chairman and Non-Executive Directors/Supervisory Board Members. This

is entirely understandable given that it is ultimately the Board which takes the strategic, valueenhancing or destroying decisions for the company. However, this in no way diminishes the role

of IR: there is a wealth of day-to-day interaction which wise investors prefer to have with a wellinformed IRO. And when the IRO also has deep knowledge of the company and understanding

of the sector and the environment, it is eminently possible for the IRO to maintain a strategic

dialogue with the buy side. This does not undermine the critical role of the CEO or CFO, but

certainly facilitates a much better use of their time and ensures that investors are well prepared in

advance of management discussions.

W W W.CNC- COMMUNICATIONS.COM

Plea for Strategic IR

The IRO rolemouthpiece or strategic advisor?

CNC Communications & Network Consulting recently conducted a global study of investor

and sell-side views involving over 500 interviews split evenly between Europe, the US

and Asia. The increasing importance of high-quality IR to the global investor community

was one of the features of the results. Exactly half of investors said that a dedicated and

cruciallywell informed IR function had become more important in allowing them to

understand a companys equity story over the past few years, a view echoed by two-thirds

of sell-side respondents. Furthermore, 86% of investors believe that the quality of a

companys investor communications is an important driver of valuation for any company.

SHAREHOLDER ACTIVISM

Shareholder activism is no longer just a phenomenon we see across the other side of the Atlantic.

Activist assets under management were recently estimated to be in the region of $120bn

by The Economist/Hedge Fund Research February 2015. A not insubstantial portion is available

for investment in European companies. Activism around governance in the UK has certainly

picked up, in particular regarding Executive remuneration and Board composition, for

example. Many observers expect this phenomenon to establish itself imminently and fully in

Continental Europe.

Strategic IR very much comes into its own when confronted with aggressive investor activity:

a compelling, long-term equity story offering unequivocal strategic direction and showing a clear

trajectory for continuous value generation is the best antidote to activists frequently short-term

profit agenda.

Given the growing activist focus on governance in Europe, we are surprised to see some IR

Directors, particularly in the UK, walk away from difficult strategic and governance topics such as

senior executive pay. In many companies, we see IR ceding ground to the Company Secretary, for

example. There is a very real danger of poorly co-ordinated communication between the company

and its shareholders and some of the disagreements on executive pay have almost certainly been

exacerbated by lack of alignment internally. We consider it ill-advised for IR to stand back from this

thorny topic. In Continental Europe, with its different governance structures, we typically find the

IR Director out of necessity being much more hands-on regarding governance issues, including,

for example, remuneration and the thorny topic of CEO succession to the role of Chairman of the

Supervisory Board.

THE STRATEGIC IROTHE IDEAL PROFILE

Quite clearly, structures are dependent on people and the calibre of the individual in the IR role is

of paramount importance. If he or she does an excellent job, the demands on senior management

time will be reduced. If the IRO is not seen to be up to the job or close enough to the strategic and

decision-making hub of the organisation, senior management can expect that their phones will

continue to ring. This is the challenge and the opportunity for the Board when hiring or promoting

into this position. So what is the ideal profile for strategic IR?

Plea for Strategic IR

The IRO rolemouthpiece or strategic advisor?

There is no silver bullet, no perfect profile. The optimal IR capability is company dependent and

determined by market capitalisation and freefloat, capital structure and shareholder composition,

geographic footprint and stakeholder make-up. An effective IR team is one that helps to deliver

the companys strategic goals by creating strategic freedom to act for the Board. More often than

not, delivering strategic IR is complex and typically a team effort.

COMBINING A RARE SET OF SKILLS

IR is an unusual function. It combines heavy-duty, highly technical valuation skills with compelling

storytelling abilities. More recently, a working knowledge of social media has also been added to

the mix. It is indeed rare to find individuals who excel at these very distinctive skills. Thus most IR

functions, certainly for larger companies, are a composite.

In Continental Europe, particularly Germany, we find larger teams and larger budgets, albeit

considerably smaller than the Communications budgets. Equally, we frequently find a more

structured, sometimes even a strategic, approach to IR. This extends to a clear sense of the roles

and responsibilities within the IR team with distinct skill sets, for example team members focusing

on key clients of IR including institutional buy- and sell-side, often with a geographic split; retail

investors; debt investors; CSR and more recently digital.

In the UK, the IR team is typically smaller, quite often comprising a Head of IR with access to a

PA or perhaps an analyst. Traditionally in the UK, the corporate broker has effectively provided

an extended work bench for the IR team. Since the financial crisis, however, there has been some

evidence of withdrawal of the corporate broking resource. Indeed in response, the in-house IR

function is beginning to pick up where the broker left off. In addition to the core valuation and

communication skills, we are seeing much greater attention being paid to softer skills which

include the ability to influence; a proactive targeting capability; and a strong grasp of how digital

can support the IR function.

In summary, we see the following characteristics as providing the basis for strategic IR:

Heavy-duty valuation skills

As the IR remit becomes more global, we have seen increased demand for technical and

valuation skills in the IR function. Good IR ensures that investors have the information they

need to value the company. It therefore tends to reduce the valuation gap between the company

and the market, and also irons out volatility caused by clumsy guidance. Indeed expectations

management is core to the IR role. This includes soft skills but importantly also necessitates a

robust understanding of how investors go about the process of valuing a stock and a company.

This will clearly shape disclosure.

If the IRO has a strong financial background, we frequently see the IR role combined with

corporate development, particularly in companies with an affinity towards strategic acquisitions

or divestments. Having IR closely involved in these transactions lends additional credibility to

the strategic significance of the IR role.

W W W.CNC- COMMUNICATIONS.COM

Plea for Strategic IR

The IRO rolemouthpiece or strategic advisor?

For Private Equity investors looking to bring a company to market, the IR role is regarded as

being important in an IPO and we find PE investors are taking a keen interest in the calibre of

the IR professional filling that role. Here, we typically see a keen expectation with regard to

valuation skills, as well as a preference for in-house, hands-on IR experience.

The story-teller

One of the key IR responsibilities is crafting and developing an equity story that resonates and

compels. The ability to quickly absorb and process new data, distil and make sense of a complex

set of circumstances is a pre-requisite. More importantly, a highly articulate, strategically astute

professional is required to translate raw information into an equity story and to identify the hooks

to the investment community. For companies with multinational operations, performance is

often affected by both macro- and micro-economic factors. A high-performing IR team needs to

be on the front foot and highly attuned to the sensibilities of both the buy- and sell-side audience.

Shaping the narrative is a critical element of the IR role.

Influencing inwards and outwards

We see most IROs demonstrating a strong ability to communicate externally spending time on

the road and building strong relationships within the investment community. Not all, however,

are as diligent at demonstrating their strategic value internally by conveying valuable market

feedback back into the organization; the two-way street mentioned earlier. A successful IRO

absolutely needs to hone internal influencing skills; the ability to shape opinions both internally

and externally is critical in a matrix organization with multiple stakeholders. From being the

spokesperson for the company, to playing a supporting role for the management team; from

coordinating amongst peers in other departments to gathering information, to feeding back

difficult and challenging messages straight to the Board, IR requires maturity and judgment, as

well as conviction in the value the role delivers.

Nature or nurture?

All this begs the question what is the route into IR? Over the years, it has been typical for sellside analysts in particular to cross the fence and become IROs. After all, the sell-side analyst

has a firm grasp of valuation and typically a deep sector understanding. Also they are used to

marketing as it has become a much larger part of what the sell-side analyst does. Interestingly,

however, as IR has become a more mature profession, we have also seen a number of companies

insisting on prior in-house IR experience. Part of the reason for this is that not every investment

banker transitions well into a corporate environment. As mentioned, the ability to influence

internally is critically important to strategic IR and a seasoned corporate executive may well be

better at this than a more narrowly focused analyst.

Very few start their career in IR and we certainly see the benefit of prior experience. There is no

one route into the profession and the best IR teams will be diverse in terms of experience and

career trajectory.

Plea for Strategic IR

The IRO rolemouthpiece or strategic advisor?

CONCLUSION

We are firm believers in what IR as a profession can deliver. We also agree that many IR

teams do not yet have the seat at the top table that is needed in order to make a strategic

contribution which ultimately flows through to valuation. If IR is to occupy this strategic

position the Board, colleagues and investors must be won over. The first step for IR is to

be confident and articulate about the value that the function can deliver. The next step is

embedding strategic IR within the organisation. Here Board-level buy in is crucial.

This article has been prepared by

Harald Kinzler

Kevin Soady

CNC Communications & Network Consulting

Gillian Karran-Cumberlege

Shu Zhang

Fidelio Partners

ABOUT CNCCOMMUNICATIONS & NETWORK CONSULTING

CNC is an experienced international strategic

consultancy which helps clients solve business

problems

through

communications.

When

Communication Matters, companies, institutions and

individuals use CNCs unrivalled expertise to advise

on communications affecting decisions, valuation,

and change and reputation. We work in corporate and

financial communications, public affairs, crisis support

and change management, underpinned by a strong

understanding of the rapidly evolving digital media

environment. CNC has 11 offices in eight countries

worldwide.

ABOUT FIDELIO PARTNERS

Fidelio Partners is a Board Development and Executive

Search consultancy. Based in London we work inter

nationally. Business leaders choose to partner with

Fidelio because of our deep understanding of

Finance, Strategy, Communications and Governance

and our ability to source world-class talent across

these functions. Through Evaluation, Development

and Search our clients can ensure that the Board and

CNCCommunications & Network Consulting LTD

55 Whitfield Street London W1T 4AH

United Kingdom

T +44 20 32 19 88 00

london@cnc-communications.com

leadership team are well placed to: secure on-going

access to capital, sustain corporate reputation and

maintain the license to operate, and thereby increase

the value of the business.

Fidelio operates internationally from London and its

talented, highly qualified in-house research capability

includes fluent Mandarin, Cantonese, German, Italian

and Spanish speakers.

CNC Communications & Network Consulting AG

Leopold-Palais Leopoldstrae 10

80802 Munich Germany

T +49 89 599 458 0

F +49 89 599 458 200

info@cnc-communications.com

W W W.CNC- COMMUNICATIONS.COM

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Trump Book - Nov 14Documento82 páginasTrump Book - Nov 14MSL100% (1)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Mind The Gap From Salterbaxter MSLGROUPDocumento41 páginasMind The Gap From Salterbaxter MSLGROUPMSLAún no hay calificaciones

- Governing A Divided Nation - EbookDocumento43 páginasGoverning A Divided Nation - EbookMSLAún no hay calificaciones

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- A Guide To The Trump AdministrationDocumento81 páginasA Guide To The Trump AdministrationMSLAún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Powered by AI - Country ResultsDocumento28 páginasPowered by AI - Country ResultsMSLAún no hay calificaciones

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Work The Switches Before The German Federal ElectionDocumento3 páginasWork The Switches Before The German Federal ElectionMSLAún no hay calificaciones

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Insights Brussels - Brexit and BeyondDocumento20 páginasInsights Brussels - Brexit and BeyondMSL100% (1)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Navigating A Changing Energy Landscape - ON Energy Report Sept 2016Documento15 páginasNavigating A Changing Energy Landscape - ON Energy Report Sept 2016MSLAún no hay calificaciones

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Temer's First 100 Days and BeyondDocumento3 páginasTemer's First 100 Days and BeyondMSLAún no hay calificaciones

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- (Salterbaxter MSLGROUP Directions) Materiality - Breaking Out of The Strait-JacketDocumento6 páginas(Salterbaxter MSLGROUP Directions) Materiality - Breaking Out of The Strait-JacketMSLAún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Innovation Without Boundaries - People's Insights Aug & Sept 2015Documento40 páginasInnovation Without Boundaries - People's Insights Aug & Sept 2015MSLAún no hay calificaciones

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Brexit at Work Barometer - Inaugural Findings by CNCDocumento6 páginasBrexit at Work Barometer - Inaugural Findings by CNCMSLAún no hay calificaciones

- Six Things We Learnt From The EU ReferendumDocumento9 páginasSix Things We Learnt From The EU ReferendumMSLAún no hay calificaciones

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- A Chance For Change: The Tipping Point For Sustainable BusinessDocumento172 páginasA Chance For Change: The Tipping Point For Sustainable BusinessMSL100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Directions // Integrated Reporting: Measurement MattersDocumento12 páginasDirections // Integrated Reporting: Measurement MattersMSLAún no hay calificaciones

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Brazil's New GovernmentDocumento4 páginasBrazil's New GovernmentMSLAún no hay calificaciones

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- On Strawberries and Grapes - An Update On The Political Situation in BrazilDocumento2 páginasOn Strawberries and Grapes - An Update On The Political Situation in BrazilMSLAún no hay calificaciones

- Optimising Digital Collaboration From The Inside OutDocumento26 páginasOptimising Digital Collaboration From The Inside OutMSLAún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Insights Brussels - February 2016Documento16 páginasInsights Brussels - February 2016MSL100% (1)

- From Brussels To Paris and Beyond - ON Energy Report November '15Documento13 páginasFrom Brussels To Paris and Beyond - ON Energy Report November '15MSLAún no hay calificaciones

- Directions 2015: The Rise of ScienceDocumento48 páginasDirections 2015: The Rise of ScienceMSLAún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- MSLGROUP Germany Public Affairs Survey 2015Documento11 páginasMSLGROUP Germany Public Affairs Survey 2015MSLAún no hay calificaciones

- The Digital and Social Media Revolution in Public AffairsDocumento35 páginasThe Digital and Social Media Revolution in Public AffairsMSL100% (1)

- Insights Brussels - Oct 2015Documento9 páginasInsights Brussels - Oct 2015MSLAún no hay calificaciones

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- MSLGROUP Reputation Impact Indicator Study 2015 (China Edition)Documento48 páginasMSLGROUP Reputation Impact Indicator Study 2015 (China Edition)MSLAún no hay calificaciones

- Collective Citizenship - People's Insights June & July 2015Documento46 páginasCollective Citizenship - People's Insights June & July 2015MSL100% (1)

- MATTERS - Defining The New Communications AgendaDocumento48 páginasMATTERS - Defining The New Communications AgendaMSLAún no hay calificaciones

- HLB SME 1form (Original)Documento14 páginasHLB SME 1form (Original)Mandy ChanAún no hay calificaciones

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (120)

- Eng. Book PDFDocumento93 páginasEng. Book PDFSelvaraj VillyAún no hay calificaciones

- INCOME TAX OF INDIVIDUALS Part 1Documento3 páginasINCOME TAX OF INDIVIDUALS Part 1Abby TañafrancaAún no hay calificaciones

- JAIIB Paper 4 Module A Retail Banking PDFDocumento21 páginasJAIIB Paper 4 Module A Retail Banking PDFAssr Murty100% (1)

- Motor Vehicle InsuranceDocumento6 páginasMotor Vehicle InsuranceArunKumarAún no hay calificaciones

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2101)

- What's Your Investing IQDocumento256 páginasWhat's Your Investing IQAmir O. OshoAún no hay calificaciones

- Errata Group Statements Vol 2 17th Ed Reprint 2021Documento10 páginasErrata Group Statements Vol 2 17th Ed Reprint 2021THABO CLARENCE MohleleAún no hay calificaciones

- Business Studies - Exam Paper 1Documento12 páginasBusiness Studies - Exam Paper 1Azar100% (1)

- Escorts LTDDocumento34 páginasEscorts LTDSheersh jainAún no hay calificaciones

- Chapter 3 - Value and Logistics CostsDocumento19 páginasChapter 3 - Value and Logistics CostsTran Ngoc Tram AnhAún no hay calificaciones

- Module 4 - Executive Summary 6110Documento7 páginasModule 4 - Executive Summary 6110auwal0112Aún no hay calificaciones

- Ayush Gaur First Internship Project ReportDocumento43 páginasAyush Gaur First Internship Project Report777 FamAún no hay calificaciones

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Technical Indicators: - Stochastic Oscillator - Relative Strength Index - Moving Average Convergence-DivergenceDocumento32 páginasTechnical Indicators: - Stochastic Oscillator - Relative Strength Index - Moving Average Convergence-DivergenceChartSniperAún no hay calificaciones

- Varengold Bank FX Trading-Challenge - Prize 1,000,000 USDDocumento1 páginaVarengold Bank FX Trading-Challenge - Prize 1,000,000 USDKostas KazakosAún no hay calificaciones

- Pi ECO Vietnam Project Abstract & Summary 7 March 2019Documento11 páginasPi ECO Vietnam Project Abstract & Summary 7 March 2019ICT Bảo HànhAún no hay calificaciones

- Module 5 - Interests Formula and RatesDocumento14 páginasModule 5 - Interests Formula and RatesHazel NantesAún no hay calificaciones

- Application GuideDocumento130 páginasApplication GuideValentin DobchevAún no hay calificaciones

- Creating Value Beyond The Deal: Financial Services: Maximise Success by Keeping An Intense Focus On Three Key ElementsDocumento24 páginasCreating Value Beyond The Deal: Financial Services: Maximise Success by Keeping An Intense Focus On Three Key ElementsNick HuAún no hay calificaciones

- PBCom V CA, G.R. No. 118552, February 5, 1996Documento6 páginasPBCom V CA, G.R. No. 118552, February 5, 1996ademarAún no hay calificaciones

- Pivot Boss SummaryDocumento36 páginasPivot Boss SummaryVarun Vasurendran100% (2)

- CL Ka and SolutionsDocumento4 páginasCL Ka and SolutionsInvisible CionAún no hay calificaciones

- BSP M-2020-016 PDFDocumento9 páginasBSP M-2020-016 PDFRaine Buenaventura-EleazarAún no hay calificaciones

- Real Estate Business PlanDocumento3 páginasReal Estate Business PlanJio Victorino100% (2)

- Standar Gaji Indonesia 2008 - 2009 UpdatedDocumento8 páginasStandar Gaji Indonesia 2008 - 2009 Updatedwitoyo100% (40)

- SM1001904 Chapter-5 Caselets PDFDocumento4 páginasSM1001904 Chapter-5 Caselets PDFsai bhargavAún no hay calificaciones

- Foreign Exchange Market: Unit HighlightsDocumento29 páginasForeign Exchange Market: Unit HighlightsBivas MukherjeeAún no hay calificaciones

- Annexure A (Excel)Documento108 páginasAnnexure A (Excel)Sanjana JaiswalAún no hay calificaciones

- Law of Financial Institutions and Securities BLO3405: Vu - Edu.auDocumento28 páginasLaw of Financial Institutions and Securities BLO3405: Vu - Edu.auYuting WangAún no hay calificaciones

- Format Laporan Petty CashDocumento8 páginasFormat Laporan Petty CashIchalz NtsAún no hay calificaciones

- Assignment 2 POF Muhammad Yaseen (48535)Documento5 páginasAssignment 2 POF Muhammad Yaseen (48535)Muhammad Yaseen ShiekhAún no hay calificaciones

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)De EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Calificación: 4.5 de 5 estrellas4.5/5 (11)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0De EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Calificación: 5 de 5 estrellas5/5 (1)

- Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantDe EverandBlue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantCalificación: 4 de 5 estrellas4/5 (387)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsDe EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsCalificación: 5 de 5 estrellas5/5 (48)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewDe EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewCalificación: 4.5 de 5 estrellas4.5/5 (104)

- Generative AI: The Insights You Need from Harvard Business ReviewDe EverandGenerative AI: The Insights You Need from Harvard Business ReviewCalificación: 4.5 de 5 estrellas4.5/5 (2)

- Power and Prediction: The Disruptive Economics of Artificial IntelligenceDe EverandPower and Prediction: The Disruptive Economics of Artificial IntelligenceCalificación: 4.5 de 5 estrellas4.5/5 (38)

- Summary of Richard Rumelt's Good Strategy Bad StrategyDe EverandSummary of Richard Rumelt's Good Strategy Bad StrategyCalificación: 5 de 5 estrellas5/5 (1)