Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Business Policy

Cargado por

MikeeMouse070 calificaciones0% encontró este documento útil (0 votos)

18 vistas2 páginasBusiness Policy

Derechos de autor

© © All Rights Reserved

Formatos disponibles

DOCX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoBusiness Policy

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

18 vistas2 páginasBusiness Policy

Cargado por

MikeeMouse07Business Policy

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 2

White elephant definition

Any investment that nobody wants because it will

most likely end up being unprofitable. An

unprofitable investment, property or business that is

so expensive to operate and maintain that it is

extremely difficult to actually make a profit. An item

whose cost of upkeep is not in line with how useful

or valuable the item is.

increased from 24% in 2006 to 35% in 2012 (Annual

Report, 2012) through mergers and acquisitions as

discussed above, as well as, on the basis of

formation of direct subsidiaries. Moreover, PepsiCo

CEO

Indra

Nooyi

has

publicly

expressed

commitments to further increase the level of

presence of the company in emerging markets.

Strategic planning can be defined as the process of

determining an organisations primary objectives

and adopting courses of action that will achieve

these objectives (Boone and Kurtz, 2013, p.39) and

it plays a critical role in ensuring long-term growth

of a business entity.

Fourth, focus

on

organisational

culture.

Organisational culture can be defined as the

collection of words, actions, thoughts, and stuff

that clarifies and reinforces what a company truly

values and the nature of organisational culture

directly impacts its performance in short-term and

long-term perspectives.

PepsiCo mission statement has been worded by CEO

Indra Nooyi as Performance with Purpose and this

principle is closely integrated with the strategic

direction chosen for the company.

The most prominent aspects of PepsiCo strategy

forwarded by Ms Nooyi are based on the following

seven principles.

First, international market expansion strategy

through mergers and acquisitions. Mergers and

acquisitions can offer the advantages of gaining

access to competencies and infrastructure, reducing

direct costs and overheads and achieving organic

growth.

Recently, PepsiCo has engaged in important

mergers and acquisitions such as acquisition of juice

and diary businesses Lebedyansky and Wimm-BillDann in Russia, Lucky snacks and Mabel cookies in

Brazil, and Dilexis cookies in Argentina.

Second, formation of strategic alliances in

global scale. Specifically, strategic partnerships

have been formed with Tingyi in China in order to

claim a share in growing beverage market in China.

Moreover, formation of a joint-venture with Tata in

India to enhance drinking water manufacturing

capabilities, and initiation of strategic partnership

with Almarai in Saudi Arabia can be mentioned to

illustrate PepsiCos adoption of strategic alliances as

an integral part of the corporate strategy.

Important strategic alliances are formed by PepsiCo

at home markets as well. Specifically, by forming a

strategic alliance with Starbucks a global coffee

house chain, PepsiCo has been able to claim its

share from increasing energy drink market segment.

Third, focus on emerging markets. The share of

net revenues from developing and emerging

markets such as China, India, and Russia have been

PepsiCo CEO Indra Nooyi is widely believed to be an

unconventional corporate leader for a good reason.

It has been noted that shes been known to walk

the halls at Pepsi barefoot, sometimes even singing

along the way (Sheetz-Runkle, 2010, p.112) and

this fact communicates her willingness to embrace

her differences with positive implications on

employee morale and organisational culture.

The same message is effectively communicated to

organisational stakeholders and integrated into

Pepsi Brand as well in a way that the brand

marketing message is associated with making the

most of the moment, and embracing own

individuality.

Being listed among the top 25 Worlds Best

Multinational Workplaces by the Great Place to

Work Institute in 2012 can be interpreted as an

indication of effective working culture within

PepsiCo.

Fifth, developing and promoting the idea of

One PepsiCo. Specifically, Indra Nooyi has been

striving to increase the level of association of

individual brands with PepsiCo company values and

philosophy through promoting the idea of One

PepsiCo. This is meant to be facilitated through

sharing

supply-chain

management

and

infrastructure, operational costs for many brands

within PepsiCo portfolio have been decreased.

Sixth, innovation in marketing initiatives. A

wide range of innovative marketing initiatives

developed by PepsiCo marketing team include Do

Us a Flavor campaign that involved consumers in

17 countries submitting flavour ideas, development

of Lipton Brisk Star Wars game application for

mobile phones, and using celebrity endorsement in

an innovative manner by attracting a popular singer

amongst Pepsi brand target customer segment

Beyonce Knowles.

Importantly, cross-cultural differences in various

markets are taken into account when developing

and delivering PepsiCo marketing messages. For

example, the marketing tagline of Live for Now

associated with Pepsi brand has been modified as

Yalla Now and Oh Yes Abhi for Middle East and

Indian markets respectively taking into account

cross-cultural differences associated with these

markets.

Seventh, focus on increasing core organic

revenue. Core organic revenue can be explained as

a type of revenue that is achieved through

increasing the volume of production and sales.

PepsiCo core organic revenues were increased by

5% during 2012 (Annual Report, 2012) and the

company strategic level management is committed

to further increase the levels of core organic

revenues

through

maintaining

high

quality

standards and applying effective marketing strategy.

Moreover, organic revenues can be further

increased by concentrating on core competencies of

the business. It can be specified that a competence

is an attribute or collection of attributes possessed

by all or most of the companies in an industry

(Campbell et al., 2012, p.34).

High Inflation Rate

Exchange rate gains or losses related to foreign

currency transactions are recognized as transaction

gains or losses in our income statement as incurred.

We may enter into derivatives, primarily forward

contracts with terms of no more than two years, to

manage our exposure to foreign currency

transaction risk. Our foreign currency derivatives

had a total face value of $2.3 billion as of December

31, 2011 and $1.7 billion as of December 25, 2010.

At the end of 2011, we estimate that an unfavorable

10% change in the exchange rates would have

decreased our net unrealized gains by $105 million.

For foreign currency derivatives that do not qualify

for hedge accounting treatment, all losses and gains

were offset by changes in the underlying hedged

items, resulting in no net material impact on

earningas.

También podría gustarte

- Republic of The Philippines RA 8424Documento235 páginasRepublic of The Philippines RA 8424MikeeMouse07Aún no hay calificaciones

- Nature and Description of The Company: Tagline: "Enhancing Land, Enriching Lives, For More People."Documento11 páginasNature and Description of The Company: Tagline: "Enhancing Land, Enriching Lives, For More People."MikeeMouse07Aún no hay calificaciones

- Budget SummaryDocumento1 páginaBudget SummaryMikeeMouse07Aún no hay calificaciones

- Civil Action-After The Assessment Made by The Commissioner of Internal Revenue HasDocumento1 páginaCivil Action-After The Assessment Made by The Commissioner of Internal Revenue HasMikeeMouse07Aún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Registration of PropertyDocumento13 páginasRegistration of PropertyambonulanAún no hay calificaciones

- 2019 Apr 20 Dms Aiu MasterDocumento25 páginas2019 Apr 20 Dms Aiu MasterIrsyad ArifiantoAún no hay calificaciones

- Economy of Pakistan Course OutlineDocumento2 páginasEconomy of Pakistan Course OutlineFarhan Sarwar100% (1)

- Customs Officer PDFDocumento2 páginasCustoms Officer PDFHimanshu YadavAún no hay calificaciones

- 617 NP BookletDocumento77 páginas617 NP BookletDexie Cabañelez ManahanAún no hay calificaciones

- Bitumen Price List 1-09-2010 & 16-09-2010Documento2 páginasBitumen Price List 1-09-2010 & 16-09-2010Vizag RoadsAún no hay calificaciones

- Sustainable Space Exploration?Documento11 páginasSustainable Space Exploration?Linda BillingsAún no hay calificaciones

- Process of Environmental Clerance and The Involve inDocumento9 páginasProcess of Environmental Clerance and The Involve inCharchil SainiAún no hay calificaciones

- Sourecon 2011-Regn.Documento11 páginasSourecon 2011-Regn.kumareshcbeAún no hay calificaciones

- Hansen Aise Im Ch02Documento39 páginasHansen Aise Im Ch02FirlanaSubekti100% (1)

- Lecture 3 Profit Maximisation and Competitive SupplyDocumento36 páginasLecture 3 Profit Maximisation and Competitive SupplycubanninjaAún no hay calificaciones

- Introduction To GlobalizationDocumento6 páginasIntroduction To GlobalizationcharmaineAún no hay calificaciones

- Application Form For GKM-EAPDocumento1 páginaApplication Form For GKM-EAPCamille CasugaAún no hay calificaciones

- Awnser KeyDocumento3 páginasAwnser KeyChristopher FulbrightAún no hay calificaciones

- Economic System and BusinessDocumento51 páginasEconomic System and BusinessJoseph SathyanAún no hay calificaciones

- Algorithmic Market Making StrategiesDocumento34 páginasAlgorithmic Market Making Strategiessahand100% (1)

- Outward Remittance Form PDFDocumento2 páginasOutward Remittance Form PDFAbhishek GuptaAún no hay calificaciones

- Government Business InterfaceDocumento14 páginasGovernment Business InterfaceManoj SharmaAún no hay calificaciones

- 2017 Hu Spence Why Globalization Stalled and How To Restart ItDocumento11 páginas2017 Hu Spence Why Globalization Stalled and How To Restart Itmilan_ig81Aún no hay calificaciones

- Microeconomics ProjectDocumento5 páginasMicroeconomics ProjectRakesh ChoudharyAún no hay calificaciones

- Assignment 1Documento13 páginasAssignment 1Muhammad Asim Hafeez ThindAún no hay calificaciones

- Day Trading StrategiesDocumento3 páginasDay Trading Strategiesswetha reddy100% (2)

- Poverty Alleviation Programmes in IndiaDocumento4 páginasPoverty Alleviation Programmes in IndiaDEEPAK GROVERAún no hay calificaciones

- Joint Venture AgreementDocumento7 páginasJoint Venture AgreementFirman HamdanAún no hay calificaciones

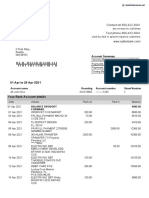

- Sutton Bank StatementDocumento2 páginasSutton Bank StatementNadiia AvetisianAún no hay calificaciones

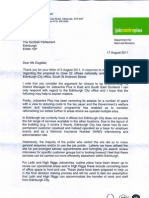

- Job Centre PlusDocumento4 páginasJob Centre PlusKezia Dugdale MSPAún no hay calificaciones

- Business ResearchDocumento8 páginasBusiness ResearchDhrumil GadariaAún no hay calificaciones

- Tentative Renovation Cost EstimatesDocumento6 páginasTentative Renovation Cost EstimatesMainit VOnAún no hay calificaciones

- Sanjay Sir ShahjahanpurDocumento3 páginasSanjay Sir Shahjahanpursinghutkarsh3344Aún no hay calificaciones

- PPF in SAP EWM 1Documento10 páginasPPF in SAP EWM 1Neulers0% (1)