Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Sources of Output VAT

Cargado por

Nadine SantiagoDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Sources of Output VAT

Cargado por

Nadine SantiagoCopyright:

Formatos disponibles

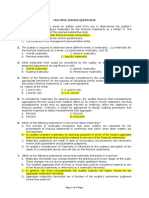

Liable to Business Tax (Requisites)

1) Regular/Habitual

More than 1 isolated transaction

Repetition & continuity of action

Exception to regularity (NOT regular activity BUT

theres business tax)

a) services rendered in the Philippines by NRA

b) importation of goods for personal use (subject to

VAT)

c) single sale of shares of stock (domestic corp.) thru

stock market (subject to OPT)

d) single overseas communication (subject to OPT)

e) single horse race winnings (subject to OPT)

f) incidental transactions

2) Economic Activity/

pecuniary estimation

Commercial Activity

flow of commodity

(capable of being measured in money)

Purpose: profit/income

Exception to regularity (NOT economic/commercial

activity BUT theres business tax)

a) importation of goods for personal use (subject to

VAT)

b) overseas communication

c) Annual Gross Receipts/Sales must exceed 100k

Sources of Output VAT

1) Actual Sale

sale of goods/services

lease of property

2) Transactions Deemed Sale

goods intended for sale

ONLY applicable for sale of goods & NOT of services

Transfer, use/consumption NOT in the ordinary

course of business (used by the owner/seller) of

goods/properties ordinarily intended for sale/use in

the ordinary course of business

Distribution/payment to:

shareholders (share in their profits of VAT reg person)

creditors (as payment of debt)

Consigned goods exceed 60 days

3) Zero Rated Sales

does NOT result in output tax

input tax shall be available as:

- Deduction/tax credit against output VAT

- Tax credit against any internal revenue taxes

Zero Rated Transactions

Exempt Transactions

subject to 0% VAT rate

NOT subject to VAT

NO output tax BUT

entitled to credit/refund

of input taxes

NO tax credit/refund

for input taxes are

allowed

Zero Rated Transactions

Sale of goods/services

a) Foreign Currency Denominated Sale

sales to nonresidents of the Philippines, accounted

for in accordance with the rules & regulations of BSP

(except: automobiles & non-essential goods subject to

excise tax)

b) Sales which is Vat exempt under special

laws/international agreements which the Phil. Is a

signatory (SBMA, PEZA, IRRI, CDA, ADB)

c) Sale of power/fuel generated through renewable

sources of energy (performed in the Philippines)

d) Actual Export Sales [consumption/destination principle]

directly shipped by a VAT registered resident to a

place outside the Philippines ( from Philippines to a

foreign country)

e) Deemed Export Sales

Sale of RM/packaging materials to an export

oriented enterprise whose export sales exceed 70% of

the total production

Sale of gold to BSP

Sale of goods, supplies, equipment & fuel to

personnel engaged in the international shipping/air

transport operations (see 109t)

Sales under EO 226 (Omnibus Investment Code

1987) & other special laws

f) Transport of passengers & cargo by domestic air/sea

carriers from Philippines to foreign country

(goods returned w/in 60 days are NOT deemed sold)

Ending inventory at the time of cessation as a VAT

registered person & as a business

Basis : Acquisition cost or FMV (whichever is LOWER)

NADZ

Sources of Input VAT

1) Actual Local Purchase of goods/services

Input VAT on capital Goods (depreciable goods)

useful life must be greater than or equal to 1 year

(otherwise, not considered as capital asset)

treated as depreciable asset under the tax code

used directly/indirectly in production/sale of taxable

goods/services

*Aggregate purchases

during the month, net of VAT

Exceeds 1M AND Useful life exceeds 1 year

(exclusive of VAT)

*{acquisition costpurchase price (not payments actually made)}

NO

OUTRIGHT

input VAT is

deductible at full

amount from output

VAT in the month of

acquisition

YES

3) Presumptive (4%)

purchase of VAT exempt primary agricultural &

marine food products at their original state which are

used as inputs to their production

sardines

refined sugar/sugar cane

mackerel

cooking oil

milk

packed noodles

4) Transitional (2%)

from VAT registered suppliers ONLY

non VAT registered suppliers (actual 12%)

OPT of 3% should be deducted from output VAT to

avoid double taxation

dont forget to deduct input tax on purchases (12%)

if theres any

HIGHER between:

Beg Inventory (end inv before) of 1st time VAT payer

Actual Input VAT

MIXED BUSINESS TRANSACTIONS

SPREAD

over:

60 months

SHORTER

useful life

Unclaimed Input VAT for the month of acquisition

if capital goods is sold/disposed within 5 years or prior to

exhaustion of input VAT, entire unamortized input VAT can

be claimed as input tax credit during the month/quarter the

sale/disposal is made

VAT registered

person

12% VAT

0% VAT

VAT exempt

INPUT VAT

Creditable against output VAT

Input tax credit against output VAT of VATable

transactions(regular VAT sales)/eligible for tax

refund/issuance of TCC

Cost of sale/OPEX

exempt from 12% VAT BUT if issued with

VAT invoice, shall be subject to 12% output

VAT;ONLY the portion of VAT exempt sale with

VAT is allowed to have input Vat

2) VAT on Importation

importation of goods in the Philippines (whether

personal/business use-except VAT exempt

transactions)

a) in general

Total Value for tariff & custom duties*

Custom Duties

Excise Tax

Other legitimate charges prior to the release of

goods from customs duty_______

_______

TAX BASE

X 12%

VAT on Importation

*(dutiable value--determined by BOC)

b) based on quantity/volume of goods

Invoice Cost

Freight

Insurance

Customs duties

Excise Taxes

Other legitimate charges prior to the release of

goods from customs duty_________________

LANDED COST

X 12%

VAT on Importation

*(dutiable value--determined by BOC)

ONLY importation by a VAT person for business use is

creditable as Input VAT (p.466 V&R)

NADZ

También podría gustarte

- Four-Variance Method Explained for Overhead Cost AnalysisDocumento3 páginasFour-Variance Method Explained for Overhead Cost AnalysisMeghan Kaye LiwenAún no hay calificaciones

- Sale Price of Replaced Equipment P 40,000Documento15 páginasSale Price of Replaced Equipment P 40,000Jay GamboaAún no hay calificaciones

- TAX-301 (VAT-Subject Transactions)Documento10 páginasTAX-301 (VAT-Subject Transactions)Edith DalidaAún no hay calificaciones

- AC 510 Kimwell Chapter 5 Solutions 1Documento134 páginasAC 510 Kimwell Chapter 5 Solutions 1Jeston TamayoAún no hay calificaciones

- Gelinas-Dull 8e Chapter 11 Billing & ReceivableDocumento30 páginasGelinas-Dull 8e Chapter 11 Billing & Receivableleen mercado100% (1)

- Subsequent Measurement Accounting Property Plant and EquipmentDocumento60 páginasSubsequent Measurement Accounting Property Plant and EquipmentNatalie SerranoAún no hay calificaciones

- Chan - A Comparison of Government Accounting and Business AccountingDocumento10 páginasChan - A Comparison of Government Accounting and Business AccountingInternational Consortium on Governmental Financial Management100% (4)

- Ar&Inventory ManagementDocumento10 páginasAr&Inventory ManagementKarlo D. ReclaAún no hay calificaciones

- Special Taxpayers Subject To Preferential Tax RatesDocumento42 páginasSpecial Taxpayers Subject To Preferential Tax RatesErneylou RanayAún no hay calificaciones

- Problem 14-5: Kayla Cruz & Gabriel TekikoDocumento7 páginasProblem 14-5: Kayla Cruz & Gabriel TekikoNURHAM SUMLAYAún no hay calificaciones

- Chapter 9 Part 1 Input VatDocumento25 páginasChapter 9 Part 1 Input VatChristian PelimcoAún no hay calificaciones

- MAS - 1416 Profit Planning - CVP AnalysisDocumento24 páginasMAS - 1416 Profit Planning - CVP AnalysisAzureBlazeAún no hay calificaciones

- 07 - Revenue - Consignment Sales PDFDocumento17 páginas07 - Revenue - Consignment Sales PDFCarla MarieAún no hay calificaciones

- Tax MockboardDocumento8 páginasTax MockboardJaneAún no hay calificaciones

- Substantive Tests of Expenditure Cycle Accounts Substantive TestsDocumento3 páginasSubstantive Tests of Expenditure Cycle Accounts Substantive TestsJuvelyn RedutaAún no hay calificaciones

- Chapt-1 Gen. PrinDocumento2 páginasChapt-1 Gen. Pringiopar0850% (4)

- A Government Employee May Claim The Tax InformerDocumento3 páginasA Government Employee May Claim The Tax InformerYuno NanaseAún no hay calificaciones

- Consumption Tax On Sales (Percentage Tax)Documento32 páginasConsumption Tax On Sales (Percentage Tax)Alicia Feliciano100% (1)

- Cost Accounting Study FlashcardsDocumento7 páginasCost Accounting Study FlashcardsWilliam SusetyoAún no hay calificaciones

- SW05Documento7 páginasSW05Nadi HoodAún no hay calificaciones

- Differential Analysis:: The Key To Decision MakingDocumento32 páginasDifferential Analysis:: The Key To Decision MakingkimmyAún no hay calificaciones

- Computer-Based Accounting Systems: Automation and ReengineeringDocumento5 páginasComputer-Based Accounting Systems: Automation and ReengineeringHendrikus AndriantoAún no hay calificaciones

- H03 - Principles of Income TaxationDocumento10 páginasH03 - Principles of Income Taxationnona galidoAún no hay calificaciones

- Chapter 6Documento8 páginasChapter 6Christine Joy OriginalAún no hay calificaciones

- Quiz 1: Tax 3 Final Period QuizzesDocumento10 páginasQuiz 1: Tax 3 Final Period QuizzesJhun bondocAún no hay calificaciones

- PrelimQ2 - CVP Analysis AnsKeyDocumento7 páginasPrelimQ2 - CVP Analysis AnsKeyaira atonAún no hay calificaciones

- Fedillaga Case13Documento19 páginasFedillaga Case13Luke Ysmael FedillagaAún no hay calificaciones

- Filling, Penalties and RemediesDocumento14 páginasFilling, Penalties and RemediesMichael Brian TorresAún no hay calificaciones

- Example 1: 5-Step Model: Step 1: Identify The Contract With A CustomerDocumento4 páginasExample 1: 5-Step Model: Step 1: Identify The Contract With A CustomerJhon SudiarmanAún no hay calificaciones

- WMSU Chapter 4 Costing SystemsDocumento12 páginasWMSU Chapter 4 Costing Systemschelsea kayle licomes fuentesAún no hay calificaciones

- CW6 - MaterialityDocumento3 páginasCW6 - MaterialityBeybi JayAún no hay calificaciones

- It5 Activity1Documento6 páginasIt5 Activity1Venice Dato67% (3)

- Government Accounting and Auditing Part 1Documento7 páginasGovernment Accounting and Auditing Part 1Harley GumaponAún no hay calificaciones

- Estate TaxDocumento2 páginasEstate Taxucc second yearAún no hay calificaciones

- Input:Output Tax ReviewerDocumento2 páginasInput:Output Tax ReviewerHiedi SugamotoAún no hay calificaciones

- Chap. 6 8Documento44 páginasChap. 6 82vpsrsmg7jAún no hay calificaciones

- Chapter 3 & 4 Tax ProblemsDocumento3 páginasChapter 3 & 4 Tax ProblemsCorazon Lim LeeAún no hay calificaciones

- Consolidation at Acquisition DateDocumento29 páginasConsolidation at Acquisition DateLee DokyeomAún no hay calificaciones

- Chapter 04 SDocumento41 páginasChapter 04 SDavid DavidAún no hay calificaciones

- Assignment-VAT On Sale of Goods or PropertiesDocumento2 páginasAssignment-VAT On Sale of Goods or PropertiesBenzon Agojo OndovillaAún no hay calificaciones

- Set A Leases Problem SERANADocumento6 páginasSet A Leases Problem SERANASherri BonquinAún no hay calificaciones

- Perez Long Quiz Auditing and Assurance Concepts and ApplicationDocumento7 páginasPerez Long Quiz Auditing and Assurance Concepts and ApplicationMitch MinglanaAún no hay calificaciones

- Reviewer in InventoriesDocumento2 páginasReviewer in InventoriesNicole AutrizAún no hay calificaciones

- Toaz - Info Afar Backflush Costing With Answers 1 PRDocumento5 páginasToaz - Info Afar Backflush Costing With Answers 1 PRNicole Andrea TuazonAún no hay calificaciones

- Long Problems For Prelim'S Product: Case 1Documento7 páginasLong Problems For Prelim'S Product: Case 1Mae AstovezaAún no hay calificaciones

- Responsibility Accounting MethodsDocumento4 páginasResponsibility Accounting MethodsLee Suarez100% (1)

- 19Documento3 páginas19Kristine Arsolon100% (2)

- Interactive Model of An EconomyDocumento142 páginasInteractive Model of An Economyrajraj999Aún no hay calificaciones

- FARAP 4404 Property Plant EquipmentDocumento11 páginasFARAP 4404 Property Plant EquipmentJohn Ray RonaAún no hay calificaciones

- Cvp-Analysis AbsvarcostingDocumento13 páginasCvp-Analysis AbsvarcostingGwy PagdilaoAún no hay calificaciones

- Answers To Assignement 1 Period 3Documento16 páginasAnswers To Assignement 1 Period 3trishaAún no hay calificaciones

- 3 - Discussion - Joint Products and ByproductsDocumento2 páginas3 - Discussion - Joint Products and ByproductsCharles TuazonAún no hay calificaciones

- Prepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020Documento1 páginaPrepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020versAún no hay calificaciones

- QUIZ 4 - Income TaxDocumento4 páginasQUIZ 4 - Income TaxTUAZON JR., NESTOR A.Aún no hay calificaciones

- CASH MANAGEMENT AND WORKING CAPITAL OPTIMIZATIONDocumento2 páginasCASH MANAGEMENT AND WORKING CAPITAL OPTIMIZATIONR100% (1)

- Revenue From Contracts With CustomersDocumento39 páginasRevenue From Contracts With Customersnglc srzAún no hay calificaciones

- Allowable Deductions Part 1Documento3 páginasAllowable Deductions Part 1John Rich GamasAún no hay calificaciones

- Transfer and Business Taxation - MIDTERMDocumento14 páginasTransfer and Business Taxation - MIDTERMYvette Pauline JovenAún no hay calificaciones

- Tax UpdatesDocumento19 páginasTax UpdatesYeoh MaeAún no hay calificaciones

- Income Recognition and Measurement of Net AssetsDocumento29 páginasIncome Recognition and Measurement of Net AssetsNadine SantiagoAún no hay calificaciones

- Ca - en - 13-3505 - IFRS - Practical - Guides - Design PDFDocumento20 páginasCa - en - 13-3505 - IFRS - Practical - Guides - Design PDFNadine SantiagoAún no hay calificaciones

- Interim ReportingDocumento13 páginasInterim ReportingNadine SantiagoAún no hay calificaciones

- Region 5Documento3 páginasRegion 5Nadine SantiagoAún no hay calificaciones

- Kambal House 2014jan22 - SiteDocumento1 páginaKambal House 2014jan22 - SiteNadine SantiagoAún no hay calificaciones

- Chap 018Documento48 páginasChap 018mas azizAún no hay calificaciones

- Heavy Duty Sliding Door Track up to 450kgDocumento1 páginaHeavy Duty Sliding Door Track up to 450kgNadine SantiagoAún no hay calificaciones

- Income Statement and Statement of Cash FlowsDocumento29 páginasIncome Statement and Statement of Cash FlowsNadine Santiago100% (1)

- Accounting For PostEmployment BenefitsDocumento23 páginasAccounting For PostEmployment BenefitsNadine Santiago100% (1)

- Tunay Na KaibiganDocumento15 páginasTunay Na KaibiganNadine SantiagoAún no hay calificaciones

- Mario Bruschi's life-changing confession with Padre PioDocumento6 páginasMario Bruschi's life-changing confession with Padre PioNadine SantiagoAún no hay calificaciones

- FTB Detail1Documento1 páginaFTB Detail1Nadine SantiagoAún no hay calificaciones

- Evolution and Ecology PDFDocumento46 páginasEvolution and Ecology PDFNadine SantiagoAún no hay calificaciones

- 101Documento6 páginas101Nadine SantiagoAún no hay calificaciones

- Chapter 17 - Governmental Entities: Introduction and General Fund AccountingDocumento37 páginasChapter 17 - Governmental Entities: Introduction and General Fund AccountingNadine SantiagoAún no hay calificaciones

- The Great Book of Best Quotes of All Time. - OriginalDocumento204 páginasThe Great Book of Best Quotes of All Time. - OriginalAbhi Sharma100% (3)

- 1Documento3 páginas1Nadine SantiagoAún no hay calificaciones

- TOA Reviewer Conceptual FrameworkDocumento2 páginasTOA Reviewer Conceptual FrameworkNadine SantiagoAún no hay calificaciones

- Worksheet 3.3: Determining RRL ThemesDocumento1 páginaWorksheet 3.3: Determining RRL ThemesNadine SantiagoAún no hay calificaciones

- Mas 10Documento8 páginasMas 10CGAún no hay calificaciones

- Penny Stocks and Blue Chip Stocks ExcelDocumento14 páginasPenny Stocks and Blue Chip Stocks ExcelNadine SantiagoAún no hay calificaciones

- BibliographyDocumento5 páginasBibliographyNadine SantiagoAún no hay calificaciones

- Lauderbach TB Ch09Documento16 páginasLauderbach TB Ch09Nadine SantiagoAún no hay calificaciones

- The Inside Story: Sine Wave vs. Modified Sine Wave: Which Is Better?Documento1 páginaThe Inside Story: Sine Wave vs. Modified Sine Wave: Which Is Better?asimnaqvi2008Aún no hay calificaciones

- PrayersDocumento5 páginasPrayersNadine SantiagoAún no hay calificaciones

- Worksheet 3.3: Determining RRL ThemesDocumento1 páginaWorksheet 3.3: Determining RRL ThemesNadine SantiagoAún no hay calificaciones

- 1Documento3 páginas1Nadine SantiagoAún no hay calificaciones

- Thesis PropDocumento1 páginaThesis PropNadine SantiagoAún no hay calificaciones

- Squat ChallengeDocumento1 páginaSquat ChallengeNadine SantiagoAún no hay calificaciones

- Arm Sculpting ChallengeDocumento1 páginaArm Sculpting ChallengeNadine SantiagoAún no hay calificaciones

- The Evolution of Economic Ideas and Systems PDFDocumento207 páginasThe Evolution of Economic Ideas and Systems PDFFrancis Gabriel Abog100% (1)

- Garbage Charges Waive Off Communication and DecisionDocumento6 páginasGarbage Charges Waive Off Communication and Decisionabhinavg.astrologyAún no hay calificaciones

- Dynamics of Mixed EconomyDocumento7 páginasDynamics of Mixed EconomySukumar Nandi100% (4)

- CIR Vs Aluminum WheelsDocumento3 páginasCIR Vs Aluminum WheelsJenifferRimandoAún no hay calificaciones

- PdataDocumento6 páginasPdataRazor11111Aún no hay calificaciones

- Annual Report For The Year 2018-19Documento180 páginasAnnual Report For The Year 2018-19Rithesh KAún no hay calificaciones

- Tax Invoice for ElectronicsDocumento2 páginasTax Invoice for Electronicskrishna chaitanyaAún no hay calificaciones

- Contract to Sell Residential Condo UnitDocumento9 páginasContract to Sell Residential Condo UnitArl100% (1)

- Wallstreetjournal 20160203 The Wall Street JournalDocumento44 páginasWallstreetjournal 20160203 The Wall Street JournalstefanoAún no hay calificaciones

- F5 - 14financial Performance MeasurementDocumento7 páginasF5 - 14financial Performance Measurementsajid newaz khanAún no hay calificaciones

- Street Hype Newspaper - December 1-31, 218Documento24 páginasStreet Hype Newspaper - December 1-31, 218Patrick MaitlandAún no hay calificaciones

- Macro To Upload Data From Excel To Oracle FormsDocumento223 páginasMacro To Upload Data From Excel To Oracle Formshafeez72Aún no hay calificaciones

- Direct Tax Laws Paper DecodedDocumento26 páginasDirect Tax Laws Paper DecodedANIL JARWALAún no hay calificaciones

- CTPDocumento53 páginasCTPsuraj nairAún no hay calificaciones

- Notes To Capital Work-In-progressDocumento3 páginasNotes To Capital Work-In-progressJitendra VernekarAún no hay calificaciones

- Bharti Airtel LTD (BHARTI IN) - AdjustedDocumento4 páginasBharti Airtel LTD (BHARTI IN) - AdjustedDebarnob SarkarAún no hay calificaciones

- Fapgi PDFDocumento5 páginasFapgi PDFAP GoaAún no hay calificaciones

- PM Unit IiiDocumento106 páginasPM Unit IiiAnonymous kwi5IqtWJAún no hay calificaciones

- Siti Aniza Binti Hasan Kompeni Bekalan 71 BN KPD Kem Penrissen Lama 93677, KUCHING, SARDocumento2 páginasSiti Aniza Binti Hasan Kompeni Bekalan 71 BN KPD Kem Penrissen Lama 93677, KUCHING, SARhafizianiza1990Aún no hay calificaciones

- 11 CIR V JavierDocumento11 páginas11 CIR V JavierNeil BorjaAún no hay calificaciones

- 5-KW Solar System QuotationDocumento1 página5-KW Solar System QuotationKidzee KidzeeAún no hay calificaciones

- Archer Daniels Midland: A Case Study in Corporate Welfare, Cato Policy AnalysisDocumento27 páginasArcher Daniels Midland: A Case Study in Corporate Welfare, Cato Policy AnalysisCato InstituteAún no hay calificaciones

- Government Accounting PDFDocumento33 páginasGovernment Accounting PDFKenneth RobledoAún no hay calificaciones

- Ecb 401 National IncomeDocumento19 páginasEcb 401 National IncomeSuryansh SrinetAún no hay calificaciones

- Principles of Macroeconomics 7th Edition Gregory Mankiw Solutions ManualDocumento36 páginasPrinciples of Macroeconomics 7th Edition Gregory Mankiw Solutions Manualzebrinnylecturn.r997t100% (23)

- Axcelasia 2 PDFDocumento408 páginasAxcelasia 2 PDFInvest StockAún no hay calificaciones

- VAT Registration Certificate 3D CONCEPTSDocumento2 páginasVAT Registration Certificate 3D CONCEPTSLahiru Supun SamaraweeraAún no hay calificaciones

- Ppo Id - : Revised Government of Telangana (Annual Verification Certificate)Documento2 páginasPpo Id - : Revised Government of Telangana (Annual Verification Certificate)SeshuAún no hay calificaciones

- Reflection Papertax Compliance On PayrollDocumento1 páginaReflection Papertax Compliance On PayrollJoyceAún no hay calificaciones

- BEML Inventory ManagementDocumento75 páginasBEML Inventory ManagementCrazy TamizhaAún no hay calificaciones