Documentos de Académico

Documentos de Profesional

Documentos de Cultura

USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic Aggregates

Cargado por

Eduardo PetazzeTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic Aggregates

Cargado por

Eduardo PetazzeCopyright:

Formatos disponibles

USA - Oil and Gas Extraction - Estimated Impact by Low Prices on Economic Aggregates

by Eduardo Petazze

10/05/15

The fall in international crude oil prices have had a significant and negative impact on the financial results of the

exploration and production of oil and gas in the US

However, the continuous improvement of these results are expected from the 2nd quarter of 2015

This document is intended to estimate the impact that lower crude oil prices will have on US macroeconomic

aggregates for the sector of oil and gas extraction.

Between 1998 and 2013 (latest official GDP data), at current prices, the Gross Output by O&G Extraction has

increased from 0.446% of the Gross Output by All Industries up to 1.343%. During this period, the Gross Value

Added has increased from 0.427% to 1.741%, in relation to gross value added by all industries.

For the first quarter of 2015 it is estimated that in the oil and gas extraction, the Operating Surplus has been reduced

by 77.7% over the previous quarter, but still maintains a positive sign. By 2015 it is estimated that the Operating

Surplus of the sector will be reduced by 59.4% over 2014.

If the analysis is performed with S&P 500, Energy Sector, the operating margin in 1Q2015 was located in negative

territory (0.56% of sales) from a positive margin of 5.72% in 4Q2014. By 2015 it is estimated that the operating

margin will be around to 3.37% from 7.95% in 2014. By 2016 it is estimated that the operating margin will be located

at 5.91% of sales.

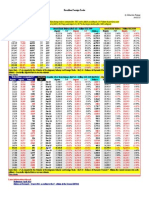

The following table shows the annual, and an estimate of the quarterly, evolution of the main components of Gross

Output by O&G Extraction industry.

Gross

Output

72.1

85.1

144.9

142.7

116.9

166.2

198.9

260.6

271.0

293.6

395.4

223.6

289.7

343.7

348.4

399.2

425.1

264.4

311.9

YoY

Mining: O&G Sector Billions of Dollars

Intermediate Value

Employees

Net Operating

YoY

Consumption Added

Compensation taxes Surplus

33.3 38.8 -29.71%

12.3

8.1

18.4

41.2 43.9 13.14%

12.3

7.9

23.7

76.7 68.2 55.35%

13.4

10.1

44.8

65.5 77.2 13.20%

14.1

11.6

51.5

46.4 70.5

-8.68%

13.2

11.3

46.0

72.6 93.6 32.77%

13.6

13.2

66.7

85.5 113.4 21.15%

15.6

15.3

82.5

104.4 156.2 37.74%

17.2

20.1

118.9

92.8 178.2 14.08%

20.9

23.3

134.0

88.4 205.3 15.21%

22.6

27.0

155.7

114.8 280.5 36.63%

27.3

36.4

216.8

39.0 184.6 -34.19%

25.9

24.0

134.8

80.3 209.3 13.38%

27.6

27.0

154.7

91.2 252.5 20.64%

30.6

32.0

189.9

88.0 260.4

3.13%

34.7

32.5

193.2

107.3 291.9 12.10%

36.0

33.0

223.0

121.9 303.2

3.86%

36.9

35.0

231.3

109.2 155.2 -48.82%

36.6

24.7

93.9

117.1 194.8 25.57%

35.4

27.2

132.3

YoY

1998

-26.28%

-45.88%

1999

18.03%

28.80%

2000

70.27%

89.03%

2001

-1.52%

14.96%

2002

-18.08%

-10.68%

2003

42.17%

45.00%

2004

19.68%

23.69%

2005

31.02%

44.12%

2006

3.99%

12.70%

2007

8.34%

16.19%

2008

34.67%

39.24%

2009

-43.45%

-37.82%

2010

29.56%

14.76%

2011

18.64%

22.75%

2012

1.37%

1.74%

2013

14.58%

15.42%

2014

6.49%

3.72%

2015

-37.81%

-59.41%

2016

17.98%

40.88%

Latest data

Provisional data based on official data for the entire mining industry

Own estimation, alternative optimistic version

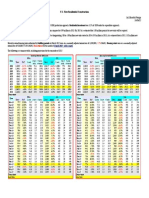

Mining: O&G Sector, Billions of Dollars, at annual rate

Gross

Intermediate Value

Employees

Net Operating

QoQ

QoQ

QoQ

Output

Consumption Added

Compensation taxes Surplus

2006Q1

277.6

-6.64%

99.8 177.8

-1.06%

20.2

22.4

135.2

-4.52%

2006Q2

272.6

-1.80%

94.0 178.5

0.39%

20.7

22.9

134.9

-0.22%

2006Q3

272.0

-0.22%

92.8 179.2

0.39%

21.1

23.7

134.4

-0.37%

2006Q4

261.9

-3.70%

84.5 177.4

-1.00%

21.5

24.0

131.9

-1.86%

2007Q1

265.9

1.53%

85.0 181.0

2.03%

21.9

26.6

132.5

0.45%

2007Q2

291.4

9.59%

89.1 202.3 11.77%

22.3

26.9

153.1 15.55%

2007Q3

297.1

1.96%

87.7 209.5

3.56%

22.7

27.3

159.5

4.18%

2007Q4

320.0

7.71%

91.9 228.2

8.93%

23.4

27.3

177.5 11.29%

2008Q1

376.2 17.56%

123.5 252.6 10.69%

26.4

35.5

190.7

7.44%

2008Q2

461.5 22.67%

152.2 309.2 22.41%

26.8

35.5

246.9 29.47%

2008Q3

437.7

-5.16%

125.3 312.3

1.00%

27.8

36.7

247.8

0.36%

2008Q4

306.2 -30.04%

58.3 247.9 -20.62%

28.2

37.9

181.8 -26.63%

2009Q1

234.4 -23.45%

37.6 196.8 -20.61%

26.6

23.6

146.6 -19.36%

2009Q2

210.8 -10.07%

34.4 176.4 -10.37%

26.0

24.3

126.1 -13.98%

2009Q3

212.6

0.85%

37.5 175.1

-0.74%

25.7

24.4

125.0

-0.87%

2009Q4

236.6 11.29%

46.5 190.1

8.57%

25.4

23.7

141.0 12.80%

2010Q1

280.1 18.36%

71.1 208.9

9.89%

27.2

28.0

153.7

9.01%

2010Q2

280.2

0.05%

78.5 201.7

-3.45%

27.5

27.2

147.0

-4.36%

2010Q3

293.6

4.78%

88.1 205.5

1.88%

27.7

26.4

151.4

2.99%

2010Q4

304.8

3.80%

83.5 221.2

7.64%

28.0

26.4

166.8 10.17%

2011Q1

319.6

4.87%

87.1 232.5

5.11%

29.3

32.0

171.2

2.64%

2011Q2

351.1

9.84%

96.7 254.3

9.38%

30.3

32.0

192.0 12.15%

2011Q3

346.7

-1.25%

91.3 255.3

0.39%

31.0

32.0

192.3

0.16%

2011Q4

357.5

3.12%

89.6 267.8

4.90%

31.9

32.0

203.9

6.03%

2012Q1

357.7

0.07%

94.1 263.6

-1.57%

33.9

33.0

196.7

-3.53%

2012Q2

336.9

-5.81%

84.4 252.5

-4.21%

34.5

33.0

185.0

-5.95%

2012Q3

342.2

1.56%

84.3 257.9

2.14%

35.0

32.3

190.6

3.03%

2012Q4

356.9

4.30%

89.3 267.6

3.76%

35.3

31.5

200.8

5.35%

2013Q1

368.4

3.22%

97.0 271.3

1.38%

36.1

34.7

200.5

-0.15%

2013Q2

390.3

5.96%

104.4 285.9

5.38%

35.9

33.8

216.2

7.83%

2013Q3

426.6

9.29%

118.2 308.3

7.83%

36.0

32.2

240.1 11.05%

2013Q4

411.6

-3.50%

109.5 302.1

-2.01%

36.0

31.3

234.8

-2.21%

2014Q1

416.8

1.26%

120.7 296.1

-1.99%

36.3

35.8

224.0

-4.60%

2014Q2

452.2

8.49%

132.9 319.3

7.84%

36.6

37.5

245.2

9.46%

2014Q3

435.5

-3.69%

125.3 310.2

-2.85%

37.1

35.0

238.1

-2.90%

2014Q4

395.9

-9.09%

108.8 287.1

-7.45%

37.6

31.6

217.9

-8.48%

2015Q1

216.8 -45.24%

106.8 110.0 -61.69%

36.8

24.6

48.6 -77.70%

2015Q2

266.1 22.74%

110.1 156.0 41.82%

36.4

24.0

95.6 96.71%

2015Q3

286.7

7.74%

113.5 173.2 11.03%

36.6

24.8

111.8 16.95%

2015Q4

287.9

0.42%

106.5 181.4

4.73%

36.6

25.3

119.5

6.89%

2016Q1

299.5

4.03%

110.4 189.1

4.24%

35.7

26.1

127.3

6.53%

2016Q2

308.7

3.07%

120.4 188.3

-0.42%

35.2

26.9

126.2

-0.86%

2016Q3

317.7

2.92%

123.0 194.7

3.40%

35.4

27.6

131.7

4.36%

2016Q4

321.7

1.26%

114.5 207.2

6.42%

35.3

28.1

143.8

9.19%

Latest official annual figure, restated for quarter

Provisional data based on official data for the entire mining industry

Provisional own estimate (optimistic version)

Own estimation, alternative optimistic version - It has not been taken into account possible effects on the variable

compensation of employees

Note: Estimates and provisional data are based on the third quintile of a projection model (optimistic version)

PS: S&P500-Energy is comprised of 40.7% for Integrated O&G and 25.92% by O&G Exploration & Production.

También podría gustarte

- China - Price IndicesDocumento1 páginaChina - Price IndicesEduardo PetazzeAún no hay calificaciones

- WTI Spot PriceDocumento4 páginasWTI Spot PriceEduardo Petazze100% (1)

- México, PBI 2015Documento1 páginaMéxico, PBI 2015Eduardo PetazzeAún no hay calificaciones

- Retail Sales in The UKDocumento1 páginaRetail Sales in The UKEduardo PetazzeAún no hay calificaciones

- Brazilian Foreign TradeDocumento1 páginaBrazilian Foreign TradeEduardo PetazzeAún no hay calificaciones

- U.S. New Residential ConstructionDocumento1 páginaU.S. New Residential ConstructionEduardo PetazzeAún no hay calificaciones

- Euro Area - Industrial Production IndexDocumento1 páginaEuro Area - Industrial Production IndexEduardo PetazzeAún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Plant Report Template Class 81Documento2 páginasPlant Report Template Class 81Kamran KhanAún no hay calificaciones

- Channel & Lomolino 2000 Ranges and ExtinctionDocumento3 páginasChannel & Lomolino 2000 Ranges and ExtinctionKellyta RodriguezAún no hay calificaciones

- India Biotech Handbook 2023Documento52 páginasIndia Biotech Handbook 2023yaduraj TambeAún no hay calificaciones

- Pautas Anatómicas para La Inserción de Minitornillos: Sitios PalatinosDocumento11 páginasPautas Anatómicas para La Inserción de Minitornillos: Sitios PalatinosValery V JaureguiAún no hay calificaciones

- Medabots-Rokusho Version (European) - Medal Codes (Part 1) (GBA Cheats) - CodeTwink ForumsDocumento5 páginasMedabots-Rokusho Version (European) - Medal Codes (Part 1) (GBA Cheats) - CodeTwink Forumsdegraded 4resterAún no hay calificaciones

- Strategic Audit of VodafoneDocumento35 páginasStrategic Audit of VodafoneArun Guleria89% (9)

- Navi-Planner User ManualDocumento331 páginasNavi-Planner User ManualRichard KershawAún no hay calificaciones

- DLI Watchman®: Vibration Screening Tool BenefitsDocumento2 páginasDLI Watchman®: Vibration Screening Tool Benefitssinner86Aún no hay calificaciones

- Report-Smaw Group 12,13,14Documento115 páginasReport-Smaw Group 12,13,14Yingying MimayAún no hay calificaciones

- List of Modern Equipment and Farm ToolsDocumento15 páginasList of Modern Equipment and Farm ToolsCarl Johnrich Quitain100% (2)

- USDA List of Active Licensees and RegistrantsDocumento972 páginasUSDA List of Active Licensees and Registrantswamu885Aún no hay calificaciones

- Beer Pilkhani DistilleryDocumento44 páginasBeer Pilkhani DistillerySunil Vicky VohraAún no hay calificaciones

- DN12278 - 5008 - Indicative Cable Way Route - Rev BDocumento9 páginasDN12278 - 5008 - Indicative Cable Way Route - Rev BArtjoms LusenkoAún no hay calificaciones

- Uh 60 ManualDocumento241 páginasUh 60 ManualAnonymous ddjwf1dqpAún no hay calificaciones

- Mother Tongue K To 12 Curriculum GuideDocumento18 páginasMother Tongue K To 12 Curriculum GuideBlogWatch100% (5)

- Assessment 4 PDFDocumento10 páginasAssessment 4 PDFAboud Hawrechz MacalilayAún no hay calificaciones

- Garments Costing Sheet of LADIES Skinny DenimsDocumento1 páginaGarments Costing Sheet of LADIES Skinny DenimsDebopriya SahaAún no hay calificaciones

- Grasa LO 915Documento2 páginasGrasa LO 915Angelo Carrillo VelozoAún no hay calificaciones

- O'Dell v. Medallia, Inc. Et Al, 1 - 21-cv-07475, No. 1 (S.D.N.Y. Sep. 7, 2021)Documento15 páginasO'Dell v. Medallia, Inc. Et Al, 1 - 21-cv-07475, No. 1 (S.D.N.Y. Sep. 7, 2021)yehuditgoldbergAún no hay calificaciones

- Course DescriptionDocumento54 páginasCourse DescriptionMesafint lisanuAún no hay calificaciones

- SodiumBenzoate PDFDocumento3 páginasSodiumBenzoate PDFyotta024Aún no hay calificaciones

- Route Clearence TeamDocumento41 páginasRoute Clearence Teamctenar2Aún no hay calificaciones

- Design and Optimization of A Medium Altitude Long Endurance UAV Wingbox StructureDocumento8 páginasDesign and Optimization of A Medium Altitude Long Endurance UAV Wingbox StructureamirAún no hay calificaciones

- Reference by John BatchelorDocumento1 páginaReference by John Batchelorapi-276994844Aún no hay calificaciones

- Revised Corporation Code - Non Stock Close and Special CorporationsDocumento19 páginasRevised Corporation Code - Non Stock Close and Special CorporationsVenziel PedrosaAún no hay calificaciones

- Case Study On Goodearth Financial Services LTDDocumento15 páginasCase Study On Goodearth Financial Services LTDEkta Luciferisious Sharma0% (1)

- Risha Hannah I. NazarethDocumento4 páginasRisha Hannah I. NazarethAlpaccino IslesAún no hay calificaciones

- Arithmetic-Progressions - MDDocumento8 páginasArithmetic-Progressions - MDJay Jay GwizaAún no hay calificaciones

- FKTDocumento32 páginasFKTNeeraj SharmaAún no hay calificaciones

- IPS PressVest Premium PDFDocumento62 páginasIPS PressVest Premium PDFLucian Catalin CalinAún no hay calificaciones