Documentos de Académico

Documentos de Profesional

Documentos de Cultura

First Phil Industrial Corp

Cargado por

lovesresearchDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

First Phil Industrial Corp

Cargado por

lovesresearchCopyright:

Formatos disponibles

E-Library - Information At Your Fingertips: Printer Friendly

9/20/14, 9:28 PM

G.R. No. 125948

SECOND DIVISION

[ G.R. No. 125948, December 29, 1998 ]

FIRST PHILIPPINE INDUSTRIAL CORPORATION, PETITIONER,

VS. COURT OF APPEALS, HONORABLE PATERNO V. TAC-AN,

BATANGAS CITY AND ADORACION C. ARELLANO, IN HER

OFFICIAL CAPACITY AS CITY TREASURER OF BATANGAS,

RESPONDENTS.

DECISION

MARTINEZ, J.:

This petition for review on certiorari assails the Decision of the Court of Appeals dated

November 29, 1995, in CA-G.R. SP No. 36801, affirming the decision of the Regional

Trial Court of Batangas City, Branch 84, in Civil Case No. 4293, which dismissed

petitioners' complaint for a business tax refund imposed by the City of Batangas.

Petitioner is a grantee of a pipeline concession under Republic Act No. 387, as

amended, to contract, install and operate oil pipelines. The original pipeline concession

was granted in 1967[1] and renewed by the Energy Regulatory Board in 1992.[2]

Sometime in January 1995, petitioner applied for a mayor's permit with the Office of

the Mayor of Batangas City. However, before the mayor's permit could be issued, the

respondent City Treasurer required petitioner to pay a local tax based on its gross

receipts for the fiscal year 1993 pursuant to the Local Government Code.[3] The

respondent City Treasurer assessed a business tax on the petitioner amounting to

P956,076.04 payable in four installments based on the gross receipts for products

pumped at GPS-1 for the fiscal year 1993 which amounted to P181,681,151.00. In

order not to hamper its operations, petitioner paid the tax under protest in the amount

of P239,019.01 for the first quarter of 1993.

On January 20, 1994, petitioner filed a letter-protest addressed to the respondent City

Treasurer, the pertinent portion of which reads:

"Please note that our Company (FPIC) is a pipeline operator with a

government concession granted under the Petroleum Act. It is engaged in

the business of transporting petroleum products from the Batangas

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/36618

Page 1 of 10

E-Library - Information At Your Fingertips: Printer Friendly

9/20/14, 9:28 PM

refineries, via pipeline, to Sucat and JTF Pandacan Terminals. As such, our

Company is exempt from paying tax on gross receipts under Section 133 of

the Local Government Code of 1991 x x x x

"Moreover, Transportation contractors are not included in the enumeration

of contractors under Section 131, Paragraph (h) of the Local Government

Code. Therefore, the authority to impose tax 'on contractors and other

independent contractors' under Section 143, Paragraph (e) of the Local

Government Code does not include the power to levy on transportation

contractors.

"The imposition and assessment cannot be categorized as a mere fee

authorized under Section 147 of the Local Government Code. The said

section limits the imposition of fees and charges on business to such

amounts as may be commensurate to the cost of regulation, inspection, and

licensing. Hence, assuming arguendo that FPIC is liable for the license fee,

the imposition thereof based on gross receipts is violative of the aforecited

provision. The amount of P956,076.04 (P239,019.01 per quarter) is not

commensurate to the cost of regulation, inspection and licensing. The fee is

already a revenue raising measure, and not a mere regulatory imposition."

[4]

On March 8, 1994, the respondent City Treasurer denied the protest contending that

petitioner cannot be considered engaged in transportation business, thus it cannot

claim exemption under Section 133 (j) of the Local Government Code.[5]

On June 15, 1994, petitioner filed with the Regional Trial Court of Batangas City a

complaint[6] for tax refund with prayer for a writ of preliminary injunction against

respondents City of Batangas and Adoracion Arellano in her capacity as City Treasurer.

In its complaint, petitioner alleged, inter alia, that: (1) the imposition and collection of

the business tax on its gross receipts violates Section 133 of the Local Government

Code; (2) the authority of cities to impose and collect a tax on the gross receipts of

"contractors and independent contractors" under Sec. 141 (e) and 151 does not include

the authority to collect such taxes on transportation contractors for, as defined under

Sec. 131 (h), the term "contractors" excludes transportation contractors; and, (3) the

City Treasurer illegally and erroneously imposed and collected the said tax, thus

meriting the immediate refund of the tax paid.[7]

Traversing the complaint, the respondents argued that petitioner cannot be exempt

from taxes under Section 133 (j) of the Local Government Code as said exemption

applies only to "transportation contractors and persons engaged in the transportation

by hire and common carriers by air, land and water." Respondents assert that pipelines

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/36618

Page 2 of 10

E-Library - Information At Your Fingertips: Printer Friendly

9/20/14, 9:28 PM

are not included in the term "common carrier" which refers solely to ordinary carriers

such as trucks, trains, ships and the like. Respondents further posit that the term

"common carrier" under the said code pertains to the mode or manner by which a

product is delivered to its destination.[8]

On October 3, 1994, the trial court rendered a decision dismissing the complaint, ruling

in this wise:

"xxx Plaintiff is either a contractor or other independent contractor.

xxx the exemption to tax claimed by the plaintiff has become unclear. It is a

rule that tax exemptions are to be strictly construed against the taxpayer,

taxes being the lifeblood of the government. Exemption may therefore be

granted only by clear and unequivocal provisions of law.

"Plaintiff claims that it is a grantee of a pipeline concession under Republic

Act 387, (Exhibit A) whose concession was lately renewed by the Energy

Regulatory Board (Exhibit B). Yet neither said law nor the deed of

concession grant any tax exemption upon the plaintiff.

"Even the Local Government Code imposes a tax on franchise holders under

Sec. 137 of the Local Tax Code. Such being the situation obtained in this

case (exemption being unclear and equivocal) resort to distinctions or other

considerations may be of help:

1. That the exemption granted under Sec. 133 (j) encompasses only

common carriers so as not to overburden the riding public or commuters

with taxes. Plaintiff is not a common carrier, but a special carrier extending

its services and facilities to a single specific or "special customer" under a

"special contract."

2. The Local Tax Code of 1992 was basically enacted to give more and

effective local autonomy to local governments than the previous

enactments, to make them economically and financially viable to serve the

people and discharge their functions with a concomitant obligation to accept

certain devolution of powers, x x x So, consistent with this policy even

franchise grantees are taxed (Sec. 137) and contractors are also taxed

under Sec. 143 (e) and 151 of the Code."[9]

Petitioner assailed the aforesaid decision before this Court via a petition for review. On

February 27, 1995, we referred the case to the respondent Court of Appeals for

consideration and adjudication.[10] On November 29, 1995, the respondent court

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/36618

Page 3 of 10

E-Library - Information At Your Fingertips: Printer Friendly

9/20/14, 9:28 PM

rendered a decision[11] affirming the trial court's dismissal of petitioner's complaint.

Petitioner's motion for reconsideration was denied on July 18, 1996.[12]

Hence, this petition. At first, the petition was denied due course in a Resolution dated

November 11, 1996.[13] Petitioner moved for a reconsideration which was granted by

this Court in a Resolution[14] of January 20, 1997. Thus, the petition was reinstated.

Petitioner claims that the respondent Court of Appeals erred in holding that (1) the

petitioner is not a common carrier or a transportation contractor, and (2) the

exemption sought for by petitioner is not clear under the law.

There is merit in the petition.

A "common carrier" may be defined, broadly, as one who holds himself out to the

public as engaged in the business of transporting persons or property from place to

place, for compensation, offering his services to the public generally.

Article 1732 of the Civil Code defines a "common carrier" as "any person, corporation,

firm or association engaged in the business of carrying or transporting passengers or

goods or both, by land, water, or air, for compensation, offering their services to the

public."

The test for determining whether a party is a common carrier of goods is:

1. He must be engaged in the business of carrying goods for others as a

public employment, and must hold himself out as ready to engage in the

transportation of goods for person generally as a business and not as a

casual occupation;

2. He must undertake to carry goods of the kind to which his business is

confined;

3. He must undertake to carry by the method by which his business is

conducted and over his established roads; and

4. The transportation must be for hire.[15]

Based on the above definitions and requirements, there is no doubt that petitioner is a

common carrier. It is engaged in the business of transporting or carrying goods, i.e.

petroleum products, for hire as a public employment. It undertakes to carry for all

persons indifferently, that is, to all persons who choose to employ its services, and

transports the goods by land and for compensation. The fact that petitioner has a

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/36618

Page 4 of 10

E-Library - Information At Your Fingertips: Printer Friendly

9/20/14, 9:28 PM

limited clientele does not exclude it from the definition of a common carrier. In De

Guzman vs. Court of Appeals[16] we ruled that:

"The above article (Art. 1732, Civil Code) makes no distinction between one

whose principal business activity is the carrying of persons or goods or

both, and one who does such carrying only as an ancillary activity (in local

idiom, as a 'sideline'). Article 1732 x x x avoids making any distinction

between a person or enterprise offering transportation service on a

regular or scheduled basis and one offering such service on an

occasional, episodic or unscheduled basis. Neither does Article 1732

distinguish between a carrier offering its services to the 'general

public,' i.e., the general community or population, and one who

offers services or solicits business only from a narrow segment of

the general population. We think that Article 1877 deliberately

refrained from making such distinctions.

So understood, the concept of 'common carrier' under Article 1732 may be

seen to coincide neatly with the notion of 'public service,' under the Public

Service Act (Commonwealth Act No. 1416, as amended) which at least

partially supplements the law on common carriers set forth in the Civil

Code. Under Section 13, paragraph (b) of the Public Service Act, 'public

service' includes:

'every person that now or hereafter may own, operate, manage, or control

in the Philippines, for hire or compensation, with general or limited

clientele, whether permanent, occasional or accidental, and done for

general business purposes, any common carrier, railroad, street railway,

traction railway, subway motor vehicle, either for freight or passenger, or

both, with or without fixed route and whatever may be its classification,

freight or carrier service of any class, express service, steamboat, or

steamship line, pontines, ferries and water craft, engaged in the

transportation of passengers or freight or both, shipyard, marine repair

shop, wharf or dock, ice plant, ice-refrigeration plant, canal, irrigation

system gas, electric light heat and power, water supply and power

petroleum, sewerage system, wire or wireless communications systems,

wire or wireless broadcasting stations and other similar public services.' "

(Underscoring Supplied)

Also, respondent's argument that the term "common carrier" as used in Section 133 (j)

of the Local Government Code refers only to common carriers transporting goods and

passengers through moving vehicles or vessels either by land, sea or water, is

erroneous.

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/36618

Page 5 of 10

E-Library - Information At Your Fingertips: Printer Friendly

9/20/14, 9:28 PM

As correctly pointed out by petitioner, the definition of "common carriers" in the Civil

Code makes no distinction as to the means of transporting, as long as it is by land,

water or air. It does not provide that the transportation of the passengers or goods

should be by motor vehicle. In fact, in the United States, oil pipe line operators are

considered common carriers.[17]

Under the Petroleum Act of the Philippines (Republic Act 387), petitioner is considered

a "common carrier." Thus, Article 86 thereof provides that:

"Art. 86. Pipe line concessionaire as a common carrier. - A pipe line

shall have the preferential right to utilize installations for the transportation

of petroleum owned by him, but is obligated to utilize the remaining

transportation capacity pro rata for the transportation of such other

petroleum as may be offered by others for transport, and to charge without

discrimination such rates as may have been approved by the Secretary of

Agriculture and Natural Resources."

Republic Act 387 also regards petroleum operation as a public utility. Pertinent portion

of Article 7 thereof provides:

"that everything relating to the exploration for and exploitation of

petroleum x x and everything relating to the manufacture, refining, storage,

or transportation by special methods of petroleum, is hereby declared

to be a public utility." (Underscoring Supplied)

The Bureau of Internal Revenue likewise considers the petitioner a "common carrier."

In BIR Ruling No. 069-83, it declared:

"x x x since [petitioner] is a pipeline concessionaire that is engaged only in

transporting petroleum products, it is considered a common carrier under

Republic Act No. 387 x x x. Such being the case, it is not subject to

withholding tax prescribed by Revenue Regulations No. 13-78, as

amended."

From the foregoing disquisition, there is no doubt that petitioner is a "common carrier"

and, therefore, exempt from the business tax as provided for in Section 133 (j), of the

Local Government Code, to wit:

"Section 133. Common Limitations on the Taxing Powers of Local

Government Units. - Unless otherwise provided herein, the exercise of the

taxing powers of provinces, cities, municipalities, and barangays shall not

extend to the levy of the following :

xxx

xxx

xxx

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/36618

Page 6 of 10

E-Library - Information At Your Fingertips: Printer Friendly

9/20/14, 9:28 PM

(j) Taxes on the gross receipts of transportation contractors and persons

engaged in the transportation of passengers or freight by hire and common

carriers by air, land or water, except as provided in this Code."

The deliberations conducted in the House of Representatives on the Local Government

Code of 1991 are illuminating:

"MR. AQUINO (A). Thank you, Mr. Speaker.

Mr. Speaker, we would like to proceed to page 95, line 1. It states :

"SEC.121 [now Sec. 131]. Common Limitations on the Taxing Powers of

Local Government Units." x x x

MR. AQUINO (A.). Thank you Mr. Speaker.

Still on page 95, subparagraph 5, on taxes on the business of

transportation. This appears to be one of those being deemed to be

exempted from the taxing powers of the local government units. May we

know the reason why the transportation business is being excluded

from the taxing powers of the local government units?

MR. JAVIER (E.). Mr. Speaker, there is an exception contained in Section

121 (now Sec. 131), line 16, paragraph 5. It states that local government

units may not impose taxes on the business of transportation, except as

otherwise provided in this code.

Now, Mr. Speaker, if the Gentleman would care to go to page 98 of Book II,

one can see there that provinces have the power to impose a tax on

business enjoying a franchise at the rate of not more than one-half of 1

percent of the gross annual receipts. So, transportation contractors who are

enjoying a franchise would be subject to tax by the province. That is the

exception, Mr. Speaker.

What we want to guard against here, Mr. Speaker, is the imposition

of taxes by local government units on the carrier business. Local

government units may impose taxes on top of what is already being

imposed by the National Internal Revenue Code which is the so-called

"common carriers tax." We do not want a duplication of this tax, so we

just provided for an exception under Section 125 [now Sec. 137] that a

province may impose this tax at a specific rate.

MR. AQUINO (A.). Thank you for that clarification, Mr. Speaker. x x

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/36618

Page 7 of 10

E-Library - Information At Your Fingertips: Printer Friendly

9/20/14, 9:28 PM

x[18]

It is clear that the legislative intent in excluding from the taxing power of the local

government unit the imposition of business tax against common carriers is to prevent a

duplication of the so-called "common carrier's tax."

Petitioner is already paying three (3%) percent common carrier's tax on its gross

sales/earnings under the National Internal Revenue Code.[19] To tax petitioner again

on its gross receipts in its transportation of petroleum business would defeat the

purpose of the Local Government Code.

WHEREFORE, the petition is hereby GRANTED. The decision of the respondent Court

of Appeals dated November 29, 1995 in CA-G.R. SP No. 36801 is REVERSED and SET

ASIDE.

SO ORDERED.

Bellosillo, (Chairman), Puno, and Mendoza, JJ., concur.

[1] Rollo, pp. 90-94.

[2] Decision of the Energy Regulatory Board in ERB Case No. 92-94, renewing the

Pipeline Concession of petitioner First Philippine Industrial Corporation, formerly known

as Meralco Securities Industrial Corporation , (Rollo, pp. 95-100).

[3] Sec. 143. Tax on Business. The municipality may impose taxes on the following

business:

xxx

xxx

xxx

(e) On contractors and other independent contractors, in accordance with the following

schedule:

With gross receipts for the preceding

Amount of Tax Per Annum

Calendar year in the amount:

xxx

xxx

P2,000,000.00 or more

at a rate not exceeding fifty

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/36618

Page 8 of 10

E-Library - Information At Your Fingertips: Printer Friendly

9/20/14, 9:28 PM

Percent (50%) of one (1%)

[4] Letter Protest dated January 20, 1994, Rollo, pp. 110-111.

[5] Letter of respondent City Treasurer, Rollo, p. 112.

[6] Complaint, Annex "C", Rollo, pp. 51-56.

[7] Rollo, pp. 51-57.

[8] Answer, Annex "J", Rollo, pp. 122-127.

[9] RTC Decision, Rollo, pp. 58-62.

[10] Rollo, p. 84.

[11] CA-G.R. SP No.36801; Penned by Justice Jose C. De la Rama and concurred in by

Justice Jaime M. Lantin and Justice Eduardo G. Montenegro; Rollo, pp. 33-47.

[12] Rollo, p. 49.

[13] Resolution dated November 11, 1996 excerpts of which are hereunder quoted:

"The petition is unmeritorious.

"As correctly ruled by respondent appellate court, petitioner is not a common carrier as

it is not offering its services to the public.

"Art. 1732 of the Civil Code defines Common Carriers as: persons, corporations, firms

or association engaged in the business of carrying or transporting passengers or goods

or both, by land, water, or air, for compensation, offering their services to the public.

"We sustain the view that petitioner is a special carrier. Based on the facts on hand, it

appears that petitioner is not offering its services to the public.

"We agree with the findings of the appellate court that the claim for exemption from

taxation must be strictly construed against the taxpayer. The present understanding of

the concept of "common carriers" does not include carriers of petroleum using

pipelines. It is highly unconventional to say that the business of transporting petroleum

through pipelines involves "common carrier" business. The Local Government Code

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/36618

Page 9 of 10

E-Library - Information At Your Fingertips: Printer Friendly

9/20/14, 9:28 PM

intended to give exemptions from local taxation to common carriers transporting goods

and passengers through moving vehicles or vessels and not through pipelines. The

term common carrier under Section 133 (j) of the Local Government Code must be

given its simple and ordinary or generally accepted meaning which would definitely not

include operators of pipelines."

[14] G.R. No. 125948 (First Philippine Industrial Corporation vs. Court of Appeals, et.

al.)- Considering the grounds of the motion for reconsideration, dated December 23,

1996, filed by counsel for petitioner, of the resolution of November 11, 1996 which

denied the petition for review on certiorari, the Court Resolved:

(a) to GRANT the motion for reconsideration and to REINSTATE the petition; and

(b) to require respondent to COMMENT on the petition, within ten (10) days from

notice.

[15] Agbayani, Commercial Laws of the Phil., 1983 Ed., Vol. 4, p. 5.

[16] 168 SCRA 617-618 [1998].

[17] Giffin v. Pipe Lines, 172 Pa. 580, 33 Alt. 578; Producer Transp. Co. v. Railroad

Commission, 241 US 228, 64 L ed 239, 40 S Ct 131.

[18] Journal and Record of the House of Representatives, Fourth Regular Session,

Volume 2, pp. 87-89, September 6, 1990; Underscoring Ours.

[19] Annex "D" of Petition, Rollo, pp. 101-109.

Source: Supreme Court E-Library

This page was dynamically generated

by the E-Library Content Management System (E-LibCMS)

http://elibrary.judiciary.gov.ph/thebookshelf/showdocsfriendly/1/36618

Page 10 of 10

También podría gustarte

- 3 FijiDocumento33 páginas3 FijilovesresearchAún no hay calificaciones

- 1601E - August 2008Documento3 páginas1601E - August 2008lovesresearchAún no hay calificaciones

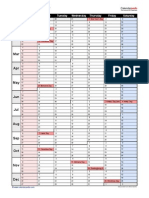

- 2015 Calendar Portrait 2 PagesDocumento2 páginas2015 Calendar Portrait 2 PageslovesresearchAún no hay calificaciones

- 31 CathayPacific2003 - Invol UpgradingDocumento13 páginas31 CathayPacific2003 - Invol UpgradinglovesresearchAún no hay calificaciones

- For BIR Use Only Annual Income Tax ReturnDocumento12 páginasFor BIR Use Only Annual Income Tax Returnmiles1280Aún no hay calificaciones

- De GuzmanDocumento7 páginasDe GuzmanlovesresearchAún no hay calificaciones

- 2015 Calendar Portrait RollingDocumento1 página2015 Calendar Portrait RollinglovesresearchAún no hay calificaciones

- Annual Information Return of Creditable Income Taxes WithheldDocumento2 páginasAnnual Information Return of Creditable Income Taxes WithheldAngela ArleneAún no hay calificaciones

- 2015 Calendar Landscape 4 PagesDocumento8 páginas2015 Calendar Landscape 4 PageslovesresearchAún no hay calificaciones

- 2015 Calendar Landscape 2 Pages LinearDocumento2 páginas2015 Calendar Landscape 2 Pages LinearEdmir AsllaniAún no hay calificaciones

- 2015 Calendar Landscape 4 PagesDocumento8 páginas2015 Calendar Landscape 4 PageslovesresearchAún no hay calificaciones

- A.F. Sanchez BrokerageDocumento13 páginasA.F. Sanchez BrokeragelovesresearchAún no hay calificaciones

- RA 10607 Part4A (Settl-Prescription)Documento2 páginasRA 10607 Part4A (Settl-Prescription)lovesresearchAún no hay calificaciones

- Legal Primer On Foreign InvestmentDocumento9 páginasLegal Primer On Foreign InvestmentleslansanganAún no hay calificaciones

- De GuzmanDocumento7 páginasDe GuzmanlovesresearchAún no hay calificaciones

- RA 10607 Part4A (Settl-Prescription)Documento2 páginasRA 10607 Part4A (Settl-Prescription)lovesresearchAún no hay calificaciones

- Calvo V UCPBDocumento9 páginasCalvo V UCPBlovesresearchAún no hay calificaciones

- Further, That The Right To Import The Drugs: Wretz Musni Page 1 of 5Documento5 páginasFurther, That The Right To Import The Drugs: Wretz Musni Page 1 of 5lovesresearchAún no hay calificaciones

- RA 10607 Part4A (Settl-Prescription)Documento2 páginasRA 10607 Part4A (Settl-Prescription)lovesresearchAún no hay calificaciones

- RA 10607 Part1 (Gen)Documento10 páginasRA 10607 Part1 (Gen)lovesresearchAún no hay calificaciones

- RA 10607 Part4 (Reins, Settlement)Documento3 páginasRA 10607 Part4 (Reins, Settlement)lovesresearchAún no hay calificaciones

- 10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5Documento226 páginas10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5lovesresearchAún no hay calificaciones

- RA 10607 Part4A (Settl-Prescription)Documento2 páginasRA 10607 Part4A (Settl-Prescription)lovesresearchAún no hay calificaciones

- 10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5Documento226 páginas10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5lovesresearchAún no hay calificaciones

- Dulay V Dulay PDFDocumento8 páginasDulay V Dulay PDFlovesresearchAún no hay calificaciones

- RA 10607 Part4 (Reins, Settlement)Documento3 páginasRA 10607 Part4 (Reins, Settlement)lovesresearchAún no hay calificaciones

- Villanueva V Quisumbing PDFDocumento7 páginasVillanueva V Quisumbing PDFlovesresearchAún no hay calificaciones

- 60 SB V MartinezDocumento4 páginas60 SB V MartinezlovesresearchAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Guidelines For RE WorksDocumento3 páginasGuidelines For RE Worksಪರಮಮಿತ್ರಸಂಪತ್ಕುಮಾರ್ಶೆಟ್ಟಿAún no hay calificaciones

- NDA MyHSR MalaysiaDocumento5 páginasNDA MyHSR Malaysia2742481Aún no hay calificaciones

- Cross-Section and SuperelevationDocumento14 páginasCross-Section and SuperelevationMarilu' CrAún no hay calificaciones

- Bus Rapid Transit System in Madurai Terminuses: R.ManimalaDocumento9 páginasBus Rapid Transit System in Madurai Terminuses: R.Manimalasenthur kumarAún no hay calificaciones

- Deutz TCD WH 2015 03123514Documento710 páginasDeutz TCD WH 2015 03123514Harlinton descalzi100% (10)

- Track Maintenance Manual 2020-01-27Documento335 páginasTrack Maintenance Manual 2020-01-27muhammad aliAún no hay calificaciones

- Denah Lt. 1: Departemen Arsitektur Fakultas Teknik Universitas HasanuddinDocumento1 páginaDenah Lt. 1: Departemen Arsitektur Fakultas Teknik Universitas HasanuddinEceAún no hay calificaciones

- 01 Resume David Changwon ParkDocumento2 páginas01 Resume David Changwon Parkapi-351994796Aún no hay calificaciones

- Circular Paris Metro MapDocumento1 páginaCircular Paris Metro MapAna VillaramaAún no hay calificaciones

- Electric Motor HistoryDocumento20 páginasElectric Motor HistoryArman S. PettersenAún no hay calificaciones

- M12 Series Standard Installation Drawings: Engineering Drawing SignalsDocumento26 páginasM12 Series Standard Installation Drawings: Engineering Drawing SignalspanduranganraghuramaAún no hay calificaciones

- Midleton Record of Protected StructuresDocumento84 páginasMidleton Record of Protected Structuresapi-284601216Aún no hay calificaciones

- Lesson PlanDocumento7 páginasLesson Planapi-321908127Aún no hay calificaciones

- T-5-Waseem Dekelbab-NCHRP 12-92 Proposed LRFD Bridge Design Specifications For Light Rail Transit LoadsDocumento20 páginasT-5-Waseem Dekelbab-NCHRP 12-92 Proposed LRFD Bridge Design Specifications For Light Rail Transit Loadsw1000000Aún no hay calificaciones

- 2010.CE-I (SPL) .IRUSSOR.W&M.1 Dated11.08.2011Documento1 página2010.CE-I (SPL) .IRUSSOR.W&M.1 Dated11.08.2011sunny dream11Aún no hay calificaciones

- ExcitationDocumento27 páginasExcitationkr_abhijeet72356587Aún no hay calificaciones

- Case Study TomDocumento4 páginasCase Study TomKAPADIA OWAIS ARIFAún no hay calificaciones

- Lesson 5 Vocabulary Months Days Grammar Sentences Practice ConversationDocumento7 páginasLesson 5 Vocabulary Months Days Grammar Sentences Practice ConversationJERRY ESPIRITUAún no hay calificaciones

- Traffic capacity guide for urban roadsDocumento14 páginasTraffic capacity guide for urban roadsuppaiahAún no hay calificaciones

- 2002 Yamaha FZS1000 Service Repair Manual PDFDocumento30 páginas2002 Yamaha FZS1000 Service Repair Manual PDFjhjnsemmemAún no hay calificaciones

- Presentation On Cable Car ProjectDocumento23 páginasPresentation On Cable Car ProjectAshiq Hossain100% (6)

- Services For Bulk Material Handling Projects: Project Formulation Phase Project Engineering PhaseDocumento29 páginasServices For Bulk Material Handling Projects: Project Formulation Phase Project Engineering PhasesrichmechAún no hay calificaciones

- 620N - 620X - 621 - 622 - 642 - 642X - Timetable 27 January 2015Documento16 páginas620N - 620X - 621 - 622 - 642 - 642X - Timetable 27 January 2015David WangAún no hay calificaciones

- Spring Breeze by Hubert Haddad Translated by Louise Rogers LalaurieDocumento12 páginasSpring Breeze by Hubert Haddad Translated by Louise Rogers LalaurieThe GuardianAún no hay calificaciones

- Federal Register-02-28093Documento1 páginaFederal Register-02-28093POTUSAún no hay calificaciones

- Weights of MaterialsDocumento25 páginasWeights of MaterialsAnonymous o5VxyCg73% (30)

- Marine Quiz by AR RanjithDocumento23 páginasMarine Quiz by AR RanjithRanjith ARAún no hay calificaciones

- 54e1 60e1 Railway Turnouts Techspec WebDocumento36 páginas54e1 60e1 Railway Turnouts Techspec WebShah SudAaisAún no hay calificaciones

- Accidents in Mumbai Local Trains - 2019 PDFDocumento15 páginasAccidents in Mumbai Local Trains - 2019 PDFvarun ganatraAún no hay calificaciones