Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Manila Standard Today - Business Daily Stocks Review (February 24, 2015)

Cargado por

Manila Standard TodayDescripción original:

Derechos de autor

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Manila Standard Today - Business Daily Stocks Review (February 24, 2015)

Cargado por

Manila Standard TodayCopyright:

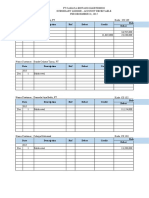

MST Business Daily Stocks Review

Tuesday, February 24, 2015

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

75.3

99.4

105.2

2.3

4.2

63

19.6

31.6

22.5

1.01

92.9

1.65

30.5

75

99

140

392

59

146.8

1700

130

63.5

67.5

82.5

1.9

1.1

50

14.5

23.2

6.84

0.175

69.35

1.2

20.45

58

76

119

276

41.5

105.1

1281

116

Asia United Bank

69.75

Banco de Oro Unibank Inc. 112.90

Bank of PI

99.10

BDO Leasing & Fin. INc. 2.28

Bright Kindle Resources 2.65

China Bank

47.05

COL Financial

16.3

Eastwest Bank

26.5

Filipino Fund Inc.

7.28

MEDCO Holdings

0.560

Metrobank

95.65

Natl. Reinsurance Corp. 1

PB Bank

18.52

Phil Bank of Comm

32.50

Phil. National Bank

83.00

Phil. Savings Bank

95.60

PSE Inc.

350

RCBC `A

47.9

Security Bank

153

Sun Life Financial

1360.00

Union Bank

70.80

FINANCIAL

69.8

67.85

114.00 113.50

99.00

97.95

2.28

2.27

2.72

2.64

47.5

47.05

16.3

16.04

26.5

26.3

7.43

7.36

0.600

0.530

96.5

94.7

0.98

0.94

18.60

18.50

32.15

32.15

83.50

83.00

95.60

95.30

351

350

47

46.8

160.3

153

1390.00 1380.00

70.50

70.35

INDUSTRIAL

45

44.4

1.93

1.8

1.13

1.1

2

1.99

8.2

8.14

18.8

18.58

21

20

58.8

56.5

1.79

1.76

13.2

13.02

19.000 18.38

11.26

10.80

8.76

8.65

10.72

10.64

1.36

1.35

23

19

29.35

28.95

104

102.5

14.50

14.40

0.4900 0.4600

14.90

14.90

6.88

6.76

0.650

0.650

227.00 218.80

10.26

10.1

40.10

40.00

2.8

2.6

74.00

50.00

32.35

31.9

31.05

30.5

8.100

8.030

284.60 281.00

4.29

4.29

4.62

4.55

10.44

10.30

4.68

4.68

10.84

10.50

3.94

3.86

2.67

2.55

5.74

5.59

6.6

6.6

205

203.8

1.97

1.77

0.237

0.162

1.58

1.57

2.30

2.26

218.00 217.2

4.55

4.49

0.75

0.72

1.59

1.55

HOLDING FIRMS

0.480

0.480

58.00

57.70

24.95

24.50

1.45

1.41

7.14

7.11

1.64

1.60

2.58

2.30

2.7

2.4

745

740

9.72

9.36

15.88

15.60

4.57

4.41

0.375

0.350

1203

1197

67.90

66.60

4.03

4.03

5.47

5.47

8.75

8.58

0.72

0.69

15.3

15.1

0.63

0.61

5.15

5.11

5.15

5.05

0.0480 0.0430

1.330

1.330

0.720

0.710

78.70

77.20

924.50 917.50

1.22

1.20

0.96

0.96

112.80 106.10

0.6200 0.5000

0.2550 0.2400

0.345

0.335

PROPERTY

9.930

9.800

1.10

1.07

1.350

1.320

0.275

0.275

37.00

36.50

4.42

4.38

5.06

5.05

Net Foreign

Change Volume

Trade/Buying

69.8

114.00

98.75

2.27

2.64

47.15

16.3

26.5

7.43

0.540

94.7

0.94

18.52

32.15

83.00

95.30

351

46.95

159

1380.00

70.45

0.07

0.97

-0.35

-0.44

-0.38

0.21

0.00

0.00

2.06

-3.57

-0.99

-6.00

0.00

-1.08

0.00

-0.31

0.29

-1.98

3.92

1.47

-0.49

45620

5,901,370

388,690

73,000

122,000

58,900

6,400

150,900

7,800

4,281,000

1,701,960

323,000

95,900

8,500

72,210

8,520

8,370

76,400

3,138,030

25

13,300

814340

25,708,337.00

-13,606,691.00

44.9

1.92

1.13

2

8.19

18.78

21

57

1.79

13.02

18.760

10.84

8.70

10.70

1.36

19.1

29

102.6

14.50

0.4800

14.90

6.77

0.650

219.60

10.26

40.10

2.74

59.00

32.2

30.95

8.040

282.00

4.29

4.57

10.38

4.68

10.80

3.89

2.60

5.70

6.6

204.8

1.84

0.203

1.57

2.28

218

4.5

0.72

1.58

0.34

-1.03

2.73

-0.50

-0.12

0.32

5.00

-3.06

2.29

-1.36

2.51

0.00

0.23

0.38

4.62

-13.18

0.00

-0.39

0.69

-4.00

0.00

-1.60

4.84

-2.83

1.38

-14.68

7.45

18.47

-0.31

0.65

0.00

1.08

4.63

-0.87

-0.19

0.00

1.89

-0.51

-1.52

1.97

0.00

-0.10

5.14

25.31

1.29

0.44

0.18

0.22

-2.70

1.28

1,651,500

91,000

739,000

1,979,000

1,800

568,800

990,100

170,890

26,000

349,800

5,228,700

18,855,500

19,564,300

208,000

23,000

646,300

4,442,500

784,330

5,300

1,723,000

14,000

1,013,700

32,000

2,433,010

4,320,500

9,500

157,000

1,300

1,709,200

608,100

109,100

578,120

3,000

587,000

4,220,900

1,000

400

441,000

2,875,000

590,900

5,400

3,950

2,287,000

76,831,980

78,000

3,603,000

2,502,090

344,000

946,000

494,000

-2,254,230.00

9,150.00

-56,500.00

532,000.00

0.480

57.95

24.70

1.45

7.12

1.64

2.53

2.51

741.5

9.72

15.68

4.50

0.350

1198

67.55

4.03

5.47

8.65

0.7

15.18

0.61

5.14

5.06

0.0450

1.330

0.720

77.90

918.00

1.22

0.96

106.10

0.5000

0.2480

0.335

0.00

0.78

-0.60

1.40

0.00

0.61

10.00

4.58

0.20

2.64

0.51

0.22

-5.41

-0.17

-0.44

-0.49

-0.18

0.82

0.00

-0.65

-1.61

-0.19

0.00

9.76

-1.48

1.41

0.84

0.00

1.67

0.00

-1.76

-10.71

2.90

-2.90

50,000

1,394,960 40,913,272.50

8,315,400 -1,978,630.00

159,000

2,800

67,000

765,000

197,430

340,170

19,220,965.00

7,908,500 44,491,731.00

4,328,900 30,980,924.00

60,000

-4,410.00

4,050,000

207,715

42,298,000.00

1,542,690 -10,712,884.50

50,000

400

8,573,800 -14,927,266.00

570,000

-13,110.00

3,764,700 -25,781,744.00

2,399,000

16,874,100 2,715,468.00

35,400

60,900,000

2,000

1,660,000

141,990

-2,320,709.00

1,376,070 -100,389,005.00

92,000

23,000

16,200

114,307,000 -898,200.00

4,320,000 286,500.00

520,000

9.900

1.08

1.350

0.275

37.00

4.42

5.05

-0.30

-3.57

1.50

-1.79

1.37

0.23

-0.20

949,200

174,000

54,000

10,000

11,778,500

6,544,000

37,800

8,020.00

-50,320.00

10,200.00

-31,796,242.00

10,340.00

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

2

1.5

0.201

0.98

1.09

0.370

2.25

1.77

1.6

4.88

0.180

0.470

0.74

4.45

24.8

2.06

3.6

19.62

1.02

6.66

1.96

6.5

1.22

0.97

0.068

0.47

0.87

0.175

1.22

1.18

1.19

2.75

0.070

0.325

0.4

2.5

18.72

1.45

2.9

14.1

0.58

3.05

0.87

4.37

Century Property

Cityland Dev. `A

Crown Equities Inc.

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Phil. Realty `A

Primex Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

0.95

0.98

0.143

0.465

0.920

0.217

1.69

1.62

1.38

5.32

0.117

0.3750

0.5200

6.03

28.20

1.77

3.20

19.40

0.91

7.25

1.020

7.200

Net Foreign

Change Volume

Trade/Buying

0.98

0.93

0.96

0.98

0.98

0.98

0.144

0.138

0.138

0.465

0.460

0.460

0.920

0.910

0.920

0.216

0.209

0.215

1.69

1.66

1.69

1.70

1.62

1.66

1.41

1.37

1.40

5.36

5.29

5.34

0.147

0.117

0.133

0.3750 0.3400

0.3750

0.5000 0.5000

0.5000

6.01

5.9

6

28.40

27.70

27.70

1.77

1.77

1.77

3.20

3.18

3.18

20.05

19.50

20.00

0.93

0.89

0.91

7.25

7.25

7.25

1.100

1.030

1.080

7.240

7.120

7.240

SERVICES

3.25

1.55 2GO Group

5.62

5.79

5.55

5.65

43.7

27

ABS-CBN

61.35

62.7

61.5

61.6

1.09

0.59 APC Group, Inc.

0.690

0.710

0.690

0.690

12.46

10

Asian Terminals Inc.

12.6

12.6

12.5

12.5

14

8.28 Bloomberry

11.64

11.82

11.62

11.76

0.1640 0.0960 Boulevard Holdings

0.1100

0.1110 0.1090

0.1100

4.05

2.97 Calata Corp.

4.4

4.4

4.24

4.39

71

44.8 Cebu Air Inc. (5J)

89.9

90.6

89.9

90.1

12.3

10.14 Centro Esc. Univ.

10.8

10.86

10.28

10.28

3.28

1.99 Discovery World

1.69

1.7

1.67

1.7

9

4

DFNN Inc.

6.40

6.60

6.36

6.38

1700

1080 FEUI

1095

1095

1090

1090

2008

1580 Globe Telecom

1910

1920

1906

1910

9.04

7.12 GMA Network Inc.

6.28

6.30

6.21

6.22

2.02

1.2

Harbor Star

1.53

1.56

1.52

1.52

118.9

94.4 I.C.T.S.I.

112.9

113

112

112

18.4

5

Imperial Res. `A

4.49

4.01

4.01

4.01

12.5

8.72 IPeople Inc. `A

11.88

11.86

10.82

11.86

0.017

0.012 IP E-Game Ventures Inc. 0.014

0.015

0.015

0.015

0.0653 0.026 Island Info

0.275

0.300

0.265

0.275

2.2800 1.560 ISM Communications

1.3900

1.4000 1.3200

1.3300

6.99

1.95 Jackstones

4

4

3.36

3.9

9.67

5.82 Leisure & Resorts

9.80

9.90

9.65

9.70

2.85

1.15 Liberty Telecom

1.93

1.96

1.95

1.96

2.2

1.1

Lorenzo Shipping

1.42

1.36

1.36

1.36

4.32

1.9

Macroasia Corp.

2.29

2.25

2.19

2.25

1.97

0.485 Manila Bulletin

0.700

0.700

0.700

0.700

14.46

10.14 Melco Crown

10.4

10.44

10.32

10.4

0.62

0.35 MG Holdings

0.370

0.380

0.360

0.370

1.040

0.36 NOW Corp.

0.520

0.520

0.510

0.510

22.8

14.54 Pacific Online Sys. Corp. 18

17.88

17.88

17.88

6.6

5.2

PAL Holdings Inc.

4.69

4.86

4.67

4.67

2.85

1.85 Paxys Inc.

3.25

3.2

3.2

3.2

107

81

Phil. Seven Corp.

96.70

96.75

96.50

96.50

11.3

4.39 Philweb.Com Inc.

12.74

12.74

12.50

12.72

3486

2572 PLDT Common

3176.00

3174.00 3160.00

3164.00

0.710

0.250 PremiereHorizon

0.590

0.600

0.580

0.600

2.01

0.26 Premium Leisure

1.740

1.760

1.690

1.710

48.5

32.2 Puregold

41.25

41.25

40.10

40.35

74

48

Robinsons RTL

85.20

86.00

85.00

85.85

SSI Group

10.34

10.42

10.30

10.36

0.87

0.59 STI Holdings

0.71

0.71

0.69

0.69

11.46

7.78 Travellers

7

7.1

6.98

7

0.435

0.305 Waterfront Phils.

0.380

0.385

0.370

0.385

1.6

1.04 Yehey

1.400

1.450

1.420

1.450

MINING & OIL

0.0086 0.0028 Abra Mining

0.0058

0.0058 0.0055

0.0056

5.45

1.72 Apex `A

2.90

2.90

2.88

2.90

17.24

11.48 Atlas Cons. `A

9.70

9.79

9.42

9.76

0.325

0.225 Basic Energy Corp.

0.265

0.275

0.265

0.270

12.8

6.2

Benguet Corp `A

7.6800

8

7.52

7.5200

1.2

0.5

Century Peak Metals Hldgs 1.01

1.05

1

1

1.73

0.76 Coal Asia

0.9

0.9

0.89

0.9

10.98

4.93 Dizon

7.51

7.80

7.51

7.52

Ferronickel

2.54

2.67

2.52

2.64

0.46

0.385 Geograce Res. Phil. Inc. 0.350

0.350

0.330

0.350

0.455

0.3000 Lepanto `A

0.270

0.275

0.255

0.260

0.730

0.2950 Lepanto `B

0.270

0.270

0.260

0.265

0.024

0.012 Manila Mining `A

0.0150

0.0160 0.0150

0.0150

0.026

0.014 Manila Mining `B

0.0160

0.0160 0.0160

0.0160

8.2

1.960 Marcventures Hldgs., Inc. 5.85

5.85

5.75

5.79

48.85

14.22 Nickelasia

26.75

27.9

26.85

27.6

3.35

1.47 Nihao Mineral Resources 3.03

3.08

3.01

3.05

1.030

0.220 Omico

0.7700

0.7800 0.7400

0.7400

3.06

1.24 Oriental Peninsula Res. 2.310

2.340

2.270

2.300

0.021

0.016 Oriental Pet. `A

0.0140

0.0140 0.0130

0.0140

0.023

0.017 Oriental Pet. `B

0.0140

0.0140 0.0140

0.0140

7.67

4.02 Petroenergy Res. Corp. 5.86

5.86

5.86

5.86

12.88

7.8

Philex `A

8.28

8.39

8.21

8.21

10.42

6.5

PhilexPetroleum

5

5

4.79

4.9

0.042

0.031 Philodrill Corp. `A

0.016

0.017

0.015

0.016

420

123 Semirara Corp.

156.00

156.90 155.00

155.00

9

4.3

TA Petroleum

3.68

3.82

3.69

3.82

0.016

0.0087 United Paragon

0.0110

0.0120 0.0110

0.0120

PREFERRED

44.1

26.3 ABS-CBN Holdings Corp. 61.9

64

61.95

63.8

Ayala Corp. Pref `B1

501

505

501

505

60

30

Ayala Corp. Pref B2

506

507

507

507

116

102 First Gen G

107.7

108

108

108

511

480 GLOBE PREF P

499.2

504

499.2

504

9.04

6.76 GMA Holdings Inc.

6

6.01

6.01

6.01

PCOR-Preferred B

1030

1033

1033

1033

77.3

74.2 SMC Preferred A

76.1

75.9

75

75.05

78.95

74.5 SMC Preferred B

79

78

78

78

81.85

75

SMC Preferred C

82

81.6

81.5

81.5

WARRANTS & BONDS

2.42

0.0010 LR Warrant

4.500

4.520

4.270

4.340

SME

10.96

2.4

Double Dragon

7.73

7.85

7.68

7.72

35

7.74 IRipple E-Business Intl 72

71.95

64

69.95

Xurpas

10.42

11.34

10.42

11.02

EXCHANGE TRADED FUNDS

119.6

94

First Metro ETF

126.5

126.8

126.3

126.3

1.05

0.00

-3.50

-1.08

0.00

-0.92

0.00

2.47

1.45

0.38

13.68

0.00

-3.85

-0.50

-1.77

0.00

-0.63

3.09

0.00

0.00

5.88

0.56

7,283,000 -632,000.00

2,000

34,160,000 8,460.00

920,000

442,000

130,000

424,000

47,028,000 -21,087,130.00

945,000

22,647,400 58,046,527.00

168,790,000 972,320.00

320,000

25,000

57,900

1,791.00

736,600

6,816,740.00

200,000

339,840.00

12,000

37,511,300 352,243,990.00

949,000

1,300

1,502,000 10,760.00

9,923,900 -4,391,870.00

0.53

0.41

0.00

-0.79

1.03

0.00

-0.23

0.22

-4.81

0.59

-0.31

-0.46

0.00

-0.96

-0.65

-0.80

-10.69

-0.17

7.14

0.00

-4.32

-2.50

-1.02

1.55

-4.23

-1.75

0.00

0.00

0.00

-1.92

-0.67

-0.43

-1.54

-0.21

-0.16

-0.38

1.69

-1.72

-2.18

0.76

0.19

-2.82

0.00

1.32

3.57

364,000

722,752.00

354,280

734,000

300

-10.00

2,158,300 -1,756,814.00

25,320,000 272,190.00

411,000

-12,720.00

464,280

8,007,441.50

6,600

31,000

8,350.00

103,800

-511,080.00

60

-32,850.00

45,090

41,138,165.00

64,700

364,000

487,440

-6,413,005.00

2,000

40,600

39,100,000

300,860,000 324,100.00

3,509,000 146,800.00

4,220,000

125,500

578,388.00

41,000

10,000

76,000

3,000

818,700

7,096,318.00

780,000

61,200.00

282,000

500

93,000

23,450.00

50,000

7,520

629,606.00

37,200

94,350

50,564,660.00

1,383,000

10,925,000 4,967,580.00

6,808,700 -109,088,755.00

2,274,890 -19,205,437.00

2,878,200 5,892,420.00

1,361,000 35,000.00

2,632,200 14,048,893.00

330,000

2,000

-3.45

0.00

0.62

1.89

-2.08

-0.99

0.00

0.13

3.94

0.00

-3.70

-1.85

0.00

0.00

-1.03

3.18

0.66

-3.90

-0.43

0.00

0.00

0.00

-0.85

-2.00

0.00

-0.64

3.80

9.09

1,054,000,000 -39,200.00

34,000

189,900

543,335.00

2,050,000

6,000

1,999,000 -155,500.00

762,000

37,100

-22,590.00

18,672,000 -10,457,830.00

200,000

45,640,000

4,280,000 21,100.00

41,200,000

77,100,000

908,300

116,668,335

1,461,000

2,847,000

336,000

400,000

800,000

3,900

415,600

143,200

-2,550.00

421,000,000 -153,600.00

363,010

-12,878,458.00

144,000

-152,060.00

49,700,000 1,200.00

3.07

0.80

0.20

0.28

0.96

0.17

0.29

-1.38

-1.27

-0.61

684,100

12,170

15,840

9,500

29,800

53,400

500

164,050

6,200

26,800

-3.56

467,000

-0.13

-2.85

5.76

2,289,799

7,760

6,766,400 -196,682.00

-0.16

38,710

MST

42.6

31.75 Aboitiz Power Corp.

44.75

6.1

2.51 Agrinurture Inc.

1.94

1.66

0.88 Alliance Tuna Intl Inc.

1.1

2.3

1.25 Alsons Cons.

2.01

17.98

9.58 Asiabest Group

8.2

17.2

14.6 Century Food

18.72

15.8

9.82 Cirtek Holdings (Chips) 20

56.8

21.5 Concepcion

58.8

4.57

0.82 Da Vinci Capital

1.75

39.5

17.3 Del Monte

13.2

14

5.98 DNL Industries Inc.

18.300

12.98

9.05 Emperador

10.84

8.15

4.25 Energy Devt. Corp. (EDC) 8.68

12.34

8.68 EEI

10.66

2.5

1.01 Euro-Med Lab

1.3

17

8.61 Federal Res. Inv. Group 22

27.1

12.2 First Gen Corp.

29

90.5

48.9 First Holdings A

103

27

16

Ginebra San Miguel Inc. 14.40

0.014

0.0097 Greenergy

0.5000

15.74

12.8 Holcim Philippines Inc. 14.90

9.4

2.05 Integ. Micro-Electronics 6.88

0.98

0.32 Ionics Inc

0.620

199.8

150.8 Jollibee Foods Corp.

226.00

10.98

8.55 Lafarge Rep

10.12

79

48.5 Liberty Flour

47.00

5.2

2.8

LMG Chemicals

2.55

45.45

16

Macay Holdings

49.80

30

20.35 Manila Water Co. Inc.

32.3

90

12

Maxs Group

30.75

14.7

10.1 Megawide

8.040

317

246 Mla. Elect. Co `A

279.00

6.49

3.37 Panasonic Mfg Phil. Corp. 4.10

5.37

4

Pepsi-Cola Products Phil. 4.61

14.48

11.56 Petron Corporation

10.40

7.5

5

Phil H2O

4.68

14.5

9.94 Phinma Corporation

10.60

7.03

4.33 Phoenix Petroleum Phils. 3.91

Phoenix Semiconductor 2.64

6.68

4.88 RFM Corporation

5.59

8.1

2.28 Roxas Holdings

6.6

275

210 San MiguelPure Foods `B 205

2.25

1.7

Splash Corporation

1.75

0.191

0.102 Swift Foods, Inc.

0.162

2.5

1.6

TKC Steel Corp.

1.55

2.68

1.37 Trans-Asia Oil

2.27

188.6

111.3 Universal Robina

217.6

5.5

1.58 Victorias Milling

4.49

1.3

0.550 Vitarich Corp.

0.74

2.17

1.33 Vulcan Indl.

1.56

0.7

61.6

31.85

2.16

7.39

2.7

3.29

2.05

747

11.34

84

5.34

0.23

1060

59.8

8.9

5.29

6.55

0.9

19.9

0.75

5.4

5.35

0.0550

2.31

0.84

88

866

2.2

1.39

156

0.285

0.245

0.510

0.46

45.75

21.95

1.6

6.3

1.550

1.8

1.04

508

7.470

47.25

4

0.144

706

36.7

4.96

3

3.95

0.58

12.96

0.580

4.06

4.5

0.027

1.23

0.355

54.5

680

1.04

0.85

58.05

0.158

0.150

0.295

Abacus Cons. `A

0.480

Aboitiz Equity

57.50

Alliance Global Inc.

24.85

Anglo Holdings A

1.43

Anscor `A

7.12

Asia Amalgamated A

1.63

ATN Holdings A

2.30

ATN Holdings B

2.4

Ayala Corp `A

740

Cosco Capital

9.47

DMCI Holdings

15.60

Filinvest Dev. Corp.

4.49

Forum Pacific

0.370

GT Capital

1200

JG Summit Holdings

67.85

Jolliville Holdings

4.05

Keppel Holdings `A

5.48

Lopez Holdings Corp.

8.58

Lodestar Invt. Holdg.Corp. 0.7

LT Group

15.28

Mabuhay Holdings `A

0.62

Metro Pacific Inv. Corp. 5.15

Minerales Industrias Corp. 5.06

Pacifica `A

0.0410

Prime Media Hldg

1.350

Prime Orion

0.710

San Miguel Corp `A

77.25

SM Investments Inc.

918.00

Solid Group Inc.

1.20

South China Res. Inc.

0.96

Top Frontier

108.00

Unioil Res. & Hldgs

0.5600

Wellex Industries

0.2410

Zeus Holdings

0.345

9.03

1.99

2.07

0.375

35.3

6.15

6.1

5.51

0.99

1

0.185

23.7

4.41

5

8990 HLDG

A. Brown Co., Inc.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Trading Summary

FINANCIAL

INDUSTRIAL

HOLDING FIRMS

PROPERTY

SERVICES

MINING & OIL

GRAND TOTAL

SHARES

16,482,110

449,360,437

250,423,689

353,585,104

411,263,445

1,730,448,233

3,218,670,889

9.930

1.12

1.330

0.280

36.50

4.41

5.06

-3,149.50

-659,640.00

-227,500.00

534,565.00

258,839,562.00

-34,600.00

-18,311.00

-4,062,766.00

73,850.00

5,725,470.00

-1,085,732.00

-7,530,874.00

21,574,382.00

33,818,795.00

475,872.00

6,750.00

207,200.00

34,416,730.00

12,173,600.00

-27,416.00

234,220.00

47,350.00

-269,979,370.00

21,788,926.00

-9,290,245.00

2,480,655.00

-810.00

-38,084,910.00

1,444,470.00

-5,935,158.00

1,097,180.00

3,686,998.00

-157,498.00

-77,200.00

-78,800.00

-46,000.00

-79,920,176.00

5,702,359.00

159,408,815.00

27,259,270.00

-20,200.00

T op G ainers

VALUE

1,401,830,897.65

2,349,318,331.868

2,662,137,713.61

1,554,221,957.33

1,276,859,722.46

310,424,749.578

9,636,486,079.70

STOCKS

FINANCIAL

1,790.66 (up) 5.57

INDUSTRIAL

12,881.65 (down) 23.16

HOLDING FIRMS

6,906.71 (up) 4.05

PROPERTY

3,090.03 (up) 42.30

SERVICES

2,230.69 (down) 7.55

MINING & OIL

16,091.52 (up) 3.29

PSEI

7,834.86 (up) 8.79

All Shares Index

4,547.25 (up) 13.06

Gainers: 87; Losers: 95; Unchanged: 40; Total: 222

-10,278,302.50

-4,020,000.00

-210,350.00

-2,213,930.00

T op L osers

Close

(P)

Change

(%)

STOCKS

Close

(P)

Change

(%)

Swift Foods, Inc.

0.203

25.31

Liberty Flour

40.10

-14.68

Macay Holdings

59.00

18.47

Federal Res. Inv. Group

19.1

-13.18

MRC Allied Ind.

0.133

13.68

Unioil Res. & Hldgs

0.5000

-10.71

ATN Holdings A

2.53

10.00

Imperial Res. `A'

4.01

-10.69

Pacifica `A'

0.0450

9.76

Natl. Reinsurance Corp.

0.94

-6.00

United Paragon

0.0120

9.09

Forum Pacific

0.350

-5.41

LMG Chemicals

2.74

7.45

Centro Esc. Univ.

10.28

-4.81

IP E-Game Ventures Inc.

0.015

7.14

ISM Communications

1.3300

-4.32

Suntrust Home Dev. Inc.

1.080

5.88

Lorenzo Shipping

1.36

-4.23

Xurpas

11.02

5.76

Greenergy

0.4800

-4.00

También podría gustarte

- Sample Business ProposalDocumento10 páginasSample Business Proposalvladimir_kolessov100% (8)

- Change Control Procedure: Yogendra GhanwatkarDocumento19 páginasChange Control Procedure: Yogendra GhanwatkaryogendraAún no hay calificaciones

- Business Cycle Indicators HandbookDocumento158 páginasBusiness Cycle Indicators HandbookAnna Kasimatis100% (1)

- Strategic Planning For The Oil and Gas IDocumento17 páginasStrategic Planning For The Oil and Gas ISR Rao50% (2)

- Seller Commission AgreementDocumento2 páginasSeller Commission AgreementDavid Pylyp67% (3)

- Manila Standard Today - Business Daily Stocks Review (February 26, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (February 26, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (February 20, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (February 20, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (June 4, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (February 23, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (February 23, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 30, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 28, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 13, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (June 3, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (February 25, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (February 25, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (February 6, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (February 6, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 10, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 10, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 5, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 29, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 4, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 6, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 13, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 13, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (April 10, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (April 10, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 20, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 20, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 17, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 26, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 26, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 23, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 18, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 2, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 2, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 25, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (June 5, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 24, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (April 22, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (April 22, 2014)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 11, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 18, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 18, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (April 1, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (April 1, 2014)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 25, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 25, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 15, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 15, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (February 20, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (February 20, 2014)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (December 6, 2013)Documento1 páginaManila Standard Today - Business Daily Stocks Review (December 6, 2013)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (April 29, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (April 29, 2014)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 22, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (June 8, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (October 7, 2013)Documento1 páginaManila Standard Today - Business Daily Stocks Review (October 7, 2013)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (February 10, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (February 10, 2014)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (April 8, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (April 8, 2014)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 14, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 14, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 12, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 12, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (June 3, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (June 3, 2014)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (June 23, 2013)Documento1 páginaManila Standard Today - Business Daily Stocks Review (June 23, 2013)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (March 7, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 7, 2014)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (December 10, 2013)Documento1 páginaManila Standard Today - Business Daily Stocks Review (December 10, 2013)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (January 20, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (January 20, 2014)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (August 12, 2013)Documento1 páginaManila Standard Today - Business Daily Stocks Review (August 12, 2013)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Daily Stocks Review (November 19, 2013)Documento1 páginaManila Standard Today - Business Daily Stocks Review (November 19, 2013)Manila Standard TodayAún no hay calificaciones

- Nanotechnology: Basic Calculations for Engineers and ScientistsDe EverandNanotechnology: Basic Calculations for Engineers and ScientistsAún no hay calificaciones

- The Standard - Business Daily Stocks Review (June 5, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (June 3, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (June 2, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (June 8, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 26, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 13, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 18, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 22, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 28, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Documento1 páginaManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 25, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 11, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 20, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 30, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 5, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Documento1 páginaManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 4, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 29, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (May 6, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 17, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 24, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayAún no hay calificaciones

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Documento1 páginaManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 23, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 16, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Weekly Stocks Review (April 19, 2015)Documento1 páginaThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayAún no hay calificaciones

- The Standard - Business Daily Stocks Review (April 22, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayAún no hay calificaciones

- 4 P'sDocumento49 páginas4 P'sankitpnani50% (2)

- Business Plan SampleDocumento14 páginasBusiness Plan SampleGwyneth MuegaAún no hay calificaciones

- InvoiceDocumento1 páginaInvoicesunil sharmaAún no hay calificaciones

- TCW Act #4 EdoraDocumento5 páginasTCW Act #4 EdoraMon RamAún no hay calificaciones

- India of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDocumento2 páginasIndia of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDITSAAún no hay calificaciones

- Manual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesDocumento15 páginasManual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesAlbert ChangAún no hay calificaciones

- Billing Summary Customer Details: Total Amount Due (PKR) : 2,831Documento1 páginaBilling Summary Customer Details: Total Amount Due (PKR) : 2,831Shazil ShahAún no hay calificaciones

- Session 2Documento73 páginasSession 2Sankit Mohanty100% (1)

- Letter InsuranceDocumento2 páginasLetter InsuranceNicco AcaylarAún no hay calificaciones

- DX210WDocumento13 páginasDX210WScanner Camiones CáceresAún no hay calificaciones

- Kennedy 11 Day Pre GeneralDocumento16 páginasKennedy 11 Day Pre GeneralRiverheadLOCALAún no hay calificaciones

- TIPS As An Asset Class: Final ApprovalDocumento9 páginasTIPS As An Asset Class: Final ApprovalMJTerrienAún no hay calificaciones

- Dimapanat, Nur-Hussein L. Atty. Porfirio PanganibanDocumento3 páginasDimapanat, Nur-Hussein L. Atty. Porfirio PanganibanHussein DeeAún no hay calificaciones

- Clerks 2013Documento12 páginasClerks 2013Kumar KumarAún no hay calificaciones

- Levacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesDocumento14 páginasLevacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesAlvaro MedinaAún no hay calificaciones

- Situatie Avize ATRDocumento291 páginasSituatie Avize ATRIoan-Alexandru CiolanAún no hay calificaciones

- Latihan Soal PT CahayaDocumento20 páginasLatihan Soal PT CahayaAisyah Sakinah PutriAún no hay calificaciones

- HPAS Prelims 2019 Test Series Free Mock Test PDFDocumento39 páginasHPAS Prelims 2019 Test Series Free Mock Test PDFAditya ThakurAún no hay calificaciones

- Acknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisDocumento78 páginasAcknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisKuldeep BatraAún no hay calificaciones

- EU Regulation On The Approval of L-Category VehiclesDocumento15 páginasEU Regulation On The Approval of L-Category Vehicles3r0sAún no hay calificaciones

- Report of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Documento42 páginasReport of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Ravi Shankar KolluruAún no hay calificaciones

- KaleeswariDocumento14 páginasKaleeswariRocks KiranAún no hay calificaciones

- Chapter Five: Perfect CompetitionDocumento6 páginasChapter Five: Perfect CompetitionAbrha636Aún no hay calificaciones

- Jay Chou Medley (周杰伦小提琴串烧) Arranged by XJ ViolinDocumento2 páginasJay Chou Medley (周杰伦小提琴串烧) Arranged by XJ ViolinAsh Zaiver OdavarAún no hay calificaciones

- Democracy Perception Index 2021 - Topline ResultsDocumento62 páginasDemocracy Perception Index 2021 - Topline ResultsMatias CarpignanoAún no hay calificaciones