Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Ebiz Answers Oracle R12 and Fusion One or Multiple Operating Units PDF

Cargado por

tiwarihereDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Ebiz Answers Oracle R12 and Fusion One or Multiple Operating Units PDF

Cargado por

tiwarihereCopyright:

Formatos disponibles

WHITEPAPER:

Oracle R12 One or multiple Operating Units?

WHITEPAPER:

Oracle R12 One or multiple Operating Units?

The intention of this document is to provide information to

help you decide whether you should look at using multiple

operating units or one operating unit with multiple legal

entities.

CONTENTS:

Introduction .... 2

Recommended Approach .... 2

Difficulties Faced ....... 3

One Operating Unit ....... 7

eBiz Answers Ltd. WHITEPAPER: Oracle R12 One or multiple Operating Units?. Copyright 2014.

WHITEPAPER:

Oracle R12 One or multiple Operating Units?

Introduction:

The challenged faced by any company implementing a new ERP solution, whether a single entity or a

global conglomerate, is to capture the complex business requirements yet to keep the structure as simple

as possible. Creating a highly complex organisation structure is likely to lead to greater data processing

needs as well as a more labour intensive maintenance requirements but creating a risk that the solution

initially designed to help the company, ultimately leads to issues that end up consuming more resource.

Any solution architect will be considering this when they design the organisation structure deciding the best

approach for the number of ledgers, what legal entities will use these ledgers and how many operating units

will be needed to capture the data from the sub ledgers such as the Payables or Receivable modules.

The 11i approach was often to keep things as simple as possible, with one ledger where possible and only

one operating unit linked to this ledger. The primary driving factor was the time it would take to run reports,

opening and closing the month and entering data across the different legal entities. Each additional

Operating unit meant that a new responsibility was required and this meant that a user would have to

switch between these responsibilities each time they wanted to enter any data or do any month end

processes for example. If you had 10 legal entities, this meant that the same task, if 10 operating units were

used, one for each Legal entity, would have to be repeated each time. This of course would take a huge

amount of time compared to one operating unit that all 10 legal entities were assigned to!

Oracles Release 12 solution change the playing field and ultimately the way the organisations could be

established. First, ledger sets allowed multiple ledgers to be linked together as a ledger set providing that

the same calendar and chart of accounts was used. A ledger set could then be assigned to a responsibility

effectively giving access to the data in all of those ledger contained in the ledger set! Second, and more

importantly, the ability to create security profiles meant that access to operating units and inventory orgs

could now be combined together. This means that those 10 legal entities could now have 10 operating units

per legal entity and added to one or multiple security profiles. A security profile and not an individual

operating unit could now be assigned to a responsibility, giving it access across all 10 operating units! So

now the ability to maintain simplicity with one responsibility to enter data and process month end is

achieved but with the added benefits of the diversification that multiple operating units can bring.

This document is intended to highlight the potential issues if the correct number of operating units are

not used.

Recommended Approach:

The minimal number of operating units needed should at least be one per country per legal entity. This

means that if a legal entity is established in France and only operates in France then only one Operating

unit is needed. If however a similar French legal entity is registered and located in France but also has legal

branches (or permanent establishments) in Germany and Italy, then 3 operating units would be the

preferred route, one for each of the countries that the legal entity is registered in.

I would also apply this rule if a company had 5 legal entities in France, meaning that 5 operating units

would be created, one per legal entity because each legal entity only has one country.

eBiz Answers Ltd. WHITEPAPER: Oracle R12 One or multiple Operating Units?. Copyright 2014.

WHITEPAPER:

Oracle R12 One or multiple Operating Units?

Difficulties Faced:

So, if a company for example decided to create one EUR ledger for Europe and only one operating unit for

Europe instead of following the rule in the recommended approach, below would be some of the difficulties

faced that may or may not lead to serious issues further down the path of the implementation project.

Default Data

With each operating unit, it is possible to set defaults which are used when transactions are entered,

suppliers or customers created or setup done. The default currency for invoices being entered can be

based on the operating unit, as is the accounting, such as the liability account or receivables accounts. With

only one Operating unit, only one default can be used and as such either manual intervention is needed to

change the value or custom code or SLA to ensure the correct account code combination is sent to the GL.

Which Legal Entity?

If you create the legal entities in Oracle under the Legal Entity Manager Responsibility, there is a high

chance that you have legal entities that are used as holding companies, are dormant or having a naming

convention which means the different companies are very similar in name. If you need to get users to

choose the correct legal entity, the values that they can choose from may be confusing and present a risk in

getting the wrong one. With an operating unit, you will only set up the operating unit that you need and will

then link the legal entity to it. So the users only need to worry about the operating unit they are in with the

legal entity automatically assigned.

Party Data

Suppliers and customers when set up assign the sites to operating units. If only one operating unit is used

then it is possible for the wrong supplier site to be chosen when an invoice is being entered. This would

then lead to incorrect accounting hitting the GL which may not ever be discovered. Multiple Operating units

limit the user to select only the sites that are linked to the operating unit that they are working with.

Purchasing

In a scenario where you have one Operating unit with Legal Entities/Balancing Segments and appended to

the operating unit you also have Inventory Organizations representing the different locations. When a

purchase order is raised for one entity, the expense account gets defaulted with the expense account as

defined for the Ship to Organizations hence the correct code combination. The other side of the entry, the

Expense AP Accrual account is where the problem lies as this is set at Operating Unit level hence if the

balance segment value of the entity for the expense is different to that of the Expense AP Accrual, a

problem arises. This is one of the drawbacks of using one Operating Unit. Of course, SLA can be used to

derive the correct balancing segment on the expense AP accrual but when we are looking at it from a

Global Perspective, it doesnt make sense as you end up with a multitude of SLA rules for something that

could easily have been resolved.

Purchase Orders

Purchase orders are set up and only linked to an Operating Unit, there is nowhere to link the Legal Entity to

the purchase order! So the buying team can make purchases knowing who the legal entity they are buying

for but this information is not available to the Payables team via the matched transaction and the payables

team could be in a different country on a different time zone. The point of making a purchase order is to

capture all the information up front to save time downstream, but as you cannot assign the Legal Entity to

the purchase order then this information will be needed at a later date slowing down the process.

eBiz Answers Ltd. WHITEPAPER: Oracle R12 One or multiple Operating Units?. Copyright 2014.

WHITEPAPER:

Oracle R12 One or multiple Operating Units?

Purchase Order Matching

If purchase orders are used then when matched, the purchase order will automatically select the correct

operating unit without the user having to first choose the operating unit.

Month End Closing

It is often thought that having one operating unit assigned to multiple legal entities would make the month

end close easier as all the month end steps can be applied at once. A responsibility that has a security

profile assigned to it containing multiple operating units can perform the same month end tasks across all

1

operating units at the same time making the close time the same as if only having one operating unit.

However, as an added feature, if one there was an issue in closing one of the legal entities and multiple

operating units were used, then it would be possible to close the other operating units to allow business as

usual rather than having to delay the period close whilst the problems were resolved with the legal entity

with the issue.

Printed Documents

Particularly in Europe, the printed documents that are sent out to customers such as statements or invoices

need to comply with local statutory requirements. If only one operating unit is used then it is far harder to

differentiate as to what data to put on to those printed documents. However, multiple operating units will

allow for formatting, language and other statutory requirements per operating unit.

Payables Options by Operating Unit

Exclude Tax from Discount Calculation is only set once so if there is a legal requirement to not discount the

tax then this would be difficult without this option which is set at Operating Unit level.

Country Localisations

Whilst Oracle has been designed to work in every country globally, the out of the box solution cannot meet

every single statutory requirement for every country. For this reason, Oracle provides country specific

localisations which when assigned, need to be differentiated from the common solution. In order to do this,

the localisations need to be assigned to specific responsibilities and often require a separate operating unit

where custom code is needed. Utilising one operating unit for multiple legal entities that span multiple

countries could cause issues that would need custom code to resolve.

Transaction Types

If only one operating unit is used then all the transactions types needed will be visible when being chosen

potentially making it harder for a user to choose the correct value and risk making a mistake, choosing the

wrong transaction type and generating a transaction for one legal entity that should have been for another.

Multiple operating units would allow the transaction types, receipt classes, sources etc. to be linked and

limited by the operating unit making it easier for users to choose the correct values to use.

Transaction Tax

Without doubt, one of the most import things to get right on any implementation is the transactions taxes

being calculated and ultimately reported. Whether Sales and Use tax, VAT or GST, if taxation is not right

then a company could be subject to huge fines and time consuming tax audits. The emphasis to get the tax

solution correct is paramount for the success of any ERP implementation and the number of operating units

Some custom processes maybe required.

eBiz Answers Ltd. WHITEPAPER: Oracle R12 One or multiple Operating Units?. Copyright 2014.

WHITEPAPER:

Oracle R12 One or multiple Operating Units?

can heavily influence the creation of the tax solution. Having multiple operating units, at least by country

2

allows the tax to be easily controlled and confined to just that one countrys tax regime .

Tax Receivables Bill From Address

The Bill from address for AR transactions comes from the address that is linked to the legal entity unit. This

means that if only one operating unit is used then you will need to rely on transaction types that can be

linked to a legal entity to help create the correct invoices. But if more than one Legal Entity are linked to the

Operating Unit then you will need some way to automate the process which would otherwise be automated

if linked to the OU.

Tax Payables Bill To Address

The Bill to address for AP invoices comes from the address that is linked to the Legal Entity. This means

that you need to choose the legal entity manually each time you enter a transaction and because a

purchase order is only linked to an Operating Unit and not the LE, it means that no Legal Entity is defaulted

in when the AP invoice is just linked to the matched to the invoice. Take for example an Operating Unit with

50 legal entities assigned to it. All the Purchase orders are linked to the Operating Unit but for each invoice

entered, the user not only has to choose the correct legal entity but they will also need to work out which

one to use which is a risk in itself. As all the tax information is linked to the Legal Entity such as the

registration details, party classifications etc., if you dont choose the legal entity then all transactions just go

to one! This can cause issues with tax setup and intercompany processes where the tax exemptions are

driven by the use of the same VAT group number or certain tax regimes and rules are linked to just the

legal entity, all this is lost.

Tax Accounts

When a tax rate is created, it needs at least one tax account assigned to it which is done by linking the

account to a ledger and an operating unit. For each operating unit that may use that particular tax rate, a

tax account needs to be assigned to the rate. This means that a default tax account will be used for each

operating unit. If only one operating unit is used that is linked to multiple legal entities (and we assume that

each legal entity has its own balancing segment) then only one tax account can be assign to that rate.

Customisation, usually by using SLA will then be needed in order to correctly determine what account to

use and push to the GL. The issue with the SLA option is that the change to accounting takes place after

the distribution lines have been created so the distribution lines will show one GL code but what actually

hits your GL is a different GL code. This of course can be avoided if an operating unit is used for each

Legal entity per country.

Tax place of supply

For a tax regime to be selected to be used, it needs to match the country of the tax regime against the

value determined by the place of supply rule linked to that regimes tax rules. The place of supply rule will

determine the country used in the ship to, the ship form, the bill from or bill to and if this matches the tax

regime country then the tax will be activated. As an example, if only one operating unit is used for a

European rollout where the Finnish site (who is registered for VAT) sells a product to Sweden and ships

from a distribution centre in the Netherlands then it is possible that the single Operating unit (the bill from) is

defaulted to be in the Netherlands, the Ship from is also in the Netherlands and the Bill To and Ship To are

Sweden, then at no state can the place of supply rule determine Finland unless the legal entity is changed

and therefore not activate the Finnish VAT.

As

described

in

this

document,

tax

regimes

can

be

assigned

to

a

legal

entity

but

this

then

requires

the

manual

selection

of

that

legal

entity

each

time.

eBiz Answers Ltd. WHITEPAPER: Oracle R12 One or multiple Operating Units?. Copyright 2014.

WHITEPAPER:

Oracle R12 One or multiple Operating Units?

Tax Rules

Each tax regime needs to be assigned to the operating unit or legal entity that may use them. If only one

tax regime is assigned to an operating unit then only that tax regime will ever be called upon. If an

operating unit is used for multiple country tax registrations then each of those tax regimes are assigned to

the operating unit. The more tax regimes assigned to an operating unit, the more complex the tax rules

need to be in order to correctly determine the tax to be used as it is possible for multiple taxes to be

determined for each transaction. With one tax regime per operating unit, the rules can be simplified as there

is no possibility of the wrong tax regime calculating a tax for the transaction. The Tax regimes can also be

linked to the Legal Entity within the Operating unit but this can have additional problems as indicated in the

next paragraph.

Choosing the Legal Entity

It is possible to link tax codes to the legal entity but the biggest drawback to this is that during invoice entry

in payables, a Legal Entity must be chosen each time. For manually entered transactions this may seem an

acceptable option but it is difficult for users to know which operating unit to choose and can easily take the

wrong Legal Entity by mistake and because they are of the same Operating Unit as the other Legal Entities,

there are no restrictions on access to suppliers as we would see when separating by Operating Unit. With

the separate operating unit, if you put the wrong Operating unit in then try and chose the supplier, it wont

exist! And because the purchase order is not linked to any Legal Entity then one of the advantages of using

purchase orders is lost as invoices must first choose the Legal Entity Customer Tax Payer ID on the

invoice workbench before choosing the PO number.

Same VAT Group

The logic that can drive the correct tax rates for transactions between entities that belong to the same VAT

group number can easily managed by setting the registration status of both parties involved, this is for both

AP and AR. When a new company is added to the VAT group then their registration status is changed and

automatically the correct tax logic will apply. This means that the correct Legal Entity has to be chosen

each time which is a manual process. This is a simple and future proofed solution. There is a work around

and that is to create rules linked to the balancing segment value of the transactions taking place together

with the registration status of the supplier/customer but whenever there is a new supplier or customer

added then new rules are needed making this a maintenance nightmare and to be avoided when possible.

Migrated Data

When data is migrated into the newly created ERP solution, it is usually assigned to an operating unit (for

Sub ledger data). If only one operating unit is used for multiple legal entities then at a later stage, it is far

more difficult to pull that data out if it needs to be separated at a later stage, if the legal entity is sold off for

example.

Reporting

With multiple operating units, the reports can be run by operating unit and thus give another level to split

the data out to make the reporting easier to see and also reconcile.

Intercompany

Whether drop shipments or using AGIS, having multiple operating units makes it far easier to create

intercompany transactions. If only one operating unit is used then intercompany transactions are limited

using just one operating unit and the ship from and the ship to.

eBiz Answers Ltd. WHITEPAPER: Oracle R12 One or multiple Operating Units?. Copyright 2014.

WHITEPAPER:

Oracle R12 One or multiple Operating Units?

Secondary Ledgers

If you have an Operating Unit that has both France and Spain for example, you will need to create a

secondary ledger for France using the fiscal CoA. This means that when you post your transactions to the

secondary ledger, you will also be posting the Spanish transaction too so a custom process would be need

to filter out the Spanish values from going to the French secondary ledger.

Sequencing

Some countries, like Italy, by law require sequencing to be gapless and on every transaction generated.

Having only one Operating Unit makes it easier to generate the correct sequence number for the

transactions.

More than one Legal Entity per country (Intercompany)

When an intercompany AP transaction is created, no Ship-To information is brought in, nor is the Customer

Taxpayer ID changed. This means that it is not possible to calculate the correct tax and only the location

linked to the operating unit (bill to) is available to calculate taxes.

One Operating Unit:

The evidence above demonstrates the areas that will cause issues if you are trying to use just

one operating unit instead of one operating unit per country per legal entity. But all of the

scenarios above can be overcome with customisations, SLA or workarounds. The decision to

make is to decide if it worth all the extra setup, testing and on-going maintenance in the future for

the sake of having less operating units when the whole point of R12 in Financials is to make it

easier to have access across multiple Operating units with MOAC!

Also bear in mind that you may be able to successfully go live but then when it comes to patches,

support or future upgrades, all those customisations and workarounds will only cause further

problems. Why create custom processes, changes to SLA and workarounds when standard

functionality already exists to do the task!

This WHITEPAPER was produced by eBiz Answers Ltd. We hope it was helpfull.

For further Whitepapers or advice visit: www.ebizanswers.net

eBiz Answers Ltd. WHITEPAPER: Oracle R12 One or multiple Operating Units?. Copyright 2014.

También podría gustarte

- Implementing Oracle Financials in Latin AmericaDocumento6 páginasImplementing Oracle Financials in Latin AmericaAnimorphsAún no hay calificaciones

- In This Document: Goal Solution Standard Patching Process Patch Wizard Still Have Questions? ReferencesDocumento18 páginasIn This Document: Goal Solution Standard Patching Process Patch Wizard Still Have Questions? ReferencesRajaAún no hay calificaciones

- Arctools Structured Data ArchivingDocumento1 páginaArctools Structured Data ArchivingManoj BaghelAún no hay calificaciones

- Pre Configuration PlanDocumento23 páginasPre Configuration Planmariaduque9Aún no hay calificaciones

- Oracle Payables: R12 New FeaturesDocumento50 páginasOracle Payables: R12 New FeaturesnaveenravellaAún no hay calificaciones

- FSG - What Is ItDocumento11 páginasFSG - What Is ItchinbomAún no hay calificaciones

- What Is The Period Close Process For Oracle Assets in Release 12Documento2 páginasWhat Is The Period Close Process For Oracle Assets in Release 12OracleERPAún no hay calificaciones

- Oracle Applications 11i - Financials OverviewDocumento351 páginasOracle Applications 11i - Financials Overviewvarachartered283100% (1)

- PatilEBS Financials and Cloud Financials - Similarities and Differences - PPTDocumento55 páginasPatilEBS Financials and Cloud Financials - Similarities and Differences - PPTjeedAún no hay calificaciones

- Setting Up Cost Accounting in Fusion: Source SystemsDocumento35 páginasSetting Up Cost Accounting in Fusion: Source SystemsShiva KumarAún no hay calificaciones

- Oracle Financials Cloud Hands-On IntroductionDocumento55 páginasOracle Financials Cloud Hands-On IntroductionFernanda Gerevini PereiraAún no hay calificaciones

- EWT Fusion Financials Training General Ledger Day 3 and 4 PDFDocumento40 páginasEWT Fusion Financials Training General Ledger Day 3 and 4 PDFotunla PhilipAún no hay calificaciones

- Building The Business Case To Upgrade To Oracle EBS R12Documento9 páginasBuilding The Business Case To Upgrade To Oracle EBS R12Angie PinedaAún no hay calificaciones

- Business Case Study and Set Up in Oracle Applications IDocumento105 páginasBusiness Case Study and Set Up in Oracle Applications Irahulkatarey100% (4)

- EBS R12 FinancialsDocumento38 páginasEBS R12 FinancialsNarumon SrisuwanAún no hay calificaciones

- Oracle Subledger Accounting Method - Concept ExplainedDocumento2 páginasOracle Subledger Accounting Method - Concept Explainedعبدالرحمن فؤادAún no hay calificaciones

- SLA FA With Custom SourcesDocumento90 páginasSLA FA With Custom SourcesPoshala_RameshAún no hay calificaciones

- Oracle Apps - Third Party Payments in Oracle Payables R12 PDFDocumento6 páginasOracle Apps - Third Party Payments in Oracle Payables R12 PDFAhmed ElhendawyAún no hay calificaciones

- Asset Revaluation or Impairment Understanding The Accounting For Fixed Assets in Release 12 White PaperDocumento7 páginasAsset Revaluation or Impairment Understanding The Accounting For Fixed Assets in Release 12 White Papervarachartered283Aún no hay calificaciones

- Oracle Tax Analytics: Key FeaturesDocumento5 páginasOracle Tax Analytics: Key FeaturesArunkumar ktAún no hay calificaciones

- Ibydc STD1Documento1 páginaIbydc STD1shameem_ficsAún no hay calificaciones

- Set up multi-org structures in Oracle Apps for multiple business unitsDocumento2 páginasSet up multi-org structures in Oracle Apps for multiple business unitsBhargi111Aún no hay calificaciones

- Getting Started With Smart ViewDocumento27 páginasGetting Started With Smart ViewMahesh PrasadAún no hay calificaciones

- Co A DefinitionsDocumento12 páginasCo A DefinitionsMiguel FelicioAún no hay calificaciones

- Oracle - Receivables: Date - 1 MAR 2006 1 OF 5Documento5 páginasOracle - Receivables: Date - 1 MAR 2006 1 OF 5AnjanAún no hay calificaciones

- Oracle 12 Receivables Subledger Accounting - ReceivablesDocumento15 páginasOracle 12 Receivables Subledger Accounting - ReceivablesappsrajeshoracleAún no hay calificaciones

- How To Define Secondary LedgerDocumento1 páginaHow To Define Secondary Ledgerdsgandhi6006Aún no hay calificaciones

- Ifrs Ebs FinalDocumento49 páginasIfrs Ebs Finalnara640% (1)

- Difference Between 11i and R12 FeaturesDocumento5 páginasDifference Between 11i and R12 FeaturesAbhishek RaiAún no hay calificaciones

- Getting Started With E-Business Tax: Functional Overview and Strategies For AdoptionDocumento38 páginasGetting Started With E-Business Tax: Functional Overview and Strategies For AdoptionDu Dinh TruongAún no hay calificaciones

- How To Disable The 'Auto-Merge' Feature For Create Mass Additions in R12.1 Doc ID 1540186.1Documento2 páginasHow To Disable The 'Auto-Merge' Feature For Create Mass Additions in R12.1 Doc ID 1540186.1عبدالرحمن فؤادAún no hay calificaciones

- Build Oracle ERP R12, 11i General Ledger Financial ReportDocumento2 páginasBuild Oracle ERP R12, 11i General Ledger Financial ReportzoneglAún no hay calificaciones

- My DocumentDocumento261 páginasMy DocumentSiva Prathap Reddy UlasalaAún no hay calificaciones

- Related Business Objects: Functional Setup Report Date:7/14/20 10:26 AMDocumento5 páginasRelated Business Objects: Functional Setup Report Date:7/14/20 10:26 AMchandan_infotechAún no hay calificaciones

- Oracle BI Cheat Sheet 11 Feb 2014 DownloadDocumento4 páginasOracle BI Cheat Sheet 11 Feb 2014 DownloadYueHong DaiAún no hay calificaciones

- Data Migration R12 PDFDocumento3 páginasData Migration R12 PDFram knlAún no hay calificaciones

- Oracle Fusion Financials: General Ledger 2014 Essentials exam reviewDocumento27 páginasOracle Fusion Financials: General Ledger 2014 Essentials exam reviewshu1706100% (1)

- R12 Recommended Browsers For Oracle E-Business Suite (Doc ID 389422.1)Documento1 páginaR12 Recommended Browsers For Oracle E-Business Suite (Doc ID 389422.1)Gopal Chandra SamantaAún no hay calificaciones

- R13 - Using-PIM For Product-M-D-MDocumento219 páginasR13 - Using-PIM For Product-M-D-MRon DeLongAún no hay calificaciones

- RI Training - Sem Logo - V.03 - EnGDocumento73 páginasRI Training - Sem Logo - V.03 - EnGPaulo GolpeConsumado Silva100% (1)

- Oracle Inventory and Costing Cloud EbookDocumento11 páginasOracle Inventory and Costing Cloud Ebooksingh_indrajeetkumarAún no hay calificaciones

- Billing Offset ExampleDocumento7 páginasBilling Offset ExampleDhanesh DhamanaskarAún no hay calificaciones

- AP/AR Netting: 1.define Netting Control AccountDocumento11 páginasAP/AR Netting: 1.define Netting Control AccountVijay SharmaAún no hay calificaciones

- Using Supply Chain Cost ManagementDocumento436 páginasUsing Supply Chain Cost ManagementDeepak Pai100% (1)

- Hyperion InstallationDocumento82 páginasHyperion InstallationAnonymous isUyKYK1zwAún no hay calificaciones

- BP040 Current Process ModelDocumento12 páginasBP040 Current Process ModelOdair MeloAún no hay calificaciones

- R12 E-Business Tax - Part 1Documento26 páginasR12 E-Business Tax - Part 1srama1986Aún no hay calificaciones

- Oracle Learning Management User Implementation GuideDocumento62 páginasOracle Learning Management User Implementation GuideJaynendra RoyAún no hay calificaciones

- Customize Oracle Iexpenses WorkflowsDocumento6 páginasCustomize Oracle Iexpenses Workflowsjogil7730Aún no hay calificaciones

- Using New Succession Planning Model GuideDocumento80 páginasUsing New Succession Planning Model GuideAbdallah FayezAún no hay calificaciones

- Managing A Successful R12 Ebusiness Suite Upgrade: A Repeatable Methodology To Help Ensure SuccessDocumento9 páginasManaging A Successful R12 Ebusiness Suite Upgrade: A Repeatable Methodology To Help Ensure SuccessJussara OliveiraAún no hay calificaciones

- User Roles & Management: Oracle Cloud ServiceDocumento39 páginasUser Roles & Management: Oracle Cloud ServiceLenny MwangiAún no hay calificaciones

- The Business Analyst's Guide to Oracle Hyperion Interactive Reporting 11De EverandThe Business Analyst's Guide to Oracle Hyperion Interactive Reporting 11Calificación: 5 de 5 estrellas5/5 (1)

- Oracle Cloud Applications A Complete Guide - 2019 EditionDe EverandOracle Cloud Applications A Complete Guide - 2019 EditionAún no hay calificaciones

- Oracle E-Business Suite The Ultimate Step-By-Step GuideDe EverandOracle E-Business Suite The Ultimate Step-By-Step GuideAún no hay calificaciones

- Oracle Business Intelligence Enterprise Edition 12c A Complete Guide - 2020 EditionDe EverandOracle Business Intelligence Enterprise Edition 12c A Complete Guide - 2020 EditionAún no hay calificaciones

- Introduction to History Part 1: Key ConceptsDocumento32 páginasIntroduction to History Part 1: Key ConceptsHarendraAún no hay calificaciones

- Student Guide - Accounting HubDocumento326 páginasStudent Guide - Accounting HubtiwarihereAún no hay calificaciones

- Key Terms - Hapsburgs and HohenzollernsDocumento17 páginasKey Terms - Hapsburgs and HohenzollernstiwarihereAún no hay calificaciones

- After The Fall of RomeDocumento16 páginasAfter The Fall of RometiwarihereAún no hay calificaciones

- Lead Time CalculationDocumento6 páginasLead Time CalculationtiwarihereAún no hay calificaciones

- LPG BrochureDocumento59 páginasLPG BrochuretiwarihereAún no hay calificaciones

- SLA and Cost AcctgDocumento57 páginasSLA and Cost AcctgcadigvijayAún no hay calificaciones

- Document 2495257.1 Fusion Assets IFRS 16 - AccountingDocumento2 páginasDocument 2495257.1 Fusion Assets IFRS 16 - AccountingtiwarihereAún no hay calificaciones

- After The Fall of RomeDocumento16 páginasAfter The Fall of RometiwarihereAún no hay calificaciones

- How To Setup The Daily DepreciationDocumento3 páginasHow To Setup The Daily DepreciationtiwarihereAún no hay calificaciones

- SLA and Cost AcctgDocumento57 páginasSLA and Cost AcctgcadigvijayAún no hay calificaciones

- Global Variable in Form PersonalizationDocumento53 páginasGlobal Variable in Form PersonalizationSaurabh Sonkusare92% (12)

- Oracle SCM Accounting Quick Reference - Discrete ManufacturingDocumento5 páginasOracle SCM Accounting Quick Reference - Discrete ManufacturingtiwarihereAún no hay calificaciones

- How To Setup Oracle Applications r12 Ebtax1Documento14 páginasHow To Setup Oracle Applications r12 Ebtax1Avijit BanerjeeAún no hay calificaciones

- LCM EntriesDocumento12 páginasLCM EntriesRamesh GarikapatiAún no hay calificaciones

- How To Match Invoice To Purchase OrdersDocumento17 páginasHow To Match Invoice To Purchase OrdersKiran Oluguri100% (1)

- CISA Review - Week 1Documento66 páginasCISA Review - Week 1tiwarihere100% (1)

- Order To Cash Cycle IIIDocumento48 páginasOrder To Cash Cycle IIIrahulkatarey100% (3)

- The Basics of Mergers and AcquisitionsDocumento15 páginasThe Basics of Mergers and Acquisitionsapi-27605522Aún no hay calificaciones

- A Case Study On r12 SlaDocumento15 páginasA Case Study On r12 Slawake12upAún no hay calificaciones

- Ebiz Answers Oracle R12 and Fusion One or Multiple Operating Units PDFDocumento7 páginasEbiz Answers Oracle R12 and Fusion One or Multiple Operating Units PDFtiwarihereAún no hay calificaciones

- Tarka MenuDocumento2 páginasTarka MenutiwarihereAún no hay calificaciones

- Test Bank For Experiential Approach To Organization Development 8th Edition by Donald R BrownDocumento24 páginasTest Bank For Experiential Approach To Organization Development 8th Edition by Donald R BrownPaulJohnsonegko100% (49)

- Leo Strauss & NietzscheDocumento11 páginasLeo Strauss & Nietzschebengerson0% (1)

- Unit 4.3 Royalty Accounts Exam ProblemsDocumento4 páginasUnit 4.3 Royalty Accounts Exam ProblemsRashmi AnuththaraAún no hay calificaciones

- Communication Sher Shah Suri PDFDocumento18 páginasCommunication Sher Shah Suri PDFalamgirianAún no hay calificaciones

- Meadows Appeal DeniedDocumento49 páginasMeadows Appeal DeniedWSB-TVAún no hay calificaciones

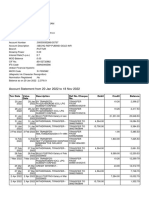

- Bank StatementDocumento4 páginasBank Statementvenkatarammana99Aún no hay calificaciones

- Electronic Media and Regulatory LawDocumento8 páginasElectronic Media and Regulatory LawAnamAún no hay calificaciones

- Rajesh Lodha Case - BriefDocumento4 páginasRajesh Lodha Case - BriefAniket PandeyAún no hay calificaciones

- Expressing Permission, Obligation and Prohibition Using ModalsDocumento16 páginasExpressing Permission, Obligation and Prohibition Using ModalsJake Red BalaisAún no hay calificaciones

- Search Mechanics for SOASPDocumento6 páginasSearch Mechanics for SOASPGwendolyn PansoyAún no hay calificaciones

- Marcos Jr leads Philippines as politics as usual continues in 2022 yearenderDocumento2 páginasMarcos Jr leads Philippines as politics as usual continues in 2022 yearenderMARK ALLEN ARIMADOAún no hay calificaciones

- ONGC 2010-11 Annual Report Highlights Record Production and ProfitsDocumento256 páginasONGC 2010-11 Annual Report Highlights Record Production and ProfitsAmit VirmaniAún no hay calificaciones

- ERISA Class Notes (Spring 2011) - 1Documento107 páginasERISA Class Notes (Spring 2011) - 1shaharhr1100% (1)

- TESTCASE1Documento15 páginasTESTCASE1yuvarajraju016Aún no hay calificaciones

- Deed of Separation and DivorceDocumento1 páginaDeed of Separation and DivorceJaishree KaushikAún no hay calificaciones

- Castets-Renard - 2020 - Algorithmic Content Moderation On Social Media in EU LawDocumento43 páginasCastets-Renard - 2020 - Algorithmic Content Moderation On Social Media in EU LawAlice CalixtoAún no hay calificaciones

- How To Keep ScoreDocumento2 páginasHow To Keep ScoreJoyasLoniAún no hay calificaciones

- Rehlat PDFDocumento2 páginasRehlat PDFfadhelAún no hay calificaciones

- Rics ConflictsDocumento24 páginasRics ConflictsChris Gonzales100% (2)

- (William Tordoff) Government and Politics in Afric PDFDocumento345 páginas(William Tordoff) Government and Politics in Afric PDFSean JoshuaAún no hay calificaciones

- Lesson 2.1: Online Safety, Security and NetiquetteDocumento6 páginasLesson 2.1: Online Safety, Security and NetiquetteChanie Baguio PitogoAún no hay calificaciones

- Dvornik Byz Apostolicity PDFDocumento351 páginasDvornik Byz Apostolicity PDFDejan DoslicAún no hay calificaciones

- Part CDocumento2 páginasPart CNorainun AzwaAún no hay calificaciones

- In Flux - Contemporary Art in Asia PDFDocumento144 páginasIn Flux - Contemporary Art in Asia PDFhabibainsafAún no hay calificaciones

- RAM Foundation User ManualDocumento122 páginasRAM Foundation User ManualJohn DoeAún no hay calificaciones

- Psychiatry, Psychology and LawDocumento28 páginasPsychiatry, Psychology and LawDaimon MichikoAún no hay calificaciones

- Palma, Ian Jeric MagtalasDocumento2 páginasPalma, Ian Jeric MagtalasIan PalmaAún no hay calificaciones

- Gujarat Technological UniversityDocumento2 páginasGujarat Technological Universitymohil thakorAún no hay calificaciones

- P2P flow with new ProductDocumento166 páginasP2P flow with new ProductRohit DaswaniAún no hay calificaciones

- Investor Integrity Speaker BiosDocumento7 páginasInvestor Integrity Speaker BiosFrank KaufmannAún no hay calificaciones