Documentos de Académico

Documentos de Profesional

Documentos de Cultura

ICICI Securities Limited: Particulars

Cargado por

Shashi KapoorTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

ICICI Securities Limited: Particulars

Cargado por

Shashi KapoorCopyright:

Formatos disponibles

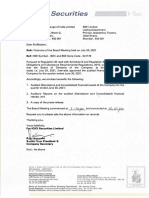

ICICI Securities Limited

MEMBER OF NSEIL & BSE

( Derivative Market Segment )

SEBI REGN. NO.: INF 230773037 (NSE)

SEBI REGN. NO.: INF 010773035 (BSE)

Registered Office : ICICI Centre,

H.T. Parekh Marg, Churchgate,

Mumbai - 400 020, India. Tel No : 022 - 2288 2460 / 2470

Corporate Office:

Shree Sawan Knowledge Park,

Gr. Floor, Plot No. D-507, TTC Industrial Area, MIDC, Turbhe,

Navi Mumbai-400 705, India

Tel : 91-22-4070 1000

Fax: 91-22-4070 1022

Compliance Officer :

Ms.Mamta Shetty, Tel No : 022 - 40701000

Email : complianceofficer@icicisecurities.com

Compliance Officer Address: Same as corporate address

F&O Margin Statement

Client Code

8502626449

Client Name

VIJAY LAKSHMI

Trade Date

Exchange

30-Oct-2014

NSE & BSE

Particulars

Net Amount allocated from bank account (A)

25768.08

I-Sec Margin Amount (B)

93102.62

Shares as Margin (After Haircut) (C)

Margins available till

T day

Margin required by

NSE end of T day

Margin required by

BSE end of T day

30-Oct-2014 After Mkt Hrs

Total Margin Available (D)=(A)+(B)+(C)

0.00

118870.70

Adjustments for the day - NSE* (E)

-4450.00

Adjustments for the day - BSE* (F)

0.00

Limit Available (G)=(D)+/-(E) +/-(F)

114420.70

Initial margin (Futures & Options) (H)

43295.00

Exposure margin (Futures & Options) (I)

23960.00

Total margin (J)=(H)+(I)

67255.00

Initial margin (Futures & Options) (K)

0.00

Exposure margin (Futures & Options) (L)

0.00

Total margin (M)=(K)+(L)

0.00

Total Margin Requirment by NSE & BSE (N) = (J) + (M)

67255.00

Excess/Shortfall w.r.t. requirement by Exchanges(O)=(G)-(N)

47165.70

Margin required by ISec end of T day

Total Initial Margin Required For Open Positions

(Futures & Options) in NSE (P)

91191.76

Total Initial Margin Required For Open Positions

(Futures & Options) in BSE (Q)

0.00

Total Initial Margin Required (R) = (P) +(Q)

91191.76

Additional margin required as per I-Sec RMS (S)=(R)-(N)

23936.76

Margin Status At EOD (Balance with Member / Due from client) (T) = (G) - (R)

23228.94

(*Adjustments for the day - MTM (Loss/Profit), Brokerage, Other statutory Charges, Premium Adjustments, Profit On Exercise, Loss

On Assignment, P/L On Covered Leg, Previous O/s)

NOTES:

1. Please note that you need to provide margin as per I-Sec Risk Management System (RMS) to safeguard your positions. Even if

you meet the margin requirements as prescribed by NSE/BSE, your positions may be squared off if sufficient margin is not

provided as per I-Sec RMS.

2. Open Positions falling under Mark To Market Loop may be squared off due to insufficient margin during Intra day MTM process.

ICICI Securities reserves the right to square off open positions in either of the Exchanges, at its own discretion, due to margin

shortfall arising out of insufficient margin provided by customers.

3. It is advisable to the customers to monitor their margin requirements during market hours and keep higher allocation to

safeguard the open positions.

4. Kindly note that margin blocked on overnight orders (orders placed during non market hours) will not be reflected in the margin

statement. Kindly login to the website for ascertaining details of margin blocked on pending orders.

5. In case of NRI clients,TDS amount payable is not reflected in the margin statement. Please log-in to your online trading account

for verifying the TDS amount payable.

6. The securities allocation amount considered in this statement is the Shares as Margin (SAM) limits allocated by you towards

Derivatives (F&O) segment only.

7. Please note that 'Margin required by Exchange/NSCCL end of T day' excludes premium obligation on Option positions and the

same has been covered in' Adjustments for the day.

También podría gustarte

- RIARequest FinalDocumento2 páginasRIARequest FinalMOHAN SAún no hay calificaciones

- BSE, NSE To Conduct Special Live Trading Session On 2-Mar-24 5paisaDocumento1 páginaBSE, NSE To Conduct Special Live Trading Session On 2-Mar-24 5paisaravi kumarAún no hay calificaciones

- Brokerage ModificationDocumento1 páginaBrokerage ModificationMushkan YadavAún no hay calificaciones

- Margin Statement As On Begining of Day: 17-May-2012Documento1 páginaMargin Statement As On Begining of Day: 17-May-2012Devraaj YadavAún no hay calificaciones

- Margin Statement As On Begining of Day: 13-Jan-2012Documento1 páginaMargin Statement As On Begining of Day: 13-Jan-2012Job AbrahamAún no hay calificaciones

- BYKPT2196M 14 09 2022 09 - 53 - 05 - UnDocumento52 páginasBYKPT2196M 14 09 2022 09 - 53 - 05 - UnHani AjmalAún no hay calificaciones

- ICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Documento5 páginasICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Vijaykumar D SAún no hay calificaciones

- Risk Management PolicyDocumento10 páginasRisk Management Policymahak guptaAún no hay calificaciones

- ICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Documento2 páginasICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Lakshmi MuraliAún no hay calificaciones

- Date: 01/04/2020 Mumbai For ICICI Securities Limited. Yours Faithfully, PlaceDocumento2 páginasDate: 01/04/2020 Mumbai For ICICI Securities Limited. Yours Faithfully, PlaceVikas KunduAún no hay calificaciones

- Contract NotesDocumento2 páginasContract NotesdharmendraAún no hay calificaciones

- Equity KycDocumento39 páginasEquity KycRP groupAún no hay calificaciones

- FAQ Compiled FinalDocumento5 páginasFAQ Compiled Finalnitincs9999Aún no hay calificaciones

- CIC/ Securities: Pro PDocumento24 páginasCIC/ Securities: Pro Pmallesh kAún no hay calificaciones

- Gmail - Welcome! Set Your PasswordDocumento2 páginasGmail - Welcome! Set Your Passwordmanojsaini00.1978Aún no hay calificaciones

- TRX Equity - 05 04 2014 - 12556Documento1 páginaTRX Equity - 05 04 2014 - 12556Silambu SelvanAún no hay calificaciones

- Contract NotesDocumento3 páginasContract NotesHarshal VaidyaAún no hay calificaciones

- Software Development AgreementDocumento5 páginasSoftware Development Agreementmahesh tankAún no hay calificaciones

- Demat AccountDocumento25 páginasDemat AccountSanjay ChinnalaAún no hay calificaciones

- Customer Care CenterDocumento2 páginasCustomer Care CenterRushikesh HirveAún no hay calificaciones

- Acctstmt HDocumento2 páginasAcctstmt Hmaakabhawan26Aún no hay calificaciones

- Comprehensive Portfolio Management Services: State Bank of IndiaDocumento13 páginasComprehensive Portfolio Management Services: State Bank of IndiaGreen Sustain EnergyAún no hay calificaciones

- FAQ-MemberInspection 240919Documento5 páginasFAQ-MemberInspection 240919Tushar GuptaAún no hay calificaciones

- GIBAR805: Atul Maruti Jadhav: Closing BalanceDocumento2 páginasGIBAR805: Atul Maruti Jadhav: Closing BalancePravin BhoiteAún no hay calificaciones

- Technical Trends 07-08-08Documento4 páginasTechnical Trends 07-08-08gagan585Aún no hay calificaciones

- Pcdagri TODINNOFRILLDocumento3 páginasPcdagri TODINNOFRILLANBUAún no hay calificaciones

- National Stock Exchange of India LimitedDocumento3 páginasNational Stock Exchange of India LimitedKeval ShahAún no hay calificaciones

- Mr. Ravi Narain, 9 July 2010. Managing Director and CeosDocumento6 páginasMr. Ravi Narain, 9 July 2010. Managing Director and CeosRahul SamantAún no hay calificaciones

- Im - Infra Series IVDocumento89 páginasIm - Infra Series IVdroy21Aún no hay calificaciones

- Mutual Fund StatementDocumento3 páginasMutual Fund StatementSaurabh Kumar80% (5)

- Tata Motors Abridged LOF - Vfinal PDFDocumento88 páginasTata Motors Abridged LOF - Vfinal PDFdhanoj6522100% (1)

- Bse LTD Subscribe: IPO ReportDocumento3 páginasBse LTD Subscribe: IPO ReportSachinShingoteAún no hay calificaciones

- Groww Stock Account Opening FormDocumento12 páginasGroww Stock Account Opening FormAbdulla ThajilaAún no hay calificaciones

- MCXDocumento32 páginasMCXMANSI POKARNAAún no hay calificaciones

- Nse Circular - 2Documento14 páginasNse Circular - 2Arup GhoshAún no hay calificaciones

- R. Abilash 12bsphh010774 PDM-CDocumento2 páginasR. Abilash 12bsphh010774 PDM-CAbilash RamanAún no hay calificaciones

- All SAMCO1721929T20201026144715 SIGNEDDocumento10 páginasAll SAMCO1721929T20201026144715 SIGNEDbelikehawkgamingAún no hay calificaciones

- Bill Desk - Online Premium PaymentDocumento1 páginaBill Desk - Online Premium PaymentcfrtdfgtAún no hay calificaciones

- Account Statement: Folio No.: 8859269 / 96Documento3 páginasAccount Statement: Folio No.: 8859269 / 96maakabhawan26Aún no hay calificaciones

- IDFCLettertoSEOutcome04052023 04052023144510Documento21 páginasIDFCLettertoSEOutcome04052023 04052023144510Major LoonyAún no hay calificaciones

- Ar 21023 Ethosltd 2021 2022 01092022171315Documento246 páginasAr 21023 Ethosltd 2021 2022 01092022171315Akhil RawatAún no hay calificaciones

- CHAPTER NO 4 Ventura LTDDocumento6 páginasCHAPTER NO 4 Ventura LTDamir420007Aún no hay calificaciones

- Daily Equity Newsletter: Indian MarketDocumento4 páginasDaily Equity Newsletter: Indian Marketapi-196234891Aún no hay calificaciones

- Draft Letter of Buyback Offer (Company Update)Documento55 páginasDraft Letter of Buyback Offer (Company Update)Shyam SunderAún no hay calificaciones

- Account Opening FormDocumento21 páginasAccount Opening Formautocrats 207Aún no hay calificaciones

- TRANEQTYDERServletDocumento1 páginaTRANEQTYDERServletRahul SharmaAún no hay calificaciones

- Investor Analysis of Mutualfund in Jhavery PVT Ltd.Documento53 páginasInvestor Analysis of Mutualfund in Jhavery PVT Ltd.Chintan PavsiyaAún no hay calificaciones

- Introduction To Sumeru Securities Pvt. LTD: 3.1 Background of The OrganizationDocumento5 páginasIntroduction To Sumeru Securities Pvt. LTD: 3.1 Background of The Organizationsagar timilsinaAún no hay calificaciones

- TML Rights Issue LofDocumento445 páginasTML Rights Issue LofPriya SumanAún no hay calificaciones

- CN Commoncontract 20151005 SHP204 0255429 PDFDocumento2 páginasCN Commoncontract 20151005 SHP204 0255429 PDFnaseefardAún no hay calificaciones

- Groww Stock Account Opening Form-1Documento21 páginasGroww Stock Account Opening Form-1Karamsigh rawat 9277Aún no hay calificaciones

- MF-In-DeMAT Client Activation FormDocumento1 páginaMF-In-DeMAT Client Activation FormHemalAún no hay calificaciones

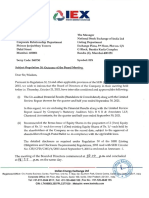

- P.M. On The Same Day.: Indian Energy ExchangeDocumento16 páginasP.M. On The Same Day.: Indian Energy ExchangeSandyAún no hay calificaciones

- Adjudication Order in Respect of Crosseas Capital Services PVT LTD in The Matter of Essdee Aluminium LimitedDocumento14 páginasAdjudication Order in Respect of Crosseas Capital Services PVT LTD in The Matter of Essdee Aluminium LimitedShyam SunderAún no hay calificaciones

- AnnualGlobalTransactionStatement 2018 2019 - SUMMARYDocumento2 páginasAnnualGlobalTransactionStatement 2018 2019 - SUMMARYVijaykumar D SAún no hay calificaciones

- MTNL Annual Report 2009-10Documento157 páginasMTNL Annual Report 2009-10Mohammad ShoaibAún no hay calificaciones

- Trading Account Opening FormDocumento53 páginasTrading Account Opening Formkaysenterprises636Aún no hay calificaciones

- Mastering Tally PRIME: Training, Certification & JobDe EverandMastering Tally PRIME: Training, Certification & JobAún no hay calificaciones

- 11 Years of Supreme Court On Employer-Employee Relations About 400 One Liner Judgments (1990-2007Documento33 páginas11 Years of Supreme Court On Employer-Employee Relations About 400 One Liner Judgments (1990-2007Shashi KapoorAún no hay calificaciones

- Eicher Sells 2244 Units in Nov 2013: The Following Are The Key Highlights For Nov 2013Documento1 páginaEicher Sells 2244 Units in Nov 2013: The Following Are The Key Highlights For Nov 2013Shashi KapoorAún no hay calificaciones

- Tata Steel Application Form PDFDocumento4 páginasTata Steel Application Form PDFShashi Kapoor0% (2)

- CLC HR Shared Services Competency Model GuideDocumento6 páginasCLC HR Shared Services Competency Model GuideShashi KapoorAún no hay calificaciones

- Wockhardt: CMP: INR440Documento4 páginasWockhardt: CMP: INR440Shashi KapoorAún no hay calificaciones

- PMS Quiz On 24 Leadership Mail To Mulla Mulla Assignment Pending On This Thursday Sarla Assignment Deadline 3 MarchDocumento1 páginaPMS Quiz On 24 Leadership Mail To Mulla Mulla Assignment Pending On This Thursday Sarla Assignment Deadline 3 MarchShashi KapoorAún no hay calificaciones

- A Study of Talent Management As A Strategic Tool For The Organization in Selected Indian IT CompaniesDocumento10 páginasA Study of Talent Management As A Strategic Tool For The Organization in Selected Indian IT CompaniesShashi KapoorAún no hay calificaciones

- Farewell Party:) : Assignment Date/DeadlineDocumento2 páginasFarewell Party:) : Assignment Date/DeadlineShashi KapoorAún no hay calificaciones

- DM QuestionnaireDocumento2 páginasDM QuestionnaireShashi KapoorAún no hay calificaciones

- 1290 Mamin Ullah The Emerging Roles of HR Professionals in DrivingDocumento11 páginas1290 Mamin Ullah The Emerging Roles of HR Professionals in DrivingShashi KapoorAún no hay calificaciones

- Alembic Pharma LTD (APL) Stock Update: Retail ResearchDocumento5 páginasAlembic Pharma LTD (APL) Stock Update: Retail ResearchShashi KapoorAún no hay calificaciones

- Indianivesh Securities Private Limited: Balanced Aggressive ConservativeDocumento9 páginasIndianivesh Securities Private Limited: Balanced Aggressive ConservativeShashi KapoorAún no hay calificaciones

- 04 Simple AnovaDocumento9 páginas04 Simple AnovaShashi KapoorAún no hay calificaciones

- WWW Sociologyguide Com 3Documento1 páginaWWW Sociologyguide Com 3Shashi KapoorAún no hay calificaciones

- Q.1. Critically Discuss Gandhi and Nehru's Idea of India'Documento11 páginasQ.1. Critically Discuss Gandhi and Nehru's Idea of India'Shashi KapoorAún no hay calificaciones

- Tentative Schedule12062013Documento1 páginaTentative Schedule12062013Shashi KapoorAún no hay calificaciones

- FCHR5 Quantitative Research 2013-15Documento4 páginasFCHR5 Quantitative Research 2013-15Shashi KapoorAún no hay calificaciones

- Shri Ram Centre For Industrial Relations and Human ResourcesDocumento21 páginasShri Ram Centre For Industrial Relations and Human ResourcesShashi KapoorAún no hay calificaciones

- Glosario de SAP en InglésDocumento129 páginasGlosario de SAP en InglésTester_10Aún no hay calificaciones

- Zuellig V Sibal PDFDocumento25 páginasZuellig V Sibal PDFCarlo AfAún no hay calificaciones

- John Deere Case Study 12 27 11Documento3 páginasJohn Deere Case Study 12 27 11Rdx ProAún no hay calificaciones

- E3 Expo Booklet - 2018Documento22 páginasE3 Expo Booklet - 2018CoachTinaFJAún no hay calificaciones

- Econ 305 Dr. Claudia Strow Sample Final Exam QuestionsDocumento5 páginasEcon 305 Dr. Claudia Strow Sample Final Exam Questionscognac19840% (1)

- CH 14Documento8 páginasCH 14Lemon VeinAún no hay calificaciones

- Case Study WilkersonDocumento2 páginasCase Study WilkersonHIMANSHU AGRAWALAún no hay calificaciones

- Structure and Composition of Foreign Exchange Management SystemDocumento28 páginasStructure and Composition of Foreign Exchange Management SystemParthadeep SharmaAún no hay calificaciones

- Retirement QuestionDocumento2 páginasRetirement QuestionshubhamsundraniAún no hay calificaciones

- COBECON - Math ProblemsDocumento16 páginasCOBECON - Math ProblemsdocumentsAún no hay calificaciones

- Balance of Payments With A Focus On NigeriaDocumento33 páginasBalance of Payments With A Focus On NigeriaJohn KargboAún no hay calificaciones

- A2 Form Sample - Gokul KRISHNANDocumento3 páginasA2 Form Sample - Gokul KRISHNANAlbi GokulAún no hay calificaciones

- Gilaninia and MousavianDocumento9 páginasGilaninia and Mousavianpradeep110Aún no hay calificaciones

- E1.developments in The Indian Money MarketDocumento16 páginasE1.developments in The Indian Money Marketrjkrn230% (1)

- Vietnam Tax Legal HandbookDocumento52 páginasVietnam Tax Legal HandbookaAún no hay calificaciones

- Fundamental Accounting Ii Final ModuleDocumento174 páginasFundamental Accounting Ii Final ModuleFanuel Derese100% (2)

- Term Paper Edit Swizel and VernonDocumento10 páginasTerm Paper Edit Swizel and VernonswizelAún no hay calificaciones

- Using Sage 50 Accounting 2017 Canadian 1st Edition Purbhoo Test BankDocumento13 páginasUsing Sage 50 Accounting 2017 Canadian 1st Edition Purbhoo Test Bankmungoosemodus1qrzsk100% (25)

- Apple and Tesla Have Split Their StocksDocumento11 páginasApple and Tesla Have Split Their Stocksyogesh patilAún no hay calificaciones

- SCM AgreementDocumento6 páginasSCM AgreementankitaprakashsinghAún no hay calificaciones

- Structured Note ProductsDocumento10 páginasStructured Note Productschandkhand2Aún no hay calificaciones

- AgarbattiDocumento42 páginasAgarbattiDhwani Thakkar50% (2)

- Banking Law Honors PaperDocumento4 páginasBanking Law Honors PaperDudheshwar SinghAún no hay calificaciones

- Definitions of Globalization - A Comprehensive Overview and A Proposed DefinitionDocumento21 páginasDefinitions of Globalization - A Comprehensive Overview and A Proposed Definitionnagendrar_2Aún no hay calificaciones

- Aditya Pandey - Summer Internship Report PDFDocumento52 páginasAditya Pandey - Summer Internship Report PDFHustle TvAún no hay calificaciones

- Tck-In Day 9Documento3 páginasTck-In Day 9Julieth RiañoAún no hay calificaciones

- Bba PDFDocumento50 páginasBba PDFLakhan KumarAún no hay calificaciones

- Bank Statement (Various Formats)Documento48 páginasBank Statement (Various Formats)Araman AmruAún no hay calificaciones

- TaxDocumento4 páginasTaxMendoza KelvinAún no hay calificaciones

- 1.pmsby - Scheme in Brief PDFDocumento1 página1.pmsby - Scheme in Brief PDFRanjit RjtAún no hay calificaciones