Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Mod - Features of A Cash Flow Waterfall in Project Finance

Cargado por

pierrefrancTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Mod - Features of A Cash Flow Waterfall in Project Finance

Cargado por

pierrefrancCopyright:

Formatos disponibles

Features of a cash flow waterfall in project finance - Corality

FEATURES OF A CASH FLOW

WATERFALL IN PROJECT

FINANCE

21/07/2014 14:37

BY NICK CRAWLEY

Contact Nick Crawley

(mailto:nick_crawley@corality.com)

25 SEPTEMBER 2008

The cash flow waterfall ensures that each cash flow item occurs

at the correct seniority to other items. This tutorial outlines key

categories of cash flow items and how to present the cash flow

waterfall in comparison to the cash flow statement in a project

finance model.

In project finance, a projects cash flow is summarised using a cash flow waterfall, which

shows the priority of each cash inflow and outflow. The cash flow waterfall ensures that

each cash flow item occurs at the correct seniority to other items. The cash flow waterfall

becomes especially important when illustrating debt repayments of many debt tranches

with reducing seniority.

Cash flow waterfall categories

A cash flow waterfall is simple in its approach, as all cash flow items are placed in the

order in which they occur. The main categories of a cash flow waterfall, in order of

occurrence are:

Revenues: Operating revenues and other income

Expenses: Operating expenses and capital expenses

Tax

Debt service: Principal repayments and interest paid

Distributions

Net movement in cash balance

Key summary lines of cash flow waterfall

The cash flow waterfall is used to calculate key cash flow lines, which are used in

different parts of project finance modelling. Key lines of the cash flow waterfall are:

Cash flow available for debt service (CFADS): (/training/learning/bloglist/blogs/september-2008/cfads--cash-flow-available-for-debt-service)This is the

most significant line which drives all debt repayment calculations and ratios, including

debt service coverage ratio (DSCR) (/training/learning/blog-list/blogs/september2008/dscr--debt-service-coverage-ratio), project life coverage ratio (PLCR)

http://www.corality.com/tutorials/features-cashflow-waterfall-project-finance

Page 1 sur 4

Features of a cash flow waterfall in project finance - Corality

21/07/2014 14:37

(/training/learning/blog-list/blogs/march-2009/plcr--project-life-cover-ratio) and

loan life coverage ratio (LLCR) (/training/campus/blog-list/blogs/september2008/llcr-loan-life-coverage-ratio)

Cash flow before funding: This line is useful as a quick check against funding, to ensure

that initial construction costs are being met by debt or equity

Cash flow available for debt service reserve (or other reserve) account (DSRA)

(/training/learning/blog-list/blogs/september-2008/cfads--cash-flow-available-fordebt-service)

Cash flow available to equity to calculate distributions

Net cash flow

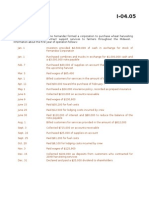

Screenshot 1 is a high level illustration of a typical cash flow waterfall. Each category will

be separated into individual line items, such as individual operating costs.

It clearly shows that by going down the page, you are able to identify the timing and

seniority of each cash flow and the highlighted key cash flow lines.

IMAGE 1: CASH FLOW WATERFALL PRESENTED IN A PROJECT FINANCE MODEL

Comparison of a cash flow statement and a

cash flow waterfall

Grouping of cash flows

The cash flow statement presents information in three key categories: Cash flow from

operations; cash flow from investing; and cash flow from financing, which are standalone

from one another.

Seniority of cash flow items

http://www.corality.com/tutorials/features-cashflow-waterfall-project-finance

Page 2 sur 4

Features of a cash flow waterfall in project finance - Corality

21/07/2014 14:37

The cash flow statement does not order cash flows in order of seniority, thereby making it

less efficient when analysing a projects debt repayment ability. The cash flow waterfall

clearly shows the amount of cash flow at each level as described in the term sheet.

Investors or financiers?

The cash flow statement provides information that can be readily analysed from an

external investors perspective, whereas the cash flow waterfall provides information that

can be easily analysed by the banks.

Screenshot 2 is an illustration of a cash flow statement. When compared with the

structure of the cash flow waterfall in screenshot 1, the differences are easily identified.

IMAGE 2: CASH FLOW STATEMENT SUITABLE FOR FINANCIAL MODELLING OF CORPORATE

FINANCE TRANSACTIONS OR ANALYSIS

Points to consider in cash flow waterfall

modelling

The term sheet specifies the seniority of certain categories, such as

reserve accounts.

The addition of an annual cash flow waterfall significantly improves the usability of the

model, as it facilitates analysis at a high level. This is efficiently coded using the SUMIF

formula based on calendar year, financial year or operating year.

Ensure that debt is being repaid according to seniority of the tranches.

This is especially important in downside sensitivity or scenario analysis, where the

operating cash flows are highly stressed.

The cash flow waterfall is used to calculate the net movement in the cash

balance and also the cash closing balance.

Adding an integrity check to this line that indicates whether the closing cash balance (or

balance carried forward balance C/f) is negative is a critical component of a complete

model. If this integrity check is not added, a project can appear to be funded by a

negative cash balance which is not a realistic scenario.

http://www.corality.com/tutorials/features-cashflow-waterfall-project-finance

Page 3 sur 4

Features of a cash flow waterfall in project finance - Corality

http://www.corality.com/tutorials/features-cashflow-waterfall-project-finance

21/07/2014 14:37

Page 4 sur 4

También podría gustarte

- Case Problem Project FinanceDocumento37 páginasCase Problem Project FinanceSaurabh SumanAún no hay calificaciones

- SPAC LBO Structuring Model - 1Documento7 páginasSPAC LBO Structuring Model - 1www.gazhoo.com100% (1)

- Cash Sweep TutorialDocumento2 páginasCash Sweep Tutorialsourabh manglaAún no hay calificaciones

- Master in Business For Architecture and DesignDocumento27 páginasMaster in Business For Architecture and DesignpierrefrancAún no hay calificaciones

- I 04.05studentDocumento22 páginasI 04.05studentFaizan Yousuf67% (3)

- FI - Cross Currency Swap Theory and Practice (Nicholas Burgess) PDFDocumento26 páginasFI - Cross Currency Swap Theory and Practice (Nicholas Burgess) PDFpierrefrancAún no hay calificaciones

- Loan and Revolver For Debt Modelling Practice On ExcelDocumento2 páginasLoan and Revolver For Debt Modelling Practice On ExcelMohd IzwanAún no hay calificaciones

- Structuring Introduction To Luxembourg Alternative Investment Vehicles (PWC)Documento21 páginasStructuring Introduction To Luxembourg Alternative Investment Vehicles (PWC)pierrefranc100% (1)

- Chapter 7 FinalDocumento18 páginasChapter 7 FinalMichael Hu92% (12)

- Power Project Finance: Experience in Developing CountriesDocumento57 páginasPower Project Finance: Experience in Developing CountriesJyothi GunturAún no hay calificaciones

- Case Study On Delhivery. FinalDocumento8 páginasCase Study On Delhivery. FinaldsgrAún no hay calificaciones

- Infrastructure Financing Instruments and Incentives PDFDocumento74 páginasInfrastructure Financing Instruments and Incentives PDFmanugeorgeAún no hay calificaciones

- LBO Fundamentals: Structure, Performance & Exit StrategiesDocumento40 páginasLBO Fundamentals: Structure, Performance & Exit StrategiesSouhail TihaniAún no hay calificaciones

- Financing and Investing in Infrastructure Week 1 SlidesDocumento39 páginasFinancing and Investing in Infrastructure Week 1 SlidesNeindow Hassan YakubuAún no hay calificaciones

- Babson Capital Mezz Middle Market WPDocumento8 páginasBabson Capital Mezz Middle Market WPrhapsody1447Aún no hay calificaciones

- Financial Modelling PowerDocumento4 páginasFinancial Modelling Powerarunjangra566Aún no hay calificaciones

- Mezzanine Finance 12Documento8 páginasMezzanine Finance 12bryant_bedwellAún no hay calificaciones

- Mezzanine DebtDocumento2 páginasMezzanine DebtIan Loke100% (1)

- Cash Flow Analysis, Target Cost, Variable CostDocumento29 páginasCash Flow Analysis, Target Cost, Variable CostitsmenatoyAún no hay calificaciones

- Ch02 P14 Build A Model AnswerDocumento4 páginasCh02 P14 Build A Model Answersiefbadawy1Aún no hay calificaciones

- Introduction To: Capital MarketsDocumento57 páginasIntroduction To: Capital MarketsTharun SriramAún no hay calificaciones

- Primer 2015Documento18 páginasPrimer 2015pierrefrancAún no hay calificaciones

- Semi-Annual Debt in A Quarterly ModelDocumento2 páginasSemi-Annual Debt in A Quarterly ModelSyed Muhammad Ali SadiqAún no hay calificaciones

- Creating Value Through Required ReturnDocumento74 páginasCreating Value Through Required Returnriz4winAún no hay calificaciones

- Summary Project Finance in Theory and PracticeDocumento30 páginasSummary Project Finance in Theory and PracticeroseAún no hay calificaciones

- Infrastructure Development Plan for Chhattisgarh - Road Project Viability OptionsDocumento3 páginasInfrastructure Development Plan for Chhattisgarh - Road Project Viability Optionsjavedarzoo50% (2)

- Average DSCR Calculation 1 01cDocumento20 páginasAverage DSCR Calculation 1 01cLuharuka100% (1)

- Capital IQ Excel Plug-In GuideDocumento21 páginasCapital IQ Excel Plug-In GuideAndi EjronAún no hay calificaciones

- 2014.05.22. Interventions Required For The Development of The Gas Sector in NigeriaDocumento21 páginas2014.05.22. Interventions Required For The Development of The Gas Sector in NigeriasiriuslotAún no hay calificaciones

- Lehman Brothers Forex Training Manual PDFDocumento130 páginasLehman Brothers Forex Training Manual PDFZubaidi Othman100% (3)

- Asset ManagementDocumento12 páginasAsset ManagementSantosh JhawarAún no hay calificaciones

- 8 LMS-Tutorial CFW PDFDocumento6 páginas8 LMS-Tutorial CFW PDFEnriko SagaAún no hay calificaciones

- Valuation Report DCF Power CompanyDocumento34 páginasValuation Report DCF Power CompanySid EliAún no hay calificaciones

- Pre Operating CFADSDocumento2 páginasPre Operating CFADSpolobook378250% (2)

- Advisors Report 2010Documento35 páginasAdvisors Report 2010bluesbankyAún no hay calificaciones

- Chapter 13 - Statement of Cash FlowsDocumento31 páginasChapter 13 - Statement of Cash Flowselizabeth karina100% (1)

- Session 6 - Case Study On Haripur 360 MW Combined Cycle Power Plant by Nazrul IslamDocumento27 páginasSession 6 - Case Study On Haripur 360 MW Combined Cycle Power Plant by Nazrul IslamFarukHossainAún no hay calificaciones

- Toll Road Infrastructure Project Financial Model - FinalyticsDocumento1 páginaToll Road Infrastructure Project Financial Model - FinalyticsAbd Aziz MohamedAún no hay calificaciones

- CFADS Calculation ApplicationDocumento2 páginasCFADS Calculation ApplicationSyed Muhammad Ali Sadiq100% (2)

- Set Up Actual Costing in SAPDocumento29 páginasSet Up Actual Costing in SAPedward_soaresAún no hay calificaciones

- Mezzanine Debt Benefits and DrawbacksDocumento8 páginasMezzanine Debt Benefits and DrawbacksDhananjay SharmaAún no hay calificaciones

- Custom Number Formats ExcelDocumento2 páginasCustom Number Formats ExcelKwaaziAún no hay calificaciones

- Project Financing in Laos' Hydropower For Export of Electricity To ThailandDocumento4 páginasProject Financing in Laos' Hydropower For Export of Electricity To Thailandits4krishna3776Aún no hay calificaciones

- Project Finance: Valuing Unlevered ProjectsDocumento41 páginasProject Finance: Valuing Unlevered ProjectsKelsey GaoAún no hay calificaciones

- Session 3: Project Unlevered Cost of Capital: N. K. Chidambaran Corporate FinanceDocumento25 páginasSession 3: Project Unlevered Cost of Capital: N. K. Chidambaran Corporate FinanceSaurabh GuptaAún no hay calificaciones

- PLCR TutorialDocumento2 páginasPLCR TutorialSyed Muhammad Ali SadiqAún no hay calificaciones

- Projecting Financials & ValuationsDocumento88 páginasProjecting Financials & ValuationsPratik ModyAún no hay calificaciones

- 2.1 New Model For Indian Road PPPDocumento17 páginas2.1 New Model For Indian Road PPPRohitAún no hay calificaciones

- Debt Sculpting TutorialDocumento2 páginasDebt Sculpting TutorialYogesh More100% (1)

- AC6101 Lecture 6 - Valuing Levered ProjectsDocumento16 páginasAC6101 Lecture 6 - Valuing Levered ProjectsKelsey GaoAún no hay calificaciones

- Wind Project Financing StructuresDocumento82 páginasWind Project Financing StructuresSajjad JafferAún no hay calificaciones

- Merger and Acquisition As A Survival Strategy in The Nigeria Banking IndustryDocumento14 páginasMerger and Acquisition As A Survival Strategy in The Nigeria Banking IndustryOtunba Olowolafe MichaelAún no hay calificaciones

- Introduction to Infrastructure in IndiaDocumento61 páginasIntroduction to Infrastructure in Indiaanilnair88Aún no hay calificaciones

- 1.0 Financial Modeling Intro v2Documento28 páginas1.0 Financial Modeling Intro v2Arif JamaliAún no hay calificaciones

- EY Infrastructure Investments For Insurers PDFDocumento24 páginasEY Infrastructure Investments For Insurers PDFDallas DragonAún no hay calificaciones

- DSCR Tutorial: Understanding the Debt Service Coverage RatioDocumento2 páginasDSCR Tutorial: Understanding the Debt Service Coverage RatioArun Pasi100% (1)

- Mezzanine Debt StructuresDocumento2 páginasMezzanine Debt StructuresJavierMuñozCanessaAún no hay calificaciones

- CFADS Calculation ApplicationDocumento2 páginasCFADS Calculation Applicationtransitxyz100% (1)

- Cashflow Waterfall TutorialDocumento2 páginasCashflow Waterfall TutorialRichard Neo67% (3)

- CFADS Calculation & Application PDFDocumento2 páginasCFADS Calculation & Application PDFJORGE PUENTESAún no hay calificaciones

- Debt Sizing For Minimum DSCR With VBA Goal Seek - Solve For Zero Delta!Documento5 páginasDebt Sizing For Minimum DSCR With VBA Goal Seek - Solve For Zero Delta!serpepeAún no hay calificaciones

- The Use of Mini Perms in UK PFI Passing Fad or Here To StayDocumento18 páginasThe Use of Mini Perms in UK PFI Passing Fad or Here To Stayaditya29121980Aún no hay calificaciones

- INTERNATIONAL PROJECT FINANCE STRUCTURINGDocumento4 páginasINTERNATIONAL PROJECT FINANCE STRUCTURINGSandeep SinghAún no hay calificaciones

- CERC Regulations 2009-14: Key Changes to Return on Equity, Depreciation, O&M Expenses & MoreDocumento42 páginasCERC Regulations 2009-14: Key Changes to Return on Equity, Depreciation, O&M Expenses & MoreVineel KambalaAún no hay calificaciones

- Growth Lending Guide BOOST and Co Apr19Documento31 páginasGrowth Lending Guide BOOST and Co Apr19Ilya HoffmanAún no hay calificaciones

- LBO Model Algeco - For StudentsDocumento5 páginasLBO Model Algeco - For StudentsZexi WUAún no hay calificaciones

- Free Cash Flow To Equity Valuation Model For Coca ColaDocumento5 páginasFree Cash Flow To Equity Valuation Model For Coca Colaafridi65Aún no hay calificaciones

- Waterfall chart showing company revenues by categoryDocumento10 páginasWaterfall chart showing company revenues by categoryEvert TrochAún no hay calificaciones

- Valuation Cash Flow A Teaching NoteDocumento5 páginasValuation Cash Flow A Teaching NotesarahmohanAún no hay calificaciones

- Financial RatioDocumento69 páginasFinancial RatioSwaroop VarmaAún no hay calificaciones

- SM Alk 9Documento35 páginasSM Alk 9Jogja AntiqAún no hay calificaciones

- REF - Loan Underwriting Process 1Documento9 páginasREF - Loan Underwriting Process 1pierrefrancAún no hay calificaciones

- REF - Loans & Secured Financing 2022 - Luxembourg (Lexology)Documento11 páginasREF - Loans & Secured Financing 2022 - Luxembourg (Lexology)pierrefrancAún no hay calificaciones

- REF - Negative Pledges in Commercial Real Estate Financings - Why Do We Need Them (Cadwalader)Documento4 páginasREF - Negative Pledges in Commercial Real Estate Financings - Why Do We Need Them (Cadwalader)pierrefrancAún no hay calificaciones

- RELAW - The IRR Ate My CapitalDocumento3 páginasRELAW - The IRR Ate My Capitalpierrefranc100% (1)

- Mort Mag GR en 0118 FinalDocumento8 páginasMort Mag GR en 0118 FinalpierrefrancAún no hay calificaciones

- REF - Loan Underwriting Process 3Documento13 páginasREF - Loan Underwriting Process 3pierrefrancAún no hay calificaciones

- Banks Coordinate Sale of €592M Stake in Saipem After Rights Issue FailureDocumento13 páginasBanks Coordinate Sale of €592M Stake in Saipem After Rights Issue FailurepierrefrancAún no hay calificaciones

- RELAW - Enhanced Protection For Preferred Equity DealsDocumento3 páginasRELAW - Enhanced Protection For Preferred Equity DealspierrefrancAún no hay calificaciones

- SolvencyII Snapshot ONLINE MAY2017 v3Documento2 páginasSolvencyII Snapshot ONLINE MAY2017 v3pierrefrancAún no hay calificaciones

- DERI Remembering The Range Accrual BloodbathDocumento2 páginasDERI Remembering The Range Accrual BloodbathpierrefrancAún no hay calificaciones

- CMBS 101: Trepp's Essential Guide to Commercial Mortgage-Backed SecuritiesDocumento7 páginasCMBS 101: Trepp's Essential Guide to Commercial Mortgage-Backed SecuritiespierrefrancAún no hay calificaciones

- Steffen Murau GEGI Study 2 Feb 2021Documento38 páginasSteffen Murau GEGI Study 2 Feb 2021pierrefrancAún no hay calificaciones

- REDEV - Phased Development of Retail Projects (Pircher)Documento4 páginasREDEV - Phased Development of Retail Projects (Pircher)pierrefrancAún no hay calificaciones

- BDS CoWork - 10 Coworking Space Marketing Tips To Drive More MembersDocumento9 páginasBDS CoWork - 10 Coworking Space Marketing Tips To Drive More MemberspierrefrancAún no hay calificaciones

- Paros Development 101 (ULI)Documento5 páginasParos Development 101 (ULI)pierrefrancAún no hay calificaciones

- FI - Financial Statement Analysis of Leverage and How It Informs About Profitability and Price-To-book Ratios (Stephen H. Penman)Documento45 páginasFI - Financial Statement Analysis of Leverage and How It Informs About Profitability and Price-To-book Ratios (Stephen H. Penman)pierrefrancAún no hay calificaciones

- DCM FSG Interest Rate Derivatives Deutsche BankDocumento7 páginasDCM FSG Interest Rate Derivatives Deutsche BankpierrefrancAún no hay calificaciones

- An MMT Response On What Causes Inflation - FT AlphavilleDocumento27 páginasAn MMT Response On What Causes Inflation - FT AlphavillepierrefrancAún no hay calificaciones

- REFI Option Value in Presale of Real Estate PropertyDocumento16 páginasREFI Option Value in Presale of Real Estate PropertypierrefrancAún no hay calificaciones

- NPL - CoStar UK - The Leader in Commercial Property InformationDocumento2 páginasNPL - CoStar UK - The Leader in Commercial Property InformationpierrefrancAún no hay calificaciones

- Debt-Exchange Offers Get New Life as Court Expands Restructuring OptionsDocumento4 páginasDebt-Exchange Offers Get New Life as Court Expands Restructuring OptionspierrefrancAún no hay calificaciones

- Spactiv PresentazioneDocumento29 páginasSpactiv PresentazionepierrefrancAún no hay calificaciones

- Presentation - Rocket Internet Co-Investment Fund (20160119) PDFDocumento15 páginasPresentation - Rocket Internet Co-Investment Fund (20160119) PDFpierrefrancAún no hay calificaciones

- Basics of Early Stage Legal Issues - Guide For Entrepreneurs PDFDocumento106 páginasBasics of Early Stage Legal Issues - Guide For Entrepreneurs PDFpierrefrancAún no hay calificaciones

- 3 Analuzing The Industry EnviromentDocumento33 páginas3 Analuzing The Industry EnviromentAlfonso OrtizAún no hay calificaciones

- The Impact of Brand Image On Consumer Behavior: A Literature ReviewDocumento7 páginasThe Impact of Brand Image On Consumer Behavior: A Literature ReviewFaye Diane GodinezAún no hay calificaciones

- Thapelo Khambule Adidas Cover Letter.Documento2 páginasThapelo Khambule Adidas Cover Letter.Thapelo KhambuleAún no hay calificaciones

- BBS Final Year ProjectDocumento39 páginasBBS Final Year ProjectSamsher Kunwar100% (2)

- Werabe University Collage of Business and EconomicsDocumento5 páginasWerabe University Collage of Business and EconomicsshersfaAún no hay calificaciones

- Modern Face of Retail Survey - Google FormsDocumento6 páginasModern Face of Retail Survey - Google FormsRishi KumarAún no hay calificaciones

- Ecommerce For TVET 10 162Documento153 páginasEcommerce For TVET 10 162nasAún no hay calificaciones

- Fund Accounting NotesDocumento33 páginasFund Accounting NotesnirbhayAún no hay calificaciones

- Mkt101-Chap 15-Part 2Documento3 páginasMkt101-Chap 15-Part 2Hải Yến NguyễnAún no hay calificaciones

- Process Costing Sample ProblemDocumento1 páginaProcess Costing Sample ProblemHannah CaparasAún no hay calificaciones

- PuregoldDocumento9 páginasPuregoldCarmina BacunganAún no hay calificaciones

- Acctg13 PPE ProblemsDocumento4 páginasAcctg13 PPE ProblemsKristel Keith NievaAún no hay calificaciones

- LERO9 Magento BRDDocumento7 páginasLERO9 Magento BRDKriti ShamsherAún no hay calificaciones

- What Is A Commercial BankDocumento12 páginasWhat Is A Commercial BankDEEPUAún no hay calificaciones

- Recognize and Understand The MarketDocumento11 páginasRecognize and Understand The MarketKaren JonsonAún no hay calificaciones

- Product & Service Design-Operation ManagementDocumento4 páginasProduct & Service Design-Operation ManagementHtetThinzarAún no hay calificaciones

- AnirudhDocumento81 páginasAnirudhbalki123Aún no hay calificaciones

- 02 Break Even AnalysisDocumento9 páginas02 Break Even AnalysisMarenightAún no hay calificaciones

- Production Cost Equivalent UnitsDocumento6 páginasProduction Cost Equivalent UnitsMultahadi QismanAún no hay calificaciones

- Chapter 6 Common Business Terminologies PDFDocumento30 páginasChapter 6 Common Business Terminologies PDFDiya SardaAún no hay calificaciones

- Proposed Chart of Accounts-8Documento62 páginasProposed Chart of Accounts-8Zimbo Kigo100% (1)

- Understanding Income Statements EPS CalculationsDocumento39 páginasUnderstanding Income Statements EPS CalculationsKeshav KaplushAún no hay calificaciones

- Kontrak Kuliah Audit InternalDocumento13 páginasKontrak Kuliah Audit Internalhesti murwaniAún no hay calificaciones

- Erp 2017 Studyguide FinalDocumento20 páginasErp 2017 Studyguide Finalken_ng333Aún no hay calificaciones

- Chapter 3 Homework Chapter 3 HomeworkDocumento8 páginasChapter 3 Homework Chapter 3 HomeworkPhương NguyễnAún no hay calificaciones