Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Circular 166

Cargado por

Vigneshwar Raju Prathikantam0 calificaciones0% encontró este documento útil (0 votos)

109K vistas2 páginasRe-employed ex-sm to get da

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoRe-employed ex-sm to get da

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

109K vistas2 páginasCircular 166

Cargado por

Vigneshwar Raju PrathikantamRe-employed ex-sm to get da

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 2

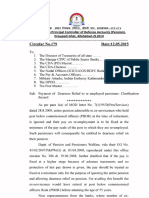

Circular No.

166

To,

No. AT/Tech/263- XVI

O/o the Pr. C.D.A. (P), Allahabad

Date: 07.03.2013

1. The CMD(Bank of Baroda, Oriental Bank of Commerce, Dena Bank

&Punjab &Sind Bank)

2. The Director of Treasuries of all state .

3. The Nodal Officers (ICICI/IDBI/AXIS/HDFC Bank).

4. The CDA (PD) Meerut.

5. The CDA-Chennai.

6. The Manger CPPC of Public Sector Banks (except banks mentioned at

1 above)

7. The Pay & Accounts Officers

8. Military & Air Attache, Indian Embassy Kathmandu-Nepal

9. The DPDO

10 The Post Master..

Sub: - Non payment of Dearness Relief on Disability Element While on ReEmployment.

*****************

The payment of dearness relief during re-employment / employment /

permanently absorption of pensioners / family pensioners under the Central or

State Government or in a Statutory Corporation / Company / Body / Bank under

them in India or abroad is not being regulated correctly by various Pension

Disbursing Authorities. Where some Pension Disbursing Authorities are

disallowing dearness relief to re-employed pensioner of commissioned officer

on disability element, others are allowing in few cases. Similar irregularities

have been noticed in case of pensioners of PBOR. The instances of not allowing

dearness relief to family pensioners during their employment are also drawing

attention of this office/Ministry from time to time. The position on the subject is

though clearly stipulated in Ministry of Personnel, Public Grievances &

Pensions, Deptt of P&PW letter No. 45/73/97-P&PW(G) dt. 2nd July, 1999 and

Ministry of Defence letter No. 79(1)/95/D (Pen/Services) dated 28th August

2000 and Deptt of P&PW UO No. 41/42/2007-P&PW(G) dt. 3-4-2008.

However, position is re-clarified as under for uniform implementation of above

orders.

(a) In case of re-employed pensioners who hold Group A post or posts of

the ranks of commissioned officers at the time of their re-employment will not

be entitled to any dearness relief on pension on the fact that:(i)

A certain portion of pension is taken into account and is not entirely

ignored.

(ii) The pay in the post of re-employment is not required to be fixed at the

minimum of the scale in all cases, and

(iii) Dearness allowance at the rates applicable from time to time is also

admissible on the pay fixed on re-employment.

(b)(i) The entire pension admissible is to be ignored in the case of civilian

pensioner who held posts below Group A and those ex-servicemen who held

posts below the ranks of commissioned officers, at the time of their retirement.

Their pay on re-employment is to be fixed at the minimum of the pay scale of

the post in which they are re-employed. Such civilian pensioners will

consequently be entitled to dearness relief on their pension at the rates

applicable from time to time.

(b)(ii) The ex-servicemen (PBOR) who retired before attaining the age of 55

years and re-employed thereafter and their pay fixed at a higher stage because of

advance increments and no protection of the last pay drawn is being given, the

pay should be treated as fixed at a minimum only for the purpose of ignoring the

entire pension and allowing dearness relief on pension.

(c)

The disability element is part of disability pension, therefore position

explained at a & b above will also apply for regulating dearness relief on

disability element during re-employment of pensioner drawing disability

pension.

(d) The family pension received by the eligible central Govt.

employees/Armed Forces pensioners is, in any case, not taken into account in

determining their pay on employment therefore, dearness relief at the rates

applicable from time to time shall be admissible on their family pension.

Incorrect payment of pension is not only infringement of Govt. orders

but also cause of concern to pensioners. It is, therefore, requested to instruct

Pension Paying Branches / CPPC / Offices / Treasuries under your jurisdictions

to regulate the payment of dearness relief on pension /family pension on reemployment/employment/permanently

absorption

of

pensioners/family

pensioners as explained above.

Copy to:1.

2.

3.

4.

5.

6.

7.

8.

9.

(P.N. CHOPRA)

Asst.CDA (P)

The CGDA, ULAN BATAR ROAD, Palam Delhi Cantt-110010For information w.r.to HQrs. Office letter No.5609/AT-P/XXXI/PF

dt.14.02.2013

The Pr.CDA (Navy), Cooperage Road Mumbai.

The CDA (AF), New Delhi

PA to CDA (AT) / CDA (Gts) in Main Office.

PA to all Addl. CDA / Jt.CDA, in Main Office.

All GOs, in Main Office.

Officer-in-Charge, G-I/ M (Tech), G-I/C (Tech) and. Gts(Ors) /Tech

Section (Local).

Officer-in-Charge in all section (Local).

Officer-in-Charge EDP Centre (Local). For inclusion and uploading at

Website of this office.

(S.BASUMATARY)

ACCOUNTS OFFICER (P)

También podría gustarte

- Modified Assured Career Progression Scheme 28052019Documento1 páginaModified Assured Career Progression Scheme 28052019Vigneshwar Raju PrathikantamAún no hay calificaciones

- CBIC Order On 5400 On Contempt CaseDocumento4 páginasCBIC Order On 5400 On Contempt CaseVigneshwar Raju Prathikantam100% (1)

- Eo (Go) 47-2018 (Prom of Insp To Cadre of Supdt)Documento4 páginasEo (Go) 47-2018 (Prom of Insp To Cadre of Supdt)Vigneshwar Raju PrathikantamAún no hay calificaciones

- Eo (Go) 46-2018 (Prom of Insp To Cadre of Supdt)Documento4 páginasEo (Go) 46-2018 (Prom of Insp To Cadre of Supdt)Vigneshwar Raju PrathikantamAún no hay calificaciones

- Eo (Ngo) 38-2017 (Insp Concordance Order)Documento12 páginasEo (Ngo) 38-2017 (Insp Concordance Order)Vigneshwar Raju PrathikantamAún no hay calificaciones

- Constitution of Aiacegeo (Pre Convention)Documento6 páginasConstitution of Aiacegeo (Pre Convention)Vigneshwar Raju PrathikantamAún no hay calificaciones

- Supreme Court - Order - 5400 G P 10-Oct-2017Documento2 páginasSupreme Court - Order - 5400 G P 10-Oct-2017Vigneshwar Raju Prathikantam100% (1)

- Eo (Go) 48-2018 (Prom of Insp To Cadre of Supdt)Documento4 páginasEo (Go) 48-2018 (Prom of Insp To Cadre of Supdt)Vigneshwar Raju PrathikantamAún no hay calificaciones

- Eo (Go) 48-2018 (Prom of Insp To Cadre of Supdt)Documento4 páginasEo (Go) 48-2018 (Prom of Insp To Cadre of Supdt)Vigneshwar Raju PrathikantamAún no hay calificaciones

- Eo (Go) 47-2018 (Prom of Insp To Cadre of Supdt)Documento4 páginasEo (Go) 47-2018 (Prom of Insp To Cadre of Supdt)Vigneshwar Raju PrathikantamAún no hay calificaciones

- Eo (Go) 40-2017 (Supdt Concordance Order)Documento10 páginasEo (Go) 40-2017 (Supdt Concordance Order)Vigneshwar Raju PrathikantamAún no hay calificaciones

- Eo (Go) 39-2017 (Ict Supdt Retention)Documento2 páginasEo (Go) 39-2017 (Ict Supdt Retention)Vigneshwar Raju PrathikantamAún no hay calificaciones

- Order of Appealate AuthorityDocumento4 páginasOrder of Appealate AuthorityVigneshwar Raju PrathikantamAún no hay calificaciones

- Cabinet Approval 7th CPC AllowancesDocumento27 páginasCabinet Approval 7th CPC AllowancesVigneshwar Raju Prathikantam100% (1)

- WP 39218 2012Documento3 páginasWP 39218 2012Vigneshwar Raju PrathikantamAún no hay calificaciones

- Circular 570Documento15 páginasCircular 570Vigneshwar Raju Prathikantam100% (3)

- D (Pen-Pol-30 09 2016)Documento7 páginasD (Pen-Pol-30 09 2016)Vigneshwar Raju Prathikantam0% (1)

- PBORSDocumento51 páginasPBORSVigneshwar Raju PrathikantamAún no hay calificaciones

- Circular 568Documento11 páginasCircular 568Vigneshwar Raju Prathikantam80% (10)

- Resolution: (To Be Published in The Gazette of India (Extraordinary) Section 1Documento6 páginasResolution: (To Be Published in The Gazette of India (Extraordinary) Section 1Vigneshwar Raju PrathikantamAún no hay calificaciones

- Hearing Notice OROPDocumento1 páginaHearing Notice OROPVigneshwar Raju PrathikantamAún no hay calificaciones

- Resolution On Pensionary Matter On Recommendation of 7th CPCDocumento4 páginasResolution On Pensionary Matter On Recommendation of 7th CPCVigneshwar Raju PrathikantamAún no hay calificaciones

- Ministry of Defence Letter On DRDocumento3 páginasMinistry of Defence Letter On DRVigneshwar Raju PrathikantamAún no hay calificaciones

- 3 2014 Estt A IVDocumento2 páginas3 2014 Estt A IVVigneshwar Raju PrathikantamAún no hay calificaciones

- Agt 2016 Circular For The Cadre of InspectorsDocumento6 páginasAgt 2016 Circular For The Cadre of InspectorsVigneshwar Raju PrathikantamAún no hay calificaciones

- Pre-2006 DOPT Order 7.4.2016Documento2 páginasPre-2006 DOPT Order 7.4.2016Vigneshwar Raju PrathikantamAún no hay calificaciones

- Circular-179 DR On PensionDocumento2 páginasCircular-179 DR On PensionVigneshwar Raju Prathikantam100% (1)

- Circular-165 DA On PensionDocumento7 páginasCircular-165 DA On PensionVigneshwar Raju PrathikantamAún no hay calificaciones

- D (Pen Policy) Desw Orop 03-02-2016Documento3 páginasD (Pen Policy) Desw Orop 03-02-2016Vigneshwar Raju PrathikantamAún no hay calificaciones

- Draft Alert List For Agt 2016Documento4 páginasDraft Alert List For Agt 2016Vigneshwar Raju PrathikantamAún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5782)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Subordinate or Delegated LegislationDocumento27 páginasSubordinate or Delegated LegislationThakur Sandy SinghAún no hay calificaciones

- Faculty: Dr. Pooja Sharma: Case: Money Cash Flow IncDocumento3 páginasFaculty: Dr. Pooja Sharma: Case: Money Cash Flow IncAlumni RelationsAún no hay calificaciones

- Choi & Lotz (2017)Documento23 páginasChoi & Lotz (2017)MUC kediriAún no hay calificaciones

- Resume For Fashion InternshipDocumento4 páginasResume For Fashion Internshipdthtrtlfg100% (2)

- Business Writing SkillsDocumento99 páginasBusiness Writing SkillsvijayAún no hay calificaciones

- DGA RateCards 2018-2019 FinalDocumento30 páginasDGA RateCards 2018-2019 FinalAnonymous rdyFWm9Aún no hay calificaciones

- DS Smith Annual Report 2017Documento144 páginasDS Smith Annual Report 2017DSSmithPlcAún no hay calificaciones

- Amir PathanDocumento72 páginasAmir PathansumitAún no hay calificaciones

- Cares Act-Palm Beach CountyDocumento1 páginaCares Act-Palm Beach CountyScott SuttonAún no hay calificaciones

- 2290 PDFDocumento222 páginas2290 PDFmittupatel190785Aún no hay calificaciones

- Deleg WSH Cetsp01 326406 7Documento30 páginasDeleg WSH Cetsp01 326406 7Việt Đặng XuânAún no hay calificaciones

- MBA 106 - Human Resource ManagementDocumento8 páginasMBA 106 - Human Resource ManagementRahul YadavAún no hay calificaciones

- 947 - Apperntiship Adani Airport - 31-08-2023Documento2 páginas947 - Apperntiship Adani Airport - 31-08-2023Deep PatelAún no hay calificaciones

- Evolution of Management TheoryDocumento51 páginasEvolution of Management TheoryWinn WinAún no hay calificaciones

- Business English - SyllabusDocumento3 páginasBusiness English - Syllabusapi-241222198Aún no hay calificaciones

- Impact of Covid 19 On The Indian EconomyDocumento10 páginasImpact of Covid 19 On The Indian EconomySabyasachi DeyAún no hay calificaciones

- Business Cycle The 6 Different Stages of A Business CycleDocumento3 páginasBusiness Cycle The 6 Different Stages of A Business CyclevinayAún no hay calificaciones

- Here Are Some Job AdvertisementsDocumento2 páginasHere Are Some Job AdvertisementsSanz MartinezAún no hay calificaciones

- Aero SealDocumento14 páginasAero SealRyanAún no hay calificaciones

- Carter Cleaning Company Case StudyDocumento3 páginasCarter Cleaning Company Case StudyArnab Hasan OmiAún no hay calificaciones

- Form - 10 Employees Provident Fund Organisation: Date: Place Authorised Signatory For VHPLDocumento1 páginaForm - 10 Employees Provident Fund Organisation: Date: Place Authorised Signatory For VHPLjohn0% (1)

- Tenancy Contract in Beirut-SampleDocumento4 páginasTenancy Contract in Beirut-Sampleiaakil50% (2)

- Quantitive Easing As A Highway To InflationDocumento377 páginasQuantitive Easing As A Highway To InflationvicdomAún no hay calificaciones

- Final Research - The Impacts Covid's On TourismDocumento12 páginasFinal Research - The Impacts Covid's On TourismThảo BùiAún no hay calificaciones

- John MetcalfDocumento11 páginasJohn MetcalfCheska Fernandez0% (1)

- Employment ApplicationDocumento1 páginaEmployment ApplicationBharat SinghAún no hay calificaciones

- Understanding The Purpose of A Job InterviewDocumento4 páginasUnderstanding The Purpose of A Job Interviewuphie zakiAún no hay calificaciones

- Capco Edition 18 Organisational Structure and TeamworkDocumento22 páginasCapco Edition 18 Organisational Structure and TeamworksurapongAún no hay calificaciones

- Tieu Luan Mau 2Documento7 páginasTieu Luan Mau 2Bảo MinhAún no hay calificaciones

- Challan Form PARC DEODocumento5 páginasChallan Form PARC DEOامیر مختارAún no hay calificaciones