Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Daily Market Watch - 24 12 2014 PDF

Cargado por

Randora LkTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Daily Market Watch - 24 12 2014 PDF

Cargado por

Randora LkCopyright:

Formatos disponibles

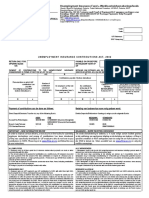

DAILY MARKET WATCH

First Capital Research

December 24, 2014

MARKET INDICES

ASPI

S&P SL20

7,270

4,072

4,070

4,068

4,066

4,064

4,062

4,060

4,058

7,260

7,250

7,240

7,230

7,220

7,210

ASPI

S&P SL20

MARKET TURNOVER & VOLUME

Domestic - 99%,

Turnover ('Mn)

Foreign - 1%

Volume

5,000

80

70

60

50

40

30

20

10

0

4,000

3,000

2,000

1,000

0

Turnover

Today

ASPI

S&P SL20

7,263.25

4,069.75

7,238.05

4,063.17

0.35%

0.16%

Turnover (LKR 'Mn)

3,841.86

3,379.81

13.67%

32.70

40.41

-19.07%

Market Cap. (LKR 'Bn)

3,087.27

3,076.55

0.35%

Market Cap. (USD 'Bn)

23.57

23.49

0.35%

196

193

1.55%

Foreign Purchases (LKR 'Mn)

Foreign Sales (LKR 'Mn)

39.48

28.33

230.34

117.69

-82.86%

-75.93%

Net Foreign Inflow (LKR 'Mn)

11.15

112.65

-90.10%

Volume ('Mn)

Traded Companies

Change (%)

MTD Net Foreign Flow (LKR 'Mn)

1,195.21

YTD Net Foreign Flow (LKR 'Mn)

20,846.90

MARKET COMMENTARY

A parcel trade in DFCC gave an early boost to the index which saw positive market

momentum being maintained during the remainder of the day so that the ASPI

closed 25 points higher at 7,263. The DFCC crossing of 17.0mn shares at LKR 208.00

per share contributed LKR 3.5bn out of the day's market turnover of LKR 3.8bn

despite a decline in volumes. Approaching the end of the year, foreign activity

slowed to account for only 1% of market turnover and generated a net foreign

inflow of LKR 11.1mn for the day.

ESTIMATED LARGEST FOREIGN FLOW

('Mn)

14

-5

-5

AEL

UBC

HNB

LLUB

CTC

LIOC

RHL (X)

SAMP

NEST

RHL

113

11

-74

-180

-3

-2

-2

2

6

6

8

10

-10

Net FII

TOP 5 GAINERS

Previous

Volume

NET FOREIGN FLOW

150

100

50

0

-50

-100

-150

-200

MARKET PERFORMANCE

-5

10

15

Estimated Value (LKR 'Mn)

Today

Previous

Change (%)

TOP 5 LOSERS

Today

Previous

Change (%)

MORISONS [X]

285.00

230.20

23.81% PC HOUSE

0.20

0.30

-33.33%

LANKA CERAMIC

123.90

107.00

15.79% TESS AGRO [X]

1.30

1.40

-7.14%

327.00

350.00

-6.57%

1.50

1.60

-6.25%

COMM LEASE & FIN

ASIA CAPITAL

CARGO BOAT

TOP 5 TURNOVER

4.70

4.30

11.90

11.10

137.80

Price

130.00

9.30% RENUKA CITY HOT.

7.21% MULLERS

6.00% DIMO

Volume

Turnover

('Mn)

('Mn)

TOP 5 VOLUME

DFCC BANK

218.50

17.0

JKH

250.00

0.2

3,545.83 DFCC BANK

52.21 BROWNS INVSTMNTS

ACCESS ENG SL

35.00

0.9

30.33 VALLIBEL

UNION BANK

24.90

1.1

27.08 UNION BANK

VALLIBEL ONE

23.60

0.6

14.20 AMANA TAKAFUL

642.00

Price

674.00

-4.75%

Volume

Turnover

('Mn)

('Mn)

218.50

17.0

3,545.83

1.90

3.4

6.38

7.00

1.2

8.53

24.90

1.1

27.08

0.60

1.0

0.71

First Capital Equities (Pvt) Ltd

No.1, Lake Crescent,

Colombo 2

Sales Desk:

+94 11 2145 000

Fax:

+94 11 2145 050

HEAD OFFICE

BRANCHES

No.1, Lake Crescent,

Matara

Negombo

Colombo 2

No. 24, Mezzanine Floor,

No.72A, 2/1,

Sales Desk:

+94 11 2145 000 E.H. Cooray Building,

Old Chilaw Road,

Fax:

+94 11 2145 050 Anagarika Dharmapala Mw,

Negombo

Matara

Tel:

+94 41 2237 636

Tel:

Jaliya Wijeratne

+94 71 5329 602

Negombo

SALES

+94 31 2233 299

BRANCHES

CEO

Priyanka Anuruddha

+94 76 6910 035

Priyantha Wijesiri

+94 76 6910 036

Colombo

Nishantha Mudalige

+94 76 6910 041

Matara

Anushka Buddhika

+94 77 9553 613

Sumeda Jayawardana

+94 76 6910 038

Gamini Hettiarachchi

+94 76 6910 039

Thushara Abeyratne

+94 76 6910 037

Nishani Prasangi

+94 76 6910 033

Ishanka Wickramanayaka

+94 77 7611 200

RESEARCH

Dimantha Mathew

+94 11 2145 016

Reshan Wediwardana

+94 11 2145 017

Nandika Fonseka

+94 11 2145 018

FIRST CAPITAL GROUP

HEAD OFFICE

BRANCHES

No. 2, Deal Place,

Matara

Kurunegala

Kandy

Colombo 3

No. 24, Mezzanine Floor,

No. 6, 1st Floor,

No.213-215,

Tel:

E.H. Cooray Building,

Union Assurance Building,

Peradeniya Road,

Anagarika Dharmapala Mawatha,

Rajapihilla Mawatha,

Kandy

Matara

Kurunegala

+94 11 2576 878

Tel:

+94 41 2222 988

Tel:

+94 37 2222 930

Tel:

+94 81 2236 010

Disclaimer:

This Review is prepared and issued by First Capital Equities (Pvt) Ltd. based on information in the public domain, internally developed and other sources, believed to be

correct. Although all reasonable care has been taken to ensure the contents of the Review are accurate, First Capital Equities (Pvt) Ltd and/or its Directors,

employees, are not responsible for the correctness, usefulness, reliability of same. First Capital Equities (Pvt) Ltd may act as a Broker in the investments which are the

subject of this document or related investments and may have acted on or used the information contained in this document, or the research or analysis on which it is

based, before its publication. First Capital Equities (Pvt) Ltd and/or its principal, their respective Directors, or Employees may also have a position or be otherwise interested

in the investments referred to in this document. This is not an offer to sell or buy the investments referred to in this document. This Review may contain data which are

inaccurate and unreliable. You hereby waive irrevocably any rights or remedies in law or equity you have or may have against First Capital Equities (Pvt) Ltd with respect to

the Review and agree to indemnify and hold First Capital Equities (Pvt) Ltd and/or its principal, their respective directors and employees harmless to the fullest extent

allowed by law regarding all matters related to your use of this Review. No part of this document may be reproduced, distributed or published in whole or in part by any

means to any other person for any purpose without prior permission.

También podría gustarte

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5795)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Police PatrolDocumento130 páginasPolice PatrolEcho EchoAún no hay calificaciones

- Property Plant and EquipmentDocumento32 páginasProperty Plant and EquipmentKyllie CamantigueAún no hay calificaciones

- #25 Magno V CADocumento2 páginas#25 Magno V CAGladys CubiasAún no hay calificaciones

- Laurel Vs MisaDocumento5 páginasLaurel Vs MisaAj Guadalupe de MataAún no hay calificaciones

- Lesson 02 Course OCI IAM ServiceDocumento22 páginasLesson 02 Course OCI IAM ServiceKrish LeeAún no hay calificaciones

- CBSL Organizational Structure - (10.02.2015) PDFDocumento1 páginaCBSL Organizational Structure - (10.02.2015) PDFRandora LkAún no hay calificaciones

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocumento4 páginasWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkAún no hay calificaciones

- 03 September 2015 PDFDocumento9 páginas03 September 2015 PDFRandora LkAún no hay calificaciones

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocumento3 páginasICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkAún no hay calificaciones

- Global Market Update - 04 09 2015 PDFDocumento6 páginasGlobal Market Update - 04 09 2015 PDFRandora LkAún no hay calificaciones

- Press 20150831ebDocumento2 páginasPress 20150831ebRandora LkAún no hay calificaciones

- Dividend Hunter - Apr 2015 PDFDocumento7 páginasDividend Hunter - Apr 2015 PDFRandora LkAún no hay calificaciones

- Daily - 23 04 2015 PDFDocumento4 páginasDaily - 23 04 2015 PDFRandora LkAún no hay calificaciones

- Wei 20150402 PDFDocumento18 páginasWei 20150402 PDFRandora LkAún no hay calificaciones

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocumento4 páginasWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkAún no hay calificaciones

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Documento5 páginasN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkAún no hay calificaciones

- Trader's Daily Digest - 12.02.2015 PDFDocumento6 páginasTrader's Daily Digest - 12.02.2015 PDFRandora LkAún no hay calificaciones

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocumento9 páginasJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkAún no hay calificaciones

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Documento5 páginasN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkAún no hay calificaciones

- Daily Stock Watch: ThursdayDocumento9 páginasDaily Stock Watch: ThursdayRandora LkAún no hay calificaciones

- Press Release: Communications DepartmentDocumento3 páginasPress Release: Communications DepartmentRandora LkAún no hay calificaciones

- Press 20150227e PDFDocumento1 páginaPress 20150227e PDFRandora LkAún no hay calificaciones

- Daily Stock Watch: ThursdayDocumento9 páginasDaily Stock Watch: ThursdayRandora LkAún no hay calificaciones

- WRWBM96 GST InvoiceDocumento1 páginaWRWBM96 GST InvoiceSIDDESWAR MANOJ ChikkaAún no hay calificaciones

- ch08 Financial Accounting, 7th EditionDocumento72 páginasch08 Financial Accounting, 7th Editionrobbi ajaAún no hay calificaciones

- Eutropije-Breviarium Historiae RomanaeDocumento95 páginasEutropije-Breviarium Historiae RomanaeedinjuveAún no hay calificaciones

- David Misch Probable Cause AffidavitDocumento2 páginasDavid Misch Probable Cause AffidavitNational Content DeskAún no hay calificaciones

- Quiz 2 - Prof 3Documento5 páginasQuiz 2 - Prof 3Tifanny MallariAún no hay calificaciones

- SOP Regulation Rate Charges and Terms&ConditionDocumento12 páginasSOP Regulation Rate Charges and Terms&ConditionSPIgroupAún no hay calificaciones

- Pemex Vs HPDocumento36 páginasPemex Vs HPOmarVargasAún no hay calificaciones

- Outline-Bare Unit: DWN by CK'D by Third Angle ProjectionDocumento1 páginaOutline-Bare Unit: DWN by CK'D by Third Angle ProjectionHelder ChavezAún no hay calificaciones

- Agael Et - Al vs. Mega-Matrix (Motion For Reconsideration)Documento5 páginasAgael Et - Al vs. Mega-Matrix (Motion For Reconsideration)John TorreAún no hay calificaciones

- CH 02Documento60 páginasCH 02kevin echiverriAún no hay calificaciones

- How Do Different Political Ideologies and Perspectives On Gun Control Implicate The Individuals and Societies?Documento12 páginasHow Do Different Political Ideologies and Perspectives On Gun Control Implicate The Individuals and Societies?Andy HuỳnhAún no hay calificaciones

- 01 Baguio Country Club Corp. v. National Labor Relations CommissionDocumento4 páginas01 Baguio Country Club Corp. v. National Labor Relations CommissionGina RothAún no hay calificaciones

- Afjrotc Creed: Before Self, and Excellence in All We DoDocumento1 páginaAfjrotc Creed: Before Self, and Excellence in All We DoKatlynn McCannAún no hay calificaciones

- ACD10403 Group Assignment 2019Documento3 páginasACD10403 Group Assignment 2019Atqh ShamsuriAún no hay calificaciones

- Havells India LTD: Actuals Key Financials (Rs. in CRS.)Documento159 páginasHavells India LTD: Actuals Key Financials (Rs. in CRS.)milan kakkadAún no hay calificaciones

- Timetable - 42389 - X6, 7, 7A, N7, X7 & 8Documento4 páginasTimetable - 42389 - X6, 7, 7A, N7, X7 & 8geo32Aún no hay calificaciones

- MtknfcdtaDocumento1 páginaMtknfcdtaMuzaffar HussainAún no hay calificaciones

- Nkandu Vs People 13th June 2017Documento21 páginasNkandu Vs People 13th June 2017HanzelAún no hay calificaciones

- June 2008 Steel & Cement RatesDocumento1 páginaJune 2008 Steel & Cement RatesVizag Roads100% (1)

- Rfe 2021Documento119 páginasRfe 2021nietgrAún no hay calificaciones

- Site Planning and Design Handbook Karya Thomas H. RassDocumento25 páginasSite Planning and Design Handbook Karya Thomas H. RassNolphy DjoAún no hay calificaciones

- Form - U17 - UIF - Payment AdviceDocumento2 páginasForm - U17 - UIF - Payment Advicesenzo scholarAún no hay calificaciones

- Annexure-I: Check List For Application FormDocumento4 páginasAnnexure-I: Check List For Application FormShubham ShuklaAún no hay calificaciones

- Comprimise, Arrangement and Amalgamation NotesDocumento6 páginasComprimise, Arrangement and Amalgamation Notesitishaagrawal41Aún no hay calificaciones

- Business Organizations Grade 8: Private SectorDocumento16 páginasBusiness Organizations Grade 8: Private SectorCherryl Mae AlmojuelaAún no hay calificaciones